Noticias del mercado

-

21:00

Dow -0.27% 16,954.34 -46.02 Nasdaq -0.43% 4,654.34 -20.04 S&P -0.19% 1,985.52 -3.74

-

18:46

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fells in volatile trading on Thursday as a slide in oil prices undermined gains from the European Central Bank's move to cut rates and expand its stimulus program. The ECB pushed deposit rate deeper into negative territory and increased its asset-buying program to 80 billion euros a month from 60 billion euros in an effort to boost growth in the region. Crude prices fell about 2%. Reuters reported that a proposed meeting between oil producers to discuss an output cut was unlikely to take place on March 20 as Iran had not committed to participate.

Most of Dow stocks in negative area (26 of 30). Top looser - Microsoft Corporation (MSFT, -2,26%). Top gainer - Merck & Co. Inc. (MRK, +0,74%).

All of S&P sectors in negative area. Top looser - Basic Materials (-1,3%).

At the moment:

Dow 16784.00 -130.00 -0.77%

S&P 500 1966.25 -13.50 -0.68%

Nasdaq 100 4252.25 -33.25 -0.78%

Oil 37.75 -0.54 -1.41%

Gold 1270.20 +12.80 +1.02%

U.S. 10yr 1.95 +0.06

-

18:00

European stocks close: stocks closed lower on the ECB’s interest rate decision

Stock indices closed lower on the European Central Bank's (ECB) interest rate decision. The central bank cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt. The central bank will launch further four targeted longer-term refinancing operations (LTRO).

The ECB lowered its inflation and growth forecasts. Inflation in the Eurozone is expected to be 0.1% in 2016, down from its December estimate of 1.0%, 1.3% in 2017, down from its December estimate of 1.6%, and 1.6% in 2018. The central bank expects the economy in the Eurozone to expand 1.4% in 2016, down from its December estimate of 1.7%, 1.7% in 2017, down from its December forecast of 1.9%, and 1.8% in 2018.

The European Central Bank (ECB) President Mario Draghi said in a press conference on Thursday that new stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone. He noted that further interest rate cuts were unlikely.

Draghi also said that the slowdown in the global economy and geopolitical risks were the downside risks to the outlook.

The ECB president pointed out that effective structural and fiscal policies should be implemented by government to support the monetary policy.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,036.7 -109.62 -1.78 %

DAX 9,498.15 -224.94 -2.31 %

CAC 40 4,350.98 -74.67 -1.70 %

-

18:00

European stocks closed: FTSE 100 6,036.7 -109.62 -1.78% CAC 40 4,350.35 -75.30 -1.70% DAX 9,498.15 -224.94 -2.31%

-

17:57

WSE: Session Results

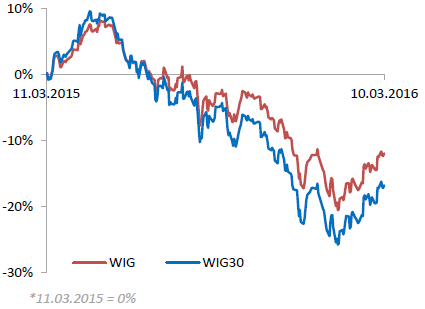

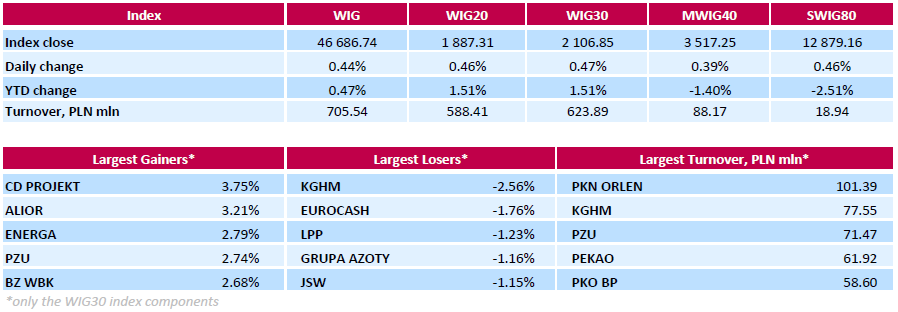

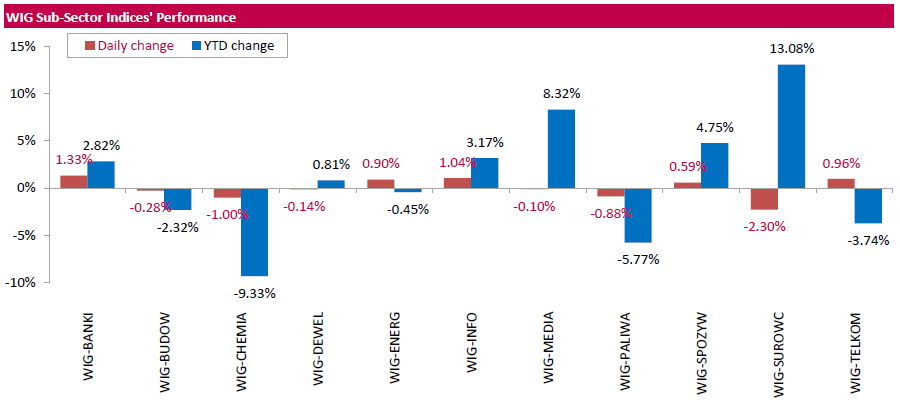

Polish equity market closed higher Thursday. The broad market measure, the WIG Index advanced by 0.44%. Sector performance within the WIG Index was mixed. Banking sector (+1.33%) was the strongest group, while materials (-2.30%) lagged behind.

The highlight of the day was the decision of the European Central Bank to lower its main interest rate to a record low of 0%. In addition, the ECB increased from EUR 60 to 80 bln monthly expenditure for QE program and expanded the range of instruments that are eligible for regular purchases, adding to Treasury and government bonds non-financial corporations bonds. Investors responded enthusiastically, the WIG20 temporarily broke the barrier of 1,900 points, growing about 1.5% in relation to Wednesday's closing level. The end of trading, however, was disappointing, as the WIG20 Index pulled back from the 1,900 points level on light trading turnover.

The large-cap stocks' measure, the WIG30 Index, added 0.47%. In the index basket, videogame developer CD PROJEKT (WSE: CDR) led the way up, climbing by 3.75% after the company stated that its FY 2015 net profit rose to PLN 342 mln from PLN 5 mln a year earlier. Other major gainers were genco ENERGA (WSE: ENG), insurer PZU (WSE: PZU), thermal coal miner BOGDANKA (WSE: LWB) and three banking sector names ALIOR (WSE: ALR), BZ WBK (WSE: BZW) and ING BSK (WSE: ING), growing by 2.39%-3.21%. On the other side of the ledger, copper producer KGHM (WSE: KGH) recorded the largest decline of 2.56%. It was followed by clothing retailer LPP (WSE: LPP) and FMCG-wholesaler EUROCASH (WSE: EUR), which tumbled by 1.76% and 1.23% respectively.

-

17:15

Producer prices in Japan fall 0.2% in February

The Bank of Japan (BoJ) released its Corporate Goods Price Index (CGPI) data on late Wednesday evening. Producer prices in Japan declined 0.2% in February, after a 1.0% fall in January. January's figure was revised down from a 0.9% decrease.

Export prices fell 0.2% in February, while import prices declined 2.9%.

On a yearly basis, producer prices slid 3.4% in February, after a 3.2% drop in January. January's figure was revised down from a 3.1% fall.

Export prices dropped 5.2% year-on-year in February, while import prices plunged 15.1%.

-

16:59

Germany’s labour costs per hour worked rise 0.5% in the fourth quarter

The German statistical office Destatis released its labour costs data for the fourth quarter on Thursday. Labour costs per hour worked rose 0.5% in the fourth quarter on a seasonally and calendar adjusted basis, after a 0.1% increase in the third quarter.

On a yearly basis, labour costs per hour worked increased 2.1% in the fourth quarter on a calendar adjusted basis, after a 2.4% gain in the third quarter.

The costs of gross earnings climbed a calendar adjusted 1.6% year-on-year in the fourth quarter, while non-wage costs were up 3.7%.

In 2015 as whole, labour costs per hour worked climbed 2.6%, after a 1.9% growth in 2014.

-

16:27

Greek unemployment rate declines to 24.0% in December

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.0% in December from 24.4% in November. November's figure was revised down from 24.6%.

The number of unemployed fell by 19,365 persons compared with November 2015.

In 2015 as whole, the unemployment rate was 24.0%, down from 25.9% in 2014.

-

16:18

European Central Bank President Mario Draghi: new stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone

The European Central Bank (ECB) President Mario Draghi said in a press conference on Thursday:

- New stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone;

- Interest rate would remain at low levels for an extended period of time, and as well past the horizon of net asset purchases;

- Negative inflation was unavoidable over the next few months, driven by low oil prices;

- The Eurozone's economy expanded weaker than expected at the beginning of this year;

- The economy is expected to continue to grow moderately;

- Low oil prices should lift up domestic demand;

- The slowdown in the global economy and geopolitical risks are the downside risks to the outlook;

- Effective structural and fiscal policies should be implemented by government to support the monetary policy.

- New stimulus measures would help to boost inflation and to support the economic recovery in the Eurozone;

-

15:47

European Central Bank downgrades its inflation and growth forecasts

The European Central Bank (ECB) lowered its inflation and growth forecasts. Inflation in the Eurozone is expected to be 0.1% in 2016, down from its December estimate of 1.0%, 1.3% in 2017, down from its December estimate of 1.6%, and 1.6% in 2018.

The central bank expects the economy in the Eurozone to expand 1.4% in 2016, down from its December estimate of 1.7%, 1.7% in 2017, down from its December forecast of 1.9%, and 1.8% in 2018.

-

15:46

After start on Wall Street

Weekly data from the US today were overshadowed by the new measures taken by the ECB. Nevertheless, they fit into the picture of the different monetary policies on both sides of the Atlantic. It turns out that the labor market in the US surprised positively, which may mean another rate hike by Janet Yellen. At the same time, Mario Draghi presents new easing action. Markets beginning to pay attention to one another unexpected new round of financing banks within TLTRO.

Mario Draghi signaled that there not will be more rate cuts, which means that the ECB sees its possible negative effects. Now attention is move from the level of interest rates to other unconventional measures. At these words responds particularly the foreign exchange market, where the euro is strengthened. On the equity markets it reflects with the slightly increases. Investors recognize that there are some limits in monetary policy, while in January Mario Draghi said that there is no limit.

In the course of the head of the ECB we had roller-coaster on markets. The large variability particularly in on currency markets and equity markets gains have been brutally ended.

The main characteristic of today's trading on the WSE is low activity, despite the important events around the actions of the ECB. In the segment of blue chips we only achieved a low level of turnover at PLN 370 mln. In addition, the deterioration of the mood lightly dismissed index from the psychological level of 1,900 points.

-

15:34

U.S. Stocks open: Dow +0.35%, Nasdaq +0.45%, S&P +0.34%

-

15:26

Before the bell: S&P futures +0.65%, NASDAQ futures +0.83%

U.S. stock-index futures rallied after the European Central Bank expanded stimulus by more than anticipated.

Global Stocks:

Nikkei 16,852.35 +210.15 +1.26%

Hang Seng 19,984.42 -11.84 -0.06%

Shanghai Composite 2,804.35 -58.20 -2.03%

FTSE 6,182.31 +35.99 +0.59%

CAC 4,547.96 +122.31 +2.76%

DAX 9,961.67 +238.58 +2.45%

Crude oil $38.26 (-0.08%)

Gold $1252.20 (-0.41%)

-

15:02

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Citigroup Inc., NYSE

C

41.65

1.22%

Apple Inc.

AAPL

102.05

0.92%

Caterpillar Inc

CAT

72.40

0.74%

McDonald's Corp

MCD

120.50

0.72%

Microsoft Corp

MSFT

53.20

0.68%

Walt Disney Co

DIS

98.25

0.60%

Barrick Gold Corporation, NYSE

ABX

13.70

0.07%

ALCOA INC.

AA

9.42

0.00%

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.01

-1.53%

-

15:00

Canada’s new housing price index climbs 0.1% in January

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in January, missing expectations of a 0.2% gain, after a 0.1% rise in December.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.2% in January, while prices in Vancouver climbed 0.4%.

-

14:50

Canadian capacity utilisation rate is down to 81.1% in the fourth quarter

Statistics Canada released its capacity utilisation rate on Thursday. Canadian capacity utilisation rate declined to 81.1% in the fourth quarter from 81.6% in the third quarter. The third quarter's figure was revised down from 82.0%.

The decrease was mainly driven by declines in the mining, quarrying, and oil and gas extraction industries, and construction. The capacity utilisation rate in the mining, quarrying, and oil and gas extraction industry fell to 76.2% in the fourth quarter from 76.8% in the third quarter, while the capacity utilisation rate in construction declined to 83.7% from 84.7%.

In 2015 as whole, capacity utilisation rate was 81.3%, down from 82.3% in 2014.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

FedEx (FDX) target lowered to $153 from $157 at RBC Capital Mkts

Apple (AAPL) reiterated with a Buy at Mizuho, target $120

Apple (AAPL) target lowered to $128 from $130 at Credit Agricole

-

14:40

Initial jobless claims slide to 259,000 in the week ending March 05

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending March 05 in the U.S. decreased by 18,000 to 259,000 from 277,000 in the previous week. It was the lowest reading since mid-October.

The previous week's figure was revised down from 278,000.

Analysts had expected jobless claims to decline to 275,000.

Jobless claims remained below 300,000 the 53rd straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 32,000 to 2,225,000 in the week ended February 27.

-

14:25

European Central Bank cut its interest rate to 0.00% in March

The European Central Bank (ECB) cut its interest rate to 0.00% from 0.05% (this decision was not expected by market participants) and deposit rate to -0.4% from -0.3%.

The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The central bank will launch further four targeted longer-term refinancing operations (LTRO).

-

12:01

European stock markets mid session: stocks traded lower the ECB’s interest rate decision

Stock indices traded lower ahead of the release of the European Central Bank's (ECB) interest rate decision. The ECB President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

Market participants speculate that the ECB could cut its deposit by 0.10% to -0.40% and/ or expand its monthly asset purchases by €10 billion.

Britain's Prime Minister David Cameron will warn on Thursday that Britain's exit from the European Union (Brexit) would weigh on the pound.

"It means pressure on the pound sterling. It means jobs being lost. It means mortgage rates might rise. It means businesses closing. It means hardworking people losing their livelihoods," he will say according to extracts of his speech reported in local media.

Current figures:

Name Price Change Change %

FTSE 100 6,115.65 -30.67 -0.50 %

DAX 9,720.82 -2.27 -0.02 %

CAC 40 4,419.4 -6.25 -0.14 %

-

11:55

Britain’s Prime Minister David Cameron will warn that Brexit would weigh on the pound

Britain's Prime Minister David Cameron will warn on Thursday that Britain's exit from the European Union (Brexit) would weigh on the pound.

"It means pressure on the pound sterling. It means jobs being lost. It means mortgage rates might rise. It means businesses closing. It means hardworking people losing their livelihoods," he will say according to extracts of his speech reported in local media.

-

11:50

RICS house price balance for the U.K. rises to +50% in February

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance rose to +50% in February from +48% in January. January's figure was revised down from +49%.

"It is inevitable that over the coming months, April's Stamp Duty changes will take a little of the heat out of the investor market," RICS Chief Economist, Simon Rubinsohn, said.

-

11:41

French final non-farm employment increases 0.2% in the fourth quarter

The French statistical office Insee released its final non-farm employment data on Thursday. French non-farm employment increased 0.2% in the fourth quarter, in line with the preliminary reading, after a 0.1% increase in the third quarter. The third quarter's figure was revised up from a flat reading.

Employment excluding temporary work rose 0.1% in the fourth quarter.

Temporary employment rose by 3.3% in the fourth quarter.

Employment in the industry was down by 0.3% in the fourth quarter, while employment in construction declined by 0.5%.

Overall, job creation in the market services sector climbed by 0.4% in the fourth quarter.

-

11:35

French industrial production climbs 1.3% in January

The French statistical office Insee its industrial production figures on Thursday. Industrial production in France climbed 1.3% in January, exceeding expectations for a 0.8% increase, after a 0.6% fall in December. December's figure was revised up from a 1.6% drop.

Manufacturing output increased 0.8% in January, while construction output jumped 7.3%.

Output in mining and quarrying, energy, water supply and waste management climbed 4.9% in January.

On a yearly basis, the French industrial production climbed 1.9% in January, after a 2.0% gain in December.

-

11:30

Greek consumer prices decline 0.4% in February

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Thursday. Greek consumer prices slid 0.4% in February, after a 1.9% drop in January.

On a yearly basis, the Greek consumer price index declined 0.5% in February, after a 0.7 fall in January. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 7.1% in February, transport costs dropped by 5.4%, clothing and footwear prices were down 1.0%, while household equipment prices decreased 2.8%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 0.9% in February, while alcoholic beverages and tobacco prices increased by 2.0%.

-

11:20

Retail sales in Spain rise at a seasonally adjusted rate of 0.4% in January

The Spanish statistical office INE released its retail sales data on Thursday. Retail sales in Spain rose at a seasonally adjusted rate of 0.4% in January, after a 0.1% increase in December.

Food sales were up 0.6% in January, while non-food sales increased by 1.5%.

On a yearly basis, retail sales climbed at a seasonally adjusted rate of 3.3% in January, after a 2.7% rise in December. December's figure was revised up from a 2.2% gain.

Sales of non-food products fell 0.5% in January from a year ago, while food sales jumped 6.6%.

-

11:12

Germany's trade surplus falls to €18.9 billion in January

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to a seasonally adjusted €18.9 billion in January from 20.3 in December.

Exports fell 0.5% in January, while imports increased 1.2%.

On a yearly basis, German exports decreased 1.4% in January, while imports rose by 1.5%.

Germany's current account surplus was €13.2 billion in January, down from €26.3 billion in December. December's figure was revised down from a surplus of €25.6 billion.

-

10:53

Reserve Bank of New Zealand lowers its interest rate to 2.25% in March

The Reserve Bank of New Zealand (RBNZ) on Wednesday lowered its interest rate to 2.25% from 2.50%. This decision was not expected by market participants.

The RBNZ Graeme Wheeler pointed out on Wednesday that further monetary policy easing was possible.

"Further policy easing may be required to ensure that future average inflation settles near the middle of the target range," he said.

He noted that there were risks to the outlook from the weakness in the dairy sector, the fall in inflation expectations, the high net immigration, and pressures in the housing market.

The RBNZ governor also said that inflation was low, driven by lower prices for fuel and other imports, adding that headline inflation was expected to rise over 2016.

Wheeler pointed out that the outlook for global growth deteriorated since the December, due the slowdown in emerging markets, and slower growth in Europe.

-

10:21

Chinese consumer price index rises at annual rate of 2.3% in February

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in February, exceeding expectations for a 1.9% increase, after a 1.8% gain in January. It was the biggest rise since July 2014.

Food prices rose at an annual rate of 7.3% in February, while non-food prices increased 1.0%.

On a monthly basis, consumer price inflation increased 1.6% in February, after a 0.5% rise in January.

The Chinese producer price index (PPI) dropped 4.9% in February, in line with expectations, after a 5.3% decline in January.

-

10:10

Unemployment rate in the OECD area declines to 6.5% in January

The Organization for Economic Cooperation and Development (OECD) released its unemployment rate figures on Wednesday. The OECD unemployment rate declined to 6.5% in January from 6.6% in December.

The unemployment rate in Eurozone was down by 0.1% to 10.3% in January.

The U.S. unemployment rate fell by 0.1% to 4.9% in January.

39.9 million people were unemployed in the OECD area in January.

The youth unemployment fell to 13.3% in January from 13.6 in December. The highest youth unemployment was in Spain with 45.0%, followed by Italy with 39.3% and Portugal with 29.9%.

-

08:21

Asian session: Yen fell

Yen fell as the Japanese finance Minister today let slip that he was not very confident Japan won't go back to deflation.

The Aussie dollar fell as China's consumer price index rose 2.3% in February from a year earlier, quicker than a 1.8% year-over-year increase in January, data from the National Bureau of Statistics showed, with rising food prices among the main factors pushing up the index. The rise in the key inflation gauge exceeded a median 1.9% gain forecast by 17 economists in a survey by The Wall Street Journal.

The New Zealand dollar plunged Wednesday after the Reserve Bank of New Zealand cut its official cash interest rate by 25 basis points to 2.25%. Most analysts believed the RBNZ would opt to leave rates on hold in March, though many expected a cut would follow some time this year.

EUR/USD: during the Asian session the pair fell to $1.0970

GBP/USD: during the Asian session the pair fell to $1.4185

USD/JPY: during the Asian session the pair rose to Y113.80

-

07:24

Global Stocks: Investors were being cautious ahead of the European Central Bank monetary policy meeting

European stocks and U.S. stocks finished higher Wednesday, scoring a fillip from a surge in crude-oil futures and energy stocks, ahead of the European Central Bank's highly anticipated policy decision Thursday. On Thursday, the ECB is widely expected to push its deposit rate further into negative territory, but analysts are also betting on an expansion of the ECB's aggressive quantitative-easing program as well as another round of cheap loans to banks. The moves could put pressure on Treasurys and global currencies.

Asian markets traded mixed as traders digested another round of Chinese economic data and interest rate decisions from central banks in New Zealand and South Korea. China's consumer price index rose 2.3% in February from a year earlier, quicker than a 1.8% year-over-year increase in January, data from the National Bureau of Statistics showed, with rising food prices among the main factors pushing up the index. The rise in the key inflation gauge exceeded a median 1.9% gain forecast by 17 economists in a survey by The Wall Street Journal.

Based on MarketWatch materials

-

03:02

Nikkei 225 16,838.77 +196.57 +1.18 %, Hang Seng 20,156.87 +160.61 +0.80 %, Shanghai Composite 2,848.77 -13.78 -0.48 %

-

00:30

Stocks. Daily history for Sep Mar 9’2016:

(index / closing price / change items /% change)

Nikkei 225 16,642.2 -140.95 -0.84 %

Hang Seng 19,996.26 -15.32 -0.08 %

Shanghai Composite 2,862.56 -38.83 -1.34 %

FTSE 100 6,146.32 +20.88 +0.34 %

CAC 40 4,425.65 +21.63 +0.49 %

Xetra DAX 9,723.09 +30.27 +0.31 %

S&P 500 1,989.26 +10.00 +0.51 %

NASDAQ Composite 4,674.38 +25.55 +0.55 %

Dow Jones 17,000.36 +36.26 +0.21 %

-