Noticias del mercado

-

20:21

American focus: the US dollar appreciated strongly against most major currencies

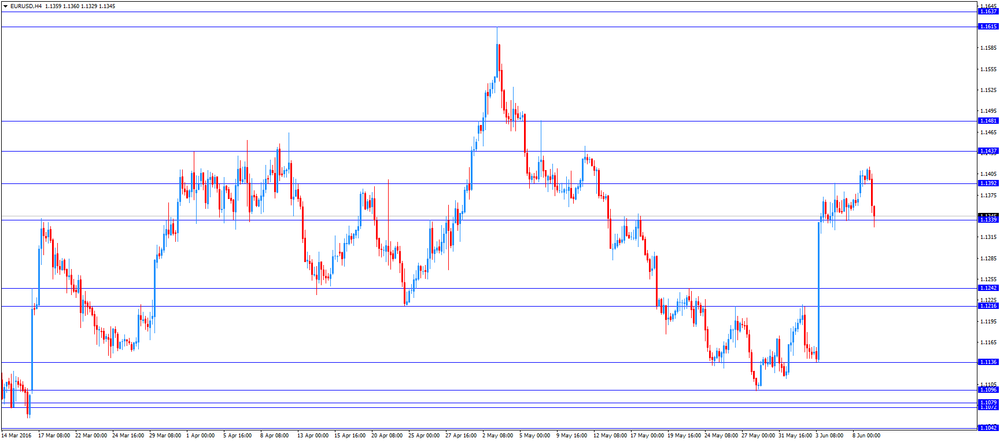

The US dollar rose significantly against the euro, by updating a maximum of 6 June and nearer to the psychological level of $ 1.1300. Experts point out that the US currency continues to receive support from the yield spread of bonds and bonds, as well as labor market statistics.

The Labor Department reported that the number of initial applications for unemployment benefits fell last week, a sign that layoffs remain under control, despite the recent slowdown in hiring. The number of initial claims for unemployment benefits fell by 4,000, reaching 264,000 in the week ending 4 June. Economists had expected 270,000 initial claims. Applications for the week ended May 28 were revised to an increase by 1000 to 268 000. The Labor Department said that no special factors did not affect the index last week. The moving average of four weeks, which helps to smooth out fluctuations in the data, fell by 7,500 last week to 269 500. Applications are below 300 000 for 66 consecutive weeks, the longest streak since 1973. Repeated requests for unemployment benefits fell by 77,000 to 2.095 million in the week ended May 28th.

Attention is also switched to the Fed meeting. The results of the latest poll The Wall Street Journal revealed that the deterioration of the employment situation is likely to cause the Fed to refrain from raising rates at the June meeting. Previously, many economists expect the Central Bank to raise rates in June, but now 52% of respondents believe that the Fed will postpone the decision until July. Meanwhile, 30% of respondents believe that rates will remain unchanged until September. Fed futures rates suggest that the probability of a rate hike in June was 4%, and the chances of an increase in rates are estimated at 27% in July.

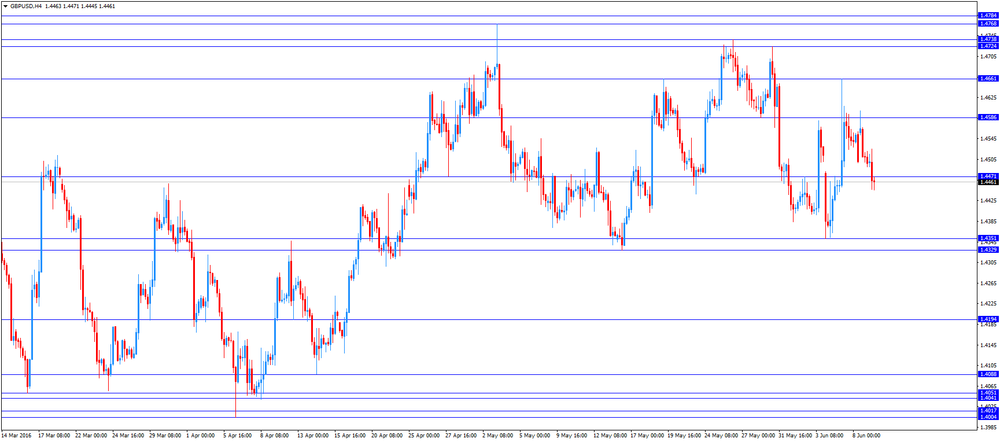

The British pound fell moderately against the dollar, reaching a minimum of 7 June, which was due to the widespread strengthening of the US currency and fears regarding the upcoming referendum on the country's withdrawal from the European Union. Little support for the pound has had a positive trade statistics. UK Office for National Statistics reported that the trade deficit shrank in April more than expected, after a record increase in the volume of exports of goods. The volume of exports has jumped by 11.2%, or £ 2,2 billion compared to the previous month, increasing the total value of exports of goods up to £ 26.1 Bln. Imports rose by £ 2 billion to £ 36.6 Bln. For the growth of the export volume of trade deficit narrowed in April to £ 3.29 billion, compared with the revised downward £ 3.53 in March, which was the lowest since September 2015.

The evidence suggests that the recent weakness of the trade data is likely coming to an end. However, sentiment on the pound remained fragile on the eve of the referendum June 23 to the exit of Britain from the EU structure.

The Swiss franc fell against the dollar, having lost almost all of yesterday earned position. The reason for such dynamics was a general recovery of the dollar and the decline in global stock markets. Focus was also a report on the labor market. The State Secretariat for Economic Affairs said that the unemployment rate in Switzerland to a seasonally adjusted remained at around 3.5 percent, which was slightly above forecasts of experts (+3.4 percent). The unemployment rate in the unadjusted basis decreased to 3.3 percent from 3.5 percent the previous month. The number of unemployed fell by 4,762 from the previous month to 144,778 at the end of May. Youth unemployment, which belongs to the age group 15-24 years, dropped to 3 per cent compared with 3.2 per cent in April.

-

17:35

Swiss Federal Statistical Office expects consumer price inflation to be -0.4% this year

The Swiss Federal Statistical Office released its inflation forecasts on Thursday. Consumer price inflation in Switzerland is expected to be -0.4% this year and 0.3% next year.

-

17:11

Greek unemployment rate declines to 24.1% in March

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.1% in March from 24.2% in February.

The number of unemployed decreased by 4,609 persons compared with February.

The youth unemployment rate was down to 50.4% in March from 52.1% compared with March 2015.

-

17:07

Greek industrial production climbs 4.0% in April

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Thursday. Greek industrial production climbed 4.0% in April, after a 0.3% fall in March.

On a yearly basis, industrial production in Greece climbed at an adjusted rate of 2.8% in April, after a 3.6% decrease in March. March's figure was revised up from a 4.0% drop.

Production in the manufacturing sector increased at an annual rate of 5.8% in April, output in the mining and quarrying sector dropped 24.3%, while electricity production slid by 1.0%.

-

17:02

Greek consumer prices decline 0.4% in May

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Thursday. Greek consumer prices slid 0.4% in May, after a 0.7% rise in April.

On a yearly basis, the Greek consumer price index declined 0.9% in May, after a 1.3 fall in April. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 4.6% in May, transport costs dropped by 4.8%, clothing and footwear prices were up 1.2%, while household equipment prices decreased 1.9%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 0.8% in May, while alcoholic beverages and tobacco prices increased by 1.1%.

-

16:56

French final non-farm employment increases 0.3% in the first quarter

The French statistical office Insee released its final non-farm employment data on Thursday. French non-farm employment increased 0.3% in the first quarter, up from the preliminary reading of a 0.2% gain, after a 0.2% increase in the fourth quarter.

Employment excluding temporary work rose 0.1% in the fourth quarter.

Temporary employment rose by 0.3% in the first quarter.

Employment in the industry was down by 0.3% in the first quarter, while employment in construction increased by 0.1%.

Overall, job creation in the market services sector climbed by 0.4% in the first quarter.

-

16:33

Germany’s labour costs per hour worked rise 1.7% in the first quarter

The German statistical office Destatis released its labour costs data for the first quarter on Thursday. Labour costs per hour worked rose 1.7% in the first quarter on a seasonally and calendar adjusted basis, after a 0.5% increase in the fourth quarter.

On a yearly basis, labour costs per hour worked increased 3.1% in the first quarter on a calendar adjusted basis, after a 2.0% gain in the fourth quarter.

The costs of gross earnings climbed a calendar adjusted 3.2% year-on-year in the first quarter, while non-wage costs were up 2.7%.

-

16:25

Core machinery orders in Japan drop 11.0% in April

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan dropped 11.0% in April, missing expectations for a 3.8% decrease, after a 5.5% gain in March.

The total number of machinery orders plunged 20.2% in April from a month earlier.

Orders from non-manufacturers were down 3.9% in April, while orders from manufacturers dropped 13.3%.

On a yearly basis, core machinery orders slid 8.5% in April, missing expectations for a 2.3% fall, after a 3.2% increase in March.

-

16:20

RICS house price balance for the U.K. drops to +19% in May

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on late Wednesday evening. The monthly house price balance fell to +19% in May from +39% in April. It was the lowest level since November 2012.

April's figure was revised down from +41%.

The RICS noted that the decline was driven by the impact of Stamp Duty changes and uncertainty around the EU referendum.

-

16:14

Wholesale inventories in the U.S. increase 0.6% in April

The U.S. Commerce Department released wholesale inventories on Thursday. Wholesale inventories in the U.S. increased 0.6% in April, exceeding expectations for a 0.1% gain, after a 0.2% rise in March. March's figure was revised up from a 0.1% increase.

The increase was mainly driven by a rise in inventories of durable and non-durable goods. Inventories of non-durable goods increased 1.3% in April, while inventories of durable goods rose 0.2%.

Wholesale sales rose 1.0% in April, after a 0.2% increase in March.

-

16:00

U.S.: Wholesale Inventories, April 0.6% (forecast 0.1%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1300-15 (EUR 812m) 1.1395-1.1405 (732m)

USD/JPY 107.50 (USD 395m) 108.00 (580m)

GBP/USD 1.4445-60 (GBP 549m)

USD/CHF 0.9780 (USD 320m) 0.9925 (260m)

AUD/USD 0.7200-20 (AUD 2.3bln) 0.7500 (513m)

USD/CAD 1.2985 (USD 843m)

NZD/USD 0.6900 (NZD 200m)

AUD/JPY 78.90 (AUD 286m)

-

15:40

Canadian capacity utilisation rate is up to 81.4% in the first quarter

Statistics Canada released its capacity utilisation rate on Thursday. Canadian capacity utilisation rate rose to 81.4% in the first quarter from 80.9% in the fourth quarter, exceeding expectations for an increase to 81.3%. The fourth quarter's figure was revised down from 81.1%.

The increase was mainly driven by a rise in the mining, quarrying, and oil and gas extraction industries. The capacity utilisation rate in the mining, quarrying, and oil and gas extraction industry climbed to 77.0% in the first quarter from 75.9% in the fourth quarter.

-

15:26

Canada’s new housing price index climbs 0.3% in April

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.3% in April, exceeding expectations of a 0.2% gain, after a 0.2% rise in March.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.7% in April, while prices in Vancouver climbed 0.2%.

-

14:42

Initial jobless claims fall to 264,000 in the week ending June 04

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 04 in the U.S. decreased by 4,000 to 264,000 from 268,000 in the previous week. The previous week's figure was revised up from 267,000.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 66th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 77,000 to 2,095,000 in the week ended May 28. It was the lowest level since October 2000.

-

14:31

U.S.: Continuing Jobless Claims, May 2095 (forecast 2171)

-

14:30

Canada: New Housing Price Index, MoM, April 0.3% (forecast 0.2%)

-

14:30

U.S.: Initial Jobless Claims, June 264 (forecast 270)

-

14:30

Canada: Capacity Utilization Rate, Quarter I 81.4% (forecast 81.3%)

-

14:20

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:10 New Zealand RBNZ Governor Graeme Wheeler Speaks

01:30 China PPI y/y May -3.4% -3.3% -2.8%

01:30 China CPI y/y May 2.3% 2.3% 2.0%

05:30 France Non-Farm Payrolls (Finally) Quarter I 0.2% 0.2% 0.3%

05:45 Switzerland Unemployment Rate (non s.a.) May 3.5% 3.5% 3.3%

06:00 Germany Current Account April 29.9 Revised From 30.4 28.8

06:00 Germany Trade Balance (non s.a.), bln April 26.2 Revised From 26.0 25.6

06:00 Japan Prelim Machine Tool Orders, y/y May -26.4% -25.0%

07:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Total Trade Balance April -3.532 Revised From -3.83 -3.294

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 3,000 to 270,000 last week.

Wholesale inventories in the U.S. are expected to rise 0.1% in April, after a 0.1% increase in February.

The euro traded higher against the U.S. dollar on comments by the European Central Bank (ECB) President Mario Draghi. He said in a speech at the Brussels Economic Forum on Thursday that governments should implement structural reforms to support the central bank's stimulus measures.

"There are many understandable political reasons to delay structural reform, but there are few good economic ones. The cost of delay is simply too high," he said.

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to €25.6 billion in April from 26.2 in March. March's figure was revised up from a surplus of €26.0 billion. Exports were flat in April, while imports were down 0.2%.

The British pound traded lower against the U.S. dollar despite the positive trade data from the U.K. The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Thursday. The U.K. trade deficit in goods narrowed to £10.53 billion in April from £10.65 billion in March. March's figure was revised up from a deficit of £11.20 billion.

The decline in deficit was driven by a rise in good exports, which increased by £11.2 billion in April.

The total trade deficit, including services, narrowed to £3.29 billion in April from £3.53 billion in March. It was the lowest level since September 2015.

March's figure was revised up from a deficit of £3.83 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.2% in April, after a 0.2% gain in March.

The Bank of Canada Governor Stephen Poloz is scheduled to speak at 15:15 GMT.

The Swiss franc traded lower against the U.S. dollar. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.5% in May.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.3% from 3.5% in April. Analysts had expected the unemployment rate to remain unchanged at 3.5%.

EUR/USD: the currency pair was down to $1.1329

GBP/USD: the currency pair declined to $1.4445

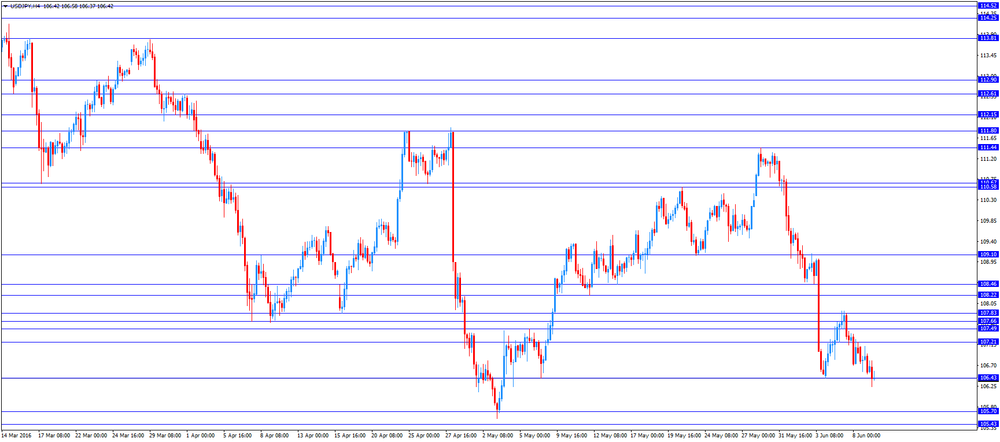

USD/JPY: the currency pair fell to Y106.24

The most important news that are expected (GMT0):

12:30 Canada Capacity Utilization Rate Quarter I 81.1% 81.3%

12:30 Canada New Housing Price Index, MoM April 0.2% 0.2%

12:30 U.S. Continuing Jobless Claims May 2172 2171

12:30 U.S. Initial Jobless Claims June 267 270

14:00 U.S. Wholesale Inventories April 0.1% 0.1%

15:15 Canada BOC Gov Stephen Poloz Speaks

-

11:55

European Central Bank President Mario Draghi: governments should implement structural reforms to support the central bank’s stimulus measures

The European Central Bank (ECB) President Mario Draghi said in a speech at the Brussels Economic Forum on Thursday that governments should implement structural reforms to support the central bank's stimulus measures.

"There are many understandable political reasons to delay structural reform, but there are few good economic ones. The cost of delay is simply too high," he said.

-

11:30

U.K. trade deficit in goods narrows to £10.53 billion in April

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Thursday. The U.K. trade deficit in goods narrowed to £10.53 billion in April from £10.65 billion in March. March's figure was revised up from a deficit of £11.20 billion.

The decline in deficit was driven by a rise in good exports, which increased by £11.2 billion in April.

The total trade deficit, including services, narrowed to £3.29 billion in April from £3.53 billion in March. It was the lowest level since September 2015.

March's figure was revised up from a deficit of £3.83 billion.

-

11:10

Germany's trade surplus declines to €25.6 billion in April

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to €25.6 billion in April from 26.2 in March. March's figure was revised up from a surplus of €26.0 billion.

Exports were flat in April, while imports were down 0.2%.

On a yearly basis, German exports increased 3.8% in April, while imports were flat.

Germany's current account surplus was €28.8 billion in April, down from €29.9 billion in March. March's figure was revised down from a surplus of €30.4 billion.

-

10:57

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.5% in May

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.5% in May.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.3% from 3.5% in April. Analysts had expected the unemployment rate to remain unchanged at 3.5%.

The number of unemployed people in Switzerland fell by 4,762 to 144,778 in May from the previous month.

The youth unemployment rate was down to 3.0% in May from 3.2% in April.

-

10:30

United Kingdom: Total Trade Balance, April -3.294

-

10:27

Chinese consumer price index rises at annual rate of 2.0% in May

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 2.0% in May, missing expectations for a 2.3% increase, after a 2.3% gain in April.

Food prices rose at an annual rate of 5.9% in May, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation decreased 0.5% in May, after a 0.2% fall in April.

The Chinese producer price index (PPI) dropped 2.8% in May, beating expectations for a 3.3% fall, after a 3.4% decline in April.

-

10:20

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1300-15 (EUR 812m) 1.1395-1.1405 (732m)

USD/JPY 107.50 (USD 395m) 108.00 (580m)

GBP/USD 1.4445-60 (GBP 549m)

USD/CHF 0.9780 (USD 320m) 0.9925 (260m)

AUD/USD 0.7200-20 (AUD 2.3bln) 0.7500 (513m)

USD/CAD 1.2985 (USD 843m)

NZD/USD 0.6900 (NZD 200m)

AUD/JPY 78.90 (AUD 286m)

-

10:09

Reserve Bank of New Zealand keeps its interest rate unchanged at 2.25% in June

The Reserve Bank of New Zealand (RBNZ) on Wednesday kept its interest rate unchanged at 2.25% as widely expected by analysts.

The RBNZ Graeme Wheeler said that New Zealand's economy was supported by strong inward migration, construction activity, tourism, and the central bank's accommodative monetary policy.

He pointed out on Wednesday that further monetary policy easing was possible.

"Further policy easing may be required to ensure that future average inflation settles near the middle of the target range," he said, adding that the monetary policy will depend on the incoming economic data.

Wheeler noted that the New Zealand dollar was "higher than appropriate", adding that a weaker currency was desirable.

The RBNZ governor also said that inflation was low, driven by lower prices for fuel and other imports, but long-term inflation expectations were well-anchored at 2%.

Wheeler pointed out that there were risks to inflation forecasts from the possible high net immigration and pressures in the housing market.

The RBNZ lowered its interest rate to 2.25% from 2.50% in March. This decision was not expected by market participants.

-

08:30

Options levels on thursday, June 9, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1549 (1680)

$1.1514 (1653)

$1.1489 (1787)

Price at time of writing this review: $1.1396

Support levels (open interest**, contracts):

$1.1316 (2341)

$1.1256 (1459)

$1.1186 (2226)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 33772 contracts, with the maximum number of contracts with strike price $1,1500 (5370);

- Overall open interest on the PUT options with the expiration date July, 8 is 61007 contracts, with the maximum number of contracts with strike price $1,0900 (12260);

- The ratio of PUT/CALL was 1.81 versus 1.91 from the previous trading day according to data from June, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.4824 (1730)

$1.4728 (758)

$1.4633 (674)

Price at time of writing this review: $1.4512

Support levels (open interest**, contracts):

$1.4462 (482)

$1.4366 (673)

$1.4269 (455)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 15351 contracts, with the maximum number of contracts with strike price $1,5000 (1844);

- Overall open interest on the PUT options with the expiration date July, 8 is 31314 contracts, with the maximum number of contracts with strike price $1,4100 (3099);

- The ratio of PUT/CALL was 2.04 versus 1.88 from the previous trading day according to data from June, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:06

Japan: Prelim Machine Tool Orders, y/y , May -25.0%

-

08:01

Germany: Trade Balance (non s.a.), bln, April 24.0

-

08:00

Germany: Current Account , April 28

-

07:45

Switzerland: Unemployment Rate (non s.a.), May 3.3% (forecast 3.5%)

-

07:30

Asian session: The kiwi was up

The New Zealand dollar took centre stage on Thursday, surging to a one-year high after the Reserve Bank of New Zealand kept interest rates unchanged, surprising some investors who had been betting on a rate cut.

Reserve Bank of New Zealand governor Graeme Wheeler said at a media conference the central bank would not hesitate to adjust interest rates if needed.

Wheeler added that inflation expectations have stabilised and that some inflation pressures were beginning to come through.

Going into the central bank decision, some short-term speculators seem to have put on bearish bets against the New Zealand dollar, said Stephen Innes, senior trader for FX broker OANDA in Singapore, adding that their short-covering likely helped add to the kiwi's bounce on Thursday.

The RBNZ governor's post-meeting remarks also helped bolster the kiwi, as there were no concrete hints that the central bank would cut interest rates very soon, Innes said.

"I don't think there was any clear-cut forward guidance that the market could read from that and I think that's why we're seeing the trend continue," he said, referring to the kiwi's rise.

The dollar index inched 0.1 percent lower to 93.515, not far from a one-month low of 93.425 plumbed on Wednesday amid fading expectations the U.S. Federal Reserve would raise interest rates as early as its meeting next week.

U.S. interest rate futures implied traders saw nearly no chance the Fed would increase rates at its two-day policy meeting ending next Wednesday, according to CME Group's FedWatch, after last week's downbeat employment data pushed back expectations of an imminent rate hike.

The dollar was 0.3 percent lower at 106.63 yen, moving back toward Monday's one-month low of 106.35.

Data showed that Japan's core machinery orders tumbled 11 percent in April from the previous month, more than the median estimate of a 3.8 percent drop, in a worrying sign for business investment.

The euro rose 0.1 percent to $1.1405, and set a fresh four-week high of $1.1416 even after German Bund yields notched record lows on Wednesday as the European Central Bank began buying corporate debt for its stimulus programme.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1395-1.1415

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.4490-1.4520

USD / JPY: during the Asian session, the pair is trading in the range of $ 106.50-107.00

Based on Reuters materials

-

07:30

France: Non-Farm Payrolls, Quarter I 0.3% (forecast 0.2%)

-

03:30

China: CPI y/y, May 2.0% (forecast 2.3%)

-

03:30

China: PPI y/y, May -2.8% (forecast -3.3%)

-

01:50

Japan: Core Machinery Orders, y/y, April -8.5% (forecast -2.3%)

-

01:50

Japan: Core Machinery Orders, April -11.0% (forecast -3.8%)

-

00:57

Currencies. Daily history for Jun 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1397 +0,36%

GBP/USD $1,4510 -0,21%

USD/CHF Chf0,969 +0,40%

USD/JPY Y106,89 -0,39%

EUR/JPY Y121,84 -0,03%

GBP/JPY Y155,1 -0,61%

AUD/USD $0,7483 +0,41%

NZD/USD $0,7086 +1,68%

USD/CAD C$1,2689 -0,51%

-