Noticias del mercado

-

22:47

New Zealand: Current Account , Quarter IV -2.61 (forecast -2.8)

-

21:00

U.S.: Net Long-term TIC Flows , January -12.0

-

21:00

U.S.: Total Net TIC Flows, January 118.4

-

17:23

Japan's tertiary industry activity index increases 1.5% in January

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Tuesday. The index increased 1.5% in January, after a 0.6% fall in December.

The rise was driven by increases in wholesale trade, finance and insurance, business-related services, real estate, transport and postal activities, medical, health care and welfare, electricity, gas, heat supply and water, and retail trade.

-

17:17

Final industrial production in Japan climbs 3.7% in January

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Tuesday. Final industrial production in Japan climbed 3.7% in January, in line with the preliminary estimate, after a 1.7% decrease in December.

Industrial shipments jumped 3.5% in January, up from the preliminary estimate of 3.4%, while inventories fell 2.2%, down from the preliminary estimate of -2.1%.

On a yearly basis, Japan's industrial production was down 3.8% in January, after a 1.9% drop in December.

-

16:56

Fitch affirms Australia’s sovereign debt rating at 'AAA'

Rating agency Fitch Ratings affirmed Australia's sovereign debt rating at 'AAA'. The outlook is 'stable'.

The agency noted that Australia's rating was supported by "the economy's high income, strong institutions and effective governance".

"The free-floating exchange rate, credible monetary policy framework, low public debt and growing recognition of the Australian dollar as a reserve currency allow the economy to adjust to changing economic conditions," Fitch added.

-

16:29

U.S. business inventories increase 0.1% in January

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.1% in January, exceeding expectations for a flat reading, after a 0.1% increase in December.

Retail inventories climbed 0.3% in January, wholesale inventories were up 0.3%, while manufacturing inventories decreased 0.4%.

Retail sales declined 0.3% in January, while business sales were down 0.4%.

The business inventories/sales ratio rose to 1.40 months in January from 1.39 months in December. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:21

NAHB housing market index remains unchanged at 58 in March

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index remained unchanged at 58 in March, missing expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index climbed to 43 in March from 39 in February, the current sales conditions sub-index remained unchanged at 65, while the sub-index measuring sales expectations in the next six months decreased to 61 from 64.

"Builders continue to report problems regarding a shortage of lots and labour," the NAHB Chairman Ed Brady.

"Solid job growth, low mortgage rates and improving mortgage availability will help keep the housing market on a gradual upward trajectory in the coming months," the NAHB Chief Economist David Crowe said.

-

15:01

U.S.: NAHB Housing Market Index, March 58 (forecast 59)

-

15:00

U.S.: Business inventories , January 0.1% (forecast 0.0%)

-

14:56

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies after the release of the U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (MoM) February 0.4% Revised From 0.5% -0.1%

00:30 Australia New Motor Vehicle Sales (YoY) February 5.1% 2.3%

00:30 Australia RBA Meeting's Minutes

04:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan Industrial Production (MoM) (Finally) January -1.7% 3.7% 3.7%

04:30 Japan Industrial Production (YoY) (Finally) January -1.9% -3.8% -3.8%

06:30 Japan BOJ Press Conference

10:00 Eurozone Employment Change Quarter IV 0.3% 0.2% 0.3%

12:30 U.S. Retail sales February -0.4% Revised From 0.2% -0.1% -0.1%

12:30 U.S. Retail Sales YoY February 3.0% Revised From 3.4% 3.1%

12:30 U.S. Retail sales excluding auto February -0.4% Revised From 0.1% -0.2% -0.1%

12:30 U.S. PPI, m/m February 0.1% -0.2% -0.2%

12:30 U.S. PPI, y/y February -0.2% 0.1% 0%

12:30 U.S. PPI excluding food and energy, m/m February 0.4% 0.1% 0.0%

12:30 U.S. PPI excluding food and energy, Y/Y February 0.6% 1.2%

12:30 U.S. NY Fed Empire State manufacturing index March -16.64 -10 0.62

The U.S. dollar traded mixed against the most major currencies after the release of the U.S. economic data. The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales decreased 0.1% in February, in line with expectations, after a 0.4% drop in January. January's figure was revised down from a 0.2% increase.

The decrease was mainly driven by a drop in sales at auto dealerships.

The U.S. producer price index declined 0.2% in February, in line with expectations, after a 0.1% rise in January.

The decrease was mainly driven by drops in energy and food prices. Energy prices declined 3.4% in February, wholesale food prices decreased 0.3%.

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index jumped to 0.62 in March from -16.64 in February, exceeding expectations for an increase to -10.00.

The euro traded mixed against the U.S. dollar after the better-than-expected employment data from the Eurozone. Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% gain, after a 0.3% rise in the third quarter.

Main contributors were Malta (+1.7%), Spain, Luxembourg and Portugal (all +0.7%).

On a yearly basis, employment in the Eurozone increased by 1.2% in the fourth quarter, after a 1.1% gain in the third quarter.

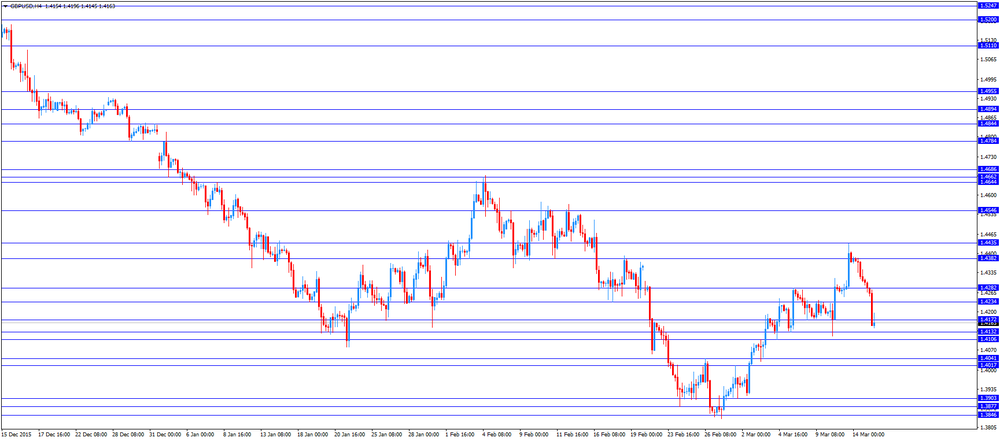

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

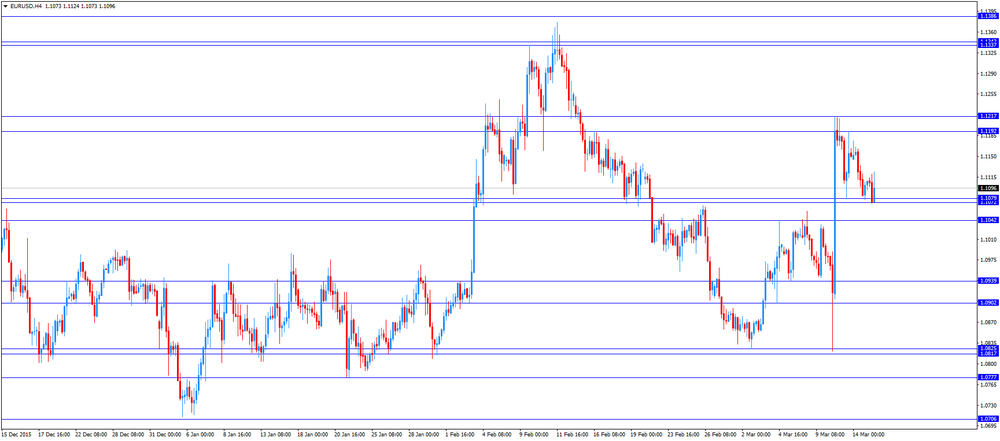

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.14145

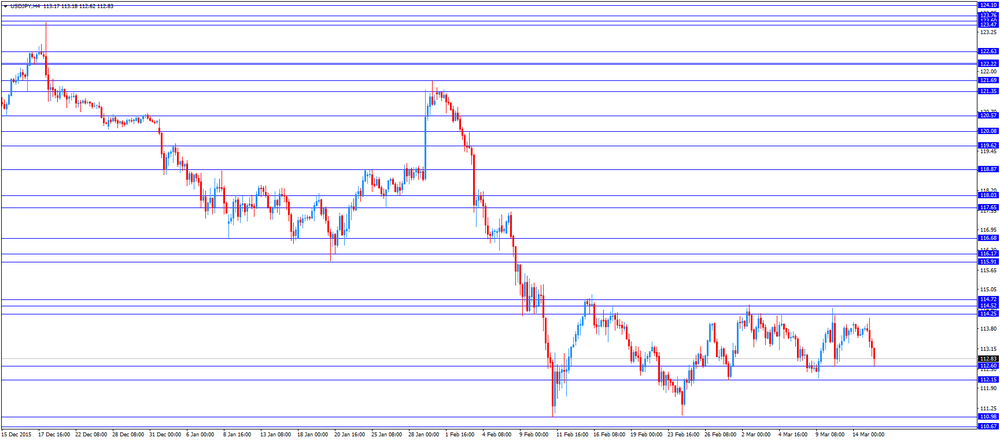

USD/JPY: the currency pair fell to Y112.62

The most important news that are expected (GMT0):

14:00 U.S. Business inventories January 0.1% 0.0%

14:00 U.S. NAHB Housing Market Index March 58 59

20:00 U.S. Total Net TIC Flows January -114

20:00 U.S. Net Long-term TIC Flows January -29.4

21:45 New Zealand Current Account Quarter IV -4.75 -2.8

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY: 113.00 (USD 575m) 113.50 (453m) 114.00 (500m)

EURUSD: 1.0885 (EUR 551m) 1.0900 (752m) 1.1000 (435m) 1.1095-1.1100 (488m)

GBPUSD: None listed

USDCHF 0.9815 (USD 224m) 1.0000 (206m)

AUDUSD 0.7350 (AUD 315m) 0.7500 (701m)

USDCAD 1.3350 (USD 425m) 1.3475 (250m)

NZDUSD 0.6400 (NZD 315m) 0.6600 (251m)

-

14:48

NY Fed Empire State manufacturing index rises to 0.62 in March

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index jumped to 0.62 in March from -16.64 in February, exceeding expectations for an increase to -10.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The March 2016 Empire State Manufacturing Survey indicates that business activity steadied for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to 9.57 in March from -11.63 in February, while the shipments index climbed to 13.88 from -11.56.

The general business conditions expectations index for the next six months jumped to 25.52 in March from 14.48 in February.

The price-paid index remained unchanged at 2.97 in March.

The index for the number of employees fell to -1.98 in March from -0.99 in February.

-

14:43

U.S. producer prices fall 0.2% in February

The U.S. Commerce Department released the producer price index figures on Tuesday. The U.S. producer price index declined 0.2% in February, in line with expectations, after a 0.1% rise in January.

The decrease was mainly driven by drops in energy and food prices. Energy prices declined 3.4% in February, wholesale food prices decreased 0.3%.

Services prices were flat in February.

On a yearly basis, the producer price index was flat in February, missing expectations for a 0.1% increase, after a 0.2% fall in January.

The producer price index excluding food and energy was flat in February, missing expectations for a 0.1% gain, after a 0.4% increase in January.

On a yearly basis, the producer price index excluding food and energy climbed 1.2% in February, after a 0.6% rise in January.

These figures could mean that the Fed will delay its further interest rate hikes.

-

14:28

U.S. retail sales decline 0.1% in February

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales decreased 0.1% in February, in line with expectations, after a 0.4% drop in January. January's figure was revised down from a 0.2% increase.

The decrease was mainly driven by a drop in sales at auto dealerships.

Sales at clothing retailers were up 0.9% in February, sales at building material and garden equipment stores increased 1.6%, while sales at auto dealerships slid 0.2%.

Retail sales excluding automobiles declined 0.1% in February, beating expectations for a 0.2% fall, after a 0.4% decrease in January. January's figure was revised down from a 0.1% rise.

Sales at service stations dropped 4.4% in February, while sales at furniture stores fell 0.5%.

These figures could mean that the Fed will likely not raise its interest rate in March as consumers remained cautious.

-

14:20

Orders

EUR/USD

Offers 1.1125 1.1150 1.1180 1.1200 1.1230 1.1250-60 1.1275 1.1300 1.1310-20

Bids 1.1075-80 1.1050 1.1030 1.1000 1.0985 1.0950 1.0925-30 1.0900

GBP/USD

Offers 1.4250-55 1.4280 1.4300 1.4320 1.4350 1.4385 1.4400 1.4420-25 1.4450

Bids 1.4220 1.4200 1.4180-85 1.4150 1.4130 1.4100 1.4080 1.4065 1.4050

EUR/JPY

Offers 125.80 126.00 126.309 126.50 126.80 27.00 127.30 127.50

Bids 125.20 125.00 124.50 124.20 124.00

EUR/GBP

Offers 0.7820 0.7850 0.7880 0.7900 0.7925 0.7950

Bids 0.7785 0.7770 0.7750 0.7725-30 0.7700 0.7675 0.7650

USD/JPY

Offers 113.20 113.35 113.50 113.80-85 114.00 114.25-30 114.50

Bids 112.80 112.40 112.20 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers 0.7500 0.7550 0.7575-80 0.7600 0.7650

Bids 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

13:32

U.S.: PPI excluding food and energy, Y/Y, February 1.2%

-

13:30

U.S.: PPI, m/m, February -0.2% (forecast -0.2%)

-

13:30

U.S.: PPI excluding food and energy, m/m, February 0.0% (forecast 0.1%)

-

13:30

U.S.: PPI, y/y, February 0% (forecast 0.1%)

-

13:30

U.S.: NY Fed Empire State manufacturing index , March 0.62 (forecast -10)

-

13:30

U.S.: Retail sales, February -0.1% (forecast -0.1%)

-

13:30

U.S.: Retail sales excluding auto, February -0.1% (forecast -0.2%)

-

13:30

U.S.: Retail Sales YoY, February 3.1%

-

11:44

Bank of Japan Governor Haruhiko Kuroda: the central bank needs time to analyse the effect of negative interest rates on the real economy

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference after the release of the BoJ' interest rate decision that the central bank needed time to analyse the effect of negative interest rates on the real economy, adding that negative interest rates would lead to lower borrowing costs.

He reiterated that the BoJ would further stimulus measures if needed to reach 2% inflation target.

-

11:33

Final consumer prices in Italy decline 0.2% in February

The Italian statistical office Istat released its final consumer price inflation data for Italy on Tuesday. Final consumer prices in Italy fell 0.2% in February, in line with preliminary reading, after a 0.2% decrease in January.

The drop was mainly driven by a decline in prices of energy products, which fell 1.2% in February.

On a yearly basis, consumer prices declined 0.3% in February, in line with preliminary reading, after a 0.3% increase in January.

The declines was mainly driven by a faster decline of prices of non-regulated energy products, and drops in prices of unprocessed food and services related to transport. Prices of non-regulated energy products slid 8.5% year-on-year in February, prices of unprocessed food declined 1.2%, while prices of services related to transport decreased 0.7%.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in February from 0.8% in January.

-

11:17

French final consumer price inflation rises 0.3% in February

The French statistical office Insee released its final consumer price inflation for France on Tuesday. The French consumer price inflation rose 0.3% in February, up from the preliminary reading of 0.2%, after a 1.0% drop in January.

On a yearly basis, the consumer price index decreased 0.2% in February, in line with the preliminary reading, after a 0.2% rise in January. It was first fall since March 2015.

Fresh food prices rose 0.4% year-on-year in February, services prices climbed by 0.8%, while petroleum products prices dropped by 12.8%.

-

11:11

Eurozone's employment increases by 0.3% in the fourth quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% gain, after a 0.3% rise in the third quarter.

Main contributors were Malta (+1.7%), Spain, Luxembourg and Portugal (all +0.7%).

On a yearly basis, employment in the Eurozone increased by 1.2% in the fourth quarter, after a 1.1% gain in the third quarter.

-

11:00

Eurozone: Employment Change, Quarter IV 0.3% (forecast 0.2%)

-

10:39

March’s Reserve Bank of Australia monetary policy meeting: the Australian economy expands slightly below the trend

The Reserve Bank of Australia (RBA) released its minutes from March monetary policy meeting on Tuesday. The RBA said that the Australian economy expanded slightly below the trend, adding that there were "further signs of a rebalancing of activity towards non-mining sectors of the economy".

The RBA noted that the employment was expected to grow, while wages remained at low levels.

Members also said that further interest rate cut may be needed.

"Members noted that continued low inflation would provide scope to ease monetary policy further, should that be appropriate to lend support to demand," the minutes said.

The central bank will analyse the incoming economic data, the RBA said in its minutes.

The RBA kept unchanged its interest rate at 2.00% in March.

-

10:26

Bank of Japan keeps its interest rate unchanged at -0.1% in March

The Bank of Japan (BoJ) released its interest rate decision on Tuesday. The central bank kept its interest rate unchanged at -0.1% as widely expected by analysts. The monetary base target remained unchanged at 275 trillion yen, while the central bank said that it will expand its monetary base at an annual pace of 80 trillion yen as expected by analysts.

7 of 9 board members voted to keep interest rate unchanged, while 8 of 9 members voted for raising the monetary base at an annual pace of 80 trillion yen.

The central bank noted that it would expand its stimulus measures if needed to reach 2% inflation target.

The BoJ said that Japan's economy continued to expand moderately, but exports and production were sluggish due the slowdown in emerging economies, adding that domestic private consumption was resilient.

The central bank expects consumer inflation to be about 0% "for the time being" due to low energy prices.

-

10:12

Federal Reserve Bank of New York’s survey: consumer inflation expectations rise in February

The Federal Reserve Bank of New York released its February 2016 Survey of Consumer Expectations on Monday. Consumer inflation expectations for the coming year in the U.S. rose to 2.7% in February from 2.4% in January.

Inflation expectations for coming three years in the U.S. increased to 2.6% in February from 2.5% in January.

The increase was driven by a rise in expectations for gas prices.

-

09:22

Option expiries for today's 10:00 ET NY cut

USD/JPY: 113.00 (USD 575m) 113.50 (453m) 114.00 (500m)

EUR/USD: 1.0885 (EUR 551m) 1.0900 (752m) 1.1000 (435m) 1.1095-1.1100 (488m)

USD/CHF 0.9815 (USD 224m) 1.0000 (206m)

AUD/USD 0.7350 (AUD 315m) 0.7500 (701m)

USD/CAD 1.3350 (USD 425m) 1.3475 (250m)

NZD/USD 0.6400 (NZD 315m) 0.6600 (251m) -

08:22

Asian session: The Australian dollar fell

The Australian dollar fell as RBA March meeting minutes. There was not much to surprise in them, though there was an extended discussion on the risks posed by China (and the positives too, the RBA is inclined to be objective, to not simply (and lazily) focus on the negatives). The Australian dollar remained under pressure, managing a pop to just above 0.7520 before hitting new lows (from overnight trade).

The yen strengthened the most in a week after the Bank of Japan held policy steady as expected and offered a bleaker view of the country's economy in the face of lingering anxiety over slowing global growth. The BOJ also removed language from its statement that it would cut interest rates further into negative territory if needed, a little more than six weeks after it shocked markets by adopting minus rates in stepped up efforts to revitalize growth and stoke inflation.

EUR/USD: during the Asian session the pair traded in the range of $1.1090-15GBP/USD: during the Asian session the pair dropped to $1.4265

USD/JPY: during the Asian session the pair fell to Y113.25

Based on ForexLive materials -

08:15

Options levels on tuesday, March 15, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1247 (1119)

$1.1201 (2032)

$1.1157 (3150)

Price at time of writing this review: $1.1095

Support levels (open interest**, contracts):

$1.1048 (1180)

$1.1002 (2539)

$1.0941 (4559)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 37901 contracts, with the maximum number of contracts with strike price $1,0900 (3150);

- Overall open interest on the PUT options with the expiration date April, 8 is 62364 contracts, with the maximum number of contracts with strike price $1,0900 (5819);

- The ratio of PUT/CALL was 1.65 versus 1.66 from the previous trading day according to data from March, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.4506 (1429)

$1.4410 (2464)

$1.4314 (890)

Price at time of writing this review: $1.4255

Support levels (open interest**, contracts):

$1.4190 (613)

$1.4093 (610)

$1.3995 (1529)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20925 contracts, with the maximum number of contracts with strike price $1,4400 (2464);

- Overall open interest on the PUT options with the expiration date April, 8 is 19291 contracts, with the maximum number of contracts with strike price $1,3850 (3266);

- The ratio of PUT/CALL was 0.92 versus 0.92 from the previous trading day according to data from March, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:46

Japan: Industrial Production (YoY), January -3.8% (forecast -3.8%)

-

05:32

Japan: Industrial Production (MoM) , January 3.7% (forecast 3.7%)

-

04:58

Japan: BoJ Interest Rate Decision, -0.1%

-

04:58

Japan: Bank of Japan Monetary Base Target, 275

-

01:32

Australia: New Motor Vehicle Sales (MoM) , February -0.1%

-

01:32

Australia: New Motor Vehicle Sales (YoY) , February 2.3%

-

00:31

Currencies. Daily history for Mar 14’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1101 -0,44%

GBP/USD $1,4300 -0,50%

USD/CHF Chf0,9871 +0,47%

USD/JPY Y113,79 -0,01%

EUR/JPY Y126,32 -0,45%

GBP/JPY Y162,71 -0,51%

AUD/USD $0,7507 -0,69%

NZD/USD $0,6669 -1,08%

USD/CAD C$1,3265 +0,28%

-

00:01

Schedule for today, Tuesday, Mar 15’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia New Motor Vehicle Sales (MoM) February 0.5%

00:30 Australia New Motor Vehicle Sales (YoY) February 5.1%

00:30 Australia RBA Meeting's Minutes

04:00 Japan BoJ Interest Rate Decision -0.1%

04:00 Japan Bank of Japan Monetary Base Target 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan Industrial Production (MoM) (Finally) January -1.7%

04:30 Japan Industrial Production (YoY) (Finally) January -1.9%

06:30 Japan BOJ Press Conference

10:00 Eurozone Employment Change Quarter IV 0.3%

12:30 U.S. Retail sales February 0.2% -0.2%

12:30 U.S. Retail Sales YoY February 3.4%

12:30 U.S. Retail sales excluding auto February 0.1% -0.2%

12:30 U.S. PPI, m/m February 0.1% -0.1%

12:30 U.S. PPI, y/y February -0.2% 0.1%

12:30 U.S. PPI excluding food and energy, m/m February 0.4% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y February 0.6%

12:30 U.S. NY Fed Empire State manufacturing index March -16.64 -9.5

14:00 U.S. Business inventories January 0.1% 0.0%

14:00 U.S. NAHB Housing Market Index March 58 59

20:00 U.S. Total Net TIC Flows January -114

20:00 U.S. Net Long-term TIC Flows January -29.4

21:45 New Zealand Current Account Quarter IV -4.75

-