Noticias del mercado

-

23:59

Schedule for today, Wednesday, Jul 8’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan Eco Watchers Survey: Current June 53.3 53.2

05:00 Japan Eco Watchers Survey: Outlook June 54.5

07:00 United Kingdom Halifax house price index June -0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y June 8.6%

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications July -4.7%

11:30 United Kingdom Annual Budget Release

12:30 Canada Building Permits (MoM) May 11.6% -5.0%

14:30 U.S. Crude Oil Inventories July 2.386

18:00 U.S. FOMC Member Williams Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y May 3.0% 16.3%

23:50 Japan Core Machinery Orders May 3.8% -5%

-

17:05

Athens does not present new proposals at the Eurogroup’s meeting

According to multiple sources, Athens did not present new proposals at the Eurogroup's meeting today. Reuters reported that Greece will present new proposals maybe tomorrow.

-

16:52

Maltese Finance Minister Edward Scicluna: the probability of a Greek exit from the Eurozone is 50%

Maltese Finance Minister Edward Scicluna said before the Eurogroup's meeting on Tuesday that the probability of a Greek exit from the Eurozone is 50%, saying it is a "realistic possibility".

He added that the Eurogroup should ensure that the aftereffects of a Greek exit will be well managed.

Scicluna also said that Athens was no longer trusted by its partners.

-

16:40

Reserve Bank of Australia kept its interest rate at 2.00%

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

Stevens repeated that the Australian dollar declined against a US dollar and against a basket of currencies, and the further interest rate cut is "both likely and necessary" as the Australian dollar fell due to lower key commodity prices.

The RBA governor noted that there was little impact on bond markets due to problems in Greece and China.

"Despite fluctuations in markets associated with the respective developments in China and Greece, long-term borrowing rates for most sovereigns and creditworthy private borrowers remain remarkably low," Stevens said.

The RBA cut its interest rate to 2.00% from 2.25% in May.

-

16:28

NIESR’s gross domestic product rises by 0.7% in three months to June

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.7% in three months to June, after a 0.6% growth in three months to May.

The think tank said that the U.K. economy expanded by 2.7% in the last 12 months.

"We expect the Bank of England to begin increasing Bank Rate in early 2016. Of course, risks to this outlook persist, not least the ongoing euro area saga," the NIESR said.

-

16:14

Job openings rise to 5.363 million in May

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 5.363 million in May from 5.334 million in Apil. It was the highest reading since December 2000.

April's figure was revised up from 5.350 million.

The number of job openings increased for total private (4.852 million) and for government (511,000) in April.

The hires rate was 3.5% in May.

Total separations fell to 4.743 million in May from 4.895 million in April.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:01

U.S.: JOLTs Job Openings, May 5.363 (forecast 5.35)

-

16:00

United Kingdom: NIESR GDP Estimate, June 0.7%

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.53bn), $1.1000(E646mn), $1.1090-$1.1100(E650mn), $1.1125(E355mn)

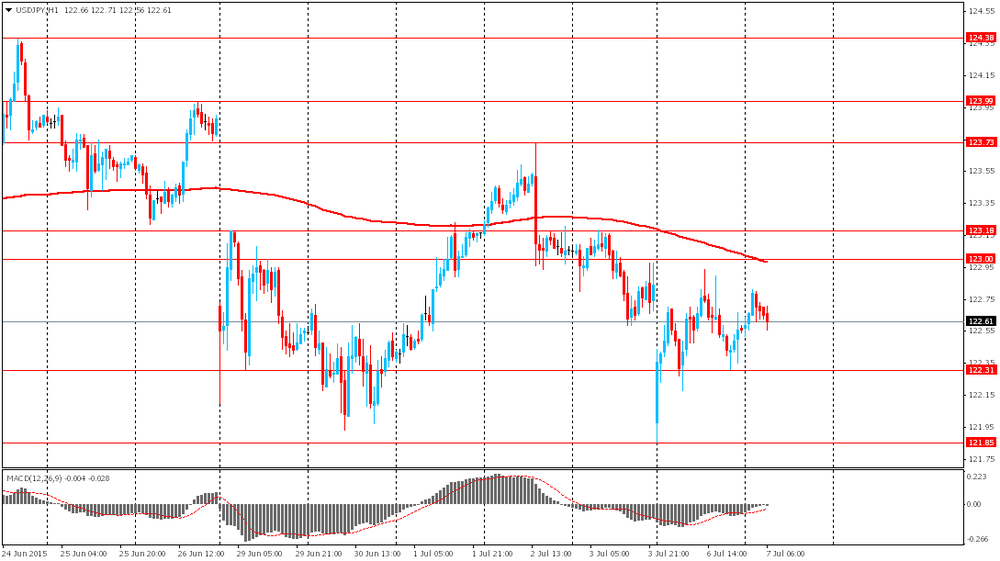

USD/JPY: Y122.00($1.64bn), Y122.50($745mn), Y124.00($1.5bn)

EUR/JPY: Y134.50(E225mn), Y137.00(E283mn)

GBP/USD: $1.5700(Gbp527mn)

AUD/USD: $0.7500(A$206mn), $0.7525(A$200mn), $0.7600(A$548mn)

USD/CAD: C$1.2550($550mn), C$1.2600($260mn), C$1.2700($567mn)

-

15:09

U.S. trade deficit widens to $41.87 billion in May

The U.S. Commerce Department released the trade data on Tuesday. The U.S. trade deficit widened to $41.87 billion in May from a deficit of $40. 7 billion in April. April's figure was revised up from a deficit of $40.88 billion.

Analysts had expected a trade deficit of $42.6 billion.

The rise of a deficit was driven by lower exports. Exports fell by 0.8% in May, while imports decreased by 0.1%.

A stronger U.S. dollar weighs on exports as it makes U.S. goods and services less affordable abroad. Weak overseas demand also weighed on exports.

Exports to France declined 4.2% in May, exports to Germany dropped 6.0%, and exports to Japan fell 3.0%, while exports to Mexico were down 2.1%.

Imports from China climbed 9.5% in May.

-

14:53

Canada's trade deficit widens to C$3.34 billion in May

Statistics Canada released the trade data on Tuesday. Canada's trade deficit widened to C$3.34 billion in May from a deficit of C$2.99 billion in April. April's figure was revised down from a deficit of C$2.97 billion.

Analysts had expected a trade deficit of C$2.5 billion.

The increase in deficit was driven by lower exports. Exports dropped 0.6% in May. It was the fifth consecutive monthly fall.

Exports of energy products climbed by 1.3% in May, exports of metal and non-metallic mineral products dropped 5.8%, while exports of metal ores and non-metallic minerals fell 9.2%.

Imports rose 0.2% in May.

Imports of aircraft and other transportation equipment and parts dropped by 12.4% in May, imports of metal and non-metallic mineral products surged 5.0%, imports of energy products increased 2.9%, while imports of consumer goods were up 2.3%.

-

14:37

German Finance Minister Wolfgang Schaeuble: Athens should provide new proposals in order to get help

German Finance Minister Wolfgang Schaeuble said on Tuesday that Athens should provide new proposals in order to get help. He added that debt cuts are not allowed under Europe's bailout rules.

-

14:30

Canada: Trade balance, billions, May -3.34 (forecast -2.5)

-

14:30

U.S.: International Trade, bln, May -41.87 (forecast -42.6)

-

14:21

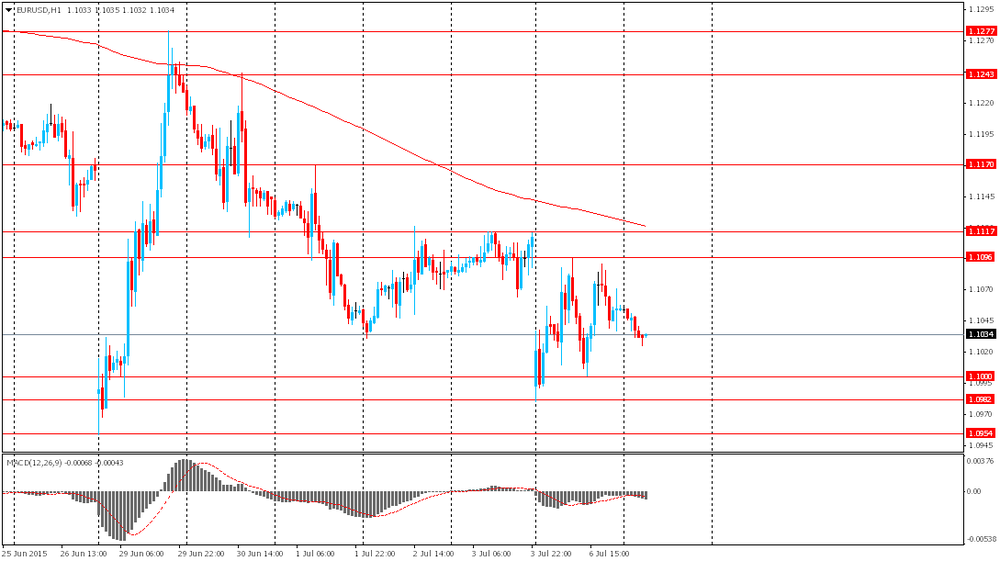

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the debt talks between Greece and its lenders

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

05:45 Switzerland Unemployment Rate (non s.a.) June 3.2% 3.3% 3.1%

06:00 Germany Industrial Production s.a. (MoM) May 0.6% Revised From 0.9% 0.1% 0.0%

06:00 Germany Industrial Production (YoY) May 1.1% Revised From 1.4% 2.1%

06:45 France Trade Balance, bln May -3.3 Revised From -3.0 -3.3 -4.0

07:00 Switzerland Foreign Currency Reserves June 517.7 516.2

08:30 United Kingdom Industrial Production (YoY) May 1.2% 1.6% 2.1%

08:30 United Kingdom Industrial Production (MoM) May 0.3% Revised From 0.4% -0.2% 0.4%

08:30 United Kingdom Manufacturing Production (MoM) May -0.4% 0.1% -0.6%

08:30 United Kingdom Manufacturing Production (YoY) May 0.1% Revised From 0.2% 1.8% 1%

09:00 Eurozone Euro Summit

09:00 Eurozone Eurogroup Meetings

The U.S. dollar traded higher against the most major currencies ahead of U.S. economic data. The U.S. trade deficit is expected to widen to $42.6 billion in May from $40.88 billion in April.

Job openings are expected to decline to 5.35 million in May from 5.376 million in April.

The euro traded lower against the U.S. dollar on the uncertainty over the debt talks between Greece and its lenders. Eurozone leaders are awaiting new proposals from Greek Prime Minister Alexis Tsipras.

Greek Finance Minister Yanis Varoufakis has resigned after Greeks said "No" to the creditors' proposals. Euclides Tsakalotos has been named Greece's new finance minister.

News reported that Greek banks remain closed until July 08. Daily cash withdrawals remain limited to 60 euros and payments and transfers abroad remain banned.

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Monday.

Meanwhile, the economic data from the Eurozone was mixed. German industrial production was flat in May, missing expectations for a 0.1% gain, after a 0.6% rise in April. April's figure was revised down from a 0.9% increase.

According to the French Customs, France's trade deficit widened to €4.0 billion in May from €3.3 billion in April. April's figure was revised down from a deficit of €3.0 billion.

Analysts had expected a trade deficit of €3.3 billion.

Exports declined 0.6% in May, while imports rose 1.2%.

The British pound traded lower against the U.S. dollar despite the mostly solid economic data from the U.K. Manufacturing production in the U.K. dropped 0.6% in May, missing expectations for a 0.1% gain, after a 0.4% decrease in April.

Manufacturing output was driven by a decline in a decline in the manufacture of weapons and ammunition, which dropped 21.5%.

On a yearly basis, manufacturing production in the U.K. increased 1.0% in May, missing forecast of a 1.8% gain, after a 0.1% rise in April. April's figure was revised down from a 0.2% gain.

Industrial production in the U.K. climbed 0.4% in May, beating forecasts of a 0.2% fall, after a 0.3% gain in April. April's figure was revised down from 0.4% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 7.3% in May.

On a yearly basis, industrial production in the U.K. gained 2.1% in May, exceeding expectations for a 1.6% rise, after a 1.2% increase in April.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian trade data. The Canadian trade deficit is expected to narrow to C$2.5 billion in May from C$2.97 billion in April.

The Swiss franc traded lower against the U.S. dollar after the mixed economic data from Switzerland. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in June.

On a seasonally unadjusted basis, the unemployment rate in Switzerland declined to 3.1% in June from 3.2% in May. Analysts had expected the unemployment rate to increase to 3.3%.

The Swiss National Bank's foreign exchange reserves decreased to 516.240 billion Swiss francs in June from 517.718 billion francs in May. It was the third consecutive decline despite the intervention by the Swiss National Bank.

May's figure was revised up from 517.488 billion francs.

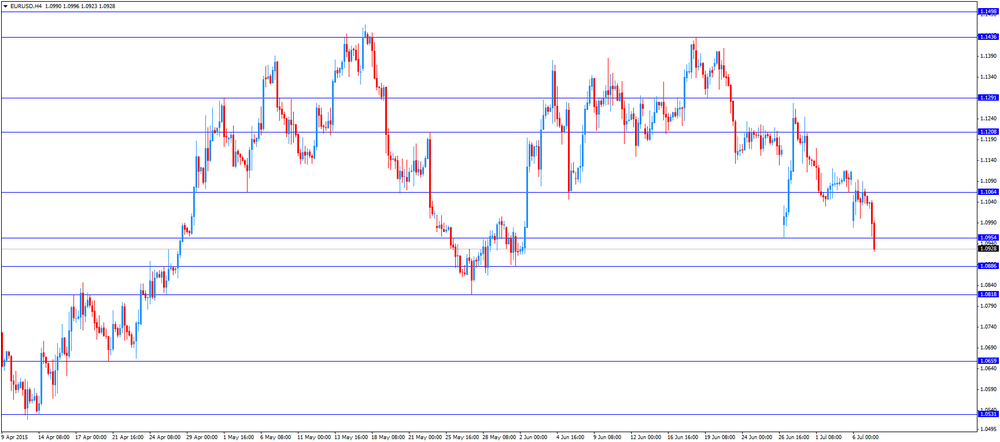

EUR/USD: the currency pair fell to $1.0923

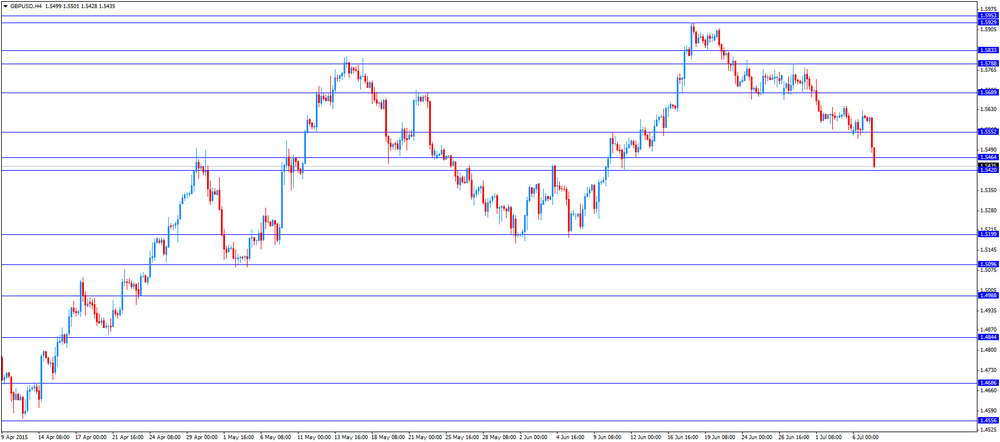

GBP/USD: the currency pair declined to $1.5428

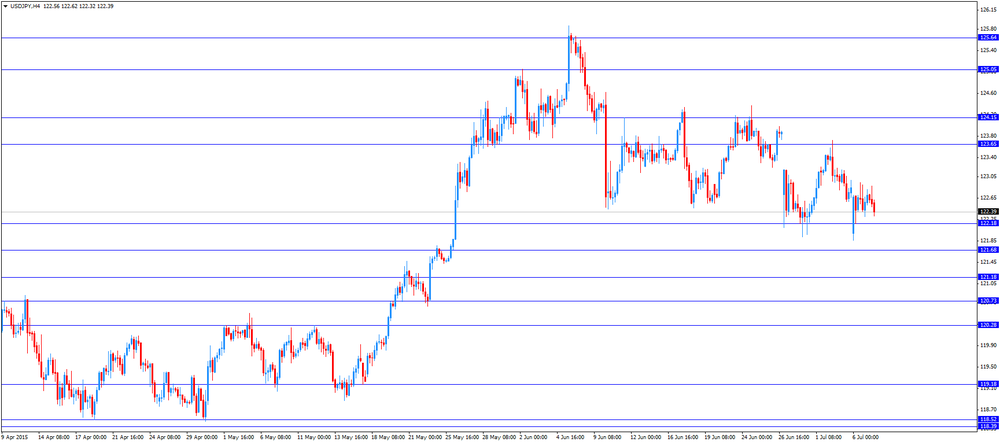

USD/JPY: the currency pair decreased to Y122.32

The most important news that are expected (GMT0):

12:30 Canada Trade balance, billions May -2.97 -2.5

12:30 U.S. International Trade, bln May -40.88 -42.6

14:00 U.S. JOLTs Job Openings May 5.376 5.35

-

14:01

Orders

EUR/USD

Offers 1.1050 1.1085 1.1100 1.1120 1.1145-50 1.1180 1.1200 1.1220-25 1.1245 1.1280

Bids 1.1000 1.0980 1.0960 1.0930 1.0900 1.0880 1.0850 1.0825 1.0800

GBP/USD

Offers 1.5585 1.5600 1.5625 1.5640-50 1.5665 1.5680 1.5700 1.5725

Bids 1.5485 1.5470 1.5450 1.5430 1.5400

EUR/GBP

Offers 0.7100 0.7125-30 0.7150 0.7170 0.7180-85 0.7200 0.7225 0.7240

Bids 0.7055-60 0.7040 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 135.30 135.50 135.80 136.00 136.40 136.80 137.00 137.30 137.50

Bids 135.00 134.85 134.50 134.00 133.85 133.50

USD/JPY

Offers 122.85 123.00 123.20-25 123.50 123.80 124.00 124.20 124.50

Bids 122.50 122.20-25 122.00 121.80 121.65 121.50 121.00

AUD/USD

Offers 0.7470 0.7485 0.7500 0.7520 0.7550 0.7580 0.7600 0.7625 0.7640 0.7680 0.7700

Bids 0.7425 0.7400 0.7380 0.7350 0.7330 0.7300 0.7285 0.7250

-

11:52

Swiss National Bank's foreign exchange reserves fall to 516.240 billion Swiss francs in June

The Swiss National Bank's foreign exchange reserves decreased to 516.240 billion Swiss francs in June from 517.718 billion francs in May. It was the third consecutive decline despite the intervention by the Swiss National Bank.

May's figure was revised up from 517.488 billion francs.

-

11:44

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.3% in June

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in June.

On a seasonally unadjusted basis, the unemployment rate in Switzerland declined to 3.1% in June from 3.2% in May. Analysts had expected the unemployment rate to increase to 3.3%.

The number of unemployed people in Switzerland decreased by 3,093 to 133,256 in June from 136,349 in May.

The youth unemployment rate was down to 2.8% in June from 2.9% in May.

-

11:37

France's trade deficit widens to €4.0 billion in May

According to the French Customs, France's trade deficit widened to €4.0 billion in May from €3.3 billion in April. April's figure was revised down from a deficit of €3.0 billion.

Analysts had expected a trade deficit of €3.3 billion.

Exports declined 0.6% in May, while imports rose 1.2%.

-

11:29

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.53bn), $1.1000(E646mn), $1.1090-$1.1100(E650mn), $1.1125(E355mn)

USD/JPY: Y122.00($1.64bn), Y122.50($745mn), Y124.00($1.5bn)

EUR/JPY: Y134.50(E225mn), Y137.00(E283mn)

GBP/USD: $1.5700(Gbp527mn)

AUD/USD: $0.7500(A$206mn), $0.7525(A$200mn), $0.7600(A$548mn)

USD/CAD: C$1.2550($550mn), C$1.2600($260mn), C$1.2700($567mn)

-

11:28

German industrial production is flat in May

Destatis released its industrial production data for Germany on Tuesday. German industrial production was flat in May, missing expectations for a 0.1% gain, after a 0.6% rise in April. April's figure was revised down from a 0.9% increase.

The output of capital goods climbed 0.4% in May, energy output dropped 3.1%, and the production in the construction sector fell 0.3%, while the production of intermediate goods was down 0.2%.

The output of consumer goods gained 1.2%.

-

11:17

U.K. manufacturing production drops 0.6% in May, but industrial production climbs 0.4%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. dropped 0.6% in May, missing expectations for a 0.1% gain, after a 0.4% decrease in April.

Manufacturing output was driven by a decline in a decline in the manufacture of weapons and ammunition, which dropped 21.5%.

On a yearly basis, manufacturing production in the U.K. increased 1.0% in May, missing forecast of a 1.8% gain, after a 0.1% rise in April. April's figure was revised down from a 0.2% gain.

Industrial production in the U.K. climbed 0.4% in May, beating forecasts of a 0.2% fall, after a 0.3% gain in April. April's figure was revised down from 0.4% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 7.3% in May.

On a yearly basis, industrial production in the U.K. gained 2.1% in May, exceeding expectations for a 1.6% rise, after a 1.2% increase in April.

-

11:04

The U.S. is urging European and Greek leaders to reach a deal

The U.S. is urging European and Greek leaders to reach a deal, and Greece should remain in the Eurozone. The US treasury secretary, Jack Lew, said that he hopes a deal would "allow Greece to make difficult but necessary fiscal and structural reforms, return to growth, and achieve debt sustainability within the Eurozone".

-

10:52

Greek banks remain closed until July 08

News reported that Greek banks remain closed until July 08. Daily cash withdrawals remain limited to 60 euros and payments and transfers abroad remain banned.

At the same time, these restrictions do not apply to foreign tourists.

Previously, The Wall Street Journal reported that it is unlikely that Greek bank will reopen sooner than in a few weeks.

-

10:41

European Central Bank Governing Council Member Ewald Nowotny: the central bank will not provide with the liquidity the Greek financial system if Greece misses to repay the central bank’s loans on July 20

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview on Monday that the central bank will not provide with the liquidity the Greek financial system if Greece misses to repay the central bank's loans on July 20.

"That would be a state bankruptcy, a default in English," he said.

Nowotny added that a solution should be found as soon as possible.

-

10:30

United Kingdom: Manufacturing Production (YoY), May 1% (forecast 1.8%)

-

10:30

United Kingdom: Industrial Production (MoM), May 0.4% (forecast -0.2%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , May -0.6% (forecast 0.1%)

-

10:30

United Kingdom: Industrial Production (YoY), May 2.1% (forecast 1.6%)

-

10:27

European Central Bank (ECB) purchases €63.2 of public and private debt in June

The European Central Bank (ECB) purchased €63.2 of public and private debt under its quantitative-easing program in June, compared to €63.1 billion in May.

ECB Executive Board member Benoit Coeure said on May 18 that the central bank would raise the pace of asset-buying due to lower liquidity in July and August.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €51.4 billion of government and agency bonds in June, €10.2 billion of covered bonds, and €1.59 billion of asset-backed securities.

-

10:15

European Central Bank Executive Board Member Benoit Coeure: the central bank is ready to do more if needed to boost inflation

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Sunday that the central bank is ready to do more if needed to boost inflation. He noted that high unemployment led to lower prices.

"We are strictly focused on our goal to ensure price stability. That's why we are concerned with unemployment. If we had to do more, we will do more, we will find the necessary instruments, we will use these instruments," Mr. Coeure said.

-

09:00

Switzerland: Foreign Currency Reserves, June 516.2

-

08:45

France: Trade Balance, bln, May -4.0 (forecast -3.3)

-

08:41

Foreign exchange market. Asian session: the Australian dollar little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

05:45 Switzerland Unemployment Rate (non s.a.) June 3.2% 3.3% 3.1%

06:00 Germany Industrial Production s.a. (MoM) May 0.6% 0.1% 0.0%

06:00 Germany Industrial Production (YoY) May 1.4% 2.1%

The Australian dollar showed little reaction after the Reserve Bank of Australia left its key interest rate unchanged at 2% in line with expectations. The central bank decided not to take any actions despite current risks to the economy arising from uncertainty over Greece and sharp declines in Chinese stocks. RBA Governor Glenn Stevens reiterated that further declines in the Australian dollar are required.

The euro traded lower ahead of today's euro zone summit. It is expected that Greece and its lenders will be unable to come to an understanding today. However markets partly consider a possibility of a deal and they will be disappointed if there is no progress.

Germany and France have called on Athens to make new proposals after Greeks voted against austerity terms. Greece's banks have been closed for more than a week and only urgent lending may prevent their insolvency. At the same time investors started to treat the euro better after Greece's finance minister Yanis Varoufakis resigned on Monday.

EUR/USD: the pair declined to $1.1025 in Asian trade

USD/JPY: the pair rose to Y122.80

GBP/USD: the pair fell to $1.5580

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Trade Balance, bln May -3.0 -3.3

07:00 United Kingdom Halifax house price index June -0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y June 8.6%

07:00 Switzerland Foreign Currency Reserves June 517.5

08:30 United Kingdom Industrial Production (YoY) May 1.2% 1.6%

08:30 United Kingdom Industrial Production (MoM) May 0.4% -0.2%

08:30 United Kingdom Manufacturing Production (MoM) May -0.4% 0.1%

08:30 United Kingdom Manufacturing Production (YoY) May 0.2% 1.8%

09:00 Eurozone Euro Summit

09:00 Eurozone Eurogroup Meetings

12:30 Canada Trade balance, billions May -2.97 -2.5

12:30 U.S. International Trade, bln May -40.88 -42.6

14:00 United Kingdom NIESR GDP Estimate June 0.6%

14:00 U.S. JOLTs Job Openings May 5.376 5.35

20:30 U.S. API Crude Oil Inventories June 1.9

23:50 Japan Current Account, bln May 1326.4 1542

-

08:26

Options levels on tuesday, July 7, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1275 (1513)

$1.1224 (433)

$1.1165 (418)

Price at time of writing this review: $1.1038

Support levels (open interest**, contracts):

$1.0971 (1006)

$1.0953 (2504)

$1.0933 (1218)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 40746 contracts, with the maximum number of contracts with strike price $1,1500 (2888);

- Overall open interest on the PUT options with the expiration date August, 7 is 50282 contracts, with the maximum number of contracts with strike price $1,0800 (5642);

- The ratio of PUT/CALL was 1.23 versus 1.21 from the previous trading day according to data from July, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5904 (1161)

$1.5806 (1759)

$1.5709 (577)

Price at time of writing this review: $1.5592

Support levels (open interest**, contracts):

$1.5490 (1036)

$1.5393 (931)

$1.5295 (849)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 17081 contracts, with the maximum number of contracts with strike price $1,5800 (1759);

- Overall open interest on the PUT options with the expiration date August, 7 is 16102 contracts, with the maximum number of contracts with strike price $1,5600 (1624);

- The ratio of PUT/CALL was 0.94 versus 0.98 from the previous trading day according to data from July, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Industrial Production (YoY), May 2.1%

-

08:00

Germany: Industrial Production s.a. (MoM), May 0.0% (forecast 0.1%)

-

07:45

Switzerland: Unemployment Rate (non s.a.), June 3.1% (forecast 3.3%)

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2%)

-

01:32

Australia: AiG Performance of Construction Index, June 46.4

-

00:28

Currencies. Daily history for Jul 6’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1055 -0,52%

GBP/USD $1,5602 +0,22%

USD/CHF Chf0,9424 +0,29%

USD/JPY Y122,56 -0,23%

EUR/JPY Y135,49 -0,75%

GBP/JPY Y191,21 -0,12%

AUD/USD $0,7497 -0,21%

NZD/USD $0,6670 -0,34%

USD/CAD C$1,2645+0,55%

-

00:01

Schedule for today, Tuesday, Jul 7’2015:

(time / country / index / period / previous value / forecast)

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

04:30 Australia RBA Rate Statement

05:45 Switzerland Unemployment Rate (non s.a.) June 3.2%

06:00 Germany Industrial Production s.a. (MoM) May 0.9% 0.1%

06:00 Germany Industrial Production (YoY) May 1.4%

06:45 France Trade Balance, bln May -3.0

07:00 United Kingdom Halifax house price index June -0.1%

07:00 United Kingdom Halifax house price index 3m Y/Y June 8.6%

07:00 Switzerland Foreign Currency Reserves June 517.5

08:30 United Kingdom Industrial Production (YoY) May 1.2% 1.6%

08:30 United Kingdom Industrial Production (MoM) May 0.4% -0.2%

08:30 United Kingdom Manufacturing Production (MoM) May -0.4% 0.1%

08:30 United Kingdom Manufacturing Production (YoY) May 0.2% 1.8%

09:00 Eurozone Euro Summit

09:00 Eurozone Eurogroup Meetings

12:30 Canada Trade balance, billions May -2.97 -2.45

12:30 U.S. International Trade, bln May -40.88 -42.6

14:00 United Kingdom NIESR GDP Estimate June 0.6%

14:00 U.S. JOLTs Job Openings May 5.376 5.35

20:30 U.S. API Crude Oil Inventories June 1.9

23:50 Japan Current Account, bln May 1326.4 1542

-