Noticias del mercado

-

17:05

European Central Bank Governing Council member Francois Villeroy de Galhau: the central bank’s new stimulus measures should help to encourage lending

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Monday that the central bank's new stimulus measures should help to encourage lending.

"Our priority, and we made a point of it, is financing the real economy," he said.

de Galhau pointed that there was no deflation in the Eurozone.

-

16:15

European Central Bank purchases €12.51 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.51 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.71 billion of covered bonds, and €185 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% last Thursday. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

16:01

Fitch affirms Greece’s rating to 'CCC'

Rating agency Fitch Ratings on Friday affirmed Greece's sovereign debt rating at 'CCC'.

"Substantial progress has been made towards agreeing the first review of the financial assistance programme with the European Stability Mechanism (ESM) but implementation risks remain," Fitch said.

"The next set of measures agreed with creditors is expected to place greater emphasis on facilitating the workout of non-performing loans and strengthening legal processes and institutions which, if successful, would boost Greece's growth potential," Fitch added.

-

15:55

Fitch cuts Finland’s rating to 'AA+'

Rating agency Fitch Ratings on Friday downgraded Finland's sovereign debt rating to 'AA+' from 'AAA'. The outlook is 'stable'.

According to the agency, the downward revision was driven by a weak economic growth and high public debt.

"In Fitch's view, key macro-economic and public debt metrics are no longer consistent with Finland retaining a 'AAA' rating, particularly given the economy's relatively small size and the vulnerability to idiosyncratic shocks that has been evidenced in recent years," Fitch said.

-

15:17

Preliminary real GDP of G 20 area falls to 0.7% in the fourth quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Monday. Real GDP of G 20 area fell to 0.7% in the fourth quarter from 0.8% in the third quarter.

Real GDP of the United States was down to 0.3% in the fourth quarter from 0.5% in the third quarter, real GDP of Germany remained unchanged at 0.3%, while Britain's economy increased to 0.5% from 0.4%.

GDP of France remained unchanged at 0.3% in the fourth quarter, China's GDP decreased to 1.6% from 1.8%, while Japan's GDP dropped to --0.3% from 0.3%.

Eurozone's economy expanded at 0.3% in the fourth quarter, after a 0.3% rise in the third quarter.

On a yearly basis, GDP of G 20 area was up 3.0% in the fourth quarter, after a 3.1% gain in the previous quarter.

In 2015 as whole, GDP of G 20 area increased 3.2%, after a 3.3% growth in 2014.

-

14:54

Option expiries for today's 10:00 ET NY cut

USDJPY: 112.75 ( USD 539m) 112.85-90 (640m) 113.00 (802m) 113.50 (611m) 114.00 (650m) 114.34-45 (980m)

EURUSD: 1.0990-1.1000 (EUR 1.8bln) 1.1000 (1.2bln) 1.1200 (401m) 1.1250 (924m)

GBPUSD: 1.4275 (GBP 180m) 1.4420 (180m)

USDCHF 0.9900 (USD 279m) 1.0200 (350m)

AUDUSD 0.7400 ( AUD 325m) 0.7450 (553m) 0.7500 (346m)

-

14:30

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the better-than-expected industrial production data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

10:00 Eurozone Industrial production, (MoM) January -0.5% Revised From -1% 1.7% 2.1%

10:00 Eurozone Industrial Production (YoY) January -0.1% Revised From -1.3% 1.4% 2.8%

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded lower against the U.S. dollar despite the better-than-expected industrial production data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone climbed 2.1% in January, exceeding expectations for a 1.7% increase, after a 0.5% fall in December.

Non-durable consumer goods output increased 2.4% in January, capital goods output climbed 3.9%, while energy output rose 2.4%.

On a yearly basis, Eurozone's industrial production rise 2.8% in January, exceeding expectations for a 1.4% rise, after a 0.1% decrease in December. December's figure was revised up from a 1.3% drop.

Durable consumer goods climbed by 3.2% in January from a year ago, capital goods rose by 4.6%, non-durable consumer goods gained by 7.3%, while intermediate goods output increased by 1.9%.

Energy output declined by 3.7% in January from a year ago.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

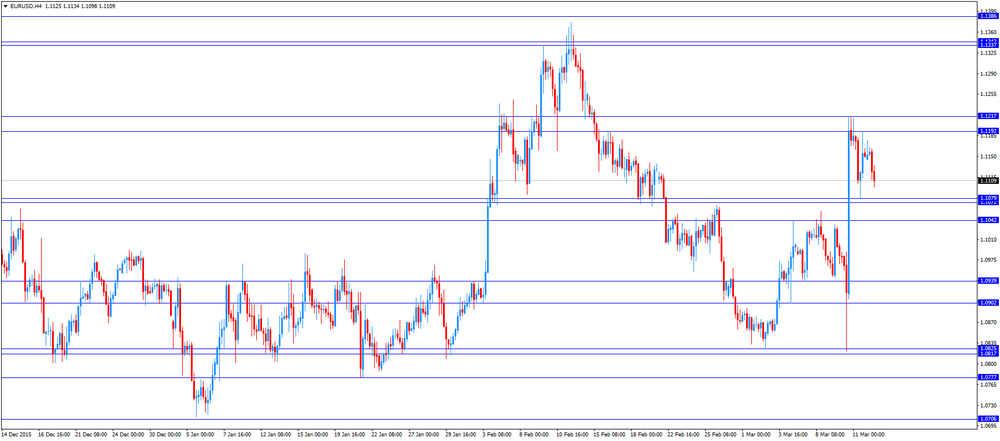

EUR/USD: the currency pair declined to $1.1098

GBP/USD: the currency pair traded mixed

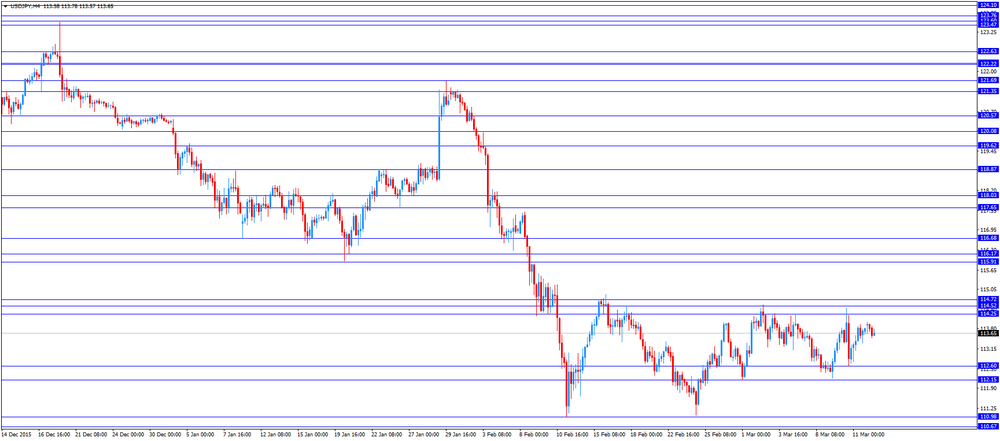

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

19:00 New Zealand RBNZ Governor Graeme Wheeler Speaks

-

14:00

Offers

EUR/USD

Offers 1.1135 1.1150 1.1180 1.1200 1.1230 1.1250-60 1.1275 1.1300 1.1310-20

Bids 1.1100 1.1080 1.1050 1.1030 1.1000 1.0985 1.0950 1.0925-301.0900

GBP/USD

Offers 1.4385 1.4400 1.4420-25 1.4450 1.4475 1.4500 1.4520 1.4550

Bids 1.4325-30 1.4300 1.4280 1.4250 1.4225-30 1.4200 1.4180-85 1.4150

EUR/JPY

Offers 126.80 27.00 127.30 127.50 127.80 128.00 128.50

Bids 126.20 126.00 125.75 125.50 125.00 124.50 124.20 124.00

EUR/GBP

Offers 0.7770 0.7800 0.7820 0.7850 0.7880 0.7900

Bids 0.7725-30 0.7700 0.7675 0.7650

USD/JPY

Offers 113.85 114.00 114.25-30 114.50 114.75 114.85 115.00 115.30 115.50

Bids 113.60 113.20 113.00 112.80 112.40 112.20 112.00 111.85 111.50

AUD/USD

Offers 0.7550 0.7575-80 0.7600 0.7650

Bids 0.7500 0.7475-80 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

11:17

Eurozone’s industrial production climbs 2.1% in January

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone climbed 2.1% in January, exceeding expectations for a 1.7% increase, after a 0.5% fall in December. December's figure was revised up from a 1.0% decrease.

Non-durable consumer goods output increased 2.4% in January, capital goods output climbed 3.9%, while energy output rose 2.4%.

Intermediate goods output was up 0.9% in January, while durable consumer goods gained 1.3%.

On a yearly basis, Eurozone's industrial production rise 2.8% in January, exceeding expectations for a 1.4% rise, after a 0.1% decrease in December. December's figure was revised up from a 1.3% drop.

Durable consumer goods climbed by 3.2% in January from a year ago, capital goods rose by 4.6%, non-durable consumer goods gained by 7.3%, while intermediate goods output increased by 1.9%.

Energy output declined by 3.7% in January from a year ago.

-

11:00

Eurozone: Industrial production, (MoM), January 2.1% (forecast 1.7%)

-

11:00

Eurozone: Industrial Production (YoY), January 2.8% (forecast 1.4%)

-

10:56

Consumer inflation expectations for the coming year in the UK decline to 1.8% in March, the lowest level since November 1999

The Bank of England (BoE) released its quarterly survey on Friday. Consumer inflation expectations for the coming year in the UK declined to 1.8% in March from 2.0% in November. March's reading was the lowest level since November 1999.

Inflation expectations for coming two years in the U.K. fell to 2.1% in March from 2.3% in November.

The annual consumer price inflation in the U.K. was 0.3% in January, below the central bank's 2% target.

-

10:22

China’s industrial production increases 5.4% year-on-year in January and February

The National Bureau of Statistics said on Saturday that China's industrial production increased 5.4% year-on-year in January and February, missing expectations for a 5.6% rise, down from a 5.9% gain in December.

Fixed-asset investment in China climbed 10.0% year-on-year in the January-February period.

Retail sales in China increased 10.2% year-on-year in January and February, missing expectations for a 10.8% gain, after a 11.1% rise in December.

These data added to concerns over the slowdown in the Chinese economy.

-

10:08

Core machinery orders in Japan climb 15.0% in January

Japan's Cabinet Office released its core machinery orders data on late Sunday evening. Core machinery orders in Japan climbed 15.0% in January, after a 4.2% rise in December. It was the slowest growth since 2008.

The total number of machinery orders climbed 14.3% in January from a month earlier.

Orders from non-manufacturers were up 1.0% in January, while orders from manufacturers soared 41.2%.

On a yearly basis, core machinery orders rose 8.4% in January, beating expectations for a 3.6% decrease, after a 3.6% drop in December.

-

09:19

Option expiries for today's 10:00 ET NY cut

USD/JPY: 112.75 ( USD 539m) 112.85-90 (640m) 113.00 (802m) 113.50 (611m) 114.00 (650m) 114.34-45 (980m)

EUR/USD: 1.0990-1.1000 (EUR 1.8bln) 1.1000 (1.2bln) 1.1200 (401m) 1.1250 (924m)

GBP/USD: 1.4275 (GBP 180m) 1.4420 (180m)

USD/CHF 0.9900 (USD 279m) 1.0200 (350m)

AUD/USD 0.7400 ( AUD 325m) 0.7450 (553m) 0.7500 (346m) -

07:07

Options levels on monday, March 14, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1270 (2737)

$1.1237 (1812)

$1.1216 (3153)

Price at time of writing this review: $1.1158

Support levels (open interest**, contracts):

$1.1073 (1288)

$1.1018 (2367)

$1.0950 (3681)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 37180 contracts, with the maximum number of contracts with strike price $1,0900 (3153);

- Overall open interest on the PUT options with the expiration date April, 8 is 61560 contracts, with the maximum number of contracts with strike price $1,0700 (5676);

- The ratio of PUT/CALL was 1.66 versus 1.67 from the previous trading day according to data from March, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.4607 (970)

$1.4510 (1421)

$1.4415 (2463)

Price at time of writing this review: $1.4375

Support levels (open interest**, contracts):

$1.4289 (324)

$1.4192 (589)

$1.4095 (610)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20900 contracts, with the maximum number of contracts with strike price $1,4400 (2463);

- Overall open interest on the PUT options with the expiration date April, 8 is 19191 contracts, with the maximum number of contracts with strike price $1,3850 (3263);

- The ratio of PUT/CALL was 0.92 versus 0.93 from the previous trading day according to data from March, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:01

Currencies. Daily history for Mar 11’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1150 -0,24%

GBP/USD $1,4371 +0,64%

USD/CHF Chf0,9825 -0,23%

USD/JPY Y113,80 +0,55%

EUR/JPY Y126,89 +0,30%

GBP/JPY Y163,54 +1,19%

AUD/USD $0,7559 +1,40%

NZD/USD $0,6741 +1,11%

USD/CAD C$1,3228 -0,88%

-

00:51

Japan: Core Machinery Orders, y/y, January 8.4% (forecast -3.6%)

-