Noticias del mercado

-

21:00

Dow +0.58% 17,965.10 +102.96 Nasdaq +1.04% 4,851.13 +49.95 S&P +0.90% 2,087.15 +18.62

-

18:05

European stocks close: stocks closed higher on news about a ceasefire between Russian separatists and Ukrainian forces

Stock indices traded closed higher on news about a cease-fire between Russian separatists and Ukrainian forces. Russian President Vladimir Putin said the agreement would mean the removal of heavy weapons and a full ceasefire would be in place on February 15.

Eurozone's finance ministers meeting has ended without an agreement on extending the Greece's bailout on late Wednesday. The next meeting is scheduled to be on Monday.

Industrial production in the Eurozone was flat in December, missing expectations for a 0.3% increase, after a 0.1% rise in November. November's figure was revised down from a 0.2 increase.

On a yearly basis, Eurozone's industrial production fell 0.2% in December, missing expectations for a 0.3% rise, after a 0.8% drop in November. November's figure was revised down from a 0.4 decrease.

The Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected.

The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,828.11 +9.94 +0.15%

DAX 10,919.65 +167.54 +1.56%

CAC 40 4,726.2 +46.82 +1.00%

-

18:00

European stocks closed: FTSE 6,828.11 +9.94 +0.15% CAC 40 4,726.2 +46.82 +1.00% DAX 10,919.65 +167.54 +1.56%

-

17:40

Oil: a review of the market situation

Oil prices rose sharply during today's session, which was caused by the weakening of the dollar in response to weak data on retail sales and the labor market in the United States. Recall weakening of the dollar increases the demand for raw materials as an alternative investment and makes dollar-denominated commodities cheaper for buyers in other currencies.

Previously submitted report showed that sales in retail stores and restaurants, the US fell by 0.8% last month. On a seasonally adjusted, they were $ 439.77 billion, said Thursday the Ministry of Commerce. Retail sales fell 0.9% in December after rising 0.4% in November. Gasoline prices falling since last summer. But even excluding purchases at gas stations, retail sales were unchanged in January after falling 0.2% in December. Except of motor vehicles, sales fell 0.9% in January after an identical reduction in December. Except as gasoline and car sales rose 0.2% in January after reading unchanged in December. Economists had expected sales to fall by only 0.3% last month. Retailers sales rose 3.3% in January compared with a year earlier - at the same pace as in December. Retail sales data can be volatile from month to month. 0.8% decline in January, was presented with the error of 0.5 percentage points.

Also, today's growth is due to the positive response to reports from Minsk, where Vladimir Putin, Peter Poroshenko, Angela Merkel and Francois Hollande for 16 hours negotiated the settlement of the situation in Ukraine. Putin said that the participants in the meeting agreed on a cease February 15 combat operations in Ukraine, as well as the withdrawal of heavy weapons.

Meanwhile, add that concern excess of stocks of raw materials today pushed aside. Recall data on oil reserves in the United States, published yesterday, showed that stocks the last week rose by 4.87 million barrels. Analysts on average had forecast an increase of only 3.75 million barrels. Production volume jumped 49 th. Barrels per day (b / d) - up to 9.23 million b / d, the highest level since January 1983.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 50.35 dollars per barrel on the New York Mercantile Exchange.

March futures price for North Sea petroleum mix of Brent rose $ 1.74 to $ 56.75 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales data

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales data. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December.

Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

The decline was driven by gasoline station sales and clothing stores sales.

The number of initial jobless claims in the week ending February 07 in the U.S. rose by 25,000 to 304,000 from 279,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected the number of initial jobless claims to decrease to 278,000.

The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

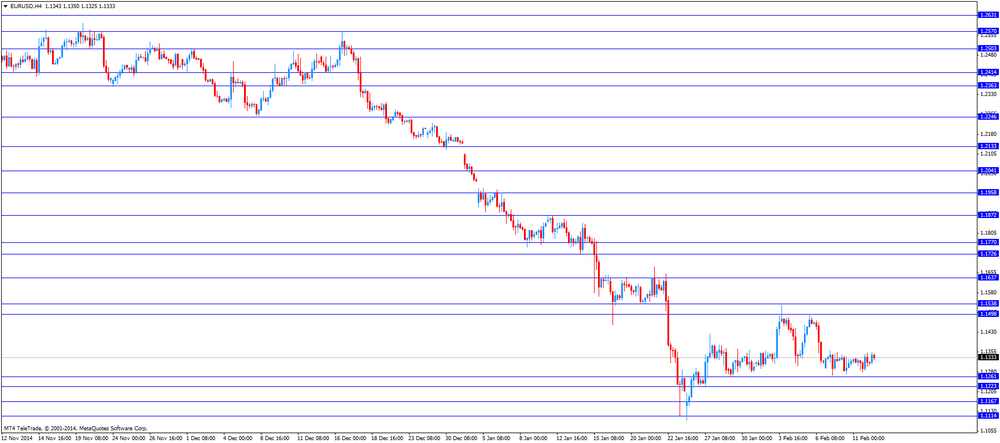

The euro traded higher against the U.S. dollar despite the euro group of finance ministers meeting has ended without an agreement on extending the Greece's bailout. The next meeting is scheduled to be on Monday.

Industrial production in the Eurozone was flat in December, missing expectations for a 0.3% increase, after a 0.1% rise in November. November's figure was revised down from a 0.2 increase.

On a yearly basis, Eurozone's industrial production fell 0.2% in December, missing expectations for a 0.3% rise, after a 0.8% drop in November. November's figure was revised down from a 0.4 decrease.

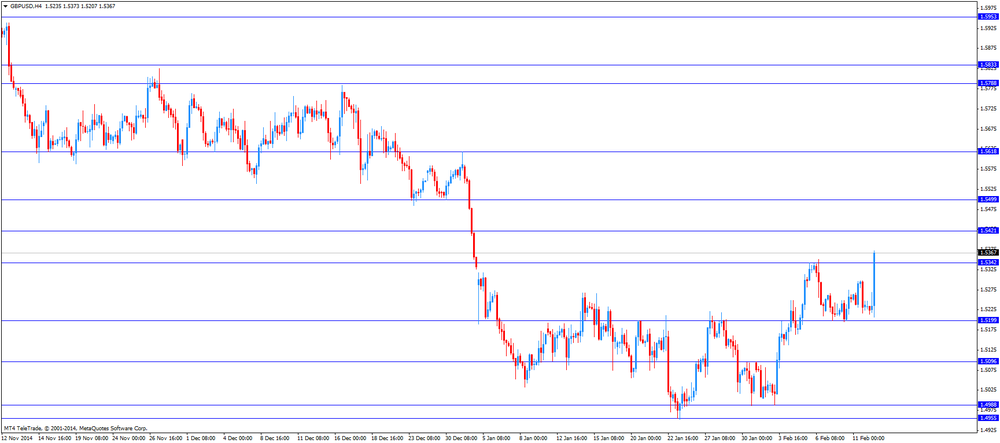

The British pound traded higher against the U.S. dollar as the Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected.

The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

The Canadian dollar rose against the U.S. dollar despite the weaker-than-expected Canadian new housing price index. New housing price index in Canada rose 0.1% in December, missing expectations for a 0.2% gain, after a 0.1% increase in November.

The increase was driven by gains in the Toronto region where prices rose 0.2%.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the weak Business NZ manufacturing purchasing managers' index from New Zealand. The index declined to 50.9 in January from 57.1 in December. December's figure was revised down from 57.7.

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie dropped against the greenback after the weaker-than-expected labour market data from Australia. Australia's unemployment rate rose to 6.4% in January from 6.1% in December, missing expectations for a rise to 6.2%. That was the lowest level since August 2002.

The number of employed people in Australia dropped by 12,200 in January, missing expectations for a decrease by 4,700, after a gain by 42,400 in November. December's figure was revised up from an increase by 37,400.

The Melbourne Institute's consumer inflation expectations for Australia increased to 4.0% in February from 3.2% in January.

The Japanese yen increased against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mixed economic data from Japan. Japan's core machinery orders jumped 8.3% in December, exceeding expectations for a 2.4% increase, after a 1.3% rise in November.

On a yearly basis, Japan's core machinery orders surged 11.4% in December, beating forecasts of 5.9% rise, after a 14.6% drop in November.

Japan's preliminary machine tool orders fell to 20.4% in January from 33.9% in December. December's figure was revised up from 33.8%.

-

17:20

Gold: a review of the market situation

Gold prices rose slightly, but remained near five-week low, helped by depreciation of the dollar, and increased uncertainty regarding the Greek debt. It is learned that the negotiations between Greece and the European Union representatives were unsuccessful, although both sides stressed that the hope for the adoption of the agreement is maintained. The next round of talks scheduled for next Monday .. The term of this agreement for the provision of economic aid to Greece will expire on February 28, and the new Greek government does not want to renew it,

Also affected the course of trading posts by the Bank of Sweden, which cut its key repo rate from 0 to -0.1% and announced the purchase of government bonds with maturity of up to five years to 10 billion kronor ($ 1.2 billion). Central Bank went on these measures and "ready to do more as soon as possible" to bring inflation to the target value, said in a statement. It is 2%, and central bankers are hoping that this will happen in the second half of 2016. However, in December, consumer prices have declined at an annual rate of 0.3%. Bank of Sweden was the first central bank has set a negative repo rate. Earlier, the European Central Bank and the central banks of Denmark and Switzerland have set negative interest rates on deposits for commercial banks. Moreover, the Danish Central Bank for three weeks reduced the rate of four times and did not do it for the acceleration of inflation, and to protect the crown pegged to the euro

Market participants also drew attention to US data showing that initial applications for unemployment benefits rose by 25,000 and reached a seasonally adjusted 304,000 in the week ended Feb. 7. Economists had expected 278,000 new claims. Splash of winter weather in the north-east, may have contributed to the growth of applications for unemployment benefits. Treatment for a week to 31 January were revised to increase by 1000 to 279 000. The four-week moving average of initial claims, which smooths out volatility in the weekly data, fell by 3,250 to 289,750 last week. The report also showed that the number of people re-apply for unemployment benefits fell by 51,000 to 2.35 million in the week ended Jan. 31.

Meanwhile, the price of gold has influenced the report from the World Gold Council (WGC), which stated that the results of 2014, global demand for gold (in physical terms) decreased by 4%, reaching at this 3 thousand. 923.7 tons . Meanwhile, in monetary terms, demand fell by 14% - to $ 159.754 billion. In the WGC reported that the main component of demand remain jewelry. In 2014, their consumption was 2 thousand. 152.9 tons. We also learned that the investment demand for gold has increased by 2% in 2014 and amounted to 904.6 tons. Purchases of gold coins and bullion fell by 40% to 1 thousand. 63.6 tons, but the outflow of gold exchange-traded funds has decreased by 5.5 times to 159.1 tons.

March futures price of gold on the COMEX today rose $ 2 to 1221.00 dollars per ounce.

-

16:41

U.S. business inventories rose by 0.1% in December

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

Business sales declined 0.9% in December, the largest decrease since January 2014.

Retail inventories excluding autos climbed 0.1% in December.

The business inventories/sales ratio climbed 1.33 months in December from 1.31 in November, the highest ration since July 2009. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:08

Canada’s new housing price index increased 0.1% in December

Statistics Canada released its new housing price index on Thursday. New housing price index rose 0.1% in December, missing expectations for a 0.2% gain, after a 0.1% increase in November.

The increase was driven by gains in the Toronto region where prices rose 0.2%.

On a yearly basis, the index climbed to 1.7% in December.

-

16:00

U.S.: Business inventories , December +0.1% (forecast +0.2%)

-

15:45

U.S. retail sales dropped 0.8% in January

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December.

Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

Automobiles sales decreased 0.5% in January.

The decline was driven by gasoline station sales and clothing stores sales. Gasoline station sales plunged 9.3%, the biggest decline since December 2008. Sales at clothing retailers decreased 0.8%.

These figures indicates that the U.S. economic growth was slow at the beginning of the first quarter.

-

15:35

U.S. Stocks open: Dow +0.18%, Nasdaq +0.63%, S&P +0.39%

-

15:29

Before the bell: S&P futures +0.31%, Nasdaq futures +0.50%

U.S. stock-index futures rose as optimism over a cease-fire in Ukraine offset an unexpectedly steep drop in American retail sales.

Global markets:

Nikkei 17,979.72 +327.04 +1.85%

Hang Seng 24,422.15 +107.13 +0.44%

Shanghai Composite 3,173.35 +15.65 +0.50%

FTSE 6,824.61 +6.44 +0.09%

CAC 4,731.23 +51.85 +1.11%

DAX 10,939.25 +187.14 +1.74%

Crude oil $49.90 (+2.17%)

Gold $1225.60 (+0.49%)

-

15:15

Stocks before the bell

(company / ticker / price / change, % / volume)

Amazon.com Inc., NASDAQ

AMZN

376.00

+0.23%

4.8K

McDonald's Corp

MCD

94.45

+0.25%

0.4K

Verizon Communications Inc

VZ

49.94

+0.26%

5.7K

Google Inc.

GOOG

537.36

+0.26%

1.3K

AT&T Inc

T

34.49

+0.29%

2.0K

ALTRIA GROUP INC.

MO

54.92

+0.29%

0.3K

The Coca-Cola Co

KO

42.50

+0.31%

1.0K

International Paper Company

IP

55.68

+0.31%

0.1K

3M Co

MMM

165.00

+0.32%

0.1K

General Electric Co

GE

24.85

+0.32%

5.5K

Microsoft Corp

MSFT

42.52

+0.33%

9.7K

Boeing Co

BA

148.50

+0.39%

0.4K

Starbucks Corporation, NASDAQ

SBUX

91.14

+0.39%

2.5K

Goldman Sachs

GS

188.50

+0.45%

0.6K

Walt Disney Co

DIS

102.33

+0.45%

37.7K

Nike

NKE

91.75

+0.48%

4.4K

General Motors Company, NYSE

GM

37.85

+0.48%

8.9K

International Business Machines Co...

IBM

159.00

+0.51%

1.6K

Pfizer Inc

PFE

34.43

+0.53%

0.3K

Procter & Gamble Co

PG

86.10

+0.54%

45.1K

Visa

V

267.50

+0.57%

2.3K

Facebook, Inc.

FB

76.96

+0.59%

82.2K

Hewlett-Packard Co.

HPQ

38.41

+0.60%

0.8K

Johnson & Johnson

JNJ

100.99

+0.61%

1.8K

Home Depot Inc

HD

111.00

+0.63%

0.2K

JPMorgan Chase and Co

JPM

58.74

+0.63%

7.3K

Caterpillar Inc

CAT

83.95

+0.65%

44.3K

Wal-Mart Stores Inc

WMT

86.90

+0.65%

2.4K

Intel Corp

INTC

33.77

+0.66%

5.4K

Citigroup Inc., NYSE

C

50.02

+0.68%

8.7K

Exxon Mobil Corp

XOM

91.25

+0.72%

8.0K

AMERICAN INTERNATIONAL GROUP

AIG

52.64

+0.75%

0.1K

Chevron Corp

CVX

109.90

+0.91%

3.8K

ALCOA INC.

AA

15.60

+0.91%

16.7K

Ford Motor Co.

F

16.40

+0.92%

2.0K

Apple Inc.

AAPL

126.10

+0.98%

703.9K

Travelers Companies Inc

TRV

109.00

+1.14%

0.2K

Twitter, Inc., NYSE

TWTR

48.05

+1.16%

46.0K

Barrick Gold Corporation, NYSE

ABX

12.09

+1.26%

18.0K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.08

+2.58%

21.0K

Yandex N.V., NASDAQ

YNDX

16.76

+4.75%

80.7K

Cisco Systems Inc

CSCO

29.00

+7.69%

704.8K

Yahoo! Inc., NASDAQ

YHOO

42.96

0.00%

14.2K

American Express Co

AXP

83.75

-2.63%

14.6K

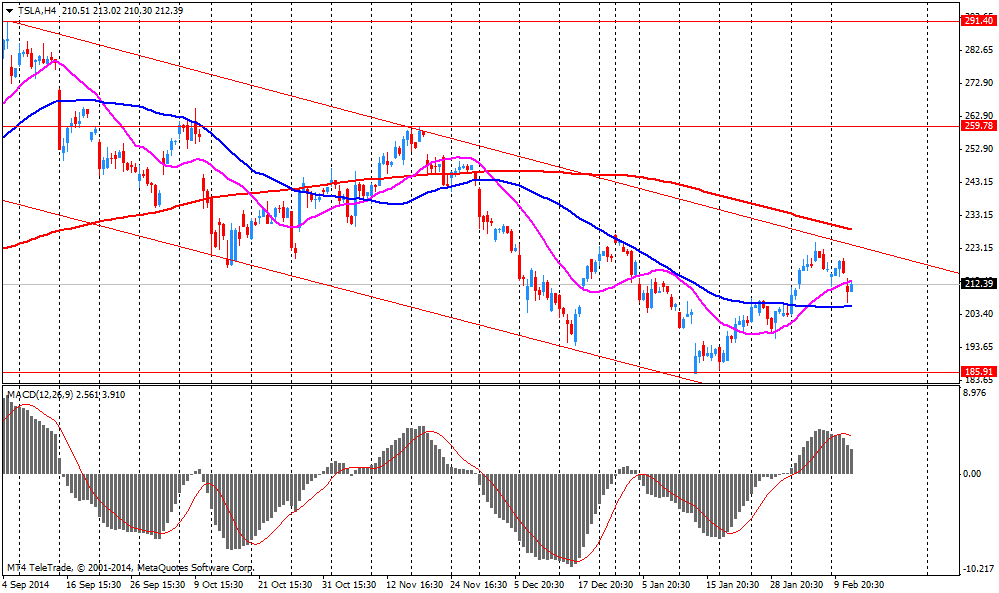

Tesla Motors, Inc., NASDAQ

TSLA

196.51

-7.66%

316.5K

-

15:09

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Tesla Motors (TSLA) downgraded from Neutral to Underweight at JP Morgan

Other:

Wal-Mart (WMT) target raised to $95 from $87 at Credit Suisse; Outperform

Cisco Systems (CSCO) target raised from $29 to $31 at RBC Capital Mkts, from $29 to $30 at Oppenheimer, from $28 to $29 at Wunderlich

-

14:52

Company News: Tesla Motors Inc (TSLA) reported weaker than expected fourth quarter profits

Tesla Motors Inc (TSLA) earned $0.13 per share in the fourth quarter, missing analysts' estimate of $0.32. Revenue in the fourth quarter increased 43.9% year-over-year to $1.10 billion, but missing analysts' estimate of $1.23 billion.

The company announced that it delivered 9,834 cars in the fourth quarter, missing analysts' estimate of 11,000 cars and the company's estimate of 11,200 cars. The company expects to deliver 55,000 cars in 2015 (analysts' estimate: 50,000 - 60,000 cars)

Tesla Motors Inc (TSLA) shares decreased to $196.85 (-7.50%) prior to the opening bell.

-

14:45

Company News: Cisco Systems Inc (CSCO) reported better than expected second fiscal quarter profits

Cisco Systems Inc (CSCO) earned $0.53 per share in the second fiscal quarter, beating analysts' estimate of $0.51. Revenue in the second fiscal quarter increased 7.0% year-over-year to $11.94 billion, exceeding analysts' estimate of $11.80 billion.

The company announced a 10.5% rise in its quarterly dividend to $0.21 per share.

Cisco Systems Inc (CSCO) shares increased to $28.95 (+7.50%) prior to the opening bell.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 119.00 (USD 2.3bln) 119.25-30 (USD 515m) 120.75-80 (USD 1.25bln) 121.00 (USD 2.6bln)

EURUSD 1.1335 (EUR 876m)

GBPUSD 1.5000 (GBP 300m)

AUDUSD 0.7700 (AUD 3.4bln) 0.7800 (AUD 2.6bln)

NZDUSD 0.7700 (NZD 402m)

EURGBP 0.7400 0.7475 (EUR 216m)

-

14:30

U.S.: Initial Jobless Claims, February 304 (forecast 278)

-

14:30

Canada: New Housing Price Index , December +0.1% (forecast +0.2%)

-

14:30

U.S.: Retail sales, January -0.8% (forecast -0.3%)

-

14:30

U.S.: Retail sales excluding auto, January -0.9% (forecast -0.4%)

-

14:11

Foreign exchange market. European session: British pound rose against the U.S. dollar as the Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation February +3.2% +4.0%

00:01 United Kingdom RICS House Price Balance January 12% Revised From 11% 10% 7%

00:30 Australia Unemployment rate January 6.1% 6.2% 6.4%

00:30 Australia Changing the number of employed January +42.4 Revised From +37.4 -4.7 -12.2

06:00 Japan Prelim Machine Tool Orders, y/y January +33.8% +20.4%

07:00 Germany CPI, m/m (Finally) January -1.0% -1.0% -1.1%

07:00 Germany CPI, y/y (Finally) January -0.3% -0.3% -0.4%

09:00 Eurozone EU Economic Summit

10:00 Eurozone Industrial production, (MoM) December +0.1% Revised From +0.2% +0.3% 0.0%

10:00 Eurozone Industrial Production (YoY) December -0.8% Revised From -0.4% +0.3% -0.2%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. retail sales are expected to decline 0.3% in January, after a 0.9% drop in December.

Retail sales excluding automobiles are expected to decrease 0.4% in January, after a 1.0% fall in December.

The U.S. business inventories are expected to rise 0.2% in December, after a 0.2% gain in November.

The euro traded higher against the U.S. dollar despite the euro group of finance ministers meeting has ended without an agreement on extending the Greece's bailout. The next meeting is scheduled to be on Monday.

Industrial production in the Eurozone was flat in December, missing expectations for a 0.3% increase, after a 0.1% rise in November. November's figure was revised down from a 0.2 increase.

On a yearly basis, Eurozone's industrial production fell 0.2% in December, missing expectations for a 0.3% rise, after a 0.8% drop in November. November's figure was revised down from a 0.4 decrease.

The British pound rose against the U.S. dollar as the Bank of England (BoE) Governor Mark Carney said that the central bank could hike its interest rate sooner than expected.

The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

The Canadian dollar rose against the U.S. dollar ahead of Canadian new housing price index. Canada's new housing price index is expected to rise 0.2% in December, after a 0.1% gain in November.

EUR/USD: the currency pair rose to $1.1354

GBP/USD: the currency pair increased to $1.5373

USD/JPY: the currency pair fell to Y118.72

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims February 278 278

13:30 U.S. Retail sales January -0.9% -0.3%

13:30 U.S. Retail sales excluding auto January -1.0% -0.4%

15:00 U.S. Business inventories December +0.2% +0.2%

22:30 Australia RBA's Governor Glenn Stevens Speech

-

14:00

Orders

EUR/USD

Offers 1.1350-55 1.1380 1.1400 1.1420 1.1460 1.1485 1.1500

Bids 1.1300 1.1270-75 1.1240-50 1.1200 1.1180-85 1.1150

GBP/USD

Offers 1.5265 1.5280 1.5300 1.5320-25 1.5350 1.5380 1.5400

Bids 1.5200-10 1.5185 1.5165-70 1.5150 1.5130 1.5110

EUR/JPY

Offers 136.00 136.50 136.80 137.00

Bids 135.00 134.80 134.50 134.00

USD/JPY

Offers 119.80 120.00 120.20-30 120.50

Bids 119.00 118.80-85 118.40 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7450-55 0.7470 0.7490-7500 0.7510-20

Bids 0.7410 0.7400 0.7385 0.7370-75 0.7350

-

13:42

Bank of England Governor Mark Carney: the central bank could hike its interest rate sooner than expected

The Bank of England (BoE) released its Inflation Letter on Thursday. The central bank expects the consumer price inflation in the U.K. to be at around zero in the second and third quarters this year before starting to increase towards the end of 2015.

The consumer price inflation declined to 0.5% in December. The decline was driven by falling oil prices.

The BoE Governor Mark Carney said that he current period of low inflation was positive for the British economy.

The BoE said that it could lower interest rates below 0.5% or could expand its £375 billion asset buying programme if inflation remained below target for a longer period.

The central bank upgraded its growth forecast for this year to 2.9% from 2.6%. The growth in 2016 is expected to be 2.9%.

Carney noted that the BoE could hike its interest rate sooner than expected.

-

13:12

Australia's unemployment rate reaches the lowest level since August 2002

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.4% in January from 6.1% in December, missing expectations for a rise to 6.2%. That was the lowest level since August 2002.

The number of employed people in Australia dropped by 12,200 in January, missing expectations for a decrease by 4,700, after a gain by 42,400 in November. December's figure was revised up from an increase by 37,400.

Full-time employment declined by 28,100 in January, while part-time employment rose 15,900.

Participation rate remained unchanged at 64.8%.

These figures could mean that the Reserve Bank of Australia might cut its interest rate again. The central bank said that rising unemployment was one of the main reasons for the interest rate cut last week.

-

13:00

European stock markets mid-session: Indices gain on Ukraine peace deal and Swedish economic stimulus

European stocks add gains fuelled by the Swedish surprise move lowering benchmark interest rates and the Ukrainian peace deal. Leaders of Germany, France, Russia and Ukraine agreed on a deal to stop fighting. Sweden's central bank today unexpectedly lowered its benchmark interest rate by 10 basis points to -0.10% from 0.0% and launched quantitative easing measures to counter deflation in the largest Nordic economy.

Greek officials reaffirmed today that they are confident of reaching a deal with its creditors. Yesterday's emergency meeting of the E.U. finance ministers failed to reach an agreement and deliver a joint statement on the outcome. Greece presented a 10 point plan to replace 30% of the bailout deal but creditors are insisting on the terms of the original agreement. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit" weigh on the markets as decisions on the bailout-deal are postponed until next week, February 16th, were the next meeting is scheduled. Today E.U. leaders will meet at a summit.

Consumer Price Inflation in the Eurozone's biggest economy declined more-than-expected to a seasonally adjusted -1.1% in January - down for the third consecutive month. Analysts expected inflation to stay at the same level as in December, at -1.0%. The decline was mainly driven by falling oil prices. Year on year German Consumer Prices fell -0.4%, more than the expected -0.3%.

Eurozone's Industrial Production came in unexpectedly flat in December according to Eurostat. The data fuels concerns over the economic outlook of the single currency bloc. Analysts had forecasted a growth around +0.3%. Novembers figures were revised down from +0.3% to +0.2%. Year on year Industrial Production declined by -0.2% in December from a year earlier, compared to forecast of an increase of +0.3%.

The FTSE 100 index is currently trading +0.19% quoted at 6,831.18 points. Germany's DAX 30 added +1.56% trading at 10,920.03. France's CAC 40 is currently trading at 4,721.76 points, +0.91%.

-

12:30

Eurozone: Industrial Production unexpectedly flat in December

Eurozone's Industrial Production came in unexpectedly flat in December according to Eurostat. The data fuels concerns over the economic outlook of the single currency bloc. Analysts had forecasted a growth around +0.3%. Novembers figures were revised down from +0.3% to +0.2%.

Year on year Industrial Production declined by -0.2% in December from a year earlier, compared to forecast of an increase of +0.3%.

-

12:20

Oil: Prices recover from 2-day decline

Oil prices rebounded in today's trading after prices fell more than 7% in the last two days. Yesterday the Department of Energy has stated that during the week from 31 January to 6 February crude oil reserves rose by 4.9 million barrels to 417.9 million barrels, while the average forecast assumes an increase of 4 million barrels. It is worth emphasizing reserves reached a historical high for the entire period of reference of the statistics (since August 1982). Brent Crude added +1.79%, currently trading at USD55.64 a barrel. On January 13th Crude hit a low at USD45.19 and began to rise on reports on declining rig numbers in the U.S. and capital expenditure cuts. Crude registered the biggest 2-week gain in 17 years last week. West Texas Intermediate rose by +2.68% currently quoted at USD50.15, above the level of USD50 again.

Saudi Arabia, Iraq, Kuwait and Iran - OPEC's four biggest producers in the 12 member club - further cut prices to Asia in a fight for market share. Last week Saudi Arabia cut its prices to the lowest level in 14 years.

Worldwide supply still exceeds demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices. Smaller OPEC members want to cut production but the organisation, responsible for 40% of worldwide production focuses on its fight for market share. Rising U.S. stockpiles are contributing to a global glut that drove prices lower. The U.S., Brazil, Russia and the OPEC are producing at record levels.

-

12:00

Gold prices recover from yesterday’s drop to 5-week lows

Gold is trading higher today, recovering from 5-week lows, as concerns over Greece after the Eurozone Emergency Meeting boost haven assets. The meetings failed to reach an agreement and deliver a joint statement on the outcome. Greece presented a 10 point plan to replace the bailout deal but creditors are insisting on the terms of the original agreement. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit", support the precious metal, as decisions on the bailout-deal are postponed until next week, February 16th, were the next meeting is scheduled. Today E.U. leaders will meet at a summit.

A stronger U.S. dollar and the prospect for higher U.S. rates following last week's robust U.S. jobs report weigh on the precious metal as it is dollar-denominated and not yield-bearing.

The precious metal is currently quoted at USD1,223.60, +0,29% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:18

Option expiries for today's 10:00 ET NY cut

USDJPY 119.00 (USD 2.3bln) 119.25-30 (USD 515m) 120.75-80 (USD 1.25bln) 121.00 (USD 2.6bln)

EURUSD 1.1335 (EUR 876m)

GBPUSD 1.5000 (GBP 300m)

AUDUSD 0.7700 (AUD 3.4bln) 0.7800 (AUD 2.6bln)

NZDUSD 0.7700 (NZD 402m)

EURGBP 0.7400 0.7475 (EUR 216m)

-

11:00

Eurozone: Industrial production, (MoM), December 0.0% (forecast +0.3%)

-

11:00

Eurozone: Industrial Production (YoY), December -0.2% (forecast +0.3%)

-

10:30

Press Review: Goldman: Here's Why Oil Crashed—and Why Lower Prices Are Here to Stay

BLOOMBERG

Goldman: Here's Why Oil Crashed-and Why Lower Prices Are Here to Stay

Too. Much. Oil.

Oil prices have gotten crushed for the last six months. The extent to which that was caused by an excess of supply or by a slowdown in demand has big implications for where prices will head next. People wishing for a big rebound may not want to read farther.

Goldman Sachs released an intriguing analysis on Wednesday that shows what many already suspected: The big culprit in the oil crash has been an abundance of oil flooding the market. A massive supply shock in the second half of last year accounted for most of the decline. In December and January, slowing demand contributed to the continued sell-off. Goldman was able to quantify these effects.

REUTERS

Icahn values Apple at more than $1 trillion(Reuters) - Activist investor and major Apple Inc shareholder Carl Icahn said the iPhone maker's stock should be trading at $216, far above its record high of $124.92 hit on Wednesday.

At $216 per share, Apple - already the world's most valuable company - would be worth about $1.3 trillion, or about the size of South Korea's gross domestic product.

The company is valued at just over $700 billion currently.

Icahn said Apple should be trading at 20 times earnings per share, which taken together with net cash of $22 per share works out to $216 per share.

Source: http://www.reuters.com/article/2015/02/12/us-apple-icahn-idUSKBN0LF2EU20150212

REUTERS

Greece, euro zone fail to agree on debt, to try again on Monday(Reuters) - Greece's new leftist government and its international creditors failed to agree on a way forward on the country's unpopular bailout and will try again on Monday, with time running out for a financing deal.

In seven hours of crisis talks in Brussels that ended after midnight, euro zone finance ministers were unable to agree even a joint statement on the next procedural steps. Both sides played down the setback, insisting there had been no rupture.

But Greek stock prices, which whipped higher after hours in New York on talk of an accord, sagged with disappointment when it emerged that Greece's laconic new Finance Minister Yanis Varoufakis had walked away from a draft deal to extend current credit terms after conferring with fellow Greek officials.

Source: http://www.reuters.com/article/2015/02/12/us-eurozone-greece-idUSKBN0LF1CE20150212

-

10:00

European Stocks. First hour: Stocks add gains – Greece and quarterly reports in focus

European stocks add gains in early trading. Investors focus on Greece. Yesterday's emergency meeting of the E.U. finance ministers failed to reach an agreement and deliver a joint statement on the outcome. Greece presented a 10 point plan to replace the bailout deal but creditors are insisting on the terms of the original agreement. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit" weighs on the markets as decisions on the bailout-deal are postponed until next week, February 16th, were the next meeting is scheduled. Today E.U. leaders will meet at a summit.

Today a large number of quarterly reports are also in the focus.

The FTSE 100 index is currently trading +0.28% quoted at 6,837.50 points. Germany's DAX 30 rose +0.73% trading at 10,830.35. France's CAC 40 added +0.17%, currently trading at 4,687.11 points.

-

09:56

Sweden's Riksbank Lowers Key Rate to -0.1%

Sweden's central bank today unexpectedly lowered its benchmark interest rate by 10 basis points to -0.10% from 0.0% in an effort to counter deflation in the largest Nordic economy.

-

09:25

German Consumer Price Inflation declines more-than-expected -1.1%

Consumer Price Inflation in the Eurozone's biggest economy declined more-than-expected to a seasonally adjusted -1.1% in January - down for the third consecutive month. Analysts expected inflation to stay at the same level as in December, at -1.0%. The decline was mainly driven by falling oil prices.

Year on year German Consumer Prices fell -0.4%, more than the expected -0.3%.

-

09:00

Global Stocks: Wall Street flat, China and Japan add gains

U.S. markets closed almost unchanged on Wednesday. The DOW JONES index lost -0.04% closing at 17,862.14 points. The S&P 500 closed flat at +0.00% with a final quote of 2,068.53as investors worried about the outcome of the negotiations with Greece. The Eurozone Finance Minister Meetings failed to reach an agreement and deliver a joint statement on the outcome. Officials stated that discussions will continue. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit", add to uncertainty and weigh on the markets.

Today U.S. data on Initial Jobless Claims, Retail Sales and Business Inventories are due at 13:30 GMT

Chinese shares added gains on Thursday in the wake of the Chinese New Year were volumes are expected to remain low. Hong Kong's Hang Seng is trading +0.36% at 24,402.37 points. China's Shanghai Composite closed at 3,173.35 points +0.50%. The index has gained more than 50% over the past year boosted by monetary easing and the creation of an exchange link with Hong Kong.

Japanese markets after being closed yesterday for a public holiday, trade at 7-1/2 -year highs. The Nikkei skyrocketed, closing +1.85% with a final quote of 17,979.72 points on a weaker yen boosting exporter shares.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded stronger against the most major currencies, the Japanese Yen and sterling trade stronger

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation February +3.2% +4.0%

00:01 United Kingdom RICS House Price Balance January 11% 10% 7%

00:30 Australia Unemployment rate January 6.1% 6.2% 6.4%

00:30 Australia Changing the number of employed January +37.4 -4.7 -12.2

06:00 Japan Prelim Machine Tool Orders, y/y January +33.8% +20.4%

07:00 Germany CPI, m/m (Finally) January -1.0% -1.0% -1.1%

07:00 Germany CPI, y/y (Finally) January -0.3% -0.3% -0.4%

The U.S. dollar traded higher against the most major currencies, except the Japanese yen and sterling, in the absence of any major economic reports from the U.S.

Political developments in Greece and its plan not to continue the international bailout in a standoff with the European Union continue to weigh on the euro after the Eurozone Finance Minister Meetings. The meetings failed to reach an agreement and deliver a joint statement on the outcome. Greece's bailout will expire on February 28th. Fears that Greece might leave the Eurozone, the "Grexit", weigh on the single currency.

Today U.S. data on Initial Jobless Claims, Retail Sales and Business Inventories are due at 13:30 GMT

The Australian dollar slumped versus the greenback for a third day after disappointing jobs data. The Unemployment Rate for January came in at 6.4%, the highest side 2002, 0.2% higher than forecasts and higher than the 6.1% in the previous month. The number of employed people sank by 12,200, far more than the expected decline of 4,700. Figures for December were revised up from +37,400 to +42,000. Consumer Inflation Expectation for February rose from +3.2% to +4.0%. The aussie has declined 5% in the last month. On February 2nd the Reserve Bank of Australia decided to lower key rates. Markets await RBA's Governor Glenn Stevens speech scheduled for 22:30 GMT.

New Zealand's dollar added traded weaker against the greenback in Asian trade for a third consecutive day. Markets await data on the Food Price Index late in the day due at 21:45 GMT.

The Japanese yen traded stronger against the greenback on Thursday on disappointing jobs data from Australia and no deal in the talks between Greece and its international creditors as investors were looking for haven assets. Japan's Core Machinery Orders for December rose more-than-expected +8.3% from +1.3% in the previous month. Analysts expected an increase of +2.4%. Year on year orders rose +11.4% from -14.6% beating expectations of an increase of +5.9%.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar weakened against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone EU Economic Summit

10:00 Eurozone Industrial production, (MoM) December +0.2% +0.3%

10:00 Eurozone Industrial Production (YoY) December -0.4% +0.3%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims February 278 278

13:30 U.S. Retail sales January -0.9% -0.3%

13:30 U.S. Retail sales excluding auto January -1.0% -0.4%

15:00 U.S. Business inventories December +0.2% +0.2%

21:45 New Zealand Food Prices Index, m/m January +0.3%

21:45 New Zealand Food Prices Index, y/y January +1.0%

22:30 Australia RBA's Governor Glenn Stevens Speech

-

08:00

Germany: CPI, m/m, January -1.1% (forecast -1.0%)

-

08:00

Germany: CPI, y/y , January -0.4% (forecast -0.3%)

-

07:26

Options levels on thursday, February 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1500 (2559)

$1.1429 (762)

$1.1380 (350)

Price at time of writing this review: $1.1314

Support levels (open interest**, contracts):

$1.1243 (3651)

$1.1184 (1886)

$1.1128 (2135)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 100441 contracts, with the maximum number of contracts with strike price $1,1500 (5225);

- Overall open interest on the PUT options with the expiration date March, 6 is 103321 contracts, with the maximum number of contracts with strike price $1,1200 (5520);

- The ratio of PUT/CALL was 1.03 versus 0.99 from the previous trading day according to data from February, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (2183)

$1.5407 (1753)

$1.5311 (1942)

Price at time of writing this review: $1.5221

Support levels (open interest**, contracts):

$1.5188 (1718)

$1.5092 (1496)

$1.4994 (2137)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 25556 contracts, with the maximum number of contracts with strike price $1,5500 (2183);

- Overall open interest on the PUT options with the expiration date March, 6 is 30756 contracts, with the maximum number of contracts with strike price $1,5000 (2137);

- The ratio of PUT/CALL was 1.20 versus 1.21 from the previous trading day according to data from February, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:29

Nikkei 225 17,925.44 +272.76 +1.55%, Hang Seng 24,240.6 -74.42 -0.31%, Shanghai Composite 3,157.96 +0.26 +0.01%

-

01:30

Australia: Changing the number of employed, January -12.2 (forecast -4.7)

-

01:30

Australia: Unemployment rate, January 6.4% (forecast 6.2%)

-

01:01

Australia: Consumer Inflation Expectation, February +4.0%

-

01:01

United Kingdom: RICS House Price Balance, January 7% (forecast 10%)

-

00:51

Japan: Core Machinery Orders, y/y, December +11.4% (forecast +5.9%)

-

00:51

Japan: Core Machinery Orders, December +8.3% (forecast +2.4%)

-

00:44

Commodities. Daily history for Feb 11’2015:

(raw materials / closing price /% change)

Light Crude 48.84 -2.36%

Gold 1,218.30 -0.11%

-

00:40

Stocks. Daily history for Feb 11’2015:

(index / closing price / change items /% change)

Hang Seng 24,315.02 -213.08 -0.87%

Shanghai Composite 3,157.7 +16.11 +0.51%

FTSE 100 6,818.17 -10.95 -0.16%

CAC 40 4,679.38 -16.27 -0.35%

Xetra DAX 10,752.11 -1.72 -0.02%

S&P 500 2,068.53 -0.06 0.00%

NASDAQ Composite 4,801.18 +13.54 +0.28%

Dow Jones 17,862.14 -6.62 -0.04%

-

00:31

Currencies. Daily history for Feb 11’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1337 +0,15%

GBP/USD $1,5237 -0,11%

USD/CHF Chf0,9284 +0,25%

USD/JPY Y120,45 +0,86%

EUR/JPY Y136,53 +0,99%

GBP/JPY Y183,55 +0,76%

AUD/USD $0,7716 -0,70%

NZD/USD $0,7362 -0,53%

USD/CAD C$1,2630 +0,35%

-

00:00

Schedule for today, Thursday, Feb 12’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation February +3.2%

00:01 United Kingdom RICS House Price Balance January 11% 10%

00:30 Australia Unemployment rate January 6.1% 6.2%

00:30 Australia Changing the number of employed January +37.4 -4.7

06:00 Japan Prelim Machine Tool Orders, y/y January +33.8%

07:00 Germany CPI, m/m (Finally) January -1.0% -1.0%

07:00 Germany CPI, y/y (Finally) January -0.3% -0.3%

09:00 Eurozone EU Economic Summit

10:00 Eurozone Industrial production, (MoM) December +0.2% +0.3%

10:00 Eurozone Industrial Production (YoY) December -0.4% +0.3%

10:30 United Kingdom BOE Inflation Letter

10:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 Canada New Housing Price Index December +0.1% +0.2%

13:30 U.S. Initial Jobless Claims February 278 278

13:30 U.S. Retail sales January -0.9% -0.3%

13:30 U.S. Retail sales excluding auto January -1.0% -0.4%

15:00 U.S. Business inventories December +0.2% +0.2%

21:45 New Zealand Food Prices Index, m/m January +0.3%

21:45 New Zealand Food Prices Index, y/y January +1.0%

22:30 Australia RBA's Governor Glenn Stevens Speech

-