Noticias del mercado

-

21:10

U.S. stocks closed

U.S. stocks slipped in light trading, with the Standard & Poor's 500 Index posting back-to-back declines for the first time this month, as investors considered the capacity of central banks to boost global growth.

U.S. equities retreated with shares in Asia and Europe after the Bank of Japan refrained from adding more stimulus. Central banks around the world have indicated a willingness to continue measures to support economic growth and stabilize markets, helping stocks rebound in the past month. The Federal Reserve kicked off a two-day policy meeting today, with investors tempering their trading before the outcome Wednesday afternoon.

Fed officials have stressed that the pace of rate increases will be gradual and data-dependent. A report showed retail sales dropped in February and the prior month's gain was revised to a decline, calling into question the narrative that bigger gains in consumer spending would propel economic growth at the start of 2016. Separate data showed wholesale prices fell last month, held down by lower fuel costs that have kept inflation languishing below the Fed's goal.

Another measure showed confidence among homebuilders held in March at a nine-month low as sales prospects waned, while other data indicated inventories at warehouses, stores and showrooms are not being drawn down amid tepid underlying demand.

-

20:00

DJIA 17215.81 -13.32 -0.08%, NASDAQ 4722.04 -28.24 -0.59%, S&P 500 2011.40 -8.24 -0.41%

-

18:01

European stocks close: stocks closed lower on a decline in oil prices

Stock indices closed lower as oil prices declined. Oil prices fell on concerns over the global oil oversupply. Iranian Oil Minister Bijan Zanganeh said on Sunday that the country was not ready to freeze its oil output until output of 4.0 million barrels a day was reached.

Market participants are awaiting the release of the Fed's interest rate decision tomorrow. Analysts expect the Fed to keep its monetary policy unchanged.

Market participants also eyed the Eurozone's economic data. Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% gain, after a 0.3% rise in the third quarter.

Main contributors were Malta (+1.7%), Spain, Luxembourg and Portugal (all +0.7%).

On a yearly basis, employment in the Eurozone increased by 1.2% in the fourth quarter, after a 1.1% gain in the third quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,139.97 -34.60 -0.56 %

DAX 9,933.85 -56.41 -0.56 %

CAC 40 4,472.63 -33.96 -0.75 %

-

18:00

European stocks closed: FTSE 6139.97 -34.60 -0.56%, DAX 9933.85 -56.41 -0.56%, CAC 40 4472.63 -33.96 -0.75%

-

17:46

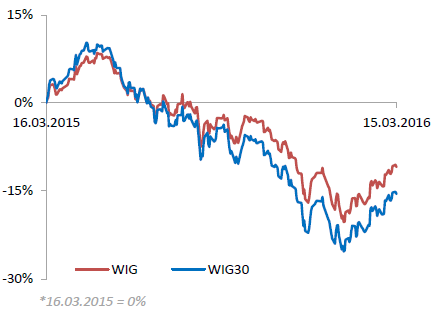

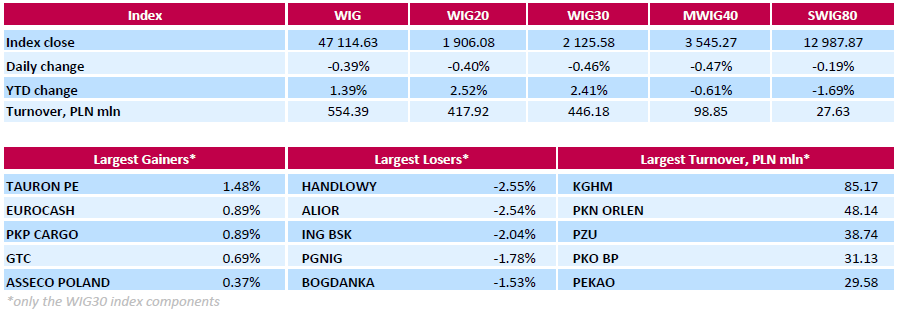

WSE: Session Results

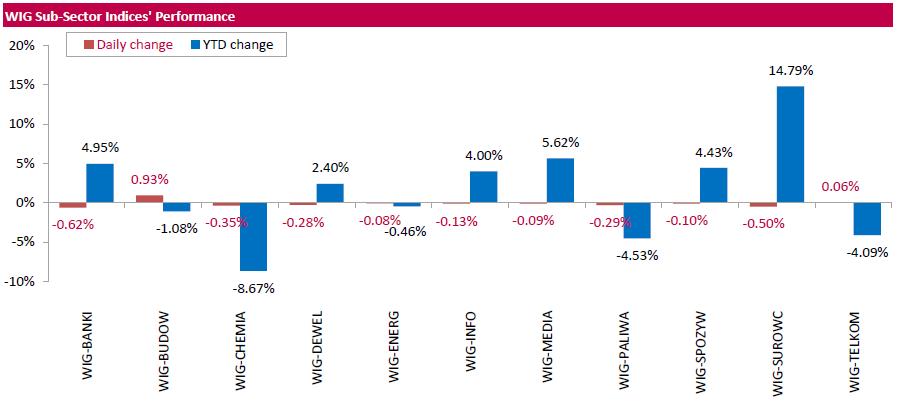

Polish equities declined on Tuesday. The broad market benchmark, the WIG Index, lost 0.39%. Most sectors fell, with banking sector stocks (-0.62%) posting the sharpest decline.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.46%. Within the index components, banking sector names HNDLOWY (WSE: BHW), ALIOR (WSE: ALR) and ING BSK (WSE: ING) recorded the biggest losses of 2.04%-2.54%. Other major laggards were oil and gas company PGNIG (WSE: PGN), thermal coal miner BOGDANKA (WSE: LWB) and chemical producer GRUPA AZOTY (WSE: ATT), declining by 1.78%, 1.53% and 1.49% respectively. On the other side of the ledger, genco TAURON PE (WSE: TPE) led the gainers with a 1.48% advance, followed by FMCG-wholesaler EUROCASH (WSE: EUR) and railway freight transport operator PKP CARGO (WSE: PKP), each adding 0.89%.

Beyond the WIG30 Index, power industry company KOGERENCJA SA (WSE: KGN) soared by 5.29% after the publication of the company's annual financial report.

-

17:34

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as a slide in oil prices dragged down energy stocks and investors kept to the sidelines ahead of the U.S. Federal Reserve's policy meeting. Global markets fell and the yen rose as investors sought safe havens after the Bank of Japan's lowered inflation expectations suggested it may increase its stimulus program. Data on Tuesday showed retail sales dipped 0,1% in February, less than the 0,2% drop estimated, but a sharp downward revision to January's sales could reignite concerns about the economy's growth prospects. The Fed is not expected to raise interest rates at its two-day meeting, which starts on Tuesday, but its comments will be parsed for clues on the path of future hikes.

Dow stocks mixed (17 in negative area vs 13 in positive area). Top looser - Chevron Corporation (СVX, -1,97%). Top gainer - Apple Inc. (AAPL, +2,38%).

All S&P sectors in negative area. Top looser - Basic Materials (-2,2%).

At the moment:

Dow 17093.00 -35.00 -0.20%

S&P 500 1998.50 -10.75 -0.54%

Nasdaq 100 4345.75 -12.00 -0.28%

Oil 36.05 -1.13 -3.04%

Gold 1232.90 -12.20 -0.98%

U.S. 10yr 1.95 -0.01

-

17:23

Japan's tertiary industry activity index increases 1.5% in January

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Tuesday. The index increased 1.5% in January, after a 0.6% fall in December.

The rise was driven by increases in wholesale trade, finance and insurance, business-related services, real estate, transport and postal activities, medical, health care and welfare, electricity, gas, heat supply and water, and retail trade.

-

17:17

Final industrial production in Japan climbs 3.7% in January

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Tuesday. Final industrial production in Japan climbed 3.7% in January, in line with the preliminary estimate, after a 1.7% decrease in December.

Industrial shipments jumped 3.5% in January, up from the preliminary estimate of 3.4%, while inventories fell 2.2%, down from the preliminary estimate of -2.1%.

On a yearly basis, Japan's industrial production was down 3.8% in January, after a 1.9% drop in December.

-

16:56

Fitch affirms Australia’s sovereign debt rating at 'AAA'

Rating agency Fitch Ratings affirmed Australia's sovereign debt rating at 'AAA'. The outlook is 'stable'.

The agency noted that Australia's rating was supported by "the economy's high income, strong institutions and effective governance".

"The free-floating exchange rate, credible monetary policy framework, low public debt and growing recognition of the Australian dollar as a reserve currency allow the economy to adjust to changing economic conditions," Fitch added.

-

16:29

U.S. business inventories increase 0.1% in January

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.1% in January, exceeding expectations for a flat reading, after a 0.1% increase in December.

Retail inventories climbed 0.3% in January, wholesale inventories were up 0.3%, while manufacturing inventories decreased 0.4%.

Retail sales declined 0.3% in January, while business sales were down 0.4%.

The business inventories/sales ratio rose to 1.40 months in January from 1.39 months in December. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:21

NAHB housing market index remains unchanged at 58 in March

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index remained unchanged at 58 in March, missing expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index climbed to 43 in March from 39 in February, the current sales conditions sub-index remained unchanged at 65, while the sub-index measuring sales expectations in the next six months decreased to 61 from 64.

"Builders continue to report problems regarding a shortage of lots and labour," the NAHB Chairman Ed Brady.

"Solid job growth, low mortgage rates and improving mortgage availability will help keep the housing market on a gradual upward trajectory in the coming months," the NAHB Chief Economist David Crowe said.

-

14:54

WSE: After start on Wall Street

The first session of the week in the US was marked by insignificant fluctuations in anticipation of the FOMC meeting results, which will be announced tomorrow.

Everything points to reinforce the expectation that today's session will look similar.

The downward start on Wall Street was expected after an earlier, rather weak, behavior of futures, which indicated a 0.5% decline at the opening.

Also consequential is the decline in oil quotations, which was largely ignored yesterday by Wall Street, but was spotted by the mining companies.

-

14:48

NY Fed Empire State manufacturing index rises to 0.62 in March

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index jumped to 0.62 in March from -16.64 in February, exceeding expectations for an increase to -10.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The March 2016 Empire State Manufacturing Survey indicates that business activity steadied for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to 9.57 in March from -11.63 in February, while the shipments index climbed to 13.88 from -11.56.

The general business conditions expectations index for the next six months jumped to 25.52 in March from 14.48 in February.

The price-paid index remained unchanged at 2.97 in March.

The index for the number of employees fell to -1.98 in March from -0.99 in February.

-

14:43

U.S. producer prices fall 0.2% in February

The U.S. Commerce Department released the producer price index figures on Tuesday. The U.S. producer price index declined 0.2% in February, in line with expectations, after a 0.1% rise in January.

The decrease was mainly driven by drops in energy and food prices. Energy prices declined 3.4% in February, wholesale food prices decreased 0.3%.

Services prices were flat in February.

On a yearly basis, the producer price index was flat in February, missing expectations for a 0.1% increase, after a 0.2% fall in January.

The producer price index excluding food and energy was flat in February, missing expectations for a 0.1% gain, after a 0.4% increase in January.

On a yearly basis, the producer price index excluding food and energy climbed 1.2% in February, after a 0.6% rise in January.

These figures could mean that the Fed will delay its further interest rate hikes.

-

14:33

U.S. Stocks open: Dow -0.53%, Nasdaq -0.42%, S&P -0.57%

-

14:28

U.S. retail sales decline 0.1% in February

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales decreased 0.1% in February, in line with expectations, after a 0.4% drop in January. January's figure was revised down from a 0.2% increase.

The decrease was mainly driven by a drop in sales at auto dealerships.

Sales at clothing retailers were up 0.9% in February, sales at building material and garden equipment stores increased 1.6%, while sales at auto dealerships slid 0.2%.

Retail sales excluding automobiles declined 0.1% in February, beating expectations for a 0.2% fall, after a 0.4% decrease in January. January's figure was revised down from a 0.1% rise.

Sales at service stations dropped 4.4% in February, while sales at furniture stores fell 0.5%.

These figures could mean that the Fed will likely not raise its interest rate in March as consumers remained cautious.

-

14:27

Before the bell: S&P futures -0.55%, NASDAQ futures -0.36%

U.S. stock-index fell.

Global Stocks:

Nikkei 17,117.07 -116.68 -0.68%

Hang Seng 20,288.77 -146.57 -0.72%

Shanghai Composite 2,864.26 +4.76 +0.17%

FTSE 6,136.53 -38.04 -0.62%

CAC 4,458.68 -47.91 -1.06%

DAX 9,914.64 -75.62 -0.76

Crude oil $36.13 (-2.82%)

Gold $1234.30 (-0.87%)

-

13:48

Upgrades and downgrades before the market open

Upgrades:

Barrick Gold (ABX) upgraded to Buy from Hold at Argus; target $18

Downgrades:

Other:

UnitedHealth (UNH) target raised to $150 from $131 at Mizuho

-

12:34

WSE: Mid session comment

No important changes on the Warsaw floor till mid-day, the turnover in the overall market slightly exceeded PLN 200 mln. Variability, like yesterday, remained small, and investors are waiting for a message from the FOMC.

The decline in futures on Wall Street has exceeded 0.5%, a similar downturn persists in the German market. The environment of the Warsaw Stock Exchange is dominated by the supply side, unlike yesterday.

-

12:01

European stock markets mid session: stocks traded lower on a fall in oil prices

Stock indices traded lower as oil prices declined. Oil prices fell on concerns over the global oil oversupply.

Market participants are awaiting the release of the Fed's interest rate decision tomorrow. Analysts expect the Fed to keep its monetary policy unchanged.

Market participants also eyed the Eurozone's economic data. Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% gain, after a 0.3% rise in the third quarter.

Main contributors were Malta (+1.7%), Spain, Luxembourg and Portugal (all +0.7%).

On a yearly basis, employment in the Eurozone increased by 1.2% in the fourth quarter, after a 1.1% gain in the third quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,132.26 -42.31 -0.69 %

DAX 9,941.18 -49.08 -0.49 %

CAC 40 4,463.94 -42.65 -0.95 %

-

11:44

Bank of Japan Governor Haruhiko Kuroda: the central bank needs time to analyse the effect of negative interest rates on the real economy

Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference after the release of the BoJ' interest rate decision that the central bank needed time to analyse the effect of negative interest rates on the real economy, adding that negative interest rates would lead to lower borrowing costs.

He reiterated that the BoJ would further stimulus measures if needed to reach 2% inflation target.

-

11:33

Final consumer prices in Italy decline 0.2% in February

The Italian statistical office Istat released its final consumer price inflation data for Italy on Tuesday. Final consumer prices in Italy fell 0.2% in February, in line with preliminary reading, after a 0.2% decrease in January.

The drop was mainly driven by a decline in prices of energy products, which fell 1.2% in February.

On a yearly basis, consumer prices declined 0.3% in February, in line with preliminary reading, after a 0.3% increase in January.

The declines was mainly driven by a faster decline of prices of non-regulated energy products, and drops in prices of unprocessed food and services related to transport. Prices of non-regulated energy products slid 8.5% year-on-year in February, prices of unprocessed food declined 1.2%, while prices of services related to transport decreased 0.7%.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in February from 0.8% in January.

-

11:17

French final consumer price inflation rises 0.3% in February

The French statistical office Insee released its final consumer price inflation for France on Tuesday. The French consumer price inflation rose 0.3% in February, up from the preliminary reading of 0.2%, after a 1.0% drop in January.

On a yearly basis, the consumer price index decreased 0.2% in February, in line with the preliminary reading, after a 0.2% rise in January. It was first fall since March 2015.

Fresh food prices rose 0.4% year-on-year in February, services prices climbed by 0.8%, while petroleum products prices dropped by 12.8%.

-

11:11

Eurozone's employment increases by 0.3% in the fourth quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% gain, after a 0.3% rise in the third quarter.

Main contributors were Malta (+1.7%), Spain, Luxembourg and Portugal (all +0.7%).

On a yearly basis, employment in the Eurozone increased by 1.2% in the fourth quarter, after a 1.1% gain in the third quarter.

-

10:55

WSE: Net profit of Kogeneracja SA rose y/y to PLN 125.4 mln in 2015.

Kogeneracja SA (WSE: KGN) recorded PLN 125.4 mln consolidated net profit attributable to shareholders of the parent company in 2015 compared to PLN 49.31 mln profit a year earlier, the company said in a report.

Operating profit amounted to PLN 169.03 mln from PLN 57.68 mln profit a year earlier.

Consolidated sales revenues reached PLN 972.88 mln in 2015 against PLN 880.32 mln year earlier.

Kogeneracja SA is the group of power and heat plants and consists of three production plants: EC Wrocław, EC Czechnica and EC Zawidawie.

-

10:39

March’s Reserve Bank of Australia monetary policy meeting: the Australian economy expands slightly below the trend

The Reserve Bank of Australia (RBA) released its minutes from March monetary policy meeting on Tuesday. The RBA said that the Australian economy expanded slightly below the trend, adding that there were "further signs of a rebalancing of activity towards non-mining sectors of the economy".

The RBA noted that the employment was expected to grow, while wages remained at low levels.

Members also said that further interest rate cut may be needed.

"Members noted that continued low inflation would provide scope to ease monetary policy further, should that be appropriate to lend support to demand," the minutes said.

The central bank will analyse the incoming economic data, the RBA said in its minutes.

The RBA kept unchanged its interest rate at 2.00% in March.

-

10:26

Bank of Japan keeps its interest rate unchanged at -0.1% in March

The Bank of Japan (BoJ) released its interest rate decision on Tuesday. The central bank kept its interest rate unchanged at -0.1% as widely expected by analysts. The monetary base target remained unchanged at 275 trillion yen, while the central bank said that it will expand its monetary base at an annual pace of 80 trillion yen as expected by analysts.

7 of 9 board members voted to keep interest rate unchanged, while 8 of 9 members voted for raising the monetary base at an annual pace of 80 trillion yen.

The central bank noted that it would expand its stimulus measures if needed to reach 2% inflation target.

The BoJ said that Japan's economy continued to expand moderately, but exports and production were sluggish due the slowdown in emerging economies, adding that domestic private consumption was resilient.

The central bank expects consumer inflation to be about 0% "for the time being" due to low energy prices.

-

10:12

Federal Reserve Bank of New York’s survey: consumer inflation expectations rise in February

The Federal Reserve Bank of New York released its February 2016 Survey of Consumer Expectations on Monday. Consumer inflation expectations for the coming year in the U.S. rose to 2.7% in February from 2.4% in January.

Inflation expectations for coming three years in the U.S. increased to 2.6% in February from 2.5% in January.

The increase was driven by a rise in expectations for gas prices.

-

09:12

WSE: After opening

Futures market (FW20H16) opened with drop of 0.26% to 1,910 points. This behavior is consistent with the lower opening in Europe, where the contract for the DAX went down approximately by 0.5%.

WIG20 index opened at 1,909.88 points (-0.21% to previous close)

WIG 47,199.25 -0.21%

WIG20 1,909.88 -0.21%

WIG30 2,128.41 -0.33%

mWIG40 3,558.56 -0.10%

We go deeper into the week of the expiration of the contracts in the background, and the day before the meeting of the FOMC, for many investors this is not the time to take important decisions. Thus, the most likely scenario is that today the session will unravel in a calm, standby mode.

-

08:35

WSE: Before opening

This morning Asian markets were in the red, led by the Nikkei, after the BoJ refrained from further actions to support the economy, and has not referred in its communication to a possibility of further interest rates lowering.

Today, several large companies listed on the Warsaw Stock Exchange published their financial results. Investors should pay particular attention to PZU and Energa, where there have been differences from expectations.

Somewhat declining prices of raw materials before the session should give a small advantage for the supply side, which today can also test the determination of demand to keep the market above the level of 1900 points.

-

07:23

Global Stocks: Bank of Japan held policy steady

European stocks pushed higher, led by miners, on Monday, while the broader market continued to welcome last week's boost in stimulus from the European Central Bank.

The Dow industrials logged a new closing high for 2016 on Monday, while the S&P 500 edged lower as losses in the materials and energy sector capped gains for consumer-discretionary shares.

Asian stocks languished near the day's lows on Tuesday, after the Bank of Japan held policy steady as expected and offered a bleaker view of the country's economy in the face of lingering anxiety over slowing global growth.

Based on MarketWatch materials

-

03:06

Nikkei 225 17,201.71 -32.04 -0.19 %, Hang Seng 20,355.7 -79.64 -0.39 %, Shanghai Composite 2,856.98 -2.52 -0.09 %

-

00:32

Stocks. Daily history for Sep Mar 14’2016:

(index / closing price / change items /% change)

Nikkei 225 17,233.75 +294.88 +1.74 %

Hang Seng 20,435.34 +235.74 +1.17 %

Shanghai Composite 2,859.5 +49.19 +1.75 %

FTSE 100 6,174.57 +34.78 +0.57 %

CAC 40 4,506.59 +13.80 +0.31 %

Xetra DAX 9,990.26 +159.13 +1.62 %

S&P 500 2,019.64 -2.55 -0.13 %

NASDAQ Composite 4,750.28 +1.81 +0.04 %

Dow Jones 17,229.13 +15.82 +0.09 %

-