Noticias del mercado

-

17:32

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales data

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales data. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December.

Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

The decline was driven by gasoline station sales and clothing stores sales.

The number of initial jobless claims in the week ending February 07 in the U.S. rose by 25,000 to 304,000 from 279,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected the number of initial jobless claims to decrease to 278,000.

The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

The euro traded higher against the U.S. dollar despite the euro group of finance ministers meeting has ended without an agreement on extending the Greece's bailout. The next meeting is scheduled to be on Monday.

Industrial production in the Eurozone was flat in December, missing expectations for a 0.3% increase, after a 0.1% rise in November. November's figure was revised down from a 0.2 increase.

On a yearly basis, Eurozone's industrial production fell 0.2% in December, missing expectations for a 0.3% rise, after a 0.8% drop in November. November's figure was revised down from a 0.4 decrease.

The British pound traded higher against the U.S. dollar as the Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected.

The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

The Canadian dollar rose against the U.S. dollar despite the weaker-than-expected Canadian new housing price index. New housing price index in Canada rose 0.1% in December, missing expectations for a 0.2% gain, after a 0.1% increase in November.

The increase was driven by gains in the Toronto region where prices rose 0.2%.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the weak Business NZ manufacturing purchasing managers' index from New Zealand. The index declined to 50.9 in January from 57.1 in December. December's figure was revised down from 57.7.

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie dropped against the greenback after the weaker-than-expected labour market data from Australia. Australia's unemployment rate rose to 6.4% in January from 6.1% in December, missing expectations for a rise to 6.2%. That was the lowest level since August 2002.

The number of employed people in Australia dropped by 12,200 in January, missing expectations for a decrease by 4,700, after a gain by 42,400 in November. December's figure was revised up from an increase by 37,400.

The Melbourne Institute's consumer inflation expectations for Australia increased to 4.0% in February from 3.2% in January.

The Japanese yen increased against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mixed economic data from Japan. Japan's core machinery orders jumped 8.3% in December, exceeding expectations for a 2.4% increase, after a 1.3% rise in November.

On a yearly basis, Japan's core machinery orders surged 11.4% in December, beating forecasts of 5.9% rise, after a 14.6% drop in November.

Japan's preliminary machine tool orders fell to 20.4% in January from 33.9% in December. December's figure was revised up from 33.8%.

-

16:41

U.S. business inventories rose by 0.1% in December

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

Business sales declined 0.9% in December, the largest decrease since January 2014.

Retail inventories excluding autos climbed 0.1% in December.

The business inventories/sales ratio climbed 1.33 months in December from 1.31 in November, the highest ration since July 2009. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:08

Canada’s new housing price index increased 0.1% in December

Statistics Canada released its new housing price index on Thursday. New housing price index rose 0.1% in December, missing expectations for a 0.2% gain, after a 0.1% increase in November.

The increase was driven by gains in the Toronto region where prices rose 0.2%.

On a yearly basis, the index climbed to 1.7% in December.

-

16:00

U.S.: Business inventories , December +0.1% (forecast +0.2%)

-

15:45

U.S. retail sales dropped 0.8% in January

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December.

Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

Automobiles sales decreased 0.5% in January.

The decline was driven by gasoline station sales and clothing stores sales. Gasoline station sales plunged 9.3%, the biggest decline since December 2008. Sales at clothing retailers decreased 0.8%.

These figures indicates that the U.S. economic growth was slow at the beginning of the first quarter.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 119.00 (USD 2.3bln) 119.25-30 (USD 515m) 120.75-80 (USD 1.25bln) 121.00 (USD 2.6bln)

EURUSD 1.1335 (EUR 876m)

GBPUSD 1.5000 (GBP 300m)

AUDUSD 0.7700 (AUD 3.4bln) 0.7800 (AUD 2.6bln)

NZDUSD 0.7700 (NZD 402m)

EURGBP 0.7400 0.7475 (EUR 216m)

-

14:30

U.S.: Initial Jobless Claims, February 304 (forecast 278)

-

14:30

Canada: New Housing Price Index , December +0.1% (forecast +0.2%)

-

14:30

U.S.: Retail sales, January -0.8% (forecast -0.3%)

-

14:30

U.S.: Retail sales excluding auto, January -0.9% (forecast -0.4%)

-

14:11

Foreign exchange market. European session: British pound rose against the U.S. dollar as the Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation February +3.2% +4.0%

00:01 United Kingdom RICS House Price Balance January 12% Revised From 11% 10% 7%

00:30 Australia Unemployment rate January 6.1% 6.2% 6.4%

00:30 Australia Changing the number of employed January +42.4 Revised From +37.4 -4.7 -12.2

06:00 Japan Prelim Machine Tool Orders, y/y January +33.8% +20.4%

07:00 Germany CPI, m/m (Finally) January -1.0% -1.0% -1.1%

07:00 Germany CPI, y/y (Finally) January -0.3% -0.3% -0.4%

09:00 Eurozone EU Economic Summit

10:00 Eurozone Industrial production, (MoM) December +0.1% Revised From +0.2% +0.3% 0.0%

10:00 Eurozone Industrial Production (YoY) December -0.8% Revised From -0.4% +0.3% -0.2%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. retail sales are expected to decline 0.3% in January, after a 0.9% drop in December.

Retail sales excluding automobiles are expected to decrease 0.4% in January, after a 1.0% fall in December.

The U.S. business inventories are expected to rise 0.2% in December, after a 0.2% gain in November.

The euro traded higher against the U.S. dollar despite the euro group of finance ministers meeting has ended without an agreement on extending the Greece's bailout. The next meeting is scheduled to be on Monday.

Industrial production in the Eurozone was flat in December, missing expectations for a 0.3% increase, after a 0.1% rise in November. November's figure was revised down from a 0.2 increase.

On a yearly basis, Eurozone's industrial production fell 0.2% in December, missing expectations for a 0.3% rise, after a 0.8% drop in November. November's figure was revised down from a 0.4 decrease.

The British pound rose against the U.S. dollar as the Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected.

The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

The Canadian dollar rose against the U.S. dollar ahead of Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in December, after a 0.1% gain in November.

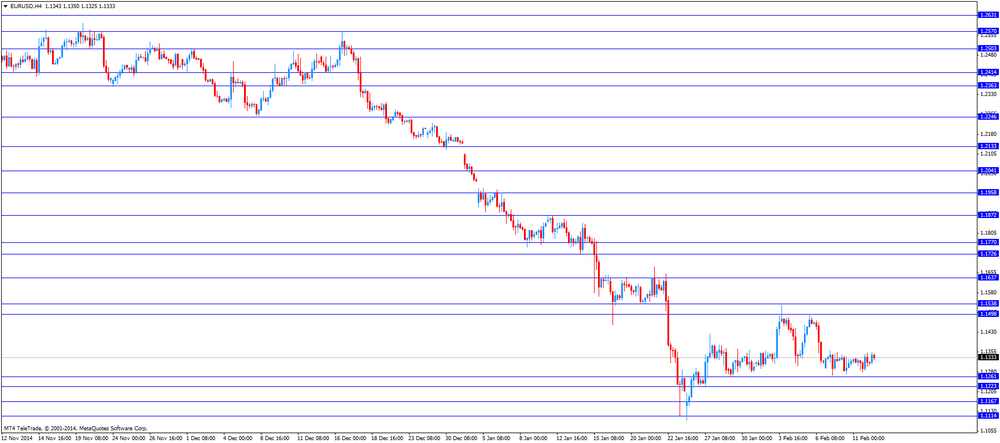

EUR/USD: the currency pair rose to $1.1354

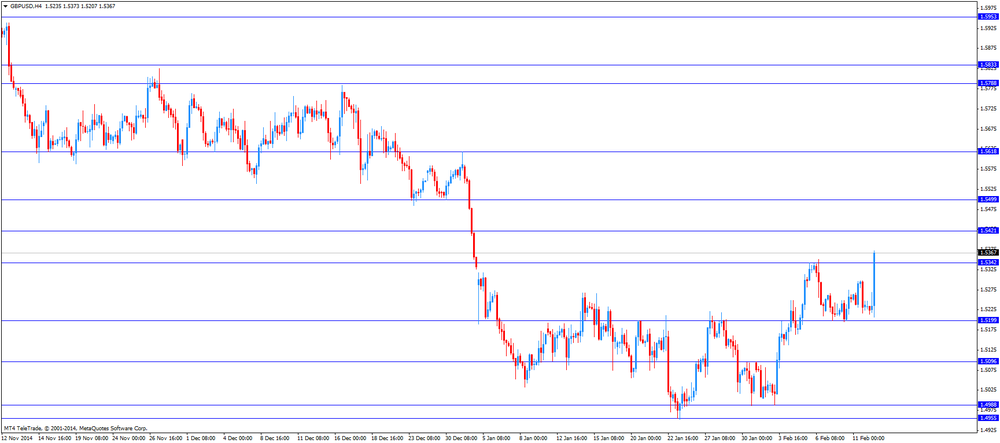

GBP/USD: the currency pair increased to $1.5373

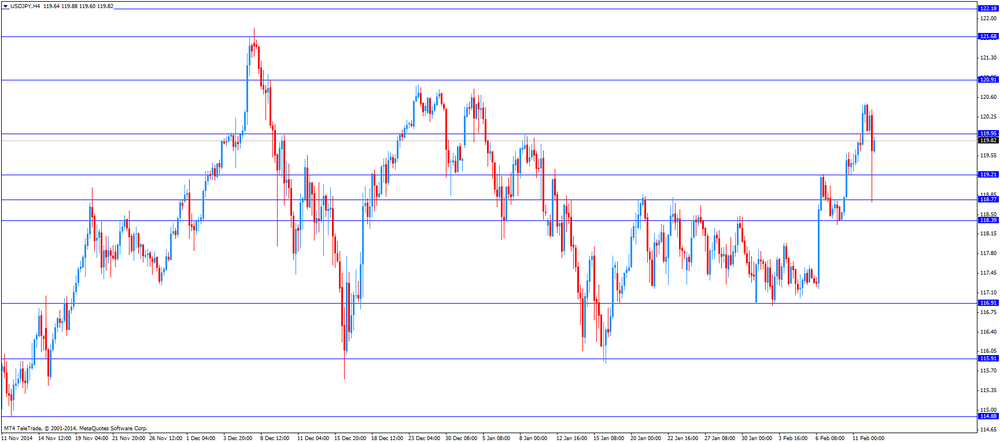

USD/JPY: the currency pair fell to Y118.72

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims February 278 278

13:30 U.S. Retail sales January -0.9% -0.3%

13:30 U.S. Retail sales excluding auto January -1.0% -0.4%

15:00 U.S. Business inventories December +0.2% +0.2%

22:30 Australia RBA's Governor Glenn Stevens Speech

-

14:00

Orders

EUR/USD

Offers 1.1350-55 1.1380 1.1400 1.1420 1.1460 1.1485 1.1500

Bids 1.1300 1.1270-75 1.1240-50 1.1200 1.1180-85 1.1150

GBP/USD

Offers 1.5265 1.5280 1.5300 1.5320-25 1.5350 1.5380 1.5400

Bids 1.5200-10 1.5185 1.5165-70 1.5150 1.5130 1.5110

EUR/JPY

Offers 136.00 136.50 136.80 137.00

Bids 135.00 134.80 134.50 134.00

USD/JPY

Offers 119.80 120.00 120.20-30 120.50

Bids 119.00 118.80-85 118.40 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7450-55 0.7470 0.7490-7500 0.7510-20

Bids 0.7410 0.7400 0.7385 0.7370-75 0.7350

-

13:42

Bank of England Governor Mark Carney: the central bank could hike its interest rate sooner than expected

The Bank of England (BoE) released its Inflation Letter on Thursday. The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The consumer price inflation declined to 0.5% in December. The decline was driven by falling oil prices.

The BoE Governor Mark Carney said that he current period of low inflation was positive for the British economy.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

The central bank upgraded its growth forecast for this year to 2.9% from 2.6%. The growth in 2016 is expected to be 2.9%.

Carney noted that the BoE could hike its interest rate sooner than expected.

-

13:12

Australia's unemployment rate reaches the lowest level since August 2002

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.4% in January from 6.1% in December, missing expectations for a rise to 6.2%. That was the lowest level since August 2002.

The number of employed people in Australia dropped by 12,200 in January, missing expectations for a decrease by 4,700, after a gain by 42,400 in November. December's figure was revised up from an increase by 37,400.

Full-time employment declined by 28,100 in January, while part-time employment rose 15,900.

Participation rate remained unchanged at 64.8%.

These figures could mean that the Reserve Bank of Australia might cut its interest rate again. The central bank said that rising unemployment was one of the main reasons for the interest rate cut last week.

-

12:30

Eurozone: Industrial Production unexpectedly flat in December

Eurozone's Industrial Production came in unexpectedly flat in December according to Eurostat. The data fuels concerns over the economic outlook of the single currency bloc. Analysts had forecasted a growth around +0.3%. Novembers figures were revised down from +0.3% to +0.2%.

Year on year Industrial Production declined by -0.2% in December from a year earlier, compared to forecast of an increase of +0.3%.

-

11:18

Option expiries for today's 10:00 ET NY cut

USDJPY 119.00 (USD 2.3bln) 119.25-30 (USD 515m) 120.75-80 (USD 1.25bln) 121.00 (USD 2.6bln)

EURUSD 1.1335 (EUR 876m)

GBPUSD 1.5000 (GBP 300m)

AUDUSD 0.7700 (AUD 3.4bln) 0.7800 (AUD 2.6bln)

NZDUSD 0.7700 (NZD 402m)

EURGBP 0.7400 0.7475 (EUR 216m)

-

11:00

Eurozone: Industrial production, (MoM), December 0.0% (forecast +0.3%)

-

11:00

Eurozone: Industrial Production (YoY), December -0.2% (forecast +0.3%)

-

10:30

Press Review: Goldman: Here's Why Oil Crashed—and Why Lower Prices Are Here to Stay

BLOOMBERG

Goldman: Here's Why Oil Crashed-and Why Lower Prices Are Here to Stay

Too. Much. Oil.

Oil prices have gotten crushed for the last six months. The extent to which that was caused by an excess of supply or by a slowdown in demand has big implications for where prices will head next. People wishing for a big rebound may not want to read farther.

Goldman Sachs released an intriguing analysis on Wednesday that shows what many already suspected: The big culprit in the oil crash has been an abundance of oil flooding the market. A massive supply shock in the second half of last year accounted for most of the decline. In December and January, slowing demand contributed to the continued sell-off. Goldman was able to quantify these effects.

REUTERS

Icahn values Apple at more than $1 trillion(Reuters) - Activist investor and major Apple Inc shareholder Carl Icahn said the iPhone maker's stock should be trading at $216, far above its record high of $124.92 hit on Wednesday.

At $216 per share, Apple - already the world's most valuable company - would be worth about $1.3 trillion, or about the size of South Korea's gross domestic product.

The company is valued at just over $700 billion currently.

Icahn said Apple should be trading at 20 times earnings per share, which taken together with net cash of $22 per share works out to $216 per share.

Source: http://www.reuters.com/article/2015/02/12/us-apple-icahn-idUSKBN0LF2EU20150212

REUTERS

Greece, euro zone fail to agree on debt, to try again on Monday(Reuters) - Greece's new leftist government and its international creditors failed to agree on a way forward on the country's unpopular bailout and will try again on Monday, with time running out for a financing deal.

In seven hours of crisis talks in Brussels that ended after midnight, euro zone finance ministers were unable to agree even a joint statement on the next procedural steps. Both sides played down the setback, insisting there had been no rupture.

But Greek stock prices, which whipped higher after hours in New York on talk of an accord, sagged with disappointment when it emerged that Greece's laconic new Finance Minister Yanis Varoufakis had walked away from a draft deal to extend current credit terms after conferring with fellow Greek officials.

Source: http://www.reuters.com/article/2015/02/12/us-eurozone-greece-idUSKBN0LF1CE20150212

-

09:56

Sweden's Riksbank Lowers Key Rate to -0.1%

Sweden's central bank today unexpectedly lowered its benchmark interest rate by 10 basis points to -0.10% from 0.0% in an effort to counter deflation in the largest Nordic economy.

-

09:25

German Consumer Price Inflation declines more-than-expected -1.1%

Consumer Price Inflation in the Eurozone's biggest economy declined more-than-expected to a seasonally adjusted -1.1% in January - down for the third consecutive month. Analysts expected inflation to stay at the same level as in December, at -1.0%. The decline was mainly driven by falling oil prices.

Year on year German Consumer Prices fell -0.4%, more than the expected -0.3%.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded stronger against the most major currencies, the Japanese Yen and sterling trade stronger

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation February +3.2% +4.0%

00:01 United Kingdom RICS House Price Balance January 11% 10% 7%

00:30 Australia Unemployment rate January 6.1% 6.2% 6.4%

00:30 Australia Changing the number of employed January +37.4 -4.7 -12.2

06:00 Japan Prelim Machine Tool Orders, y/y January +33.8% +20.4%

07:00 Germany CPI, m/m (Finally) January -1.0% -1.0% -1.1%

07:00 Germany CPI, y/y (Finally) January -0.3% -0.3% -0.4%

The U.S. dollar traded higher against the most major currencies, except the Japanese yen and sterling, in the absence of any major economic reports from the U.S.

Political developments in Greece and its plan not to continue the international bailout in a standoff with the European Union continue to weigh on the euro after the Eurozone Finance Minister Meetings. The meetings failed to reach an agreement and deliver a joint statement on the outcome. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit", weigh on the single currency.

Today U.S. data on Initial Jobless Claims, Retail Sales and Business Inventories are due at 13:30 GMT

The Australian dollar slumped versus the greenback for a third day after disappointing jobs data. The Unemployment Rate for January came in at 6.4%, the highest side 2002, 0.2% higher than forecasts and higher than the 6.1% in the previous month. The number of employed people sank by 12,200, far more than the expected decline of 4,700. Figures for December were revised up from +37,400 to +42,000. Consumer Inflation Expectation for February rose from +3.2% to +4.0%. The aussie has declined 5% in the last month. On February 2nd the Reserve Bank of Australia decided to lower key rates. Markets await RBA's Governor Glenn Stevens speech scheduled for 22:30 GMT.

New Zealand's dollar added traded weaker against the greenback in Asian trade for a third consecutive day. Markets await data on the Food Price Index late in the day due at 21:45 GMT.

The Japanese yen traded stronger against the greenback on Thursday on disappointing jobs data from Australia and no deal in the talks between Greece and its international creditors as investors were looking for haven assets. Japan's Core Machinery Orders for December rose more-than-expected +8.3% from +1.3% in the previous month. Analysts expected an increase of +2.4%. Year on year orders rose +11.4% from -14.6% beating expectations of an increase of +5.9%.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar weakened against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone EU Economic Summit

10:00 Eurozone Industrial production, (MoM) December +0.2% +0.3%

10:00 Eurozone Industrial Production (YoY) December -0.4% +0.3%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims February 278 278

13:30 U.S. Retail sales January -0.9% -0.3%

13:30 U.S. Retail sales excluding auto January -1.0% -0.4%

15:00 U.S. Business inventories December +0.2% +0.2%

21:45 New Zealand Food Prices Index, m/m January +0.3%

21:45 New Zealand Food Prices Index, y/y January +1.0%

22:30 Australia RBA's Governor Glenn Stevens Speech

-

08:00

Germany: CPI, m/m, January -1.1% (forecast -1.0%)

-

08:00

Germany: CPI, y/y , January -0.4% (forecast -0.3%)

-

07:26

Options levels on thursday, February 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1500 (2559)

$1.1429 (762)

$1.1380 (350)

Price at time of writing this review: $1.1314

Support levels (open interest**, contracts):

$1.1243 (3651)

$1.1184 (1886)

$1.1128 (2135)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 100441 contracts, with the maximum number of contracts with strike price $1,1500 (5225);

- Overall open interest on the PUT options with the expiration date March, 6 is 103321 contracts, with the maximum number of contracts with strike price $1,1200 (5520);

- The ratio of PUT/CALL was 1.03 versus 0.99 from the previous trading day according to data from February, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (2183)

$1.5407 (1753)

$1.5311 (1942)

Price at time of writing this review: $1.5221

Support levels (open interest**, contracts):

$1.5188 (1718)

$1.5092 (1496)

$1.4994 (2137)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 25556 contracts, with the maximum number of contracts with strike price $1,5500 (2183);

- Overall open interest on the PUT options with the expiration date March, 6 is 30756 contracts, with the maximum number of contracts with strike price $1,5000 (2137);

- The ratio of PUT/CALL was 1.20 versus 1.21 from the previous trading day according to data from February, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:30

Australia: Changing the number of employed, January -12.2 (forecast -4.7)

-

01:30

Australia: Unemployment rate, January 6.4% (forecast 6.2%)

-

01:01

Australia: Consumer Inflation Expectation, February +4.0%

-

01:01

United Kingdom: RICS House Price Balance, January 7% (forecast 10%)

-

00:51

Japan: Core Machinery Orders, y/y, December +11.4% (forecast +5.9%)

-

00:51

Japan: Core Machinery Orders, December +8.3% (forecast +2.4%)

-

00:31

Currencies. Daily history for Feb 11’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1337 +0,15%

GBP/USD $1,5237 -0,11%

USD/CHF Chf0,9284 +0,25%

USD/JPY Y120,45 +0,86%

EUR/JPY Y136,53 +0,99%

GBP/JPY Y183,55 +0,76%

AUD/USD $0,7716 -0,70%

NZD/USD $0,7362 -0,53%

USD/CAD C$1,2630 +0,35%

-

00:00

Schedule for today, Thursday, Feb 12’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation February +3.2%

00:01 United Kingdom RICS House Price Balance January 11% 10%

00:30 Australia Unemployment rate January 6.1% 6.2%

00:30 Australia Changing the number of employed January +37.4 -4.7

06:00 Japan Prelim Machine Tool Orders, y/y January +33.8%

07:00 Germany CPI, m/m (Finally) January -1.0% -1.0%

07:00 Germany CPI, y/y (Finally) January -0.3% -0.3%

09:00 Eurozone EU Economic Summit

10:00 Eurozone Industrial production, (MoM) December +0.2% +0.3%

10:00 Eurozone Industrial Production (YoY) December -0.4% +0.3%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims February 278 278

13:30 U.S. Retail sales January -0.9% -0.3%

13:30 U.S. Retail sales excluding auto January -1.0% -0.4%

15:00 U.S. Business inventories December +0.2% +0.2%

21:45 New Zealand Food Prices Index, m/m January +0.3%

21:45 New Zealand Food Prices Index, y/y January +1.0%

22:30 Australia RBA's Governor Glenn Stevens Speech

-