Noticias del mercado

-

22:15

U.S. stocks closed

U.S. stocks rose, after the Standard & Poor's 500 Index rebounded from a drop below its average price during the past 200 days, as speculation grew that Greece's crisis would be contained.

The S&P 500 bounced back after falling through the 200-day moving average, an event that has coincided with past rebounds. Stocks have only crossed the level once since 2012 -- the period of last October's selloff, which gave way to an 11 percent advance at the end of 2014.

Greek Prime Minister Alexis Tsipras is in Brussels today for what could be a last chance to secure a rescue from European leaders and keep his country in the euro. Greece promised to put its economic proposals in writing as German Chancellor Angela Merkel warned that "only a few days" are left to reach a deal.

Finance ministers and leaders from the euro region have all made clear the onus is on Greece to explain how it plans to pull itself out of the crisis. Greek banks and the stock market will remain shut shut through Wednesday.

The S&P 500 fell the most in three months last week as the escalating crisis in Greece stole attention from U.S. economic data and the Federal Reserve. The benchmark measure is down 2.3 percent since its all-time high in May. Minutes from the Fed's June meeting due Wednesday may offer more perspective on the central bank's assessment of the economy's strength.

-

21:00

S&P 500 2,064.58 -4.18 -0.20 %, NASDAQ 4,974.8 -17.14 -0.34 %, Dow 17,697.94 +14.36 +0.08 %

-

19:24

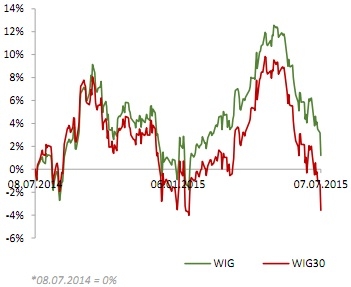

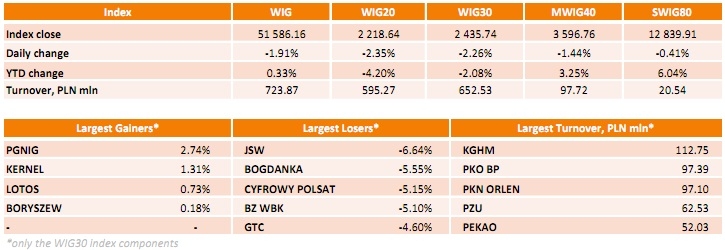

WSE: Session Results

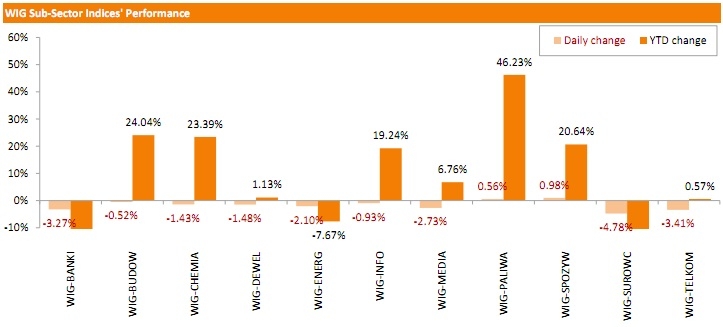

Polish equities were lower on Tuesday, with the broad-market measure, the WIG index, losing 1.91%. Sector performance was mainly negative as nine sectors declined. Materials names sank 4.87%. Telecommunication sector stocks and banking names also underperformed, dropping 3.41% and 3.27% respectively. On the contrary, food producers stocks and oil and gas sector names were strong, returning advances of 0.98% and 0.56% respectively.

The large-cap stocks' measure, the WIG30 Index, slid down 2.26%. Within the WIG30 Index components, coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB) suffered the steepest declines, plunging 6.64% and 5.55% respectively. CYFROWY POLSAT (WSE: CPS), BZ WBK (WSE: BZW), GTC (WSE: GTC) and KGHM (WSE: KGH) posted less significant losses, sliding down in the range between 4.59% and 5.15%. Only four names managed to post positive returns, with PGNIG (WSE: PGN) outperforming with 2.74% growth. Other gainers were KERNEL (WSE: KER), LOTOS (WSE: LTS) and BORYSZEW (WSE: BRS), adding 1.31%, 0.73% and 0.18% respectively.

-

18:01

European stocks closed: FTSE 100 6,432.21 -103.47 -1.58 %, CAC 40 4,604.64 -106.90 -2.27 %, DAX 10,676.78 -213.85 -1.96 %

-

18:00

European stocks close: stocks closed lower on concerns over the possible Greek exit from the Eurozone

Stock indices closed lower on concerns over the possible Greek exit from the Eurozone. The Eurogroup's meeting ended without results today. According to multiple sources, Athens did not present new proposals. Reuters reported that Greece will present new proposals maybe tomorrow.

The summit of the Eurozone leaders is scheduled to be later in the day.

Meanwhile, the economic data from the Eurozone was mixed. German industrial production was flat in May, missing expectations for a 0.1% gain, after a 0.6% rise in April. April's figure was revised down from a 0.9% increase.

According to the French Customs, France's trade deficit widened to €4.0 billion in May from €3.3 billion in April. April's figure was revised down from a deficit of €3.0 billion.

Analysts had expected a trade deficit of €3.3 billion.

Exports declined 0.6% in May, while imports rose 1.2%.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. dropped 0.6% in May, missing expectations for a 0.1% gain, after a 0.4% decrease in April.

Manufacturing output was driven by a decline in a decline in the manufacture of weapons and ammunition, which dropped 21.5%.

On a yearly basis, manufacturing production in the U.K. increased 1.0% in May, missing forecast of a 1.8% gain, after a 0.1% rise in April. April's figure was revised down from a 0.2% gain.

Industrial production in the U.K. climbed 0.4% in May, beating forecasts of a 0.2% fall, after a 0.3% gain in April. April's figure was revised down from 0.4% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 7.3% in May.

On a yearly basis, industrial production in the U.K. gained 2.1% in May, exceeding expectations for a 1.6% rise, after a 1.2% increase in April.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.7% in three months to June, after a 0.6% growth in three months to May.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,432.21 -103.47 -1.58 %

DAX 10,676.78 -213.85 -1.96 %

CAC 40 4,604.64 -106.90 -2.27 %

-

17:05

Athens does not present new proposals at the Eurogroup’s meeting

According to multiple sources, Athens did not present new proposals at the Eurogroup's meeting today. Reuters reported that Greece will present new proposals maybe tomorrow.

-

16:52

Maltese Finance Minister Edward Scicluna: the probability of a Greek exit from the Eurozone is 50%

Maltese Finance Minister Edward Scicluna said before the Eurogroup's meeting on Tuesday that the probability of a Greek exit from the Eurozone is 50%, saying it is a "realistic possibility".

He added that the Eurogroup should ensure that the aftereffects of a Greek exit will be well managed.

Scicluna also said that Athens was no longer trusted by its partners.

-

16:40

Reserve Bank of Australia kept its interest rate at 2.00%

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

Stevens repeated that the Australian dollar declined against a US dollar and against a basket of currencies, and the further interest rate cut is "both likely and necessary" as the Australian dollar fell due to lower key commodity prices.

The RBA governor noted that there was little impact on bond markets due to problems in Greece and China.

"Despite fluctuations in markets associated with the respective developments in China and Greece, long-term borrowing rates for most sovereigns and creditworthy private borrowers remain remarkably low," Stevens said.

The RBA cut its interest rate to 2.00% from 2.25% in May.

-

16:28

NIESR’s gross domestic product rises by 0.7% in three months to June

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.7% in three months to June, after a 0.6% growth in three months to May.

The think tank said that the U.K. economy expanded by 2.7% in the last 12 months.

"We expect the Bank of England to begin increasing Bank Rate in early 2016. Of course, risks to this outlook persist, not least the ongoing euro area saga," the NIESR said.

-

16:14

Job openings rise to 5.363 million in May

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 5.363 million in May from 5.334 million in Apil. It was the highest reading since December 2000.

April's figure was revised up from 5.350 million.

The number of job openings increased for total private (4.852 million) and for government (511,000) in April.

The hires rate was 3.5% in May.

Total separations fell to 4.743 million in May from 4.895 million in April.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:33

U.S. Stocks open: Dow +0.06%, Nasdaq -0.05%, S&P +0.07%

-

15:28

Before the bell: S&P futures +0.05%, NASDAQ futures -0.05%

U.S. stock-index futures were little changed before European leaders meet to discuss Greece's debt crisis.

Nikkei 20,376.59 +264.47 +1.31%

Hang Seng 24,975.31 -260.97 -1.03%

Shanghai Composite 3,728.19 -47.72 -1.26%

FTSE 6,519.57 -16.11 -0.25%

CAC 4,671.39 -40.15 -0.85%

DAX 10,821.77 -68.86 -0.63%

Crude oil $52.34 (-0.34%)

Gold $1160.80 (-1.07%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Chevron Corp

CVX

94.78

+0.01%

1.4K

Yandex N.V., NASDAQ

YNDX

14.92

+0.07%

6.7K

Nike

NKE

109.93

+0.08%

0.3K

Travelers Companies Inc

TRV

99.02

+0.08%

1.1K

International Business Machines Co...

IBM

164.90

+0.10%

5.3K

Verizon Communications Inc

VZ

47.12

+0.17%

8.1K

Visa

V

68.25

+0.19%

8.2K

American Express Co

AXP

77.78

+0.24%

0.8K

Facebook, Inc.

FB

87.76

+0.24%

51.0K

Microsoft Corp

MSFT

44.50

+0.25%

3.3K

Wal-Mart Stores Inc

WMT

72.74

+0.29%

0.5K

Procter & Gamble Co

PG

80.30

+0.31%

1.5K

Google Inc.

GOOG

524.50

+0.31%

0.4K

McDonald's Corp

MCD

95.96

+0.32%

0.7K

Amazon.com Inc., NASDAQ

AMZN

437.50

+0.33%

2.9K

Johnson & Johnson

JNJ

98.53

+0.34%

0.6K

Merck & Co Inc

MRK

57.76

+0.36%

0.6K

Starbucks Corporation, NASDAQ

SBUX

54.50

+0.36%

0.5K

The Coca-Cola Co

KO

39.57

+0.38%

15.3K

Home Depot Inc

HD

111.75

+0.39%

0.2K

Boeing Co

BA

141.10

+0.41%

3.5K

AT&T Inc

T

35.76

+0.42%

4.4K

Pfizer Inc

PFE

33.42

+0.51%

28.1K

Walt Disney Co

DIS

116.35

+0.56%

2.5K

General Motors Company, NYSE

GM

32.88

+0.70%

0.8K

E. I. du Pont de Nemours and Co

DD

60.50

+0.83%

29.6K

General Electric Co

GE

26.31

0.00%

14.0K

AMERICAN INTERNATIONAL GROUP

AIG

61.85

0.00%

0.4K

Apple Inc.

AAPL

125.95

-0.04%

132.0K

Exxon Mobil Corp

XOM

82.49

-0.05%

5.1K

Ford Motor Co.

F

14.78

-0.07%

13.4K

Goldman Sachs

GS

207.88

-0.08%

0.7K

JPMorgan Chase and Co

JPM

67.25

-0.12%

10.0K

FedEx Corporation, NYSE

FDX

168.50

-0.15%

0.4K

Citigroup Inc., NYSE

C

54.97

-0.20%

29.7K

Twitter, Inc., NYSE

TWTR

35.35

-0.23%

42.2K

Caterpillar Inc

CAT

82.88

-0.32%

3.4K

ALCOA INC.

AA

10.99

-0.36%

31.9K

Yahoo! Inc., NASDAQ

YHOO

38.33

-0.73%

8.3K

Intel Corp

INTC

29.80

-0.80%

63.8K

Tesla Motors, Inc., NASDAQ

TSLA

275.60

-1.47%

46.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.52

-1.79%

4.0K

Barrick Gold Corporation, NYSE

ABX

10.59

-2.40%

3.6K

-

15:09

U.S. trade deficit widens to $41.87 billion in May

The U.S. Commerce Department released the trade data on Tuesday. The U.S. trade deficit widened to $41.87 billion in May from a deficit of $40. 7 billion in April. April's figure was revised up from a deficit of $40.88 billion.

Analysts had expected a trade deficit of $42.6 billion.

The rise of a deficit was driven by lower exports. Exports fell by 0.8% in May, while imports decreased by 0.1%.

A stronger U.S. dollar weighs on exports as it makes U.S. goods and services less affordable abroad. Weak overseas demand also weighed on exports.

Exports to France declined 4.2% in May, exports to Germany dropped 6.0%, and exports to Japan fell 3.0%, while exports to Mexico were down 2.1%.

Imports from China climbed 9.5% in May.

-

15:04

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Overweight from Neutral at Atlantic Equities

Downgrades:

Tesla Motors (TSLA) downgraded to Hold at Deutsche Bank

Other:

Amazon (AMZN) target raised to $435 from $370 at Cowen

-

14:53

Canada's trade deficit widens to C$3.34 billion in May

Statistics Canada released the trade data on Tuesday. Canada's trade deficit widened to C$3.34 billion in May from a deficit of C$2.99 billion in April. April's figure was revised down from a deficit of C$2.97 billion.

Analysts had expected a trade deficit of C$2.5 billion.

The increase in deficit was driven by lower exports. Exports dropped 0.6% in May. It was the fifth consecutive monthly fall.

Exports of energy products climbed by 1.3% in May, exports of metal and non-metallic mineral products dropped 5.8%, while exports of metal ores and non-metallic minerals fell 9.2%.

Imports rose 0.2% in May.

Imports of aircraft and other transportation equipment and parts dropped by 12.4% in May, imports of metal and non-metallic mineral products surged 5.0%, imports of energy products increased 2.9%, while imports of consumer goods were up 2.3%.

-

14:37

German Finance Minister Wolfgang Schaeuble: Athens should provide new proposals in order to get help

German Finance Minister Wolfgang Schaeuble said on Tuesday that Athens should provide new proposals in order to get help. He added that debt cuts are not allowed under Europe's bailout rules.

-

12:05

European stock markets mid session: stocks traded slightly lower ahead of the summit of the Eurozone leaders today

Stock indices traded slightly lower ahead of the summit of the Eurozone leaders today. Eurozone leaders are awaiting new proposals from Greek Prime Minister Alexis Tsipras.

Greek Finance Minister Yanis Varoufakis has resigned after Greeks said "No" to the creditors' proposals. Euclides Tsakalotos has been named Greece's new finance minister.

Meanwhile, the economic data from the Eurozone was mixed. German industrial production was flat in May, missing expectations for a 0.1% gain, after a 0.6% rise in April. April's figure was revised down from a 0.9% increase.

According to the French Customs, France's trade deficit widened to €4.0 billion in May from €3.3 billion in April. April's figure was revised down from a deficit of €3.0 billion.

Analysts had expected a trade deficit of €3.3 billion.

Exports declined 0.6% in May, while imports rose 1.2%.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. dropped 0.6% in May, missing expectations for a 0.1% gain, after a 0.4% decrease in April.

Manufacturing output was driven by a decline in a decline in the manufacture of weapons and ammunition, which dropped 21.5%.

On a yearly basis, manufacturing production in the U.K. increased 1.0% in May, missing forecast of a 1.8% gain, after a 0.1% rise in April. April's figure was revised down from a 0.2% gain.

Industrial production in the U.K. climbed 0.4% in May, beating forecasts of a 0.2% fall, after a 0.3% gain in April. April's figure was revised down from 0.4% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 7.3% in May.

On a yearly basis, industrial production in the U.K. gained 2.1% in May, exceeding expectations for a 1.6% rise, after a 1.2% increase in April.

Current figures:

Name Price Change Change %

FTSE 100 6,530.03 -5.65 -0.09 %

DAX 10,857.18 -33.45 -0.31 %

CAC 40 4,689.46 -22.08 -0.47 %

-

11:52

Swiss National Bank's foreign exchange reserves fall to 516.240 billion Swiss francs in June

The Swiss National Bank's foreign exchange reserves decreased to 516.240 billion Swiss francs in June from 517.718 billion francs in May. It was the third consecutive decline despite the intervention by the Swiss National Bank.

May's figure was revised up from 517.488 billion francs.

-

11:44

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.3% in June

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in June.

On a seasonally unadjusted basis, the unemployment rate in Switzerland declined to 3.1% in June from 3.2% in May. Analysts had expected the unemployment rate to increase to 3.3%.

The number of unemployed people in Switzerland decreased by 3,093 to 133,256 in June from 136,349 in May.

The youth unemployment rate was down to 2.8% in June from 2.9% in May.

-

11:37

France's trade deficit widens to €4.0 billion in May

According to the French Customs, France's trade deficit widened to €4.0 billion in May from €3.3 billion in April. April's figure was revised down from a deficit of €3.0 billion.

Analysts had expected a trade deficit of €3.3 billion.

Exports declined 0.6% in May, while imports rose 1.2%.

-

11:28

German industrial production is flat in May

Destatis released its industrial production data for Germany on Tuesday. German industrial production was flat in May, missing expectations for a 0.1% gain, after a 0.6% rise in April. April's figure was revised down from a 0.9% increase.

The output of capital goods climbed 0.4% in May, energy output dropped 3.1%, and the production in the construction sector fell 0.3%, while the production of intermediate goods was down 0.2%.

The output of consumer goods gained 1.2%.

-

11:17

U.K. manufacturing production drops 0.6% in May, but industrial production climbs 0.4%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. dropped 0.6% in May, missing expectations for a 0.1% gain, after a 0.4% decrease in April.

Manufacturing output was driven by a decline in a decline in the manufacture of weapons and ammunition, which dropped 21.5%.

On a yearly basis, manufacturing production in the U.K. increased 1.0% in May, missing forecast of a 1.8% gain, after a 0.1% rise in April. April's figure was revised down from a 0.2% gain.

Industrial production in the U.K. climbed 0.4% in May, beating forecasts of a 0.2% fall, after a 0.3% gain in April. April's figure was revised down from 0.4% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 7.3% in May.

On a yearly basis, industrial production in the U.K. gained 2.1% in May, exceeding expectations for a 1.6% rise, after a 1.2% increase in April.

-

11:04

The U.S. is urging European and Greek leaders to reach a deal

The U.S. is urging European and Greek leaders to reach a deal, and Greece should remain in the Eurozone. The US treasury secretary, Jack Lew, said that he hopes a deal would "allow Greece to make difficult but necessary fiscal and structural reforms, return to growth, and achieve debt sustainability within the Eurozone".

-

10:52

Greek banks remain closed until July 08

News reported that Greek banks remain closed until July 08. Daily cash withdrawals remain limited to 60 euros and payments and transfers abroad remain banned.

At the same time, these restrictions do not apply to foreign tourists.

Previously, The Wall Street Journal reported that it is unlikely that Greek bank will reopen sooner than in a few weeks.

-

10:41

European Central Bank Governing Council Member Ewald Nowotny: the central bank will not provide with the liquidity the Greek financial system if Greece misses to repay the central bank’s loans on July 20

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview on Monday that the central bank will not provide with the liquidity the Greek financial system if Greece misses to repay the central bank's loans on July 20.

"That would be a state bankruptcy, a default in English," he said.

Nowotny added that a solution should be found as soon as possible.

-

10:27

European Central Bank (ECB) purchases €63.2 of public and private debt in June

The European Central Bank (ECB) purchased €63.2 of public and private debt under its quantitative-easing program in June, compared to €63.1 billion in May.

ECB Executive Board member Benoit Coeure said on May 18 that the central bank would raise the pace of asset-buying due to lower liquidity in July and August.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €51.4 billion of government and agency bonds in June, €10.2 billion of covered bonds, and €1.59 billion of asset-backed securities.

-

10:15

European Central Bank Executive Board Member Benoit Coeure: the central bank is ready to do more if needed to boost inflation

The European Central Bank (ECB) Executive Board Member Benoit Coeure said on Sunday that the central bank is ready to do more if needed to boost inflation. He noted that high unemployment led to lower prices.

"We are strictly focused on our goal to ensure price stability. That's why we are concerned with unemployment. If we had to do more, we will do more, we will find the necessary instruments, we will use these instruments," Mr. Coeure said.

-

09:06

Global Stocks: Chinese stocks declined further

U.S. stocks ended lower on Monday amid results of Greece's referendum, in which the majority of citizens rejected austerity conditions demanded by lenders. The country's finance minister Yanis Varoufakis resigned on Monday.

The Dow Jones industrial average fell 43.49 points, or 0.25%, to 17,686.62, the S&P 500 lost 7.96 points, or 0.38% (energy companies lost 1.3% amid declines in oil prices), to 2,068.82 and the Nasdaq Composite fell 17.27 points, or 0.34%, to 4,991.94.

In Asia this morning Hong Kong Hang Seng fell by 1.38%, or 347.89 points, to 24,888.39. China Shanghai Composite Index dropped 3.62%, or 136.84 points, to 3,639.08. Meanwhile the Nikkei advanced by 1.27%, or 254.78 points, to 20,366.90.

Chinese stocks declined despite recent steps to support the market and stop this major selloff. Indices outside China mostly advanced amid considerations that losses after the Creek referendum might have been excessive.

-

04:00

Nikkei 225 20,377.96 +265.84 +1.32 %, Hang Seng 25,247.65 +11.37 +0.05 %, Shanghai Composite 3,654.78 -121.13 -3.21 %

-

00:29

Stocks. Daily history for Jul 6’2015:

(index / closing price / change items /% change)

Nikkei 225 20,112.12 -427.67 -2.08 %

Hang Seng 25,236.28 -827.83 -3.18 %

Shanghai Composite 3,776.18 +89.27 +2.42 %

FTSE 100 6,535.68 -50.10 -0.76 %

CAC 40 4,711.54 -96.68 -2.01 %

Xetra DAX 10,890.63 -167.76 -1.52 %

S&P 500 2,068.76 -8.02 -0.39 %

NASDAQ Composite 4,991.94 -17.27 -0.34 %

Dow Jones 17,683.58 -46.53 -0.26 %

-