Noticias del mercado

-

17:37

British Chambers of Commerce’s Quarterly Economic Survey: Britain’s economy continues to slow in the first quarter

The British Chambers of Commerce (BCC) released its Quarterly Economic Survey for the U.K. on Monday. The BCC said that Britain's economy continued to slow in the first quarter.

According to the survey, the manufacturing sector improved slightly in the first quarter, while several key indicators for the services sector declined slightly.

The BCC pointed out that there were the downside risks to the outlook.

"These results are disappointing but not surprising. Although GDP growth for the previous quarter was upgraded slightly, our survey points to a slowdown in Q1 2016. This is the inevitable consequence of mounting global and domestic uncertainties, but it is nevertheless concerning that the vibrant and dominant services sector is likely to face mounting challenges in the next few years," David Kern, Chief Economist of the British Chambers of Commerce, said.

-

16:17

German Economy Ministry: the German economy accelerates at the start of this year

German Economy Ministry said in its monthly report on Monday that the country's economy accelerated at the start of this year, driven by domestic demand, but external environment remains subdued.

"The German economy has picked up speed at the start of the year," the ministry said.

The ministry noted that the growth is expected to slow in the coming months.

-

16:08

Bank of Japan’ survey: consumer confidence in Japan decline in March

According to a quarterly survey by the Bank of Japan, consumer confidence in Japan declined to -22.5 in March from -17.3 in December. One-year expectations fell to -30.9 in March from -19.9 in December.

75.7% of respondents expect inflation to rise next year, down from 77.6% in December.

-

16:01

U.S. Treasury Secretary Jack Lew said on Monday that the competitive devaluation of currencies was "unacceptable"

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY: 108.00 (USD 260m) 109.95-110.00 (380m)

EURUSD: 1.1319 (USD 203m) 1.1350 (244m) 1.1400 (227m) 1.1430 (388m)

GBPUSD: 1.4200 (GBP 383m)

EURGBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

AUDUSD: 0.7240 (AUD 497m) 0.7260-65 (AUD 1.53bln) 0.7395 (291m) 0.7605 (200m)

USDCAD: 1.3000 (USD 200m) 1.3200-05 (225m)

-

15:34

European Central Bank Governing Council member Francois Villeroy de Galhau: a post of the finance minister for the Eurozone should be created

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Monday that a post of the finance minister for the Eurozone should be created. The finance minister should coordinate national fiscal and structural polices, de Galhau noted.

-

14:35

OECD’s leading composite leading indicator declines to 99.6 in February

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.6 in February from 99.7 in December.

It signalled stable growth in the Eurozone as a whole.

The index for the U.S., the U.K., Germany, Italy and Japan pointed to an easing in growth momentum.

The index for Canada, India, France and China showed the signs of stabilisation.

The index for Russia showed signs of a loss in growth momentum.

-

14:11

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans February -4.4% Revised From -3.9% 2.0% 1.5%

01:30 China PPI y/y March -4.9% -4.6% -4.3%

01:30 China CPI y/y March 2.3% 2.5% 2.3%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

New York Fed President William Dudley is scheduled to speak at 13:25 GMT. Dudley said in a speech on Friday that the Fed should be cautious in raising its interest rate as there were risks from abroad to the U.S. economy. He noted that there were still the downside risks to U.S. inflation and growth outlooks.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

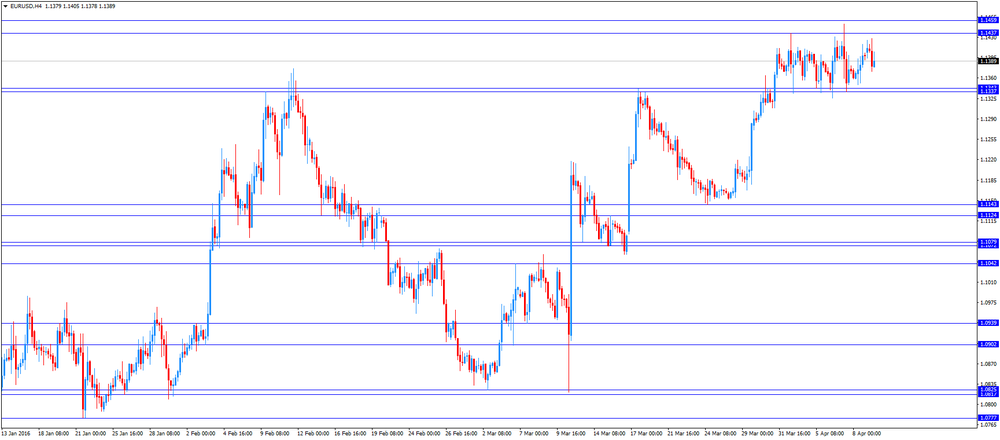

EUR/USD: the currency pair declined to $1.1371

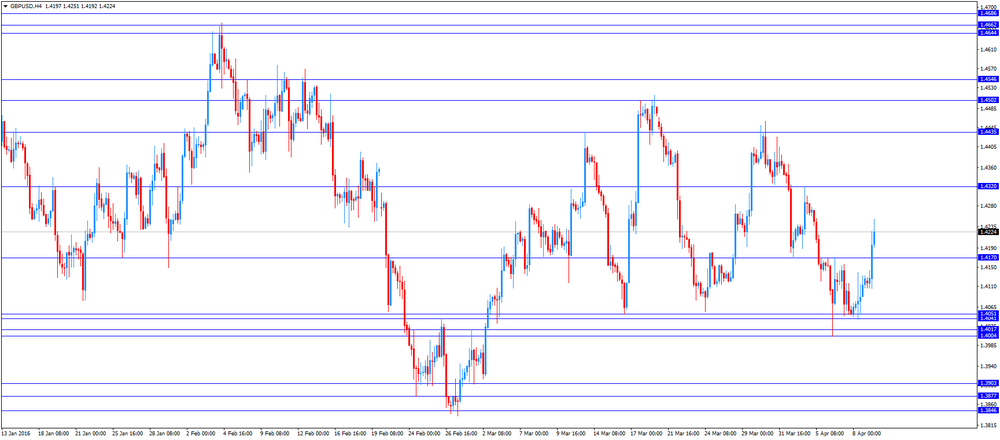

GBP/USD: the currency pair rose to $1.4251

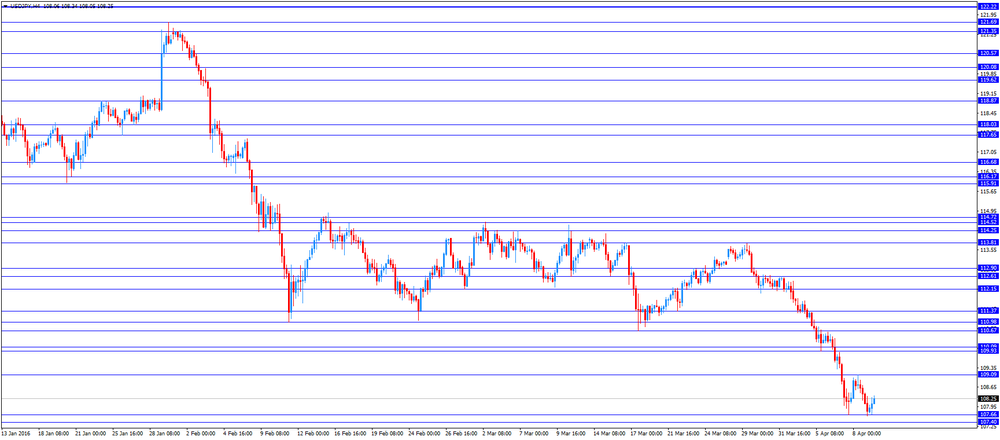

USD/JPY: the currency pair increased to Y108.34

The most important news that are expected (GMT0):

13:25 U.S. FOMC Member Dudley Speak

-

13:50

Orders

EUR/USD

Offers 1.1425-30 1.1450 1.1460-70 1.1480 1.1500 1.1530 1.1550

Bids 1.1385 1.1370 1.1350 1.1330-35 1.1310 1.1300 1.1275-80 1.1250 1.1230 1.1200

GBP/USD

Offers 1.4150-55 1.4180-85 1.4200 1.4230 1.4250 1.4280 1.4300

Bids 1.4100 1.4080 1.4050-60 1.4025-30 1.4000 1.3980-85 1.3965 1.3950

EUR/JPY

Offers 123.20 123.50 123.80 124.00 124.30 124.50 124.80 125.00

Bids 122.70-75 122.50 122.00 121.80 121.50 121.00

EUR/GBP

Offers 0.8100 0.8120 0.8130 0.8150 0.8180 0.8200

Bids 0.8050-55 0.8025-30 0.8000 0.7970-75 0.7950

USD/JPY

Offers 108.00 108.25-30 108.50 108.80-85 109.00-10 109.30 109.50

Bids 107.60-65 107.50 107.30 107.00 1.0680 106.50 106.00

AUD/USD

Offers 0.7575-80 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids 0.7520-25 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

11:47

World Bank: developing East Asia will expand 6.3% in 2016

The World Bank released its forecast for economic growth in developing countries in East Asia and Pacific on Monday. Developing East Asia is expected to expand 6.3% in 2016, down from its October estimate of a 6.4% growth, and 6.2% in 2017, down from its October estimate of a 6.3% growth.

Developing East Asia grew 6.5% in 2015.

The downgrade was driven by a slowdown in the Chinese economy.

China is expected to grow 6.7% in 2016 and 6.5% in 2017, unchanged from October forecasts.

"The region has benefited from careful macroeconomic policies, including efforts to boost domestic revenue in some commodity-exporting countries. But sustaining growth amid challenging global conditions will require continued progress on structural reforms," incoming World Bank East Asia and Pacific Regional Vice President, Victoria Kwakwa, said.

-

11:37

Home loans in Australia rise 1.5% in February

The Australian Bureau of Statistics released its home loans data on Monday. Home loans in Australia rose 1.5% in February, missing expectations for a 2.0% gain, after 4.4% decrease in January. January's figure was revised down from a 3.9% drop.

The value of owner occupied loans increased at a seasonally adjusted 1.7% in February, investment lending climbed 4.1%, while the number of loans for the construction of dwellings slid 1.9%.

-

11:27

Bank of Japan Governor Haruhiko Kuroda: the central bank will add further stimulus measures if needed to achieve its inflation target

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Monday that the central bank would add further stimulus measures if needed to achieve 2% inflation target. He also said that the BoJ would closely monitor which impact the developments on the global markets could have on the Japanese economy and prices.

-

11:22

Core machinery orders in Japan slide 9.2% in February

Japan's Cabinet Office released its core machinery orders data on late Sunday evening. Core machinery orders in Japan slid 9.2% in February, beating expectations for a 12.4% decline, after a 15.0% rise in January.

The total number of machinery orders climbed 4.7% in February from a month earlier.

Orders from non-manufacturers were up 10.2% in February, while orders from manufacturers plunged 30.6%.

On a yearly basis, core machinery orders declined 0.7% in February, beating expectations for a 2.7% decrease, after a 8.4% increase in January.

-

11:14

Industrial production in Italy falls 0.6% in February

The Italian statistical office Istat released its industrial production data on Monday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.6% in February, after a 1.7% rise in January. January's figure was revised down from a 1.9% increase.

The decrease was mainly driven by declines in production of energy goods and in production of consumer goods.

On a yearly basis, industrial production in Italy climbed at a seasonally-adjusted rate of 1.2% in February, after a 3.8% increase in January. January's figure was revised down from 3.9% gain.

-

11:05

Former Bank of Japan’s Board member Sayuri Shirai: it is unlikely that the central bank will add further stimulus measures at its next meeting

Former Bank of Japan's Board member Sayuri Shirai said on Monday that it is unlikely that the central bank will add further stimulus measures at its next meeting April 27-28. She noted that there was not a lot of room to cut interest rate further.

-

10:36

Institute of International Finance’s report: capital outflows from emerging economies are expected to slow this year

According to a report by the Institute of International Finance (IIF), capital outflows from emerging economies are expected to slow this year. Net outflows from emerging economies are expected to be $500 billion in 2016, down from $750 billion in 2015, while net outflows from China expected to decline to $530 billion from $675 billion.

-

10:23

Chinese consumer price index rises at annual rate of 2.3% in March

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Monday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in March, missing expectations for a 2.5% increase, after a 2.3% gain in February.

Food prices rose at an annual rate of 7.8% in March, while non-food prices increased 1.0%.

On a monthly basis, consumer price inflation decreased 0.4% in March, after a 1.6% rise in February.

The Chinese producer price index (PPI) dropped 4.3% in March, beating expectations for a 4.6% fall, after a 4.9% decline in February.

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY: 108.00 (USD 260m) 109.95-110.00 (380m)

EUR/USD: 1.1319 (USD 203m) 1.1350 (244m) 1.1400 (227m) 1.1430 (388m)

GBP/USD: 1.4200 (GBP 383m)

EUR/GBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

AUD/USD: 0.7240 (AUD 497m) 0.7260-65 (AUD 1.53bln) 0.7395 (291m) 0.7605 (200m)

USD/CAD: 1.3000 (USD 200m) 1.3200-05 (225m)

-

08:28

Asian session: The dollar notched a fresh 17-month low against the yen

The dollar notched a fresh 17-month low against the yen. In addition to a stronger currency, data released early on Monday showed Japan's core machinery orders fell 9.2 percent in February from the previous month, in a sign that business investment remains subdued.

Data out on Monday showed China's consumer price inflation was less than expected in March, while wholesale prices declined less than anticipated, in a sign that deflationary pressure in the industrial sector may be easing. While the figures pointed to stabilizing prices, they also underscored that the central bank's prolonged easing campaign begun in late 2014 has yet to result in substantial price increases.

The greenback's recent slide against the yen prompted a chorus of warnings from officials in Tokyo and put investors on alert for direct yen-selling intervention, though many believed Japan would stay its invention hand.

Japan's top government spokesman, Chief Cabinet Secretary Yoshihide Suga, said on Monday that recent currency moves were one-sided and speculative and that the government would take steps as needed.

The dollar wallowed close to lows notched last week, as investors mulled the outlook for U.S. monetary policy, with the Federal Reserve seen as being more cautious on hiking interest rates than some investors had believed.

EUR/USD: during the Asian session the pair traded in the range of $1.1395-25

GBP/USD: during the Asian session the pair traded in the range of $1.4105-45

USD/JPY: during the Asian session the pair fell to Y107.65

Based on Reuters materials

-

07:08

Options levels on monday, April 11, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1550 (1831)

$1.1502 (1755)

$1.1456 (480)

Price at time of writing this review: $1.1411

Support levels (open interest**, contracts):

$1.1339 (152)

$1.1295 (2462)

$1.1236 (2286)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 28687 contracts, with the maximum number of contracts with strike price $1,1500 (2622);

- Overall open interest on the PUT options with the expiration date May, 6 is 40895 contracts, with the maximum number of contracts with strike price $1,0900 (4911);

- The ratio of PUT/CALL was 1.43 versus 1.55 from the previous trading day according to data from April, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.4406 (1463)

$1.4309 (1061)

$1.4213 (1023)

Price at time of writing this review: $1.4139

Support levels (open interest**, contracts):

$1.4085 (1170)

$1.3989 (1521)

$1.3892 (907)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 21701 contracts, with the maximum number of contracts with strike price $1,4500 (2198);

- Overall open interest on the PUT options with the expiration date May, 6 is 22407 contracts, with the maximum number of contracts with strike price $1,3800 (2524);

- The ratio of PUT/CALL was 1.03 versus 0.97 from the previous trading day according to data from April, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:31

China: PPI y/y, March -4.3% (forecast -4.6%)

-

03:31

Australia: Home Loans , February 1.5% (forecast 2.0%)

-

03:30

China: CPI y/y, March 2.3% (forecast 2.5%)

-

01:50

Japan: Core Machinery Orders, y/y, February -0.7% (forecast -2.7%)

-

01:50

Japan: Core Machinery Orders, February -9.2% (forecast -12.4%)

-

00:29

Currencies. Daily history for Apr 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1398 +0,23%

GBP/USD $1,4125 +0,52%

USD/CHF Chf0,9532 -0,30%

USD/JPY Y108,06 -0,19%

EUR/JPY Y123,15 +0,03%

GBP/JPY Y152,61 +0,33%

AUD/USD $0,7553 +0,65%

NZD/USD $0,6808 +0,47%

USD/CAD C$1,2987 -1,26%

-