Noticias del mercado

-

16:50

Bank of Japan Governor Haruhiko Kuroda: inflation in Japan slows down on lower oil prices

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that inflation in Japan slowed down due to a drop in oil prices. He added that inflation excluding oil was improving.

-

16:21

The European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €100 million

According to the Bank of Greece on Thursday, the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks by €100 million to €71.3 billion.

"The reduction of €0.1 billion in the ceiling reflects an improvement of the liquidity situation of Greek banks, amid a reduction of uncertainty and the stabilization of private sector deposits flows," the Bank of Greece said in its statement.

-

16:05

Greek unemployment rate increases to 24.4% in the fourth quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate increased to 24.4% in the fourth quarter from 24.0% in the third quarter.

The number of unemployed people rose by 1.2% in the fourth quarter from the previous quarter.

The youth unemployment rate was up to 49.0% in the fourth quarter from 48.8% in the third quarter.

-

15:20

Job openings climb to 5.541 million in January

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Thursday. Job openings rose to 5.541 million in January from 5.281 million in December. December's figure was revised down from 5.607 million.

The number of job openings climbed for total private (5.075 million) in January from December, while the number of job openings declined for government (466,000).

The hires rate was 3.5% in January.

Total separations decreased to 4.903 million in January from 5.128 million in December.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:13

U.S. leading economic index rises 0.1% in February

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index rose 0.1% in February, missing expectations for a 0.2% increase, after a 0.2% decline in January.

The coincident economic index climbed 0.1% in February, after a 0.3% gain in January.

"The U.S. LEI increased slightly in February, after back-to-back monthly declines, but housing permits, stock prices, consumer expectations, and new orders remain sources of weakness. Although the LEI's six-month growth rate has moderated considerably in recent months, the outlook remains positive with little chance of a downturn in the near-term," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

15:01

U.S.: JOLTs Job Openings, January 5.541 (forecast 5.5)

-

15:00

U.S.: Leading Indicators , February 0.1% (forecast 0.2%)

-

14:50

Foreign exchange market. European session: the U.S. dollar traded mixed to lower against the most major currencies after the release of the mostly positive U.S. economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Bulletin

00:30 Australia Changing the number of employed February -7.4 Revised From -7.9 10 0.3

00:30 Australia Unemployment rate February 6.0% 6% 5.8%

06:30 Japan BOJ Governor Haruhiko Kuroda Speaks

08:15 Switzerland Producer & Import Prices, m/m February -0.4% 0.2% -0.6%

08:15 Switzerland Producer & Import Prices, y/y February -5.3% -5.1% -4.6%

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

10:00 Eurozone Trade balance unadjusted January 25.4 Revised From 24.3 9.0 6.2

10:00 Eurozone Harmonized CPI February -1.4% 0.1% 0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) February 0.3% -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) February 1% 0.7% 0.8%

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:30 Canada Wholesale Sales, m/m January 1.8% Revised From 2.0% 0.2% 0.0%

12:30 U.S. Current account, bln Quarter IV -129.9 Revised From -124.1 -118.9 -125.3

12:30 U.S. Continuing Jobless Claims March 2227 Revised From 2225 2228 2235

12:30 U.S. Philadelphia Fed Manufacturing Survey March -2.8 -1.7 12.4

12:30 U.S. Initial Jobless Claims March 258 Revised From 259 268 265

The U.S. dollar traded mixed to lower against the most major currencies after the release of the mostly positive U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 12 in the U.S. increased by 7,000 to 265,000 from 258,000 in the previous week. The previous week's figure was revised down from 259,000. Analysts had expected jobless claims to rise to 268,000.

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to 12.4 in March from -2.8 in February, exceeding expectations for an increase to -1.7.

Yesterday's interest rate decision by the Fed weighed on the greenback. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.2% this year, down from the previous estimate of 2.4%, while inflation is expected to be 1.2%, down from the previous estimate of 1.6%.

The euro traded lower against the U.S. dollar after the mixed economic data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.2% in February, up from the preliminary reading of 0.1%, after a 1.4% drop in January.

On a yearly basis, Eurozone's final consumer price inflation dropped to -0.2% in February from 0.3% in January, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in February, rents increased by 0.08%, fruit prices rose by 0.06%, fuel prices for transport declined by 0.49%, heating oil prices decreased by 0.24%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco decreased to at an annual rate of 0.8% in February from 1.0 in January, up from the preliminary reading of 0.7%.

Eurozone's unadjusted trade surplus slid to €6.2 billion in January from €24.3 billion in December, missing expectations for a decline to €9.0 billion.

Exports fell at an unadjusted annual rate of 2.0% in January, while imports decreased 1.0%.

The British pound traded higher against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged. The BoE noted that the private domestic demand remained solid, while the labour market strengthened.

The Canadian dollar traded mixed against the U.S. dollar after the release of the negative Canadian economic data. Statistics Canada released wholesale sales figures on Thursday. Wholesale sales were flat in January, missing expectations for a 0.2% gain, after a 1.8% rise in December. December's figure was revised up from a 2.0% increase. A rise in the machinery, equipment and supplies subsector was offset by a drop in the motor vehicle and parts subsector.

The Swiss Franc traded higher against the U.S. dollar. The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed. The SNB noted that the Swiss franc was still significantly overvalued.

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency downgraded its 2016 growth forecast to 1.4% from 1.5%. GDP for 2017 was downgraded to 1.8% from 1.9%. "The strong appreciation of the Swiss franc was a main factor slowing down economic growth," the SECO said in its Spring report.

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices fell 0.6% in February, missing expectations for a 0.2% gain, after a 0.4% decrease in January. The decrease was mainly driven by lower prices for chemical and pharmaceutical, and petroleum products.

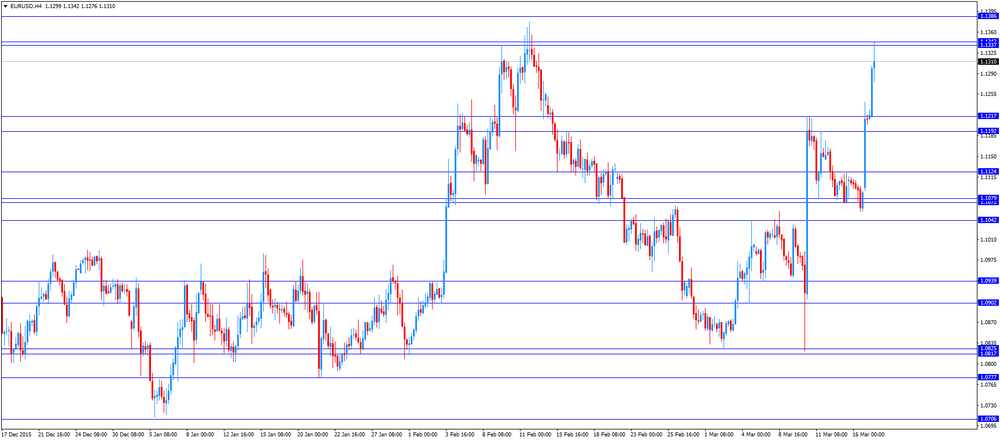

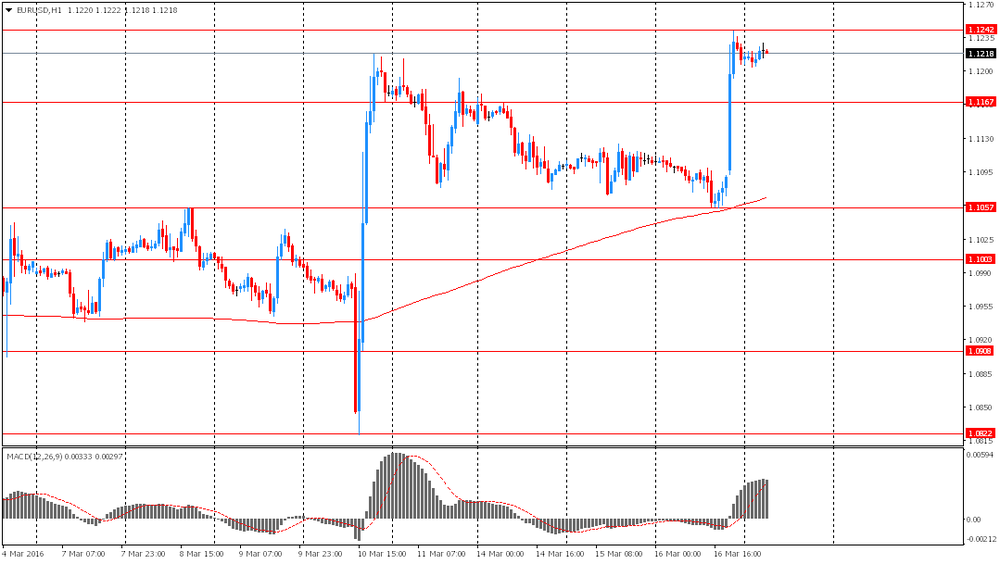

EUR/USD: the currency pair rose to $1.1342

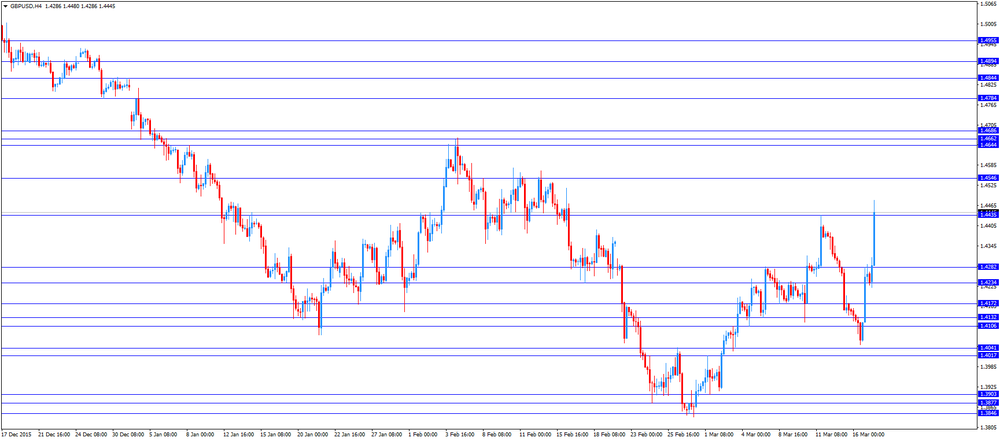

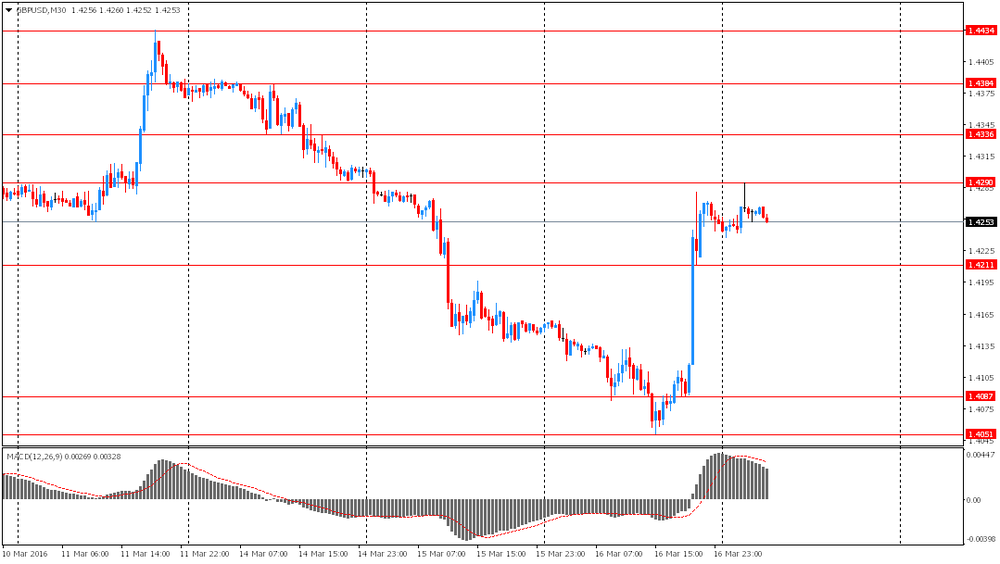

GBP/USD: the currency pair declined to $1.4480

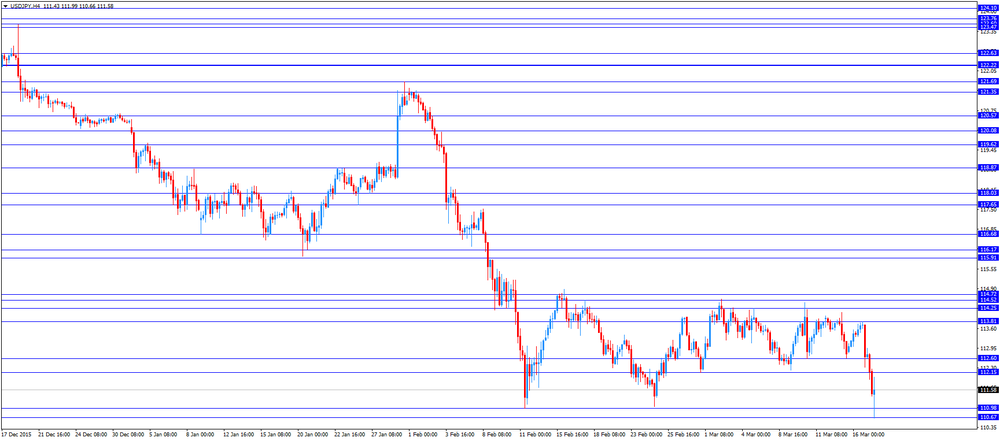

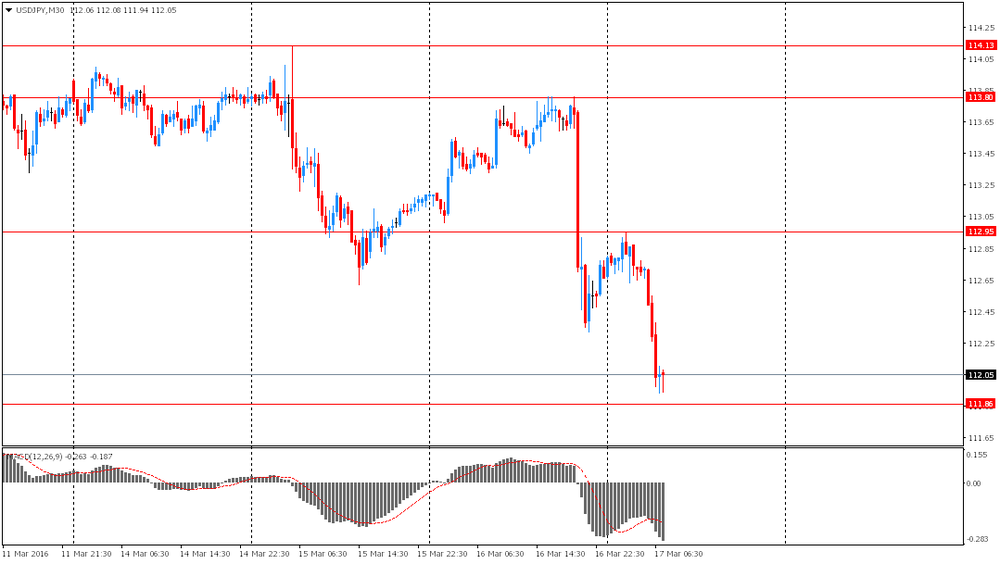

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Leading Indicators February -0.2% 0.2%

14:00 U.S. JOLTs Job Openings January 5.607 5.5

23:50 Japan Monetary Policy Meeting Minutes

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: 113.00 (USD 330m) 113.25 (680m) 113.65 (419m) 113.75-80 (440m) 114.00 (1.39bln) 115.00 (1.44bln)

EUR/USD: 1.0800 (EUR 386m) 1.0900-05 (625m) 1.0945-50 (339m) 1.1100 (925m) 1.1125 (253m) 1.1200 (445m) 1.1325 (312m) 1.1350 (700m) 1.1395-1.1400 (243m) 1.1450 (692m)

USD/CHF 0.9800 (USD 250m) 1.0000 (310m)

AUD/USD 0.7350-55 (AUD 335m) 0.7500 (324m) 0.7650 (221m)

USD/CAD 1.3000 (USD 490m) 1.3300 (380m) 1.3345 (288m)

NZD/USD 0.6500-10 (NZD 902m) 0.6625 (214m) 0.7100 (305m)

-

14:38

Bank of England's Monetary Policy Committee March minutes: private domestic demand remains solid

The Bank of England's Monetary Policy Committee (MPC) released its March meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind in February.

The consumer price inflation in the U.K. was 0.3% in January, below the central bank's 2% target. The BoE noted that inflation was driven by declines in energy and food prices.

The BoE noted that the private domestic demand remained solid, while the labour market strengthened.

The central bank said that there are downside risks to the global growth and to the central bank's forecasts from the slowdown in emerging economies.

The BoE noted that the pound depreciated due to the uncertainty around the referendum on U.K. membership of the European Union, and it could weigh on the domestic demand.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles", adding that further interest rate decision will depend on the incoming economic data.

-

14:26

Bank of England keeps its interest rate on hold at 0.5% in March

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

14:24

Canada’s wholesale sales are flat in February

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales were flat in January, missing expectations for a 0.2% gain, after a 1.8% rise in December. December's figure was revised up from a 2.0% increase.

A rise in the machinery, equipment and supplies subsector was offset by a drop in the motor vehicle and parts subsector.

Sales of motor vehicle and parts were down 2.3% in January, while sales in in the machinery, equipment and supplies subsector rose 2.6%.

Inventories increased by 0.3% in January.

-

14:19

Philadelphia Federal Reserve Bank’s manufacturing index climbs to 12.4 in March

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to 12.4 in March from -2.8 in February, exceeding expectations for an increase to -1.7.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Firms responding to the Manufacturing Business Outlook Survey reported an improvement in business conditions this month. The indicator for general activity rose sharply in March to its first positive reading in seven months," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index climbed to 22.1 in March from 2.5 in February.

The new orders index increased to 15.7 in March from -5.3 in February.

The prices paid index rose to -0.9% in March from -2.2 in February, while the prices received index rose to 3.5 from -4.5.

The number of employees index was up to 1.1 in March from -5.0 in February.

According to the report, the future general activity index jumped to 28.8 in March from 17.3 in February.

-

14:14

Orders

EUR/USD

Offers 1.1300 1.1310-20 1.1350 1.1375 1.1400 1.1430 1.1450

Bids 1.1270 1.1250 1.1220 1.1200 1.1175 1.1150 1.1130 1.1100 1.1075 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4320 1.4345-55 1.4375-80 1.4400 1.4420 1.4450

Bids 1.4280 1.4265 1.4250 1.4235 1.4220 1.4200 1.4175 1.4150 1.4100 1.4080-85 1.4065 1.4050

EUR/JPY

Offers 126.20 126.50 126.80 27.00 127.30 127.50

Bids 125.80 125.50 125.20 125.00 124.50 124.20 124.00

EUR/GBP

Offers 0.7900-10 0.7925 0.7950 0.7985 0.8000

Bids 0.7880 0.7865 0.7850 0.7835 0.7820 0.7800 0.7785 0.7770 0.7750

USD/JPY

Offers 111.85 112.00 112.20-25 112.50 112.80-85 113.00 113.30 113.60 113.80-85 114.00

Bids 111.50 111.30 111.00 110.85 110.65 110.50 110.30 110.00

AUD/USD

Offers 0.7650 0.7680 0.7700 0.7725-30 0.7750

Bids 0.7600 0.7580 0.7550 0.7520 0.7500 0.7475 0.7450

-

14:00

Initial jobless claims rise to 265,000 in the week ending March 12

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 12 in the U.S. increased by 7,000 to 265,000 from 258,000 in the previous week. The previous week's figure was revised down from 259,000.

Analysts had expected jobless claims to rise to 268,000.

Jobless claims remained below 300,000 the 54th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 8,000 to 2,235,000 in the week ended March 05.

-

13:31

U.S.: Philadelphia Fed Manufacturing Survey, March 12.4 (forecast -1.7)

-

13:30

Canada: Wholesale Sales, m/m, January 0.0% (forecast 0.2%)

-

13:30

U.S.: Initial Jobless Claims, March 265 (forecast 268)

-

13:30

U.S.: Current account, bln, Quarter IV -125.3 (forecast -118.9)

-

13:30

U.S.: Continuing Jobless Claims, March 2235 (forecast 2228)

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

11:54

Swiss National Bank keeps its rates steady at -0.75% in March, but it downgrades its economic growth and inflation forecasts

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed.

The SNB noted that the Swiss franc was still significantly overvalued.

Inflation was downgraded to -0.8% in 2016 from the previous forecast of -0.5%. The central bank expects inflation to be 0.1% in 2017, down from the previous forecast of 0.3%.

The downward revision was driven by a further decline in oil prices.

The central bank noted that global economic outlook deteriorated slightly in recent months.

According to the central bank, the central bank's assessment of the global economic outlook was less favourable than in December.

The SNB said that the Swiss economy to expanded "just under" 1% in 2015. The central bank expect the Swiss economy to grow between 1% and 1.5%, down from its previous estimate of 1.5%.

-

11:44

State Secretariat for Economic Affairs downgrades its GDP and inflation forecasts for Switzerland

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency downgraded its 2016 growth forecast to 1.4% from 1.5%. GDP for 2017 was downgraded to 1.8% from 1.9%.

"The strong appreciation of the Swiss franc was a main factor slowing down economic growth," the SECO said in its Spring report.

SECO expects the negative exchange rate effects to dissipate through 2016 and 2017.

The agency noted that there was "no clear sign of a marked acceleration of global growth".

The average annual unemployment rate is expected to be 3.6% this year and 3.5% next year.

The consumer price inflation is expected to be -0.6% this year, down from the December estimate of -0.1%, and +0.2% in 2017, unchanged from the December estimate.

-

11:32

Switzerland's producer and import prices are down 0.6% in February

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices fell 0.6% in February, missing expectations for a 0.2% gain, after a 0.4% decrease in January.

The decrease was mainly driven by lower prices for chemical and pharmaceutical, and petroleum products.

The Import Price Index decreased by 1.0% in February, while producer prices fell 0.5%.

On a yearly basis, producer and import prices plunged 4.6% in February, beating expectations for a 5.1% fall, after a 5.3% drop in January.

The Import Price Index fell by 6.9% year-on year in February, while producer prices dropped 3.5%.

-

11:24

Italy’ trade surplus narrows to €0.04 billion in January

The Italian statistical office Istat released its trade data for Italy on Thursday. Italy' trade surplus narrowed to €0.04 billion in January from €6.00 billion in December. December's figure was revised down €6.02 billion.

Exports dropped 3.5% year-on-year in January, while imports decreased 3.2%.

On a monthly basis, exports fell a seasonally-adjusted 2.2% in January, while imports were down 0.6%.

The seasonally-adjusted trade surplus with the EU was €1.03 billion in January, while the trade surplus with non-EU countries was €2.83 billion.

-

11:15

Eurozone's unadjusted trade surplus slides to €6.2 billion in January

Eurostat released its trade data for the Eurozone on Thursday. Eurozone's unadjusted trade surplus slid to €6.2 billion in January from €24.3 billion in December, missing expectations for a decline to €9.0 billion.

Exports fell at an unadjusted annual rate of 2.0% in January, while imports decreased 1.0%.

-

11:09

Eurozone's harmonized consumer price index rises 0.2% in February

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.2% in February, up from the preliminary reading of 0.1%, after a 1.4% drop in January.

On a yearly basis, Eurozone's final consumer price inflation dropped to -0.2% in February from 0.3% in January, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in February, rents increased by 0.08%, fruit prices rose by 0.06%, fuel prices for transport declined by 0.49%, heating oil prices decreased by 0.24%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco decreased to at an annual rate of 0.8% in February from 1.0 in January, up from the preliminary reading of 0.7%.

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, February 0.8% (forecast 0.7%)

-

11:00

Eurozone: Harmonized CPI, February 0.2% (forecast 0.1%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, February -0.2% (forecast -0.2%)

-

11:00

Eurozone: Trade balance unadjusted, January 6.2 (forecast 9.0)

-

10:59

Australia's unemployment rate declines to 5.8% in February

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate declined to 5.8% in February from 6.0% in January. Analysts had expected the unemployment rate to remain unchanged at 6.0%.

The number of employed people in Australia increased by 300 in February, missing forecast of a rise by 10,000, after a decline by 7,400 in January. January's figure was revised up from a fall by 7,900.

Full-time employment climbed by 15,900 in February, while part-time employment fell by 15,600.

The participation rate declined to 64.9% in February from 65.1% in February.

-

10:44

Japan's trade deficit turns into a surplus of ¥242.8 billion in February

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit turned into a surplus of ¥242.8 billion in February from a deficit of ¥648.8 billion in January. January's figure was revised down from a deficit of ¥645.9 billion.

Analysts had expected a surplus of ¥388.6 billion.

Exports fell 4.0% year-on-year in February, while imports dropped 14.2%.

Exports to Asia declined by 6.1% year-on-year in February, exports to the United States increased by 0.2%, while exports to the European Union climbed by 9.2%.

Imports from Asia plunged by 15.9% year-on-year in February, imports from the United States rose by 5.1%, while imports from the European Union climbed by 14.2%.

-

10:24

New Zealand's economy expanded at 0.9% in the fourth quarter

Statistics New Zealand released its GDP data on late Wednesday evening. New Zealand's GDP rose 0.9% in the fourth quarter, exceeding expectations for a 0.6% increase, after a 0.9% gain in the third quarter.

The increase was driven mainly by a rise in the service industries.

The overall services sector rose 0.8% in the fourth quarter, construction climbed 2.5%, while the manufacturing sector declined.

On a yearly basis, New Zealand's GDP climbed by 2.3% in the fourth quarter, beating expectations for a 2.0% growth, after a 2.3% rise in the third quarter.

-

10:12

The Fed keeps its monetary unchanged in March

The Fed's released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed reviewed its interest rate forecasts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year. The Fed expects its fed-funds rate to be 1.7% by the end of 2017, down from its previous estimate of 2.375%, and 3.00% by the end of 2018, down from its previous estimate of 3.25%.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.2% this year, down from the previous estimate of 2.4%, while inflation is expected to be 1.2%, down from the previous estimate of 1.6%.

The Fed said in its statement that the U.S. economy expanded moderately, household spending rose moderately, the labour market continued to strengthen, while inflation increased in recent months but remained below the Fed's 2% target. The Fed said that there were risks to the U.S. economy from the global economic and financial developments.

Comments by the Fed Chairwoman Janet Yellen were "dovish". She noted that low oil prices continued to weigh on inflation. Yellen pointed out that the Fed was not considering negative interest rates but was analysing their effects in other countries.

The Fed chairwoman also said that an interest rate hike in April was possible.

-

09:30

Switzerland: SNB Interest Rate Decision, -0.75% (forecast -0.75%)

-

09:15

Switzerland: Producer & Import Prices, m/m, February -0.6% (forecast 0.2%)

-

09:15

Switzerland: Producer & Import Prices, y/y, February -4.6% (forecast -5.1%)

-

09:12

Option expiries for today's 10:00 ET NY cut

USD/JPY: 113.00 (USD 330m) 113.25 (680m) 113.65 (419m) 113.75-80 (440m) 114.00 (1.39bln) 115.00 (1.44bln)

EUR/USD: 1.0800 (EUR 386m) 1.0900-05 (625m) 1.0945-50 (339m) 1.1100 (925m) 1.1125 (253m) 1.1200 (445m) 1.1325 (312m) 1.1350 (700m) 1.1395-1.1400 (243m) 1.1450 (692m)

USD/CHF 0.9800 (USD 250m) 1.0000 (310m)

AUD/USD 0.7350-55 (AUD 335m) 0.7500 (324m) 0.7650 (221m)

USD/CAD 1.3000 (USD 490m) 1.3300 (380m) 1.3345 (288m)

NZD/USD 0.6500-10 (NZD 902m) 0.6625 (214m) 0.7100 (305m)

-

08:27

Options levels on thursday, March 17, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1370 (2957)

$1.1315 (2617)

$1.1275 (3232)

Price at time of writing this review: $1.1239

Support levels (open interest**, contracts):

$1.1185 (237)

$1.1155 (439)

$1.1110 (1145)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 41151 contracts, with the maximum number of contracts with strike price $1,1100 (3232);

- Overall open interest on the PUT options with the expiration date April, 8 is 63915 contracts, with the maximum number of contracts with strike price $1,0900 (6683);

- The ratio of PUT/CALL was 1.55 versus 1.65 from the previous trading day according to data from March, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.4504 (1444)

$1.4407 (2513)

$1.4311 (853)

Price at time of writing this review: $1.4251

Support levels (open interest**, contracts):

$1.4187 (598)

$1.4091 (695)

$1.3994 (1628)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 21018 contracts, with the maximum number of contracts with strike price $1,4400 (2513);

- Overall open interest on the PUT options with the expiration date April, 8 is 19663 contracts, with the maximum number of contracts with strike price $1,3850 (3252);

- The ratio of PUT/CALL was 0.94 versus 0.94 from the previous trading day according to data from March, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

Asian session: The Australian dollar rose

The Australian dollar rose as Australia's unemployment rate fell from 6 to 5.8 per cent in February because a large number of people gave up looking for work. The Bureau of Statistics estimated that only 300 jobs were added in February, but unemployment still fell because the participation rate dropped. Seasonally adjusted figures point to a 0.2-percentage-point fall in the proportion of the adult population in work or actively looking for it.

The New Zealand Dollar gained as New Zealand's gross domestic product gained 0.9 percent on quarter in the fourth quarter of 2015, Statistics New Zealand said on Thursday. That beat forecasts for an increase of 0.7 percent following the 0.9 percent increase in the third quarter. Individually, business services were up 1.5 percent due to growth in advertising, market research, and management services. Construction was up 2.5 percent.

EUR/USD: during the Asian session the pair rose to $1.1230

GBP/USD: during the Asian session the pair rose to $1.4290

USD/JPY: during the Asian session the pair fell to a Y112.00

-

01:30

Australia: Changing the number of employed, February 0.3 (forecast 10)

-

01:30

Australia: Unemployment rate, February 5.8% (forecast 6%)

-

00:53

Japan: Trade Balance Total, bln, February 242,8 (forecast 388.6)

-

00:27

Currencies. Daily history for Mar 16’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1212 +0,95%

GBP/USD $1,4251 +0,70%

USD/CHF Chf0,978 -0,91%

USD/JPY Y112,66 -0,47%

EUR/JPY Y126,32 +0,51%

GBP/JPY Y160,56 +0,24%

AUD/USD $0,7561 +1,36%

NZD/USD $0,6760 +2,28%

USD/CAD C$1,3116 -1,78%

-