Noticias del mercado

-

20:01

DJIA 17258.48 45.17 0.26%, NASDAQ 4759.32 10.85 0.23%, S&P 500 2022.53 0.34 0.02%

-

18:08

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday as losses in energy shares were offset by gains in consumer discretionary stocks and investors paused ahead of the U.S. Federal Reserve's meeting on monetary policy this week. The Fed is not expected to raise interest rates at the two-day meeting, which begins on Tuesday, but investors will be on the lookout for its view on the economy and clues on the path of future hikes. Crude prices fell more than 4% after Iran quashed hopes of a quick deal by major producers to freeze output. Brent crude fell below $40 a barrel.

Dow stocks mixed (15 vs 15). Top looser - Pfizer Inc. (PFE, -1,08%). Top gainer - McDonald's Corp. (MCD, +1,33%).

Most of all S&P sectors in negative area. Top looser - Basic Materials (-1,3%). Top gainer - Services (+0,2%).

At the moment:

Dow 17145.00 +54.00 +0.32%

S&P 500 2010.00 -0.50 -0.02%

Nasdaq 100 4363.75 +19.25 +0.44%

Oil 36.91 -1.59 -4.13%

Gold 1244.90 -14.50 -1.15%

U.S. 10yr 1.95 -0.03

-

18:00

European stocks close: stocks closed higher, remained supported by last week's further stimulus measures by the ECB

Stock indices closed higher, remained supported by last week's further stimulus measures by the European Central Bank's (ECB). The central bank last Thursday cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

Market participants also eyed the Eurozone's economic data. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone climbed 2.1% in January, exceeding expectations for a 1.7% increase, after a 0.5% fall in December.

Non-durable consumer goods output increased 2.4% in January, capital goods output climbed 3.9%, while energy output rose 2.4%.

On a yearly basis, Eurozone's industrial production rise 2.8% in January, exceeding expectations for a 1.4% rise, after a 0.1% decrease in December. December's figure was revised up from a 1.3% drop.

Durable consumer goods climbed by 3.2% in January from a year ago, capital goods rose by 4.6%, non-durable consumer goods gained by 7.3%, while intermediate goods output increased by 1.9%.

Energy output declined by 3.7% in January from a year ago.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,174.57 +34.78 +0.57 %

DAX 9,990.26 +159.13 +1.62 %

CAC 40 4,506.59 +13.80 +0.31 %

-

18:00

European stocks closed: FTSE 6174.57 34.78 0.57%, DAX 9990.26 159.13 1.62%, CAC 40 4506.59 13.80 0.31%

-

17:57

WSE: Session Results

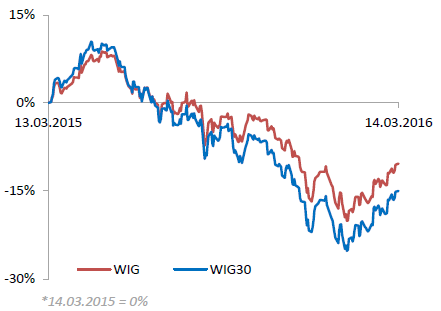

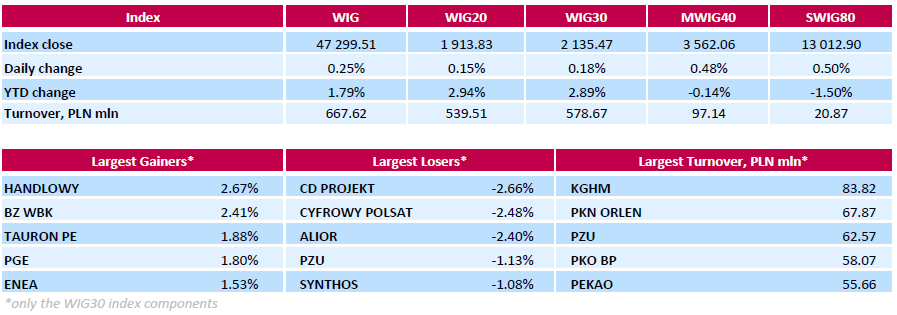

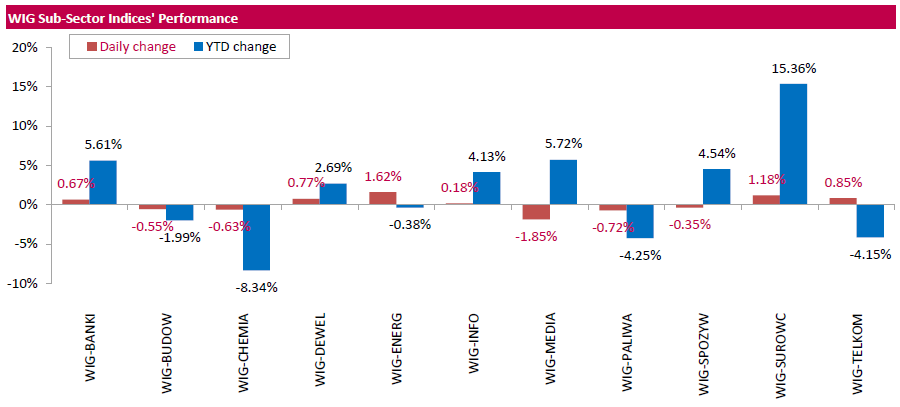

Polish equity market closed higher on Monday. The broad market measure, the WIG index, added 0.25%. Market volatility was quite clearly limited. Sector performance within the WIG Index was mixed. Utilities stocks (+1.62%) were the strongest group, while media sector names (-1.85%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, advanced 0.18%. In the WIG30, banking names HNDLOWY (WSE: BHW) and BZ WBK (WSE: BZW) recorded the strongest daily gains of 2.67% and 2.41% respectively. All four energy generating sector's names TAURON (WSE: TPE), PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG) also delivered solid advances, growing by 1.52%-1.88%. On the other side of the ledger, videogame developer CD PROJEKT (WSE: CDR), media group CYFROWY POLSAT (WSE: CPS) and bank ALIOR (WSE: ALR) were the major laggards, losing 2.66%, 2.48% and 2.40% respectively.

-

17:05

European Central Bank Governing Council member Francois Villeroy de Galhau: the central bank’s new stimulus measures should help to encourage lending

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Monday that the central bank's new stimulus measures should help to encourage lending.

"Our priority, and we made a point of it, is financing the real economy," he said.

de Galhau pointed that there was no deflation in the Eurozone.

-

16:15

European Central Bank purchases €12.51 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.51 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.71 billion of covered bonds, and €185 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% last Thursday. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:01

Fitch affirms Greece’s rating to 'CCC'

Rating agency Fitch Ratings on Friday affirmed Greece's sovereign debt rating at 'CCC'.

"Substantial progress has been made towards agreeing the first review of the financial assistance programme with the European Stability Mechanism (ESM) but implementation risks remain," Fitch said.

"The next set of measures agreed with creditors is expected to place greater emphasis on facilitating the workout of non-performing loans and strengthening legal processes and institutions which, if successful, would boost Greece's growth potential," Fitch added.

-

15:55

Fitch cuts Finland’s rating to 'AA+'

Rating agency Fitch Ratings on Friday downgraded Finland's sovereign debt rating to 'AA+' from 'AAA'. The outlook is 'stable'.

According to the agency, the downward revision was driven by a weak economic growth and high public debt.

"In Fitch's view, key macro-economic and public debt metrics are no longer consistent with Finland retaining a 'AAA' rating, particularly given the economy's relatively small size and the vulnerability to idiosyncratic shocks that has been evidenced in recent years," Fitch said.

-

15:17

Preliminary real GDP of G 20 area falls to 0.7% in the fourth quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Monday. Real GDP of G 20 area fell to 0.7% in the fourth quarter from 0.8% in the third quarter.

Real GDP of the United States was down to 0.3% in the fourth quarter from 0.5% in the third quarter, real GDP of Germany remained unchanged at 0.3%, while Britain's economy increased to 0.5% from 0.4%.

GDP of France remained unchanged at 0.3% in the fourth quarter, China's GDP decreased to 1.6% from 1.8%, while Japan's GDP dropped to --0.3% from 0.3%.

Eurozone's economy expanded at 0.3% in the fourth quarter, after a 0.3% rise in the third quarter.

On a yearly basis, GDP of G 20 area was up 3.0% in the fourth quarter, after a 3.1% gain in the previous quarter.

In 2015 as whole, GDP of G 20 area increased 3.2%, after a 3.3% growth in 2014.

-

14:43

After start on Wall Street

Session in the US begins with a gentle withdrawal of about -0.25%. Regarding the balance of Friday's session it is not much. As always in such cases the beginning is designed to be a better option than starting the session with a great optimism, which would make the maintenance of the high level quickly troublesome.

The Warsaw Stock Exchange is maintained above the level of 1,900 points., although at low activity. The overall market turnover did not exceed PLN 400 mln, and in the blue chips segment with amount about PLN 300 mln.

-

14:35

U.S. Stocks open: Dow -0.17%, Nasdaq -0.25%, S&P -0.26%

-

14:26

Before the bell: S&P futures -0.26%, NASDAQ futures -0.24%

U.S. stock-index slipped.

Global Stocks:

Nikkei 17,233.75 +294.88 +1.74%

Hang Seng 20,435.34 +235.74 +1.17%

Shanghai Composite 2,859.89 +49.58 +1.76%

FTSE 6,160.21 +20.42 +0.33%

CAC 4,515.48 +22.69 +0.51%

DAX 9,981.91 +150.78 +1.53%

Crude oil $37.49 (-2.62%)

Gold $1256.90 (-0.20%)

-

13:52

Upgrades and downgrades before the market open

Upgrades:

Yandex N.V. (YNDX) upgraded to Buy from Neutral at Citigroup

Johnson & Johnson (JNJ) upgraded to Neutral from Sell at Goldman

Tesla Motors (TSLA) upgraded to Outperform from Neutral at Robert W. Baird; target raised to $300 from $230

Downgrades:

Other:

HP (HPQ) target raised to $12 from $11 at RBC Capital Mkts

-

12:31

Mid session comment

The mood in Warsaw is becoming weaker and weaker after a slight withdrawal of the German market. Low turnover is always a potential threat and supply take advantage of such a situation. From time to time some basket sales orders are thrown into market and lead the WIG20 index to increasingly lower levels. In this situation, we begin to slump towards 1,900 points, where there is a chance for the first test of this level.

-

12:02

European stock markets mid session: stocks traded higher, supported by last week’s further stimulus measures by the ECB

Stock indices traded higher, supported by last week's further stimulus measures by the European Central Bank's (ECB). The central bank last Thursday cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

Market participants also eyed the Eurozone's economic data. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone climbed 2.1% in January, exceeding expectations for a 1.7% increase, after a 0.5% fall in December.

Non-durable consumer goods output increased 2.4% in January, capital goods output climbed 3.9%, while energy output rose 2.4%.

On a yearly basis, Eurozone's industrial production rise 2.8% in January, exceeding expectations for a 1.4% rise, after a 0.1% decrease in December. December's figure was revised up from a 1.3% drop.

Durable consumer goods climbed by 3.2% in January from a year ago, capital goods rose by 4.6%, non-durable consumer goods gained by 7.3%, while intermediate goods output increased by 1.9%.

Energy output declined by 3.7% in January from a year ago.

Current figures:

Name Price Change Change %

FTSE 100 6,177.26 +37.47 +0.61 %

DAX 9,989.85 +158.72 +1.61 %

CAC 40 4,518.07 +25.28 +0.56 %

-

11:17

Eurozone’s industrial production climbs 2.1% in January

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone climbed 2.1% in January, exceeding expectations for a 1.7% increase, after a 0.5% fall in December. December's figure was revised up from a 1.0% decrease.

Non-durable consumer goods output increased 2.4% in January, capital goods output climbed 3.9%, while energy output rose 2.4%.

Intermediate goods output was up 0.9% in January, while durable consumer goods gained 1.3%.

On a yearly basis, Eurozone's industrial production rise 2.8% in January, exceeding expectations for a 1.4% rise, after a 0.1% decrease in December. December's figure was revised up from a 1.3% drop.

Durable consumer goods climbed by 3.2% in January from a year ago, capital goods rose by 4.6%, non-durable consumer goods gained by 7.3%, while intermediate goods output increased by 1.9%.

Energy output declined by 3.7% in January from a year ago.

-

10:56

Consumer inflation expectations for the coming year in the UK decline to 1.8% in March, the lowest level since November 1999

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK declined to 1.8% in March from 2.0% in November. March's reading was the lowest level since November 1999.

Inflation expectations for coming two years in the U.K. fell to 2.1% in March from 2.3% in November.

The annual consumer price inflation in the U.K. was 0.3% in January, below the central bank's 2% target.

-

10:25

mBank SA earns outlook upgrade to stable from negative S&P

The rating agency Standard & Poor's Rating Services (S&P) changed its outlook for mBank SA (WSE: MBK) from negative to stable due to a similar change in the outlook for Commerzbank AG, the bank said.

mBank S.A. had a negative outlook from 3 February this year.

On March 7, mBank received a rating upgrade to 'BBB' from 'BBB-' from Fitch rating agency following the upgrade of Commerzbank AG.

mBank SA is a unit of German Commerzbank AG which holds 69,49% of shares.

-

10:22

China’s industrial production increases 5.4% year-on-year in January and February

The National Bureau of Statistics said on Saturday that China's industrial production increased 5.4% year-on-year in January and February, missing expectations for a 5.6% rise, down from a 5.9% gain in December.

Fixed-asset investment in China climbed 10.0% year-on-year in the January-February period.

Retail sales in China increased 10.2% year-on-year in January and February, missing expectations for a 10.8% gain, after a 11.1% rise in December.

These data added to concerns over the slowdown in the Chinese economy.

-

10:08

Core machinery orders in Japan climb 15.0% in January

Japan's Cabinet Office released its core machinery orders data on late Sunday evening. Core machinery orders in Japan climbed 15.0% in January, after a 4.2% rise in December. It was the slowest growth since 2008.

The total number of machinery orders climbed 14.3% in January from a month earlier.

Orders from non-manufacturers were up 1.0% in January, while orders from manufacturers soared 41.2%.

On a yearly basis, core machinery orders rose 8.4% in January, beating expectations for a 3.6% decrease, after a 3.6% drop in December.

-

09:11

After opening

Futures market (FW20H16) opens up a rise of 0.26% to 1,920 points. Future contract for the DAX gained even more.

The WIG20 index opened at level of 1917.09 points (+0.33%).

WIG 47427.54 + 0.52% /*

WIG20 1917.09 + 0.33%

WIG30 2143.32 + 0.55%

mWIG40 3558.49 + 0.38%

*/ Change to Previous Close

Locally moods are more balanced, but the goal is met from the beginning, that is, the market remains above acquired on Friday the level of 1900 points.

Last weekend there was a change from winter to summer time in the US. This means that until the "alignment", that is, for the next two weeks, all the macro data from the US, as well as the hour of the session, will be shifted by one hour earlier. So the data, which typically received eg. at 15:30, will appear at 14:30. This means that the growth of global activity can be expected already in the area of 14 o'clock (Warsaw time).

-

08:32

Before opening

Monday's session should be calmer, but there are also some impulses to potential change. On Saturday were published a series of data from China for January and February, where disappoint might have been in relation to industrial production and retail sales. Production growth turned out to be the weakest since 2008, and sales since May 2015. Investment in urban areas were better. Consequently, exchanges in China gain, as in the whole of Asia, which, however, stems from the need to catch up the good mood from Friday, when Europe and the US was seen considerable growth.

In this context morning in Europe can be calmer, although copper is gaining, which supporting mining companies.

-

08:18

Asian session: Japanese yen traded a little lower

Weekend data from China (a miss on industrial production and retail sales, while a beat on fixed asset investment) gave us an early morning dip on the Australian dollar. This shows up as a 'gap' on many charts and, as I have said before numerous times (too often to mention, but here I go again) a small gap against the trend on an early Monday morning is a strong candidate for a filling in. AUD/USD has since traded to a fresh trend high and above last week's highs. The strength looks set to continue.

Japanese yen traded a little lower in the Tokyo morning and then popped on the release of the Machine orders data - the data was a net yen positive but that didn't stop it from weakening. It tested (very briefly) to 114 and is below there as I update at more or less its session mid point.

EUR/USD: during the Asian session the pair traded in the range of $1.1140-75

GBP/USD: during the Asian session the pair traded in the range of $1.4365-85

USD/JPY: during the Asian session the pair traded in a range Y113.65-00

RBNZ Governor Wheeler speaks at 1900GMT. Its a non-public speech that will not be reported. The RBNZ reasons that "the majority of our presentations are off-the-record to allow wider discussions with less risk of candid dialogue being misinterpreted".

Based on ForexLive materials

-

07:33

Global Stocks: key meetings this week by central banks in the U.S. and Japan

European stocks finished higher Friday as investors, viewing measures of the European Central Bank's stimulus as supportive to the financial sector, bought bank shares.

U.S. stocks finished higher Friday, clinching their fourth straight weekly gain and highest close of the year, as crude oil prices rallied and worries about slowing global growth faded.

Shares were up in Asia early Monday, extending a four-week rally ahead of key meetings this week by central banks in the U.S. and Japan. Investors are now looking to the Federal Reserve's meeting on March 15-16. The Bank of Japan is also expected to keep monetary policy unchanged after announcing a move to negative interest rates in late January.

Based on MarketWatch materials

-

03:12

Nikkei 225 17,263.88 +325.01 +1.92 %, Hang Seng 20,363.79 +164.19 +0.81 %, Shanghai Composite 2,824.22 +13.92 +0.50 % \

-

01:02

Stocks. Daily history for Sep Mar 11’2016:

(index / closing price / change items /% change)

Nikkei 225 16,938.87 +86.52 +0.51%

Hang Seng 20,199.6 +215.18 +1.08%

Shanghai Composite 2,809.17 +4.44 +0.16%

FTSE 100 6,139.79 +103.09 +1.71%

CAC 40 4,492.79 +142.44 +3.27%

Xetra DAX 9,831.13 +332.98 +3.51%

S&P 500 2,022.19 +32.62 +1.64%

NASDAQ Composite 4,748.47 +86.31 +1.85%

Dow Jones 17,213.31 +218.18 +1.28%

-