Noticias del mercado

-

22:12

U.S. stocks closed

U.S. stocks rose to a one-week high as crude pushed past $42 a barrel to overshadow a tepid start to the first-quarter earnings season.

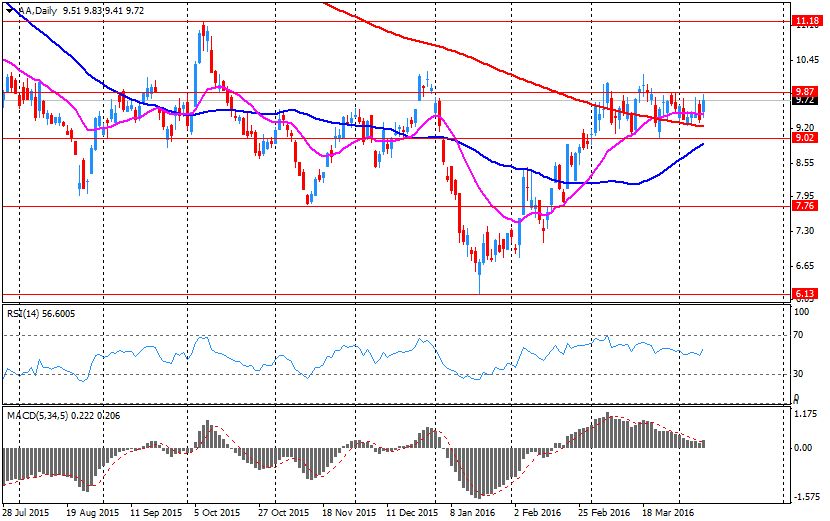

Energy producers surged 2.7 percent as crude climbed to a four-month high after Saudi Arabia and Russia were seen agreeing on whether to freeze oil production. Chesapeake Energy Corp. surged the most on record after pledging assets to maintain access to financing. Alcoa Inc. slid 3.4 percent after the largest U.S. aluminum producer cut its forecast for global demand. Juniper Networks Inc. plunged 7.5 percent after sales missed forecasts, dragging the semiconductor industry lower.

West Texas Intermediate rose 4.5 percent in New York. Saudi Arabia and Russia have reached a consensus on an output freeze, Interfax said Tuesday, citing an unidentified "informed diplomatic source" in Doha.

The rally in crude is overshadowing the start of earnings season that is forecast to be the worst since the financial crisis, with analysts projecting first-quarter profits shrank 10 percent -- including a 20 percent decline for banks -- compared with earlier estimates for flat growth.

After a tumultuous start to the year that saw the S&P 500 tumble as much as 11 percent, U.S. equities rebounded 13 percent in the following six weeks. They are now little changed in the past two weeks after falling the most since February last week.

All 10 main S&P 500 groups advanced Tuesday, with energy and financial shares leading the way. JPMorgan Chase & Co. and Citigroup Inc. are among companies that report corporate results this week.

Among other stocks active on corporate news, Fastenal Co. lost 3.1 percent after also posting sales and earnings that missed the average analyst estimate.

-

21:00

DJIA 17716.12 159.71 0.91%, NASDAQ 4868.57 35.17 0.73%, S&P 500 2061.20 19.21 0.94%

-

20:00

U.S.: Federal budget , March -108 (forecast -104)

-

18:00

European stocks close: stocks closed higher on an increase in oil prices

Stock indices closed higher on a rise in oil prices. Oil prices increased on news that Russia and Saudi Arabia reached a consensus about the freeze of the oil output. Russia's news agency Interfax reported on Tuesday that Russia and Saudi Arabia reached a consensus about the freeze of the oil production, according to a source familiar with the matter. The source also said that Saudi Arabia's decision would not depend on whether Iran would freeze its oil output or not.

The International Monetary Fund (IMF) released its World Economic Outlook on Tuesday. The IMF lowered its global economic growth forecasts due to a modest recovery in advanced economies and the slowdown in emerging economies.

The global economy will expand 3.2% in 2016, down from the previous forecast of 3.4%, and 3.5% in 2017, down from the previous forecast of 3.6%, according to the IMF.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.5% year-on-year in March from 0.3% in February, exceeding expectations for a rise to 0.4%.

The increase was mainly driven by rises in air fares and clothing prices. Food prices declined.

On a monthly basis, U.K. consumer prices increased 0.4% in March, exceeding expectations for a 0.4% gain, after a 0.2% rise in February.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.5% year-on-year in March from 1.2% in February, beating expectations for an increase to 1.3%.

The U.K. house price index increased at a seasonally adjusted rate of 0.4% in February, after a 0.9% rise in January.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.6% in February, after a 7.9% in January.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,242.39 +42.27 +0.68 %

DAX 9,761.47 +78.48 +0.81 %

CAC 40 4,345.91 +33.28 +0.77 %

-

18:00

European stocks closed: FTSE 6242.39 42.27 0.68%, DAX 9761.47 78.48 0.81%, CAC 40 4345.91 33.28 0.77%

-

17:49

Britain’s Prime Minister David Cameron: the International Monetary Fund is right that Britain’s exit from the European Union will pose risks to the U.K. economy

Britain's Prime Minister David Cameron said on Tuesday the International Monetary Fund (IMF) was right that Britain's exit from the European Union (EU) would pose risks to the country's economy.

"The IMF is right - leaving the EU would pose major risks for the UK economy. We are stronger, safer and better off in the European Union," he tweeted.

-

17:40

European Central Bank Governing Council member Jens Weidmann: the ECB is independent

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview with the Financial Times published on Tuesday that the central bank was independent, adding that the central bank's monetary policy was appropriate.

"It's not unusual for politicians to have opinions on monetary policy, but we are independent," he said.

"The ECB has to deliver on its price stability mandate and thus an expansionary monetary policy stance is appropriate at this juncture regardless of different views about specific measures," Weidmann added.

-

17:40

WSE: Session Results

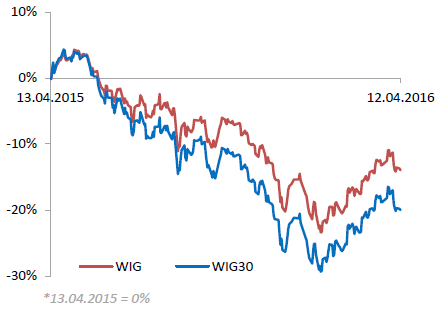

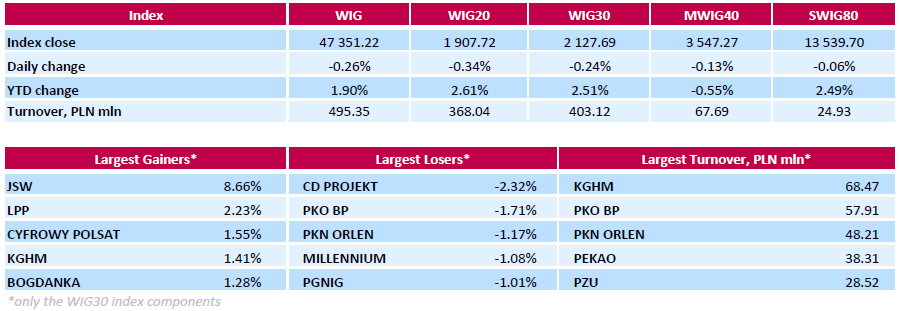

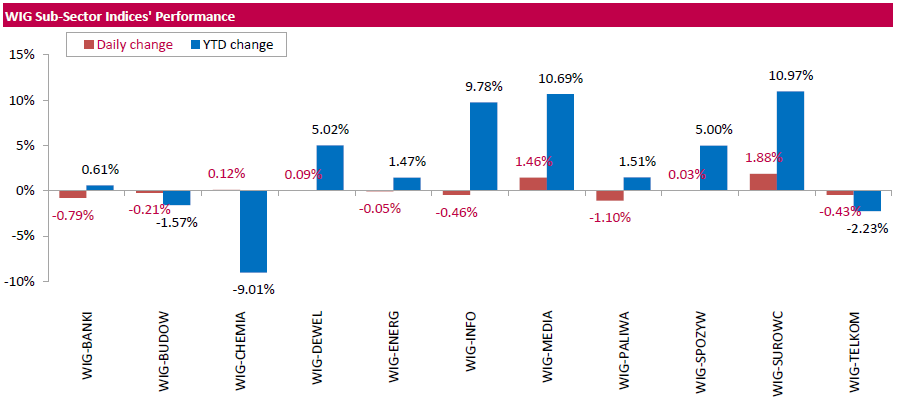

Polish equity market closed lower onTuesday. The broad market measure, the WIG index, lost 0.26%. Sector performance within the WIG Index was mixed. Oil and gas sector stocks (-1.10%) fared the worst, while materials (+1.88%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 0.24%. The decliners were led by videogame developer CD PROJEKT (WSE: CDR), which tumbled by 2.32%. Other biggest laggards included three banking sector names PKO BP (WSE: PKO), MILLENNIUM (WSE: MIL) and BZ WBK (WSE: BZW), and two oil and gas sector stocks PKN ORLEN (WSE: PKN) and PGNIG (WSE: PGN), which plunged by 0.94%-1.71%. On the other side of the ledger, coking coal producer JSW (WSE: JSW) recorded the strongest daily result, climbing 8.66% on analyst upgrade. It was followed by clothing retailer LPP (WSE: LPP), media group CYFROWY POLSAT (WSE: CPS) and copper producer KGHM (WSE: KGH), which advanced by 2.23%, 1.55% and 1.41% respectively.

-

17:33

Interfax: Russia and Saudi Arabia reach a consensus about the freeze of the oil production

Russia's news agency Interfax reported on Tuesday that Russia and Saudi Arabia reached a consensus about the freeze of the oil production, according to a source familiar with the matter. The source also said that Saudi Arabia's decision would not depend on whether Iran would freeze its oil output or not.

-

17:27

Philadelphia Fed President Patrick Harker: the Fed should delay its interest rate hike until inflation accelerates

Philadelphia Fed President Patrick Harker said in a speech on Tuesday that the Fed should delay its interest rate hike until inflation accelerated.

"It might prove prudent to wait until the inflation data are stronger before we undertake a second rate hike," he said.

Philadelphia Fed president that there were the downside risks to the inflation outlook.

Harker noted that the U.S. economy was strong.

"Overall, my view of the economy is upbeat. Our financial system is in good shape, our economic fundamentals are sound, our labour markets remain dynamic, and our income growth is solid. Consumer spending is also increasing at a solid pace," he said.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:14

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly higher on Tuesday as a surge in oil drove gains in energy stocks. Benchmark Brent edged up over $43 per barrel on hopes that a meeting of major producers on Sunday would result in a deal to curb a persistent global oversupply. Investors will turn their attention to corporate earnings over the next several weeks, amid turbulent global markets and the uncertainty surrounding the U.S. Federal Reserve's plan to raise interest rates.

Most of Dow stocks in positive area (24 of 30). Top looser - Cisco Systems, Inc. (CSCO, -0,94%). Top gainer - Chevron Corporation (CVX, +1,55%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,6%).

At the moment:

Dow 17574.00 +101.00 +0.58%

S&P 500 2045.00 +10.50 +0.52%

Nasdaq 100 4461.75 +10.25 +0.23%

Oil 41.10 +0.74 +1.83%

Gold 1256.00 -2.00 -0.16%

U.S. 10yr 1.7^ +0.04

-

16:53

Foreign direct investment inflows in China rise by an annual rate of 7.8% in March

China's Ministry of Commerce released its foreign direct investment (FDI) data on Tuesday. Foreign direct investment inflows in China rose to $12.9 billion in March, up 7.8% from a year earlier.

Foreign investors mainly invested in the country's growing services sector.

-

16:44

Moderate growth in the Eurozone is expected in the first three quarters of 2016

The German IFO, the French Insee and the Italian Istat institutes said in its survey on Tuesday that the economy in the Eurozone is expected to continue to recover moderately. Real gross domestic product (GDP) is expected to rise by 0.4% in the first three quarters of 2016. The growth will be driven by domestic demand.

According to IFO, Insee, and Istat, inflation in the Eurozone is expected to be -0.1% year-on-year in the second quarter of 2016 and 0.3% year-on-year in the third quarter of 2016. Low energy prices weigh on inflation.

Downside risks to the Eurozone's economy is the slowdown in emerging economies, the survey said.

-

16:24

Bank lending in Japan increases 2.0% year-on-year in March

The Bank of Japan released its bank lending data on Tuesday. Bank lending in Japan increased 2.0% year-on-year in March, after a 2.2% rise in February.

Lending excluding trusts climbed 2.0% in March, lending from trusts rose 2.3%, while lending from foreign banks was down 1.2%.

-

16:17

National Australia Bank’s business confidence index rises to 6 points in March

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index rose to 6 points in March from 3 points in February.

"The lift in business conditions to these levels not only suggests that Australia is withstanding the uncertainty offshore, but that the recovery in the non-mining sectors of the economy have in fact stepped up a gear this month," NAB Group Chief Economist Alan Oster said.

The main business conditions index increased to 12 points in March from 8 points in February, while employment rose to 5 points from 1 points.

-

16:12

International Monetary Fund’s World Economic Outlook: the lender cuts its global growth forecast for 2016 and 2017

The International Monetary Fund (IMF) released its World Economic Outlook on Tuesday. The IMF lowered its global economic growth forecasts due to a modest recovery in advanced economies and the slowdown in emerging economies.

The global economy will expand 3.2% in 2016, down from the previous forecast of 3.4%, and 3.5% in 2017, down from the previous forecast of 3.6%, according to the IMF.

"Lower growth means less room for error. Persistent slow growth has scarring effects that themselves reduce potential output and with it, demand and investment," Maurice Obstfeld, the IMF Economic Counsellor and Director of the Research Department, said.

The IMF said in its report that main risks to the outlook are financial risks, geopolitical shocks and political discord.

The IMF cut its growth forecasts in advanced economies to 1.9% in 2016, down from the previous estimate of 2.1%, and to 2.0% in 2017, down from 2.1%, while emerging markets expected to expand 4.1% in 2016, down from 4.5%, and 4.6% in 2017, down from 4.7%.

The lender downgraded its growth forecast for the Eurozone for 2016 to 1.5% from 1.7% and for 2017 to 1.6% from 1.7%.

The U.S. economy is expected to grow 2.4% in 2016, down from the January forecast of 2.6%, and 2.5% in 2017, down from the previous forecast of 2.6%.

China's economy is expected to expand 6.5% in 2016, up from the previous forecast of 6.3%, and 6.2% in 2017, up from the previous forecast of 6.0%, while India's economy is expected to grow 7.5% in 2016 and in 2017, unchanged from the previous estimates.

UK's GDP is expected to rise 1.9% in 2016, down from the previous forecast of 2.2%, and 2.2% in 2017, unchanged from the previous estimate.

-

15:51

Dallas Fed President Rob Kaplan: the Fed could raise its interest rate in the near future

Dallas Fed President Rob Kaplan said in an interview with the CNBC on Tuesday that the Fed could raise its interest rate in the near future. He pointed out that the interest rate hike in December was the right decision, adding that gradual interest rate hikes would be appropriate.

Kaplan expects the U.S. economy to expand below 2% this year.

Dallas Fed president noted that next five years would be more complex for the Fed than the past five years.

He also said that the weak global growth weighed on the U.S. economy.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

15:45

Option expiries for today's 10:00 ET NY cut

USDJPY: 109.30 (USD 220m) 110.00 (551m) 110.50 (660m) 111.00 (900m)

EURUSD: 1.1225-30 (USD 838m) 1.1250-55 (1.95bln) 1.1400 (227m) 1.1400 (1.88bln)1.1435 (300m) 1.1450-55 (807m) 1.1500 (635m)

EURGBP 0.7975 ( EUR 400m)

EURJPY 122.50 (EUR 200m) 126.90 (480m)

EURCHF 1.0975 (EUR 400m) 1.0989 (300m)

AUDUSD: 0.7450 (AUD 221m) 0.7475 (317m) 0.7600 (253m)

USDSGD 1.3425 (USD 443m)

-

15:40

Eurozone’s house prices are flat in the fourth quarter

Eurostat release its preliminary house price index for the Eurozone on Tuesday. The index was flat in the fourth quarter, after a 1.0% gain in the third quarter.

On a yearly basis, house prices climbed 2.9% in the fourth quarter, after a 2.2% rise in the third quarter. The third quarter's figure was revised down from a 2.3% increase.

-

15:40

WSE: After start on Wall Street

U.S. Stocks opened: Dow +0.19%, Nasdaq +0.06%, S&P +018%

The mood before the start of trading on the New York stock exchanges was cautiously positive and trading futures on US indices point to the moderately buyers' market on Wall Street.

Yesterday market fell by 0.3%, that has been blurred with today's opening. So far there is no visible any major breakthrough on the horizon. The market is clearly waiting for a pulse looking at ongoing for a few days consolidation.

On the Warsaw Stock Exchange we have PLN 250 mln of turnover on the WIG20 and 20 points of volatility.

-

15:34

U.S. Stocks open: Dow +0.19%, Nasdaq +0.06%, S&P +018%

-

15:24

Before the bell: S&P futures +0.28%, NASDAQ futures +0.26%

U.S. stock-index futures rose, as rising commodity prices offset a tepid start to the first-quarter earnings season..

Global Stocks:

Nikkei 15,928.79 +177.66 +1.13%

Hang Seng 20,504.44 +63.63 +0.31%

Shanghai Composite 3,024.53 -9.43 -0.31%

FTSE 6,206.8 +6.68 +0.11%

CAC 4,318.4 +5.77 +0.13%

DAX 9,720.68 +37.69 +0.39%

Crude oil $40.77 (+1.02%)

Gold $1261.60 (+0.26%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.41

-0.33(-3.3881%)

612340

Amazon.com Inc., NASDAQ

AMZN

598

2.07(0.3474%)

1797

American Express Co

AXP

59.81

0.01(0.0167%)

236

Apple Inc.

AAPL

109.52

0.50(0.4586%)

61915

AT&T Inc

T

38.62

0.23(0.5991%)

715

Barrick Gold Corporation, NYSE

ABX

16.41

0.10(0.6131%)

167572

Boeing Co

BA

129.38

1.47(1.1492%)

2206

Caterpillar Inc

CAT

74.5

-0.13(-0.1742%)

350

Chevron Corp

CVX

95.67

0.43(0.4515%)

1000

Cisco Systems Inc

CSCO

27.26

-0.36(-1.3034%)

47597

Citigroup Inc., NYSE

C

41.17

0.05(0.1216%)

1296

Exxon Mobil Corp

XOM

83.66

0.34(0.4081%)

1000

Facebook, Inc.

FB

109.34

0.35(0.3211%)

83303

Ford Motor Co.

F

12.69

0.03(0.237%)

12846

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.06

0.30(3.0738%)

184215

General Electric Co

GE

30.74

0.03(0.0977%)

3886

Google Inc.

GOOG

738.19

2.09(0.2839%)

801

Hewlett-Packard Co.

HPQ

12.13

0.00(0.00%)

243

Intel Corp

INTC

31.79

0.12(0.3789%)

370

International Business Machines Co...

IBM

149.3

0.05(0.0335%)

5299

JPMorgan Chase and Co

JPM

58.32

0.12(0.2062%)

857

McDonald's Corp

MCD

128.57

1.01(0.7918%)

4105

Microsoft Corp

MSFT

54.48

0.17(0.313%)

5700

Nike

NKE

58

0.08(0.1381%)

1825

Pfizer Inc

PFE

31.92

0.03(0.0941%)

892

Starbucks Corporation, NASDAQ

SBUX

59.55

-1.35(-2.2167%)

141523

Tesla Motors, Inc., NASDAQ

TSLA

250.68

0.76(0.3041%)

21568

Twitter, Inc., NYSE

TWTR

16.6

0.09(0.5451%)

23047

Verizon Communications Inc

VZ

51.8

0.19(0.3681%)

345

Visa

V

78.1

0.28(0.3598%)

1910

Yahoo! Inc., NASDAQ

YHOO

36.65

0.17(0.466%)

4098

Yandex N.V., NASDAQ

YNDX

16.07

0.39(2.4872%)

10000

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Yandex N.V. (YNDX) upgraded to Buy from Neutral at Goldman

Downgrades:

Starbucks (SBUX) downgraded to Hold from Buy at Deutsche Bank

Other:

3M (MMM) target raised to $187 from $175 at Jefferies

Alcoa (AA) reiterated with a Buy at Stifel; target lowered to $13 from $14

-

14:40

U.S. import price index increases by 0.2% in March

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index increased by 0.2% in March, missing expectations for a 1.0% rise, after a 0.4% decline in February. It was the first rise since June 2015.

February's figure was revised down from a 0.3% drop.

The rise was mainly driven by higher prices for fuel imports, which climbed 4.9% in March.

U.S. export prices were flat in March, after a 0.5% fall in February. February's figure was revised down a 0.4% decrease.

-

14:30

U.S.: Import Price Index, March 0.2% (forecast 1.0%)

-

14:23

National Federation of Independent Business’s small-business optimism index for the U.S. drops to 92.6 in March

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index dropped to 92.6 in March from 92.9 in February. It was the lowest level since February 2014.

6 of 10 sub-indexes declined last month, while 4 sub-indexes rose.

"The small business sector, which historically produced half of our private GDP and served as the "R&D" sector of our economy, is underperforming, doing little more than operating in maintenance mode. Slow economic growth is now just a result of population growth, more haircuts, retail customers, health care patients, etc. But there is no exuberance, no optimism and not much hope, the numbers make it clear," NFIB Chief Economist Bill Dunkelberg said.

-

14:14

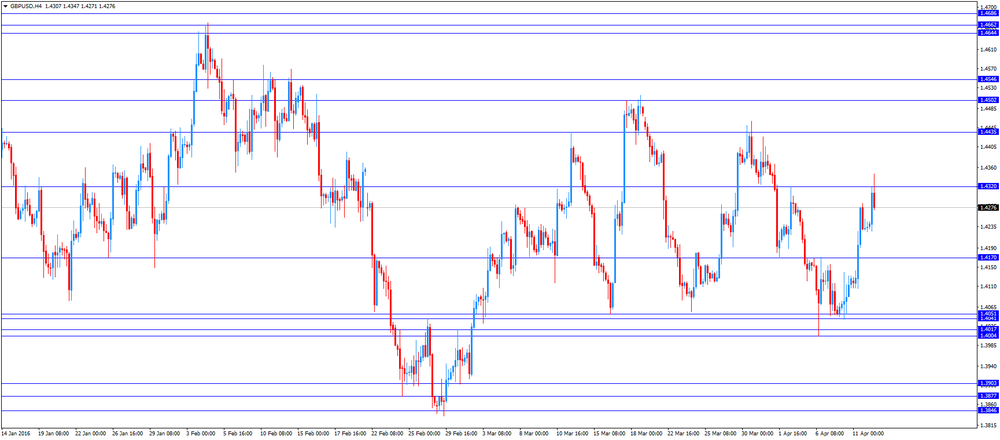

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the better-than-expected consumer price inflation data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence March 3 6

06:00 Germany CPI, m/m (Finally) March 0.4% 0.8% 0.8%

06:00 Germany CPI, y/y (Finally) March 0.0% 0.3% 0.3%

08:30 United Kingdom Producer Price Index - Input (MoM) March 0.1% 2.6% 2.0%

08:30 United Kingdom Producer Price Index - Input (YoY) March -8.2% Revised From -8.1% -6.0% -6.5%

08:30 United Kingdom Producer Price Index - Output (MoM) March 0.1% 0.2% 0.3%

08:30 United Kingdom Producer Price Index - Output (YoY) March -1.1% -1.0% -0.9%

08:30 United Kingdom Retail prices, Y/Y March 1.3% 1.4% 1.6%

08:30 United Kingdom Retail Price Index, m/m March 0.5% 0.3% 0.4%

08:30 United Kingdom HICP, m/m March 0.2% 0.3% 0.4%

08:30 United Kingdom HICP, Y/Y March 0.3% 0.4% 0.5%

08:30 United Kingdom HICP ex EFAT, Y/Y March 1.2% 1.3% 1.5%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. import price index data. The U.S. import price index is expected to rise 1.0% in March, after a 0.3% fall in February.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone. Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index were up 0.8% in March, in line with the preliminary estimate, after a 0.4% rise in February.

On a yearly basis, German final consumer price index increased to 0.3% in March from 0.0% in February, in line with the preliminary estimate.

Energy prices dropped 8.9% year-on-year in March, while food prices climbed 1.3%.

Consumer prices excluding energy increased 1.4% year-on-year in March.

The British pound traded higher against the U.S. dollar on the better-than-expected consumer price inflation data from the U.K. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.5% year-on-year in March from 0.3% in February, exceeding expectations for a rise to 0.4%.

The increase was mainly driven by rises in air fares and clothing prices. Food prices declined.

On a monthly basis, U.K. consumer prices increased 0.4% in March, exceeding expectations for a 0.4% gain, after a 0.2% rise in February.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.5% year-on-year in March from 1.2% in February, beating expectations for an increase to 1.3%.

The U.K. house price index increased at a seasonally adjusted rate of 0.4% in February, after a 0.9% rise in January.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.6% in February, after a 7.9% in January.

EUR/USD: the currency pair declined to $1.1393

GBP/USD: the currency pair rose to $1.4347

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Import Price Index March -0.3% 1.0%

18:00 U.S. Federal budget March -193 -104

-

13:50

Orders

EUR/USD

Offers 1.1445-50 1.1460-70 1.1480 1.1500 1.1530 1.1550

Bids 1.1400 1.1385 1.1370 1.1350 1.1330-35 1.1310 1.1300 1.1275-80 1.1250

GBP/USD

Offers 1.4285 1.4300 1.4320-25 1.4350 1.4380 1.4400 1.4420 1.4450

Bids 1.4250 1.4225-30 1.4200 1.4185 1.4165 1.4150 1.4100 1.4080 1.4050-60

EUR/JPY

Offers 123.80 124.00 124.30 124.50 124.80 125.00

Bids 123.30 123.00 122.70 122.50 122.00 121.80 121.50 121.00

EUR/GBP

Offers 0.8020 0.8030 0.8050 0.8075-80 0.8100 0.8120 0.8130 0.8150

Bids 0.8000 0.7985 0.797 0.7950 0.7930 0.7900 0.7880 0.7850

USD/JPY

Offers 108.50 108.80-85 109.00-10 109.30 109.50 109.80 110.00

Bids 108.00 107.85 107.60-65 107.50 107.30 107.00

AUD/USD

Offers 0.7650-55 0.7580 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids 0.7620 0.7600 0.7580 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

13:42

-

13:04

WSE: Mid session comment

Performance of the WIG20 index today is yet another confirmation of the marker's relative weakness, which, in the absence of any major determinants, allows the market to landslide under its own weight. This can be seen especially in contrast with the German market, which is currently testing around yesterday's intraday's highs. At the halfway point of the session, at 13:00 the WIG20 index stood at 1,907 points (-0,36%).

-

12:22

WSE: ORANGE POLSKA SA.

Shareholders of listed telecommunications company Orange Polska SA (WSE: OPL ) passed a PLN 0.25 dividend per share from 2015 profit.

Dividend rights day was set to June 22 and dividend payout day to July 7.

Orange Polska SA paid PLN 0.5 DPS from 2014 and 2013 profits.

Orange Poland SA is a leading provider of telecommunications services in Poland. It operates in all segments of the telecommunications market, the company is the component of the WIG20 index (2,436%).

-

12:00

European stock markets mid session: stocks traded higher in the absence of key drivers

Stock indices traded mixed in the absence of any major economic reports from Europe. Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index were up 0.8% in March, in line with the preliminary estimate, after a 0.4% rise in February. On a yearly basis, German final consumer price index increased to 0.3% in March from 0.0% in February, in line with the preliminary estimate. Energy prices dropped 8.9% year-on-year in March, while food prices climbed 1.3%. Consumer prices excluding energy increased 1.4% year-on-year in March.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.5% year-on-year in March from 0.3% in February, exceeding expectations for a rise to 0.4%.

The increase was mainly driven by rises in air fares and clothing prices. Food prices declined.

On a monthly basis, U.K. consumer prices increased 0.4% in March, exceeding expectations for a 0.4% gain, after a 0.2% rise in February.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.5% year-on-year in March from 1.2% in February, beating expectations for an increase to 1.3%.

The U.K. house price index increased at a seasonally adjusted rate of 0.4% in February, after a 0.9% rise in January.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.6% in February, after a 7.9% in January.

Current figures:

Name Price Change Change %

FTSE 100 6,203.86 +3.74 +0.06 %

DAX 9,720.53 +37.54 +0.39 %

CAC 40 4,319.08 +6.45 +0.15 %

-

11:50

BRC and KPMG sales monitor: U.K. retail sales declined by an annual rate of 0.7% on a like-for-like basis in March

According to the British Retail Consortium (BRC) and KPMG sales monitor, the U.K. retail sales decreased by an annual rate of 0.7% on a like-for-like basis in March, after a 0.1% rise in February.

On a total basis, retail sales were flat year-on-year in March.

"Neither growth nor decline in total year-on-year sales in March, although this relatively disappointing picture is distorted by the earlier timing of Easter this year," BRC Chief Executive, Helen Dickinson, said.

-

11:43

German wholesale prices rise 0.3% in March

The German statistical office Destatis released its wholesale prices for Germany on Tuesday. German wholesale prices rose 0.3% in March, after a 0.5% decrease in February.

On a yearly basis, wholesale prices in Germany dropped 2.6% in March, after a 1.9% decline in February. Wholesale prices have been declining since July 2013.

The annual fall was mainly driven by a 17.6% drop in solid fuels and related products.

-

11:32

German final consumer price inflation climbs 0.8% in March

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index were up 0.8% in March, in line with the preliminary estimate, after a 0.4% rise in February.

On a yearly basis, German final consumer price index increased to 0.3% in March from 0.0% in February, in line with the preliminary estimate.

Energy prices dropped 8.9% year-on-year in March, while food prices climbed 1.3%.

Consumer prices excluding energy increased 1.4% year-on-year in March.

-

11:27

UK house price inflation increases 0.4% in February

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index increased at a seasonally adjusted rate of 0.4% in February, after a 0.9% rise in January.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.6% in February, after a 7.9% in January.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £284,000 in February, down from £292,000 in January.

-

11:23

UK consumer price inflation rises to 0.5% year-on-year in March

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.5% year-on-year in March from 0.3% in February, exceeding expectations for a rise to 0.4%.

The increase was mainly driven by rises in air fares and clothing prices. Food prices declined.

On a monthly basis, U.K. consumer prices increased 0.4% in March, exceeding expectations for a 0.4% gain, after a 0.2% rise in February.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.5% year-on-year in March from 1.2% in February, beating expectations for an increase to 1.3%.

The Retail Prices Index increased to 1.6% year-on-year in March from 1.3% in February, exceeding expectations for a rise to 1.4%.

The consumer price inflation is below the Bank of England's 2% target.

-

10:57

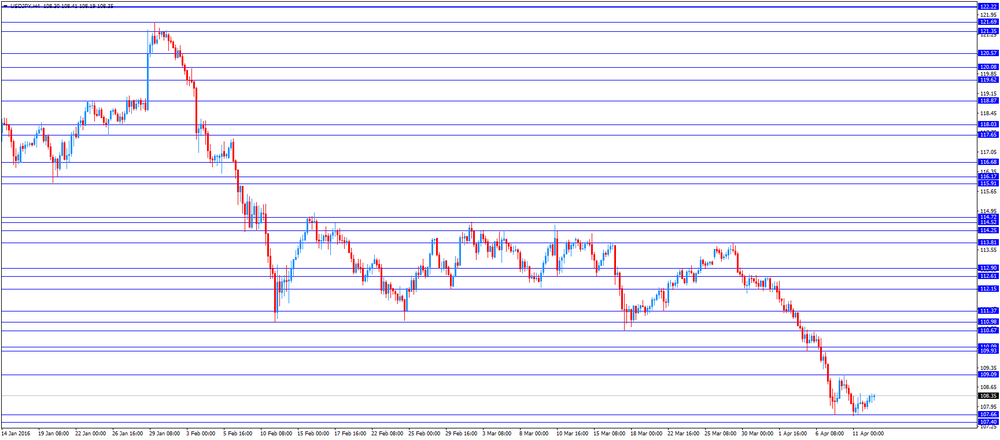

Japan’s Finance Minister Taro Aso: the government could act against the appreciation of the yen

Japan's Finance Minister Taro Aso said on Tuesday that the government could act against the appreciation of the yen if needed.

"We would take necessary steps under certain circumstances if one-sided and speculative moves were observed. I believe we can respond in line with the G20 agreement," he said.

-

10:49

Algerian Energy Minister Salah Khebri: the meeting between OPEC and non-OPEC countries in Doha on April 17 will be crucial

Algerian Energy Minister Salah Khebri said on Monday that the meeting between OPEC and non-OPEC countries in Doha on April 17 would be crucial as an agreement could help to stabilise oil prices. He noted that some key oil producers turned down Algeria's request to lower the oil output.

-

10:35

International Monetary Fund’s experts: negative interest rates have a positive impact on the economy and inflation

Experts at the International Monetary Fund (IMF), Jose Vinals, Simon Gray and Kelly Eckhold, said in a paper that negative interest rates had a positive impact on the economy and inflation, by boosting demand and supporting stable prices.

The IMF experts noted that wholesale interest rates fell, while credit growth in the Eurozone rose since the European Central Bank introduced negative interest rates.

But experts also said that there were risks as negative interest rates could lead to lower profitability of commercial banks.

-

10:30

United Kingdom: HICP, m/m, March 0.4% (forecast 0.3%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), March 2.0% (forecast 2.6%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , March -0.9% (forecast -1.0%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , March -6.5% (forecast -6.0%)

-

10:30

United Kingdom: HICP, Y/Y, March 0.5% (forecast 0.4%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), March 0.3% (forecast 0.2%)

-

10:30

United Kingdom: Retail prices, Y/Y, March 1.6% (forecast 1.4%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, March 1.5% (forecast 1.3%)

-

10:30

United Kingdom: Retail Price Index, m/m, March 0.4% (forecast 0.3%)

-

10:23

Dallas Fed President Robert Kaplan: an interest rate hike in April is unlikely

Dallas Fed President Robert Kaplan said on Monday that an interest rate hike in April was unlikely as the Fed needed more time to analyse the economic data. He added that he could vote for an interest rate hike in June if the U.S. economic data was strong.

Dallas Fed president noted that he would closely watch the GDP and labour market data.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:12

China’s Premier Li Keqiang: there are more positive signs in the Chinese economy

China's Premier Li Keqiang said on Monday that there were more positive signs in the Chinese economy, but the downward remained relatively big. He pointed out that the government would launch investment projects and implement reforms to support the economy.

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY: 109.30 (USD 220m) 110.00 (551m) 110.50 (660m) 111.00 (900m)

EUR/USD: 1.1225-30 (USD 838m) 1.1250-55 (1.95bln) 1.1400 (227m) 1.1400 (1.88bln) 1.1435 (300m) 1.1450-55 (807m) 1.1500 (635m)

EUR/GBP 0.7975 ( EUR 400m)

EUR/JPY 122.50 (EUR 200m) 126.90 (480m)

EUR/CHF 1.0975 (EUR 400m) 1.0989 (300m)

AUD/USD: 0.7450 (AUD 221m) 0.7475 (317m) 0.7600 (253m)

USD/SGD 1.3425 (USD 443m

-

08:34

Asian session: The yen has rocketed higher against the dollar

The yen has rocketed higher against the dollar in recent weeks, touching 17-month highs and having gained 11 percent since the Bank of Japan introduced negative interest rates in January.

As the Abenomics plan to revive the economy is partly predicated on a weak currency spurring exports, this has not gone down well in Tokyo. Chief Cabinet Secretary Yoshihide Suga warned on Monday that the Group of 20 rich nations' agreement to eschew competitive currency devaluations was no bar to Japan intervening to stop "one-sided" moves.

With the International Monetary Fund holding meetings later this week, now would be an embarrassing time for Japan to sell yen on currency markets. But to view this as a short-term problem of financial diplomacy is to underestimate the depth of the problem.

Negative interest rates in Japan have spawned negative unintended consequences. Stocks have fallen 13 percent, with banks, whose very business model is undermined, the hardest hit. That has left many with the belief that the Bank of Japan is constrained: neither negative rates nor its massive purchases of stocks and bonds are having the intended effect.

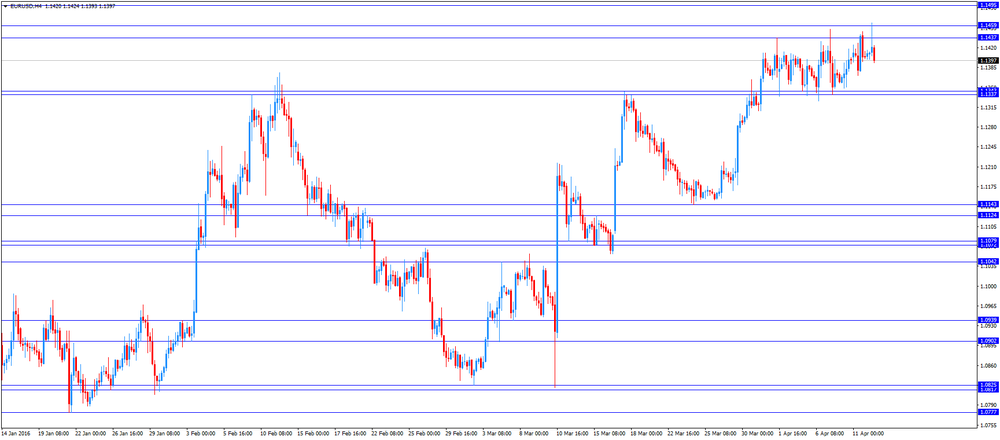

EUR/USD: during the Asian session the pair traded in the range of $1.1400-15

GBP/USD: during the Asian session the pair traded in the range of $1.4225-45

USD/JPY: during the Asian session the pair rose to Y108.25

Based on Reuters materials

-

08:25

WSE: Before opening

The first session of the new week brought a balanced but slightly negative fluctuations in the New York stock market indexes. Such benchmarks of Wall Street as S&P500, NASDAQ Composite and the DJIA, ended Monday trading respectively -0.27%, -0.36% and -0.12%. Crude oil prices on the fuel market in New York falling by 0.6 percent before the publication of data on stocks of fuel in the US, that can show that reserves of raw materials are higher and higher.

European stock exchanges in the first phase of trading today should react to supply-side changes of the US indices and relatively align to them but then find your own path and pulses to new trends.

Today we begin the celebration of the 25th anniversary of the Warsaw Stock Exchange. The anniversary celebrations will be inaugurated by President Andrzej Duda, who today will reveal the new bell on the Warsaw Stock Exchange. It is to symbolize the quarter of a century, during which the Warsaw Stock Exchange has become the largest market in Central and Eastern Europe.

-

08:17

Options levels on tuesday, April 12, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1539 (2540)

$1.1490 (1997)

$1.1456 (404)

Price at time of writing this review: $1.1412

Support levels (open interest**, contracts):

$1.1350 (150)

$1.1304 (2507)

$1.1243 (3302)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 29649 contracts, with the maximum number of contracts with strike price $1,1500 (2662);

- Overall open interest on the PUT options with the expiration date May, 6 is 43518 contracts, with the maximum number of contracts with strike price $1,0900 (4833);

- The ratio of PUT/CALL was 1.47 versus 1.43 from the previous trading day according to data from April, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.4506 (2392)

$1.4409 (1532)

$1.4313 (1093)

Price at time of writing this review: $1.4239

Support levels (open interest**, contracts):

$1.4186 (737)

$1.4090 (1250)

$1.3993 (1750)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 22510 contracts, with the maximum number of contracts with strike price $1,4500 (2392);

- Overall open interest on the PUT options with the expiration date May, 6 is 27395 contracts, with the maximum number of contracts with strike price $1,3850 (3766);

- The ratio of PUT/CALL was 1.21 versus 1.03 from the previous trading day according to data from April, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: CPI, m/m, March 0.8% (forecast 0.8%)

-

08:00

Germany: CPI, y/y , March 0.3% (forecast 0.3%)

-

07:14

Global Stocks

European stocks finished higher Monday, aided by a rally in Italian bank shares and advances within the commodities group.

U.S. stocks closed lower Monday, relinquishing earlier gains on lower-than-average volume, as oil futures rallied and the dollar traded lower against most of its rivals.

Asian stocks rose, led by Japanese equities as the yen retreated after a seven-day rally amid the start of the U.S. earnings season. Global equities are under pressure in April amid concern over the potency of central bank stimulus efforts and a selloff in Japanese shares.

Based on MarketWatch materials

-

04:03

Nikkei 225 15,935.73 +184.60 +1.17 %, Hang Seng 20,436.53 -4.28 -0.02 %, Shanghai Composite 3,026.44 -7.52 -0.25 %

-

03:30

Australia: National Australia Bank's Business Confidence, March 6

-

00:31

Commodities. Daily history for Apr 11’2016:

(raw materials / closing price /% change)

Oil 40.36 0.00%

Gold 1,259.80 +0.14%

-

00:30

Stocks. Daily history for Sep Apr 11’2016:

(index / closing price / change items /% change)

Nikkei 225 15,751.13 -70.39 -0.44 %

Hang Seng 20,440.81 +70.41 +0.35 %

S&P/ASX 200 4,931.53 -6.09 -0.12 %

Shanghai Composite 3,034.59 +49.64 +1.66 %

FTSE 100 6,200.12 -4.29 -0.07 %

CAC 40 4,312.63 +9.51 +0.22 %

Xetra DAX 9,682.99 +60.73 +0.63 %

S&P 500 2,041.99 -5.61 -0.27 %

NASDAQ Composite 4,833.4 -17.29 -0.36 %

Dow Jones 17,556.41 -20.55 -0.12 %

-

00:29

Currencies. Daily history for Apr 11’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1404 +0,05%

GBP/USD $1,4232 +0,75%

USD/CHF Chf0,9545 +0,14%

USD/JPY Y107,96 -0,09%

EUR/JPY Y123,12 -0,02%

GBP/JPY Y153,65 +0,68%

AUD/USD $0,7593 +0,53%

NZD/USD $0,6851 +0,63%

USD/CAD C$1,29 -0,67%

-

00:01

Schedule for today, Tuesday, Apr 12’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence March 3

06:00 Germany CPI, m/m (Finally) March 0.4% 0.8%

06:00 Germany CPI, y/y (Finally) March 0.0% 0.3%

08:30 United Kingdom Producer Price Index - Input (MoM) March 0.1% 2.1%

08:30 United Kingdom Producer Price Index - Input (YoY) March -8.1% -6.2%

08:30 United Kingdom Producer Price Index - Output (MoM) March 0.1% 0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) March -1.1% -1.0%

08:30 United Kingdom Retail prices, Y/Y March 1.3% 1.4%

08:30 United Kingdom Retail Price Index, m/m March 0.5% 0.3%

08:30 United Kingdom HICP, m/m March 0.2% 0.3%

08:30 United Kingdom HICP, Y/Y March 0.3% 0.4%

08:30 United Kingdom HICP ex EFAT, Y/Y March 1.2% 1.3%

12:30 U.S. Import Price Index March -0.3% 1.0%

18:00 U.S. Federal budget March -193

-