Noticias del mercado

-

21:00

Dow -0.26% 17,823.10 -45.66 Nasdaq +0.22% 4,798.25 +10.60 S&P -0.13% 2,065.90 -2.69

-

20:00

U.S.: Federal budget , January -17.5 (forecast -2.6)

-

18:02

European stocks close: stocks closed lower ahead Eurozone’s finance ministers meetings

Stock indices traded closed lower ahead Eurozone's finance ministers meetings. The euro group of finance ministers will meet in Brussels later in the day. Greece's Finance Minister Yanis Varoufakis is expected to present new reform proposals.

Investors speculate that the European Commission could extend Greece's existing bailout program. Greece's bailout expires at the end of this month.

But German Finance Minister Wolfgang Schaeuble said today that there are no plans for a new agreement.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,818.17 -10.95 -0.16 %

DAX 10,752.11 -1.72 -0.02 %

CAC 40 4,679.38 -16.27 -0.35 %

-

18:00

European stocks closed: FTSE 100 6,818.17 -10.95 -0.16% CAC 40 4,679.38 -16.27 -0.35% DAX 10,752.11 -1.72 -0.02%

-

17:40

Oil: a review of the market situation

Oil prices fell markedly, while dropping below $ 55 (Brent) and $ 49 (WTI), which was associated with the publication of data on stocks of petroleum products in the United States. The Department of Energy has stated that during the week from 31 January to 6 February crude oil reserves rose by 4.9 million barrels to 417.9 million barrels, while the average forecast assumes an increase of 4 million barrels. It is worth emphasizing reserves reached a historical high for the entire period of reference of the statistics (since August 1982). Oil reserves in Cushing terminal rose by 1.2 million barrels to 42.6 million barrels, the highest value for the half year. Distillate stocks fell by 3.3 million barrels to 131.2 million barrels, while analysts had expected a decline of 1.3 million barrels. Gasoline inventories rose by 2.0 million barrels to 242.6 million barrels. Analysts had expected an increase of 200 thousand .. refining capacity utilization rate increased by 0.1% to 90%. Expected to decline by 0.1%.

As investors continue to analyze the report from the US Energy Information Administration (EIA). As it became known, EIA has kept oil production forecast in the country in 2015-2016, contrary to expectations that production will decline because of falling world prices. According to the calculations EIA, this year the average daily production will be 9.3 million barrels, and in 2016 - 9.52 million. In January forecasted production management in the amount of 9.31 million and 9.53 million barrels, respectively. In January, the average daily production was 9.2 million barrels per day, according to a monthly report of EIA. "The volume of oil reserves in the industrialized countries, is expected to be a record at the end of this year, as world oil production is growing faster than demand for fuel," - wrote the head of the IEA report Adam Sieminski. Management raised its forecast for growth in world oil demand this year by 10,000 bpd to 1.01 million and lowered the forecast for 2016 by 20,000 bpd to 1.01 million.

Meanwhile, today, Barclays Capital analysts said that the recent rise in oil prices, as a result of which that has risen by about $ 10 per barrel, will not be sustainable, and soon the price will start to fall again. According to the calculations Reuters technical analyst Wang Tao, Brent could drop below $ 56.21 a barrel, while WTI - below $ 49.88. Analysts Jefferies Bache predict lower prices for both the standard in the near future. "We continue to expect new lows for the WTI and the price falls to $ 40. If this level is reached, the closest reference Brent price will be $ 48", - the report says Jefferies Bache.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) dropped to 49.00 dollars per barrel on the New York Mercantile Exchange.

March futures price for North Sea Brent crude oil mix fell to $ 1.30 to $ 54.95 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:33

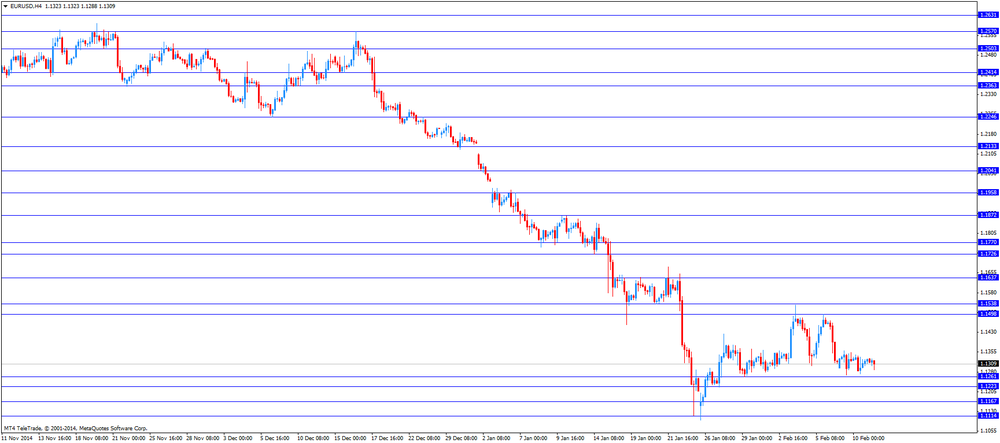

Foreign exchange market. American session: the euro traded lower against the U.S. dollar ahead of the euro group of finance ministers meetings

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded lower against the U.S. dollar as concerns over Greek exit from the Eurozone weighed on the euro. The euro group of finance ministers will meet in Brussels later in the day. Greece's Finance Minister Yanis Varoufakis is expected to present new reform proposals.

Investors speculate that the European Commission could extend Greece's existing bailout program. But German Finance Minister Wolfgang Schaeuble said today that there are no plans for a new agreement.

The British pound fell against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback despite the solid economic data from Australia. The Melbourne Institute and Westpac Bank released its consumer sentiment index for Australia on late Tuesday. The consumer sentiment index for Australia increased 8.0% in February, after a 2.4% rise in January. That was the largest monthly increase since September 2011.

The increase was driven by interest rate cut by the Reserve Bank of Australia and falling fuel prices.

Home loans in Australia climbed 2.7% in December, exceeding expectations for a 2.3% rise, after a 0.4% decrease in November. November's figure was revised up from a 0.7% drop.

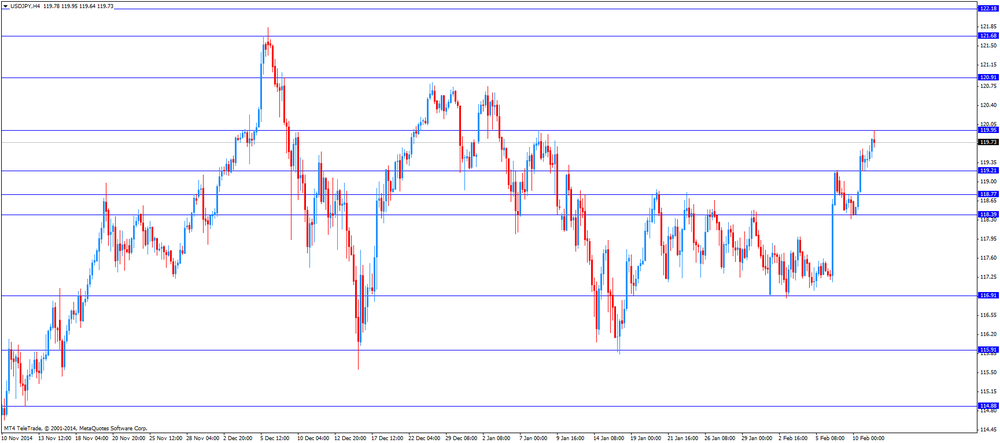

The Japanese yen dropped against the U.S. dollar. In the overnight trading session, the yen declined against the greenback on comments by the Bank of Japan Governor Haruhiko Kuroda. He said at this week's Group of 20 (G20) meetings in Istanbul that there no criticism of the Bank of Japan's monetary easing program, indicating confidence to continue monetary stimulus measures.

-

17:20

Gold: a review of the market situation

Gold prices declined significantly today, reaching at this month low, which was associated with the strengthening of the US dollar across the board. Market participants are also cautious amid uncertainty caused by the situation in Greece and Ukraine.

Since the beginning of February, spot prices fell nearly 4 percent, as a strong dollar and expectations of higher interest rates in the United States put pressure on investor sentiment. Published last week upbeat employment report in the US has forced investors to reconsider the expectations of the first rate rise in June. Expectations rise in interest rates had a negative impact on the dynamics of the price of gold, as the precious metal can not compete with the earning assets with growth rates.

"If you stop buying associated with risk aversion, gold market in the near future will continue to be under pressure. Also, it will affect the Fed's policy, especially if the market decides that the interest rates will be raised in June. Prices are subject to closer to $ 1,200 before the demand will grow enough to stop the fall in prices, "- said HSBC analyst James Steel.

Remember, today held an emergency meeting of the Eurogroup, which is expected to Greece will propose to conclude an interim agreement on the financing of the country. Finance Minister Wolfgang Schaeuble Germany there are no plans to discuss the issue dispelled expectations of a possible conclusion of the Interim Agreement.

In addition to Greece, today the market's attention is also directed to meet Ukrainian President Poroshenko, German Chancellor Merkel, French President Hollande and Russian President Vladimir Putin. Late last night came the news that Obama had a conversation with Putin, during which the US president urged his Russian counterpart, do not miss this week and a chance to find a diplomatic solution to the crisis. US Treasury Liu also said yesterday, "the urgency of early joint decision" and "some progress in this direction in the last few days"

March futures price of gold on the COMEX today fell to 1220.10 dollars per ounce.

-

17:11

Home loans in Australia rises 2.7% in December

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia climbed 2.7% in December, exceeding expectations for a 2.3% rise, after a 0.4% decrease in November. November's figure was revised up from a 0.7% drop.

Investment lending climbed 6.0% in December, after 2.2% decline in November.

The Reserve Bank of Australia introduced new guidelines for the supervision of investor lending in December.

-

16:44

Westpac Banking Corporation's consumer sentiment index for Australia shows the largest monthly increase since September 2011

The Melbourne Institute and Westpac Bank released its consumer sentiment index for Australia on late Tuesday. The consumer sentiment index for Australia increased 8.0% in February, after a 2.4% rise in January. That was the largest monthly increase since September 2011.

The increase was driven by interest rate cut by the Reserve Bank of Australia and falling fuel prices.

-

16:30

U.S.: Crude Oil Inventories, February +4.9

-

16:22

Bank of Japan Governor Haruhiko Kuroda: G20 nations didn’t criticise the Bank of Japan's monetary easing program

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at this week's Group of 20 (G20) meetings in Istanbul that there no criticism of the Bank of Japan's monetary easing program, indicating confidence to continue monetary stimulus measures.

The BoJ governor noted that "Japan will make positive contributions not only to its own economy but to the global economy" if Japan's inflation will achieve 2%.

Kuroda pointed out that G20 nations have confirmed that each central bank can use appropriate monetary policy.

-

15:54

Russia’s Finance Minister said that the country hasn't received a request for help from Greece

Greece's deputy foreign minister Nikos Chountis said on Tuesday that Russia and China had already offered financial support to Greece.

Russia's Finance Minister Anton Siluanov said that Russia hasn't received a request for help from Greece. He noted that Russia could only provide Greece with rubles.

-

15:40

U.S. Stocks open: Dow -0.20%, Nasdaq +0.09%, S&P -0.10%

-

15:29

Before the bell: S&P futures -0.12%, Nasdaq futures +0.04%

U.S. stock-index futures are mixed as investors await the outcome of a meeting between Greece and its creditors.

Global markets:

Nikkei 17,652.68 -59.25 -0.33%

Hang Seng 24,315.02 -213.08 -0.87%

Shanghai Composite 3,158.08 +16.48 +0.52%

FTSE 6,793.08 -36.04 -0.53%

CAC 4,674.29 -21.36 -0.45%

DAX 10,751 -2.83 -0.03%

Crude oil $49.58 (-0.90%)

Gold $1234.40 (+0.17%)

-

15:10

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Wal-Mart (WMT) downgraded to Neutral from Overweight at HSBC Securities

Other:

-

14:52

Company News: PepsiCo (PEP) reported better than expected fourth quarter profits

PepsiCo (PEP) earned $1.12 per share in the fourth quarter, beating analysts' estimate of $1.08. Revenue in the fourth quarter decreased 0.8% year-over-year to $19.95 billion, but exceeding analysts' estimate of $19.66 billion.

The company announced a 7.3% rise in its annualized dividend to $2.81 per share from $2.62 per share.

PepsiCo (PEP) shares increased to $100.63 (+2.69%) prior to the opening bell.

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1250(E223mn), $1.1295-1.1300(E1.1bn), $1.1450(E269mn), $1.1470(E433mn)

USD/JPY: Y118.50($272mn), Y119.00($1.2bn), Y119.50-55($719mn), Y120.00($480mn)

EUR/JPY: Y135.00(E554mn)

GBP/USD: $1.5100(Gbp1.6bn), $1.5225(Gbp338mn), $1.5300(Gbp833mn), $1.5400(Gbp290mn)

AUD/USD: $0.7750(A$200mn)

USD/CAD: C$1.2300($1.0bn), C$1.2445-60($630mn)

-

14:00

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greek exit from the Eurozone weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

00:30 Australia Home Loans December -0.4% Revised From -0.7% +2.3% +2.7%

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S.

The euro traded lower against the U.S. dollar as concerns over Greek exit from the Eurozone weighed on the euro. The euro group of finance ministers will meet in Brussels later in the day. Greece's Finance Minister Yanis Varoufakis is expected to present new reform proposals.

Investors speculate that the European Commission could extend Greece's existing bailout program. But German Finance Minister Wolfgang Schaeuble said today that there are no plans for a new agreement.

The British pound rose against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair fell to $1.1288

GBP/USD: the currency pair increased to $1.5298

USD/JPY: the currency pair rose to Y119.95

The most important news that are expected (GMT0):

17:30 Eurozone Eurogroup Meetings

21:30 New Zealand Business NZ PMI January 57.7

22:00 Australia RBA Assist Gov Debelle Speaks

23:50 Japan Core Machinery Orders December +1.3% +2.4%

23:50 Japan Core Machinery Orders, y/y December -14.6% +5.9%

-

13:50

Orders

EUR/USD

Offers $1.1410-20, $1.1400, $1.1370, $1.1345/50

Bids $1.1300/290, $1.1275, $1.1260-50

GBP/USD

Offers $1.5400, $1.5380, $1.5350-55, $1.5300/05

Bids $1.5200/197, $1.5155-45, $1.5105/00

AUD/USD

Offers $0.7900, $0.7845/50, $0.7790/00

Bids $0.7700, $0.7655/50, $0.7600

EUR/JPY

Offers Y137.50, Y137.00, Y136.50, Y136.00

Bids Y135.00, Y134.50, Y134.10/00

USD/JPY

Offers Y121.50, Y121.00, Y120.50, Y120.00

Bids Y119.10/00, Y118.50

EUR/GBP

Offers stg0.7495/500

Bids stg0.7385, stg0.7370-68, stg0.7350, stg0.7330/20

-

13:00

European stock markets mid-session: Indices decline ahead of Eurozone Meetings as uncertainty over Greece weighs

European stocks and the euro are trading lower as investors focus on Greece and the Emergency Euro Zone Meetings. Today Finance Ministers meet and tomorrow European Union Leaders. Over the weekend Greek Prime Minister Alexis Tsirpas had ruled out any extension of the international bailout and reaffirmed that he will stick to his pre-election pledges to roll back austerity measures.

Yesterday Prime Minister Alexis Tsipras won a confidence vote in Greek Parliament on his plan to cancel the international bailout. Hopes for a compromise in Greek debt negotiations lend support to the markets. Reports state that the European Commission could propose a six-month extension to the bailout program. Greece seeks to get a 10 billion euro bridging plan in order to buy time and to avoid a funding crunch but according to German Finance Minister Schäuble there are no plans to give the country more time.

The ongoing crisis in Ukraine further weigh on markets as peace-talks are taking place between Russia, Ukraine, France and Germany in Belarus.

The FTSE 100 index is currently trading -0.42% quoted at 6,800.29 points. Germany's DAX 30 lost -0.42% trading at 10,708.85. France's CAC 40 is currently trading at 4,660.88 points, -0.74%.

-

12:15

Oil: Prices decline as global glut persits

Oil prices declined in today's volatile trading. Yesterday the International Energy Agency stated that prices are likely to fall as stockpiles will increase. Stockpiles help by OPEC-members will reach an all-time high in the middle of 2015. Brent Crude lost -1.31%, currently trading at USD55.69 a barrel. On January 13th Crude hit a low at USD45.19 and began to rise on reports on declining rig numbers in the U.S. and capital expenditure cuts. Crude registered the biggest 2-week gain in 17 years last week. West Texas Intermediate declined by -0.62% currently quoted at USD49.71, below the level of USD50 again. Saudi Arabia, Iraq, Kuwait and Iran - OPEC's four biggest producers in the 12 member club - further cut prices to Asia in a fight for market share. Last week Saudi Arabia cut its prices to the lowest level in 14 years.

Markets wait data on U.S. Crude Oil Inventories due later in the day at 15:30 GMT to assess the strength of demand from the world's largest consumer.

Worldwide supply still exceeds demand in a period of low global economic growth and the OPEC refusing to cut output rates to stabilize prices. Smaller OPEC members want to cut production but the organisation, responsible for 40% of worldwide production focuses on its fight for market share. Rising U.S. stockpiles are contributing to a global glut that drove prices almost 50 percent lower last year. The U.S., Brazil, Russia and the OPEC are producing at record levels.

-

12:00

Gold prices almost flat despite Greek Standoff

Gold is trading almost flat today despite concerns over Greece and the upcoming Eurozone Emergency Meeting. Germany maintained its position that Greece has to comply with the terms of the bailout.

Yesterday Prime Minister Alexis Tsipras won a confidence vote in Greek Parliament on his plan to cancel the international bailout. Hopes for a compromise in Greek debt negotiations lend support to the markets. Reports state that the European Commission could propose a six-month extension to the bailout program. Greece seeks to get a 10 billion euro bridging plan in order to buy time and to avoid a funding crunch but according to German Finance Minister Schäuble there are no plans to give the country more time.

A stronger U.S. dollar and the prospect for higher U.S. rates following last week's robust U.S. jobs report weigh on the precious metal as it is dollar-denominated and not yield-bearing.

The precious metal is currently quoted at USD1,234.30, +0,06% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. Gold dropped on February 2nd after U.S. payroll gains.

-

11:13

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1250(E223mn), $1.1295-1.1300(E1.1bn), $1.1450(E269mn), $1.1470(E433mn)

USD/JPY: Y118.50($272mn), Y119.00($1.2bn), Y119.50-55($719mn), Y120.00($480mn)

EUR/JPY: Y135.00(E554mn)

GBP/USD: $1.5100(Gbp1.6bn), $1.5225(Gbp338mn), $1.5300(Gbp833mn), $1.5400(Gbp290mn)

AUD/USD: $0.7750(A$200mn)

USD/CAD: C$1.2300($1.0bn), C$1.2445-60($630mn)

-

10:20

Press Review: Volatility Climbs With Dollar as Germany Douses Greek Optimism

BLOOMBERG

Volatility Climbs With Dollar as Germany Douses Greek Optimism

(Bloomberg) -- Currency volatility increased along with the dollar as Germany and Greece head for a showdown that is spurring traders to take out insurance against euro losses.

The premium to protect against a decline in the euro versus the greenback rose to the highest since Jan. 23 -- the day after the European Central Bank announced it would buy sovereign bonds -- before Greece's official creditors hold an emergency meeting. A gauge of the dollar closed at its highest level in data going back to 2004 as comments from regional Federal Reserve presidents suggested policy makers may raise interest rates by mid-year.

"The outcome of the Greek bailout saga is highly uncertain," said Imre Speizer, a markets strategist at Westpac Banking Corp. in Auckland. "You'll get pre-positioning and repositioning after the event, depending on whether it's a positive or negative surprise. It might cause some volatility," and that would support dollar buying, he said.

REUTERS

Shifting goal posts on employment may signal slower Fed rate hikes(Reuters) - Federal Reserve officials are debating a historic shift in one of its core economic gauges that could lead the central bank to move even slower than now thought once it lifts its rates from rock bottom levels.

According to interviews with half a dozen current and former Fed policymakers and staff, the concept that the economy can produce far lower levels of unemployment without stoking inflation is being built into Fed models and becoming increasingly entrenched in the central bank's views.

That shift may not delay the timing of the Fed's first rate increase, still expected in mid-year. But it does offer Chair Janet Yellen a good reason to move at a snail's pace from then on to bring as many people as possible back to work and to push inflation back up to the Fed's 2-percent target.

Source: http://www.reuters.com/article/2015/02/11/us-usa-fed-employment-insight-idUSKBN0LF0AB20150211

REUTERS

Greece's Varoufakis says Greece needs debt haircut: magazine(Reuters) - Greece's finance minister said Greece would not be able to service its debt in the short-term so would need a haircut, or debt restructuring, he told Germany's Stern magazine.

"If a debt can no longer be paid off then that leads to a haircut," Yanis Varoufakis said in a pre-publication copy of the interview made available on Wednesday.

"What is critical is that Greece's debt cannot be paid off in the near future," he said.

Source: http://www.reuters.com/article/2015/02/11/us-eurozone-greece-varoufakis-idUSKBN0LF0JY20150211

-

10:00

European Stocks. First hour: Stocks little changed - Greece and Euro Zone Emergency Meetings in focus

European stocks are little changed in early trading as investors focus on Greece and the Emergency Euro Zone Meetings. Over the weekend Greek Prime Minister Alexis Tsirpas had ruled out any extension of the international bailout and reaffirmed that he will stick to his plan to roll back austerity measures.

Yesterday Prime Minister Alexis Tsipras won a confidence vote in Greek Parliament on his plan to cancel the international bailout. Hopes for a compromise in Greek debt negotiations lend support to the markets. Reports state that the European Commission could propose a six-month extension to the bailout program. Greece seeks to get a 10 billion euro bridging plan in order to buy time and to avoid a funding crunch but according to German Finance Minister Schäuble there are no plans to give the country more time.

The FTSE 100 index is currently trading -0.02% quoted at 6,827.46 points. Germany's DAX 30 rose +0.07% trading at 10,761.59. France's CAC 40 lost -0.42%, currently trading at 4,676.05 points.

-

09:00

Global Stocks: Wall Street post gains, China mixed and Japan closed for holiday

U.S. markets booked gains on Tuesday after Job openings climbed to 5.028 million in December from 4.847 million in November. That was the highest level since January 2001. November's figure was revised down from 4.972 million. Analysts had expected job openings to rise to 4.992 million. Wholesale inventories in the U.S. rose 0.1% in December, missing expectations for a 0.2% increase, after a 0.8% gain in November. The Federal Reserve Bank of Richmond President Jeffrey Lacker said on Tuesday that interest rate hike in June is "the attractive option" for him.

Hopes for a compromise in Greek debt negotiations lend support to the markets. Greece seeks to get a 10 billion euro bridging plan in order to buy time and to avoid a funding crunch but according to German Finance Minister Schäuble there are no plans to give the country more time.

The DOW JONES index added +0.79% closing at 17,868.76 points. The S&P 500 gained +1.07% with a final quote of 2,068.59 points with Apple up 1.9%. Apple is the first company worth more than USD700 billion.

Yesterday weak inflation data from China fuelled expectations on further monetary easing by the People's Bank of China to boost the world's second largest economy. China's consumer inflation hit a five-year low and factory deflation deepened. The Chinese PPI declined more-than-expected by -4.3% in January. CPI for January came in at +0.8%, lower than the estimated +1.1% further slowing compared to +1.5% in December. Hong Kong's Hang Seng is trading -0.71% at 24,355.16 points. China's Shanghai Composite closed at 3,158.27 points +0.52%. Markets await data on money supply and social financing due today at no fixed time.

Japanese markets are closed today for a public holiday. Yesterday Japan's Nikkei lost, closing -0.36% with a final quote of 17,652.68 points reversing some of its early losses. Concerns over Greece's bailout and its consequences for the whole Eurozone weighed on the index.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded stronger against the most major currencies

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Japan Bank holiday

00:30 Australia Home Loans December -0.4% Revised From -0.7% +2.3% +2.7%

The U.S. dollar traded stronger against most major currencies with better-than-expected U.S. job openings figures. The greenback traded stronger against the euro and the Australian dollar, the yen and sterling and lost against New Zealand's dollar. Job openings climbed to 5.028 million in December from 4.847 million in November. That was the highest level since January 2001. November's figure was revised down from 4.972 million. Analysts had expected job openings to rise to 4.992 million. Wholesale inventories in the U.S. rose 0.1% in December, missing expectations for a 0.2% increase, after a 0.8% gain in November. The Federal Reserve Bank of Richmond President Jeffrey Lacker said on Tuesday that interest rate hike in June is "the attractive option" for him.

Political developments in Greece continue to weigh on the euro ahead of the Eurozone Meetings. Yesterday Prime Minister Alexis Tsipras won a confidence vote in Greek Parliament on his plan to cancel the international bailout.

The Australian dollar lost versus the greenback in Asian trade and gave up some of its early gains. Yesterday the Westpac Consumer Confidence surged 8%, climbing into positive territory for the first time since February 2014 on the rate cut and low fuel prices. Home loans in December rose +2.7%, from revised -0.4% in November. Analysts expected an increase of +2.3%. RBA's Assistant Governor Debelle will speak today at 22:00 GMT.

New Zealand's dollar added traded weaker against the greenback in Asian trade. Markets await data on Business NZ PMI late in the day due at 21:30 GMT.

The Japanese yen traded weaker against the greenback on Wednesday. Japan's makrets are closed today for a bank holiday. Data on Core Machinery Orders is scheduled for 23:50 GMT today.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar strengthened against the yen

GPB/USD: Sterling traded lower against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

15:30 U.S. Crude Oil Inventories February +6.3

17:30 Eurozone Eurogroup Meetings

19:00 U.S. Federal budget January 1.9 -2.6

21:30 New Zealand Business NZ PMI January 57.7

Australia RBA Assist Gov Debelle Speaks

23:50 Japan Core Machinery Orders December +1.3% +2.4%

23:50 Japan Core Machinery Orders, y/y December -14.6% +5.9%

-

07:24

Options levels on wednesday, February 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1510 (2496)

$1.1439 (765)

$1.1391 (296)

Price at time of writing this review: $1.1320

Support levels (open interest**, contracts):

$1.1246 (3661)

$1.1184 (1903)

$1.1128 (2163)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 100393 contracts, with the maximum number of contracts with strike price $1,1500 (5241);

- Overall open interest on the PUT options with the expiration date March, 6 is 99833 contracts, with the maximum number of contracts with strike price $1,1200 (5536);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from February, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5504 (2192)

$1.5407 (1674)

$1.5311 (1929)

Price at time of writing this review: $1.5242

Support levels (open interest**, contracts):

$1.5188 (1673)

$1.5092 (1296)

$1.4995 (2032)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 24919 contracts, with the maximum number of contracts with strike price $1,5500 (2192);

- Overall open interest on the PUT options with the expiration date March, 6 is 30233 contracts, with the maximum number of contracts with strike price $1,5000 (2032);

- The ratio of PUT/CALL was 1.21 versus 1.26 from the previous trading day according to data from February, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:04

Hang Seng 24,547.51 +19.41 +0.08%, Shanghai Composite 3,145.77 +4.17 + 0.13%

-

01:32

Australia: Home Loans , December +2.7% (forecast +2.3%)

-

00:39

Commodities. Daily history for Feb 10’2015:

(raw materials / closing price /% change)

Light Crude 50.02 -5.37%

Gold 1,233.70 +0.12%

-

00:38

Stocks. Daily history for Feb 10’2015:

(index / closing price / change items /% change)

Nikkei 225 17,652.68 -59.25 -0.33%

Hang Seng 24,528.1 +7.10 +0.03%

Shanghai Composite 3,141.27 +46.15 +1.49%

FTSE 100 6,829.12 -8.03 -0.12%

CAC 40 4,695.65 +44.57 +0.96%

Xetra DAX 10,753.83 +90.32 +0.85%

S&P 500 2,068.59 +21.85 +1.07%

NASDAQ Composite 4,787.65 +61.63 +1.30%

Dow Jones 17,868.76 +139.55 +0.79%

-

00:37

Currencies. Daily history for Feb 10’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1320 -0,04%

GBP/USD $1,5253 +0,25%

USD/CHF Chf0,9261 +0,29%

USD/JPY Y119,42 +0,65%

EUR/JPY Y135,18 +0,62%

GBP/JPY Y182,15 +0,91%

AUD/USD $0,7770 -0,39%

NZD/USD $0,7401 -0,09%

USD/CAD C$1,2586 +0,95%

-

00:32

Australia: Westpac Consumer Confidence, February +8.0%

-