Noticias del mercado

-

20:19

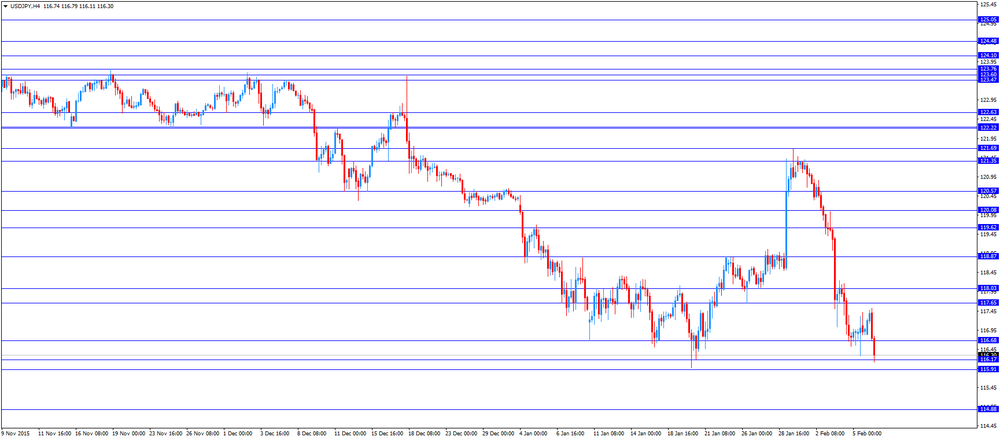

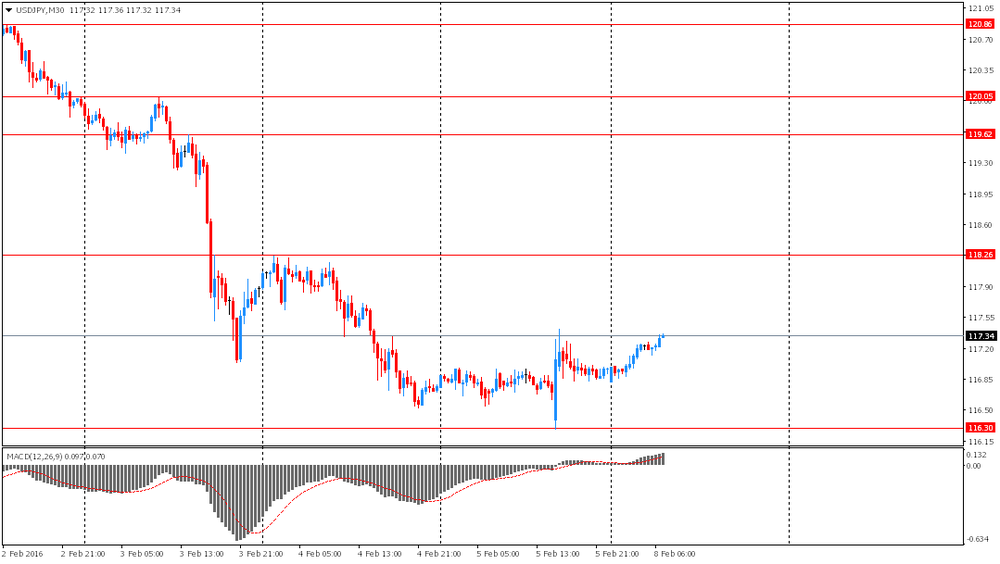

American focus: the US dollar significantly depreciated against the yen

The Japanese yen has strengthened considerably against the US dollar, reaching its highest level since 12 November, 2014. Support currency exerted intensification of risk aversion on the background of falling global stock markets and lower oil prices. "Concerns about global economic growth increased, and the Bank of Japan steps to reduce interest rates have not been able to change the trend of the movement of the yen," - said analyst Joe Manimbo Western Union.

The attention of investors is also switched on Yellen speech, which will be held on Wednesday and Thursday. If Yellen will signal the likelihood that the Fed will not raise rates this year, the dollar will likely continue to decline against the yen. In general, analysts believe that the performance Yellen will be neutral and wait to confirm the Fed's position. However, it is likely to once again demonstrate the optimistic view on the economy and inflation, although emphasize intensified the uncertainty of the forecast. The tone of speech Yellen is likely to be "dovish" that confirms a reduced likelihood of a rate hike in March. According to CME, futures on the Fed show only 2% probability of a rate hike in March and 4% chance in April.

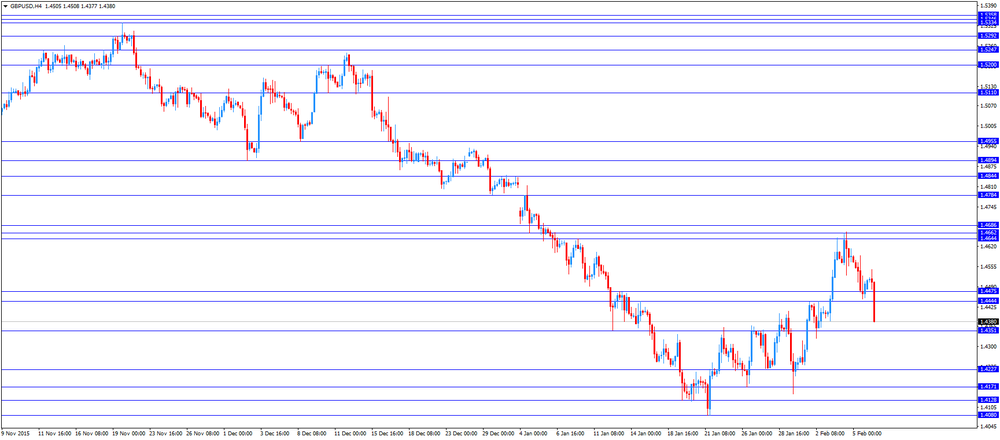

The pound depreciated significantly against the dollar, approaching to a minimum on February 2 as the flight of investors from the risks of reduced demand for high-risk currency. Little influenced by data on Britain. As shown by a study conducted in Britain, the confidence of local companies fell to a 3-year low against the background of instability in world markets due to concerns about the Chinese economy, and falling oil prices. Also on the trust put pressure Brekzita concerns. The index of business optimism BDO touched lows in 2013. BDO Analysts said that the results of the study showed that companies expect a slowdown of production to levels below the long-term trend. "The problems of the world economy put pressure on business confidence and increase the uncertainty caused by the upcoming referendum", said representative of BDO Peter Hemington.

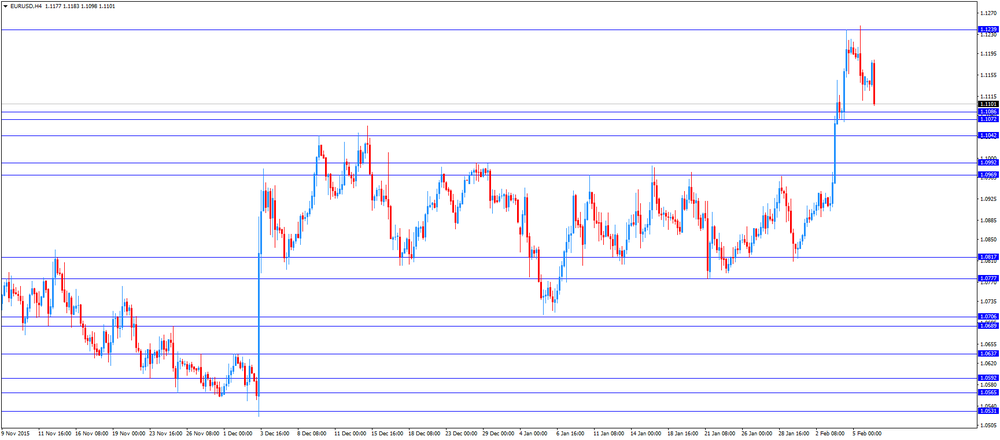

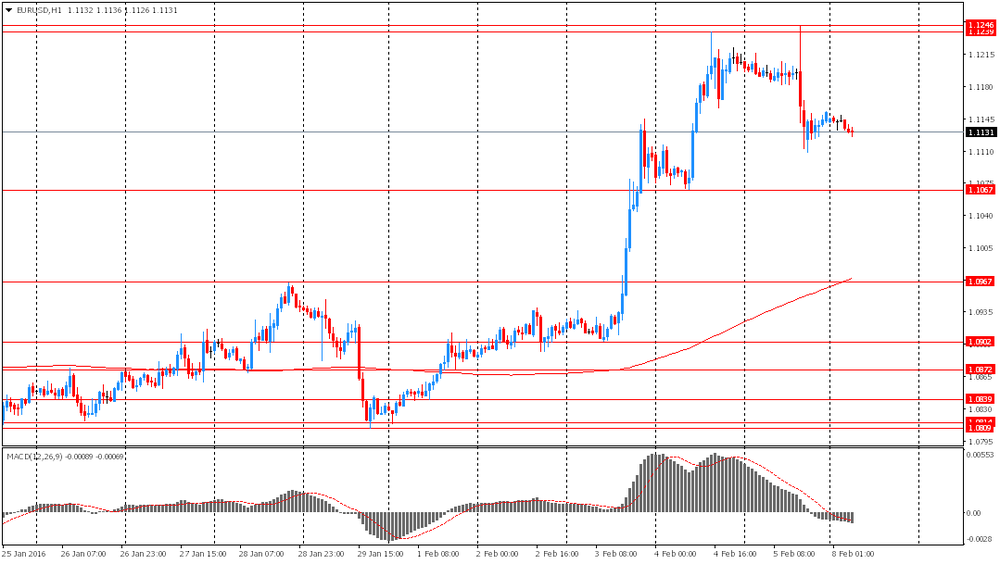

The euro rose against the dollar significantly, returning with all the previously lost positions. Analysts say that the fall of the stock markets and oil has increased the attractiveness of the euro as a funding currency. Part of statistics have affected the course of trading. The survey results from the Sentix showed that investor confidence indicator fell to 6 in February from 9.6 in January. According to the forecast index was down to 7.2. It was the lowest rate since April 2015. The index of current conditions survey fell to 10.5 (the lowest rate since April 2015) compared to 13 points in January. At the same time, the expectations index showed a sharp drop to 1.5 from 6.3 a month ago. It was the lowest since November 2014. Investor confidence in Germany has reached its weakest level since November 2014, investor sentiment index fell to 14.5 in February from 18.1 in January. The expectations index fell to -2.6 in February from 1.8 in January and the current situation index fell to 33 from 35.6 in January.

In addition, the report submitted by the Conference Board, showed that the index of conditions in the US labor market, representing a set of labor market indicators rose again in January. According to the data, the January index of conditions in the labor market increased to 128.93 compared to 127.71 in December. In annual terms, the index rose by 1.9%. "Employment Trends Index rose for the second month in a row, which reduces the likelihood of a further slowdown in employment growth, - said Gad Levanon, managing director of Macroeconomic Research Conference Board -. However, the component-time job in the industry sector fell sharply in January, as well it is one of the best leading indicators of employment growth, we will monitor it closely in the coming months. "

-

17:23

Australian ANZ job advertisements rose 1.0% in January

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements rose 1.0% in January, after a 0.1% fall in December. That was the eighth consecutive increase.

The increase was mainly driven by a rise in internet job advertisements, which climbed by 1.1% in January.

"There is some evidence in the trend numbers that job ads have lost a little momentum in the past six months. This is only an early signal and will need to be confirmed by more data. Overall we see the job ads series, in conjunction with other leading indicators of labour demand, as consistent with further moderate employment gains in early 2016, enough at least to keep the unemployment rate stable," the ANZ Chief Economist Warren Hogan noted.

-

16:57

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 128.93 in January

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index increased to 128.93 in January from 128.71 in December. December's figure was revised down from 129.30.

Five of the eight components climbed.

"The Employment Trends Index rose for the second month in a row, reducing the likelihood of further slowing in employment growth. However, the temporary help industry component declined sharply in January, and because it is one of the best leading indicators of employment growth, we will monitor it closely in the coming months," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

16:30

European Central Bank purchases €13.16 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.16 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.37 billion of covered bonds, and €92 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

16:01

U.S.: Labor Market Conditions Index, January 0.4

-

15:44

Japan’s Eco Watchers' current conditions index falls to 46.6 in January

Japan's Cabinet Office released Eco Watchers' Index figures on Monday. Japan's economy watchers' current conditions index fell to 46.6 in January from 48.7 in December.

Japan's economy watchers' future conditions index increased to 49.5 in January from 48.2 in December.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

15:06

Labour cash earnings in Japan rise 0.1% year-on-year in December

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Monday. Labour cash earnings in Japan rose 0.1% year-on-year in December, a flat reading in November.

Contractual earnings increased 0.6% year-on-year in December, while special cash earnings gained 0.7%.

Total real wages slid 0.1% in December, after a 0.4% drop in November.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: 116.00 (USD 210m) 117.00 (250m) 117.75 (200m)

EUR/USD: 1.1000 (EUR 640m) 1.1100 (608m) 1.1200 (475m)

GBP/USD: 1.4500 (GBP 344m) 1.4600 (287m, 1.4700 (518m)

AUD/USD: 0.7000 AUD (701m) 0.7025 (357m) 0.7050 (333m) 0.7065 (728m) 0.7175 (2.2bln)

AUD/JPY: 82.00 (AUD 200m) 83.25 (252m)

-

14:47

OECD’s leading composite leading indicator declines to 99.7 in December

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.7 in December from 99.8 in November.

It signalled stable growth in the Eurozone as a whole, in Germany and Italy.

There were signs of firming growth momentum in France and India.

The index for the U.S., the U.K., Canada and Japan pointed to an easing in growth momentum.

The index for China confirmed the tentative signs of stabilisation.

The index for Russia showed signs of a loss in growth momentum.

-

14:38

Building permits in Canada climb 11.3% in December

Statistics Canada released housing market data on Monday. Building permits in Canada climbed 11.3% in December, exceeding expectations for a 5.0% rise, after a 19.9% drop in November. November's figure was revised down from a 19.6% decrease.

The increase was driven by a rise in building permits for multi-family dwellings in Quebec, Ontario, British Columbia and Alberta.

Building permits for non-residential construction were up 2.5% in December, while permits in the residential sector jumped 16.3%.

In 2015 as whole, buildings permits were flat.

-

14:30

Canada: Building Permits (MoM) , December 11.3% (forecast 5%)

-

14:16

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

00:30 Australia ANZ Job Advertisements (MoM) January -0.1% 1.0%

01:30 Japan Labor Cash Earnings, YoY January 0.0% 0.1%

05:00 Japan Eco Watchers Survey: Current January 48.7 46.6

05:00 Japan Eco Watchers Survey: Outlook January 48.2 49.5

09:30 Eurozone Sentix Investor Confidence February 9.6 7.2 6.0

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S.

Market participants continued to eye Friday's U.S. labour market data. According to the U.S. Labor Department, the U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 6.0 in February from 9.6 in January. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Although the values for Asia ex Japan recover something, this month results do not shape a fundamentally new image. In particular, the loss of momentum in Germany and the United States weighs heavily and stresses that the global economy is now in a very fragile state," Sentix said in its statement.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian building permits data. The Canadian building permits are expected to fall 5.0% in December, after a 19.6% rise in November.

EUR/USD: the currency pair fell to $1.1098

GBP/USD: the currency pair declined to $1.4377

USD/JPY: the currency pair decreased to Y116.11

The most important news that are expected (GMT0):

13:30 Canada Building Permits (MoM) December -19.6% 5%

15:00 U.S. Labor Market Conditions Index January 2.9

17:05 Canada Gov Council Member Lane Speaks

-

13:45

Orders

EUR/USD

Offers 1.1160 1.1185 1.1200 1.1220 1.1235 1.125011275 1.1300

Bids 1.1120 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000 1.0980 1.0950

GBP/USD

Offers 1.4550 1.4575-80 1.4600 1.4625 1.4645-50 1.4665 1.4685 1.4700

Bids 1.4500 1.4475-80 1.4450 1.4430 1.4400 1.4385 1.4365 1.4350

EUR/GBP

Offers 0.7685 0.7700 0.7720-25 0.7750 0.7765 0.7780 0.7800 0.7830 0.7850

Bids 0.7660 0.7640 0.7625 0.7600 0.7585 0.7565 0.7550

EUR/JPY

Offers 131.00 131.30 131.50 131.80-85 132.00 132.25 132.50

Bids 130.35 130.00 129.80 129.50 129.30 129.00

USD/JPY

Offers 117.50-55 117.80 118.00 118.25 118.45-50 118.70 118.85 119.00

Bids 117.00 116.80 116.55-60 116.25 116.00 115.85 115.65 115.50 115.30 115.00

AUD/USD

Offers 0.7150 0.7175-80 0.7200 0.7220 0.7245-50 0.7270 0.7285 0.7300

Bids 0.7100 0.7080 0.7060 0.7030 0.7000 0.6985 0.6950

-

11:56

Bank of France expects the country’s economy to expand at 0.4% in the first quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.4% in the first quarter, after a 0.2% growth in the fourth quarter.

The manufacturing business confidence index increased to 101 in January from 100 in December. Companies expect a slight growth in activity in February.

The services business sentiment index remained unchanged at 96 in January. But services companies expect a rise in activity in February.

The construction business sentiment index remained unchanged at 96 in January. Companies expect a slight increase in activity in February.

-

11:50

Industrial production in Spain declines 0.2% in December

Spanish statistical office INE released its industrial production figures for Spain on Monday. Industrial production in Spain declined 0.2% in December, after a 0.1% gain in November.

On a yearly basis, industrial production in Spain climbed at adjusted 3.7% in December, after a 4.3% increase in November. November's figure was revised up from a 4.2% gain.

Output of capital goods jumped at seasonally adjusted 7.7% year-on-year in December, output of intermediate goods climbed 6.6%, energy production was down 3.5%, while consumer goods output rose 2.4%.

In 2015 as whole, industrial production rose 3.2%.

-

11:32

Japan’s current account surplus declines to ¥960.7 billion in December

Japan's Ministry of Finance released its current account data for Japan late Sunday evening. Japan's current account surplus fell to ¥960.7 billion in December from ¥1,143.5 billion in November, missing expectations for a surplus of ¥987.0 billion.

The goods trade deficit turned into a surplus of ¥188.7 billion in December, up from a deficit of ¥271.5 billion in November.

Exports dropped at an annual rate of 11.8% in December, while imports plunged 18.9%.

In 2015 as whole, the current account increased to ¥16.641 trillion from ¥2.645 trillion in 2014.

The trade balance declined to a deficit of ¥643.4 billion in 2015 from a deficit of ¥10.401 trillion in 2014.

Exports rose 1.5% in 2015, while imports dropped 10.3%.

-

11:00

Sentix investor confidence index for the Eurozone slides to 6.0 in February

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 6.0 in February from 9.6 in January. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Although the values for Asia ex Japan recover something, this month results do not shape a fundamentally new image. In particular, the loss of momentum in Germany and the United States weighs heavily and stresses that the global economy is now in a very fragile state," Sentix said in its statement.

The current conditions index fell to 10.5 in February from 13.0 in January.

The expectations index plunged to 1.5 in February from 6.3 in January.

German investor confidence index dropped to 14.5 in February from 18.1 in January.

-

10:44

China’s foreign-exchange reserves drop in January

According to data released by the People's Bank of China (PBoC) on Sunday, China's foreign-exchange reserves declined by $99.5 billion to $3.23 trillion in January, after a drop by $107.9 billion in December. It was the lowest level since 2012.

-

10:41

Option expiries for today's 10:00 ET NY cut

USD/JPY: 116.00 (USD 210m) 117.00 (250m) 117.75 (200m)

EUR/USD: 1.1000 (EUR 640m) 1.1100 (608m) 1.1200 (475m)

GBP/USD: 1.4500 (GBP 344m) 1.4600 (287m, 1.4700 (518m)

AUD/USD: 0.7000 AUD (701m) 0.7025 (357m) 0.7050 (333m) 0.7065 (728m) 0.7175 (2.2bln)

AUD/JPY: 82.00 (AUD 200m) 83.25 (252m)

-

10:24

Housing starts in Canada drop to a seasonally adjusted annualized rate of 165,861 units in January

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada dropped to a seasonally adjusted annualized rate of 165,861 units in January from 172,533 units in December. December's figure was revised down from 172,965 units.

The data had originally been scheduled to be released on February 08.

"Housing starts trended down across the country with the exception of Ontario. The overall decline is mostly attributable to a slowdown in the Prairies where the housing starts trend was at a 4-year low in January," the CMHC's Chief Economist Bob Dugan said.

-

10:12

Consumer credit in the U.S. increases by $21.27 billion in December

The Fed released its consumer credits figures on Friday. Consumer credit in the U.S. rose by $21.27 billion in December, exceeding expectations for a $16.0 billion increase, after a $14.02 billion gain November. November's figure was revised up from a $13.95 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit climbed by $5.8 billion in October, while non-revolving credit jumped by $15.4 billion.

-

07:48

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) January -0.1% 1.0%

01:30 Japan Labor Cash Earnings, YoY January 0.0% 0.1%

05:00 Japan Eco Watchers Survey: Current January 48.7 46.6

05:00 Japan Eco Watchers Survey: Outlook January 48.2 49.5

The euro little changed ahead of major economic data scheduled for this week. Euro zone GDP report will be published on Friday. The GDP is expected to have grown by 0.3% in the fourth quarter of 2015 after growth of 0.3% in the third quarter. Economists believe that the euro zone economy grew steadily despite global economic uncertainties. Growth was driven by German and Italian economies.

The yen declined against the U.S. dollar after gaining 3.6% last week (the fastest growth since July 2009). Current account data weighed on the currency. Data showed that Japan's current account came in at ¥960.7 billion vs ¥987.0 billion expected and ¥1,143.5 billion recorded previously.

The Australian dollar climbed at the beginning of the session, but remained under pressure amid a stronger U.S. dollar. ANZ released its job advertisements data today. The corresponding index rose by 1.0% in January. The index rose by 10.8% on a y/y basis. A high reading of the index is positive for the Australian economy. Analysts note strong employment growth in Australia in 2015.

EUR/USD: the pair fluctuated within $1.1125-50 in Asian trade

USD/JPY: the pair rose to Y117.35

GBP/USD: the pair traded within $1.4480-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Industrial Production s.a. (MoM) December -0.3% 0.4%

09:30 Eurozone Sentix Investor Confidence February 9.6 7.2

13:15 Canada Housing Starts January 173

13:30 Canada Building Permits (MoM) December -19.6% 5%

15:00 U.S. Labor Market Conditions Index January 2.9

17:05 Canada Gov Council Member Lane Speaks

-

07:05

Options levels on monday, February 8, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1295 (4103)

$1.1267 (3864)

$1.1208 (5268)

Price at time of writing this review: $1.1135

Support levels (open interest**, contracts):

$1.1060 (1005)

$1.1010 (3633)

$1.0946 (1754)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 58576 contracts, with the maximum number of contracts with strike price $1,1000 (5268);

- Overall open interest on the PUT options with the expiration date March, 4 is 79790 contracts, with the maximum number of contracts with strike price $1,1000 (7455);

- The ratio of PUT/CALL was 1.36 versus 1.75 from the previous trading day according to data from February, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.4805 (962)

$1.4707 (1027)

$1.4610 (845)

Price at time of writing this review: $1.4509

Support levels (open interest**, contracts):

$1.4389 (499)

$1.4293 (1667)

$1.4195 (1298)

Comments:

- Overall open interest on the CALL options with the expiration date March, 4 is 23054 contracts, with the maximum number of contracts with strike price $1,4300 (1436);

- Overall open interest on the PUT options with the expiration date March, 4 is 19693 contracts, with the maximum number of contracts with strike price $1,4350 (1843);

- The ratio of PUT/CALL was 0.85 versus 0.94 from the previous trading day according to data from February, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:16

Japan: Eco Watchers Survey: Current , January 46.6

-

06:16

Japan: Eco Watchers Survey: Outlook, January 49.5

-

02:46

Japan: Labor Cash Earnings, YoY, January 0.1%

-

01:30

Australia: ANZ Job Advertisements (MoM), January 1.0%

-

00:50

Japan: Current Account, bln, December 960.7 (forecast 987)

-

00:32

Currencies. Daily history for Feb 5’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1152 -0,48%

GBP/USD $1,4499 -0,62%

USD/CHF Chf0,992 -0,12%

USD/JPY Y116,97 +0,17%

EUR/JPY Y130,44 -0,33%

GBP/JPY Y169,58 -0,45%

AUD/USD $0,7071 -1,81%

NZD/USD $0,6632 -1,36%

USD/CAD C$1,3909 +1,13%

-

00:00

Schedule for today, Monday, Feb 8’2016:

(time / country / index / period / previous value / forecast)

00:30 Australia ANZ Job Advertisements (MoM) January -0.1%

01:30 Japan Labor Cash Earnings, YoY January 0.0%

05:00 Japan Eco Watchers Survey: Current January 48.7

05:00 Japan Eco Watchers Survey: Outlook January 48.2

07:00 Germany Industrial Production s.a. (MoM) December -0.3% 0.4%

09:30 Eurozone Sentix Investor Confidence February 9.6 7.2

13:15 Canada Housing Starts January 173

13:30 Canada Building Permits (MoM) December -19.6% 5%

15:00 U.S. Labor Market Conditions Index January 2.9

17:05 Canada Gov Council Member Lane Speaks

-