Noticias del mercado

-

21:00

Dow -0.09% 17,988.17 -16.88 Nasdaq -0.30% 4,959.89 -14.75 S&P -0.17% 2,115.56 -3.56

-

18:01

European stocks close: stocks closed lower on falling oil prices

Stock closed lower on a decline in oil prices.

The European Central Bank (ECB) President Mario Draghi said in a speech at the Brussels Economic Forum on Thursday that governments should implement structural reforms to support the central bank's stimulus measures.

"There are many understandable political reasons to delay structural reform, but there are few good economic ones. The cost of delay is simply too high," he said.

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to €25.6 billion in April from 26.2 in March. March's figure was revised up from a surplus of €26.0 billion. Exports were flat in April, while imports were down 0.2%.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Thursday. The U.K. trade deficit in goods narrowed to £10.53 billion in April from £10.65 billion in March. March's figure was revised up from a deficit of £11.20 billion.

The decline in deficit was driven by a rise in good exports, which increased by £11.2 billion in April.

The total trade deficit, including services, narrowed to £3.29 billion in April from £3.53 billion in March. It was the lowest level since September 2015.

March's figure was revised up from a deficit of £3.83 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,231.89 -69.63 -1.10 %

DAX 10,088.87 -128.16 -1.25 %

CAC 40 4,405.61 -43.12 -0.97 %

-

18:00

European stocks closed: FTSE 100 6,231.89 -69.63 -1.10% CAC 40 4,405.61 -43.12 -0.97% DAX 10,088.87 -128.16 -1.25%

-

17:40

WSE: Session Results

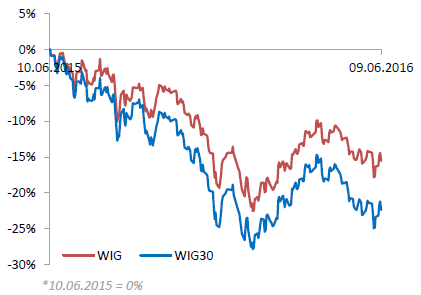

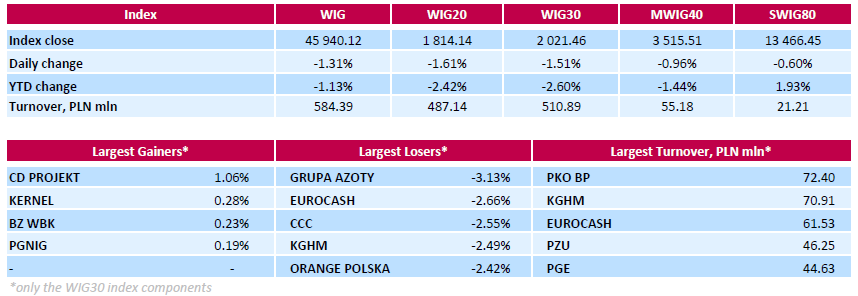

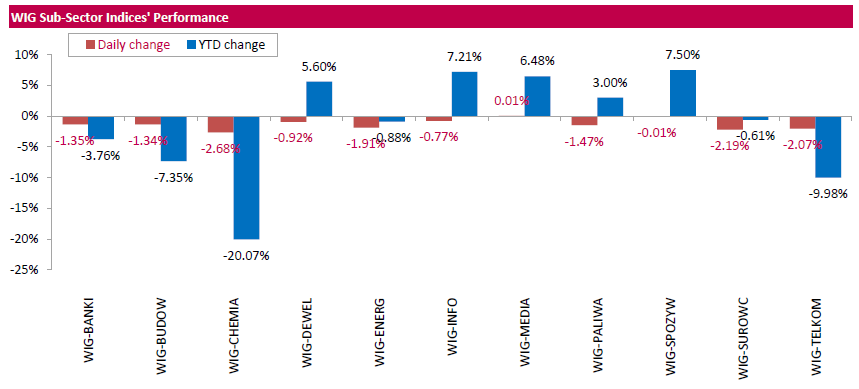

Polish equity market closed lower on Thursday. The broad market benchmark, the WIG Index, declined by 1.31%. All sectors, but for media (+0.01%), were down, with chemicals stocks (-2.68%) lagging behind.

The large-cap companies' measure, the WIG30 Index, fell by 1.51%. The WIG30 index constituents closed mainly lower with chemical producer GRUPA AZOTY (WSE: ATT) underperforming, down 3.13%. Other major decliners were FMCG-wholesaler EUROCASH (WSE: EUR), footwear retailer CCC (WSE: CCC) and copper producer KGHM (WSE: KGH), which dropped by 2.66%, 2.55% and 2.49% respectively. At the same time, the handful advancers included videogame developer CD PROJEKT (WSE: CDR), agricultural producer KERNEL (WSE: KER), bank BZ WBK (WSE: BZW) and oil and gas producer PGNIG (WSE: PGN), which gained between 0.19% and 1.06%.

-

17:35

Swiss Federal Statistical Office expects consumer price inflation to be -0.4% this year

The Swiss Federal Statistical Office released its inflation forecasts on Thursday. Consumer price inflation in Switzerland is expected to be -0.4% this year and 0.3% next year.

-

17:27

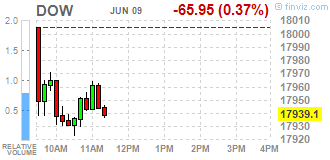

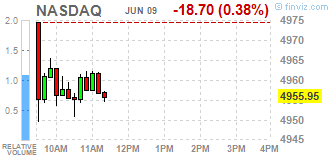

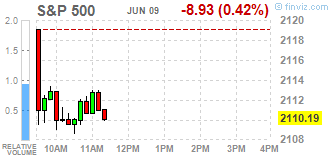

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Thursday morning, led by financials and as lower oil prices weighed on energy companies. Oil prices were down ~1% as traders took profits after a three-day rally. The number of Americans filing for unemployment benefits unexpectedly fell last week, pointing to sustained strength in the labor market despite a sharp slowdown in hiring last month. The jobless claims data gave investors their first read of the labor market since Friday when dismal May payrolls numbers jolted the markets.

Most all of Dow stocks in negative area (22 of 30). Top looser - American Express Company (AXP, -1,61%). Top gainer - NIKE, Inc. (NKE, +0,87%).

Almost all of S&P sectors also in negative area. Top looser - Basic Materials (-1,0%). Top gainer - Utilities (+0,2%).

At the moment:

Dow 17855.00 -43.00 -0.24%

S&P 500 2102.00 -7.00 -0.33%

Nasdaq 100 4505.50 -5.50 -0.12%

Oil 50.85 -0.38 -0.74%

Gold 1271.70 +9.40 +0.74%

U.S. 10yr 1.68 -0.03

-

17:11

Greek unemployment rate declines to 24.1% in March

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.1% in March from 24.2% in February.

The number of unemployed decreased by 4,609 persons compared with February.

The youth unemployment rate was down to 50.4% in March from 52.1% compared with March 2015.

-

17:07

Greek industrial production climbs 4.0% in April

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Thursday. Greek industrial production climbed 4.0% in April, after a 0.3% fall in March.

On a yearly basis, industrial production in Greece climbed at an adjusted rate of 2.8% in April, after a 3.6% decrease in March. March's figure was revised up from a 4.0% drop.

Production in the manufacturing sector increased at an annual rate of 5.8% in April, output in the mining and quarrying sector dropped 24.3%, while electricity production slid by 1.0%.

-

17:02

Greek consumer prices decline 0.4% in May

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Thursday. Greek consumer prices slid 0.4% in May, after a 0.7% rise in April.

On a yearly basis, the Greek consumer price index declined 0.9% in May, after a 1.3 fall in April. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 4.6% in May, transport costs dropped by 4.8%, clothing and footwear prices were up 1.2%, while household equipment prices decreased 1.9%.

Prices of food and non-alcoholic beverages climbed at an annual rate of 0.8% in May, while alcoholic beverages and tobacco prices increased by 1.1%.

-

16:56

French final non-farm employment increases 0.3% in the first quarter

The French statistical office Insee released its final non-farm employment data on Thursday. French non-farm employment increased 0.3% in the first quarter, up from the preliminary reading of a 0.2% gain, after a 0.2% increase in the fourth quarter.

Employment excluding temporary work rose 0.1% in the fourth quarter.

Temporary employment rose by 0.3% in the first quarter.

Employment in the industry was down by 0.3% in the first quarter, while employment in construction increased by 0.1%.

Overall, job creation in the market services sector climbed by 0.4% in the first quarter.

-

16:33

Germany’s labour costs per hour worked rise 1.7% in the first quarter

The German statistical office Destatis released its labour costs data for the first quarter on Thursday. Labour costs per hour worked rose 1.7% in the first quarter on a seasonally and calendar adjusted basis, after a 0.5% increase in the fourth quarter.

On a yearly basis, labour costs per hour worked increased 3.1% in the first quarter on a calendar adjusted basis, after a 2.0% gain in the fourth quarter.

The costs of gross earnings climbed a calendar adjusted 3.2% year-on-year in the first quarter, while non-wage costs were up 2.7%.

-

16:25

Core machinery orders in Japan drop 11.0% in April

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan dropped 11.0% in April, missing expectations for a 3.8% decrease, after a 5.5% gain in March.

The total number of machinery orders plunged 20.2% in April from a month earlier.

Orders from non-manufacturers were down 3.9% in April, while orders from manufacturers dropped 13.3%.

On a yearly basis, core machinery orders slid 8.5% in April, missing expectations for a 2.3% fall, after a 3.2% increase in March.

-

16:20

RICS house price balance for the U.K. drops to +19% in May

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on late Wednesday evening. The monthly house price balance fell to +19% in May from +39% in April. It was the lowest level since November 2012.

April's figure was revised down from +41%.

The RICS noted that the decline was driven by the impact of Stamp Duty changes and uncertainty around the EU referendum.

-

16:14

Wholesale inventories in the U.S. increase 0.6% in April

The U.S. Commerce Department released wholesale inventories on Thursday. Wholesale inventories in the U.S. increased 0.6% in April, exceeding expectations for a 0.1% gain, after a 0.2% rise in March. March's figure was revised up from a 0.1% increase.

The increase was mainly driven by a rise in inventories of durable and non-durable goods. Inventories of non-durable goods increased 1.3% in April, while inventories of durable goods rose 0.2%.

Wholesale sales rose 1.0% in April, after a 0.2% increase in March.

-

15:49

WSE: After start on Wall Street

Americans begin a day from decrease on the S&P500 index about 0.4 percent, roughly follow the expectations of contracts. This decrease is obviously too shallow to strongly threaten the bulls. Approx. 80 percent of companies among blue chips falling, including American Express, Caterpillar, Goldman Sachs and JPMorgan with a drop of more than 5 percent.

-

15:40

Canadian capacity utilisation rate is up to 81.4% in the first quarter

Statistics Canada released its capacity utilisation rate on Thursday. Canadian capacity utilisation rate rose to 81.4% in the first quarter from 80.9% in the fourth quarter, exceeding expectations for an increase to 81.3%. The fourth quarter's figure was revised down from 81.1%.

The increase was mainly driven by a rise in the mining, quarrying, and oil and gas extraction industries. The capacity utilisation rate in the mining, quarrying, and oil and gas extraction industry climbed to 77.0% in the first quarter from 75.9% in the fourth quarter.

-

15:34

U.S. Stocks open: Dow -0.30%, Nasdaq -0.42%, S&P -0.39%

-

15:27

Before the bell: S&P futures -0.44%, NASDAQ futures -0.39%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,668.41 -162.51 -0.97%

Hang Seng Closed

Shanghai Composite Closed

FTSE 6,235.13 -66.39 -1.05%

CAC 4,407.6 -41.13 -0.92%

DAX 10,071.75 -145.28 -1.42%

Crude $50.63 (-1.17%)

Gold $1260.80 (-0.12%)

-

15:26

Canada’s new housing price index climbs 0.3% in April

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.3% in April, exceeding expectations of a 0.2% gain, after a 0.2% rise in March.

The increase was mainly driven by higher prices in Toronto and Vancouver. New home prices in Toronto and Oshawa region rose 0.7% in April, while prices in Vancouver climbed 0.2%.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.75

-0.14(-1.4156%)

29305

ALTRIA GROUP INC.

MO

65.51

-0.11(-0.1676%)

1500

Amazon.com Inc., NASDAQ

AMZN

723

-3.64(-0.5009%)

6325

American Express Co

AXP

65.87

-0.39(-0.5886%)

300

AMERICAN INTERNATIONAL GROUP

AIG

56.41

-0.19(-0.3357%)

1801

Apple Inc.

AAPL

98.7

-0.24(-0.2426%)

52720

AT&T Inc

T

39.76

-0.10(-0.2509%)

1713

Barrick Gold Corporation, NYSE

ABX

19.05

-0.17(-0.8845%)

61028

Caterpillar Inc

CAT

77.54

-0.57(-0.7297%)

2299

Chevron Corp

CVX

102.35

-0.74(-0.7178%)

2438

Cisco Systems Inc

CSCO

29.06

-0.08(-0.2745%)

2098

Citigroup Inc., NYSE

C

45.22

-0.34(-0.7463%)

7832

Exxon Mobil Corp

XOM

90.25

-0.54(-0.5948%)

4041

Facebook, Inc.

FB

118.01

-0.38(-0.321%)

29320

Ford Motor Co.

F

13.26

-0.10(-0.7485%)

28597

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.23

-0.35(-3.0225%)

265143

General Electric Co

GE

30.1

-0.21(-0.6928%)

18111

General Motors Company, NYSE

GM

29.42

-0.15(-0.5073%)

5997

Goldman Sachs

GS

153.7

-0.94(-0.6079%)

5151

Home Depot Inc

HD

129.23

-0.36(-0.2778%)

1532

International Paper Company

IP

44

-0.11(-0.2494%)

1000

JPMorgan Chase and Co

JPM

64.8

-0.45(-0.6897%)

2835

Microsoft Corp

MSFT

51.89

-0.15(-0.2882%)

2401

Nike

NKE

54.1

-0.02(-0.037%)

3087

Pfizer Inc

PFE

35.1

-0.15(-0.4255%)

3200

Starbucks Corporation, NASDAQ

SBUX

55.15

-0.07(-0.1268%)

962

Tesla Motors, Inc., NASDAQ

TSLA

233.75

-1.77(-0.7515%)

12229

The Coca-Cola Co

KO

45.46

-0.09(-0.1976%)

1345

Twitter, Inc., NYSE

TWTR

14.84

-0.11(-0.7358%)

12836

Verizon Communications Inc

VZ

51.51

-0.01(-0.0194%)

1005

Visa

V

81.4

-0.25(-0.3062%)

4909

Wal-Mart Stores Inc

WMT

71.4

0.12(0.1684%)

895

Walt Disney Co

DIS

97.71

-0.33(-0.3366%)

1759

Yahoo! Inc., NASDAQ

YHOO

36.99

0.02(0.0541%)

25300

Yandex N.V., NASDAQ

YNDX

22.7

-0.38(-1.6464%)

8350

-

14:42

Initial jobless claims fall to 264,000 in the week ending June 04

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 04 in the U.S. decreased by 4,000 to 264,000 from 268,000 in the previous week. The previous week's figure was revised up from 267,000.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 66th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 77,000 to 2,095,000 in the week ended May 28. It was the lowest level since October 2000.

-

13:14

WSE: Mid session comment

The first half of today's session was marked by the strengthening of the zloty, which at yesterday's session played in the bull camp and significantly helped to distance the declines in European markets The today's morning-phase session was a simple reversal scenario. The weak zloty - pairs of USDPLN and EURPLN grow from a few hours - is combined with the pressure from the core markets and the WIG20 withdrawal to the region of 1,825 points. The activity of the market is correct and signals the realization of profits. There is no case in the fact that the role of leaders of the withdrawal was taken by energy companies, which were the engines of growth for several days.

In the mid-session the WIG20 index was at 1824 points (-1.06%). The turnover was amounted to PLN 230 mln.

-

12:00

European stock markets mid session: stocks traded lower on falling prices

Stock indices traded lower on a decline in oil prices.

The European Central Bank (ECB) President Mario Draghi said in a speech at the Brussels Economic Forum on Thursday that governments should implement structural reforms to support the central bank's stimulus measures.

"There are many understandable political reasons to delay structural reform, but there are few good economic ones. The cost of delay is simply too high," he said.

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to €25.6 billion in April from 26.2 in March. March's figure was revised up from a surplus of €26.0 billion. Exports were flat in April, while imports were down 0.2%.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Thursday. The U.K. trade deficit in goods narrowed to £10.53 billion in April from £10.65 billion in March. March's figure was revised up from a deficit of £11.20 billion.

The decline in deficit was driven by a rise in good exports, which increased by £11.2 billion in April.

The total trade deficit, including services, narrowed to £3.29 billion in April from £3.53 billion in March. It was the lowest level since September 2015.

March's figure was revised up from a deficit of £3.83 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,247.86 -53.66 -0.85 %

DAX 10,098.81 -118.22 -1.16 %

CAC 40 4,408.9 -39.83 -0.90 %

-

11:55

European Central Bank President Mario Draghi: governments should implement structural reforms to support the central bank’s stimulus measures

The European Central Bank (ECB) President Mario Draghi said in a speech at the Brussels Economic Forum on Thursday that governments should implement structural reforms to support the central bank's stimulus measures.

"There are many understandable political reasons to delay structural reform, but there are few good economic ones. The cost of delay is simply too high," he said.

-

11:30

U.K. trade deficit in goods narrows to £10.53 billion in April

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Thursday. The U.K. trade deficit in goods narrowed to £10.53 billion in April from £10.65 billion in March. March's figure was revised up from a deficit of £11.20 billion.

The decline in deficit was driven by a rise in good exports, which increased by £11.2 billion in April.

The total trade deficit, including services, narrowed to £3.29 billion in April from £3.53 billion in March. It was the lowest level since September 2015.

March's figure was revised up from a deficit of £3.83 billion.

-

11:10

Germany's trade surplus declines to €25.6 billion in April

Destatis released its trade data for Germany on Thursday. Germany's trade surplus decreased to €25.6 billion in April from 26.2 in March. March's figure was revised up from a surplus of €26.0 billion.

Exports were flat in April, while imports were down 0.2%.

On a yearly basis, German exports increased 3.8% in April, while imports were flat.

Germany's current account surplus was €28.8 billion in April, down from €29.9 billion in March. March's figure was revised down from a surplus of €30.4 billion.

-

10:57

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.5% in May

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.5% in May.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.3% from 3.5% in April. Analysts had expected the unemployment rate to remain unchanged at 3.5%.

The number of unemployed people in Switzerland fell by 4,762 to 144,778 in May from the previous month.

The youth unemployment rate was down to 3.0% in May from 3.2% in April.

-

10:27

Chinese consumer price index rises at annual rate of 2.0% in May

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 2.0% in May, missing expectations for a 2.3% increase, after a 2.3% gain in April.

Food prices rose at an annual rate of 5.9% in May, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation decreased 0.5% in May, after a 0.2% fall in April.

The Chinese producer price index (PPI) dropped 2.8% in May, beating expectations for a 3.3% fall, after a 3.4% decline in April.

-

10:09

Reserve Bank of New Zealand keeps its interest rate unchanged at 2.25% in June

The Reserve Bank of New Zealand (RBNZ) on Wednesday kept its interest rate unchanged at 2.25% as widely expected by analysts.

The RBNZ Graeme Wheeler said that New Zealand's economy was supported by strong inward migration, construction activity, tourism, and the central bank's accommodative monetary policy.

He pointed out on Wednesday that further monetary policy easing was possible.

"Further policy easing may be required to ensure that future average inflation settles near the middle of the target range," he said, adding that the monetary policy will depend on the incoming economic data.

Wheeler noted that the New Zealand dollar was "higher than appropriate", adding that a weaker currency was desirable.

The RBNZ governor also said that inflation was low, driven by lower prices for fuel and other imports, but long-term inflation expectations were well-anchored at 2%.

Wheeler pointed out that there were risks to inflation forecasts from the possible high net immigration and pressures in the housing market.

The RBNZ lowered its interest rate to 2.25% from 2.50% in March. This decision was not expected by market participants.

-

09:17

WSE: After opening

After five sessions of growth, the WIG20future contracts started from a small departure down, which was part of the morning atmosphere of futures markets Euroland.

WIG20 index opened at 1842.55 points (-0.07%)*

WIG 46520.31 -0.07%

WIG30 2052.12 -0.02%

mWIG40 3547.24 -0.07%

*/ - change to previous close

Europe begins the day of light revoke and the Warsaw Stock Exchange fits in the environment. After the first exchanges the WIG20 is located around 1,840 pts., which means a cosmetic loss of the index. Turnover is miserable. Several million for the whole basket, no opening of the two companies and clear breakout above the market of KGHM, with nearly 2 million turnover - half of the index - and with an increase of 1.7 percent. The asymmetry in the activity and strength of KGHM against falling of index indicates that the opening of the market does not have one idea, so probably soon will appear correlation with core markets.

-

08:26

WSE: Before opening

Wednesday's session on Wall Street did not finish with explosion of optimism, but joint boosters of main indices, which gained 0.3 to 0.4 percent and closed around daytime highs allow to call the close as a successful one. Currently the contract for the S&P500 is trading at light red level (-0,11%). Oil, on which force relied yesterday's booster on Wall Street, is listed on the positive territory and above the psychological barrier of $ 50. Not without significance is also the fact that the S&P500 rose the third day in a row and closed trading above 2,100 points, what promotes speculation of a breakout above the upper level of many months consolidation.

However may worry the strengthening of the euro against the dollar, which on the one hand indicates the positioning of the market to the lack of increases in US interest rates, but it also has the other side in the form of weakening demand for shares of European exporters.

On the Warsaw market yesterday's gain of the WIG20 confirms appetites of bulls to continue to rebound from the 1750 points. Inhibition in the region of 1,850 points also confirms sensitivity to equal levels and a 100-point increases in a few days are encouraged to take profits and some form of correction.

Potential threats can come from core markets, which - especially Wall Street - are in the points where it will be easy to the counterattack of supply side.

-

07:05

Global Stocks

European stocks closed mostly lower Wednesday, pulling back after their best performance in two weeks in the previous session, as attention turned to the start of corporate bond-buying by the European Central Bank.

U.S. stocks closed higher Wednesday as oil prices settled at their highest levels in nearly a year. The Dow Jones Industrial Average DJIA, +0.37% rose 66.77 points, or 0.4%, to close at 18,005.05. The S&P 500 Index SPX, +0.33% advanced 6.99 points, or 0.3%, to finish at 2,119.12, a new closing high for the year. The Nasdaq Composite Index COMP, +0.26% gained 12.89 points, or 0.3%, for a close of 4,974.64. Oil for July delivery CLN6, +0.57% settled at $51.23 a barrel, its highest level since July 2015.

Asian stocks edged up on Thursday after modest gains on Wall Street overnight, while a weaker dollar buoyed commodities such as gold and crude oil.

Investors have been stepping back into riskier assets globally over the past week after last Friday's worse-than-expected U.S. non-farm jobs report. Markets believe the weak job reading sharply reduced the chance that the Federal Reserve will raise interest rates this summer, which has taken some steam out of the dollar.

Chinese financial markets will close on Thursday and Friday for the Dragon Boat weekend holiday.

Japan's Nikkei share average fell on Thursday as a strong yen soured the mood and dragged down large-cap shares.

Some small-cap stocks, seen as safe-haven assets for investors cautious before big macro events next week, attracted buyers.

Major exporters lost ground after the dollar dipped 0.2 percent t 106.79 yen, moving back toward Monday's one-month low of 106.35.

Toyota Motor Corp and Honda Motor Co both dropped 1.2 percent, while Panasonic Corp stumbled 2.8 percent.

-

00:58

Stocks. Daily history for Jun 08’2016:

(index / closing price / change items /% change)

Nikkei 225 16,830.92 +155.47 +0.9 %

Hang Seng 21,297.88 -30.36 -0.1 %

S&P/ASX 200 5,369.98 -1.05 0.0%

Shanghai Composite 2,926.7 -9.35 -0.3 %

FTSE 100 6,301.52 +16.99 +0.3 %

CAC 40 4,448.73 -27.13 -0.6 %

Xetra DAX 10,217.03 -70.65 -0.7 %

S&P 500 2,119.12 +6.99 +0.3 %

NASDAQ Composite 4,974.64 +12.89 +0.3 %

Dow Jones Industrial Average 18,005.05 +66.77 +0.4 %

-