Noticias del mercado

-

23:58

Schedule for today, Thursday, Mar 17’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Bulletin

00:30 Australia Changing the number of employed February -7.9 10

00:30 Australia Unemployment rate February 6.0% 6%

06:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:15 Switzerland Producer & Import Prices, m/m February -0.4% 0.2%

08:15 Switzerland Producer & Import Prices, y/y February -5.3% -5.1%

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

10:00 Eurozone Trade balance unadjusted January 24.3 9.0

10:00 Eurozone Harmonized CPI February -1.4% 0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) February 0.3% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) February 1% 0.7%

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375

12:30 Canada Wholesale Sales, m/m January 2.0% 0.2%

12:30 U.S. Current account, bln Quarter IV -124.1 -118

12:30 U.S. Continuing Jobless Claims March 2225 2229

12:30 U.S. Philadelphia Fed Manufacturing Survey March -2.8 -1.5

12:30 U.S. Initial Jobless Claims March 259 266

14:00 U.S. Leading Indicators February -0.2% 0.2%

14:00 U.S. JOLTs Job Openings January 5.607 5.566

23:50 Japan Monetary Policy Meeting Minutes

-

22:45

New Zealand: GDP y/y, Quarter IV 2.3% (forecast 2%)

-

22:45

New Zealand: GDP q/q, Quarter IV 0.9% (forecast 0.6%)

-

19:00

U.S.: Fed Interest Rate Decision , 0.5% (forecast 0.5%)

-

17:28

Australian leading economic index declines 0.2% in February

Westpac Bank released the Westpac-Melbourne Institute leading economic index for Australia on late Tuesday evening. The leading economic index declined 0.2% in February, after a 0.1% rise in January. January's figure was revised up from a flat reading.

"Despite some improvement over the last two months, the Leading Index continues to point to below trend growth through much of 2016, implying a slowdown from 2015's slightly above trend pace," Westpac's Chief Economist, Matthew Hassan, said.

-

17:15

U.K. leading economic index increases 0.2% in January

The Conference Board (CB) released its leading economic index for the U.K. on Wednesday. The leading economic index (LEI) increased 0.2% in January, after a 0.3% rise in December. December's figure was revised down from a 0.4% gain.

The coincident index rose 0.3% in January, after a 0.1% decline in December. December's figure was revised down from a flat reading.

-

17:04

Britain’s government cuts growth and inflation forecasts

Britain's Chancellor George Osborne presented the budget 2016 on Wednesday. Growth and inflation forecasts were lowered. According to the U.K. Office for Budget Responsibility (OBR), the U.K. economy is expected to expand 2.0% in 2016, down from the previous forecast of 2.4%, and 2.2% in 2017, down from the previous forecast of 2.5%.

Inflation is expected to be 0.7% in 2016, down from the previous forecast of 1.0%, and 1.6% in 2017, down from the previous forecast of 1.8%.

Osborne said that the global economic outlook was weak, due to the slowdown in emerging economies and a weak growth in the developed economies.

The chancellor warned that Britain's exit from the European Union ('Brexit') would have a negative impact on the economy.

"Brexit could have negative implications for activity via business and consumer confidence and might result in greater volatility in financial and other asset markets," Osborne said.

The government will miss its public debt target. Debt forecasts as a share of GDP were upgraded.

-

15:31

U.S.: Crude Oil Inventories, March 1.317

-

15:02

U.S. weekly earnings decline 0.5% in February

The U.S. Labor Department released its real earnings data on Wednesday. Average weekly earnings declined 0.5% in February, after a 0.7% increase in January.

Average hourly earnings were flat in February, after a 0.5% rise in January.

On a yearly basis, real average weekly earnings increased 0.6% in February, while hourly earnings rose 1.2%.

-

14:53

Foreign exchange market. European session: the U.S. dollar traded higher against the most major currencies after the release of the mixed U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

09:30 United Kingdom Average Earnings, 3m/y January 1.9% 2% 2.1%

09:30 United Kingdom ILO Unemployment Rate January 5.1% 5.1% 5.1%

09:30 United Kingdom Claimant count February -28.4 Revised From -14.8 -9.1 -18

10:00 Eurozone Construction Output, y/y January 0.4% Revised From -0.4% 6%

11:00 U.S. MBA Mortgage Applications March 0.2% -3.3%

12:30 United Kingdom Annual Budget Release

12:30 Canada Foreign Securities Purchases January -1.40 Revised From -1.41 13.51

12:30 Canada Manufacturing Shipments (MoM) January 1.4% Revised From 1.2% 0.5% 2.3%

12:30 U.S. Housing Starts February 1120 Revised From 1099 1150 1178

12:30 U.S. Building Permits February 1204 Revised From 1202 1200 1167

12:30 U.S. CPI, m/m February 0.0% -0.2% -0.2%

12:30 U.S. CPI, Y/Y February 1.4% 0.9% 1.0%

12:30 U.S. CPI excluding food and energy, m/m February 0.3% 0.2% 0.3%

12:30 U.S. CPI excluding food and energy, Y/Y February 2.2% 2.2% 2.3%

13:15 U.S. Capacity Utilization February 77.1% 76.9% 76.7%

13:15 U.S. Industrial Production (MoM) February 0.8% Revised From 0.9% -0.3% -0.5%

13:15 U.S. Industrial Production YoY February -0.7% -1%

The U.S. dollar traded higher against the most major currencies after the release of the mixed U.S. economic data. The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. jumped 5.2% to 1.178 million annualized rate in February from a 1.120 million pace in January, exceeding expectations for an increase to 1.150 million. The increase was mainly driven by rise in starts of single-family homes.

The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation fell 0.2% in February, in line with expectations, after a flat reading in January.

The index was mainly driven by lower gasoline prices, which slid 13% in February.

On a yearly basis, the U.S. consumer price index decreased to 1.0% in February from 1.4% in January, beating expectations for a fall to 0.9%.

The U.S. consumer price inflation excluding food and energy gained 0.3% in February, exceeding expectations for a 0.2% rise, after a 0.3% increase in January. It was the largest rise since May 2012.

The increase was driven by rents and medical costs.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.3% in February from 2.2% in January, beating expectations for a 2.2% rise.

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production slid 0.5% in February, missing expectations for a 0.3% decrease, after a 0.8% rise in January. The decline was mainly driven by a drop in utilities.

Market participants are awaiting the release of the Fed's interest rate decision later in the day. Analysts expect the Fed to keep its monetary policy unchanged.

The euro traded lower against the U.S. dollar despite the strong construction data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone climbed 3.6% in January, after a 0.7% decline in December.

Civil engineering output rose 1.7% in January, while production in the building sector was up 4.1%.

On a yearly basis, construction output jumped 6.0% in January, after a 0.4% gain in December. December's figure was revised up from a 0.4% drop.

Civil engineering output increased 1.4% year-on-year in January, while production in the building sector climbed 7.1% year-on-year.

The British pound traded lower against the U.S. dollar as the U.K. Office for Budget Responsibility (OBR) downgrades its growth and inflation forecasts. The U.K. economy is expected to expand 2.0% in 2016, down from the previous forecast of 2.4%, and 2.2% in 2017, down from the previous forecast of 2.5%.

Inflation is expected to be 0.7% in 2016, down from the previous forecast of 1.0%, and 1.6% in 2017, down from the previous forecast of 1.8%.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the November to January quarter, in line with expectations.

The claimant count slid by 18,000 people in February, beating expectations for a fall by 9,100, after a decrease of 28,400 people in January. January's figure was revised down from a 14,800 decrease.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the November to January quarter, after a 2.0% gain in the October to December quarter.

Average weekly earnings, including bonuses, rose by 2.1% in the November to January quarter, in exceeding expectations for a 2.0% gain, after a 1.9% increase in the October to December quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Canadian dollar traded mixed against the U.S. dollar after the release of the positive Canadian economic data. Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments rose 2.3% in January, beating expectations for a 0.5% increase, after a 1.4% increase in December. December's figure was revised up from a 1.2% rise. The increase was mainly driven by higher motor vehicle products sales. Motor vehicle rose 9.6% in January, while sales of food climbed 4.6%.

Statistics Canada released foreign investment figures on Wednesday. Foreign investors purchased C$13.51 billion of Canadian securities in January, after a divestment of C$1.40 billion in December. December's figure was revised up from a divestment of C$1.41 billion. The investment was led by Canadian private corporate debt securities.

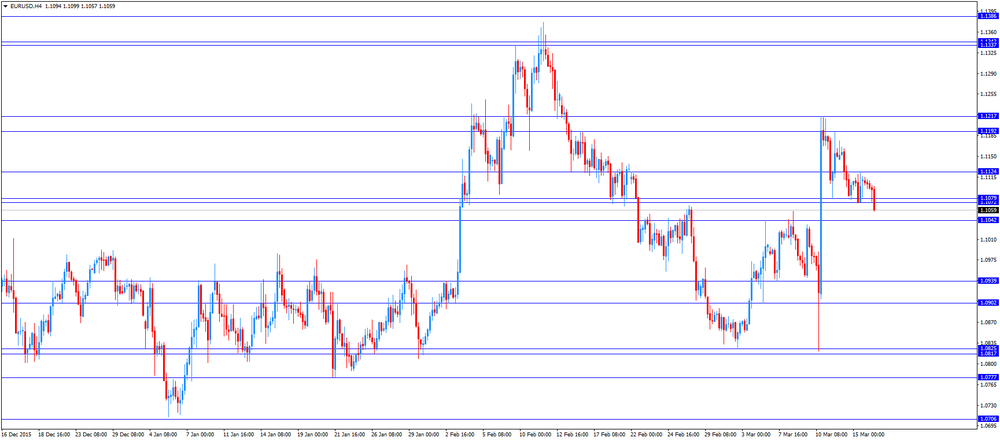

EUR/USD: the currency pair dropped to $1.1057

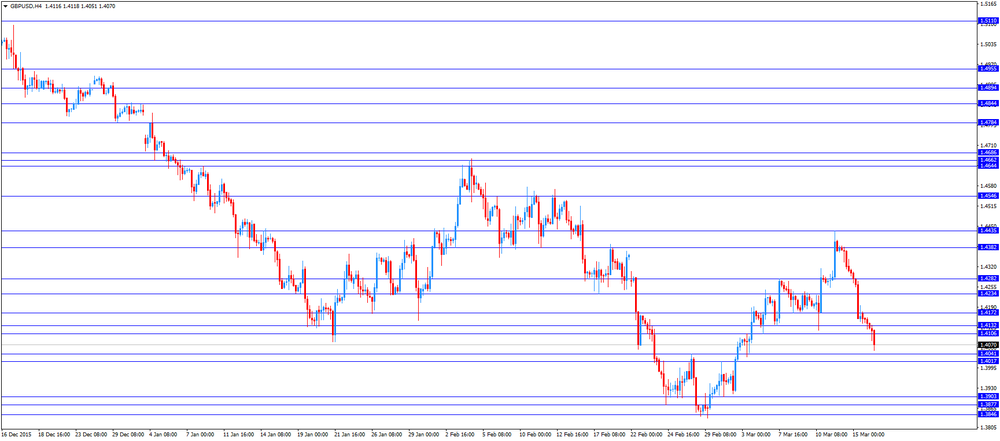

GBP/USD: the currency pair declined to $1.4051

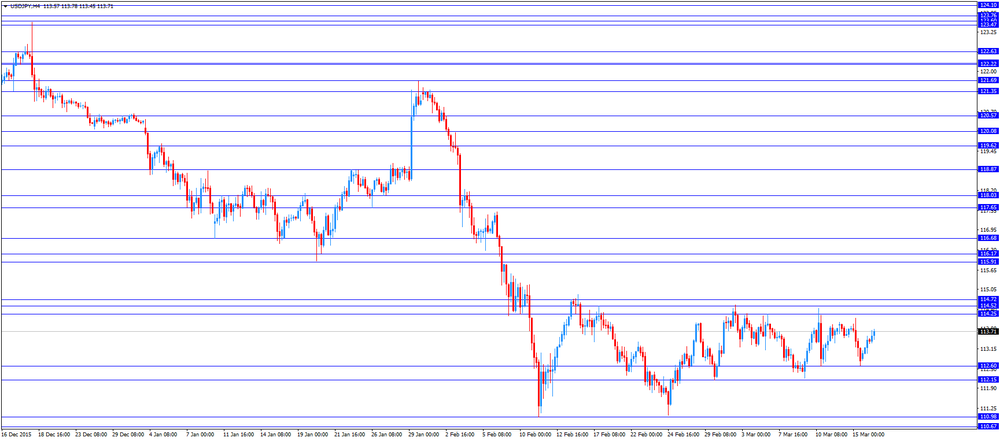

USD/JPY: the currency pair rose to Y113.78

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories March 3.88

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter IV 0.9% 0.6%

21:45 New Zealand GDP y/y Quarter IV 2.3% 2%

22:05 Australia RBA Assist Gov Debelle Speaks

23:50 Japan Trade Balance Total, bln February -645.9 388.6

-

14:49

Option expiries for today's 10:00 ET NY cut

USDJPY: 110.55 (USD 250m) 113.00 (USD430m) 113.50 (453m) 114.00 (500m)

EURUSD: 1.0800 (EUR 1.13bln) 1.0860-65 (397m) 1.0900 (313m) 1.0955 (279m) 1.0975 (298m) 1.1050 (680m) 1.1200-05 (402m) 1.1250 (763m) 1.1300 (420m)

USDCHF 0.9800 (USD 180m) 1.0000 (201m)

AUDUSD 0.7350 (AUD 200m) 0.7450 (198m) 0..7500 (181m) 0.7550 (302m)

USDCAD 1.3400-10 (USD 430m) 1.3445 (206m)

AUDNZD 1.1100 ( AUD (238M)

EURJPY 127.90-95 (EUR 496m)

-

14:37

U.S. industrial production slides 0.5% in February

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production slid 0.5% in February, missing expectations for a 0.3% decrease, after a 0.8% rise in January. January's figure was revised down from a 0.9% increase.

The decline was mainly driven by a drop in utilities. Mining output fell 1.4% in February, while utilities production plunged 4.0%.

Manufacturing output rose 0.2% in February, after a 0.5% gain in January.

Capacity utilisation rate decreased to 76.7% in February from 77.1% in January, missing expectations for a decline to 76.9%.

-

14:27

Foreign investors purchase C$13.51 billion of Canadian securities in January

Statistics Canada released foreign investment figures on Wednesday. Foreign investors purchased C$13.51 billion of Canadian securities in January, after a divestment of C$1.40 billion in December. December's figure was revised up from a divestment of C$1.41 billion.

The investment was led by Canadian private corporate debt securities.

Canadian investors sold C$13.8 billion of foreign securities in January, mainly equities.

-

14:22

Orders

EUR/USD

Offers 1.1100 1.1120 1.1150 1.1180 1.1200 1.1230 1.1250-60 1.1275 1.1300 1.1310-20

Bids 1.1075-80 1.1050 1.1030 1.1000 1.0985 1.0950 1.0925-30 1.0900

GBP/USD

Offers 1.4125-30 1.4150 1.4180 1.4200 1.4220 1.4250-55 1.4280 1.4300 1.4320 1.4350

Bids 1.4080-85 1.4065 1.4050 1.4030 1.4000 1.3985 1.3970 1.3950 1.3900

EUR/JPY

Offers 126.00 126.30 126.50 126.80 27.00 127.30 127.50

Bids 125.80 125.50 125.20 125.00 124.50 124.20 124.00

EUR/GBP

Offers 0.7880 0.7900 0.7925 0.7950 0.7985 0.8000

Bids 0.7840 0.7820 0.7800 0.7785 0.7770 0.7750

USD/JPY

Offers 113.80-85 114.00 114.25-30 114.50 114.76 115.00 115.50

Bids 113.30 113.00 112.80 112.40 112.20 112.00 111.85 111.50 111.30 111.00

AUD/USD

Offers 0.7500 0.7525-30 0.7550 0.7575-80 0.7600 0.7650

Bids 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

14:16

Canadian manufacturing shipments rise 2.3% in January

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments rose 2.3% in January, beating expectations for a 0.5% increase, after a 1.4% increase in December. December's figure was revised up from a 1.2% rise.

The increase was mainly driven by higher motor vehicle products sales. Motor vehicle rose 9.6% in January, while sales of food climbed 4.6%.

Inventories increased 0.6% in January, driven by a rise in the transportation equipment industry.

-

14:15

U.S.: Industrial Production (MoM), February -0.5% (forecast -0.3%)

-

14:15

U.S.: Capacity Utilization, February 76.7% (forecast 76.9%)

-

14:15

U.S.: Industrial Production YoY , February -1%

-

14:10

U.S. consumer price inflation drops 0.2% in February

The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation fell 0.2% in February, in line with expectations, after a flat reading in January.

The index was mainly driven by lower gasoline prices, which slid 13% in February.

Shelter costs climbed 0.3% in February, medical care costs were up 0.5%, while food prices increased 0.2%.

On a yearly basis, the U.S. consumer price index decreased to 1.0% in February from 1.4% in January, beating expectations for a fall to 0.9%.

The U.S. consumer price inflation excluding food and energy gained 0.3% in February, exceeding expectations for a 0.2% rise, after a 0.3% increase in January. It was the largest rise since May 2012.

The increase was driven by rents and medical costs.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.3% in February from 2.2% in January, beating expectations for a 2.2% rise.

The consumer price index is not preferred Fed's inflation measure.

-

13:59

Housing starts in the U.S. jump 5.2% in February

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. jumped 5.2% to 1.178 million annualized rate in February from a 1.120 million pace in January, exceeding expectations for an increase to 1.150 million. January's figure was revised up from 1.099 million units.

The increase was mainly driven by rise in starts of single-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. fell 3.1% to 1.1167 million annualized rate in February from a 1.204 million pace in January, missing expectations for a 1,200 million pace. January's figure was revised up from 1.202 million units.

Starts of single-family homes increased 7.2% in February. Building permits for single-family homes were up 0.4%.

Starts of multifamily buildings rose 0.8% in February. Permits for multi-family housing slid 8.4%.

-

13:31

U.S.: Building Permits, February 1167 (forecast 1200)

-

13:31

Canada: Manufacturing Shipments (MoM), January 2.3% (forecast 0.5%)

-

13:30

U.S.: Housing Starts, February 1178 (forecast 1150)

-

13:30

U.S.: CPI, Y/Y, February 1.0% (forecast 0.9%)

-

13:30

U.S.: CPI, m/m , February -0.2% (forecast -0.2%)

-

13:30

U.S.: CPI excluding food and energy, m/m, February 0.3% (forecast 0.2%)

-

13:30

Canada: Foreign Securities Purchases, January 13.51

-

13:30

U.S.: CPI excluding food and energy, Y/Y, February 2.3% (forecast 2.2%)

-

12:00

U.S.: MBA Mortgage Applications, March -3.3%

-

11:42

European Central Bank Governing Council member Ardo Hansson warns about the side effects on the financial stability from the central bank’s stimulus measures

European Central Bank (ECB) Governing Council member Ardo Hansson on Wednesday warned about the side effects on the financial stability from the central bank's stimulus measures. He noted that the monetary policy could lead to asset price bubbles.

Hansson also said that governments would not implement reforms as they could get cheap money.

Hansson voted against further stimulus measures last Thursday.

-

11:25

Construction production in the Eurozone climbs 3.6% in January

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone climbed 3.6% in January, after a 0.7% decline in December.

Civil engineering output rose 1.7% in January, while production in the building sector was up 4.1%.

On a yearly basis, construction output jumped 6.0% in January, after a 0.4% gain in December. December's figure was revised up from a 0.4% drop.

Civil engineering output increased 1.4% year-on-year in January, while production in the building sector climbed 7.1% year-on-year.

-

11:17

U.K. unemployment rate remains unchanged at 5.1% in the November to January quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the November to January quarter, in line with expectations.

The claimant count slid by 18,000 people in February, beating expectations for a fall by 9,100, after a decrease of 28,400 people in January. January's figure was revised down from a 14,800 decrease.

U.K. unemployment in the November to January period dropped by 28,000 to 1.68 million from the previous quarter.

The employment rate was 74.1% in the November to January quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.2% in the November to January quarter, after a 2.0% gain in the October to December quarter.

Average weekly earnings, including bonuses, rose by 2.1% in the November to January quarter, in exceeding expectations for a 2.0% gain, after a 1.9% increase in the October to December quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:00

Eurozone: Construction Output, y/y, January 6%

-

10:50

China’s Premier Li Keqiang: China will achieve all economic growth targets

China's Premier Li Keqiang said on Wednesday that the country will achieve all economic growth targets, adding that there will be no "hard landing". He noted that the government should be able to stimulate the country's economy via structural reforms.

The government expect the economy to expand 6.5% - 7.0% this year and at least 6.5% until 2020.

Li pointed out the government had tools to stimulate the economy if there will be risks that targets could not be reached.

He also said that the government planned to launch a link connecting the Hong Kong and Shenzhen stock exchanges this year.

-

10:40

Bank of Japan Governor Haruhiko Kuroda: it is possible to cut interest rate to around -0.5%.

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that it was possible to cut interest rate to around -0.5%.

Kuroda also said that negative interest rates led to lower currency but it was not the central bank's target.

He pointed out that the BoJ was ready to add further stimulus measures if needed to boost inflation toward 2% target.

-

10:30

United Kingdom: Average Earnings, 3m/y , January 2.1% (forecast 2%)

-

10:30

United Kingdom: Claimant count , February -18 (forecast -9.1)

-

10:30

United Kingdom: ILO Unemployment Rate, January 5.1% (forecast 5.1%)

-

10:22

New Zealand’s seasonally adjusted current account deficit widens to NZ$1.95 billion in the fourth quarter

Statistics New Zealand released its current account data on late Tuesday evening. New Zealand's seasonally adjusted current account deficit widened to NZ$1.95 billion in the fourth quarter from NZ$1.72 billion from the third quarter.

The rise in deficit was driven by a drop in earnings from both goods and services exports.

The services surplus fell by NZ$14 million to NZ$977 million in the fourth quarter from the previous quarter, while the goods deficit climbed by NZ$277 million to NZ$810 million.

"While lower petrol prices caused the value of imports to decrease, the fall in dairy prices in the latest quarter had a bigger impact on our exports, resulting in a larger deficit," international statistics manager Stuart Jones said.

-

09:04

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.55 (USD 250m) 113.00 (USD430m) 113.50 (453m) 114.00 (500m)

EUR/USD: 1.0800 (EUR 1.13bln) 1.0860-65 (397m) 1.0900 (313m) 1.0955 (279m) 1.0975 (298m) 1.1050 (680m) 1.1200-05 (402m) 1.1250 (763m) 1.1300 (420m)

USD/CHF 0.9800 (USD 180m) 1.0000 (201m)

AUD/USD 0.7350 (AUD 200m) 0.7450 (198m) 0..7500 (181m) 0.7550 (302m)

USD/CAD 1.3400-10 (USD 430m) 1.3445 (206m)

AUD/NZD 1.1100 ( AUD (238M)

EUR/JPY 127.90-95 (EUR 496m)

-

08:23

Asian session: Yen fell

Yen fell as Bank of Japan Gov. Haruhiko Kuroda said Wednesday it is theoretically possible to cut a short-term interest rate to around minus 0.5%, a comment that could add to uneasiness among the public over the policy experiment aimed at beating deflation. Kuroda said it is theoretically possible to bring the rate down to about minus 0.5%, and that he may take such measures if a major global economic crisis potentially threatens Japan's economy.

The New Zealand dollar fell as banks could face billions in write-offs, and may have to go to their owners for extra cash, under a grim scenario for the dairy sector. On Wednesday the Reserve Bank revealed its stress tests for New Zealand's major rural lenders about the impact of dairy prices staying low for years to come.

EUR/USD: during the Asian session the pair traded in the range of $1.1095-10

GBP/USD: during the Asian session the pair fell to $1.4120

USD/JPY: during the Asian session the pair rose to Y113.55

Based on ForexLive materials

-

08:18

Options levels on wednesday, March 16, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1254 (1112)

$1.1210 (2032)

$1.1170 (3150)

Price at time of writing this review: $1.1093

Support levels (open interest**, contracts):

$1.1035 (1399)

$1.0979 (2124)

$1.0945 (4398)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 38289 contracts, with the maximum number of contracts with strike price $1,0900 (3150);

- Overall open interest on the PUT options with the expiration date April, 8 is 62993 contracts, with the maximum number of contracts with strike price $1,0900 (5994);

- The ratio of PUT/CALL was 1.65 versus 1.65 from the previous trading day according to data from March, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.4506 (1429)

$1.4410 (2464)

$1.4314 (890)

Price at time of writing this review: $1.4255

Support levels (open interest**, contracts):

$1.4190 (613)

$1.4093 (610)

$1.3995 (1529)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20925 contracts, with the maximum number of contracts with strike price $1,4400 (2464);

- Overall open interest on the PUT options with the expiration date April, 8 is 19291 contracts, with the maximum number of contracts with strike price $1,3850 (3266);

- The ratio of PUT/CALL was 0.92 versus 0.92 from the previous trading day according to data from March, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Currencies. Daily history for Mar 15’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1105 +0,04%

GBP/USD $1,4151 -1,05%

USD/CHF Chf0,9869 -0,02%

USD/JPY Y113,19 -0,53%

EUR/JPY Y125,68 -0,51%

GBP/JPY Y160,17 -1,59%

AUD/USD $0,7458 -0,66%

NZD/USD $0,6606 -0,95%

USD/CAD C$1,3349 +0,63%

-

00:02

Schedule for today, Wednesday, Mar 16’2016:

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average Earnings, 3m/y January 1.9% 2%

09:30 United Kingdom ILO Unemployment Rate January 5.1% 5.1%

09:30 United Kingdom Claimant count February -14.8 -9.1

10:00 Eurozone Construction Output, y/y January -0.4%

11:00 U.S. MBA Mortgage Applications March 0.2%

12:30 United Kingdom Annual Budget Release

12:30 Canada Foreign Securities Purchases January -1.41

12:30 Canada Manufacturing Shipments (MoM) January 1.2% 0.5%

12:30 U.S. Housing Starts February 1099 1150

12:30 U.S. Building Permits February 1202 1200

12:30 U.S. CPI, m/m February 0.0% -0.2%

12:30 U.S. CPI, Y/Y February 1.4% 0.9%

12:30 U.S. CPI excluding food and energy, m/m February 0.3% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y February 2.2% 2.2%

13:15 U.S. Capacity Utilization February 77.1% 76.9%

13:15 U.S. Industrial Production (MoM) February 0.9% -0.3%

13:15 U.S. Industrial Production YoY February -0.7%

14:30 U.S. Crude Oil Inventories March 3.88

18:00 U.S. Fed Interest Rate Decision 0.5% 0.5%

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

21:45 New Zealand GDP q/q Quarter IV 0.9% 0.6%

21:45 New Zealand GDP y/y Quarter IV 2.3% 2%

22:05 Australia RBA Assist Gov Debelle Speaks

23:50 Japan Trade Balance Total, bln February -645.9 388.6

-