Noticias del mercado

-

18:00

WSE: Session Results

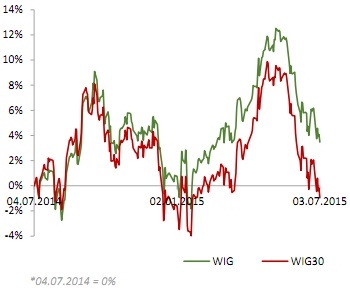

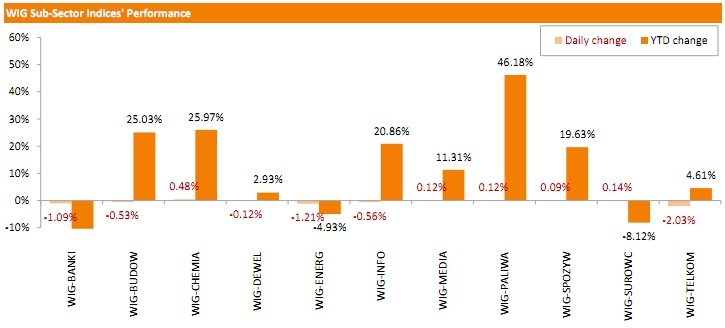

Polish equity market retreated on Friday, with the broad market measure, the WIG Index, sliding 0.58%. Sector-wise, telecommunications names (-2.03%) recorded the biggest decline, while chemicals names (+0.48%) posted the largest rise.

The large-cap stocks fell by 0.76%, as measured by the WIG30 Index. There were only a few gainers among the Index components. GRUPA AZOTY (WSE: ATT) fared the best, posting advance of 2.43%, followed by PGNIG (WSE: PGN), CYFROWY POLSAT (WSE: CPS), LOTOS (WSE: LTS), TVN (WSE: TVN) and KGHM (WSE: KGH), adding 0.19%-0.89%. On the other side of the ledger, HANDLOWY (WSE: BHW) and ORANGE POLSKA (WSE: OPL) lagged, dropping 2.18% and 2.16% respectively. Other major decliners included LPP (WSE: LPP), ENEA (WSE: ENA), SYNTHOS (WSE: SNS), PEKAO (WSE: PEO) and PGE (WSE: PGE), losing 1.48%-1.74%.

-

18:00

European stocks close: stocks closed lower ahead of the Greek referendum on Sunday

Stock indices closed lower ahead of the Greek referendum on Sunday. Greek Prime Minister Alexis Tsipras said on Friday that that Greece's debt was not sustainable. He also noted that the vote "No" would not mean that Greece have to leave the Eurozone.

Tsipras also said that he asked Greece's lenders to accept a 30% haircut on the country's debt. He pointed out that he also wants a 20-year "grace period" on repaying the rest debt.

Greek Finance Minister Yanis Varoufakis said on Friday that a deal between Greece and its creditors will be reached regardless of the outcome of Sunday's referendum. He noted that a deal was "more or less done".

Head of the Eurogroup Jeroen Dijsselbloem Jeroen Dijsselbloem said on Friday that Greece faced a difficult future regardless of the outcome of the referendum on Sunday.

He also said that a deal between Athens and its lenders is near is "completely false". He added that no new proposals have been sent to Greece.

Meanwhile, the economic data from the Eurozone was solid. Retail sales in the Eurozone rose 0.2% in May, exceeding expectations for a 0.1% gain, after a 0.7% increase in April.

The increase was driven by higher food, drinks and tobacco and non-food sales.

On a yearly basis, retail sales in the Eurozone rose 2.4% in May, beating forecasts of a 2.3% gain, after a 2.7% increase in April. April's figure was revised up from a 2.2% rise.

Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in June from 53.8 in May, in line with the preliminary reading.

The increase was driven by rises in new business and employment.

Eurozone's final composite output index increased to 54.2 in June from 53.6 in May, up from the preliminary reading of 54.1. It was the highest level since May 2011.

"Despite the escalation of the Greek crisis in the second half of the month, the final PMI for June came in slightly above the 'flash' estimate, suggesting the turmoil has so far had little discernible impact on the real economy," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 53.8 in June from 53.0 in May, missing the preliminary reading of 54.2.

The increase was driven by rises in new orders and employment.

"June's PMI results signalled a re-acceleration of service sector activity growth in Germany, after May data pointed to the weakest rise in output for five months. Encouragingly, a further increase in staff recruitment highlighted confidence about upcoming workloads despite new business rising at the slowest pace in 2015 so far," an economist at Markit, Oliver Kolodseike,said.

France's final services purchasing managers' index (PMI) climbed to 54.1 in June from 52.8 in May, in line with the preliminary reading. It was the highest reading since August 2011.

The increase was driven by a rise in new business.

"Activity growth picked up pace further in June, rounding off a solid quarter of expansion in French private sector output. The PMI figures suggest that second quarter GDP will show a further robust expansion following the 0.6% rise seen in Q1," Senior Economist at Markit Jack Kennedy said.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. jumped to 58.5 in June from 56.5 in May, exceeding expectations for a rise to 57.4.

The increase was driven by robust expansion in new work inflows.

"While uncertainty caused by the Greek debt crisis rules out any imminent hike in interest rates, the post-election rebound in service sector business activity adds to the likelihood of the Bank of England starting to nudge rates higher later this year. The survey data are indicating an acceleration of economic growth to 0.5% in the second quarter, up from 0.4% in the first three months of the year," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,585.78 -44.69 -0.67 %

DAX 11,058.39 -40.96 -0.37 %

CAC 40 4,808.22 -27.34 -0.57 %

-

17:01

European Central Bank Governing Council Member Ewald Nowotny: the central bank will discuss emergency liquidity assistance (ELA) to Greek banks on Monday

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Friday that the central bank will discuss emergency liquidity assistance (ELA) to Greek banks on Monday.

He ruled out the idea of a parallel currency to the euro in Greece.

-

16:50

Spian’s services PMI falls to 56.1 in June

Markit Economics released final services purchasing managers' index (PMI) for Spain on Friday. Spain's final services purchasing managers' index (PMI) declined to 56.1 in June from 58.4 in May.

"The June services PMI survey rounds off an encouraging second quarter of the year for Spanish service providers, with strong rises in activity and new business recorded throughout. The latest survey also continued the recent trend of quickening employment growth," Senior Economist at Markit Andrew Harker said.

-

16:28

Italy’s services PMI rises to 53.4 in June

Markit/ADACI's services purchasing managers' index (PMI) for Italy was up to 53.4 in June from 52.5 in May.

A reading above 50 indicates expansion in the sector.

The increase was driven by rises in new work and employment.

"PMI survey data show economic growth in Italy picking up in the second quarter from the 0.3% expansion seen in Q1. Importantly, the upturn in services activity has gathered pace in recent months alongside continued solid growth in manufacturing, with the latest increase in tertiary sector output the second-fastest since November 2010," an economist at Markit Phil Smith said.

-

16:04

Greek Prime Minister Alexis Tsipras: Greece’s debt was not sustainable

Greek Prime Minister Alexis Tsipras said on Friday that that Greece's debt was not sustainable. He also noted that the vote "No" would not mean that Greece have to leave the Eurozone.

Tsipras also said that he asked Greece's lenders to accept a 30% haircut on the country's debt. He pointed out that he also wants a 20-year "grace period" on repaying the rest debt.

Greece's debt totals €323 billion.

-

15:17

German Finance Minister Wolfgang Schaeuble: new debt talks with Greece after a weekend referendum would take time to reach a deal

German Finance Minister Wolfgang Schaeuble said on Friday that new debt talks with Greece after a weekend referendum would take time to reach a deal. He added that negotiations would take place "on an entirely new basis and under more difficult economic conditions".

"It will take a while," Schaeuble said.

-

14:52

Head of the Eurogroup Jeroen Dijsselbloem Jeroen Dijsselbloem: Greece faced a difficult future regardless of the outcome of the referendum on Sunday

Head of the Eurogroup Jeroen Dijsselbloem Jeroen Dijsselbloem said on Friday that Greece faced a difficult future regardless of the outcome of the referendum on Sunday.

"Any politician who says that wouldn't be necessary in the case of a 'No' vote is making a fool of his people," he said.

He also said that a deal between Athens and its lenders is near is "completely false". He added that no new proposals have been sent to Greece.

Earlier on Friday, Greek Finance Minister Yanis Varoufakis said that a deal between Greece and its creditors will be reached regardless of the outcome of Sunday's referendum. He noted that a deal was "more or less done".

-

14:39

European Central Bank Vice President Vitor Constancio could not say whether the ECB would provide emergency liquidity assistance (ELA) to Greek banks if Greeks vote 'No' in Sunday’s referendum

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that he could not say whether the ECB would provide emergency liquidity assistance (ELA) to Greek banks if Greeks vote 'No' in Sunday's referendum.

"It will be a decision by the Governing Council. We will have to wait and see how the Governing Council as a whole will analyse the situation," he said.

-

12:01

European stock markets mid session: stocks traded slightly lower ahead of the Greek referendum on Sunday

Stock indices traded slightly lower ahead of the Greek referendum on Sunday. Greek Finance Minister Yanis Varoufakis said on Friday that a deal between Greece and its creditors will be reached regardless of the outcome of Sunday's referendum. He noted that a deal was "more or less done".

The head of the Eurogroup Jeroen Dijsselbloem said on Thursday that if Greeks vote "No" on Sunday, it could mean that Greece have to leave the Eurozone. He added that Greeks should not expect better conditions if they vote "No".

Meanwhile, the economic data from the Eurozone was solid. Retail sales in the Eurozone rose 0.2% in May, exceeding expectations for a 0.1% gain, after a 0.7% increase in April.

The increase was driven by higher food, drinks and tobacco and non-food sales.

On a yearly basis, retail sales in the Eurozone rose 2.4% in May, beating forecasts of a 2.3% gain, after a 2.7% increase in April. April's figure was revised up from a 2.2% rise.

Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in June from 53.8 in May, in line with the preliminary reading.

The increase was driven by rises in new business and employment.

Eurozone's final composite output index increased to 54.2 in June from 53.6 in May, up from the preliminary reading of 54.1. It was the highest level since May 2011.

"Despite the escalation of the Greek crisis in the second half of the month, the final PMI for June came in slightly above the 'flash' estimate, suggesting the turmoil has so far had little discernible impact on the real economy," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 53.8 in June from 53.0 in May, missing the preliminary reading of 54.2.

The increase was driven by rises in new orders and employment.

"June's PMI results signalled a re-acceleration of service sector activity growth in Germany, after May data pointed to the weakest rise in output for five months. Encouragingly, a further increase in staff recruitment highlighted confidence about upcoming workloads despite new business rising at the slowest pace in 2015 so far," an economist at Markit, Oliver Kolodseike,said.

France's final services purchasing managers' index (PMI) climbed to 54.1 in June from 52.8 in May, in line with the preliminary reading. It was the highest reading since August 2011.

The increase was driven by a rise in new business.

"Activity growth picked up pace further in June, rounding off a solid quarter of expansion in French private sector output. The PMI figures suggest that second quarter GDP will show a further robust expansion following the 0.6% rise seen in Q1," Senior Economist at Markit Jack Kennedy said.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. jumped to 58.5 in June from 56.5 in May, exceeding expectations for a rise to 57.4.

The increase was driven by robust expansion in new work inflows.

"While uncertainty caused by the Greek debt crisis rules out any imminent hike in interest rates, the post-election rebound in service sector business activity adds to the likelihood of the Bank of England starting to nudge rates higher later this year. The survey data are indicating an acceleration of economic growth to 0.5% in the second quarter, up from 0.4% in the first three months of the year," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,613.43 -17.04 -0.26 %

DAX 11,078.4 -20.95 -0.19 %

CAC 40 4,812.63 -22.93 -0.47 %

-

11:41

Eurozone’s retail sales rise 0.2% in May

Eurostat released its retail sales data for the Eurozone on Friday. Retail sales in the Eurozone rose 0.2% in May, exceeding expectations for a 0.1% gain, after a 0.7% increase in April.

The increase was driven by higher food, drinks and tobacco and non-food sales. Both food, drinks and tobacco sales and non-food sales increased 0.4% in May.

Gasoline sales declined 0.7% in May.

On a yearly basis, retail sales in the Eurozone rose 2.4% in May, beating forecasts of a 2.3% gain, after a 2.7% increase in April. April's figure was revised up from a 2.2% rise.

The annual rise was driven by non-food sales, which gained 3.4% in May.

Food, drinks and tobacco sales rose 1.7% in May, while gasoline sales increased 0.7%.

-

11:22

Greek Finance Minister Yanis Varoufakis: a deal between Greece and its creditors will be reached regardless of the outcome of Sunday's referendum

Greek Finance Minister Yanis Varoufakis said on Friday that a deal between Greece and its creditors will be reached regardless of the outcome of Sunday's referendum. He noted that a deal was "more or less done".

-

11:07

UK’s services PMI jumps to 58.5 in June

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. jumped to 58.5 in June from 56.5 in May, exceeding expectations for a rise to 57.4.

A reading above 50 indicates expansion in the sector.

The increase was driven by robust expansion in new work inflows.

"While uncertainty caused by the Greek debt crisis rules out any imminent hike in interest rates, the post-election rebound in service sector business activity adds to the likelihood of the Bank of England starting to nudge rates higher later this year. The survey data are indicating an acceleration of economic growth to 0.5% in the second quarter, up from 0.4% in the first three months of the year," the Chief Economist at Markit Chris Williamson said.

-

10:49

Eurozone's final services PMI increases to 54.4 in June

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's final services purchasing managers' index (PMI) increased to 54.4 in June from 53.8 in May, in line with the preliminary reading.

The increase was driven by rises in new business and employment.

Eurozone's final composite output index increased to 54.2 in June from 53.6 in May, up from the preliminary reading of 54.1. It was the highest level since May 2011.

"Despite the escalation of the Greek crisis in the second half of the month, the final PMI for June came in slightly above the 'flash' estimate, suggesting the turmoil has so far had little discernible impact on the real economy," Chief Economist at Markit Chris Williamson said.

-

10:35

Germany's final services PMI rises to 53.8 in June

Markit Economics released final services purchasing managers' index (PMI) for Germany on Friday. Germany's final services purchasing managers' index (PMI) rose to 53.8 in June from 53.0 in May, missing the preliminary reading of 54.2.

The increase was driven by rises in new orders and employment.

"June's PMI results signalled a re-acceleration of service sector activity growth in Germany, after May data pointed to the weakest rise in output for five months. Encouragingly, a further increase in staff recruitment highlighted confidence about upcoming workloads despite new business rising at the slowest pace in 2015 so far," an economist at Markit, Oliver Kolodseike,said.

-

10:17

France's final services PMI climbs to 54.1 in June

Markit Economics released final services purchasing managers' index (PMI) for France on Friday. France's final services purchasing managers' index (PMI) climbed to 54.1 in June from 52.8 in May, in line with the preliminary reading. It was the highest reading since August 2011.

The increase was driven by a rise in new business.

"Activity growth picked up pace further in June, rounding off a solid quarter of expansion in French private sector output. The PMI figures suggest that second quarter GDP will show a further robust expansion following the 0.6% rise seen in Q1," Senior Economist at Markit Jack Kennedy said.

-

10:03

International Monetary Fund’s report: Greece requires €50 billion over the next three years

The International Monetary Fund (IMF) said in its report on Thursday that Greece requires €50 billion and easier terms on existing debt from October 2015 to end 2018 to maintain its finances sustainable, including at least €36 billion from Eurozone.

The IMF expects that Athens needs about €29 billion over the next 12 months from October 2015.

The lender downgraded Greece's economic growth forecast for this year to zero from April's estimate of 2.5%

The IMF said that state deposits in the Greek banking system dropped to less than €1 billion at the end of May.

The IMF noted that the report didn't reflect developments that happened since it was prepared, including bank closures, capital controls and IMF arrears.

"Greece faces a significantly larger financing need going forward than we thought last year," a senior IMF official said

-

09:41

Chinese services PMI declines to 51.8 in June

The HSBC/Markit Services Purchasing Managers' Index (PMI) for China declined to 51.8 in June from 53.5 in May. It was the lowest level since January.

A reading above 50 indicates expansion in the sector.

"In the service sector, business activity, new orders and employment all expanded at slower rates, while optimism towards the business outlook also moderated," an economist at Markit, Annabel Fiddes, said.

The new business sub-index dropped to 52.2 in June, an 11-month low, from 54.4 in May, while the employment sub-index decreased to its lowest level in three months.

-

09:17

Retail sales in Australia rise 0.3% in May

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia rose 0.3% in May, missing expectations for a 0.5% gain, after a 0.1% decline in April. April's figure was revised down from a flat reading.

Food retailing climbed 0.7% in May and household goods retailing rose 0.9%, while department stores sales dropped 1.4%, clothing, footwear and personal accessory retailing declined-0.8% and cafes, restaurants and takeaway food services sales fell 0.2%.

On a yearly basis, Australian retail sales increased to 4.7% in May from 4.1% in April.

-

08:54

Global Stocks: U.S. indices declined slightly amid payrolls data

U.S. stocks declined slightly on Thursday despite data, which showed that the U.S. economy generated less jobs in June than analysts had expected, and reassured investors that the Federal Reserve would be patient in raising interest rates. Investors were also cautious ahead of Sunday referendum in Greece.

According to the Labor Department, employers added 223,000 jobs in June vs 230,000 expected, while the unemployment rate fell to 5.3% from 5.5%. Wages remained flat. Although expectations were missed, the report was still strong and it marked the 14th out of the last 16 months in which the economy added more than 200,000 jobs.

The Dow Jones Industrial Average fell 27.80, or 0.2%, to 17730.11. The S&P 500 index lost 0.64 point, less than 0.1%, to 2076.78. The Nasdaq Composite Index fell 3.91, or 0.1%, to 5009.21.

U.S. stock markets will be closed on Friday in observance of Independence Day.

This morning in Asia Shanghai Composite Index declined by 2.93%, or 114.66 points, to 3,798.11. Hong Kong Hang Seng gained 0.04%, or 10.91 points, to 26,293.23. Meanwhile the Nikkei added 0.08%, or 15.61 points, to 20,538.11.

Asian stocks outside China posted modest gains as investors were cautious before Greece's Sunday referendum. Chinese stocks continued falling. The China Securities Regulatory Commission said it had opened an investigation into suspected market manipulation. -

04:03

Nikkei 225 20,431.25 -91.25 -0.44 %, Hang Seng 26,165.37 -116.95 -0.44 %, Shanghai Composite 3,669.66 -243.10 -6.21 %

-

02:30

Stocks. Daily history for Jul 2’2015:

(index / closing price / change items /% change)

HANG SENG 26,337.49 +87.46 +0.33%

S&P/ASX 200 5,599.8 +84.14 +1.53%

TOPIX 1,648.24 +11.83 +0.72%

SHANGHAI COMP 3,871.79 -181.91 -4.49%

FTSE 100 6,630.47 +21.88 +0.33 %

CAC 40 4,835.56 -47.63 -0.98 %

Xetra DAX 11,099.35 -81.15 -0.73 %

S&P 500 2,076.78 -0.64 -0.03 %

NASDAQ Composite 5,009.21 -3.91 -0.08 %

Dow Jones 17,730.11 -27.80 -0.16 %

-