Noticias del mercado

-

21:00

Dow +0.06% 16,037.29 +10.24 Nasdaq +0.14% 4,289.69 +5.94 S&P +0.18% 1,856.79 +3.35

-

18:21

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stocks fluctuated, pulling global equities from the precipice of a bear market, as a tumbling dollar bolstered materials shares and investors speculated selling in technology stocks went too far too fast. Treasuries were little changed as haven demand eased.

Most of Dow stocks in negative area (19 of 30). Top looser - Chevron Corporation (CVX, -2,80%). Top gainer - E. I. du Pont de Nemours and Company (DD, +1,15%).

All S&P sectors in negative area. Top looser - Basic Materials (-2,8%).

At the moment:

Dow 15890.00 -98.00 -0.61%

S&P 500 1841.00 -11.00 -0.59%

Nasdaq 100 3943.75 -20.50 -0.52%

Oil 29.06 -0.63 -2.12%

Gold 1194.90 -3.00 -0.25%

U.S. 10yr 1.74 -0.00

-

18:12

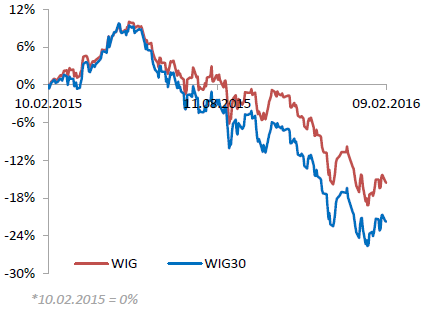

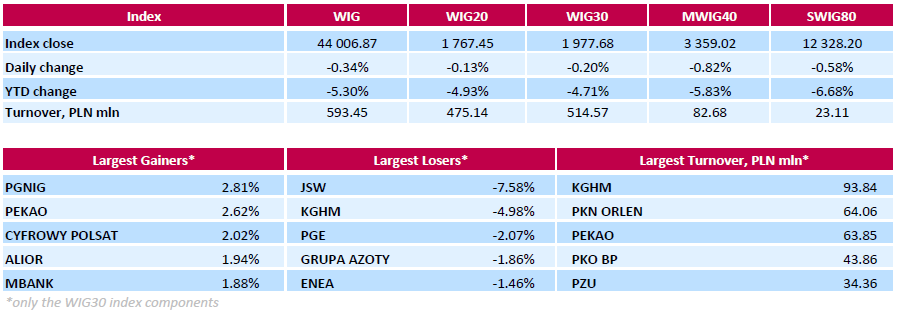

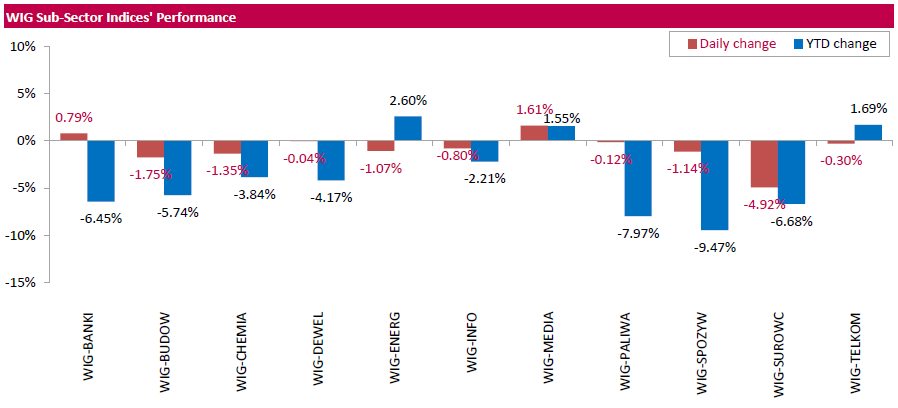

WSE: Session Results

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, slid down 0.34%. Except for banking sector (+0.79%) and media sector (+1.61%), every sector in the WIG Index declined, with materials (-4.92%) lagging behind.

The large-cap stocks' measure, the WIG30 Index lost 0.2%. Within the Index components, coking coal miner JSW (WSE: JSW) was the weakest name, retreating by 7.58% after two consecutive sessions of solid gains. Other major decliners were copper producer KGHM (WSE: KGH), genco PGE (WSE: PGE) and chemical company GRUPA AZOTY (WSE: ATT), plunging by 4.98%, 2.07% and 1.86% respectively. On the other side of the ledger, oil and gas producer PGNIG (WSE: PGN) led the advancers pack with a 2.81% surge. It was followed by banking sector name PEKAO (WSE: PEO), which climbed by 2.62% after the bank reported better-than-expected Q4 FY2015 net profit (it posted a net profit of PLN 438.4 mln versus analysts' forecast of PLN 380.5 mln).

-

18:00

European stocks close: stocks closed lower on concerns over the slowdown in the global economy

Stock indices closed lower on concerns over the slowdown in the global economy and on falling oil prices.

Meanwhile, the economic data from Eurozone was mixed. Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.2% in December, missing expectations for a 0.4% gain, after a 0.1% decline in November.

The output of capital goods decreased 2.6% in December, energy output declined 3.0%, and the production in the construction sector was down 0.2%, while the production of intermediate goods climbed 0.8%.

The output of consumer goods fell 1.4%.

German industrial production excluding energy and construction declined by 1.1% in December.

Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.8% in December, after a 2.1% fall in November.

Germany's trade surplus decreased to €18.8 billion in December from 20.5 in November. November's figure was revised down from a surplus of €20.6 billion.

Exports fell 1.6% in December, while imports decreased 1.6%.

On a yearly basis, German exports increased 3.2% in December, while imports rose by 3.5%.

Germany's current account surplus was at €25.6 billion in December, up from €24.3 billion in November. November's figure was revised down from a surplus of €24.7 billion.

In 2015 as whole, the trade surplus climbed to €247.8 billion from €213.6 billion. The latest figure was the highest ever recorded. Exports increased 6.4% in 2015, while imports rose 4.2%.

The U.K. trade deficit in goods narrowed to £9.92 billion in December from £11.50 billion in November. November's figure was revised up from a deficit of £10.64 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 0.8% in December, while imports slid 3.6%.

In 2015 as whole, the trade deficit widened to £125.028 billion from £123.143 billion in 2014.

The total trade deficit, including services, narrowed to £2.17 billion in December from £4.03 billion in November. November's figure was revised up from a deficit of £3.17 billion.

In 2015 as whole, the total trade deficit widened to £34.7 billion from £34.4 billion in 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,639.13 -50.23 -0.88 %

DAX 8,879.4 -99.96 -1.11 %

CAC 40 3,997.54 -68.77 -1.69 %

-

16:49

European Central Bank Governing Council member Jens Weidmann: inflation in the Eurozone will rise later than previously expected

European Central Bank (ECB) Governing Council member Jens Weidmann said on Tuesday that inflation in the Eurozone will rise later than previously expected as oil prices continue to drop further. He added that inflation forecast for this year should be downgraded.

The ECB is scheduled to release its growth and inflation forecasts in March.

Weidmann also said that there are no signs for a hard landing in China.

-

16:36

Bank of England Deputy Governor Jon Cunliffe: the central bank should act sooner than later to manage the financial stability risks

Bank of England (BoE) Deputy Governor Jon Cunliffe said in a speech on Tuesday that the central bank should act sooner than later to manage the financial stability risks.

"Given the vulnerability that already exists and the powerful drivers in the UK, particularly the housing market, if credit began again to grow faster than GDP, I would want to think about action to manage the financial stability risks sooner rather than later," he said.

Cunliffe noted that a rise in house prices was driven by lower interest rates.

"The rise in secured debt and the increase in house prices reflected in part structural reductions in interest rates," he said.

-

16:28

Wholesale inventories in the U.S. falls 0.1% in December

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. fell 0.1% in December, missing expectations for a 0.2 decline, after a 0.4% decrease in November. November's figure was revised down from a 0.3% decline.

The decline was driven by a fall in inventories of durable goods. Inventories of non-durable goods increased 0.1% in December, while inventories of durable goods fell 0.3%.

Wholesale sales slid 0.3% in December, after a 1.3% fall in November.

-

16:16

Job openings climb to 5.607 million in December

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings rose to 5.607 million in December from 5.346 million in November. November's figure was revised down from 5.431 million.

The number of job openings climbed for total private (5.086 million) and for government (521,000) in December from November.

The hires rate was 3.7% in December.

Total separations increased to 5.072 million in December from 4.962 million in November.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:34

Greek industrial production increases 0.8% in December

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Tuesday. Greek industrial production increased 0.8% in December, after a 2.5% rise in November.

On a yearly basis, industrial production in Greece rose at an adjusted rate of 5.2% in December, after a 2.0% increase in November. November's figure was revised up from a 1.8% gain.

Production in the manufacturing sector increased at an annual rate of 3.3% in December, output in the mining and quarrying sector climbed 9.6%, while electricity production jumped by 11.3%.

-

15:28

National Federation of Independent Business’s small-business optimism index for the U.S. drops to 93.9 in January

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index dropped to 93.9 in January from 95.2 in December.

3 of 10 sub-indexes rose last month, 6 sub-indexes fell, while one sub-index was flat.

"The Small Business Optimism Index fell a bit more than one point, not much of a response to stock market turbulence or the Federal Reserve's move to raise interest rates. The decline in optimism was accounted for by two important Index components, expected business conditions in six months and expected real sales," NFIB Chief Economist Bill Dunkelberg said.

-

15:19

Before the bell: S&P futures -1.20%, NASDAQ futures -1.44%

U.S. stock-index futures declined.

Global Stocks:

Nikkei 16,085.44 -918.86 -5.40%

Hang Seng Closed

Shanghai Composite Closed

FTSE 5,601.12 -88.24 -1.55%

CAC 3,956.71 -109.60 -2.70%

DAX 8,787.06 -192.30 -2.14 %

Crude oil $29.36 (-1.11%)

Gold $1198.00 (+0.01%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

12.09

1.51%

25.0K

International Business Machines Co...

IBM

126.98

0.00%

1K

Hewlett-Packard Co.

HPQ

9.37

0.00%

0.4K

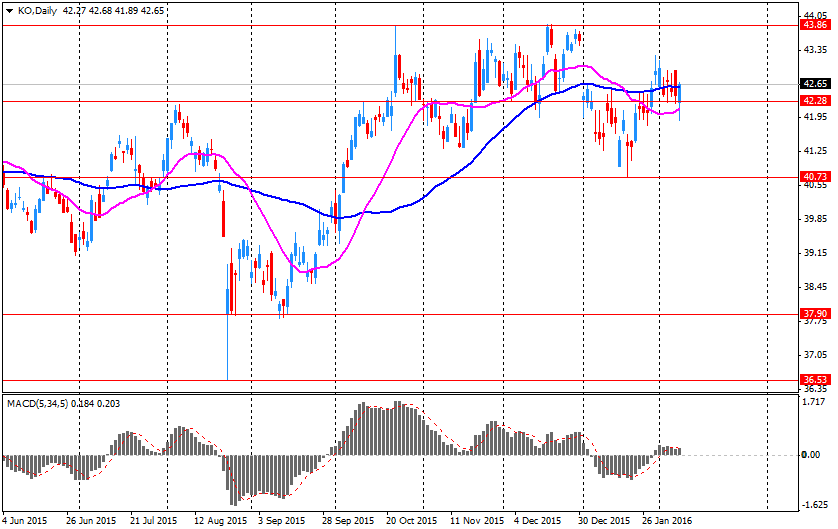

The Coca-Cola Co

KO

42.59

-0.14%

10.6K

International Paper Company

IP

34.31

-0.15%

0.5K

3M Co

MMM

153.5

-0.26%

0.3K

Caterpillar Inc

CAT

64.41

-0.26%

0.1K

General Motors Company, NYSE

GM

28.55

-0.45%

22.1K

Pfizer Inc

PFE

28.43

-0.46%

4.1K

ALTRIA GROUP INC.

MO

59.81

-0.52%

1.9K

AT&T Inc

T

36.9

-0.57%

8.0K

Cisco Systems Inc

CSCO

22.8

-0.57%

0.2K

Verizon Communications Inc

VZ

50.45

-0.57%

2.1K

Johnson & Johnson

JNJ

101.4

-0.59%

0.1K

Merck & Co Inc

MRK

48.5

-0.68%

1.1K

McDonald's Corp

MCD

115.25

-0.69%

1.4K

Procter & Gamble Co

PG

82.03

-0.71%

0.8K

American Express Co

AXP

52.02

-0.73%

0.6K

Intel Corp

INTC

28.6

-0.76%

0.4K

Ford Motor Co.

F

11.5

-0.78%

3.3K

Microsoft Corp

MSFT

49

-0.83%

23.7K

Apple Inc.

AAPL

94.2

-0.85%

78.5K

Walt Disney Co

DIS

91.32

-0.87%

4.4K

General Electric Co

GE

27.91

-0.92%

8.1K

Starbucks Corporation, NASDAQ

SBUX

53.6

-1.00%

2.7K

Yahoo! Inc., NASDAQ

YHOO

26.76

-1.07%

3.2K

Wal-Mart Stores Inc

WMT

66.15

-1.12%

3.9K

Visa

V

67

-1.14%

1.3K

Google Inc.

GOOG

673.73

-1.32%

1.9K

Chevron Corp

CVX

84.81

-1.37%

1.2K

Exxon Mobil Corp

XOM

79.33

-1.37%

12.6K

Home Depot Inc

HD

110.25

-1.43%

1.2K

Amazon.com Inc., NASDAQ

AMZN

480.77

-1.50%

6.3K

Nike

NKE

54.21

-1.51%

7.2K

Facebook, Inc.

FB

98.19

-1.56%

172.6K

AMERICAN INTERNATIONAL GROUP

AIG

51.48

-1.57%

5.0K

Citigroup Inc., NYSE

C

37.2

-1.61%

16.8K

Twitter, Inc., NYSE

TWTR

14.66

-1.61%

10.3K

JPMorgan Chase and Co

JPM

55.61

-1.64%

0.3K

Goldman Sachs

GS

146.7

-1.71%

3.5K

ALCOA INC.

AA

7.73

-2.15%

5.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

5.14

-2.47%

108.0K

Tesla Motors, Inc., NASDAQ

TSLA

140.65

-4.96%

18.0K

-

14:47

BRC and KPMG sales monitor: U.K. retail sales rise by an annual rate of 2.6% on a like-for-like basis in January

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales increased by an annual rate of 2.6% on a like-for-like basis in January, after a 0.1% rise in December.

On a total basis, retail sales climbed 3.3% year-on-year in January.

"Following on from a somewhat disappointing Christmas period for retailers, the new year kicked off to a strong start, with 3.3 per cent growth across all product categories and 2.6 per cent growth on like-for-like sales," BRC Chief Executive, Helen Dickinson, said.

"January's performance was driven by big-ticket items, in particular furniture, which is encouraging in the largest month of the year for the category," she added.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Pfizer (PFE) added to US 1 List at BofA/Merrill

Twitter (TWTR) reiterated with a Neutral at Mizuho; target $21

Cisco (CSCO) target lowered to $24 from $29 at Wunderlich

-

13:45

Company News: Coca-Cola (KO) Quarterly Results Beat Expectations

Coca-Cola reported Q4 FY 2015 earnings of $0.38 per share (versus $0.44 in Q4 FY 2014), beating analysts' consensus of $0.37.

The company's quarterly revenues amounted to $10 bln (-8% y/y), slightly beating consensus estimate of $9.910 bln.

The company also announced it expects its FY 2016 revenue growth to be 4%-5% and EPS growth to reach 4%- 6%.

KO fell to $42.64 (-0.02%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded mixed after yesterday’s significant drop

Stock indices traded mixed after yesterday's significant drop. Stocks fell on Monday driven by a decline in shares of the banking sector.

Meanwhile, the economic data from Eurozone was mixed. Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.2% in December, missing expectations for a 0.4% gain, after a 0.1% decline in November.

The output of capital goods decreased 2.6% in December, energy output declined 3.0%, and the production in the construction sector was down 0.2%, while the production of intermediate goods climbed 0.8%.

The output of consumer goods fell 1.4%.

German industrial production excluding energy and construction declined by 1.1% in December.

Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.8% in December, after a 2.1% fall in November.

Germany's trade surplus decreased to €18.8 billion in December from 20.5 in November. November's figure was revised down from a surplus of €20.6 billion.

Exports fell 1.6% in December, while imports decreased 1.6%.

On a yearly basis, German exports increased 3.2% in December, while imports rose by 3.5%.

Germany's current account surplus was at €25.6 billion in December, up from €24.3 billion in November. November's figure was revised down from a surplus of €24.7 billion.

In 2015 as whole, the trade surplus climbed to €247.8 billion from €213.6 billion. The latest figure was the highest ever recorded. Exports increased 6.4% in 2015, while imports rose 4.2%.

Current figures:

Name Price Change Change %

FTSE 100 5,706.15 +16.79 +0.30 %

DAX 8,990.86 +11.50 +0.13 %

CAC 40 4,058.68 -7.63 -0.19 %

-

11:47

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in January

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in January.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.8% in January from 3.7 in December. Analysts had expected the unemployment rate to remain unchanged at 3.7%.

The number of unemployed people in Switzerland rose by 5,015 to 163,644 in January from a month earlier.

The youth unemployment rate was up to 3.8% in January from 3.7% in December.

-

11:38

Germany’s manufacturing turnover rises 1.8% in December

Destatis released its manufacturing turnover data for Germany on Tuesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.8% in December, after a 2.1% fall in November. November's figure was revised up from a 2.3% decrease.

Domestic turnover increased by 1.7% in December, while the business with foreign customers rose 1.8%.

Sales to euro area countries rose 0.6% in December, while sales to other countries were up 2.7%.

On a yearly basis, real manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 0.3% in December.

In 2015 as whole, real manufacturing turnover increased by 1.5%.

-

11:18

Germany's trade surplus falls to €18.8 billion in December

Destatis released its trade data for Germany on Tuesday. Germany's trade surplus decreased to €18.8 billion in December from 20.5 in November. November's figure was revised down from a surplus of €20.6 billion.

Exports fell 1.6% in December, while imports decreased 1.6%.

On a yearly basis, German exports increased 3.2% in December, while imports rose by 3.5%.

Germany's current account surplus was at €25.6 billion in December, up from €24.3 billion in November. November's figure was revised down from a surplus of €24.7 billion.

In 2015 as whole, the trade surplus climbed to €247.8 billion from €213.6 billion. The latest figure was the highest ever recorded. Exports increased 6.4% in 2015, while imports rose 4.2%.

-

11:09

German industrial production declines 1.2% in December

Destatis released its industrial production data for Germany on Tuesday. German industrial production fell 1.2% in December, missing expectations for a 0.4% gain, after a 0.1% decline in November. November's figure was revised up from a 0.3% decrease.

The output of capital goods decreased 2.6% in December, energy output declined 3.0%, and the production in the construction sector was down 0.2%, while the production of intermediate goods climbed 0.8%.

The output of consumer goods fell 1.4%.

German industrial production excluding energy and construction declined by 1.1% in December.

-

11:04

U.K. trade deficit in goods narrows to £9.92 billion in December

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £9.92 billion in December from £11.50 billion in November. November's figure was revised up from a deficit of £10.64 billion.

The decline in deficit was driven by a drop in imports. Exports of goods dropped 0.8% in December, while imports slid 3.6%.

In 2015 as whole, the trade deficit widened to £125.028 billion from £123.143 billion in 2014.

The total trade deficit, including services, narrowed to £2.17 billion in December from £4.03 billion in November. November's figure was revised up from a deficit of £3.17 billion.

In 2015 as whole, the total trade deficit widened to £34.7 billion from £34.4 billion in 2014.

-

10:43

Japanese Finance Minister Taro Aso: the yen’s appreciation today was clearly sharp

Japanese Finance Minister Taro Aso said on Tuesday that the yen's appreciation today was clearly sharp, adding that he would continue to closely monitor the foreign-exchange movements.

-

10:36

Citi strategists: if the U.K. leaves the European Union (Brexit), consumer prices in the U.K. will rise to 3% - 4% for several years after a “Brexit”

Citi strategists said on Monday that if the U.K. leaves the European Union (Brexit), consumer prices in the U.K. will rise to 3% - 4% for several years after a "Brexit". The pound will depreciate by 15% - 20%, according to Citi strategists. Citi strategists noted that the annual U.K. GDP would be reduced by 1% - 1.5% in 2017 - 2019.

-

10:20

The New York Fed’s survey of consumers’ expectations for inflation: consumers’ expectations decline in January

The New York Fed released its survey of consumers' expectations for inflation on Monday. One-year median expectations fell to 2.42% in January from 2.54% in December. The three-year expectation dropped to 2.45% in January from 2.78% in December.

-

10:10

National Australia Bank’s business confidence index declines to 2 points in January

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 2 points in January from 3 points in December.

"Given all the volatility in equity and financial markets, this is yet another relatively good result from the Business Survey. It suggests things remain broadly on track for the non-mining economy," NAB Group Chief Economist Alan Oster said.

The main business conditions index decreased to 5 points in January from 6 points in December, while employment declined to -1 points from 0 points.

-

06:49

Global Stocks: U.S. stock indices fell

U.S. stock indices stepped away from session lows, but still ended Monday in the negative territory amid renewed declines in oil prices.

The Dow Jones Industrial Average finished the session with a decline of 177.92 points, or 1.1%, to 16,027.05 after trading down as much as 400 points. The S&P 500 lost 26.61 points, or 1.4%, to 1,853.44 (materials and financials were the worst performers falling 2.7% and 2.6% respectively). The Nasdaq Composite fell 79.39 points, or 1.8%, to 4,283.75.

S&P's energy sector showed little reaction and was the only one to close in the positive territory with a gain of less than 0.1%.

Oil prices fell more than 3% on Monday as a meeting between oil ministers from Saudi Arabia and Venezuela resulted in no agreement. There were also no comments about an OPEC meeting Venezuela was calling for.

This morning in Asia the Nikkei plunged 5.54%, or 942.60, to 16,016.70. Markets in China and Hong Kong are closed due to Lunar New Year.

Japanese stocks dropped following declines in U.S. indices. A stronger yen, which is unfavorable for Japanese exporters, weighed on stocks too.

-

02:01

Nikkei 225 16,342.83 -661.47 -3.89 %, S&P/ASX 200 4,856 -119.39 -2.40 %, Topix 1,324.32 -56.09 -4.06 %

-

01:02

Stocks. Daily history for Sep Feb 8’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,975.39 -0.78 -0.02%

TOPIX 1,380.41 +11.44 +0.84%

FTSE 100 5,689.36 -158.70 -2.71 %

CAC 40 4,066.31 -134.36 -3.20 %

Xetra DAX 8,979.36 -306.87 -3.30 %

S&P 500 1,853.44 -26.61 -1.42 %

NASDAQ Composite 4,283.75 -79.39 -1.82 %

Dow Jones 16,027.05 -177.92 -1.10 %

-