Noticias del mercado

-

21:26

US stocks closed

The Dow Jones Industrial Average erased its 2016 losses, as a weaker dollar spurred a rally in commodity producers and industrial shares that spread to the broader U.S. stock market.

Equities pushed to the highest levels since the end of last year as a gamut of companies that benefit from a lower U.S. currency, from General Electric Co. to Coca-Cola Co., surged. A scaled-back pace of interest-rate increases from the Federal Reserve sent the dollar spiraling lower, helping the Dow extend a rebound of more than 11 percent from a two-year low reached last month.

A five-week rally has eradicated declines in the Dow and S&P 500 that were fed by concerns a slowdown in China would spread, worries that were intensified by a deepening rout in oil and other commodity prices. Energy, raw-material shares and banks have led the rebound as crude recovered, lifting sentiment on lenders amid reduced anxiety about the solvency of some energy producers.

Caterpillar Inc. rallied Thursday with commodity shares, even after cutting its first-quarter outlook amid speculation the worst is behind the company. FedEx Corp. jumped nearly 11 percent after raising the bottom of its full-year earnings forecast range. Health-care shares sank for a fourth session, the longest since January.

-

20:00

DJIA 17509.61 183.85 1.06%, NASDAQ 4776.62 12.65 0.27%, S&P 500 2043.31 16.09 0.79%

-

18:01

European stocks close: stocks closed mixed as a stronger euro weighed on stocks

Stock indices closed mixed as a stronger euro weighed on stocks. The euro rose against the U.S. dollar after the release of the Fed's interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.2% this year, down from the previous estimate of 2.4%, while inflation is expected to be 1.2%, down from the previous estimate of 1.6%.

Market participants also eyed the Eurozone's economic data. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.2% in February, up from the preliminary reading of 0.1%, after a 1.4% drop in January.

On a yearly basis, Eurozone's final consumer price inflation dropped to -0.2% in February from 0.3% in January, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in February, rents increased by 0.08%, fruit prices rose by 0.06%, fuel prices for transport declined by 0.49%, heating oil prices decreased by 0.24%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco decreased to at an annual rate of 0.8% in February from 1.0 in January, up from the preliminary reading of 0.7%.

Eurozone's unadjusted trade surplus slid to €6.2 billion in January from €24.3 billion in December, missing expectations for a decline to €9.0 billion.

Exports fell at an unadjusted annual rate of 2.0% in January, while imports decreased 1.0%.

The Bank of England's (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected. All members voted to keep the central bank's monetary policy unchanged. The BoE noted that the private domestic demand remained solid, while the labour market strengthened.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,201.12 +25.63 +0.42 %

DAX 9,892.2 -91.21 -0.91 %

CAC 40 4,442.89 -20.11 -0.45 %

-

18:00

European stocks closed: FTSE 6201.12 25.63 0.42%, DAX 9892.20 -91.21 -0.91%, CAC 40 4442.89 -20.11 -0.45%

-

17:47

WSE: Session Results

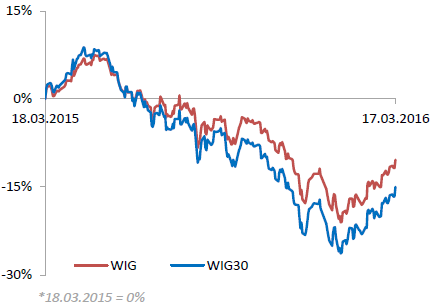

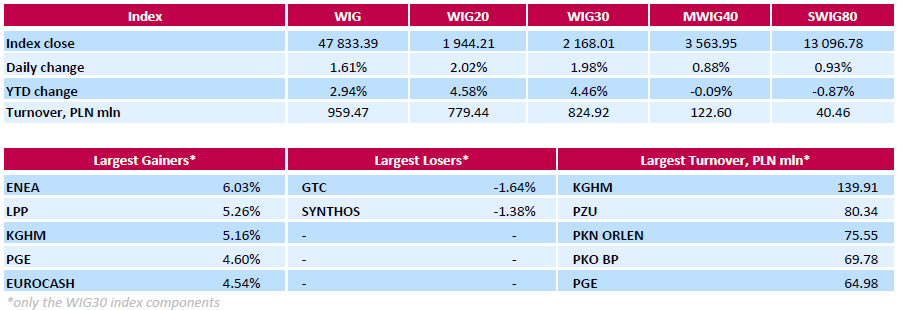

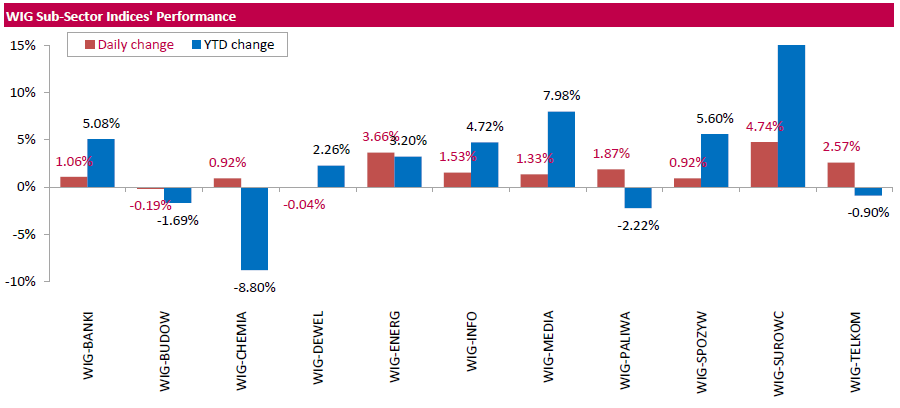

Polish equity market enjoyed a strong run on Thursday. The broad market measure, the WIG Index, surged by 1.61%. Except for developers (-0.04%) and construction sector (-0.19%), every sector in the WIG Index gained, with materials (+4.74%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 1.98%. Almost all Index components returned gains, with the way up led by genco ENEA (WSE: ENA), jumping by 6.03%. It was followed by clothing retailer LPP (WSE: LPP), copper producer KGHM (WSE: KGH), genco PGE (WSE: PGE) and FMCG-wholesaler EUROCASH (WSE: EUR), climbing by 4.54%-5.26%. At the same time, property developer GTC (WSE: GTC) and chemical producer SYNTHOS (WSE: SNS) were the only decliners, falling by 1.64% and 1.38% respectively.

Beyond the WIG30 Index, the main event of the day was the information about a conditional deal to take over a majority stake in KOPEX (WSE: KPX) by the chief shareholder of mining machinery group FAMUR (WSE: FMF). KOPEX has recently fallen into financial difficulties in the wake of coal sector problems. The firm posted PLN 0.5 bln attributable net loss in Q4 2015 on the back of over PLN 430 mln in non-cash impairments. KOPEX soared by over 32% on the end of the session, while FAMUR jumped 22%.

-

17:32

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes lower on Thursday, a day after the Federal Reserve's lowered projection of two interest rate hikes in 2016 pushed the S&P 500 to its highest close this year. The Fed, which left rates unchanged, pointed to moderate U.S. economic growth and strong job gains but cautioned about risks from an uncertain global economy. The central bank had laid out four hikes in 2016 when it raised rates in December.

Most of Dow stocks in positive area (23 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -1,97%). Top gainer - General Electric Company (GE, +2,39%).

Almost of S&P sectors in positive area. Top looser - Healthcare (-1,5%). Top gainer - Basic Materials (+2,3%).

At the moment:

Dow 17327.00 +91.00 +0.53%

S&P 500 2025.00 +7.75 +0.38%

Nasdaq 100 4384.00 -4.25 -0.10%

Oil 41.33 +1.33 +3.33%

Gold 1265.10 +35.30 +2.87%

U.S. 10yr 1.89 -0.05

-

16:50

Bank of Japan Governor Haruhiko Kuroda: inflation in Japan slows down on lower oil prices

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that inflation in Japan slowed down due to a drop in oil prices. He added that inflation excluding oil was improving.

-

16:21

The European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €100 million

According to the Bank of Greece on Thursday, the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks by €100 million to €71.3 billion.

"The reduction of €0.1 billion in the ceiling reflects an improvement of the liquidity situation of Greek banks, amid a reduction of uncertainty and the stabilization of private sector deposits flows," the Bank of Greece said in its statement.

-

16:05

Greek unemployment rate increases to 24.4% in the fourth quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate increased to 24.4% in the fourth quarter from 24.0% in the third quarter.

The number of unemployed people rose by 1.2% in the fourth quarter from the previous quarter.

The youth unemployment rate was up to 49.0% in the fourth quarter from 48.8% in the third quarter.

-

15:20

Job openings climb to 5.541 million in January

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Thursday. Job openings rose to 5.541 million in January from 5.281 million in December. December's figure was revised down from 5.607 million.

The number of job openings climbed for total private (5.075 million) in January from December, while the number of job openings declined for government (466,000).

The hires rate was 3.5% in January.

Total separations decreased to 4.903 million in January from 5.128 million in December.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:13

U.S. leading economic index rises 0.1% in February

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index rose 0.1% in February, missing expectations for a 0.2% increase, after a 0.2% decline in January.

The coincident economic index climbed 0.1% in February, after a 0.3% gain in January.

"The U.S. LEI increased slightly in February, after back-to-back monthly declines, but housing permits, stock prices, consumer expectations, and new orders remain sources of weakness. Although the LEI's six-month growth rate has moderated considerably in recent months, the outlook remains positive with little chance of a downturn in the near-term," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

15:01

WSE: After start on Wall Street

Opening in the US took place on neutral levels, after a while the major indices began to slope downwards.

Earlier today, a series of reinforcing economic data was published on Poland:

Poland's industrial output increased by 6.7% y/y in February vs. 5.5% y/y growth expected

Retail sales output increased by 3.9% y / y in February vs. 3.3% y / y forecast.

-

14:38

Bank of England's Monetary Policy Committee March minutes: private domestic demand remains solid

The Bank of England's Monetary Policy Committee (MPC) released its March meeting minutes on Thursday. All members voted to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind in February.

The consumer price inflation in the U.K. was 0.3% in January, below the central bank's 2% target. The BoE noted that inflation was driven by declines in energy and food prices.

The BoE noted that the private domestic demand remained solid, while the labour market strengthened.

The central bank said that there are downside risks to the global growth and to the central bank's forecasts from the slowdown in emerging economies.

The BoE noted that the pound depreciated due to the uncertainty around the referendum on U.K. membership of the European Union, and it could weigh on the domestic demand.

All MPC members agreed to hike interest rate gradually once the BoE starts raising its interest rate and "to a lower level than in recent cycles", adding that further interest rate decision will depend on the incoming economic data.

-

14:35

U.S. Stocks open: Dow +0.08%, Nasdaq -0.15%, S&P +0.01%

-

14:28

Before the bell: S&P futures -0.21%, NASDAQ futures -0.31%

U.S. stock-index fell.

Global Stocks:

Nikkei 16,936.38 -38.07 -0.22%

Hang Seng 20,503.81 +246.11 +1.21%

Shanghai Composite 2,905.54 +35.11 +1.22%

FTSE 6,150.88 -24.61 -0.40%

CAC 4,401.41 -61.59 -1.38%

DAX 9,808.8 -174.61 -1.75%

Crude oil $39.02 (+1.46%)

Gold $1267.00 (+3.00%)

-

14:26

Bank of England keeps its interest rate on hold at 0.5% in March

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

-

14:24

Canada’s wholesale sales are flat in February

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales were flat in January, missing expectations for a 0.2% gain, after a 1.8% rise in December. December's figure was revised up from a 2.0% increase.

A rise in the machinery, equipment and supplies subsector was offset by a drop in the motor vehicle and parts subsector.

Sales of motor vehicle and parts were down 2.3% in January, while sales in in the machinery, equipment and supplies subsector rose 2.6%.

Inventories increased by 0.3% in January.

-

14:19

Philadelphia Federal Reserve Bank’s manufacturing index climbs to 12.4 in March

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index climbed to 12.4 in March from -2.8 in February, exceeding expectations for an increase to -1.7.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Firms responding to the Manufacturing Business Outlook Survey reported an improvement in business conditions this month. The indicator for general activity rose sharply in March to its first positive reading in seven months," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index climbed to 22.1 in March from 2.5 in February.

The new orders index increased to 15.7 in March from -5.3 in February.

The prices paid index rose to -0.9% in March from -2.2 in February, while the prices received index rose to 3.5 from -4.5.

The number of employees index was up to 1.1 in March from -5.0 in February.

According to the report, the future general activity index jumped to 28.8 in March from 17.3 in February.

-

14:00

Initial jobless claims rise to 265,000 in the week ending March 12

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 12 in the U.S. increased by 7,000 to 265,000 from 258,000 in the previous week. The previous week's figure was revised down from 259,000.

Analysts had expected jobless claims to rise to 268,000.

Jobless claims remained below 300,000 the 54th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 8,000 to 2,235,000 in the week ended March 05.

-

13:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

FedEx (FDX) reiterated with a Buy; target raised to $174 from $171 at Stifel

FedEx (FDX) target raised to $158 from $153 at RBC Capital Mkts

FedEx (FDX) target raised to $180 from $175 at Cowen

Microsoft (MSFT) assumed with an Outperform at Oppenheimer

-

12:29

WSE: Mid session comment

Consecutive hours of trading resulted in an increase in the value of the European currency and weakening of Euroland markets, where the DAX lost already almost 2%, and the CAC40 1.5%. The environment therefore puts pressure on the Warsaw Stock Exchange, although the latter, having features of an emerging market, is not so strongly correlated with the developed European markets. Preservation of the current environment can still have implications for the WSE, as the Euro markets took over the movement in the currency market, where the EUR/USD pair is now at highs of February.

-

12:00

European stock markets mid session: stocks traded lower on a stronger euro

Stock indices traded lower on a stronger euro. The euro rose against the U.S. dollar after the release of the Fed's interest rate decision. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.2% this year, down from the previous estimate of 2.4%, while inflation is expected to be 1.2%, down from the previous estimate of 1.6%.

Market participants also eyed the Eurozone's economic data. Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.2% in February, up from the preliminary reading of 0.1%, after a 1.4% drop in January.

On a yearly basis, Eurozone's final consumer price inflation dropped to -0.2% in February from 0.3% in January, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in February, rents increased by 0.08%, fruit prices rose by 0.06%, fuel prices for transport declined by 0.49%, heating oil prices decreased by 0.24%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco decreased to at an annual rate of 0.8% in February from 1.0 in January, up from the preliminary reading of 0.7%.

Eurozone's unadjusted trade surplus slid to €6.2 billion in January from €24.3 billion in December, missing expectations for a decline to €9.0 billion.

Exports fell at an unadjusted annual rate of 2.0% in January, while imports decreased 1.0%.

The Bank of England (BoE) will release its interest rate decision later in the day. Analysts expect the central bank to keep its monetary policy unchanged.

Current figures:

Name Price Change Change %

FTSE 100 6,143.91 -31.58 -0.51 %

DAX 9,800.71 -182.70 -1.83 %

CAC 40 4,389.69 -73.31 -1.64 %

-

11:54

Swiss National Bank keeps its rates steady at -0.75% in March, but it downgrades its economic growth and inflation forecasts

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market if needed.

The SNB noted that the Swiss franc was still significantly overvalued.

Inflation was downgraded to -0.8% in 2016 from the previous forecast of -0.5%. The central bank expects inflation to be 0.1% in 2017, down from the previous forecast of 0.3%.

The downward revision was driven by a further decline in oil prices.

The central bank noted that global economic outlook deteriorated slightly in recent months.

According to the central bank, the central bank's assessment of the global economic outlook was less favourable than in December.

The SNB said that the Swiss economy to expanded "just under" 1% in 2015. The central bank expect the Swiss economy to grow between 1% and 1.5%, down from its previous estimate of 1.5%.

-

11:44

State Secretariat for Economic Affairs downgrades its GDP and inflation forecasts for Switzerland

The State Secretariat for Economic Affairs (SECO) released its GDP and inflation forecasts on Thursday. The agency downgraded its 2016 growth forecast to 1.4% from 1.5%. GDP for 2017 was downgraded to 1.8% from 1.9%.

"The strong appreciation of the Swiss franc was a main factor slowing down economic growth," the SECO said in its Spring report.

SECO expects the negative exchange rate effects to dissipate through 2016 and 2017.

The agency noted that there was "no clear sign of a marked acceleration of global growth".

The average annual unemployment rate is expected to be 3.6% this year and 3.5% next year.

The consumer price inflation is expected to be -0.6% this year, down from the December estimate of -0.1%, and +0.2% in 2017, unchanged from the December estimate.

-

11:32

Switzerland's producer and import prices are down 0.6% in February

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices fell 0.6% in February, missing expectations for a 0.2% gain, after a 0.4% decrease in January.

The decrease was mainly driven by lower prices for chemical and pharmaceutical, and petroleum products.

The Import Price Index decreased by 1.0% in February, while producer prices fell 0.5%.

On a yearly basis, producer and import prices plunged 4.6% in February, beating expectations for a 5.1% fall, after a 5.3% drop in January.

The Import Price Index fell by 6.9% year-on year in February, while producer prices dropped 3.5%.

-

11:24

Italy’ trade surplus narrows to €0.04 billion in January

The Italian statistical office Istat released its trade data for Italy on Thursday. Italy' trade surplus narrowed to €0.04 billion in January from €6.00 billion in December. December's figure was revised down €6.02 billion.

Exports dropped 3.5% year-on-year in January, while imports decreased 3.2%.

On a monthly basis, exports fell a seasonally-adjusted 2.2% in January, while imports were down 0.6%.

The seasonally-adjusted trade surplus with the EU was €1.03 billion in January, while the trade surplus with non-EU countries was €2.83 billion.

-

11:15

Eurozone's unadjusted trade surplus slides to €6.2 billion in January

Eurostat released its trade data for the Eurozone on Thursday. Eurozone's unadjusted trade surplus slid to €6.2 billion in January from €24.3 billion in December, missing expectations for a decline to €9.0 billion.

Exports fell at an unadjusted annual rate of 2.0% in January, while imports decreased 1.0%.

-

11:09

Eurozone's harmonized consumer price index rises 0.2% in February

Eurostat released its final consumer price inflation data for the Eurozone on Thursday. Eurozone's harmonized consumer price index rose 0.2% in February, up from the preliminary reading of 0.1%, after a 1.4% drop in January.

On a yearly basis, Eurozone's final consumer price inflation dropped to -0.2% in February from 0.3% in January, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in February, rents increased by 0.08%, fruit prices rose by 0.06%, fuel prices for transport declined by 0.49%, heating oil prices decreased by 0.24%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco decreased to at an annual rate of 0.8% in February from 1.0 in January, up from the preliminary reading of 0.7%.

-

10:59

Australia's unemployment rate declines to 5.8% in February

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate declined to 5.8% in February from 6.0% in January. Analysts had expected the unemployment rate to remain unchanged at 6.0%.

The number of employed people in Australia increased by 300 in February, missing forecast of a rise by 10,000, after a decline by 7,400 in January. January's figure was revised up from a fall by 7,900.

Full-time employment climbed by 15,900 in February, while part-time employment fell by 15,600.

The participation rate declined to 64.9% in February from 65.1% in February.

-

10:44

Japan's trade deficit turns into a surplus of ¥242.8 billion in February

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit turned into a surplus of ¥242.8 billion in February from a deficit of ¥648.8 billion in January. January's figure was revised down from a deficit of ¥645.9 billion.

Analysts had expected a surplus of ¥388.6 billion.

Exports fell 4.0% year-on-year in February, while imports dropped 14.2%.

Exports to Asia declined by 6.1% year-on-year in February, exports to the United States increased by 0.2%, while exports to the European Union climbed by 9.2%.

Imports from Asia plunged by 15.9% year-on-year in February, imports from the United States rose by 5.1%, while imports from the European Union climbed by 14.2%.

-

10:24

New Zealand's economy expanded at 0.9% in the fourth quarter

Statistics New Zealand released its GDP data on late Wednesday evening. New Zealand's GDP rose 0.9% in the fourth quarter, exceeding expectations for a 0.6% increase, after a 0.9% gain in the third quarter.

The increase was driven mainly by a rise in the service industries.

The overall services sector rose 0.8% in the fourth quarter, construction climbed 2.5%, while the manufacturing sector declined.

On a yearly basis, New Zealand's GDP climbed by 2.3% in the fourth quarter, beating expectations for a 2.0% growth, after a 2.3% rise in the third quarter.

-

10:20

WSE: Famur SA

TDJ, the chief shareholder of mining machinery group Famur (WSE: FMF), signed a conditional deal to take over a majority stake in Kopex (WSE: KPX) from its main shareholder Krzysztof Jedrzejewski.

Both Famur and Kopex are gaining on the news: Kopex shares are up by 26% and Famur by nearly 19% after the first hour of WSE trade.

Famur Group is one of the world's leading manufacturers of machinery and mining equipment.

Kopex Group is the general contractor of investment projects in the mining of coal, lignite and metal ores, offering full support for the investment.

-

10:12

The Fed keeps its monetary unchanged in March

The Fed's released its interest rate decision on Wednesday. The Fed kept its interest rate unchanged at 0.25% - 0.50% as widely expected by analysts. The Fed reviewed its interest rate forecasts. The Fed said at its March monetary policy meeting that interest rate will be 1.00% by the end of the year, down from 1.50% in December. It means that Fed officials expect the Fed to raise its interest rate twice this year. The Fed expects its fed-funds rate to be 1.7% by the end of 2017, down from its previous estimate of 2.375%, and 3.00% by the end of 2018, down from its previous estimate of 3.25%.

The Fed cut its growth and inflation forecasts. The U.S. economy is expected to expand 2.2% this year, down from the previous estimate of 2.4%, while inflation is expected to be 1.2%, down from the previous estimate of 1.6%.

The Fed said in its statement that the U.S. economy expanded moderately, household spending rose moderately, the labour market continued to strengthen, while inflation increased in recent months but remained below the Fed's 2% target. The Fed said that there were risks to the U.S. economy from the global economic and financial developments.

Comments by the Fed Chairwoman Janet Yellen were "dovish". She noted that low oil prices continued to weigh on inflation. Yellen pointed out that the Fed was not considering negative interest rates but was analysing their effects in other countries.

The Fed chairwoman also said that an interest rate hike in April was possible.

-

09:18

WSE: After opening

The WIG20 index futures (FW20H16) started off optimistically, with a 11 points gap over yesterday's close, an increase of 0.6 percent. This initial increase is due to improvement in the market sentiment that we observe after yesterday's FED, which once again helping the markets.Cash market opens with increase by 0.1% to 1,907 points. at a moderate turnover, focused on the KGHM. So modest opening allows increases in the first few minutes, which have the potential to develop towards 1950 points. We are still waiting for a bigger demand impulse, which would make the observed increase credible.

WIG 47,292.94 (+0.46%)

WIG30 2,136.57 (+0.50%)

mWIG40 3,541.54 (+0.24%)

-

08:27

WSE: Before opening

Today's session will take place in the context of the reaction to yesterday's FOMC decision. US rates have not changed, and there's a sense of disappointment in the market.

US stock market reacted slightly, the S&P500 index rose by 0.6%. Larger changes were on currency market, where the dollar weakened. That brought positive changes to the raw materials market and consequently increased appetite for assets in emerging markets.

Thus, the opening of Europe's markets promise to be positive, same as the Warsaw Stock Exchange. It does not seem that the boost from the United States was spectacularly strong. Stock market indices remain in the short-term trend growth and the decision of the FOMC does not make disruption here.

-

06:30

Global Stocks: markets rallied after the U.S. central bank said it wouldn’t raise interest rates as quickly as expected

U.K. stocks strengthened Thursday as oil and property shares gained in the wake of the British government's annual budget plans. While the oil sector scored wins following the budget outline, some midcap beverage stocks were stung by an unexpected plan to tax sugary drinks.

U.S. stocks advanced Wednesday, with the S&P 500 and Dow reaching 2016 highs, after the Federal Reserve kept its key interest rates unchanged and downgraded its forecast for the number of rate increases to two in 2016 from an earlier projection of four.

Asia stock markets rallied Thursday after the U.S. central bank said it wouldn't raise interest rates as quickly as expected.

Based on MarketWatch materials

-

03:04

Nikkei 225 17,223.78 +249.33 +1.47 %, Hang Seng 20,603.04 +345.34 +1.70 %, Shanghai Composite 2,877.5 +7.07 +0.25 %

-

00:28

Stocks. Daily history for Sep Mar 16’2016:

(index / closing price / change items /% change)

Nikkei 225 16,974.45 -142.62 -0.8 %

Hang Seng 20,257.7 -31.07 -0.2 %

Shanghai Composite 2,870.48 +6.11 +0.2 %

FTSE 100 6,175.49 +35.52 +0.6 %

CAC 40 4,463 -9.63 -0.2 %

Xetra DAX 9,983.41 +49.56 +0.5 %

S&P 500 2,027.22 +11.29 +0.6 %

NASDAQ Composite 4,763.97 +35.30 +0.7 %

Dow Jones 17,325.76 +74.23 +0.4 %

-