Noticias del mercado

-

21:00

Dow +0.17% 18,002.18 +29.80 Nasdaq +0.41% 4,877.64 +20.03 S&P +0.17% 2,091.99 +3.51

-

18:07

European stocks close: stocks closed higher on Eurozone’s GDP data

Stock indices traded closed higher on Eurozone's GDP data. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,873.52 +45.41 +0.67%

DAX 10,963.4 +43.75 +0.40%

CAC 40 4,759.36 +33.16 +0.70%

-

18:00

European stocks closed: FTSE 100 6,873.52 +45.41 +0.67% CAC 40 4,759.36 +33.16 +0.70% DAX 10,963.4 +43.75 +0.40%

-

17:40

Oil: a review of the market situation

The price of oil has increased significantly, entrenched above $ 61 (Brent) and $ 53 (WTI) amid signs that spending cuts in the mining sector may limit the excessive supply. As it became known, the US oil and gas company Apache Corp announced its intention to reduce the number of drilling rigs by 70%. In turn, the French company Total announced plans spending cuts and volumes of exploration. Due to this, the company expects to save in 2015 to $ 4 billion. Total is going to cut two thousand. Jobs by 2017 and sell assets worth $ 5.5 billion. Investments also cut General Electric, Lariat Services, Trican Well Service and Royal Dutch Shell. This leads to reduced production.

Also, market participants are waiting for the publication of today's data on the number of drilling rigs Baker Hughes (at 18:00 GMT). WTI crude oil may continue to rally above the high of the week when the report will reflect a reduction plants in the United States. Recall last week Baker Hughes, reported that the number of oil rigs in the United States decreased by 83 to 1140 units.

Support was also provided data on the GDP of the eurozone. As previously reported, the eurozone economy expanded in the fourth quarter by 0.3 percent - faster than the 0.2 percent growth in the third quarter. According to forecasts, growth rates were to remain at 0.2 percent. In annual terms, GDP grew by 0.9 percent after expanding 0.8 percent in the third quarter. Economists had forecast a GDP growth of 0.8 percent over the fourth quarter. For the entire 2014, GDP grew by 0.9 percent.

It is worth emphasizing the week the price of oil has increased by about 4 percent. "In recent weeks, oil prices recovered due to improved market sentiment and expectations that low prices lead to lower supply growth in 2015," - said Daniela Corsini from Intesa Sanpaolo.

Meanwhile, experts Capital Economics said that the recovery of the price of Brent crude oil during the first two weeks of February gives hope for their further growth to $ 70 per barrel. In its review, the experts suggest that the current recovery in oil prices is due to a sharp drop in the number of drilling rigs, as well as reports of large oil companies to reduce the investment.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 52.94 dollars per barrel on the New York Mercantile Exchange.

March futures price for North Sea petroleum mix of Brent rose $ 4.36 to $ 61.42 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:37

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the U.S. weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index

The U.S. dollar traded mixed to higher against the most major currencies after the U.S. weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2.

The harsh weather may have been a key factor of the drop.

The U.S. import price index dropped by 2.8 percent in January, beating expectations for a 3.1% fall, after a 1.9% decline in December. That was the biggest drop since December 2008.

December's figure was revised up from a 2.5% decrease.

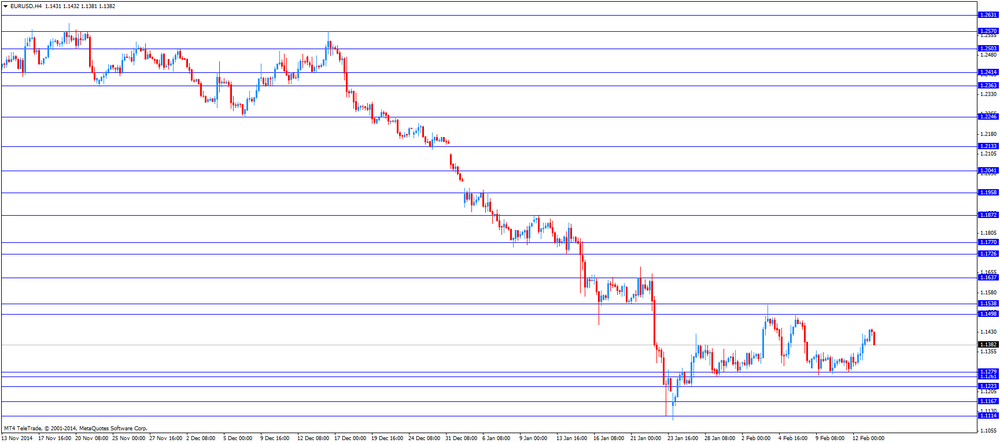

The euro traded lower against the U.S. dollar. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar after the better-than-expected Canadian manufacturing shipments. Canadian manufacturing shipments climbed 1.7% in December, beating forecasts of a 0.9% decrease, after a 1.3% drop in November. November's figure was revised up from a 1.4% decline.

The increase was driven by higher sales in the transportation equipment industry.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's producer and import prices declined 0.6% in January, in line with expectations, after a 0.4% fall in December.

On a yearly basis, producer and import prices decreased 2.7% in January, missing expectation for a 1.5% decline, after a 2.1% drop in December.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback. New Zealand's food price index rose 1.3% in January, after a 0.3% increase in December.

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie climbed against the greenback after comments by the Reserve Bank of Australia Glenn Stevens. He said that the government has to increase spending in order to boost demand as the economy has to grow at a faster pace. Monetary policy, at the current level of interest rates, has become more limited in spurring demand compared to a decade ago but still has some ability to assist the economy.

The Japanese yen increased against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any major economic data from Japan.

-

17:20

Gold: a review of the market situation

Gold prices rose moderately, updating the two-day maximum, which was associated with the weakening of the dollar after the publication of weak statistics. Strengthening gold restrained positive dynamics of US stock market.

Preliminary results presented Thomson-Reuters and the Institute of Michigan, showed that in February, US consumers are more pessimistic about the economy than last month. According to published data, in February preliminary consumer sentiment index was 93.6 points compared with the final reading for January at around 98.1 points. The median estimate of experts, this index was slightly increase - to 98.2 points.

Price increases also helps profit on short positions in anticipation of the new year according to the lunar calendar. This holiday will be celebrated next week, and many traders are on vacation. At the same time, some analysts expect further short covering.

"After the new year according to the lunar calendar, perhaps a new fall in prices. Tensions eased around Ukraine, and hopes to resolve Greece's debt crisis may reduce support for gold as a safe-haven for" - says Howie Lee, an investment analyst at Phillip Futures.

Meanwhile, market sentiment remained depressed after talks between Greece and the European Union representatives were unsuccessful, although both sides stressed that the hope for the adoption of the agreement is maintained. The next round of talks scheduled for next Monday. The term of this agreement for the provision of economic aid to Greece expire on February 28, and the new Greek government does not want to renew, reinforcing fears that the conflict with the international lenders will exit from the eurozone countries.

We also learned that the world's largest reserves of the gold-Fund ETF SPDR Gold Trust yesterday fell 0.23 percent to 771.51 tons.

On the physical market demand from Chinese buyers remained stable. Premium on the Shanghai Gold Exchange have not changed today, remaining in the range of $ 3- $ 4 per ounce.

March futures price of gold on the COMEX today rose $ 6.11 to 1231.70 dollars per ounce.

-

16:55

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 93.6 in February

The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2. That was the highest level since January 2004.

The harsh weather may have been a key factor of the drop.

A gauge of consumers' current economic conditions dropped to 103.1 in February from 109.3 in January.

The index of consumer expectations declined to 87.5 from 91.0.

The one-year inflation expectations in February climbed to 2.8% from 2.5% at the end of January.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that the decline was a result of "renewed concerns over employment and wage growth".

-

16:05

U.S. import price index dropped by 2.8 percent in January, driven by falling fuel prices

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index dropped by 2.8 percent in January, beating expectations for a 3.1% fall, after a 1.9% decline in December. That was the biggest drop since December 2008.

December's figure was revised up from a 2.5% decrease.

The decline was driven by falling fuel prices.

U.S. export prices plunged by 2.0% in January, after a 1.0% decrease in December.

For 2014 as a whole, import prices dropped by 8.0%.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, February 93.6 (forecast 98.2)

-

15:37

U.S. Stocks open: Dow +0.04%, Nasdaq +0.28%, S&P +0.04%

-

15:29

Before the bell: S&P futures +0.20%, Nasdaq futures +0.30%

U.S. stock-index futures rose as German growth data signaled a strengthening in Europe's recovery and optimism increased about Greek debt talks.

Global markets:

Nikkei 17,913.36 -66.36 -0.37%

Hang Seng 24,682.54 +260.39 +1.07%

Shanghai Composite 3,204.61 +31.19 +0.98%

FTSE 6,878.78 +50.67 +0.74%

CAC 4,775.11 +48.91 +1.03%

DAX 11,000.76 +81.11 +0.74%

Crude oil $52.74 (+2.95%)

Gold $1229.20 (+0.70%)

-

15:24

Canadian manufacturing shipments rises 1.7% in December

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments climbed 1.7% in December, beating forecasts of a 0.9% decrease, after a 1.3% drop in November.

November's figure was revised up from a 1.4% decline.

The increase was driven by higher sales in the transportation equipment industry. Sales of motor vehicles increased 9.0%, while sales of machinery rose 5.2% in December, the highest level since November 2011.

Food sales rose 1.8% in December, while sales of chemical products climbed 2.5%.

Sales in the petroleum and coal product industry declined 9.3% in December. That was the sixth consecutive decline.

-

15:13

Stocks before the bell

(company / ticker / price / change, % / volume)

Verizon Communications Inc

VZ

49.53

+0.02%

1.8K

JPMorgan Chase and Co

JPM

59.65

+0.13%

2.6K

McDonald's Corp

MCD

95.25

+0.17%

0.2K

Intel Corp

INTC

34.20

+0.22%

3.1K

Google Inc.

GOOG

544.30

+0.25%

0.3K

Goldman Sachs

GS

190.30

+0.27%

0.8K

Boeing Co

BA

148.49

+0.27%

0.3K

Twitter, Inc., NYSE

TWTR

48.10

+0.31%

63.6K

General Electric Co

GE

24.97

+0.32%

8.7K

Facebook, Inc.

FB

76.49

+0.34%

36.3K

General Motors Company, NYSE

GM

38.15

+0.34%

9.2K

Microsoft Corp

MSFT

43.24

+0.35%

19.6K

Citigroup Inc., NYSE

C

51.07

+0.35%

13.1K

AT&T Inc

T

34.74

+0.38%

30.1K

Caterpillar Inc

CAT

83.85

+0.38%

0.9K

Procter & Gamble Co

PG

86.42

+0.45%

0.1K

Apple Inc.

AAPL

127.05

+0.47%

366.1K

Johnson & Johnson

JNJ

99.00

+0.57%

0.8K

Exxon Mobil Corp

XOM

93.00

+0.68%

22.2K

ALCOA INC.

AA

15.77

+0.77%

3.7K

Nike

NKE

92.72

+0.78%

1.0K

Chevron Corp

CVX

111.80

+0.85%

10.9K

Yahoo! Inc., NASDAQ

YHOO

44.31

+0.88%

1.9K

Barrick Gold Corporation, NYSE

ABX

12.28

+1.24%

9.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.90

+2.21%

5.8K

Yandex N.V., NASDAQ

YNDX

16.86

+2.74%

26.5K

Visa

V

270.91

0.00%

3.7K

Walt Disney Co

DIS

103.55

-0.03%

1K

Ford Motor Co.

F

16.35

-0.06%

51.2K

Amazon.com Inc., NASDAQ

AMZN

376.71

-0.12%

2.2K

The Coca-Cola Co

KO

42.07

-0.24%

5.6K

Tesla Motors, Inc., NASDAQ

TSLA

202.10

-0.38%

31.6K

Pfizer Inc

PFE

34.73

-0.40%

0.8K

Cisco Systems Inc

CSCO

29.32

-0.48%

43.4K

American Express Co

AXP

79.75

-0.91%

51.4K

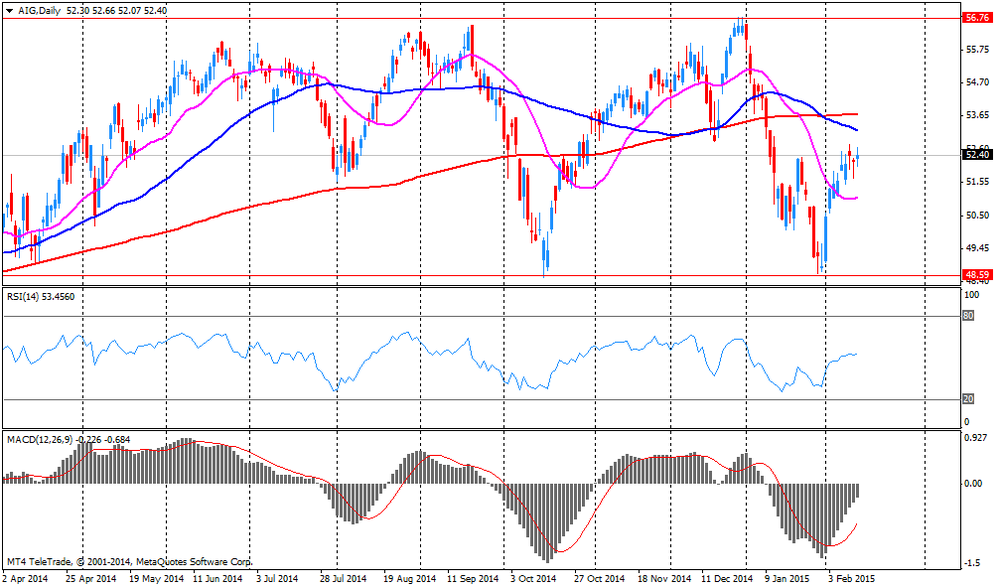

AMERICAN INTERNATIONAL GROUP

AIG

51.50

-1.81%

22.8K

-

15:08

Switzerland's producer and import prices declined 0.6% in January

The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices declined 0.6% in January, in line with expectations, after a 0.4% fall in December.

On a yearly basis, producer and import prices decreased 2.7% in January, missing expectation for a 1.5% decline, after a 2.1% drop in December.

The decline was driven by lower prices for petroleum and petroleum products.

-

15:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

American Express (AXP) downgraded to Underperform from Buy at BofA/Merrill, target lowered to $78 from $109

Other:

Apple (AAPL) target raised to $150 from $130 at UBS

American Express (AXP) target lowered to $78 from $83 at Credit Suisse

-

14:50

Company News: American Intl (AIG) reported weaker than expected fourth quarter profits

American Intl (AIG) earned $0.97 per share in the fourth quarter, missing analysts' estimate of $1.03. Revenue in the fourth quarter decreased 1.8% year-over-year to $5.21 billion, missing analysts' estimate of $8.75 billion.

American Intl (AIG) shares decreased to $51.52 (-1.77%) prior to the opening bell.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1340(E1.16bn), $1.1355(E590mn), $1.1365(E404mn), $1.1400(E571mn), $1.1450(E400mn)

USD/JPY: Y118.25($2.26bn), Y118.50($893mn), Y119.00($736mn), Y119.20-25($1.8bn), Y119.40($630mn), Y120.00($3.9bn)

GBP/USD: $1.5100(Gbp1.5bn), $1.5300(Gbp1.5bn), $1.5400(Gbp587mn)

AUD/USD: $0.7700(A$4.1bn)

NZD/USD: $0.7500(NZ$300mn)

USD/CAD: C$1.2200($1.3bn), C$1.2415($245mn), C$1.2500(280mn)

-

14:30

U.S.: Import Price Index, July -2.8% (forecast -3.1%)

-

14:30

Canada: Manufacturing Shipments (MoM), December +1.7% (forecast -0.9%)

-

14:01

Foreign exchange market. European session: the euro fell against the U.S. dollar after the mixed GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Leading Index January +1.1% +0.9%

06:30 France GDP, q/q (Preliminary) Quarter IV +0.3% +0.1% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.4% +0.2%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.3% +0.7%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.2% +1.0% +1.6%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.2% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.6% -0.6%

08:15 Switzerland Producer & Import Prices, y/y January -2.1% -1.5% -2.7%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.2% +0.2% +0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV +0.8% +0.8% +0.9%

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to rise to 98.2 in February from a final reading of 98.1 in January.

The U.S. import price index is expected to plunge 3.1% in January, after a 2.5 drop in December.

The euro fell against the U.S. dollar after the mixed GDP data from the Eurozone. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian manufacturing shipments. Canada's manufacturing shipments are expected to decrease 0.9% in December, after a 1.4% drop in November.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer and import prices declined 0.6% in January, in line with expectations, after a 0.4% fall in December.

On a yearly basis, producer and import prices decreased 2.7% in January, missing expectation for a 1.5% decline, after a 2.1% drop in December.

EUR/USD: the currency pair declined to $1.1381

GBP/USD: the currency pair decreased to $1.5369

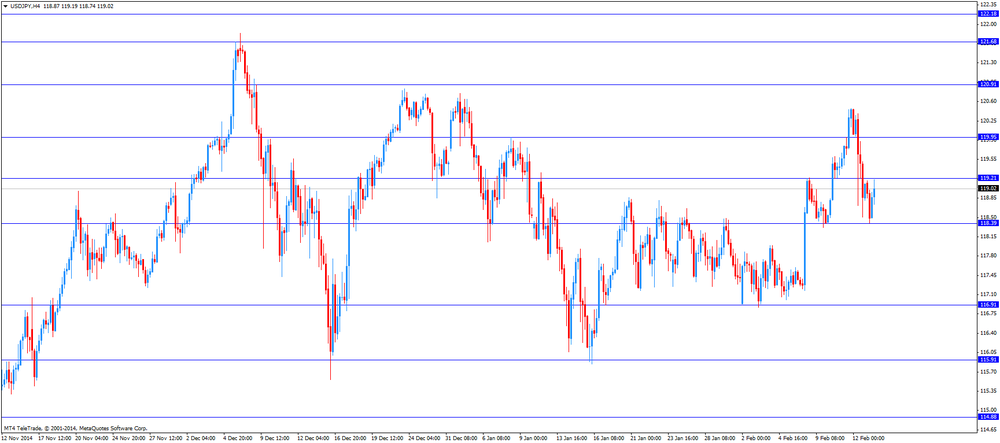

USD/JPY: the currency pair rose to Y119.19

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) December -1.4% -0.9%

13:30 U.S. Import Price Index January -2.5% -3.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.1 98.2

-

14:00

Orders

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1400 1.1380 1.1350 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5400 1.5420-25 1.5450 1.5465 1.5480 1.5500

Bids 1.5370 1.5350 1.5325-30 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.00-10 136.50 136.80 137.00

Bids 135.60 135.20 135.00 134.80 134.50 134.00

USD/JPY

Offers 119.00 119.20 119.50 119.80 120.00 120.20-30 120.50

Bids 118.60 118.40 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7400 0.7385 0.7370-75 0.7350 0.7325 0.7300

AUD/USD

Offers 0.7785 0.7800 0.7820 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:22

EU’s economy grew by 1.4% in 2014

Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

-

13:00

European stock markets mid-session: Indices trade steady at the end of the week

European stocks trade steady on a light data day. The German DAX is heading for its 9th weekly gain, the longest winning streak in 17 years. The weaker euro is supporting export-heavy sectors.

Worries over Greece continue to weigh but equities remain supported by the ECB's quantitative easing started on Monday. The ECB is buying bonds worth 60 billion euros a month.

Today Greek Prime Minister Alexis Tsipras said that his country has already started fulfilling its commitments mentioned in the Eurogroup. He said he is optimistic about finding a solution as it is in common interest. He re-affirmed that he is pro-european.

The commodity heavy FTSE 100 index is currently trading -0.11% quoted at 6,753.38, down for the week. Germany's DAX 30 added +0.05% trading at 11,805.07, below its all-time high set at 11,845.9 yesterday. France's CAC 40 is currently trading at 4,987.98 points, +0.01%.

-

12:31

European stocks climbed

European stocks climbed, with Germany's DAX Index rising above 11,000 for the first time after a report

The DAX climbed as much as 0.9 percent to 11,013.85, before paring gains to 0.5 percent. The benchmark gauge is up 12 percent this year, making Germany the best performer among 24 developed markets. A report showed German gross domestic product surged 0.7 percent in the fourth quarter, a faster pace than the previous three months. The euro region's economy also gathered momentum.

Greece's ASE Index rallied 5.7 percent, heading for its best week since November. National Bank of Greece SA and Eurobank Ergasias SA jumped, pushing their weekly gains up more than 33 percent. Benchmark measures in Italy, Spain and Portugal advanced more than 1 percent.

Prime Minister Alexis Tsipras said yesterday that political will exists in the euro region for a deal. His government is seeking a six-month bridge agreement with creditors after its current aid program expires this month. German Chancellor Angela Merkel said her first meeting with Tsipras was friendly. Greek negotiators and officials from euro-area creditors plan to meet today.

Among stocks that moved on corporate news, L'Oreal SA rose 1.3 percent after the cosmetics maker reported faster-than-estimated quarterly revenue growth and expressed confidence for 2015.

Anglo American Plc gained 1.7 percent after posting full-year earnings that beat analysts' projections and writing down assets by $3.9 billion.

Seadrill Ltd. slumped 8.2 percent after the rig operator said it's removing $1.1 billion worth of contracts with Petroleo Brasileiro SA from its order book.

Mediaset SpA declined 4.8 percent after Silvio Berlusconi's Fininvest SpA sold a 7.8 percent stake in the broadcaster.

FTSE 100 6,868.42 +40.31 +0.59%

CAC 40 4,763.92 +37.72 +0.80%

DAX 10,986.18 +66.53 +0.61%

-

11:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1340(E1.16bn), $1.1355(E590mn), $1.1365(E404mn), $1.1400(E571mn), $1.1450(E400mn)

USD/JPY: Y118.25($2.26bn), Y118.50($893mn), Y119.00($736mn), Y119.20-25($1.8bn), Y119.40($630mn), Y120.00($3.9bn)

GBP/USD: $1.5100(Gbp1.5bn), $1.5300(Gbp1.5bn), $1.5400(Gbp587mn)

AUD/USD: $0.7700(A$4.1bn)

NZD/USD: $0.7500(NZ$300mn)

USD/CAD: C$1.2200($1.3bn), C$1.2415($245mn), C$1.2500(280mn)

-

11:00

Eurozone: GDP (QoQ), Quarter IV +0.3% (forecast +0.2%)

-

11:00

Eurozone: GDP (YoY), Quarter IV +0.9% (forecast +0.8%)

-

09:30

RBA Governor Stevens: Growth will remain low and monetary easing may be less effective

Royal Bank of Australia's Governor Glenn Stevens stated in yesterday's speech that the government has to increase spending in order to boost demand as the economy has to grow at a faster pace. Monetary policy, at the current level of interest rates, has become more limited in spurring demand compared to a decade ago but still has some ability to assist the economy.

The bank cut interest rates this month to 2.25% after a 17-month pause as unemployment has risen to a 12-year high. Australia's economy faces challenges as prices for commodities, the most important export, slumped and China's economic growth slows. China is Australia's biggest trade partner.

-

09:15

Switzerland: Producer & Import Prices, m/m, January -0.6% (forecast -0.6%)

-

09:15

Switzerland: Producer & Import Prices, y/y, January -2.7% (forecast -1.5%)

-

09:00

Global Stocks: Wall Street and China add gains, Japan retreats from 7-1/2 year high

U.S. markets closed higher on Thursday despite weaker-than-expected Retail Sales data. Basic Materials, Technology and the Energy Sector drove indices higher. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December. Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

The number of initial jobless claims in the week ending February 07 in the U.S. rose by 25,000 to 304,000 from 279,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected the number of initial jobless claims to decrease to 278,000.

The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

Markets were supported by signs of easing tension between Greece and its euro-area creditors and the Ukraine resolution. The ECB raised the Emergency Liquidity Assistance cap for Greek banks by 5 billion euro.

The DOW JONES index added +0.62% closing at 17,972.38 points. The S&P 500 closed higher with a final quote of 2,088.48, +0.96%, 3 points from a record reached Dec. 29.

Chinese shares added gains on Friday in the wake of the Chinese New Year where volumes are expected to remain low. Speculations on further monetary easing supported the markets. Hong Kong's Hang Seng is trading +0.93% at 24,648.29 points. China's Shanghai Composite closed at 3,204.61 points +0.98%. The index has gained more than 50% over the past year boosted by monetary easing and the creation of an exchange link with Hong Kong.

Japanese markets retreated from yesterday's 7-1/2 -year highs. The Nikkei declined, closing -0.37% with a final quote of 17,913.36 points. Speculations that the Bank of Japan will not expand monetary easing weighed. Now all eyes are on Governor Kuroda and his comments on that matter next week.

-

08:45

France: Non-Farm Payrolls, Quarter IV 0.0% (forecast -0.1%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar drops across the board after yesterday’s weaker-than-expected retail sales data

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 China Leading Index January +1.1% +0.9%

06:30 France GDP, q/q (Preliminary) Quarter IV +0.3% +0.1% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.4% +0.2%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.3% +0.7%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.2% +1.0% +1.6%

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales data. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December. Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

The number of initial jobless claims in the week ending February 07 in the U.S. rose by 25,000 to 304,000 from 279,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected the number of initial jobless claims to decrease to 278,000.

The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

The euro strengthened against the greenback as the ECB raised the Emergency Liquidity Assistance cap for Greek banks by 5 billion euro and supported by signs of easing tension between Greece and its euro-area creditors but the outcome of Greece's bailout negotiations is still open. The next meeting is scheduled for Monday. A ceasefire agreement between Russia and Ukraine also supported the single currency.

The Australian dollar booked gains versus the greenback after Royal Bank of Australia's Governor Glenn Stevens speech stating that the government has to increase spending in order to boost demand and that monetary policy, at the current level of interest rates, has become more limited in spurring demand compared to a decade ago but still has some ability to assist the transition the economy is making, and we regarded it as appropriate to provide that support. The bank cut interst rates this month to2.25% after a 17-month pause.

China's Leading Index declined from a previous reading of +1.1% to +0.9% in January. China is Australia's most important trade partner.

New Zealand's dollar added against the greenback in Asian trade. Data on the Food Price Index came in yesterday with a reading of +1.3% in January compared to +0.2% in December.

The Japanese yen traded stronger against the greenback on Friday amid speculations that the Bank of Japan will not expand monetary easing. Now all eyes are on Governor Kuroda and his comments on that matter.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar weakened against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.6%

08:15 Switzerland Producer & Import Prices, y/y January -2.1% -1.5%

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV +0.8% +0.8%

13:30 Canada Manufacturing Shipments (MoM) December -1.4% -0.9%

13:30 U.S. Import Price Index July -2.5% -3.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.1 98.2

-

08:01

Germany: GDP (QoQ), Quarter IV +0.7% (forecast +0.3%)

-

08:01

Germany: GDP (YoY), Quarter IV +1.6% (forecast +1.0%)

-

07:30

France: GDP, q/q, Quarter IV +0.1% (forecast +0.1%)

-

07:30

France: GDP, Y/Y, Quarter IV +0.2%

-

07:27

Options levels on friday, February 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1595 (5709)

$1.1545 (2906)

$1.1506 (1836)

Price at time of writing this review: $1.1433

Support levels (open interest**, contracts):

$1.1360 (2233)

$1.1323 (3697)

$1.1273 (3918)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 102162 contracts, with the maximum number of contracts with strike price $1,1500 (5709);

- Overall open interest on the PUT options with the expiration date March, 6 is 104783 contracts, with the maximum number of contracts with strike price $1,1200 (5467);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from February, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (846)

$1.5605 (1884)

$1.5508 (2405)

Price at time of writing this review: $1.5411

Support levels (open interest**, contracts):

$1.5291 (1338)

$1.5194 (1782)

$1.5096 (1751)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 26181 contracts, with the maximum number of contracts with strike price $1,5500 (2405);

- Overall open interest on the PUT options with the expiration date March, 6 is 31607 contracts, with the maximum number of contracts with strike price $1,5000 (2055);

- The ratio of PUT/CALL was 1.21 versus 1.20 from the previous trading day according to data from February, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:37

China: Leading Index , January +0.9%

-

03:03

Nikkei 225 17,921.12 -58.60 -0.33%, Hang Seng 24,529.34 +107.19 +0.44%, Shanghai Composite 3,190.4 +16.98 +0.54%

-

00:45

Commodities. Daily history for Feb 12’2015:

(raw materials / closing price /% change)

Light Crude 51.21 +4.85%

Gold 1,223.00 +0.19%

-

00:42

Stocks. Daily history for Feb 12’2015:

(index / closing price / change items /% change)

Nikkei 225 17,979.72 +327.04 +1.85%

Hang Seng 24,422.15 +107.13 +0.44%

Shanghai Composite 3,173.42 +15.71 +0.50%

FTSE 100 6,828.11 +9.94 +0.15%

CAC 40 4,726.2 +46.82 +1.00%

Xetra DAX 10,919.65 +167.54 +1.56%

S&P 500 2,088.48 +19.95 +0.96%

NASDAQ Composite 4,857.61 +56.43 +1.18%

Dow Jones 17,972.38 +110.24 +0.62%

-

00:39

Currencies. Daily history for Feb 12’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1403 +0,58%

GBP/USD $1,5382 +0,94%

USD/CHF Chf0,9307 +0,25%

USD/JPY Y119,10 -1,13%

EUR/JPY Y135,81 -0,53%

GBP/JPY Y183,21 -0,19%

AUD/USD $0,7733 +0,22%

NZD/USD $0,7423 +0,82%

USD/CAD C$1,2507 -0,98%

-

00:01

Schedule for today, Friday, Feb 13’2015:

(time / country / index / period / previous value / forecast)

02:00 China Leading Index January +1.1%

06:30 France GDP, q/q (Preliminary) Quarter IV +0.3% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.4%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.2% +1.0%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.6%

08:15 Switzerland Producer & Import Prices, y/y January -2.1% -1.5%

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV +0.8% +0.8%

13:30 Canada Manufacturing Shipments (MoM) December -1.4% -0.9%

13:30 U.S. Import Price Index July -2.5% -3.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.1 98.2

-