Noticias del mercado

-

23:59

Schedule for today, Wednesday, Feb 10’2016:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

07:45 France Industrial Production, m/m December -0.9% 0.2%

07:45 France Industrial Production, y/y December 2.8%

09:30 United Kingdom Industrial Production (MoM) December -0.7% -0.1%

09:30 United Kingdom Industrial Production (YoY) December 0.9% 1%

09:30 United Kingdom Manufacturing Production (MoM) December -0.4% 0.1%

09:30 United Kingdom Manufacturing Production (YoY) December -1.2% -1.4%

12:00 U.S. MBA Mortgage Applications February -2.6%

15:00 United Kingdom NIESR GDP Estimate January 0.6%

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February 7.792

19:00 U.S. Federal budget January -14 10.3

21:30 New Zealand Business NZ PMI January 56.7

-

20:20

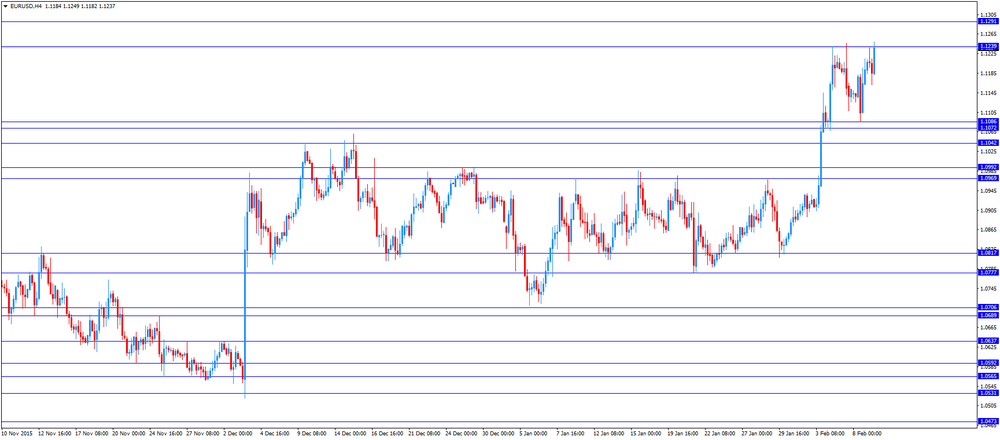

American focus: The US dollar fell against most major currencies

The euro rose substantially against the US currency for the first time since October 22, 2015 breaking the mark of $ 1.1300. The reason for this was a widespread weakening of the US dollar. A slight influence also provided data from the Commerce Department that showed that inventories at wholesalers in the US fell in December for the third month in a row, this is another sign that the company reduced replenishment to the end of 2015 against the backdrop of weak sales. Inventories fell 0.1% to a seasonally adjusted $ 582 billion. Economists had expected a decrease of 0.2%. Meanwhile, the change in inventories for November was revised to -0.4% from -0.3%. In annual terms, growth stocks slowed to 1.9% from 6% at the beginning of last year. Sales at wholesalers fell 0.3%. From December 2014 to December 2015 wholesale sales fell 4.5%, mainly due to lower demand for metals. The ratio of inventories to sales was unchanged at 1.32 months.

The attention of investors is also switched on Yellen speech, which will be held on Wednesday and Thursday. Analysts believe that the performance Yellen will be neutral and wait to confirm the Fed's position. However, it is likely to once again demonstrate the optimistic view on the economy and inflation, although emphasize intensified the uncertainty of the forecast. speech tone is likely to be "dovish" that confirms a reduced likelihood of a rate hike in March. According to CME, futures on the Fed show only 2% probability of a rate hike in March, and 6% chance in April.

The Swiss franc rose significantly against the dollar, reaching CHF0.9700 mark (the first time since Oct. 22, 2015). It is worth emphasizing, since the beginning of February the franc rose more than 500 points against the dollar. Pressure has a couple of risk aversion in the global markets and the sale of the US dollar due to the fading hopes for Fed rate increase this year. On the trading dynamics also affect the previously published data on the labor market in Switzerland. Today, the State Secretariat for Economic Affairs (SECO) reported that the unemployment rate in Switzerland has stabilized in January. The unemployment rate, seasonally adjusted 3.4 percent in January, the same as in December. On the basis of the unadjusted unemployment rate rose slightly to 3.8 percent from 3.7 percent in December. The total number of unemployed increased by 5,015 from the previous month and reached 163,644 in January. In turn, the unemployment rate among young people, which belongs to the age group 15-24 years increased to 3.8 percent from 3.7 percent a month earlier.

The pound appreciated sharply against the dollar, while approaching to the level of $ 1.4500. Amid lack of important economic data the British currency is focused on the dynamics of US stock indices. Previously it had little impact on trade balance data. The Office for National Statistics said that the trade deficit fell to 9.9 billion pounds from 11.5 billion pounds in November. Economists had forecast a deficit of EUR 10.4 billion. The narrowing was due to a fall in imports. A year ago, the deficit amounted to 13.5 billion pounds. The deficit in total trade decreased to 2.7 billion pounds from 4 billion pounds in November. Exports fell 0.8 percent compared with the previous month, while imports fell by 3.6 percent. In 2015, the overall trade deficit was 34.7 billion pounds compared to 34.4 billion pounds in the previous year. The increase in the trade deficit was due mainly to a decrease of 0.2 per cent of exports.

-

18:00

European stocks closed: FTSE 100 5,639.13 -50.23 -0.88% CAC 40 3,997.54 -68.77 -1.69% DAX 8,879.4 -99.96 -1.11%

-

16:49

European Central Bank Governing Council member Jens Weidmann: inflation in the Eurozone will rise later than previously expected

European Central Bank (ECB) Governing Council member Jens Weidmann said on Tuesday that inflation in the Eurozone will rise later than previously expected as oil prices continue to drop further. He added that inflation forecast for this year should be downgraded.

The ECB is scheduled to release its growth and inflation forecasts in March.

Weidmann also said that there are no signs for a hard landing in China.

-

16:36

Bank of England Deputy Governor Jon Cunliffe: the central bank should act sooner than later to manage the financial stability risks

Bank of England (BoE) Deputy Governor Jon Cunliffe said in a speech on Tuesday that the central bank should act sooner than later to manage the financial stability risks.

"Given the vulnerability that already exists and the powerful drivers in the UK, particularly the housing market, if credit began again to grow faster than GDP, I would want to think about action to manage the financial stability risks sooner rather than later," he said.

Cunliffe noted that a rise in house prices was driven by lower interest rates.

"The rise in secured debt and the increase in house prices reflected in part structural reductions in interest rates," he said.

-

16:28

Wholesale inventories in the U.S. falls 0.1% in December

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. fell 0.1% in December, missing expectations for a 0.2 decline, after a 0.4% decrease in November. November's figure was revised down from a 0.3% decline.

The decline was driven by a fall in inventories of durable goods. Inventories of non-durable goods increased 0.1% in December, while inventories of durable goods fell 0.3%.

Wholesale sales slid 0.3% in December, after a 1.3% fall in November.

-

16:16

Job openings climb to 5.607 million in December

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings rose to 5.607 million in December from 5.346 million in November. November's figure was revised down from 5.431 million.

The number of job openings climbed for total private (5.086 million) and for government (521,000) in December from November.

The hires rate was 3.7% in December.

Total separations increased to 5.072 million in December from 4.962 million in November.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:02

U.S.: JOLTs Job Openings, December 5.6 (forecast 5.4)

-

16:00

U.S.: Wholesale Inventories, December -0.1% (forecast -0.2%)

-

15:34

Greek industrial production increases 0.8% in December

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Tuesday. Greek industrial production increased 0.8% in December, after a 2.5% rise in November.

On a yearly basis, industrial production in Greece rose at an adjusted rate of 5.2% in December, after a 2.0% increase in November. November's figure was revised up from a 1.8% gain.

Production in the manufacturing sector increased at an annual rate of 3.3% in December, output in the mining and quarrying sector climbed 9.6%, while electricity production jumped by 11.3%.

-

15:28

National Federation of Independent Business’s small-business optimism index for the U.S. drops to 93.9 in January

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index dropped to 93.9 in January from 95.2 in December.

3 of 10 sub-indexes rose last month, 6 sub-indexes fell, while one sub-index was flat.

"The Small Business Optimism Index fell a bit more than one point, not much of a response to stock market turbulence or the Federal Reserve's move to raise interest rates. The decline in optimism was accounted for by two important Index components, expected business conditions in six months and expected real sales," NFIB Chief Economist Bill Dunkelberg said.

-

14:51

Option expiries for today's 10:00 ET NY cut

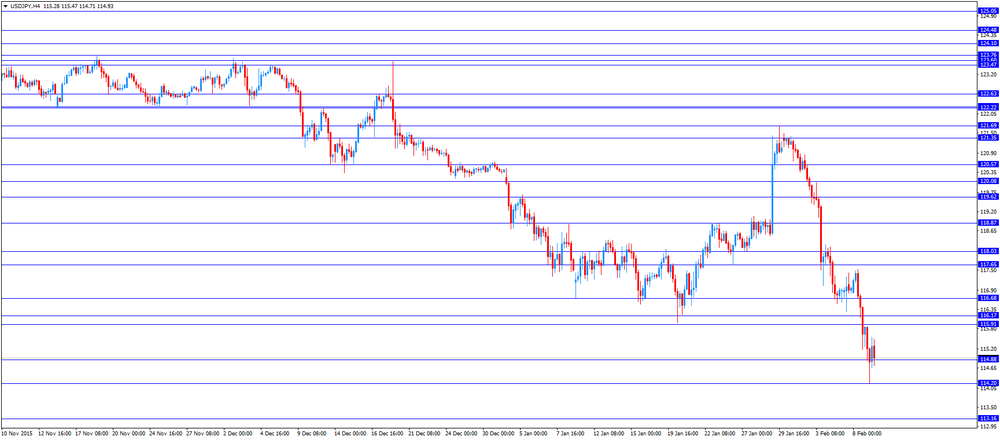

USD/JPY: 116.00 (USD 210m) 117.00 (250m) 117.75 (200m)

EUR/USD: 1.1000 (EUR 640m) 1.1100 (608m) 1.1200 (475m)

GBP/USD: 1.4500 (GBP 344m) 1.4600 (287m, 1.4700 (518m)

AUD/USD: 0.7000 AUD (701m) 0.7025 (357m) 0.7050 (333m) 0.7065 (728m) 0.7175 (2.2bln)

AUD/JPY: 82.00 (AUD 200m) 83.25 (252m)

-

14:47

BRC and KPMG sales monitor: U.K. retail sales rise by an annual rate of 2.6% on a like-for-like basis in January

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 2.6% on a like-for-like basis in January, after a 0.1% rise in December.

On a total basis, retail sales climbed 3.3% year-on-year in January.

"Following on from a somewhat disappointing Christmas period for retailers, the new year kicked off to a strong start, with 3.3 per cent growth across all product categories and 2.6 per cent growth on like-for-like sales," BRC Chief Executive, Helen Dickinson, said.

"January's performance was driven by big-ticket items, in particular furniture, which is encouraging in the largest month of the year for the category," she added.

-

14:22

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the U.K. trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia National Australia Bank's Business Confidence January 3 2

06:00 Japan Prelim Machine Tool Orders, y/y January -25.7% Revised From -25.8% -17.2%

06:45 Switzerland Unemployment Rate (non s.a.) January 3.7% 3.7% 3.8%

07:00 Germany Current Account December 24.3 Revised From 24.7 25.6

07:00 Germany Trade Balance (non s.a.), bln December 20.5 Revised From 20.6 18.8

07:00 Germany Industrial Production s.a. (MoM) December -0.1% Revised From -0.3% 0.4% -1.2%

09:30 United Kingdom Total Trade Balance December -4.03 Revised From -3.17 -2.71

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Job openings in the U.S. are expected to decline to 5.400 million in December from 5.431 million in November.

Wholesale inventories in the U.S. are expected to decline 0.2% in December, after a 0.3% decrease in November.

The euro traded higher against the U.S. dollar after the release of the mixed economic data from the Eurozone. Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.2% in December, missing expectations for a 0.4% gain, after a 0.1% decline in November.

The output of capital goods decreased 2.6% in December, energy output declined 3.0%, and the production in the construction sector was down 0.2%, while the production of intermediate goods climbed 0.8%.

The output of consumer goods fell 1.4%.

German industrial production excluding energy and construction declined by 1.1% in December.

Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.8% in December, after a 2.1% fall in November.

Germany's trade surplus decreased to €18.8 billion in December from 20.5 in November. November's figure was revised down from a surplus of €20.6 billion.

Exports fell 1.6% in December, while imports decreased 1.6%.

On a yearly basis, German exports increased 3.2% in December, while imports rose by 3.5%.

Germany's current account surplus was at €25.6 billion in December, up from €24.3 billion in November. November's figure was revised down from a surplus of €24.7 billion.

In 2015 as whole, the trade surplus climbed to €247.8 billion from €213.6 billion. The latest figure was the highest ever recorded. Exports increased 6.4% in 2015, while imports rose 4.2%.

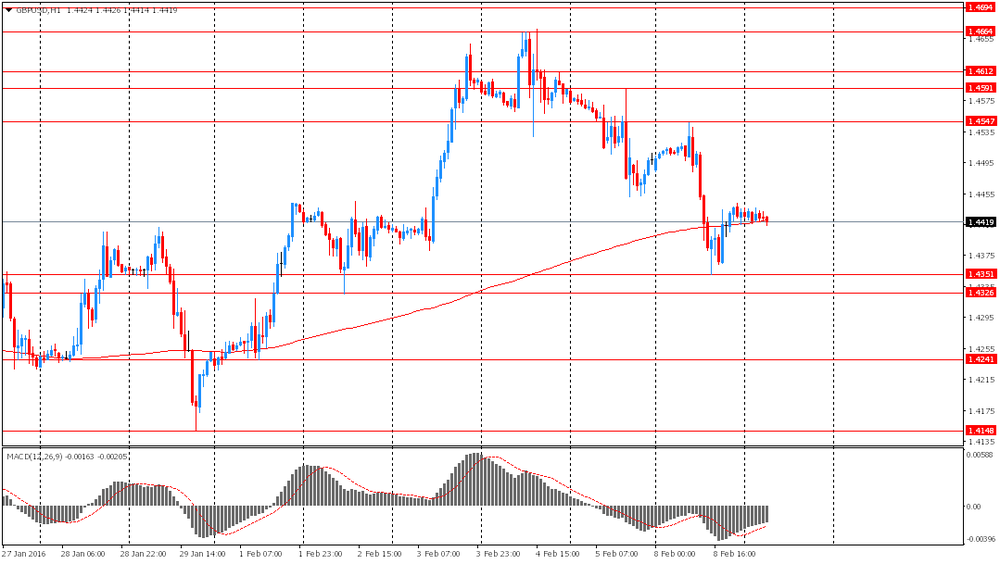

The British pound traded mixed against the U.S. dollar after the release of the U.K. trade data. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £9.92 billion in December from £11.50 billion in November. November's figure was revised up from a deficit of £10.64 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 0.8% in December, while imports slid 3.6%.

In 2015 as whole, the trade deficit widened to £125.028 billion from £123.143 billion in 2014.

The total trade deficit, including services, narrowed to £2.17 billion in December from £4.03 billion in November. November's figure was revised up from a deficit of £3.17 billion.

In 2015 as whole, the total trade deficit widened to £34.7 billion from £34.4 billion in 2014.

The Swiss franc traded higher against the U.S. dollar. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in January.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.8% in January from 3.7 in December. Analysts had expected the unemployment rate to remain unchanged at 3.7%.

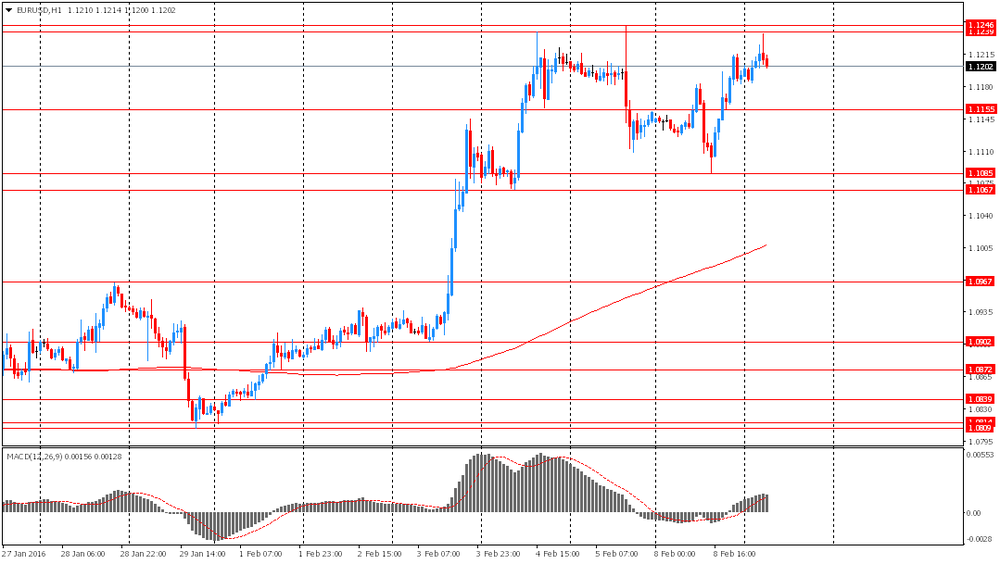

EUR/USD: the currency pair rose to $1.1249

GBP/USD: the currency pair traded mixed

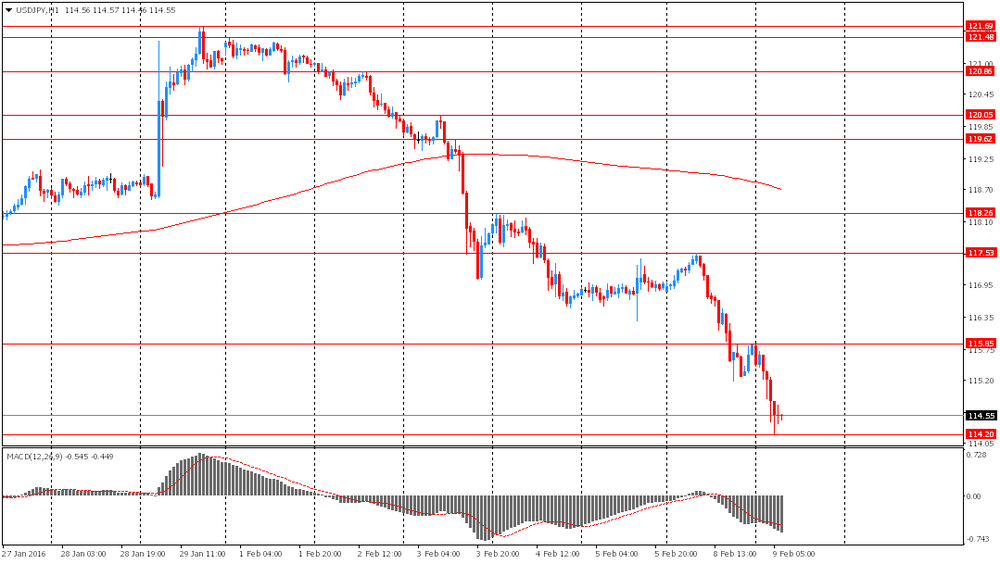

USD/JPY: the currency pair decreased to Y114.71

The most important news that are expected (GMT0):

15:00 U.S. Wholesale Inventories December -0.3% -0.2%

15:00 U.S. JOLTs Job Openings December 5.431 5.4

23:30 Australia Westpac Consumer Confidence February -3.5% -1%

-

13:50

Orders

EUR/USD

Offers 1.1200 1.1220 1.1235 1.125011275 1.1300 1.1330 1.1350

Bids 1.1165 1.1150 1.1120 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4475-80 1.4500 1.4520 1.4535 1.4550 1.4575-80 1.4600

Bids 1.4420 1.4400 1.4385 1.4365 1.4350 1.4330 1.4300

EUR/GBP

Offers 0.7765 0.7780-85 0.7800 0.7830 0.7850

Bids 0.7725-30 0.7700 0.7685 0.7660 0.7640 0.7625 0.7600

EUR/JPY

Offers 129.25 129.50 129.75 130.00 130.30 130.50 130.80 131.00

Bids 128.80 128.50 128.25 128.00 127.85 127.50

USD/JPY

Offers 115.50-55 115.8-85 116.00 116.30 116.50 116.80 117.00 117.50-55

Bids 115.20 115.00 114.85 114.65 114.50 114.20-25 114.00 113.85 113.50

AUD/USD

Offers 0.7050 0.7080 0.7100 0.7120 0.7150 0.7175-80 0.7200

Bids 0.7015-20 0.7000 0.6985 0.6950 0.6930 0.6900

-

11:47

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in January

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in January.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.8% in January from 3.7 in December. Analysts had expected the unemployment rate to remain unchanged at 3.7%.

The number of unemployed people in Switzerland rose by 5,015 to 163,644 in January from a month earlier.

The youth unemployment rate was up to 3.8% in January from 3.7% in December.

-

11:38

Germany’s manufacturing turnover rises 1.8% in December

Destatis released its manufacturing turnover data for Germany on Tuesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.8% in December, after a 2.1% fall in November. November's figure was revised up from a 2.3% decrease.

Domestic turnover increased by 1.7% in December, while the business with foreign customers rose 1.8%.

Sales to euro area countries rose 0.6% in December, while sales to other countries were up 2.7%.

On a yearly basis, real manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 0.3% in December.

In 2015 as whole, real manufacturing turnover increased by 1.5%.

-

11:18

Germany's trade surplus falls to €18.8 billion in December

Destatis released its trade data for Germany on Tuesday. Germany's trade surplus decreased to €18.8 billion in December from 20.5 in November. November's figure was revised down from a surplus of €20.6 billion.

Exports fell 1.6% in December, while imports decreased 1.6%.

On a yearly basis, German exports increased 3.2% in December, while imports rose by 3.5%.

Germany's current account surplus was at €25.6 billion in December, up from €24.3 billion in November. November's figure was revised down from a surplus of €24.7 billion.

In 2015 as whole, the trade surplus climbed to €247.8 billion from €213.6 billion. The latest figure was the highest ever recorded. Exports increased 6.4% in 2015, while imports rose 4.2%.

-

11:09

German industrial production declines 1.2% in December

Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.2% in December, missing expectations for a 0.4% gain, after a 0.1% decline in November. November's figure was revised up from a 0.3% decrease.

The output of capital goods decreased 2.6% in December, energy output declined 3.0%, and the production in the construction sector was down 0.2%, while the production of intermediate goods climbed 0.8%.

The output of consumer goods fell 1.4%.

German industrial production excluding energy and construction declined by 1.1% in December.

-

11:04

U.K. trade deficit in goods narrows to £9.92 billion in December

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £9.92 billion in December from £11.50 billion in November. November's figure was revised up from a deficit of £10.64 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 0.8% in December, while imports slid 3.6%.

In 2015 as whole, the trade deficit widened to £125.028 billion from £123.143 billion in 2014.

The total trade deficit, including services, narrowed to £2.17 billion in December from £4.03 billion in November. November's figure was revised up from a deficit of £3.17 billion.

In 2015 as whole, the total trade deficit widened to £34.7 billion from £34.4 billion in 2014.

-

10:54

Option expiries for today's 10:00 ET NY cut

USD/JPY: 116.00 (USD 210m) 117.00 (250m) 117.75 (200m)

EUR/USD: 1.1000 (EUR 640m) 1.1100 (608m) 1.1200 (475m)

GBP/USD: 1.4500 (GBP 344m) 1.4600 (287m, 1.4700 (518m)

AUD/USD: 0.7000 AUD (701m) 0.7025 (357m) 0.7050 (333m) 0.7065 (728m) 0.7175 (2.2bln)

AUD/JPY: 82.00 (AUD 200m) 83.25 (252m)

-

10:43

Japanese Finance Minister Taro Aso: the yen’s appreciation today was clearly sharp

Japanese Finance Minister Taro Aso said on Tuesday that the yen's appreciation today was clearly sharp, adding that he would continue to closely monitor the foreign-exchange movements.

-

10:36

Citi strategists: if the U.K. leaves the European Union (Brexit), consumer prices in the U.K. will rise to 3% - 4% for several years after a “Brexit”

Citi strategists said on Monday that if the U.K. leaves the European Union (Brexit), consumer prices in the U.K. will rise to 3% - 4% for several years after a "Brexit". The pound will depreciate by 15% - 20%, according to Citi strategists. Citi strategists noted that the annual U.K. GDP would be reduced by 1% - 1.5% in 2017 - 2019.

-

10:30

United Kingdom: Total Trade Balance, December -2.71

-

10:20

The New York Fed’s survey of consumers’ expectations for inflation: consumers’ expectations decline in January

The New York Fed released its survey of consumers' expectations for inflation on Monday. One-year median expectations fell to 2.42% in January from 2.54% in December. The three-year expectation dropped to 2.45% in January from 2.78% in December.

-

10:10

National Australia Bank’s business confidence index declines to 2 points in January

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 2 points in January from 3 points in December.

"Given all the volatility in equity and financial markets, this is yet another relatively good result from the Business Survey. It suggests things remain broadly on track for the non-mining economy," NAB Group Chief Economist Alan Oster said.

The main business conditions index decreased to 5 points in January from 6 points in December, while employment declined to -1 points from 0 points.

-

08:24

Options levels on tuesday, February 9, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1343 (4243)

$1.1302 (2818)

$1.1273 (5267)

Price at time of writing this review: $1.1200

Support levels (open interest**, contracts):

$1.1124 (1014)

$1.1079 (937)

$1.1050 (1647)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 61487 contracts, with the maximum number of contracts with strike price $1,1000 (5267);

- Overall open interest on the PUT options with the expiration date March, 4 is 81812 contracts, with the maximum number of contracts with strike price $1,0900 (6829);

- The ratio of PUT/CALL was 1.33 versus 1.36 from the previous trading day according to data from February, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.4706 (1033)

$1.4609 (1042)

$1.4513 (867)

Price at time of writing this review: $1.4400

Support levels (open interest**, contracts):

$1.4290 (1636)

$1.4193 (1650)

$1.4095 (1066)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 24462 contracts, with the maximum number of contracts with strike price $1,4300 (1430);

- Overall open interest on the PUT options with the expiration date March, 4 is 22187 contracts, with the maximum number of contracts with strike price $1,4350 (2598);

- The ratio of PUT/CALL was 0.91 versus 0.85 from the previous trading day according to data from February, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

Germany: Current Account , December 25.6

-

08:02

Germany: Trade Balance (non s.a.), bln, December 18.8

-

08:02

Germany: Industrial Production s.a. (MoM), December -1.2% (forecast 0.4%)

-

07:52

Foreign exchange market. Asian session: the Australian dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia National Australia Bank's Business Confidence January 3 2

06:00 Japan Prelim Machine Tool Orders, y/y January -25.8% -17.2%

06:45 Switzerland Unemployment Rate (non s.a.) January 3.7% 3.7% 3.4%

On Tuesday the U.S. dollar fell to a fifteen-month low against the yen amid falling stock indices. Investors favored the yen as a safer asset. Market participants are also waiting for Federal Reserve Chairwoman Janet Yellen to speak on Wednesday and Thursday. If Yellen signals that the central bank is unlikely to raise rates this year the dollar would most probably decline. Analysts expect neutral comments from Fed Chairwoman. According to futures there is only a 2% probability of a rate hike in March and a 4% probability of a rate hike in April.

The Australian dollar fell after the National Australia Bank released its business confidence data. The NAB Business Confidence index came in at +2 in January compared to +3 reported previously. The business conditions index declined to +5 from +6. The NAB expects the Reserve Bank of Australia to keep its monetary policy unchanged and monitor development of economic conditions outside the mining sector.

EUR/USD: the pair rose to $1.1235 in Asian trade

USD/JPY: the pair fell to Y114.20

GBP/USD: the pair traded within $1.4410-35

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Current Account December 24.7

07:00 Germany Trade Balance (non s.a.), bln December 20.6

07:00 Germany Industrial Production s.a. (MoM) December -0.3% 0.4%

09:30 United Kingdom Total Trade Balance December -3.17

15:00 U.S. Wholesale Inventories December -0.3% -0.2%

15:00 U.S. JOLTs Job Openings December 5.431 5.4

23:30 Australia Westpac Consumer Confidence February -3.5% -1%

-

07:45

Switzerland: Unemployment Rate (non s.a.), January 3.4% (forecast 3.7%)

-

07:02

Japan: Prelim Machine Tool Orders, y/y , January -17.2%

-

01:30

Australia: National Australia Bank's Business Confidence, January 2

-

01:02

Currencies. Daily history for Feb 8’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1192 +0,36%

GBP/USD $1,4431 -0,47%

USD/CHF Chf0,9869 -0,52%

USD/JPY Y115,84 -0,98%

EUR/JPY Y129,65 -0,61%

GBP/JPY Y167,15 -1,45%

AUD/USD $0,7085 +0,20%

NZD/USD $0,6626 -0,09%

USD/CAD C$1,3925 +0,11%

-

00:00

Schedule for today, Tuesday, Feb 9’2016:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

00:30 Australia National Australia Bank's Business Confidence January 3

06:00 Japan Prelim Machine Tool Orders, y/y January -25.8%

06:45 Switzerland Unemployment Rate (non s.a.) January 3.7% 3.7%

07:00 Germany Current Account December 24.7

07:00 Germany Trade Balance (non s.a.), bln December 20.6

07:00 Germany Industrial Production s.a. (MoM) December -0.3% 0.4%

09:30 United Kingdom Total Trade Balance December -3.17

15:00 U.S. Wholesale Inventories December -0.3% -0.2%

15:00 U.S. JOLTs Job Openings December 5.431

23:30 Australia Westpac Consumer Confidence February -3.5%

-