Noticias del mercado

-

20:01

DJIA 17574.36 92.87 0.53%, NASDAQ 4788.00 13.01 0.27%, S&P 500 2045.97 5.38 0.26%

-

18:37

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday as gains in healthcare and financial stocks added to a rally spurred by the Fed's tempered view on interest rates and rising oil prices. The Dow Jones industrial average extended gains for 2016, helped by a 2.7% increase in Goldman Sachs (GS). Volumes were slightly higher than usual on account of "quadruple witching," the expiry of options on stocks and indexes as well as futures on indexes and stocks.

Most of Dow stocks in positive area (19 of 30). Top looser - Caterpillar Inc. (CAT, -1,46%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,61%).

Most of S&P sectors in positive area. Top looser - Basic Materials (-0,6%). Top gainer - Healthcare (+0,7%).

At the moment:

Dow 17465.00 +80.00 +0.46%

S&P 500 2036.25 +6.00 +0.30%

Nasdaq 100 4395.00 +2.00 +0.05%

Oil 41.19 -0.47 -1.13%

Gold 1253.00 -12.00 -0.95%

U.S. 10yr 1.87 -0.04

-

18:01

European stocks close: stocks closed mixed in the absence of any major economic reports from the Eurozone

Stock indices closed mixed in the absence of any major economic reports from the Eurozone.

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview to the Italian newspaper La Repubblica on Friday that the central bank could cut its interest rate further into negative territory if risks to the outlook rise.

"If new negative shocks should worsen the outlook or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armoury," he said.

Bloomberg reported on Thursday that according to two officials familiar with the matter, European Central Bank (ECB) President Mario Draghi said to European Union leaders there was "no alternative" the central bank's recent interest rate cut and further stimulus measures. Draghi also said that European Union leaders should support the ECB's monetary policy actions.

Eurostat released its labour costs data for the Eurozone on Friday. Hourly labour costs in the Eurozone rose at an annual rate of 1.3% in the fourth quarter, after a 1.1% gain in the previous quarter.

Wages and salaries per hour climbed 1.5% year-on-year in the fourth quarter, while non-wage costs gained 0.7%.

In the fourth quarter of 2015, hourly labour costs increased 1.2% year-on-year in industry, 0.5% in construction, 1.3% in services, while 1.6% in the mainly non-business economy.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.5% in February, missing expectations for a 0.2% fall, after a 0.7% drop in January.

On a yearly basis, German PPI dropped 3.0% in February, missing expectations for a 2.6% decrease, after a 2.4% fall in January.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,189.64 -11.48 -0.19 %

DAX 9,950.8 +58.60 +0.59 %

CAC 40 4,462.51 +19.62 +0.44 %

-

18:01

European stocks closed: FTSE 6189.64 -11.48 -0.19%, DAX 9950.80 58.60 0.59%, CAC 40 4462.51 19.62 0.44%

-

17:43

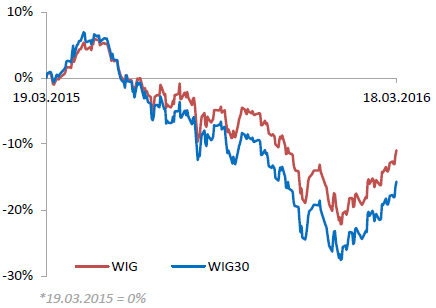

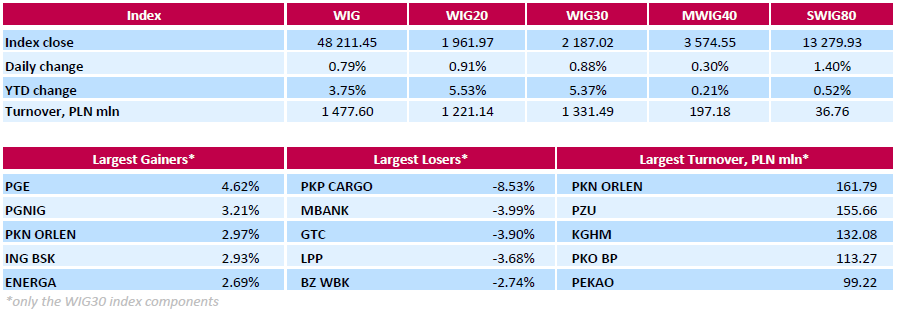

WSE: Session Results

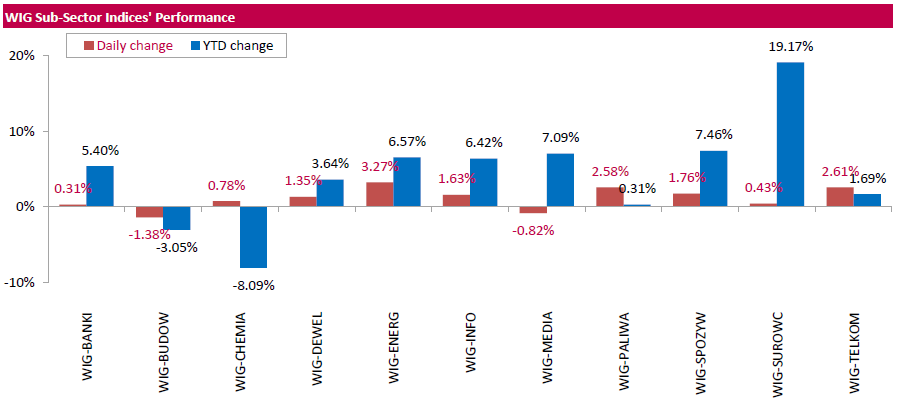

Polish equity market closed higher on Friday. The broad market benchmark, the WIG Index, added 0.79%. Except for media sector (-0.82%) and construction sector (-1.38%), every sector in the WIG Index rose, with utilities (+3.27%) outperforming.

The large-cap stocks' measure, the WIG30 Index, grew by 0.88%. In the index basket, genco PGE (WSE: PGE) and oil and gas company PGNIG (WSE: PGN) recorded the strongest daily performance, gaining 4.62% and 3.21% respectively. Other biggest advancers were oil refiner PKN ORLEN (WSE: PKN), bank ING BSK (WSE: ING), genco ENERGA (WSE: ENG) and agricultural producer KERNEL (WSE: KER), jumping by 2.64%-2.97%. At the same time, railway freight transport operator PKP CARGO (WSE: PKP) was hit the hardest, tumbling by 8.53% on the back of the news the company has no plans to pay dividend for FY2015.

-

16:35

French statistical office INSEE: the French economy wold likely expand 0.4% in the first and second quarters of 2016

The French statistical office INSEE said on Friday that the French economy wold likely expand 0.4% in the first and second quarters of 2016, driven by household spending. INSEE also said that the unemployment rate for mainland France would decline below 10% for the first time in two years (to 9.9%).

-

15:58

Labour cost per employee per month in Spain rises at annual rate of 1.2% in the fourth quarter

The Spanish statistical office INE released its labour costs data on Friday. The labour cost per employee per month rose 1.2% year-over-year in the fourth quarter, after a 0.3% increase in the previous quarter.

The labour cost per employee per month declined by 0.4% in the industry and by 2.1% in the construction, while climbed 1.9% in the services sector.

The labour cost per hour worked jumped 1.6% year-on-year in the fourth quarter.

-

15:17

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 90.0 in March

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 90.0 in March from a final reading of 91.7 in February. Analysts had expected the index to rise at 92.2.

"Consumer confidence eased in early March due to increased concerns about prospects for the economy as well as the expectation that gas prices would inch upward during the year ahead," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"While consumers do not anticipate a recession, they no longer expect the economy to outperform the 2.4% rate of economic growth recorded in the past two years," he added.

The index of current economic conditions declined to 105.6 in March from 106.8 in February, while the index of consumer expectations decreased to 80.0 from 81.9.

The one-year inflation expectations increased to 2.7% in March from 2.5% in February.

-

14:46

WSE: After start on Wall Street

The US indexes began Friday's session with the increases, which prolong the great bull run of the past few weeks. Indices S&P 500, DJIA and Nasdaq Composite enhance existing records the reflection initiated in the first half of February. As for today there is no risk to the collapse of the process due to the poor macro calendar.

The growth on Wall Street does not contribute to the situation on the Warsaw Stock Exchange. Our market consistently standing and waiting for the last 60 minutes of continuous trading.

-

14:33

U.S. Stocks open: Dow +0.28%, Nasdaq +0.31%, S&P +0.29%

-

14:26

Before the bell: S&P futures +0.32%, NASDAQ futures +0.25%

U.S. stock-index rose.

Global Stocks:

Nikkei 16,724.81 -211.57 -1.25%

Hang Seng 20,671.63 +167.82 +0.82%

Shanghai Composite 2,954.93 +50.10 +1.72%

FTSE 6,225.36 +24.24 +0.39%

CAC 4,457.66 +14.77 +0.33%

DAX 9,920.34 +28.14 +0.28%

Crude oil $42.22 (+2.21%)

Gold $1250.30 (-1.16%)

-

14:16

Eurozone’s job vacancy rate rises 1.6% in the fourth quarter

Eurostat released its job vacancy rate data for the Eurozone on Friday. The job vacancy rate in the Eurozone rose 1.6% in the fourth quarter, after a 1.5% increase in the third quarter.

The highest job vacancy rate was recorded in Germany (2.6%), while the lowest job vacancy rates were recorded in Spain and Portugal (both 0.6%).

-

13:57

Canadian consumer price inflation rises 0.2% in February

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation rose 0.2% in February, missing expectations for a 0.4% rise, after a 0.2% gain in January.

The monthly rise was mainly driven by an increase in prices for recreation, education and reading, and clothing and footwear. Prices for recreation, education and reading were up 1.6% in February, while prices clothing and footwear increased 1.4%.

On a yearly basis, the consumer price index slid to 1.4% in February from 2.0% in January, missing expectations for a decline to 1.5%.

The consumer price index was mainly driven by lower gasoline prices, which plunged 13.1% year-on-year in February.

Food prices climbed 3.9% year-on-year in February, while alcoholic beverages and tobacco products prices increased 3.3%.

The index for recreation, education and reading climbed by 1.6% in February from the same month a year earlier, the shelter index gained 1.2%, while clothing and footwear prices dropped 1.3%.

The Canadian core consumer price index, which excludes some volatile goods, increased 0.5% in February, after a 0.3% increase in January.

On a yearly basis, core consumer price index in Canada fell to 1.9% in February from 2.0% in January. Analysts had expected the index to remain unchanged at 2.0%.

The Bank of Canada's inflation target is 2.0%.

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Exxon Mobil (XOM) initiated with a Reduce at Nomura; target $70

Chevron (CVX) initiated with a Neutral at Nomura

McDonald's (MCD) initiated with a Neutral at Longbow

Starbucks (SBUX) resumed with a Hold at Stife

-

13:45

Canadian retail sales climb 2.1% in January

Statistics Canada released retail sales data on Friday. Canadian retail sales climbed by 2.1% in January, exceeding expectations for a 0.6% gain, after a 2.1% decrease in December. December's figure was revised up from a 2.2% drop.

The increase was mainly driven by higher sales at motor vehicle and parts dealers, and at general merchandise stores. Sales at motor vehicle and parts dealers rose by 4.8% in January, while sales at general merchandise stores increased by 4.9%.

Sales at gasoline stations declined 1.6% in January, while sales at food and beverage stores were flat.

Sales at building material and garden equipment and supplies dealers increased 3.0% in January, while sales at furniture and home furnishings stores declined 0.4%.

Canadian retail sales excluding automobiles rose 1.2% in January, beating expectations for a 0.4% gain, after a 1.7% drop in December. December's figure was revised down from a 1.6% fall.

-

12:13

WSE: Mid session comment

Lack of important macroeconomic data and, most of all, the third Friday of March (the day on which March forward contracts expire) are the factors not conducive to noticeable movements in the market. Everything indicates that the session will be the standard date of settlement of derivatives - low volatility and low turnover will continue until the last hour, which will bring a multitude of basket orders.

The level of the WIG20 index is slightly different from yesterday's closing level and is in the close proximity to the point where it began today's trading.

-

11:59

European stock markets mid session: stocks traded higher in the absence of any major economic data from the Eurozone

Stock indices traded higher in the absence of any major economic reports from the Eurozone.

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview to the Italian newspaper La Repubblica on Friday that the central bank could cut its interest rate further into negative territory if risks to the outlook rise.

"If new negative shocks should worsen the outlook or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armoury," he said.

Bloomberg reported on Thursday that according to two officials familiar with the matter, European Central Bank (ECB) President Mario Draghi said to European Union leaders there was "no alternative" the central bank's recent interest rate cut and further stimulus measures. Draghi also said that European Union leaders should support the ECB's monetary policy actions.

Eurostat released its labour costs data for the Eurozone on Friday. Hourly labour costs in the Eurozone rose at an annual rate of 1.3% in the fourth quarter, after a 1.1% gain in the previous quarter.

Wages and salaries per hour climbed 1.5% year-on-year in the fourth quarter, while non-wage costs gained 0.7%.

In the fourth quarter of 2015, hourly labour costs increased 1.2% year-on-year in industry, 0.5% in construction, 1.3% in services, while 1.6% in the mainly non-business economy.

Current figures:

Name Price Change Change %

FTSE 100 6,232.07 +30.95 +0.50 %

DAX 9,926.34 +34.14 +0.35 %

CAC 40 4,463.11 +20.22 +0.46 %

-

11:52

European Central Bank Executive Board member Peter Praet: the central bank could cut its interest rate further into negative territory

The European Central Bank (ECB) Executive Board member Peter Praet said in an interview to the Italian newspaper La Repubblica on Friday that the central bank could cut its interest rate further into negative territory if risks to the outlook rise.

"If new negative shocks should worsen the outlook or if financing conditions should not adjust in the direction and to the extent that is necessary to boost the economy and inflation, a rate reduction remains in our armoury," he said.

Praet noted that it was the right decision to expand stimulus measures.

"What we have got at the end makes sense from an economic point of view," he said.

-

11:40

Hourly labour costs in the Eurozone climb 1.3% in the fourth quarter

Eurostat released its labour costs data for the Eurozone on Friday. Hourly labour costs in the Eurozone rose at an annual rate of 1.3% in the fourth quarter, after a 1.1% gain in the previous quarter.

Wages and salaries per hour climbed 1.5% year-on-year in the fourth quarter, while non-wage costs gained 0.7%.

In the fourth quarter of 2015, hourly labour costs increased 1.2% year-on-year in industry, 0.5% in construction, 1.3% in services, while 1.6% in the mainly non-business economy.

-

11:35

U.S. current account deficit narrows to $125.3 billion in the fourth quarter

The U.S. Commerce Department released its current account data on Thursday. The U.S. current account deficit narrowed to $125.3 billion in the fourth quarter from $129.9 billion in the third quarter, missing expectations for a deficit of $118.9 billion. The third quarter's figure was revised down from a deficit of $124.1 billion.

The trade deficit fell due to drops in the deficits on goods and secondary income, and a rise in the surplus on services.

The deficit on goods and services fell to $133.7 billion in the fourth quarter from $138.6 billion in the third quarter.

The surplus on primary income decreased $42.8 billion in the fourth quarter from $45.4 billion in the third quarter.

The deficit on secondary income declined to $34.3 billion in the fourth quarter from $36.7 billion in the third quarter.

-

11:18

German producer prices drop 0.5% in February

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.5% in February, missing expectations for a 0.2% fall, after a 0.7% drop in January.

On a yearly basis, German PPI dropped 3.0% in February, missing expectations for a 2.6% decrease, after a 2.4% fall in January.

PPI excluding energy sector fell by 0.7% year-on-year in February.

Energy prices were down 9.4% year-on-year in February.

Consumer non-durable goods prices rose 0.2% year-on-year in February, intermediate goods sector prices decreased by 2.2%, while capital goods prices increased 0.7% and durable consumer goods sector prices gained 1.4%.

-

10:55

European Central Bank President Mario Draghi: there is “no alternative” the central bank’s recent stimulus measures

Bloomberg reported on Thursday that according to two officials familiar with the matter, European Central Bank (ECB) President Mario Draghi said to European Union leaders there was "no alternative" the central bank's recent interest rate cut and further stimulus measures. Draghi also said that European Union leaders should support the ECB's monetary policy actions.

-

10:40

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 44.3 in in the week ended March 13

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 44.3 in in the week ended March 13 from 43.8 the prior week.

The increase was mainly driven by a rise in the personal finances index. The measure of views of the economy declined to 35.4 from 35.9, the buying climate index was up to 39.5 from 39.4, while the personal finances index rose to 58.1 from 55.9, the biggest increase since the end of June 2015.

-

10:27

Home prices in China rise in February

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 3.6% in February, after a 2.5% gain in January. It was the biggest annual rise since June 2014.

The main contributor was Shenzhen, where home prices jumped by 56.9% year-on-year in February.

On a monthly base, house prices increased in 47 of 70 cities, prices slid in 15 cities, while prices remained unchanged in 8 cities.

The monthly rise was mainly driven by higher prices in Shenzhen, which climbed 3.6% in February.

-

10:13

Bank of Japan’s January monetary policy meeting minutes: there was a split over negative interest rates

The Bank of Japan (BoJ) released its January monetary policy meeting minutes on late Tuesday evening. According to minutes, there was a split over the negative interest rates. Only 5 of 9 board members voted for the interest rate cut.

The central bank said the employment and income situation continued to improve steadily, while private consumption was resilient.

Board members shared the recognition that the Japanese economy continued to expand moderately, but exports and production were affected by the slowdown in emerging economies.

Board members noted that consumer price inflation was about 0% and it was likely to remain at this level for the time being due a decline in energy prices.

The BoJ decided to lower its interest rate to -0.1% from 0.1% at its January monetary policy meeting.

BoJ Governor Haruhiko Kuroda said this week that an interest rate cut to -0.5% was possible.

-

09:48

WSE: Eurocash SA

Eurocash (WSE: EUR) announces that signed a binding preliminary deal with Pelican Ventures and two other firms (Ledi and Jim) to buy 100% in retailer Eko Holding that runs a network of 250 stores. In this way Eurocash will assume control of a network of more than 250 grocery stores in south-western Poland.

No price tag for this transactions was disclosed.

The store chain generated sales of nearly PLN 1 bln in 2015.

Eurocash Group is the largest group in Poland, engaged in wholesale distribution of food products, household chemicals, alcohol and tobacco (FMCG).

Since February 2005 Eurocash SA, is listed on the Stock Exchange in Warsaw.

-

09:13

WSE: After opening

Expiring today the series of contracts for the WIG20 (FW20H16) began the day with a slight rollback (2 points down) and opened at level of 1,948 points. June's series of the WIG20 futures contracts (FW20M16) started neutrally at yesterday's close.

WIG20 index opened at 1944.75 points (+0.03% to previous close)

WIG 47811.47 -0.05%

WIG20 1944.75 +0.03%

WIG30 2164.82 -0.15%

mWIG40 3563.44 -0.01%

-

08:33

WSE: Before opening

Thursday's sessions on Wall Street ended with the increases of the major indices. On average, they gained 0.2 to 0.9 percent. The US market was in contrast to Europe, where the stronger Euro has put a shadow of pessimism on shares of exporters, and hence yesterday's DAX dropped 0.9 percent.

On Friday we expect correction of yesterday's trading and also adjustments associated with the settlement day of derivatives. Certainly this will have an impact on the Warsaw Stock Exchange, on which the session should dominate the two factors - the correlation with the environment and wait for the final hour of the session which is taken into consideration for the settlement price of future contracts.

-

06:58

Global Stocks: shares rose amid gains in oil prices

European stocks finished slightly lower Thursday, rattled somewhat by a jump by the euro against the dollar and heightened global growth concerns after the Federal Reserve took a less aggressive stance on future rate increases.

The Dow Jones Industrial Average rose for the fifth straight session on Thursday to close in positive territory for 2016 for the first time this year. The energy, materials and industrials sectors rose sharply, helped by soaring commodity prices. Crude-oil futures jumped above $40 a barrel for the first time since Dec. 3, aided by hopes over reducing of output and a sharp drop in the U.S. dollar.

Most Asian shares rose Friday amid gains in oil prices and a surge in major currencies across the region. Stock markets that rallied rebounded on stronger currencies relative to the U.S. dollar. The moves were largely driven by the weakness in the dollar after U.S. central bank officials on Wednesday held steady the benchmark interest rate and slowed the pace of future rate increases.

Based on MarketWatch materials

-

03:31

Nikkei 225 16,627.69 -308.69 -1.82 %, Hang Seng 20,586.06 +82.25 +0.40 %, Shanghai Composite 2,910.01 +5.18 +0.18 %

-

00:36

Stocks. Daily history for Sep Mar 17’2016:

(index / closing price / change items /% change)

Nikkei 225 16,936.38 -38.07 -0.22 %

Hang Seng 20,503.81 +246.11 +1.21 %

Shanghai Composite 2,904.83 +34.40 +1.20 %

FTSE 100 6,201.12 +25.63 +0.42 %

CAC 40 4,442.89 -20.11 -0.45 %

Xetra DAX 9,892.2 -91.21 -0.91 %

S&P 500 2,040.59 +13.37 +0.66 %

NASDAQ Composite 4,774.99 +11.01 +0.23 %

Dow Jones 17,481.49 +155.73 +0.90 %

-