Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,857.05 -16.47 -0.24 %, CAC 40 4,751.95 -7.41 -0.16 %, DAX 10,923.23 -40.17 -0.37 %

-

18:00

European stocks close: stocks closed lower as investors remained cautious due to new debt deal talks between the European Union and Greece

Stock indices closed lower as investors remained cautious due to new debt deal talks between the European Union and Greece. It's unlikely that the agreement will be reached today.

Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,857.05 -16.47 -0.24 %

DAX 10,923.23 -40.17 -0.37 %

CAC 40 4,751.95 -7.41 -0.16 %

-

17:39

Оil rose slightly today

Oil prices are rising moderately, as Kuwait's oil minister has predicted their rise in the second half.

According to Kuwait's oil minister Ali al-Omaira, prices will rise in the second half due to production cuts.

Prices fell early in the session after a sharp increase last week, when the price of Brent for the first time since December exceeded $ 60 per barrel.

"Now let's see if prices hold out at $ 60 as a support level. I think it's very important level for Brent", - said analyst Olivier Petromatrix Jacob.

But many analysts are reminded that the global market is still excess oil as production remains high at relatively low demand.

"According to our estimates, in the first quarter of 2015 the world supply exceeds demand by 1.4 million barrels per day compared with 0.9 million in the fourth quarter of 2014," - the report said Bank of America Merrill Lynch.

"We reiterate our forecast that in the next two months, Brent to trade below $ 40 a barrel."

The reason for the optimism of investors is the continuing reduction in the number of drilling rigs operating in the US, which could signal a probable decrease in oil production in the country. According to the US oilfield services company Baker Hughes, last week the number of plants was reduced by 84 units to their lowest since August 2011 1054.

March futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 53.69 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea petroleum mix of Brent rose $ 0.66 to $ 62.18 a barrel on the London Stock Exchange ICE Futures Europe.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies in quiet trade

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for the Presidents' Day Holiday.

The greenback remained under pressure after Friday's the weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2.

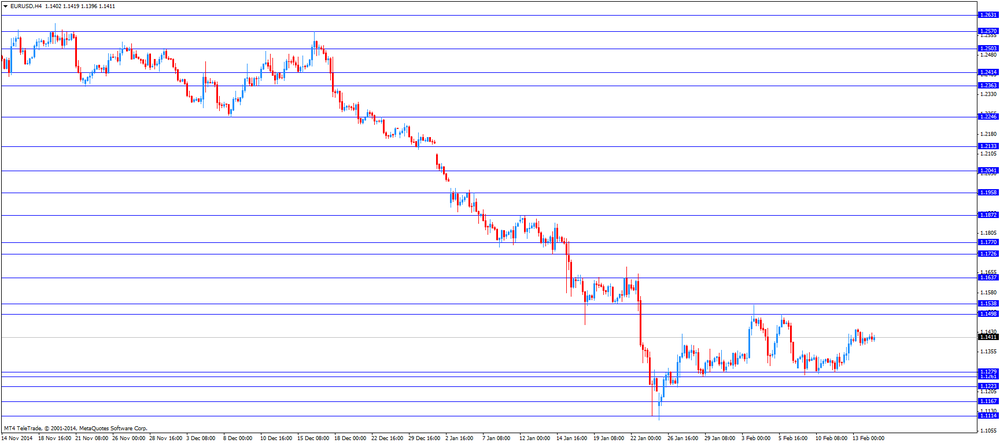

The euro traded mixed against the U.S. dollar. Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

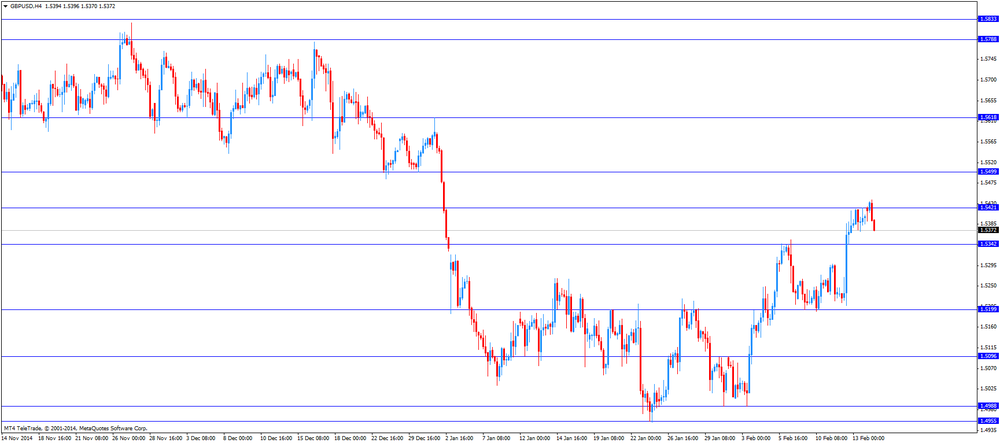

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the solid retail sales data from New Zealand. Retail sales in New Zealand rose 1.7% in the fourth quarter, up from a 1.6% increase in the previous quarter. That was the highest pace since the June 2012 quarter.

The Q3 figure was revised up from a 1.5% increase.

The rise was driven by sales in vehicles and parts.

Sales excluding automobiles climbed 1.5% in the fourth quarter, after a 1.4% gain in the previous quarter. The Q3 figure was revised up from a 1.4% rise.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after new motor vehicle sales data for Australia. Australia's new motor vehicle sales declined 1.5% in January, after a 2.6% rise in December. December's figure was revised down from a 3.0% increase.

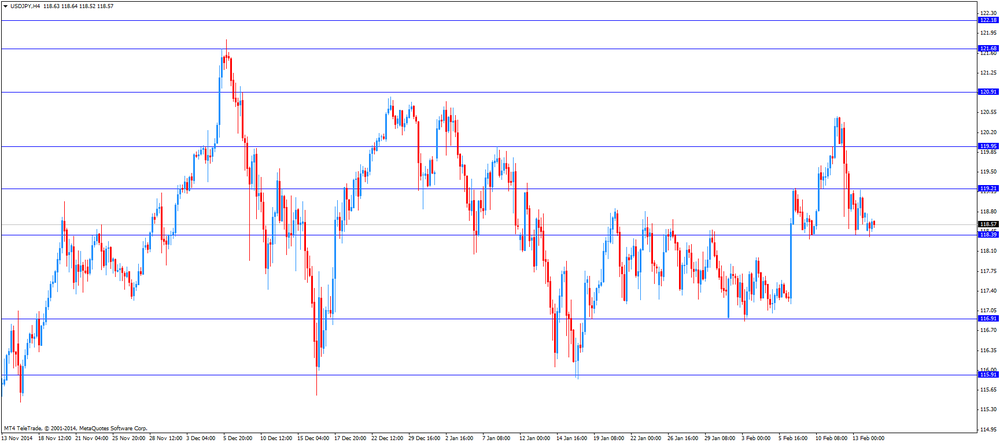

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the positive GDP data from Japan. Japan's gross domestic product increased by an annual rate of 2.3% in the fourth quarter, after a 2.3% fall in the previous quarter. The Q3 figure was revised down from a 1.9% decrease.

-

17:20

Gold rоse a third straight session

Gold prices rise on Greece talks about loans, which may affect its participation in the euro area.

If the euro zone finance ministers on Monday will not be able to negotiate with Greece on the extension of the program of financial assistance, investors worried that Greece face a credit crisis that could induce her to withdraw from the euro zone.

"Concerns on the eve of talks with creditors Greece will continue to support gold as a low-risk assets," - said an analyst at ANZ Victor Tyanpiriya.

However, many analysts predict decline in gold prices, waiting for the Fed raising interest rates this year, which will increase the dollar.

Stocks of the world's largest gold ETF-secured fund SPDR Gold Trust on Friday fell by 0.42 percent to 768.26 tons.

Demand in the physical market in China remains high on the eve of New Year celebrations, which will begin on Wednesday, but traders note that sales are lower than last year.

"Physical demand in China will keep gold in the range of $ 1.220- $ 1.235 in the next two days before Christmas," - said in a statement trading firm MKS Group.

April futures of gold on the COMEX today rose $ 6.11 to 1231.70 dollars per ounce.

-

16:44

Bundesbank’s monthly report: German economic growth in 2015 could be stronger

Germany's Bundesbank released its monthly report on Monday. The central bank said that German economic growth in 2015 could be stronger than forecasts made in the autumn of last year.

Bundesbank urged Greek banks receiving emergency funding to improve their liquidity positions.

-

15:37

Retail sales in New Zealand jumps 1.7% in the fourth quarter

Statistics New Zealand released the retail sales data on Monday. Retail sales in New Zealand rose 1.7% in the fourth quarter, up from a 1.6% increase in the previous quarter. That was the highest pace since the June 2012 quarter.

The Q3 figure was revised up from a 1.5% increase.

The rise was driven by sales in vehicles and parts. Spending on vehicles and parts jumped 3.4% in the fourth quarter.

Sales excluding automobiles climbed 1.5% in the fourth quarter, after a 1.4% gain in the previous quarter. The Q3 figure was revised up from a 1.4% rise.

-

14:40

Option expiries for today's 10:00 ET NY cut

USDJPY 117.00 (USD 2.2bln) 118.85 (USD 500m) 120.00 (USD 2.2bln)

EURUSD 1.1300-10 (EUR 781m) 1.1450 (EUR 490m)

GBPUSD 1.5400 (GBP 263m)

USDCHF 0.9000 (USD 887m) 0.9225 (USD 220m)

AUDUSD 0.7675-85 (AUD 1.7bln)

NZDUSD 0.7400 (NZD 360m)

-

14:01

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the better-than-expected trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.4% +2.1%

00:01 United Kingdom Rightmove House Price Index (YoY) February +8.2% +6.6%

00:30 Australia New Motor Vehicle Sales (MoM) January +3.0% -1.5%

00:30 Australia New Motor Vehicle Sales (YoY) January -1.0% +0.2%

02:00 China New Loans January 697 1355 1470

04:30 Japan Industrial Production (MoM) (Finally) December +1.0% +1.0% +0.8%

04:30 Japan Industrial Production (YoY) (Finally) December +0.3% +0.3% +1.0%

10:00 Eurozone Trade balance unadjusted December 21.2 Revised From 20.0 21.3 24.3

10:00 Eurozone Eurogroup Meetings

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for the Presidents' Day Holiday.

The greenback remained under pressure after Friday's the weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2.

The euro traded mixed against the U.S. dollar after the better-than-expected trade data from the Eurozone. Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.5370

USD/JPY: the currency pair traded mixed

-

13:50

Orders

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1380 1.1350 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5450 1.5465 1.5480 1.5500

Bids 1.5350 1.5325-30 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.00-10 136.50 136.80 137.00

Bids 135.00 134.80 134.50 134.00

USD/JPY

Offers 119.00 119.20 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7370-75 0.7350 0.7325 0.7300

AUD/USD

Offers 0.7820 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:27

Eurozone's trade surplus widened to €24.3 billion in December

Eurostat released trade data for the Eurozone on Monday. Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

For 2014 as whole, the trade surplus widened to €194.8 billion.

-

11:25

Option expiries for today's 10:00 ET NY cut

USDJPY 117.00 (USD 2.2bln) 118.85 (USD 500m) 120.00 (USD 2.2bln)

EURUSD 1.1300-10 (EUR 781m) 1.1450 (EUR 490m)

GBPUSD 1.5400 (GBP 263m)

USDCHF 0.9000 (USD 887m) 0.9225 (USD 220m)

AUDUSD 0.7675-85 (AUD 1.7bln)

NZDUSD 0.7400 (NZD 360m)

-

11:00

Eurozone: Trade Balance s.a., December 24,3 (forecast 21.3)

-

09:30

Japan exits recession – GDP +2.2%

Asia's second largest economy exited recession in the final quarter of last year although growth was weaker than expected as household and corporate spending were disappointing. The country slid into recession last year. Sunday's data on Japan's GDP for the fourth quarter came in at +0.6% from -0.6% (revised from +1.5%) in the previous quarter, following two quarters of contraction. Year on year GDP rose by +2.2% compared to -2.3% (revised from +2.0%).

Economic Minister Akira Amari said that the economy was on track for a recovery with signs consumer sentiment picking up.

Month on month Industrial Production rose less than expected +0.8% in December compared to +1.0% in November. Analysts expected an increase of +1.0%.

Last week the yen rose as insiders said the BoJ sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for Wednesday ending BoJ two-day policy meeting.

-

09:00

Global Stocks: Indices reach new highs

U.S. markets closed higher on Friday, ending the second consecutive week with a plus with oil above USD60 and strong fourth quarter earnings and despite U.S. consumer sentiment unexpectedly worsened in February. The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2. That was the highest level since January 2004. The harsh weather may have been a key factor of the drop.

Today U.S. markets a closed for President's day.

The DOW JONES index added +0.26% closing at 18,019.35 points, above the psychologically important level of 18,000. The S&P 500 closed higher with a final quote of 2,096.99, +0.41%, hitting a record high.

Chinese shares added gains on Monday in the wake of the Chinese New Year where volumes are expected to remain low. Speculations on further monetary easing supported the markets. Hong Kong's Hang Seng is trading +0.21% at 24,733.51 points. China's Shanghai Composite closed at 3,223.16 points +0.60%. The index has gained more than 50% over the past year boosted by monetary easing and the creation of an exchange link with Hong Kong.

Japanese markets reached new 8-year highs in today's trading. The Nikkei booked gains following Wall Street, closing +0.51% with a final quote of 18,004.77 points. Asia's second largest economy exited recession in the final quarter of last year although growth was weaker than expected. Sunday's data on Japan's GDP for the fourth quarter came in at +0.6% from -0.6% (revised from +1.5%) in the previous quarter. Year on year GDP rose by +2.2% compared to -2.3% (revised from +2.0%). Month on moth Industrial Production rose less than expected +0.8% in December compared to +1.0% in November. Analysts expected an increase by +1.0%. Insiders said the BoJ sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for Wednesday.

-

08:30

Foreign exchange market. Asian session: U.S. dollar drops across the board after weaker-than-expected consumer sentiment index

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.4% +2.1%

00:01 United Kingdom Rightmove House Price Index (YoY) February +8.2% +6.6%

00:30 Australia New Motor Vehicle Sales (MoM) January +3.0% -1.5%

00:30 Australia New Motor Vehicle Sales (YoY) January -1.0% +0.2%

02:00 China New Loans January 697 1355 1470

04:30 Japan Industrial Production (MoM) (Finally) December +1.0% +1.0% +0.8%

04:30 Japan Industrial Production (YoY) (Finally) December +0.3% +0.3% +1.0%

The U.S. dollar traded lower against the most major currencies after data on Friday showed that U.S. consumer sentiment unexpectedly worsened in February. The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2. That was the highest level since January 2004. The harsh weather may have been a key factor of the drop.

The U.S. import price index dropped by 2.8 percent in January, beating expectations for a 3.1% fall, after a 1.9% decline in December. That was the biggest drop since December 2008.

Today U.S. markets are closed for a public holiday.

The euro strengthened against the greenback as data from Germany, the Eurozone's biggest economy, showed that the economy grew at +0.7%, more than twice as fast as the forecasted +0.3%. Today further negotiations between Greece and E.U.-officials will take place. Last week's talks ended without an agreement. Over the weekend Alexis Tsirpas, Greece's Prime Minister, said in an interview he wants to create a "win-win" situation for both sides.

The Australian dollar traded stronger on Monday. New Motor Vehicle Sales declined by -1.5% in January after they rose +3.0% in December. Year on year they rose +0.2% compared to -1.0%.

Data from China, Australia's biggest trade partner, showed that New Loans rose to 1470, above estimates of 1355.

New Zealand's dollar advanced for a third day against the greenback in Asian trade as Retail Sales rose. Retail Sales rose by +1.7% from +1.6% (revised from +1.5%), year on year Retail Sales in the fourth quarter rose +1.5% compared to +1.5% (revised from +1.4%).

The Japanese yen traded stronger against the greenback on Monday Asia's second largest economy exited recession in the final quarter of last year although growth was weaker than expected. Sunday's data on Japan's GDP for the fourth quarter came in at +0.6% from -0.6% (revised from +1.5%) in the previous quarter. Year on year GDP rose by +2.2% compared to -2.3% (revised from +2.0%). Month on moth Industrial Production rose less than expected +0.8% in December compared to +1.0% in November. Analysts expected an increase by +1.0%. Last week the yen rose as insiders said the BoJ sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for Wednesday.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar weakened against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone Eurogroup Meetings

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

-

07:18

Options levels on monday, February 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1574 (5738)

$1.1520 (2859)

$1.1479 (1793)

Price at time of writing this review: $1.1417

Support levels (open interest**, contracts):

$1.1321 (3685)

$1.1275 (3945)

$1.1216 (3994)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 102527 contracts, with the maximum number of contracts with strike price $1,1500 (5738);

- Overall open interest on the PUT options with the expiration date March, 6 is 105158 contracts, with the maximum number of contracts with strike price $1,1200 (5456);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from February, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (960)

$1.5604 (1992)

$1.5507 (2698)

Price at time of writing this review: $1.5433

Support levels (open interest**, contracts):

$1.5292 (1763)

$1.5195 (2087)

$1.5097 (1765)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 27121 contracts, with the maximum number of contracts with strike price $1,5500 (2698);

- Overall open interest on the PUT options with the expiration date March, 6 is 32976 contracts, with the maximum number of contracts with strike price $1,5200 (2087);

- The ratio of PUT/CALL was 1.22 versus 1.21 from the previous trading day according to data from February, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:34

Japan: Industrial Production (MoM) , December +0.8% (forecast +1.0%)

-

05:33

Japan: Industrial Production (YoY), December +1.0% (forecast +0.3%)

-

03:04

Nikkei 225 18,039.84 +126.48 +0.71%, Hang Seng24,759.72 +77.18 +0.31%, Shanghai Composite 3,205.48 +1.66 +0.05%

-

01:32

Australia: New Motor Vehicle Sales (YoY) , January +0.2%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , January -1.5%

-

01:02

United Kingdom: Rightmove House Price Index (MoM), February +2.1%

-

01:02

United Kingdom: Rightmove House Price Index (YoY), February +6.6%

-

00:52

Japan: GDP, y/y, Quarter IV +2.2%

-

00:50

Japan: GDP, q/q, Quarter IV +0.6%

-

00:33

Commodities. Daily history for Feb 13’2015:

(raw materials / closing price /% change)

Oil 52.78 +3.07%

Gold 1,227.90 +0.07%

-

00:33

Stocks. Daily history for Feb 13’2015:

(index / closing price / change items /% change)

Nikkei 225 17,913.36 -66.36 -0.37%

Hang Seng 24,682.54 +260.39 +1.07%

Shanghai Composite 3,203.83 +30.41 +0.96%

FTSE 100 6,873.52 +45.41 +0.67%

CAC 40 4,759.36 +33.16 +0.70%

Xetra DAX 10,963.4 +43.75 +0.40%

S&P 500 2,096.99 +8.51 +0.41%

NASDAQ Composite 4,893.84 +36.22 +0.75%

Dow Jones 18,019.35 +46.97 +0.26%

-

00:32

Currencies. Daily history for Feb 13’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1398 -0,04%

GBP/USD $1,5402 +0,13%

USD/CHF Chf0,9323 +0,17%

USD/JPY Y118,78 -0,27%

EUR/JPY Y135,39 -0,31%

GBP/JPY Y182,94 -0,15%

AUD/USD $0,7765 +0,41%

NZD/USD $0,7458 +0,47%

USD/CAD C$1,2460 -0,38%

-

00:27

China: New Loans, January 1470 (forecast 1355)

-

00:01

Schedule for today, Monday, Feb 16’2015:

(time / country / index / period / previous value / forecast)

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.4%

00:01 United Kingdom Rightmove House Price Index (YoY) February +8.2%

00:30 Australia New Motor Vehicle Sales (MoM) January +3.0%

00:30 Australia New Motor Vehicle Sales (YoY) January -1.0%

02:00 China New Loans January 697 1355

04:30 Japan Industrial Production (MoM) (Finally) December +1.0% +1.0%

04:30 Japan Industrial Production (YoY) (Finally) December +0.3% +0.3%

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone Eurogroup Meetings

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

-