Noticias del mercado

-

21:00

Dow +0.39% 18,007.55 +69.27 Nasdaq +0.32% 4,977.72 +15.97 S&P +0.37% 2,119.87 +7.74

-

18:01

European stocks close: stocks closed mixed in the absence of any major economic reports from the Eurozone

Stock closed mixed in the absence of any major economic reports from the Eurozone. A fall in shares of the financial sector weighed on stock markets, while higher oil prices supported stocks. Oil prices rose on the U.S. crude inventories data.

Market participants eyed the Chinese trade data. The Chinese Customs Office released its trade data on Wednesday. China's trade surplus climbed to $49.9 billion in May from $45.56 billion in April, missing expectations for a rise to a surplus of $58.00 billion. Exports fell at an annual rate of 4.1% in May, while imports declined at an annual rate of 0.4%.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 2.0% in April, exceeding forecasts of a flat reading, after a 0.3% rise in March.

The increase was mainly driven by a rise in manufacturing.

On a yearly basis, industrial production in the U.K. increased 1.6% in April, beating expectations for a 0.4% drop, after a 0.2% decrease in March.

Manufacturing production in the U.K. was up 2.3% in April, beating expectations for a flat reading, after a 0.1% rise in March. It was the largest rise since July 2012.

The rise was mainly driven by an increase in the manufacture of basic pharmaceutical products and pharmaceutical preparations, which rose by 8.6% in April.

On a yearly basis, manufacturing production in the U.K. increased 0.8% in April, after a 1.9% drop in March.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,301.52 +16.99 +0.27 %

DAX 10,217.03 -70.65 -0.69 %

CAC 40 4,448.73 -27.13 -0.61 %

-

18:00

European stocks closed: FTSE 100 6,301.52 +16.99 +0.27% CAC 40 4,448.73 -27.13 -0.61% DAX 10,217.03 -70.65 -0.69%

-

17:47

European Central Bank (ECB) Governing Council member Ardo Hansson: purchases of corporate bonds could be more effective than purchases of government bonds

European Central Bank (ECB) Governing Council member Ardo Hansson said in an interview with The Wall Street Journal on Wednesday that purchases of corporate bonds could be more effective than purchases of government bonds.

"I've always thought that channels that work directly through enterprises and banks are the most likely channels to have an impact," he said.

The ECB started on Wednesday to buy corporate bonds under its quantitative easing programme.

Hanson also said that the central bank was prepared for the possible Britain's exit from the European Union (EU).

-

17:42

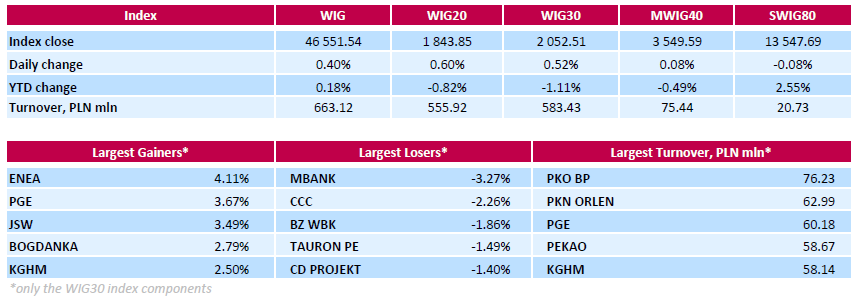

WSE: Session Results

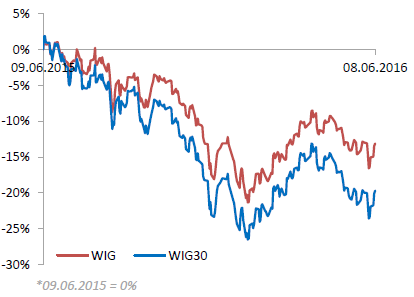

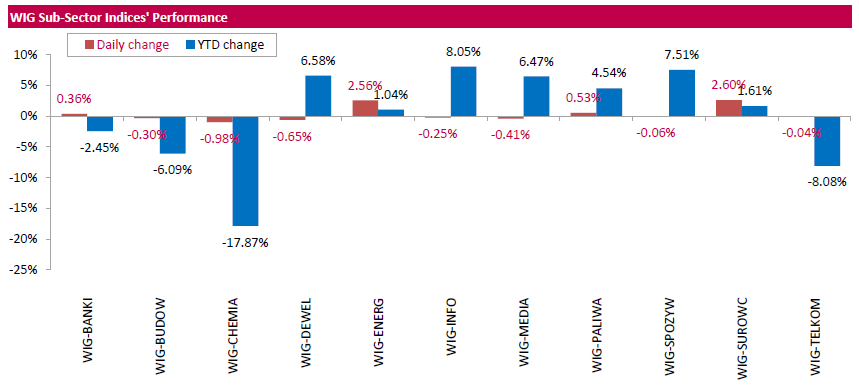

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, added 0.4%. Sector-wise, materials stocks (+2.60%) fared the best, while chemicals sector names (-0.98%) tumbled the most.

The large-cap stocks' measure, the WIG30 Index, rose by 0.52%. Within the index components, utilities names ENEA (WSE: ENA) and PGE (WSE: PGE) led the gainers, jumping by 4.11% and 3.67% respectively. Other major advancers were copper producer KGHM (WSE: KGH) and two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), which added between 2.5% and 3.49%. On the other side of the ledger, the session's biggest decliners were footwear retailer CCC (WSE: CCC) and two banking sector names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which lost between 1.86% and 3.27%.

-

17:41

European Central Bank (ECB) Governing Council member François Villeroy de Galhau: there are limits to negative interest rates

European Central Bank (ECB) Governing Council member François Villeroy de Galhau said on Wednesday that there were limits to negative interest rates.

"Not all unconventional instruments are legitimate. There are limits on how negative interest rates can go," he said.

de Galhau pointed out that helicopter money was not an option.

-

17:22

Home loans in Australia rise 1.7% in April

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia rose 1.7% in April, missing expectations for a 2.5% rise, after 0.7% decrease in March. March's figure was revised up from a 0.9% fall.

The value of owner occupied loans increased at a seasonally adjusted 0.1% in April, investment lending dropped 5.0%, while the number of loans for the construction of dwellings climbed 4.4%.

-

17:12

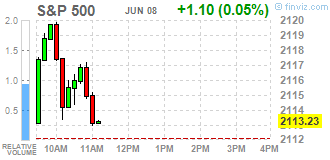

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes rose on Wednesday, with the S&P inching closer to its record high, as oil prices increased again and chances of an interest rate hike in the near term faded. Oil held above $50 for the second consecutive day on supply disruptions in Nigeria, a drop in U.S. crude inventories and strong demand in China.

Most of all of Dow stocks in positive area (19 of 30). Top looser - Verizon Communications Inc. (VZ, -0,66%). Top gainer - Caterpillar Inc. (CAT, +2,07%).

Almost all of S&P sectors also in positive area. Top looser - Conglomerates (-0,3%). Top gainer - Basic Materials (+1,2%).

At the moment:

Dow 17965.00 +32.00 +0.18%

S&P 500 2114.00 +3.75 +0.18%

Nasdaq 100 4509.00 -5.25 -0.12%

Crude Oil 50.96 +0.60 +1.19%

Gold 1263.80 +16.80 +1.35%

U.S. 10yr 1.71 -0.01

-

16:39

Japan’s Eco Watchers' current conditions index falls to 43.0 in May

Japan's Cabinet Office released Eco Watchers' Index figures on Wednesday. Japan's economy watchers' current conditions index fell to 43.0 in May from 43.5 in April. It was the lowest level since November 2014.

Japan's economy watchers' future conditions index increased to 47.5 in May from 45.5 in April.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

16:35

NIESR’s gross domestic product rises by 0.5% in three months to May

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to May, after a 0.4% growth in three months to April. The previous figure was revised up from a 0.3% growth.

"A rebound of production sector output in April has supported a reasonable GDP growth in the three months to May 2016," James Warren, NIESR Research Fellow, said.

-

16:32

Job openings climb to 5.788 million in April

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Wednesday. Job openings jumped to 5.788 million in April from 5.670 million in March, missing expectations for a rise to 5.672. March's figure was revised down from 5.757 million.

The number of job openings rose for total private (5.289 million) and for government (498,000) in April from March.

The hires rate was 3.5% in April.

Total separations decreased to 4.988 million in April from 5.096 million in March.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:46

WSE: After start on Wall Street

The behavior of currency pairs EURPLN and USDPLN leaves no doubt that some of today's power of the Warsaw market and current approach to the region 1,850 points by the WIG20 is an element of improving sentiment towards Polish assets. The last five hours on the zloty support relative strength of the WIG20 compare to European markets. In other words, there would be no increases in the WIG20 by 0.8 per cent, if not a similar decline in EURPLN and USDPLN rates. As always with such a strong currency movements, there is a risk of return, which would have seen by investors.

At the end of the day it will be important, however, closing above the trend line, which will change the balance of power on the graph and will allow to look above the level of 1,850 points on the WIG20. Risks on the last line seem to be well defined - downward pressure from German market, where the DAX is testing daily minima, potential withdrawal on Wall Street and profit taking on the zloty.

-

15:44

OECD’s leading composite leading indicator remains unchanged at 99.6 in April

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Wednesday. The composite leading indicator remained unchanged at 99.6 in April.

It signalled stable growth in the Eurozone as a whole, Canada, France, Japan, Germany and China.

Growth firmed in India.

The index for Italy and the U.K. pointed to an easing in growth momentum.

The index for the U.S. confirmed signs of stabilisation.

The index for Russia showed signs of positive change in growth momentum.

-

15:34

U.S. Stocks open: Dow +0.19%, Nasdaq +0.15%, S&P +0.14%

-

15:24

Before the bell: S&P futures +0.20%, NASDAQ futures +0.23%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 16,830.92 +155.47 +0.93%

Hang Seng 21,297.88 -30.36 -0.14%

Shanghai Composite 2,926.7 -9.35 -0.32%

FTSE 6,291.95 +7.42 +0.12%

CAC 4,461.16 -14.70 -0.33%

DAX 10,239.71 -47.97

Crude $51.00 (+1.27%)

Gold $1259.40 (+0.99%)

-

14:58

Building permits in Canada declines 0.3% in April

Statistics Canada released housing market data on Wednesday. Building permits in Canada declined 0.3% in April, missing expectations for a 1.5% rise, after a 6.3% drop in March. March's figure was revised up from a 7.0% decrease.

The decrease was driven by a decline in building permits in Ontario, Quebec and Nova Scotia.

Building permits for non-residential construction were up 2.5% in April, while permits in the residential sector plunged 1.8%.

-

14:53

Housing starts in Canada fall to a seasonally adjusted annualized rate of 188,570 units in May

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Wednesday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 188,570 units in May from 191,388 units in April. April's figure was revised down from 191,512 units.

Housing starts were mainly driven by a drop in the multi-unit segment.

"Housing starts slowed in May, and are now on pace to reach 191,000 units in Canada - falling within the upper range of our housing market outlook forecast for the year. The decline we see in the trend is led by fewer multiple starts in urban areas, particularly in larger centres like Toronto," the CMHC's Chief Economist Bob Dugan said.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.99

0.20(2.0429%)

46009

Amazon.com Inc., NASDAQ

AMZN

726

2.26(0.3123%)

8649

Apple Inc.

AAPL

99.15

0.12(0.1212%)

17176

AT&T Inc

T

39.65

-0.14(-0.3518%)

1242

Barrick Gold Corporation, NYSE

ABX

19.53

0.71(3.7726%)

103586

Caterpillar Inc

CAT

77.2

0.39(0.5077%)

3121

Chevron Corp

CVX

103.81

0.49(0.4743%)

2190

Cisco Systems Inc

CSCO

29.17

0.10(0.344%)

600

Citigroup Inc., NYSE

C

45.78

0.24(0.527%)

307

Exxon Mobil Corp

XOM

91.09

0.38(0.4189%)

7286

Facebook, Inc.

FB

118.06

0.30(0.2548%)

39063

Ford Motor Co.

F

13.42

0.04(0.299%)

36345

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.63

0.39(3.4698%)

324305

General Electric Co

GE

30.14

-0.00(-0.00%)

35746

General Motors Company, NYSE

GM

30

0.15(0.5025%)

7411

Google Inc.

GOOG

725

8.35(1.1651%)

11946

Hewlett-Packard Co.

HPQ

13.7

0.01(0.073%)

100

Intel Corp

INTC

31.87

-0.01(-0.0314%)

361

International Business Machines Co...

IBM

153.4

0.07(0.0456%)

208

Johnson & Johnson

JNJ

115.73

0.00(0.00%)

545

JPMorgan Chase and Co

JPM

65.06

-0.00(-0.00%)

1090

Microsoft Corp

MSFT

52.09

-0.01(-0.0192%)

1125

Nike

NKE

53.94

0.39(0.7283%)

3569

Starbucks Corporation, NASDAQ

SBUX

55.29

-0.01(-0.0181%)

2210

Tesla Motors, Inc., NASDAQ

TSLA

234.2

1.86(0.8005%)

37035

Twitter, Inc., NYSE

TWTR

15.1

0.10(0.6667%)

31658

Visa

V

80.99

0.39(0.4839%)

750

Walt Disney Co

DIS

98.5

0.15(0.1525%)

720

Yahoo! Inc., NASDAQ

YHOO

36.91

0.18(0.4901%)

1408

Yandex N.V., NASDAQ

YNDX

22.01

0.08(0.3648%)

1155

-

13:13

WSE: Mid session comment

In the first half of the session, the Warsaw market proved that even under the blows of the supply on banks shares caused by the reported foreign currency mortgage loans, demand can seek increases. It is a signal that investors in Warsaw all the time working on the assumption that a few weeks of the downward trend will be broken and the game will begin at higher resistances.

Stronger zloty and good attitude of energy companies prevailed and the WIG20 index recovered all the losses from the morning and close the gap from opening.

In the segment of energy companies the decrease in the valuation of shares showed Tauron (WSE: TPE) after information about the lack of dividends. AGM of the company decided not to pay a dividend amounting to PLN 0.1 per share, as previously was recommended by the Management Board.

At the halfway point of the session the index WIG20 reached the level of 1,840 points ((+041%) with the turnover of PLN 236 mln.

-

12:00

European stock markets mid session: stocks traded mixed in the absence of any major economic reports from the Eurozone

Stock indices traded mixed in the absence of any major economic reports from the Eurozone.

Market participants eyed the Chinese trade data. The Chinese Customs Office released its trade data on Wednesday. China's trade surplus climbed to $49.9 billion in May from $45.56 billion in April, missing expectations for a rise to a surplus of $58.00 billion. Exports fell at an annual rate of 4.1% in May, while imports declined at an annual rate of 0.4%.

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 2.0% in April, exceeding forecasts of a flat reading, after a 0.3% rise in March.

The increase was mainly driven by a rise in manufacturing.

On a yearly basis, industrial production in the U.K. increased 1.6% in April, beating expectations for a 0.4% drop, after a 0.2% decrease in March.

Manufacturing production in the U.K. was up 2.3% in April, beating expectations for a flat reading, after a 0.1% rise in March. It was the largest rise since July 2012.

The rise was mainly driven by an increase in the manufacture of basic pharmaceutical products and pharmaceutical preparations, which rose by 8.6% in April.

On a yearly basis, manufacturing production in the U.K. increased 0.8% in April, after a 1.9% drop in March.

Current figures:

Name Price Change Change %

FTSE 100 6,287.65 +3.12 +0.05 %

DAX 10,232.78 -54.90 -0.53 %

CAC 40 4,456.22 -19.64 -0.44 %

-

11:51

Germany’s manufacturing turnover rises by 0.8% in April

Destatis released its manufacturing turnover data for Germany on Wednesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 0.8% in April, after a 0.7% fall in March. March's figure was revised up a 1.1% decrease.

Domestic turnover increased by 0.2% in April, while the business with foreign customers climbed 1.5%.

Sales to euro area countries rose 0.5% in April, while sales to other countries were up 2.1%.

On a yearly basis, real manufacturing turnover in Germany was up on adjusted for working days basis by 0.9% in April, after a 0.9% rise in March.

-

11:46

Bank of France downgrades its growth forecast for the second quarter

The Bank of France lowered its growth forecast for the second quarter on Wednesday. The central bank expects the French economy to expand 0.2% in the second quarter, down from the previous estimate of a 0.3% growth.

The manufacturing business confidence index rose to 97 in May from 99 in April.

The services business sentiment index increased to 98 in May from 96 in April.

The construction business sentiment index remained unchanged at 97 in May.

-

11:39

Japan’s current account surplus declines to ¥1,879 billion in April

Japan's Ministry of Finance released its current account data for Japan late Tuesday evening. Japan's current account surplus fell to ¥1,879 billion in April from ¥2,980 billion in March, missing expectations for a surplus of ¥2,318.9 billion.

The trade surplus rose to ¥697.1 billion in April, down from a surplus of ¥927.2 billion in March.

Exports dropped at an annual rate of 10.4% in April, while imports plunged 23.1%.

-

11:33

Switzerland’s consumer price inflation rises 0.1% in May

The Swiss Federal Statistics Office released its consumer inflation data on Wednesday. Switzerland's consumer price index rose 0.1% in May, missing expectations for a 0.2% gain, after a 0.3% increase in April.

The increase was mainly driven by higher prices for petroleum products, food and rents.

On a yearly basis, Switzerland's consumer price index remained unchanged at -0.4% in May, in line with forecasts.

-

11:24

U.K. industrial production rises 2.0% in April

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Wednesday. Industrial production in the U.K. rose 2.0% in April, exceeding forecasts of a flat reading, after a 0.3% rise in March.

The increase was mainly driven by a rise in manufacturing.

On a yearly basis, industrial production in the U.K. increased 1.6% in April, beating expectations for a 0.4% drop, after a 0.2% decrease in March.

Manufacturing production in the U.K. was up 2.3% in April, beating expectations for a flat reading, after a 0.1% rise in March. It was the largest rise since July 2012.

The rise was mainly driven by an increase in the manufacture of basic pharmaceutical products and pharmaceutical preparations, which rose by 8.6% in April.

On a yearly basis, manufacturing production in the U.K. increased 0.8% in April, after a 1.9% drop in March.

-

11:17

European companies in China expresse pessimism about doing business in China

According to a survey by the European Union Chamber of Commerce in China, European companies in China expressed pessimism about doing business in China. 56% of respondents said that doing business became more difficult over the past year. Companies said that there were controls on the internet, and the Chinese government's implementation of the reforms was too slow.

-

11:10

Consumer credit in the U.S. increases by $13.42 billion in April

The Fed released its consumer credits figures on Tuesday. Consumer credit in the U.S. rose by $13.42 billion in April, missing expectations for a $18.00 billion increase, after a $28.38 billion gain in March. March's figure was revised down from a $29.67 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit rose by 2.1% in April, while non-revolving credit jumped by 5.4%.

-

10:53

China's trade surplus widens $49.9 billion in May

The Chinese Customs Office released its trade data on Wednesday. China's trade surplus climbed to $49.9 billion in May from $45.56 billion in April, missing expectations for a rise to a surplus of $58.00 billion.

Exports fell at an annual rate of 4.1% in May, while imports declined at an annual rate of 0.4%.

-

10:23

Japan’s final GDP rises 0.5% in the first quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Tuesday evening. Japan's GDP increased by 0.5% in the first quarter, up from the preliminary reading of a 0.4% growth, after a 0.3% drop in the fourth quarter.

Business spending fell 0.7% in the first quarter, up from a preliminary reading of a 1.4% drop, while household spending increased 0.6%, unchanged from a preliminary reading.

On a yearly basis, Japan's economy expanded 1.9% in the first quarter, up from the preliminary reading of a 1.7% rise, after a 1.1% decline in the fourth quarter.

-

10:12

World Bank lowered its global economic forecasts for 2016 and 2017

The World Bank on Tuesday cut its global economic growth forecast for 2016 and 2017 due to weak growth in advanced economies, low commodity prices, weak global trade, and diminishing capital flows.

The World Bank expects that the global economy would grow 2.4% in 2016, down from January forecast of 2.9%. 2017 global growth was downgraded to 2.8%, down from its January forecast of 3.1%.

"As advanced economies struggle to gain traction, most economies in South and East Asia are growing solidly, as are commodity-importing emerging economies around the world," World Bank Senior Vice President and Chief Economist Kaushik Basu said.

China's economy is expected to expand 6.7% in 2016 and 6.5% in 2017, both unchanged from January forecasts.

Growth in the U.S. is expected to expand 1.9% in 2016, down from January forecast of 2.7, and 2.2% in 2017, down from January forecast of 2.4.

In the Eurozone, the economy is expected to grow 1.6% in 2016, down from January forecast of 1.7%, and 1.6% in 2017, down from January forecast of 1.7%.

-

09:19

WSE: After opening

WIG20 index opened at 1833.06 points (+0.01%)

WIG 46263.25 -0.22%

WIG30 2036.56 -0.27%

mWIG40 3537.38 -0.27%

*/ - change to previous close

Our market has already accustomed to the fact that the opening usually do not have too strong deviations. Contracts started on symbolic growth deviation typing roughly sentiment in Euroland.

Build yesterday's rise, among others, on correlation with core markets has consequences for today's opening. In solidarity with Europe the WIG20 withdrawal captures more than 1 percent after after less than twenty minutes of trading. Duplicate of German DAX drop is clear and indicates that the market is influenced by the atmosphere in the environment. Despite the depreciation of the start of the day it can be considered quiet. The turnover is so low so we may not speak of a serious counterattack of supply, although the same departure from the downtrend line encourages investors to realize even short-term profits.

-

08:25

WSE: Before opening

During Tuesday's session, the S&P500 made an unsuccessful attempt to attack the historical peaks, but still managed to finish the day at the highest level in 11 months. A drawback of the session were the lowest this year turnover, however the S&P500 index reached 2119.21 points - the maximum value during Tuesday's session. New York indexes were rising to the mid-session, but investors were clearly paralyzed of proximity to a historic high on the S&P500. In the second half of the day the S&P500 returned most of the gains, ending the session with a growth of only 0.13%.

Today, in principle, there is no macro data from the US, although it can be a formality mentioned that at 13:00 (Warsaw time) we will know the dynamics of the number of weekly mortgage applications, while at 16:30 the weekly change of fuel stocks.

In Poland, the Monetary Policy Council will announce today - probably around noon or a little later - a decision on interest rates. It is assumed generally no change, ie. to maintain the level of 1.5 percent of the main interest. MPC communiqué will be announced at 16:00.

The technical situation of futures contracts FW20 after Tuesday's growth into correction motion. Despite this, in the case of continuing increases in line resistance can be expected at around 1835 - 1,849 points.

Rebound of Thursday's bottom on the Warsaw market may prove to be correction, if there would be a rapid solstice and falls in stock markets in the US. Key support is located in the region of 1,800 points.

-

07:18

Global Stocks

European stocks bounced higher Tuesday, recording a second straight gain, and its best daily percentage advance in two weeks, a day after Federal Reserve Chairwoman Janet Yellen offered guidance on U.S. monetary policy plans.

The S&P 500 and the Dow industrials eked out modest gains Tuesday as the indexes crept within striking distance of fresh highs, propelled by a sharp rally in the energy sector.

However, a slump in biotech weighed on the Nasdaq Composite, dragging it into negative territory.

Asian shares were flat on Wednesday, as weak Chinese export data offset a brightening energy sector outlook and an expected delay in interest rate hikes by the U.S. Federal Reserve.

Japan's Nikkei .N225 extended losses to trade 0.3 percent lower, weighed down by a stronger yen.

Chinese shares also slipped, with the CSI 300 .CSI300 and the Shanghai Composite indices both down 0.7 percent. Hong Kong's Hang Seng slid 0.4 percent.

Chinese dollar-denominated exports declined 4.1 percent in May from a year earlier, compared with the expected drop of 3.6 percent. Imports fell 0.4 percent, less than the expected 6 percent. China's trade surplus is forecast to hit $50 billion in May.

The advance was led by 2.1 percent gains in energy shares .SPNY as oil prices jumped more than 1 percent to hit 2016 highs on expectations of domestic stockpile draws and worries about supply shortfalls from attacks on Nigeria's oil industry.

A report by trade group American Petroleum Institute (API), released after Tuesday's close showed a crude draw of 3.6 million barrels, larger than expectations of 2.7 million barrels, supporting the market.

U.S. crude futures CLc1 rose 0.1 percent to $50.43 per barrel, near its Tuesday high of $50.53, a level last seen in October.

Global benchmark Brent futures LCOc1 was little changed at $51.47, close to the eight-month high of $51.55 per barrel hit earlier in the session.

-

04:05

Nikkei 225 16,664.15 -11.30 -0.07%, Hang Seng 21,223.36 -104.88 -0.49%, Shanghai Composite 2,929.59 -6.46 -0.22%

-

00:29

Stocks. Daily history for Jun 07’2016:

(index / closing price / change items /% change)

Nikkei 225 16,675.45 +95.42 +0.58%

Hang Seng 21,328.24 +298.02 +1.42%

S&P/ASX 200 5,371.03 +10.60 +0.20%

Shanghai Composite 2,936.21 +2.11 +0.07%

FTSE 100 6,284.53 +11.13 +0.18%

CAC 40 4,475.86 +52.48 +1.19%

Xetra DAX 10,287.68 +166.60 +1.65%

S&P 500 2,112.13 +2.72 +0.13%

NASDAQ Composite 4,961.75 -6.96 -0.14%

Dow Jones 17,938.28 +17.95 +0.10%

-