Noticias del mercado

-

22:12

U.S. stocks closed

U.S. stocks fell, with the Standard & Poor's 500 Index extending its steepest weekly drop since March, as Greece scrambled to avoid a cash crunch and energy shares tumbled with the price of oil.

Transocean Ltd. and ConocoPhillips fell more than 2.7 percent as West Texas Intermediate crude lost almost 8 percent. Aetna Inc. slid 6.8 percent, the most in three years, after agreeing to buy rival health insurer Humana Inc. for about $35 billion in cash and stock. Humana rose 1.5 percent.

While investors sold riskier assets after Greeks voted in a referendum Sunday to reject their creditors' austerity terms for aid, the declines were muted compared with a week ago. The onus is on Greece to act quickly to avoid a meltdown of its banks, which the government said will now remain shut through Wednesday. German Chancellor Angela Merkel and French President Francois Hollande are due to meet other euro-region leaders tomorrow.

Greek Finance Minister Yanis Varoufakis resigned, a move investors speculated may aid talks with creditors. Varoufakis said there was "a certain preference" among European creditors that he no longer be involved in negotiations.

U.S. stocks fell the most in three months last week as the escalating crisis in Greece stole attention from U.S. economic data and the Federal Reserve. The S&P 500 pared its 2015 gain to 0.9 percent, and finished Thursday 2.5 percent below its all-time high set in May.

The gauge suffered its biggest single-day decline of the year last Monday, down 2.1 percent, after Greece closed its banks and imposed capital controls.

The uncertainty in Greece overshadowed U.S. economic data that, while improving, wasn't strong enough to boost prospects for an increase in Fed interest rates. A report Thursday showed the U.S. economy added 233,000 jobs in June while wages stagnated and the size of the labor force receded.

Data Monday showed growth at U.S. service industries picked up in June from a more than one-year low, signaling steady improvement in the biggest part of the economy.

Investors will receive more signals on the health of the economy on Wednesday when earnings season kicks off and the Fed releases the minutes from its June meeting. The Federal Open Market Committee voted to keep the main rate at zero, where it has been since late 2008, as officials hold out for more decisive evidence of an economic rebound.

Quarterly earnings season begins that same day with Alcoa Inc. scheduled to report after the market closes. Analysts forecast corporate profits will contract 6.5 percent for the period before turning positive in the fourth quarter, according to data compiled by Bloomberg. Profits will end up growing 1.2 percent for the full 12 months, the data show.

All of the S&P 500's 10 main groups slid, with energy, raw-materials and industrial shares posting the biggest declines. WTI crude fell the most in seven months amid concerns about demand and ample supplies.

Transocean declined to a three-month low, and National Oilwell Varco Inc. lost 5.1 percent, the most in two months to pace energy losses after an industry report last week showed that the number of U.S. oil rigs in use advanced for the first time this year.

Metals miner Freeport-McMoRan Inc. retreated 3.7 percent to its lowest since March 20. Copper futures fell the most since January amid a slump in industrial metals as moves by China to halt a stock-market collapse and Greece's vote against austerity added to concern that global demand will ebb.

Industrial companies in the S&P 500 slumped to their lowest since January. Mining equipment maker Joy Global Inc. sank 3 percent to a nearly six-year low. Caterpillar Inc. and General Electric Co. lost more than 1.7 percent.

-

21:00

S&P 500 2,062.58 -14.20 -0.68 %, NASDAQ 4,969.73 -39.48 -0.79 %, Dow 17,620.78 -109.33 -0.62 %

-

19:08

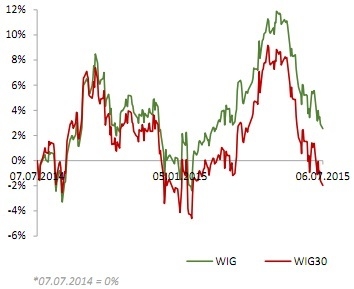

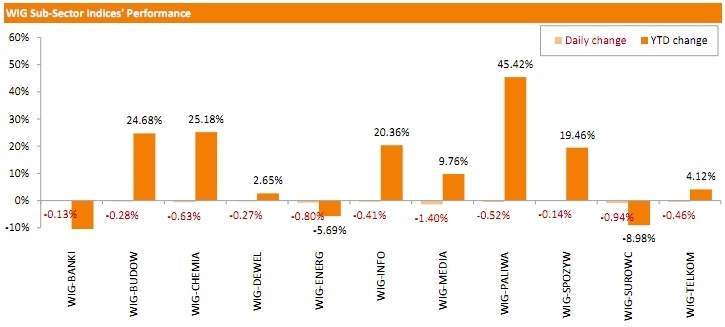

WSE: Session Results

Polish equity market continued to decline on Monday. The broad market measure, the WIG index, lost 0.33%. All 11 sectors in the WIG Index plunged, led down by media sector stocks, which fell 1.40%.

The large-cap stocks' measure, the WIG30 Index, slid down 0.37%. Within the WIG30 Index components, CYFROWY POLSAT (WSE: CPS) fared the worst, slumping 3.29%. It was followed by PGNIG (WSE: PGN), ING BSK (WSE: ING) and CCC (WSE: CCC), dropping 2.81%, 2.64% and 2.23% respectively. On the other side of the ledger, JSW (WSE: JSW) and BOGDANKA (WSE: LWB) became the session's best performers, as their stocks skyrocketed by a respective 6.76% and 3.60%, recuperating from recent drastic declines.

-

18:06

Wall Street. Major U.S. stock-indexes fell

U.S. stocks slightly fell on Monday after the International Monetary Fund said it ready to assist Greece if asked. Greeks rejected the conditions of a rescue package from creditors on Sunday, but investors remained optimistic that a deal could be reached to prevent the country's exit from the euro zone. Stock markets globally fell, but analysts said the declines were less than expected due to expectations that the European Central Bank would act to limit any damage.

Most of Dow stocks in negative area (20 of 30). Top looser - Intel Corporation (INTC, -1.29%). Top looser - Wal-Mart Stores Inc. (WMT, +0.93).

S&P index sectors mixed. Top looser - Basic Materials (-1.5%).

At the moment:

Dow 17594.00 -55.00 -0.31%

S&P 500 2062.50 -6.25 -0.30%

Nasdaq 100 4415.00 -13.75 -0.31%

10-year yield 2.33% -0.06

Oil 54.02 -2.91 -5.11%

Gold 1167.00 +3.50 +0.30%

-

18:00

European stocks closed: FTSE 100 6,535.68 -50.10 -0.76 %, CAC 40 4,711.54 -96.68 -2.01 %, DAX 10,890.63 -167.76 -1.52 %

-

18:00

European stocks close: stocks closed lower after of the Greek referendum on Sunday

Stock indices closed lower after of the Greek referendum on Sunday. 61.31% of Greeks voted "No" in the Sunday's referendum, while 38.69% of Greeks voted "Yes".

Greek Finance Minister Yanis Varoufakis has resigned after the referendum.

"Soon after the announcement of the referendum results, I was made aware of a certain preference by some eurogroup participants, and assorted 'partners', for my… 'absence' from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement," he said in his blog on early Monday.

According to a Greek government official, Greek Prime Minister Alexis Tsipras spoke by phone on Monday with Germany's Chancellor Angela Merkel. He agreed to present new Greek proposal at Tuesday's European Union (EU) summit.

Meanwhile, the economic data from the Eurozone was better than expected. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index increased to 18.5 in July from 17.1 in June, missing expectations for a decline to 18.7. The index rose despite the uncertainty over the Greek debt crisis.

German seasonal adjusted factory orders declined 0.2% in May, beating expectations for a 0.4% drop, after a 2.2% rise in April. April's figure was revised up from a 1.4% gain.

The decline was driven by a drop in new orders from the Eurozone. New orders from the Eurozone plunged 1.5% in May, while orders from other countries increased 1.2%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,535.68 -50.10 -0.76 %

DAX 10,890.63 -167.76 -1.52 %

CAC 40 4,711.54 -96.68 -2.01 %

-

17:33

Euclides Tsakalotos has been named Greece's new finance minister

-

17:03

Italian Prime Minister Matteo Renzi: Greece’s creditors should also focus on strategies to boost economic growth

Italian Prime Minister Matteo Renzi said on Monday that Greece's creditors should also focus on strategies to boost economic growth.

"We have been urging for months to talk not only about austerity and balance sheets but about growth, infrastructure, common policies on migration, innovation, the environment," he wrote on his Facebook page.

-

16:41

Canada’s Ivey purchasing managers’ index drops to 55.9 in May

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 55.9 in May from 62.3 in April. Analysts had expected the index to decrease to 55.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was 48.8 in May, while employment index was 50.7.

Inventories index was 48.9.

-

16:27

ISM non-manufacturing purchasing managers’ index climbs to 56.0 in June

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Monday. The index climbed to 56.0 in June from 55.7 in May, missing expectations for a increase to 56.2.

A reading above 50 indicates a growth in the service sector.

The subindexes were mixed.

The business activity/production index rose to 61.5 in June from 59.5 in May.

The ISM's new orders index increased to 58.3 in June from 57.9 in May.

The ISM's employment index declined to 52.7 in June from 55.3 in May.

The ISM's price index fell to 53.0 in June from 55.9 in May.

-

16:07

Makit’s final U.S. services PMI is down to 54.8 in June

Markit Economics released its final services purchasing managers' index (PMI) for the U.S. on Monday. The final U.S. services PMI declined to 54.8 in June from 56.2 in May, in line with the preliminary reading.

A reading over 50 indicates expansion in the sector.

The decline was driven by a slowdown in employment and output growth.

The employment subindex decreased to 54.1 in June from 55.5 in May.

"Although still signalling moderate growth in June, the manufacturing and service sector surveys indicate that the rate of economic expansion has slowed markedly since the start of the quarter, when business was boosted by a rebound from weather related weakness. The loss of growth momentum seen in the surveys means GDP growth could slacken off again in the third quarter and hiring could likewise ease off," Markit Economics Chief Economist Chris Williamson noted.

-

15:33

U.S. Stocks open: Dow -0.49%, Nasdaq -0.88%, S&P -0.80%

-

15:30

Greek Prime Minister Alexis Tsipras and Russian President Vladimir Putin discuss the results of Sunday’s referendum

According the Kremlin, Greek Prime Minister Alexis Tsipras and Russian President Vladimir Putin discussed by phone on Monday the results of Sunday's referendum. There is no mention of possible Russian financial help.

-

15:29

Before the bell: S&P futures -0.74%, NASDAQ futures -0.76%

U.S. stock-index futures slid after Greek voters' unexpectedly emphatic rejection of austerity measures raised the risk of a euro exit.

Nikkei 20,112.12 -427.67 -2.08%

Hang Seng 25,236.28 -827.83 -3.18%

Shanghai Composite 3,776.18 +89.27 +2.42%

FTSE 6,542.25 -43.53 -0.66%

CAC 4,718.66 -89.56 -1.86%

DAX 10,889.58 -168.81 -1.53%

Crude oil $54.57 (-4.16%)

Gold $1164.40 (+0.08%)

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

American Express Co

AXP

78.00

-0.27%

3.0K

Merck & Co Inc

MRK

57.49

-0.31%

0.2K

Johnson & Johnson

JNJ

98.10

-0.35%

0.1K

AT&T Inc

T

35.60

-0.36%

10.3K

Tesla Motors, Inc., NASDAQ

TSLA

279.01

-0.36%

23.3K

Barrick Gold Corporation, NYSE

ABX

10.53

-0.38%

0.2K

AMERICAN INTERNATIONAL GROUP

AIG

61.80

-0.45%

20.0K

Amazon.com Inc., NASDAQ

AMZN

435.58

-0.49%

5.5K

Wal-Mart Stores Inc

WMT

71.50

-0.50%

0.7K

Cisco Systems Inc

CSCO

27.19

-0.51%

4.8K

Procter & Gamble Co

PG

79.51

-0.53%

3.3K

McDonald's Corp

MCD

95.65

-0.54%

4.1K

ALTRIA GROUP INC.

MO

48.70

-0.59%

2.6K

The Coca-Cola Co

KO

39.25

-0.61%

1.5K

E. I. du Pont de Nemours and Co

DD

59.60

-0.65%

2.1K

Ford Motor Co.

F

14.77

-0.67%

29.8K

Microsoft Corp

MSFT

44.10

-0.68%

2.6K

Intel Corp

INTC

30.34

-0.70%

2.1K

Hewlett-Packard Co.

HPQ

30.46

-0.75%

1.1K

Walt Disney Co

DIS

114.09

-0.77%

5.1K

Verizon Communications Inc

VZ

46.83

-0.78%

0.8K

Apple Inc.

AAPL

125.45

-0.78%

389.0K

Google Inc.

GOOG

519.03

-0.83%

0.4K

International Business Machines Co...

IBM

163.69

-0.85%

4.3K

Boeing Co

BA

139.01

-0.86%

1.1K

Facebook, Inc.

FB

86.53

-0.86%

131.3K

Home Depot Inc

HD

110.50

-0.89%

0.7K

Twitter, Inc., NYSE

TWTR

35.40

-0.90%

67.3K

General Motors Company, NYSE

GM

32.92

-0.93%

3.1K

JPMorgan Chase and Co

JPM

66.87

-0.96%

17.2K

General Electric Co

GE

26.52

-0.97%

11.6K

Goldman Sachs

GS

207.15

-0.98%

1.4K

Starbucks Corporation, NASDAQ

SBUX

53.70

-1.00%

3.4K

3M Co

MMM

153.78

-1.03%

1.0K

Pfizer Inc

PFE

33.01

-1.08%

2.6K

Chevron Corp

CVX

94.80

-1.12%

7.9K

Exxon Mobil Corp

XOM

82.20

-1.13%

12.5K

Visa

V

67.41

-1.22%

3.6K

HONEYWELL INTERNATIONAL INC.

HON

101.22

-1.26%

0.2K

Citigroup Inc., NYSE

C

54.63

-1.34%

47.4K

ALCOA INC.

AA

10.95

-1.35%

21.6K

UnitedHealth Group Inc

UNH

120.05

-1.44%

0.5K

Yahoo! Inc., NASDAQ

YHOO

38.79

-1.50%

10.0K

Yandex N.V., NASDAQ

YNDX

15.14

-1.56%

0.6K

Caterpillar Inc

CAT

83.00

-1.64%

13.5K

Freeport-McMoRan Copper & Gold Inc.,

FCX

17.91

-2.66%

11.5K

-

15:05

European Central Bank Governing Council Member Christian Noyer: Greece’s debt held by the central bank cannot be restructured

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that Greece's debt held by the central bank cannot be restructured.

"Greek debt held by the Eurosystem is debt that cannot by its very nature be restructured because that would be monetary financing of a state," he said.

-

14:53

Head of the Eurogroup Jeroen Dijsselbloem said on Monday that the vote “No” makes negotiations more difficult, but Greece should be kept in the Eurozone

-

14:43

Greek Prime Minister Alexis Tsipras agrees to present new Greek proposal at Tuesday's European Union summit

According to a Greek government official, Greek Prime Minister Alexis Tsipras spoke by phone on Monday with Germany's Chancellor Angela Merkel. He agreed to present new Greek proposal at Tuesday's European Union (EU) summit.

-

12:00

European stock markets mid session: stocks traded lower as Greeks said “No” to the creditors’ proposals

Stock indices traded lower after of the Greek referendum on Sunday. 61.31% of Greeks voted "No" in the Sunday's referendum, while 38.69% of Greeks voted "Yes".

Greek Finance Minister Yanis Varoufakis has resigned after the referendum.

"Soon after the announcement of the referendum results, I was made aware of a certain preference by some eurogroup participants, and assorted 'partners', for my… 'absence' from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement," he said in his blog on early Monday.

Head of the Eurogroup Jeroen Dijsselbloem said on Sunday that the outcome of the referendum is "regrettable".

"I take note of the outcome of the Greek referendum. This result is very regrettable for the future of Greece. For recovery of the Greek economy, difficult measures and reforms are inevitable. We will now wait for the initiatives of the Greek authorities. The Eurogroup will discuss the state of play on Tuesday 7 July," he said.

Meanwhile, the economic data from the Eurozone was better than expected. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index increased to 18.5 in July from 17.1 in June, missing expectations for a decline to 18.7. The index rose despite the uncertainty over the Greek debt crisis.

German seasonal adjusted factory orders declined 0.2% in May, beating expectations for a 0.4% drop, after a 2.2% rise in April. April's figure was revised up from a 1.4% gain.

The decline was driven by a drop in new orders from the Eurozone. New orders from the Eurozone plunged 1.5% in May, while orders from other countries increased 1.2%.

Current figures:

Name Price Change Change %

FTSE 100 6,557.92 -27.86 -0.42 %

DAX 10,981.49 -76.90 -0.70 %

CAC 40 4,765.3 -42.92 -0.89 %

-

11:44

Industrial production in Spain increases 0.8% in May

Spanish statistical office INE released its industrial production figures for Spain on Monday. Industrial production in Spain was up 0.8% in May, after a 0.1% gain in April.

On a yearly basis, industrial production in Spain climbed at adjusted 3.4% in May, after a revised 1.7% increase in April.

The increase was driven by a rise in all subindexes. Output of capital goods jumped 6.2% in May, output of intermediate goods climbed 4.9%, energy production was up 3.3%, while consumer goods output rose 0.3%.

-

11:35

Sentix investor confidence index for the Eurozone is up to 18.5 in July

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index increased to 18.5 in July from 17.1 in June, missing expectations for a decline to 18.7.

A reading above 0.0 indicates optimism, below indicates pessimism.

The index rose despite the uncertainty over the Greek debt crisis.

The current conditions index jumped to 14.5 in July from 11.8 in June. It was the highest level since July 2011.

The expectations index fell to 22.3 in July from 22.5 in June.

German investor confidence index remained unchanged at 26.8 in July.

-

11:18

Switzerland’s consumer price inflation rises 0.1% in June

The Swiss Federal Statistics Office released its consumer inflation data on Monday. Switzerland's consumer price index rose 0.1% in June, beating expectations for a 0.1% decrease, after a 0.2% rise in May.

On a yearly basis, Switzerland's consumer price index increased to -1.0% in June from -1.2% in May, beating forecasts of a 1.2% decline.

Food and beverages prices dropped at an annual rate of 0.8% in June, clothing and footwear prices climbed 0.6%, while housing and energy prices declined 0.4%.

-

11:07

German seasonal adjusted factory orders fall 0.2% in May

Destatis released its factory orders data for Germany on Monday. German seasonal adjusted factory orders declined 0.2% in May, beating expectations for a 0.4% drop, after a 2.2% rise in April. April's figure was revised up from a 1.4% gain.

The decline was driven by a drop in new orders from the Eurozone. New orders from the Eurozone plunged 1.5% in May, while orders from other countries increased 1.2%.

Foreign orders climbed by 0.2% in May, while domestic orders decreased by 0.6%.

The intermediate goods climbed by 1.3% in May, capital goods orders were down 0.8%, while consumer goods orders decreased 1.2%.

-

10:55

Greek Finance Minister Yanis Varoufakis resigns

Greek Finance Minister Yanis Varoufakis has resigned after Greeks said "No" to the creditors' proposals.

"Soon after the announcement of the referendum results, I was made aware of a certain preference by some eurogroup participants, and assorted 'partners', for my… 'absence' from its meetings; an idea that the Prime Minister judged to be potentially helpful to him in reaching an agreement," he said in his blog on early Monday.

-

10:42

Head of the Eurogroup Jeroen Dijsselbloem: the outcome of the referendum is "regrettable"

Head of the Eurogroup Jeroen Dijsselbloem said on Sunday that the outcome of the referendum is "regrettable".

"I take note of the outcome of the Greek referendum. This result is very regrettable for the future of Greece. For recovery of the Greek economy, difficult measures and reforms are inevitable. We will now wait for the initiatives of the Greek authorities. The Eurogroup will discuss the state of play on Tuesday 7 July," he said.

-

10:28

European Parliament President Martin Schulz expresses his pessimism regarding Greece will get a deal with better conditions after voting “no”

European Parliament President Martin Schulz expressed his pessimism regarding Greece will get a deal with better conditions after voting "no". He also said that Europe needs to urgently discuss a possible humanitarian aid programme for Greece.

"The promise of the minister of finance that the banks will open tomorrow and that money will be available for tomorrow and Tuesday seems to me very difficult and dangerous. And, therefore, because I believe that the Greek people will be, during the week and even every day in a more difficult situation, I think we should tomorrow, at the latest on Tuesday for the Eurozone summit discuss a possible humanitarian aid programme for Greece," Schulz said.

-

10:14

European Central Bank Vice President Vitor Constancio: it will be difficult to reach a deal between Greece and its lenders if Greeks vote “No”

The European Central Bank (ECB) Vice President Vitor Constancio said in Vilnius, Lithuania, on Friday that it will be difficult to reach a deal between Greece and its lenders if Greeks vote "No".

"That of course would imply that the situation also in Greece becomes more difficult because the situation of banks will become weaker, if an agreement is not possible in short period of time," he said.

But Constancio added that the central bank was ready to deal with any situation.

-

08:47

Global Stocks: Asian stocks mostly tumbled

U.S. stocks ended lower on Thursday. U.S. markets were closed on Friday in observance of Independence Day.

The Dow Jones Industrial Average fell 27.80, or 0.2%, to 17730.11. The S&P 500 index lost 0.64 point, less than 0.1%, to 2076.78. The Nasdaq Composite Index fell 3.91, or 0.1%, to 5009.21.

In Asia this morning Hong Kong Hang Seng fell by 3.18%, or 829.36 points, to 25,234.75. China Shanghai Composite Index gained 2.16%, or 79.46 points, to 3,766.37. Meanwhile the Nikkei declined by 2.42%, or 497.42 points, to 20,042.37.

Asian stocks outside China fell amid results of Greece referendum. 61.31% of Greeks voted against Europe's latest bailout offer despite that the country urgently needs cash to keep its economy going and reopen banks. Some meetings regarding Greece's situation are scheduled for this week and they are anticipated by investors.

Chinese stocks advanced amid news from the country's top securities regulator, which said that the central bank of China would provide funds to China Securities Finance Corp, a company owned by the stock regulator. The company will use the money to lend to brokerages, which could then lend to investors to buy stocks. This new tool is designed to stop the massive selloff seen in Chinese stock markets lately and this is the first time central-bank funds will be provided for non-bank institutions.

-

03:58

Nikkei 225 20,276.29 -263.50 -1.28 %, Seng 26,109.53+45.42 +0.17 %, Shanghai Composi 3,975.21 +288.30 +7.82 %

-

01:00

Stocks. Daily history for Jul 3’2015:

(index / closing price / change items /% change)

Nikkei 225 20,539.79 +17.29 +0.08 %

Hang Seng 26,064.11 -218.21 -0.83 %

Shanghai Composite 3,684.36 -228.41 -5.84 %

FTSE 100 6,585.78 -44.69 -0.67 %

CAC 40 4,808.22 -27.34 -0.57 %

Xetra DAX 11,058.39 -40.96 -0.37 %

-