Noticias del mercado

-

19:45

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes gains driven by materials stocks on Monday as a weaker dollar boosted commodities, and investors turned their focus to the earnings season. Profits at S&P 500 companies are expected to have fallen 7.7% on average in the first quarter, according to Thomson Reuters, under pressure from a weak global economy.

Most of Dow stocks in positive area (21 of 30). Top looser - NIKE, Inc. (NKE, -1,46%). Top gainer - The Goldman Sachs Group, Inc. (GS, +2,24%).

Almost all S&P sectors in positive area. Top looser - Healthcare (-0,4%). Top gainer - Basic Materials (+1,2%).

At the moment:

Dow 17572.00 +87.00 +0.50%

S&P 500 2047.50 +6.75 +0.33%

Nasdaq 100 4492.25 +25.00 +0.56%

Oil 40.09 +0.37 +0.93%

Gold 1257.90 +14.10 +1.13%

U.S. 10yr 1.73 +0.01

-

18:05

European stocks closed: FTSE 6200.12 -4.29 -0.07%, DAX 9682.99 60.73 0.63%, CAC 40 4312.63 9.51 0.22%

-

18:00

European stocks close: stocks closed mixed in the absence of any major economic reports from Europe

Stock indices closed mixed in the absence of any major economic reports from Europe.

Oil prices remained in focus. Oil prices rose as market participants were awaiting the meeting between OPEC and non-OPEC countries in Doha on April 17 is likely to be in focus in the coming days. Participants plan to discuss the freeze of the oil output at January levels. There is uncertainty if a deal could be reached. Iran will participate at that meeting but it is unlikely that the country will freeze its oil output. Oil prices are expected to be volatile before the meeting

Market participants also eyed the Chinese inflation data. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Monday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in March, missing expectations for a 2.5% increase, after a 2.3% gain in February.

The Chinese producer price index (PPI) dropped 4.3% in March, beating expectations for a 4.6% fall, after a 4.9% decline in February.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,200.12 -4.29 -0.07 %

DAX 9,682.99 +60.73 +0.63 %

CAC 40 4,312.63 +9.51 +0.22 %

-

17:37

British Chambers of Commerce’s Quarterly Economic Survey: Britain’s economy continues to slow in the first quarter

The British Chambers of Commerce (BCC) released its Quarterly Economic Survey for the U.K. on Monday. The BCC said that Britain's economy continued to slow in the first quarter.

According to the survey, the manufacturing sector improved slightly in the first quarter, while several key indicators for the services sector declined slightly.

The BCC pointed out that there were the downside risks to the outlook.

"These results are disappointing but not surprising. Although GDP growth for the previous quarter was upgraded slightly, our survey points to a slowdown in Q1 2016. This is the inevitable consequence of mounting global and domestic uncertainties, but it is nevertheless concerning that the vibrant and dominant services sector is likely to face mounting challenges in the next few years," David Kern, Chief Economist of the British Chambers of Commerce, said.

-

16:17

German Economy Ministry: the German economy accelerates at the start of this year

German Economy Ministry said in its monthly report on Monday that the country's economy accelerated at the start of this year, driven by domestic demand, but external environment remains subdued.

"The German economy has picked up speed at the start of the year," the ministry said.

The ministry noted that the growth is expected to slow in the coming months.

-

16:08

Bank of Japan’ survey: consumer confidence in Japan decline in March

According to a quarterly survey by the Bank of Japan, consumer confidence in Japan declined to -22.5 in March from -17.3 in December. One-year expectations fell to -30.9 in March from -19.9 in December.

75.7% of respondents expect inflation to rise next year, down from 77.6% in December.

-

16:01

U.S. Treasury Secretary Jack Lew said on Monday that the competitive devaluation of currencies was "unacceptable"

-

15:53

WSE: After start on Wall Street

U.S. Stocks opened into the green: Dow +0.39%, Nasdaq +0.47%, S&P +0.39%

Indexes on Wall Street started the week on a positive note, encouraged by today's behavior of Euroland. It does not change much, because we still have, for more than a week, a lateral trend. So far we wait calmly until the market breaks this variability, indicating the direction for the other parquets.

The price of silver is a notable mover today, with a rise of more than 2% . Optimist is also evident in the oil market. Investors are waiting for the OPEC meeting on April 17 in Qatar, where an agreement can be signed to freeze oil output at the current level. Therefore, until a decision is announced, the markets may be playing out the possibility of restricted oil supply and thus higher prices. It is worth to remember that the direction of commodity markets can affect sentiment towards emerging markets, so it is also important for the WSE.

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY: 108.00 (USD 260m) 109.95-110.00 (380m)

EURUSD: 1.1319 (USD 203m) 1.1350 (244m) 1.1400 (227m) 1.1430 (388m)

GBPUSD: 1.4200 (GBP 383m)

EURGBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

AUDUSD: 0.7240 (AUD 497m) 0.7260-65 (AUD 1.53bln) 0.7395 (291m) 0.7605 (200m)

USDCAD: 1.3000 (USD 200m) 1.3200-05 (225m)

-

15:34

European Central Bank Governing Council member Francois Villeroy de Galhau: a post of the finance minister for the Eurozone should be created

European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said on Monday that a post of the finance minister for the Eurozone should be created. The finance minister should coordinate national fiscal and structural polices, de Galhau noted.

-

15:34

U.S. Stocks open: Dow +0.39%, Nasdaq +0.47%, S&P +0.39%

-

15:28

Before the bell: S&P futures +0.50%, NASDAQ futures +0.58%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 15,821.52 +71.68 +0.46%

Nikkei 15,751.13 -70.39 -0.44%

Hang Seng 20,440.81 +70.41 +0.35%

Shanghai Composite 3,034.59 +49.64 +1.66%

FTSE 6,204.87 +0.46 +0.01%

CAC 4,328.28 +25.16 +0.58%

DAX 9,712.19 +89.93 +0.93%

Crude oil $$40.05 (+0.83%)

Gold $1254.40 (+0.85%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.49

0.12(1.2807%)

119650

Amazon.com Inc., NASDAQ

AMZN

597.5

2.90(0.4877%)

2500

American Express Co

AXP

59.85

0.35(0.5882%)

1114

Apple Inc.

AAPL

109.05

0.39(0.3589%)

78231

AT&T Inc

T

38.64

0.14(0.3636%)

4628

Barrick Gold Corporation, NYSE

ABX

15.41

0.23(1.5152%)

167207

Chevron Corp

CVX

96.7

0.37(0.3841%)

2384

Cisco Systems Inc

CSCO

27.85

0.16(0.5778%)

16506

Citigroup Inc., NYSE

C

40.74

0.27(0.6672%)

29050

Exxon Mobil Corp

XOM

83.54

0.33(0.3966%)

8448

Facebook, Inc.

FB

110.92

0.29(0.2621%)

107392

Ford Motor Co.

F

12.63

0.08(0.6375%)

14027

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.53

0.20(2.1436%)

75167

General Electric Co

GE

30.83

0.04(0.1299%)

9926

General Motors Company, NYSE

GM

29.5

0.13(0.4426%)

1610

Google Inc.

GOOG

744.7

5.55(0.7509%)

5275

Home Depot Inc

HD

134.09

0.47(0.3517%)

442

Intel Corp

INTC

31.72

0.09(0.2845%)

5744

JPMorgan Chase and Co

JPM

58.18

0.44(0.762%)

3550

McDonald's Corp

MCD

128.6

0.64(0.5002%)

442

Merck & Co Inc

MRK

56.33

0.97(1.7522%)

2159

Microsoft Corp

MSFT

54.58

0.16(0.294%)

20423

Nike

NKE

59.42

-0.00(-0.00%)

424

Pfizer Inc

PFE

32.55

0.05(0.1538%)

3223

Procter & Gamble Co

PG

83.28

0.08(0.0962%)

5710

Tesla Motors, Inc., NASDAQ

TSLA

252.5

2.43(0.9717%)

47615

The Coca-Cola Co

KO

46.73

-0.14(-0.2987%)

682

Twitter, Inc., NYSE

TWTR

16.75

0.10(0.6006%)

32988

Verizon Communications Inc

VZ

52.38

0.20(0.3833%)

373

Visa

V

78.03

-0.00(-0.00%)

236

Wal-Mart Stores Inc

WMT

68.06

-0.00(-0.00%)

661

Walt Disney Co

DIS

96.82

0.40(0.4149%)

1343

Yahoo! Inc., NASDAQ

YHOO

36.5

0.43(1.1921%)

32702

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Alphabet (GOOG) upgraded to Buy at Pivotal Research Group; target raised to $970

Downgrades:

Other:

Yahoo! (YHOO) reiterated with a Hold at Pivotal Research Group; target raised to $40 from $35

-

14:35

OECD’s leading composite leading indicator declines to 99.6 in February

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.6 in February from 99.7 in December.

It signalled stable growth in the Eurozone as a whole.

The index for the U.S., the U.K., Germany, Italy and Japan pointed to an easing in growth momentum.

The index for Canada, India, France and China showed the signs of stabilisation.

The index for Russia showed signs of a loss in growth momentum.

-

14:25

Earnings Season in U.S.: Major Reports of the Week

April 11

After the Close:

Alcoa (AA). Consensus EPS $0.03, Consensus Revenue $5160.51 mln

April 13

Before the Open:

JPMorgan Chase (JPM). Consensus EPS $1.27, Consensus Revenue $22978.10 mln

April 14

Before the Open:

Bank of America (BAC). Consensus EPS $0.24, Consensus Revenue $20628.95 mln

April 15

Before the Open:

Citigroup (C). Consensus EPS $1.11, Consensus Revenue $17664.21 mln

-

14:11

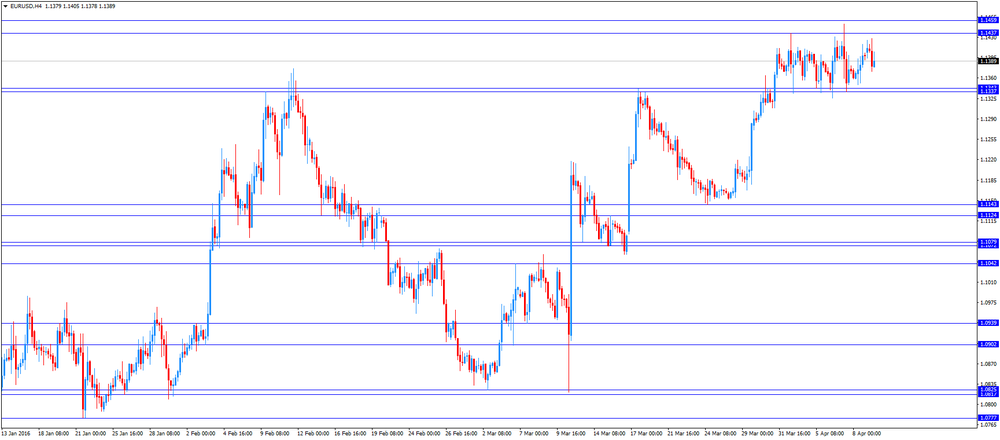

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans February -4.4% Revised From -3.9% 2.0% 1.5%

01:30 China PPI y/y March -4.9% -4.6% -4.3%

01:30 China CPI y/y March 2.3% 2.5% 2.3%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

New York Fed President William Dudley is scheduled to speak at 13:25 GMT. Dudley said in a speech on Friday that the Fed should be cautious in raising its interest rate as there were risks from abroad to the U.S. economy. He noted that there were still the downside risks to U.S. inflation and growth outlooks.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

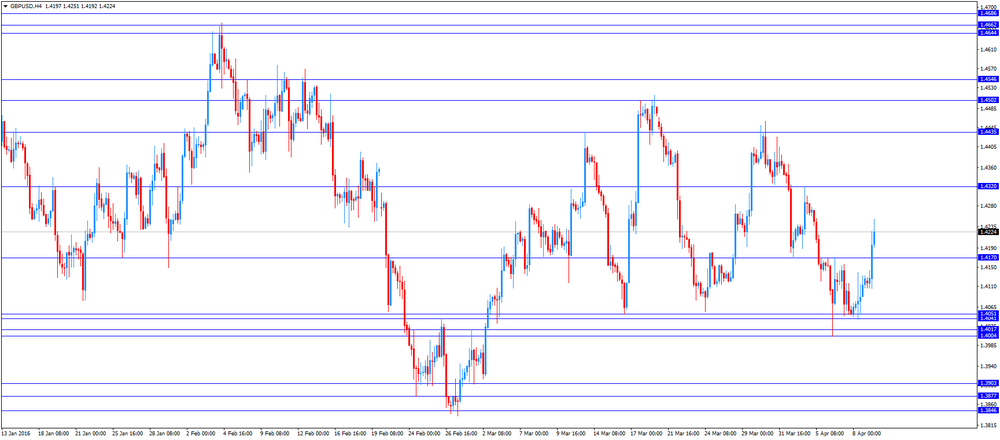

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair declined to $1.1371

GBP/USD: the currency pair rose to $1.4251

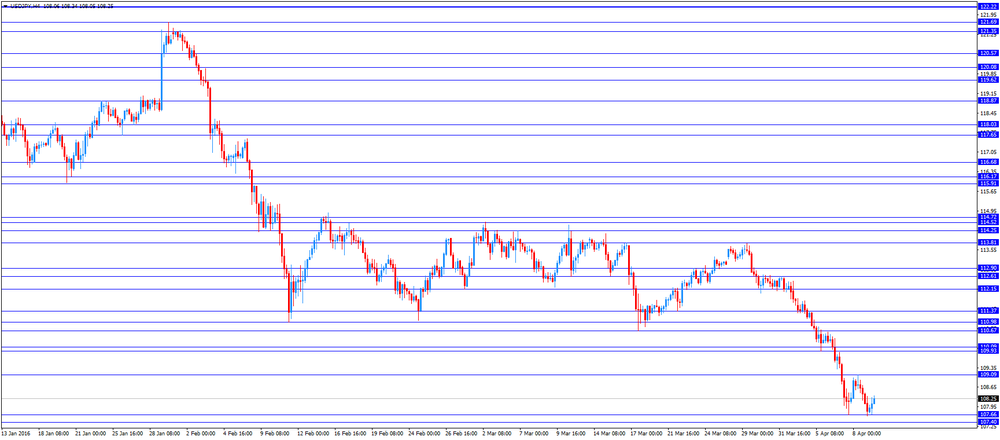

USD/JPY: the currency pair increased to Y108.34

The most important news that are expected (GMT0):

13:25 U.S. FOMC Member Dudley Speak

-

13:50

Orders

EUR/USD

Offers 1.1425-30 1.1450 1.1460-70 1.1480 1.1500 1.1530 1.1550

Bids 1.1385 1.1370 1.1350 1.1330-35 1.1310 1.1300 1.1275-80 1.1250 1.1230 1.1200

GBP/USD

Offers 1.4150-55 1.4180-85 1.4200 1.4230 1.4250 1.4280 1.4300

Bids 1.4100 1.4080 1.4050-60 1.4025-30 1.4000 1.3980-85 1.3965 1.3950

EUR/JPY

Offers 123.20 123.50 123.80 124.00 124.30 124.50 124.80 125.00

Bids 122.70-75 122.50 122.00 121.80 121.50 121.00

EUR/GBP

Offers 0.8100 0.8120 0.8130 0.8150 0.8180 0.8200

Bids 0.8050-55 0.8025-30 0.8000 0.7970-75 0.7950

USD/JPY

Offers 108.00 108.25-30 108.50 108.80-85 109.00-10 109.30 109.50

Bids 107.60-65 107.50 107.30 107.00 1.0680 106.50 106.00

AUD/USD

Offers 0.7575-80 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids 0.7520-25 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

12:35

WSE: Mid session comment

By the middle of the session, the WIG 20 index is located at 1,926 points and has gained 0.36%. The level of turnover is extremely low as at this phase of the trade and the scope of changes during the last hours is less than 15 points. On the other hand, the fact that it happens above 1,920 pts. technically leaves some room for expansion later during the session.

In Frankfurt, the DAX gained around 1%, which could bring some optimism into the trading on the Warsaw Stock Exchange. We look forward to the first bars of Wall Street, which can show the direction for the further course of the session.

-

12:00

European stock markets mid session: stocks traded mixed in the absence of any major economic reports from Europe

Stock indices traded mixed in the absence of any major economic reports from Europe.

Oil prices remained in focus. Oil prices declined ahead the meeting between OPEC and non-OPEC countries in Doha on April 17 is likely to be in focus in the coming days. Participants plan to discuss the freeze of the oil output at January levels. There is uncertainty if a deal could be reached. Iran will participate at that meeting but it is unlikely that the country will freeze its oil output. Oil prices are expected to be volatile before the meeting

Market participants also eyed the Chinese inflation data. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Monday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in March, missing expectations for a 2.5% increase, after a 2.3% gain in February.

The Chinese producer price index (PPI) dropped 4.3% in March, beating expectations for a 4.6% fall, after a 4.9% decline in February.

Current figures:

Name Price Change Change %

FTSE 100 6,204.26 -0.15 0.00%

DAX 9,707.73 +85.47 +0.89 %

CAC 40 4,322.82 +19.70 +0.46 %

-

11:47

World Bank: developing East Asia will expand 6.3% in 2016

The World Bank released its forecast for economic growth in developing countries in East Asia and Pacific on Monday. Developing East Asia is expected to expand 6.3% in 2016, down from its October estimate of a 6.4% growth, and 6.2% in 2017, down from its October estimate of a 6.3% growth.

Developing East Asia grew 6.5% in 2015.

The downgrade was driven by a slowdown in the Chinese economy.

China is expected to grow 6.7% in 2016 and 6.5% in 2017, unchanged from October forecasts.

"The region has benefited from careful macroeconomic policies, including efforts to boost domestic revenue in some commodity-exporting countries. But sustaining growth amid challenging global conditions will require continued progress on structural reforms," incoming World Bank East Asia and Pacific Regional Vice President, Victoria Kwakwa, said.

-

11:37

Home loans in Australia rise 1.5% in February

The Australian Bureau of Statistics released its home loans data on Monday. Home loans in Australia rose 1.5% in February, missing expectations for a 2.0% gain, after 4.4% decrease in January. January's figure was revised down from a 3.9% drop.

The value of owner occupied loans increased at a seasonally adjusted 1.7% in February, investment lending climbed 4.1%, while the number of loans for the construction of dwellings slid 1.9%.

-

11:27

Bank of Japan Governor Haruhiko Kuroda: the central bank will add further stimulus measures if needed to achieve its inflation target

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Monday that the central bank would add further stimulus measures if needed to achieve 2% inflation target. He also said that the BoJ would closely monitor which impact the developments on the global markets could have on the Japanese economy and prices.

-

11:22

Core machinery orders in Japan slide 9.2% in February

Japan's Cabinet Office released its core machinery orders data on late Sunday evening. Core machinery orders in Japan slid 9.2% in February, beating expectations for a 12.4% decline, after a 15.0% rise in January.

The total number of machinery orders climbed 4.7% in February from a month earlier.

Orders from non-manufacturers were up 10.2% in February, while orders from manufacturers plunged 30.6%.

On a yearly basis, core machinery orders declined 0.7% in February, beating expectations for a 2.7% decrease, after a 8.4% increase in January.

-

11:14

Industrial production in Italy falls 0.6% in February

The Italian statistical office Istat released its industrial production data on Monday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.6% in February, after a 1.7% rise in January. January's figure was revised down from a 1.9% increase.

The decrease was mainly driven by declines in production of energy goods and in production of consumer goods.

On a yearly basis, industrial production in Italy climbed at a seasonally-adjusted rate of 1.2% in February, after a 3.8% increase in January. January's figure was revised down from 3.9% gain.

-

11:05

Former Bank of Japan’s Board member Sayuri Shirai: it is unlikely that the central bank will add further stimulus measures at its next meeting

Former Bank of Japan's Board member Sayuri Shirai said on Monday that it is unlikely that the central bank will add further stimulus measures at its next meeting April 27-28. She noted that there was not a lot of room to cut interest rate further.

-

10:36

Institute of International Finance’s report: capital outflows from emerging economies are expected to slow this year

According to a report by the Institute of International Finance (IIF), capital outflows from emerging economies are expected to slow this year. Net outflows from emerging economies are expected to be $500 billion in 2016, down from $750 billion in 2015, while net outflows from China expected to decline to $530 billion from $675 billion.

-

10:23

Chinese consumer price index rises at annual rate of 2.3% in March

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Monday. The Chinese consumer price index (CPI) rose at annual rate of 2.3% in March, missing expectations for a 2.5% increase, after a 2.3% gain in February.

Food prices rose at an annual rate of 7.8% in March, while non-food prices increased 1.0%.

On a monthly basis, consumer price inflation decreased 0.4% in March, after a 1.6% rise in February.

The Chinese producer price index (PPI) dropped 4.3% in March, beating expectations for a 4.6% fall, after a 4.9% decline in February.

-

10:09

The number of active U.S. oil rigs declines by 8 rigs to 354 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. oil rigs fell by 8 rigs to 354 last week. It was the lowest level since November 2009.

The number of gas rigs increased by 1 to 89.

Combined oil and gas rigs decreased by 7 to 443.

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY: 108.00 (USD 260m) 109.95-110.00 (380m)

EUR/USD: 1.1319 (USD 203m) 1.1350 (244m) 1.1400 (227m) 1.1430 (388m)

GBP/USD: 1.4200 (GBP 383m)

EUR/GBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

AUD/USD: 0.7240 (AUD 497m) 0.7260-65 (AUD 1.53bln) 0.7395 (291m) 0.7605 (200m)

USD/CAD: 1.3000 (USD 200m) 1.3200-05 (225m)

-

09:21

WSE: After opening

The beginning of trading in the Futures market was flat, the behavior of contracts on European indices, which were traded mostly with cosmetic deviations and did not point towards any major fluctuations. As we can see, the previous increase of FW20 by 0.95% to 1,916 points seemingly exhausted the potential for further conquest and now the environment and / or macro data will only be able to develop a new impulse to change.

WIG20 index opened at 1919.03 points (-0.02%)

WIG 47556.88 0.00%

WIG30 2136.91 +0.04%

mWIG40 3543.63 -0.24%

*/ - change to previous close

The main index of the Warsaw Stock Exchange opened at about Friday's close, according to what was pointed out by the future market.

The leader of the WIG20 index are ORANGEPL shares (WSE: OPL) that gain after Monday's opening of 0.79%. In turn, the weakest link of the blue chips are PKOBP shares (WSE: PKO) that are losing 0.82%.

After a few minutes of trading WIG20 index approaches to the level of 1,910 points.

-

08:28

Asian session: The dollar notched a fresh 17-month low against the yen

The dollar notched a fresh 17-month low against the yen. In addition to a stronger currency, data released early on Monday showed Japan's core machinery orders fell 9.2 percent in February from the previous month, in a sign that business investment remains subdued.

Data out on Monday showed China's consumer price inflation was less than expected in March, while wholesale prices declined less than anticipated, in a sign that deflationary pressure in the industrial sector may be easing. While the figures pointed to stabilizing prices, they also underscored that the central bank's prolonged easing campaign begun in late 2014 has yet to result in substantial price increases.

The greenback's recent slide against the yen prompted a chorus of warnings from officials in Tokyo and put investors on alert for direct yen-selling intervention, though many believed Japan would stay its invention hand.

Japan's top government spokesman, Chief Cabinet Secretary Yoshihide Suga, said on Monday that recent currency moves were one-sided and speculative and that the government would take steps as needed.

The dollar wallowed close to lows notched last week, as investors mulled the outlook for U.S. monetary policy, with the Federal Reserve seen as being more cautious on hiking interest rates than some investors had believed.

EUR/USD: during the Asian session the pair traded in the range of $1.1395-25

GBP/USD: during the Asian session the pair traded in the range of $1.4105-45

USD/JPY: during the Asian session the pair fell to Y107.65

Based on Reuters materials

-

08:24

WSE: Before opening

The last, Friday's, session in the US proved to be neutral with solid growth of quotations of Brent crude oil (+ approx. 6%), which did not affect the decisions of investors who are waiting to start the season of quarterly results for US companies. This will be strongly volatile period for the shares in the US with the context of the verification of their profit and loss account for the last quarter.

Today morning, the New York futures record slightly chilled changes against the last closing level of the minus 0,07-0,14 percent. On the London futures for the FTSE-100 we have 0%, which does not announce sudden movements at the opening of the markets in Europe, although the Nikkei lost approx. 0.3%, with 1.05% -1.9% rise on major stock indices from China.

-

07:08

Options levels on monday, April 11, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1550 (1831)

$1.1502 (1755)

$1.1456 (480)

Price at time of writing this review: $1.1411

Support levels (open interest**, contracts):

$1.1339 (152)

$1.1295 (2462)

$1.1236 (2286)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 28687 contracts, with the maximum number of contracts with strike price $1,1500 (2622);

- Overall open interest on the PUT options with the expiration date May, 6 is 40895 contracts, with the maximum number of contracts with strike price $1,0900 (4911);

- The ratio of PUT/CALL was 1.43 versus 1.55 from the previous trading day according to data from April, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.4406 (1463)

$1.4309 (1061)

$1.4213 (1023)

Price at time of writing this review: $1.4139

Support levels (open interest**, contracts):

$1.4085 (1170)

$1.3989 (1521)

$1.3892 (907)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 21701 contracts, with the maximum number of contracts with strike price $1,4500 (2198);

- Overall open interest on the PUT options with the expiration date May, 6 is 22407 contracts, with the maximum number of contracts with strike price $1,3800 (2524);

- The ratio of PUT/CALL was 1.03 versus 0.97 from the previous trading day according to data from April, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:43

Global Stocks: The focus now turns to first-quarter earnings in the U.S.

European stocks ended the week on a strong footing on Friday, as investors ventured into riskier assets such as equities as oil prices rose and the Japanese yen retreated, while upbeat trade data lifted Germany's DAX 30 index.

U.S. stocks closed moderately higher Friday but still booked their worst week since early February as the market failed to lock in bigger early gains sparked by a crude-oil rally.

Most Asian stocks fell, as losses in Japanese equities on a stronger yen offset gains in Chinese shares. Energy producers climbed with oil. While China data showed producer prices posted their first gain since September 2013. The focus now turns to first-quarter earnings in the U.S.

Based on MarketWatch materials

-

04:03

Nikkei 225 15,821.52 +71.68 +0.46%, Hang Seng 20,370.4 +104.35 +0.51%, Shanghai Composite 2,984.96 -23.46 -0.78%

-

03:31

China: PPI y/y, March -4.3% (forecast -4.6%)

-

03:31

Australia: Home Loans , February 1.5% (forecast 2.0%)

-

03:30

China: CPI y/y, March 2.3% (forecast 2.5%)

-

01:50

Japan: Core Machinery Orders, y/y, February -0.7% (forecast -2.7%)

-

01:50

Japan: Core Machinery Orders, February -9.2% (forecast -12.4%)

-

00:31

Commodities. Daily history for Apr 08’2016:

(raw materials / closing price /% change)

Oil 39.66 -0.15%

Gold 1,240.10 -0.30%

-

00:30

Stocks. Daily history for Sep Apr 08’2016:

(index / closing price / change items /% change)

Nikkei 225 15,821.52 +71.68 +0.46 %

Hang Seng 20,370.4 +104.35 +0.51 %

S&P/ASX 200 4,937.6 -26.48 -0.53 %

Shanghai Composite 2,985.76 -22.66 -0.75 %

FTSE 100 6,204.41 +67.52 +1.10 %

CAC 40 4,303.12 +57.21 +1.35 %

Xetra DAX 9,622.26 +91.64 +0.96 %

S&P 500 2,047.6 +5.69 +0.28 %

NASDAQ Composite 4,850.69 +2.32 +0.05 %

Dow Jones 17,576.96 +35.00 +0.20 %

-

00:29

Currencies. Daily history for Apr 08’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1398 +0,23%

GBP/USD $1,4125 +0,52%

USD/CHF Chf0,9532 -0,30%

USD/JPY Y108,06 -0,19%

EUR/JPY Y123,15 +0,03%

GBP/JPY Y152,61 +0,33%

AUD/USD $0,7553 +0,65%

NZD/USD $0,6808 +0,47%

USD/CAD C$1,2987 -1,26%

-