Noticias del mercado

-

21:00

Dow -2.15% 15,856.80 -348.17 Nasdaq -3.19% 4,224.09 -139.05 S&P -2.46% 1,833.82 -46.23

-

18:50

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes in the red area in volatile trading on Monday, as technology stocks continued to sell off and oil prices remained under pressure, sending investors scurrying to safe-haven assets. Crude oil prices eased from their session lows, but were still down about 2%.

Most of Dow stocks in negative area (25 of 30). Top looser The Goldman Sachs Group, Inc. (GS, -5,76%). Top gainer - Johnson & Johnson (JNJ, +1,45%).

All S&P sectors in negative area. Top looser - Conglomerates (-3,0%).

At the moment:

Dow 15820.00 -311.00 -1.93%

S&P 500 1839.00 -36.25 -1.93%

Nasdaq 100 3931.25 -90.75 -2.26%

Oil 30.20 -0.69 -2.23%

Gold 1194.00 +36.30 +3.14%

U.S. 10yr 1.77 -0.08

-

18:07

WSE: Session Results

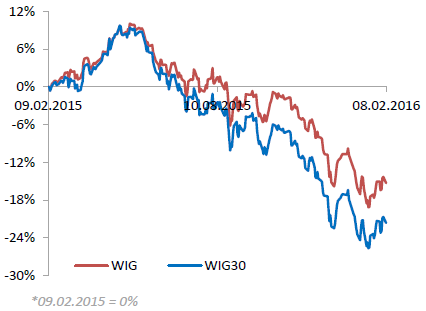

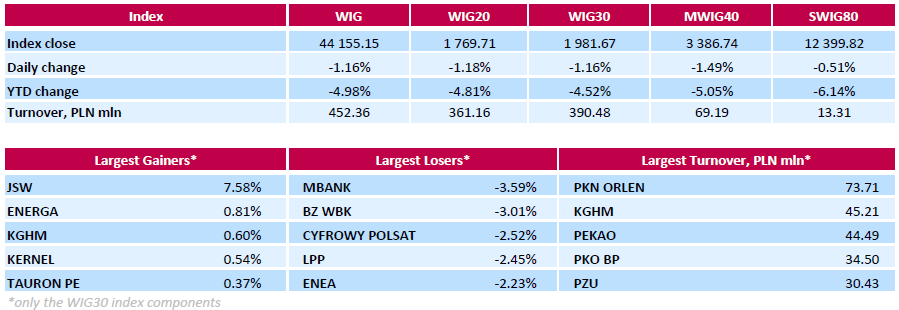

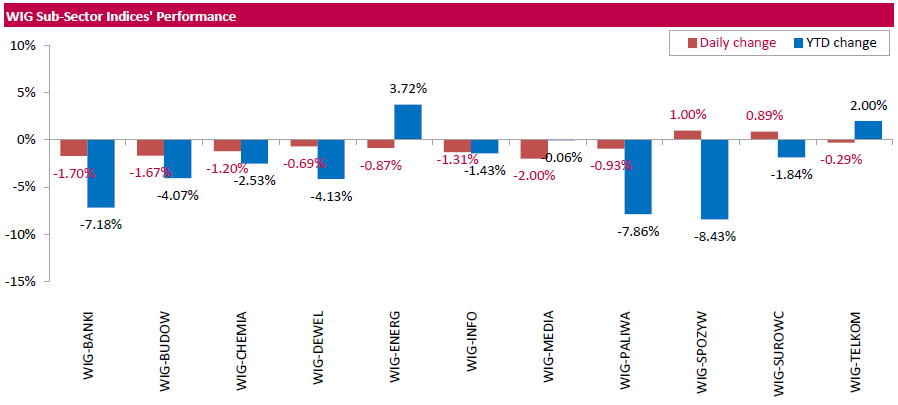

Polish equity market plunged on Monday. The broad market measure, the WIG Index, dropped by 1.16%. Except for food sector (+1.00%) and materials (+0.89%), every sector in the WIG Index declined, with media segment (-2.00%) lagging behind.

The large-cap WIG30 Index fell by 1.16%. Within the index components, banking sector names MBANK (WSE: MBK) and BZ WBK (WSE: BZW) were the weakest names, tumbling by 3.59% and 3.01% respectively. They were followed by media- and telecom-group CYFROWY POLSAT (WSE: CPS), clothing retailer LPP (WSE: LPP) and genco ENEA (WSE: ENA), declining between 2.23% and 2.52%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) became the best performer, climbing by 7.58%. Other advancers were copper producer KGHM (WSE: KGH), agricultural holding KERNEL (WSE: KER), FMCG wholesaler EUROCASH (WSE: EUR) and gencos ENERGA (WSE: ENG) and TAURON PE (WSE: TPE), adding between 0.09% and 0.81%.

-

18:01

European stocks close: stocks closed lower on concerns over the slowdown in the global economy

Stock indices closed lower on concerns over the slowdown in the global economy and on falling oil prices. Oil prices declined on concerns over the global oil oversupply. There are no signs for an emergency meeting to stabilise the oil market.

China's foreign-exchange reserves data added to speculation on the slowdown in the Chinese economy. According to data released by the People's Bank of China (PBoC) on Sunday, China's foreign-exchange reserves declined by $99.5 billion to $3.23 trillion in January, after a drop by $107.9 billion in December. It was the lowest level since 2012.

Meanwhile, the economic data from Eurozone was weak. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 6.0 in February from 9.6 in January. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Although the values for Asia ex Japan recover something, this month results do not shape a fundamentally new image. In particular, the loss of momentum in Germany and the United States weighs heavily and stresses that the global economy is now in a very fragile state," Sentix said in its statement.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,689.36 -158.70 -2.71 %

DAX 8,979.36 -306.87 -3.30 %

CAC 40 4,066.31 -134.36 -3.20 %

-

18:00

European stocks closed: FTSE 100 5,689.36 -158.70 -2.71% CAC 40 4,066.31 -134.36 -3.20% DAX 8,979.36 -306.87 -3.30%

-

17:23

Australian ANZ job advertisements rose 1.0% in January

The Australia and New Zealand Banking Group Limited (ANZ) released its job advertisements figures on Monday. Job advertisements rose 1.0% in January, after a 0.1% fall in December. That was the eighth consecutive increase.

The increase was mainly driven by a rise in internet job advertisements, which climbed by 1.1% in January.

"There is some evidence in the trend numbers that job ads have lost a little momentum in the past six months. This is only an early signal and will need to be confirmed by more data. Overall we see the job ads series, in conjunction with other leading indicators of labour demand, as consistent with further moderate employment gains in early 2016, enough at least to keep the unemployment rate stable," the ANZ Chief Economist Warren Hogan noted.

-

16:57

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 128.93 in January

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index increased to 128.93 in January from 128.71 in December. December's figure was revised down from 129.30.

Five of the eight components climbed.

"The Employment Trends Index rose for the second month in a row, reducing the likelihood of further slowing in employment growth. However, the temporary help industry component declined sharply in January, and because it is one of the best leading indicators of employment growth, we will monitor it closely in the coming months," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

16:30

European Central Bank purchases €13.16 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.16 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €2.37 billion of covered bonds, and €92 million of asset-backed securities.

The European Central Bank (ECB) President Mario Draghi hinted at a press conference in January that the central bank may add further stimulus measures at its meeting in March as downside risks rose.

-

15:44

Japan’s Eco Watchers' current conditions index falls to 46.6 in January

Japan's Cabinet Office released Eco Watchers' Index figures on Monday. Japan's economy watchers' current conditions index fell to 46.6 in January from 48.7 in December.

Japan's economy watchers' future conditions index increased to 49.5 in January from 48.2 in December.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

15:34

U.S. Stocks open: Dow -1.13%, Nasdaq -1.82%, S&P -1.22%

-

15:28

Before the bell: S&P futures -1.25%, NASDAQ futures -1.98%

U.S. stock-index futures dropped.

Global Stocks:

Nikkei 17,004.3 +184.71 +1.10%

Hang Seng Closed

Shanghai Composite Closed

FTSE 5,736.45 -111.61 -1.91%

CAC 4,092.4 -108.27 -2.58%

DAX 9,037.31 -248.92 -2.68%

Crude oil $29.86 (-3.33%)

Gold $1179.40 (+1.87%)

-

15:06

Labour cash earnings in Japan rise 0.1% year-on-year in December

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Monday. Labour cash earnings in Japan rose 0.1% year-on-year in December, a flat reading in November.

Contractual earnings increased 0.6% year-on-year in December, while special cash earnings gained 0.7%.

Total real wages slid 0.1% in December, after a 0.4% drop in November.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

11.86

1.89%

105.9K

Yandex N.V., NASDAQ

YNDX

12.83

-0.39%

13.5K

The Coca-Cola Co

KO

42.18

-0.61%

2.2K

Procter & Gamble Co

PG

80.61

-0.73%

2.8K

Hewlett-Packard Co.

HPQ

9.83

-0.81%

0.8K

United Technologies Corp

UTX

87.11

-0.83%

0.2K

Johnson & Johnson

JNJ

99.66

-0.88%

0.7K

AT&T Inc

T

36.55

-0.89%

33.2K

Wal-Mart Stores Inc

WMT

66.4

-0.90%

2.1K

Verizon Communications Inc

VZ

50.49

-0.94%

2.7K

UnitedHealth Group Inc

UNH

110.61

-0.99%

1.2K

International Business Machines Co...

IBM

125.96

-1.03%

1K

McDonald's Corp

MCD

114.18

-1.06%

6.2K

AMERICAN INTERNATIONAL GROUP

AIG

52.77

-1.12%

0.2K

Pfizer Inc

PFE

28.69

-1.17%

10.4K

Deere & Company, NYSE

DE

77.5

-1.17%

0.8K

Ford Motor Co.

F

11.31

-1.22%

7.5K

ALTRIA GROUP INC.

MO

59.01

-1.32%

1.9K

Home Depot Inc

HD

114.75

-1.44%

1.3K

Merck & Co Inc

MRK

48.66

-1.46%

1.4K

Walt Disney Co

DIS

92.5

-1.49%

2.1K

E. I. du Pont de Nemours and Co

DD

58

-1.51%

0.4K

General Electric Co

GE

28.11

-1.51%

14.5K

Apple Inc.

AAPL

92.6

-1.51%

226.5K

Microsoft Corp

MSFT

49.36

-1.59%

86.8K

Exxon Mobil Corp

XOM

78.8

-1.60%

72.3K

General Motors Company, NYSE

GM

28.08

-1.61%

19.6K

Yahoo! Inc., NASDAQ

YHOO

27.52

-1.61%

20.8K

Boeing Co

BA

120.51

-1.67%

0.2K

American Express Co

AXP

53.07

-1.69%

1.4K

Intel Corp

INTC

28.55

-1.69%

6.7K

Citigroup Inc., NYSE

C

39.1

-1.91%

3.4K

Caterpillar Inc

CAT

64.8

-2.00%

2.8K

Chevron Corp

CVX

81.2

-2.03%

6.8K

Nike

NKE

56

-2.05%

8.5K

Starbucks Corporation, NASDAQ

SBUX

53.35

-2.09%

12.1K

JPMorgan Chase and Co

JPM

56.54

-2.10%

25.3K

Visa

V

70

-2.15%

3.0K

Goldman Sachs

GS

153.01

-2.21%

9.0K

Cisco Systems Inc

CSCO

22.37

-2.27%

53.6K

Google Inc.

GOOG

667.99

-2.28%

14.5K

ALCOA INC.

AA

7.93

-2.34%

1.9K

Twitter, Inc., NYSE

TWTR

15.27

-2.86%

26.1K

Amazon.com Inc., NASDAQ

AMZN

486.67

-3.08%

27.3K

Facebook, Inc.

FB

100.7

-3.24%

152.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.48

-3.52%

93.8K

International Paper Company

IP

33.65

-3.77%

48.8K

Tesla Motors, Inc., NASDAQ

TSLA

156.06

-4.03%

15.4K

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Cisco Systems (CSCO) upgraded to Neutral from Underperform at Macquarie

Downgrades:

Other:

Walt Disney (DIS) target lowered to $131 from $133 at Topeka Capital Markets

Cisco Systems (CSCO) target lowered to $30 from $34 at Stifel

Apple (AAPL) reiterated with a Buy at Mizuho; target $120

Cisco Systems (CSCO) removed from Conviction Buy List at Goldman

-

14:47

OECD’s leading composite leading indicator declines to 99.7 in December

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.7 in December from 99.8 in November.

It signalled stable growth in the Eurozone as a whole, in Germany and Italy.

There were signs of firming growth momentum in France and India.

The index for the U.S., the U.K., Canada and Japan pointed to an easing in growth momentum.

The index for China confirmed the tentative signs of stabilisation.

The index for Russia showed signs of a loss in growth momentum.

-

14:38

Building permits in Canada climb 11.3% in December

Statistics Canada released housing market data on Monday. Building permits in Canada climbed 11.3% in December, exceeding expectations for a 5.0% rise, after a 19.9% drop in November. November's figure was revised down from a 19.6% decrease.

The increase was driven by a rise in building permits for multi-family dwellings in Quebec, Ontario, British Columbia and Alberta.

Building permits for non-residential construction were up 2.5% in December, while permits in the residential sector jumped 16.3%.

In 2015 as whole, buildings permits were flat.

-

12:01

European stock markets mid session: stocks traded lower on speculation that the Fed will delay its further interest rate hikes

Stock indices traded lower on speculation that the Fed will delay its further interest rate hikes after Friday's release of the U.S. labour market data. According to the U.S. Labor Department, the U.S. economy added 151,000 jobs in January, missing expectations for a rise of 190,000 jobs, after a gain of 262,000 jobs in December.

Job creation slowed in January. That could mean that the Fed might delay its further interest rate hikes. The Fed hiked its interest rates by a 0.25% to between 0.25% and 0.50% in December.

The U.S. unemployment rate fell to 4.9% in January from 5.0% in December. It was the lowest level since February 2008. Analysts had expected the unemployment rate to remain unchanged at 5.0%.

Average hourly earnings climbed 0.5% in January, exceeding forecasts of a 0.3% gain, after a flat reading in December.

Meanwhile, the economic data from Eurozone was weak. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 6.0 in February from 9.6 in January. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Although the values for Asia ex Japan recover something, this month results do not shape a fundamentally new image. In particular, the loss of momentum in Germany and the United States weighs heavily and stresses that the global economy is now in a very fragile state," Sentix said in its statement.

Current figures:

Name Price Change Change %

FTSE 100 5,750.18 -97.88 -1.67 %

DAX 9,051.85 -234.38 -2.52 %

CAC 40 4,103.4 -97.27 -2.32 %

-

11:56

Bank of France expects the country’s economy to expand at 0.4% in the first quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.4% in the first quarter, after a 0.2% growth in the fourth quarter.

The manufacturing business confidence index increased to 101 in January from 100 in December. Companies expect a slight growth in activity in February.

The services business sentiment index remained unchanged at 96 in January. But services companies expect a rise in activity in February.

The construction business sentiment index remained unchanged at 96 in January. Companies expect a slight increase in activity in February.

-

11:50

Industrial production in Spain declines 0.2% in December

Spanish statistical office INE released its industrial production figures for Spain on Monday. Industrial production in Spain declined 0.2% in December, after a 0.1% gain in November.

On a yearly basis, industrial production in Spain climbed at adjusted 3.7% in December, after a 4.3% increase in November. November's figure was revised up from a 4.2% gain.

Output of capital goods jumped at seasonally adjusted 7.7% year-on-year in December, output of intermediate goods climbed 6.6%, energy production was down 3.5%, while consumer goods output rose 2.4%.

In 2015 as whole, industrial production rose 3.2%.

-

11:32

Japan’s current account surplus declines to ¥960.7 billion in December

Japan's Ministry of Finance released its current account data for Japan late Sunday evening. Japan's current account surplus fell to ¥960.7 billion in December from ¥1,143.5 billion in November, missing expectations for a surplus of ¥987.0 billion.

The goods trade deficit turned into a surplus of ¥188.7 billion in December, up from a deficit of ¥271.5 billion in November.

Exports dropped at an annual rate of 11.8% in December, while imports plunged 18.9%.

In 2015 as whole, the current account increased to ¥16.641 trillion from ¥2.645 trillion in 2014.

The trade balance declined to a deficit of ¥643.4 billion in 2015 from a deficit of ¥10.401 trillion in 2014.

Exports rose 1.5% in 2015, while imports dropped 10.3%.

-

11:02

Earnings Season in U.S.: Major Reports of the Week

February 9

Before the Open:

Coca-Cola (KO). Consensus EPS $0.37, Consensus Revenue $9910.48 mln

After the Close:

Walt Disney (DIS). Consensus EPS $1.46, Consensus Revenue $14795.57 mln

February 10

After the Close:

Cisco Systems (CSCO). Consensus EPS $0.54, Consensus Revenue $11768.22 mln

Tesla Motors (TSLA). Consensus EPS $0.09, Consensus Revenue $1807.34 mln

Twitter (TWTR). Consensus EPS $0.12, Consensus Revenue $709.97 mln

February 11

After the Close:

American Intl (AIG). Consensus EPS -$0.92, Consensus Revenue $14151.50 mln

-

11:00

Sentix investor confidence index for the Eurozone slides to 6.0 in February

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index slid to 6.0 in February from 9.6 in January. It was the lowest level since April 2015.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Although the values for Asia ex Japan recover something, this month results do not shape a fundamentally new image. In particular, the loss of momentum in Germany and the United States weighs heavily and stresses that the global economy is now in a very fragile state," Sentix said in its statement.

The current conditions index fell to 10.5 in February from 13.0 in January.

The expectations index plunged to 1.5 in February from 6.3 in January.

German investor confidence index dropped to 14.5 in February from 18.1 in January.

-

10:44

China’s foreign-exchange reserves drop in January

According to data released by the People's Bank of China (PBoC) on Sunday, China's foreign-exchange reserves declined by $99.5 billion to $3.23 trillion in January, after a drop by $107.9 billion in December. It was the lowest level since 2012.

-

10:24

Housing starts in Canada drop to a seasonally adjusted annualized rate of 165,861 units in January

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada dropped to a seasonally adjusted annualized rate of 165,861 units in January from 172,533 units in December. December's figure was revised down from 172,965 units.

The data had originally been scheduled to be released on February 08.

"Housing starts trended down across the country with the exception of Ontario. The overall decline is mostly attributable to a slowdown in the Prairies where the housing starts trend was at a 4-year low in January," the CMHC's Chief Economist Bob Dugan said.

-

10:12

Consumer credit in the U.S. increases by $21.27 billion in December

The Fed released its consumer credits figures on Friday. Consumer credit in the U.S. rose by $21.27 billion in December, exceeding expectations for a $16.0 billion increase, after a $14.02 billion gain November. November's figure was revised up from a $13.95 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit climbed by $5.8 billion in October, while non-revolving credit jumped by $15.4 billion.

-

06:40

Global Stocks: U.S. stock indices fell

U.S. stock indices fell on Friday with technology stocks leading declines.

The Dow Jones Industrial Average declined 211.82 points, or 1.3%, to 16,204.83 (-1.6% over the week). The S&P 500 lost 35.40 points, or 1.9%, to 1,880.05 (-3.1% over the week). The Nasdaq Composite dropped 146.41 points, or 3.3%, to 4,363.14 (-5.4% over the week).

The U.S. Labor Department reported on Friday that the country's economy created 151,000 jobs in January, while economists had expected 190,000 new jobs. Nevertheless the unemployment rate fell to 4.9% from 5%. Average hourly earnings rose by 0.5% m/m and 2.5% y/y. On the whole the report was strong despite weaker jobs creation. It reminded market participants that a rate hike in March was still possible. Fed officials will also study February report before they hold a meeting in March.

This morning in Asia the Nikkei climbed 0.84%, or 141.68, to 16,961.27. Markets in China and Hong Kong are closed due to Lunar New Year.

Japanese stocks declined at the beginning of the session amid a stronger yen. Last week Japanese currency gained 3.6% marking the fastest weekly growth since July 2009. However later stocks advanced as the yen declined slightly after data showed that Japan's current account came in at ¥960.7 billion in December vs ¥987.0 billion expected and ¥1,143.5 billion recorded previously.

-

03:35

Nikkei 225 16,809.41 -10.18 -0.06 %, S&P/ASX 200 4,961.9 -14.28 -0.29 %

-

00:33

Stocks. Daily history for Sep Feb 5’2016:

(index / closing price / change items /% change)

Nikkei 225 16,819.59 -225.40 -1.32 %

Hang Seng 19,288.17 +105.08 +0.55 %

Shanghai Composite 2,763.95 -17.07 -0.61 %

FTSE 100 5,848.06 -50.70 -0.86 %

CAC 40 4,200.67 -27.86 -0.66 %

Xetra DAX 9,286.23 -107.13 -1.14 %

S&P 500 1,880.05 -35.40 -1.85 %

NASDAQ Composite 4,363.14 -146.42 -3.25 %

Dow Jones 16,204.97 -211.61 -1.29 %

-