Noticias del mercado

-

16:35

French statistical office INSEE: the French economy wold likely expand 0.4% in the first and second quarters of 2016

The French statistical office INSEE said on Friday that the French economy wold likely expand 0.4% in the first and second quarters of 2016, driven by household spending. INSEE also said that the unemployment rate for mainland France would decline below 10% for the first time in two years (to 9.9%).

-

15:58

Labour cost per employee per month in Spain rises at annual rate of 1.2% in the fourth quarter

The Spanish statistical office INE released its labour costs data on Friday. The labour cost per employee per month rose 1.2% year-over-year in the fourth quarter, after a 0.3% increase in the previous quarter.

The labour cost per employee per month declined by 0.4% in the industry and by 2.1% in the construction, while climbed 1.9% in the services sector.

The labour cost per hour worked jumped 1.6% year-on-year in the fourth quarter.

-

15:17

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 90.0 in March

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 90.0 in March from a final reading of 91.7 in February. Analysts had expected the index to rise at 92.2.

"Consumer confidence eased in early March due to increased concerns about prospects for the economy as well as the expectation that gas prices would inch upward during the year ahead," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"While consumers do not anticipate a recession, they no longer expect the economy to outperform the 2.4% rate of economic growth recorded in the past two years," he added.

The index of current economic conditions declined to 105.6 in March from 106.8 in February, while the index of consumer expectations decreased to 80.0 from 81.9.

The one-year inflation expectations increased to 2.7% in March from 2.5% in February.

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, March 90 (forecast 92.2)

-

14:54

Central Bank of Russia keeps its key interest rate unchanged at 11.0% in March

The Central Bank of Russia (CBR) kept its interest rate unchanged at 11.0% on Friday. The central bank noted that inflation risks remained high.

"Despite certain stabilisation in financial and commodity markets and a slowdown in inflation, inflation risks remain high. These stem from the current developments in the oil market, persistently high inflation expectations and some uncertainties surrounding budget configuration," the CBR said.

The central bank pointed out that it will need more time to tighten its monetary policy.

The CBR expects inflation to be less than 6% in March 2017 and 4% in late 2017, while the economy is expected to contract 1.3%-1.5% in 2016.

"It is expected that quarterly GDP growth rates will enter positive territory between late 2016 and early 2017," the CBR said.

The next meeting of the CBR is scheduled to be April 29, 2016.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY: 110.00 (USD 405m) 112.00-05 (727m) (USD 330m) 113.00 (433m) 113.50 (302m) 113.95-114.00 (480m) 115.00 (595m)

EURUSD: 1.1000 (EUR 1.26bln) 1.1100 (817m) 1.1110-15 (578m) 1.1200 (1.6bln) 1.1235 (210m) 1.1300 (433m) 1.1385 (584m) 1.1435-50 (830m)

GBPUSD: 1.4000 (GBP 697m) 1.4035 (490m) 1.4275 (420m) 1.4300 (729m) 1.4600 (403m) 1.4645 (298m)

EURGBP 0.7812 (EUR 707m)

AUDUSD 0.7300 (AUD 300m) 0.7362 (402m) 0.7500 (377m)

USDCAD 1.2550 (USD 300m)

-

14:29

Foreign exchange market. European session: the Canadian dollar traded higher against the U.S. dollar after the release of the mixed Canadian economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Producer Price Index (MoM) February -0.7% -0.2% -0.5%

07:00 Germany Producer Price Index (YoY) February -2.4% -2.6% -3.0%

12:30 Canada Retail Sales, m/m January -2.1% Revised From -2.2% 0.6% 2.1%

12:30 Canada Retail Sales YoY January 2.6% 6.4%

12:30 Canada Retail Sales ex Autos, m/m January -1.6% 0.4% 1.2%

12:30 Canada Consumer Price Index m / m February 0.2% 0.4% 0.2%

12:30 Canada Consumer price index, y/y February 2% 1.5% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February 2.0% 2% 1.9%

13:00 U.S. FOMC Member Dudley Speak

The U.S. dollar traded mixed against the most major currencies ahead the release of the preliminary Thomson Reuters/University of Michigan consumer sentiment index. The index is expected to increase to 92.2 in March from 91.7 in February.

The Fed's interest rate decision continued to weigh on the greenback. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year.

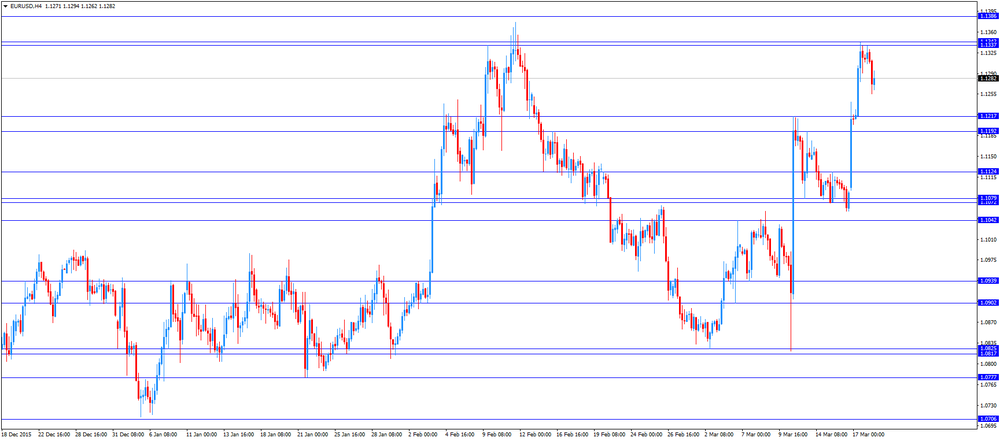

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview to the Italian newspaper La Repubblica on Friday that the central bank could cut its interest rate further into negative territory if risks to the outlook rise.

"If new negative shocks should worsen the outlook or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armoury," he said.

Bloomberg reported on Thursday that according to two officials familiar with the matter, European Central Bank (ECB) President Mario Draghi said to European Union leaders there was "no alternative" the central bank's recent interest rate cut and further stimulus measures. Draghi also said that European Union leaders should support the ECB's monetary policy actions.

Eurostat released its labour costs data for the Eurozone on Friday. Hourly labour costs in the Eurozone rose at an annual rate of 1.3% in the fourth quarter, after a 1.1% gain in the previous quarter.

Wages and salaries per hour climbed 1.5% year-on-year in the fourth quarter, while non-wage costs gained 0.7%.

In the fourth quarter of 2015, hourly labour costs increased 1.2% year-on-year in industry, 0.5% in construction, 1.3% in services, while 1.6% in the mainly non-business economy.

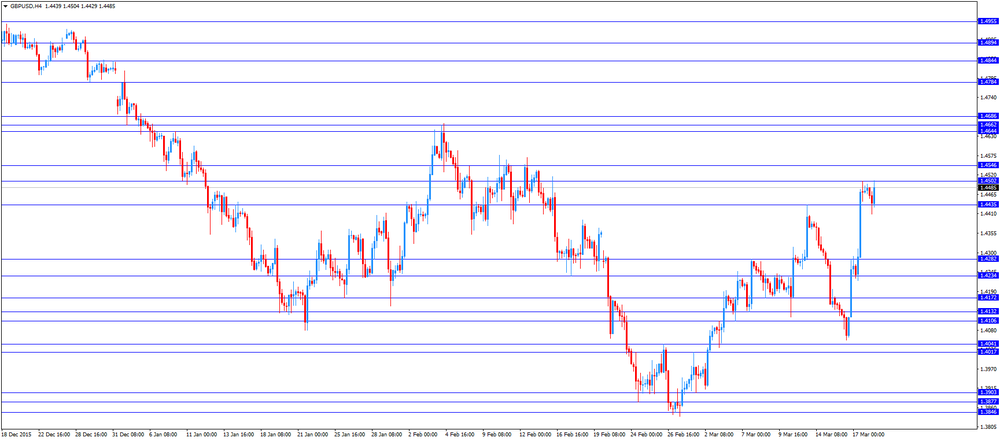

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar after the release of the mixed Canadian economic data. Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in February, missing expectations for a 0.4% rise, after a 0.2% gain in January.

The monthly rise was mainly driven by an increase in prices for recreation, education and reading, and clothing and footwear. Prices for recreation, education and reading were up 1.6% in February, while prices clothing and footwear increased 1.4%.

On a yearly basis, the consumer price index slid to 1.4% in February from 2.0% in January, missing expectations for a decline to 1.5%.

The consumer price index was mainly driven by lower gasoline prices, which plunged 13.1% year-on-year in February.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.5% in February, after a 0.3% increase in January.

On a yearly basis, core consumer price index in Canada fell to 1.9% in February from 2.0% in January. Analysts had expected the index to remain unchanged at 2.0%.

Canadian retail sales climbed by 2.1% in January, exceeding expectations for a 0.6% gain, after a 2.1% decrease in December. December's figure was revised up from a 2.2% drop. The increase was mainly driven by higher sales at motor vehicle and parts dealers, and at general merchandise stores. Sales at motor vehicle and parts dealers rose by 4.8% in January, while sales at general merchandise stores increased by 4.9%.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.4504

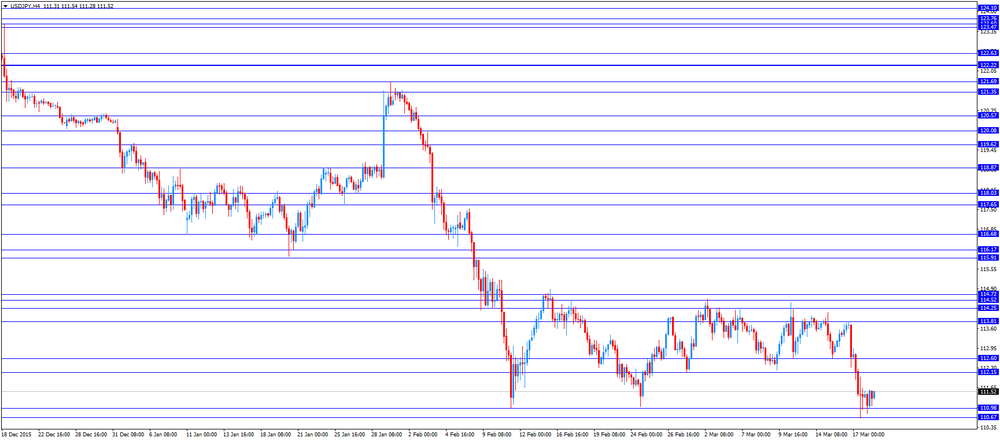

USD/JPY: the currency pair increased to Y111.54

The most important news that are expected (GMT0):

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 91.7 92.2

15:00 U.S. FOMC Member Rosengren Speaks

19:00 U.S. FOMC Member James Bullard Speaks

-

14:16

Eurozone’s job vacancy rate rises 1.6% in the fourth quarter

Eurostat released its job vacancy rate data for the Eurozone on Friday. The job vacancy rate in the Eurozone rose 1.6% in the fourth quarter, after a 1.5% increase in the third quarter.

The highest job vacancy rate was recorded in Germany (2.6%), while the lowest job vacancy rates were recorded in Spain and Portugal (both 0.6%).

-

13:57

Canadian consumer price inflation rises 0.2% in February

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in February, missing expectations for a 0.4% rise, after a 0.2% gain in January.

The monthly rise was mainly driven by an increase in prices for recreation, education and reading, and clothing and footwear. Prices for recreation, education and reading were up 1.6% in February, while prices clothing and footwear increased 1.4%.

On a yearly basis, the consumer price index slid to 1.4% in February from 2.0% in January, missing expectations for a decline to 1.5%.

The consumer price index was mainly driven by lower gasoline prices, which plunged 13.1% year-on-year in February.

Food prices climbed 3.9% year-on-year in February, while alcoholic beverages and tobacco products prices increased 3.3%.

The index for recreation, education and reading climbed by 1.6% in February from the same month a year earlier, the shelter index gained 1.2%, while clothing and footwear prices dropped 1.3%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.5% in February, after a 0.3% increase in January.

On a yearly basis, core consumer price index in Canada fell to 1.9% in February from 2.0% in January. Analysts had expected the index to remain unchanged at 2.0%.

The Bank of Canada's inflation target is 2.0%.

-

13:45

Canadian retail sales climb 2.1% in January

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 2.1% in January, exceeding expectations for a 0.6% gain, after a 2.1% decrease in December. December's figure was revised up from a 2.2% drop.

The increase was mainly driven by higher sales at motor vehicle and parts dealers, and at general merchandise stores. Sales at motor vehicle and parts dealers rose by 4.8% in January, while sales at general merchandise stores increased by 4.9%.

Sales at gasoline stations declined 1.6% in January, while sales at food and beverage stores were flat.

Sales at building material and garden equipment and supplies dealers increased 3.0% in January, while sales at furniture and home furnishings stores declined 0.4%.

Canadian retail sales excluding automobiles rose 1.2% in January, beating expectations for a 0.4% gain, after a 1.7% drop in December. December's figure was revised down from a 1.6% fall.

-

13:45

Orders

EUR/USD

Offers 1.1320 1.1340-50 1.1375 1.1400 1.1430 1.1450 1.1480 1.1500

Bids 1.1270-75 1.1250 1.1220 1.1200 1.1175 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4485 1.4500 1.4530 1.4550 1.4575 1.4600 1.4660 1.4700

Bids 1.4435 1.4420 1.4400 1.4375-80 1.4350 1.4330 1.4300 1.4280 1.4265 1.4250

EUR/JPY

Offers 125.80 126.00 126.20 126.50 126.80 127.00 127.30 127.50

Bids 125.20 125.00 124.50 124.20 124.00

EUR/GBP

Offers 0.7830 0.7850 0.7880 0.7900-10 0.7925 0.7950

Bids 0.7800 0.7785 0.7770 0.7750 0.7730 0.7700 0.7675 0.7650

USD/JPY

Offers 111.50-55 111.85 112.00 112.20-25 112.50 112.80-85 113.00

Bids 111.00 110.75-80 110.50 110.30 110.00 1.0980 1.0950

AUD/USD

Offers 0.7655-60 0.7680 0.7700 0.7725-30 0.7750

Bids 0.7600 0.7580 0.7550 0.7520 0.7500 0.7475 0.7450

-

13:31

Canada: Retail Sales YoY, January 6.4%

-

13:30

Canada: Consumer price index, y/y, February 1.4% (forecast 1.5%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, February 1.9% (forecast 2%)

-

13:30

Canada: Consumer Price Index m / m, February 0.2% (forecast 0.4%)

-

13:30

Canada: Retail Sales ex Autos, m/m, January 1.2% (forecast 0.4%)

-

13:30

Canada: Retail Sales, m/m, January 2.1% (forecast 0.6%)

-

11:52

European Central Bank Executive Board member Peter Praet: the central bank could cut its interest rate further into negative territory

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview to the Italian newspaper La Repubblica on Friday that the central bank could cut its interest rate further into negative territory if risks to the outlook rise.

"If new negative shocks should worsen the outlook or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armoury," he said.

Praet noted that it was the right decision to expand stimulus measures.

"What we have got at the end makes sense from an economic point of view," he said.

-

11:40

Hourly labour costs in the Eurozone climb 1.3% in the fourth quarter

Eurostat released its labour costs data for the Eurozone on Friday. Hourly labour costs in the Eurozone rose at an annual rate of 1.3% in the fourth quarter, after a 1.1% gain in the previous quarter.

Wages and salaries per hour climbed 1.5% year-on-year in the fourth quarter, while non-wage costs gained 0.7%.

In the fourth quarter of 2015, hourly labour costs increased 1.2% year-on-year in industry, 0.5% in construction, 1.3% in services, while 1.6% in the mainly non-business economy.

-

11:35

U.S. current account deficit narrows to $125.3 billion in the fourth quarter

The U.S. Commerce Department released its current account data on Thursday. The U.S. current account deficit narrowed to $125.3 billion in the fourth quarter from $129.9 billion in the third quarter, missing expectations for a deficit of $118.9 billion. The third quarter's figure was revised down from a deficit of $124.1 billion.

The trade deficit fell due to drops in the deficits on goods and secondary income, and a rise in the surplus on services.

The deficit on goods and services fell to $133.7 billion in the fourth quarter from $138.6 billion in the third quarter.

The surplus on primary income decreased $42.8 billion in the fourth quarter from $45.4 billion in the third quarter.

The deficit on secondary income declined to $34.3 billion in the fourth quarter from $36.7 billion in the third quarter.

-

11:18

German producer prices drop 0.5% in February

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.5% in February, missing expectations for a 0.2% fall, after a 0.7% drop in January.

On a yearly basis, German PPI dropped 3.0% in February, missing expectations for a 2.6% decrease, after a 2.4% fall in January.

PPI excluding energy sector fell by 0.7% year-on-year in February.

Energy prices were down 9.4% year-on-year in February.

Consumer non-durable goods prices rose 0.2% year-on-year in February, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.7% and durable consumer goods sector prices gained 1.4%.

-

10:55

European Central Bank President Mario Draghi: there is “no alternative” the central bank’s recent stimulus measures

Bloomberg reported on Thursday that according to two officials familiar with the matter, European Central Bank (ECB) President Mario Draghi said to European Union leaders there was "no alternative" the central bank's recent interest rate cut and further stimulus measures. Draghi also said that European Union leaders should support the ECB's monetary policy actions.

-

10:40

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.3 in in the week ended March 13

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 44.3 in in the week ended March 13 from 43.8 the prior week.

The increase was mainly driven by a rise in the personal finances index. The measure of views of the economy declined to 35.4 from 35.9, the buying climate index was up to 39.5 from 39.4, while the personal finances index rose to 58.1 from 55.9, the biggest increase since the end of June 2015.

-

10:27

Home prices in China rise in February

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 3.6% in February, after a 2.5% gain in January. It was the biggest annual rise since June 2014.

The main contributor was Shenzhen, where home prices jumped by 56.9% year-on-year in February.

On a monthly base, house prices increased in 47 of 70 cities, prices slid in 15 cities, while prices remained unchanged in 8 cities.

The monthly rise was mainly driven by higher prices in Shenzhen, which climbed 3.6% in February.

-

10:13

Bank of Japan’s January monetary policy meeting minutes: there was a split over negative interest rates

The Bank of Japan (BoJ) released its January monetary policy meeting minutes on late Tuesday evening. According to minutes, there was a split over the negative interest rates. Only 5 of 9 board members voted for the interest rate cut.

The central bank said the employment and income situation continued to improve steadily, while private consumption was resilient.

Board members shared the recognition that the Japanese economy continued to expand moderately, but exports and production were affected by the slowdown in emerging economies.

Board members noted that consumer price inflation was about 0% and it was likely to remain at this level for the time being due a decline in energy prices.

The BoJ decided to lower its interest rate to -0.1% from 0.1% at its January monetary policy meeting.

BoJ Governor Haruhiko Kuroda said this week that an interest rate cut to -0.5% was possible.

-

09:19

Option expiries for today's 10:00 ET NY cut

USD/JPY: 110.00 (USD 405m) 112.00-05 (727m) (USD 330m) 113.00 (433m) 113.50 (302m) 113.95-114.00 (480m) 115.00 (595m)

EUR/USD: 1.1000 (EUR 1.26bln) 1.1100 (817m) 1.1110-15 (578m) 1.1200 (1.6bln) 1.1235 (210m) 1.1300 (433m) 1.1385 (584m) 1.1435-50 (830m)

GBP/USD: 1.4000 (GBP 697m) 1.4035 (490m) 1.4275 (420m) 1.4300 (729m) 1.4600 (403m) 1.4645 (298m)

EUR/GBP 0.7812 (EUR 707m)

AUD/USD 0.7300 (AUD 300m) 0.7362 (402m) 0.7500 (377m)

USD/CAD 1.2550 (USD 300m)

-

08:25

Options levels on friday, March 18, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1424 (3112)

$1.1389 (2590)

$1.1352 (3126)

Price at time of writing this review: $1.1285

Support levels (open interest**, contracts):

$1.1224 (1670)

$1.1159 (1763)

$1.1080 (2762)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 44159 contracts, with the maximum number of contracts with strike price $1,1500 (3456);

- Overall open interest on the PUT options with the expiration date April, 8 is 65974 contracts, with the maximum number of contracts with strike price $1,0900 (7533);

- The ratio of PUT/CALL was 1.49 versus 1.55 from the previous trading day according to data from March, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.4705 (1553)

$1.4608 (1082)

$1.4513 (1598)

Price at time of writing this review: $1.4452

Support levels (open interest**, contracts):

$1.4390 (669)

$1.4293 (337)

$1.4196 (618)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 19977 contracts, with the maximum number of contracts with strike price $1,4400 (2105);

- Overall open interest on the PUT options with the expiration date April, 8 is 20642 contracts, with the maximum number of contracts with strike price $1,3850 (2259);

- The ratio of PUT/CALL was 1.03 versus 0.94 from the previous trading day according to data from March, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Asian session: The Australian dollar rose

The Australian dollar rose as the PBOC gave a sharp boost to the CNY at the daily reference rate setting, USD/CNY down more than 0.5% from yesterday's mid-rate. The bank also injected 110bn yuan into money markets (OMOs via 7-day reverse repos) to counter a 3-week high in rates (tax payments and convertible bond sales cited for the tightness). After a series of net drains each week since the end of the LNY holiday this week saw a net injection.

The yen pared its advance toward the highest level since October 2014 amid speculation the Bank of Japan may intervene to arrest gains that threaten to undermine almost three years of monetary stimulus. Japan's currency is headed for its biggest weekly advance against the dollar in more than a month, after the Federal Reserve pared back expectations for interest-rate increases this year.

EUR/USD: during the Asian session the pair traded in the range of $1.1305-35

GBP/USD: during the Asian session the pair traded in the range of $1.4455-95

USD/JPY: during the Asian session the pair fell to Y110.80

-

08:00

Germany: Producer Price Index (MoM), February -0.5% (forecast -0.2%)

-

08:00

Germany: Producer Price Index (YoY), February -3.0% (forecast -2.6%)

-

00:33

Currencies. Daily history for Mar 17’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1314 +0,90%

GBP/USD $1,4475 +1,55%

USD/CHF Chf0,9671 -1,13%

USD/JPY Y111,42 -1,11%

EUR/JPY Y126,06 -0,21%

GBP/JPY Y161,28 +0,45%

AUD/USD $0,7637 +1,00%

NZD/USD $0,6833 +1,07%

USD/CAD C$1,2983 -1,02%

-

00:01

Schedule for today, Friday, Mar 18’2016:

(time / country / index / period / previous value / forecast)

07:00 Germany Producer Price Index (MoM) February -0.7% -0.2%

07:00 Germany Producer Price Index (YoY) February -2.4% -2.6%

12:30 Canada Retail Sales, m/m January -2.2% 0.6%

12:30 Canada Retail Sales YoY January 2.6%

12:30 Canada Retail Sales ex Autos, m/m January -1.6% 0.4%

12:30 Canada Consumer Price Index m / m February 0.2% 0.4%

12:30 Canada Consumer price index, y/y February 2% 1.5%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February 2.0% 2%

13:00 U.S. FOMC Member Dudley Speak

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 91.7 92.2

15:00 U.S. FOMC Member Rosengren Speaks

19:00 U.S. FOMC Member James Bullard Speaks

-