Noticias del mercado

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies in quiet trade

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for the Presidents' Day Holiday.

The greenback remained under pressure after Friday's the weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2.

The euro traded mixed against the U.S. dollar. Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the solid retail sales data from New Zealand. Retail sales in New Zealand rose 1.7% in the fourth quarter, up from a 1.6% increase in the previous quarter. That was the highest pace since the June 2012 quarter.

The Q3 figure was revised up from a 1.5% increase.

The rise was driven by sales in vehicles and parts.

Sales excluding automobiles climbed 1.5% in the fourth quarter, after a 1.4% gain in the previous quarter. The Q3 figure was revised up from a 1.4% rise.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after new motor vehicle sales data for Australia. Australia's new motor vehicle sales declined 1.5% in January, after a 2.6% rise in December. December's figure was revised down from a 3.0% increase.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the positive GDP data from Japan. Japan's gross domestic product increased by an annual rate of 2.3% in the fourth quarter, after a 2.3% fall in the previous quarter. The Q3 figure was revised down from a 1.9% decrease.

-

16:44

Bundesbank’s monthly report: German economic growth in 2015 could be stronger

Germany's Bundesbank released its monthly report on Monday. The central bank said that German economic growth in 2015 could be stronger than forecasts made in the autumn of last year.

Bundesbank urged Greek banks receiving emergency funding to improve their liquidity positions.

-

15:37

Retail sales in New Zealand jumps 1.7% in the fourth quarter

Statistics New Zealand released the retail sales data on Monday. Retail sales in New Zealand rose 1.7% in the fourth quarter, up from a 1.6% increase in the previous quarter. That was the highest pace since the June 2012 quarter.

The Q3 figure was revised up from a 1.5% increase.

The rise was driven by sales in vehicles and parts. Spending on vehicles and parts jumped 3.4% in the fourth quarter.

Sales excluding automobiles climbed 1.5% in the fourth quarter, after a 1.4% gain in the previous quarter. The Q3 figure was revised up from a 1.4% rise.

-

14:40

Option expiries for today's 10:00 ET NY cut

USDJPY 117.00 (USD 2.2bln) 118.85 (USD 500m) 120.00 (USD 2.2bln)

EURUSD 1.1300-10 (EUR 781m) 1.1450 (EUR 490m)

GBPUSD 1.5400 (GBP 263m)

USDCHF 0.9000 (USD 887m) 0.9225 (USD 220m)

AUDUSD 0.7675-85 (AUD 1.7bln)

NZDUSD 0.7400 (NZD 360m)

-

14:01

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the better-than-expected trade data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.4% +2.1%

00:01 United Kingdom Rightmove House Price Index (YoY) February +8.2% +6.6%

00:30 Australia New Motor Vehicle Sales (MoM) January +3.0% -1.5%

00:30 Australia New Motor Vehicle Sales (YoY) January -1.0% +0.2%

02:00 China New Loans January 697 1355 1470

04:30 Japan Industrial Production (MoM) (Finally) December +1.0% +1.0% +0.8%

04:30 Japan Industrial Production (YoY) (Finally) December +0.3% +0.3% +1.0%

10:00 Eurozone Trade balance unadjusted December 21.2 Revised From 20.0 21.3 24.3

10:00 Eurozone Eurogroup Meetings

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for the Presidents' Day Holiday.

The greenback remained under pressure after Friday's the weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2.

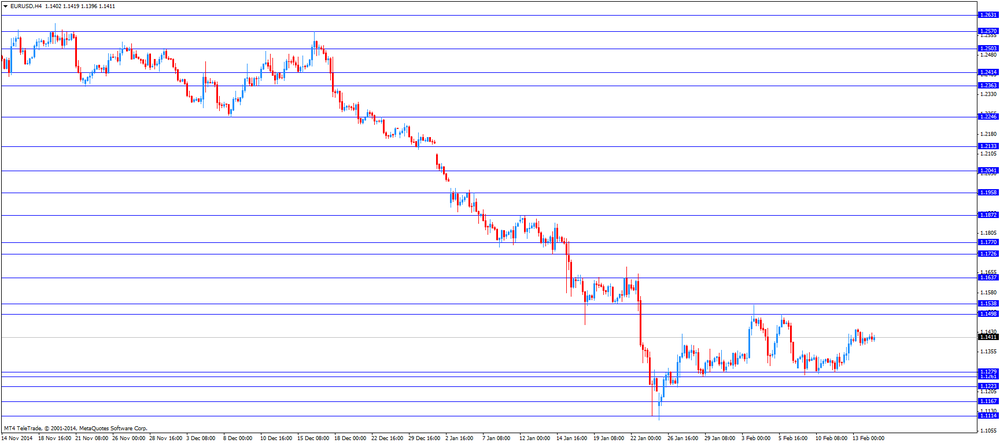

The euro traded mixed against the U.S. dollar after the better-than-expected trade data from the Eurozone. Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

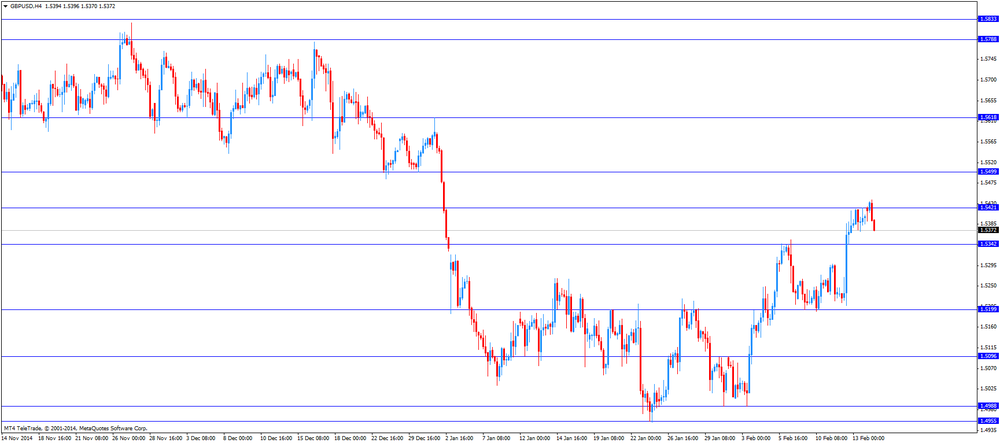

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.5370

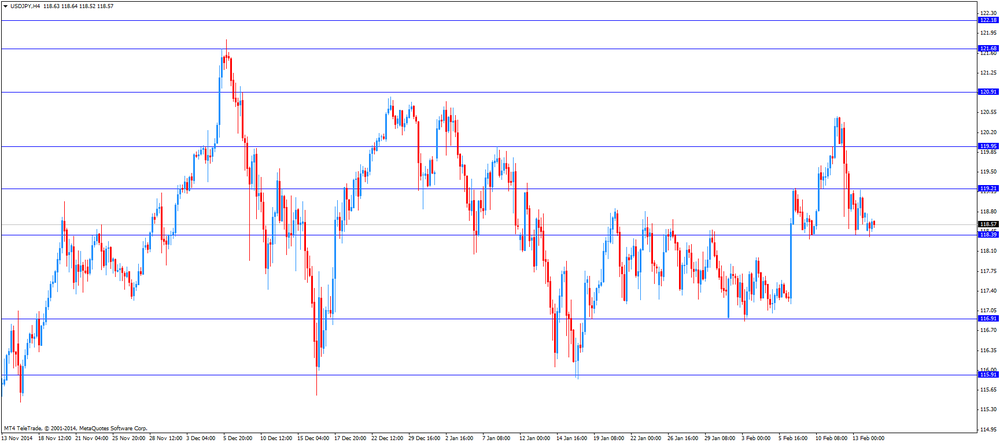

USD/JPY: the currency pair traded mixed

-

13:50

Orders

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1380 1.1350 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5450 1.5465 1.5480 1.5500

Bids 1.5350 1.5325-30 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.00-10 136.50 136.80 137.00

Bids 135.00 134.80 134.50 134.00

USD/JPY

Offers 119.00 119.20 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7370-75 0.7350 0.7325 0.7300

AUD/USD

Offers 0.7820 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:27

Eurozone's trade surplus widened to €24.3 billion in December

Eurostat released trade data for the Eurozone on Monday. Eurozone's trade surplus increased to €24.3 billion in December from €21.2 billion in November, exceeding expectations for a rise to €21.3 billion. November's figure was revised up from a surplus of €20.0 billion.

The increase was driven by lower imports.

Exports climbed by 1.0% in December, while imports fell 2.0%.

Exports were boosted by a weaker euro and lower oil prices.

For 2014 as whole, the trade surplus widened to €194.8 billion.

-

11:25

Option expiries for today's 10:00 ET NY cut

USDJPY 117.00 (USD 2.2bln) 118.85 (USD 500m) 120.00 (USD 2.2bln)

EURUSD 1.1300-10 (EUR 781m) 1.1450 (EUR 490m)

GBPUSD 1.5400 (GBP 263m)

USDCHF 0.9000 (USD 887m) 0.9225 (USD 220m)

AUDUSD 0.7675-85 (AUD 1.7bln)

NZDUSD 0.7400 (NZD 360m)

-

11:00

Eurozone: Trade Balance s.a., December 24,3 (forecast 21.3)

-

09:30

Japan exits recession – GDP +2.2%

Asia's second largest economy exited recession in the final quarter of last year although growth was weaker than expected as household and corporate spending were disappointing. The country slid into recession last year. Sunday's data on Japan's GDP for the fourth quarter came in at +0.6% from -0.6% (revised from +1.5%) in the previous quarter, following two quarters of contraction. Year on year GDP rose by +2.2% compared to -2.3% (revised from +2.0%).

Economic Minister Akira Amari said that the economy was on track for a recovery with signs consumer sentiment picking up.

Month on month Industrial Production rose less than expected +0.8% in December compared to +1.0% in November. Analysts expected an increase of +1.0%.

Last week the yen rose as insiders said the BoJ sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for Wednesday ending BoJ two-day policy meeting.

-

08:30

Foreign exchange market. Asian session: U.S. dollar drops across the board after weaker-than-expected consumer sentiment index

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.4% +2.1%

00:01 United Kingdom Rightmove House Price Index (YoY) February +8.2% +6.6%

00:30 Australia New Motor Vehicle Sales (MoM) January +3.0% -1.5%

00:30 Australia New Motor Vehicle Sales (YoY) January -1.0% +0.2%

02:00 China New Loans January 697 1355 1470

04:30 Japan Industrial Production (MoM) (Finally) December +1.0% +1.0% +0.8%

04:30 Japan Industrial Production (YoY) (Finally) December +0.3% +0.3% +1.0%

The U.S. dollar traded lower against the most major currencies after data on Friday showed that U.S. consumer sentiment unexpectedly worsened in February. The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2. That was the highest level since January 2004. The harsh weather may have been a key factor of the drop.

The U.S. import price index dropped by 2.8 percent in January, beating expectations for a 3.1% fall, after a 1.9% decline in December. That was the biggest drop since December 2008.

Today U.S. markets are closed for a public holiday.

The euro strengthened against the greenback as data from Germany, the Eurozone's biggest economy, showed that the economy grew at +0.7%, more than twice as fast as the forecasted +0.3%. Today further negotiations between Greece and E.U.-officials will take place. Last week's talks ended without an agreement. Over the weekend Alexis Tsirpas, Greece's Prime Minister, said in an interview he wants to create a "win-win" situation for both sides.

The Australian dollar traded stronger on Monday. New Motor Vehicle Sales declined by -1.5% in January after they rose +3.0% in December. Year on year they rose +0.2% compared to -1.0%.

Data from China, Australia's biggest trade partner, showed that New Loans rose to 1470, above estimates of 1355.

New Zealand's dollar advanced for a third day against the greenback in Asian trade as Retail Sales rose. Retail Sales rose by +1.7% from +1.6% (revised from +1.5%), year on year Retail Sales in the fourth quarter rose +1.5% compared to +1.5% (revised from +1.4%).

The Japanese yen traded stronger against the greenback on Monday Asia's second largest economy exited recession in the final quarter of last year although growth was weaker than expected. Sunday's data on Japan's GDP for the fourth quarter came in at +0.6% from -0.6% (revised from +1.5%) in the previous quarter. Year on year GDP rose by +2.2% compared to -2.3% (revised from +2.0%). Month on moth Industrial Production rose less than expected +0.8% in December compared to +1.0% in November. Analysts expected an increase by +1.0%. Last week the yen rose as insiders said the BoJ sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for Wednesday.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar weakened against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone Eurogroup Meetings

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

-

07:18

Options levels on monday, February 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1574 (5738)

$1.1520 (2859)

$1.1479 (1793)

Price at time of writing this review: $1.1417

Support levels (open interest**, contracts):

$1.1321 (3685)

$1.1275 (3945)

$1.1216 (3994)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 102527 contracts, with the maximum number of contracts with strike price $1,1500 (5738);

- Overall open interest on the PUT options with the expiration date March, 6 is 105158 contracts, with the maximum number of contracts with strike price $1,1200 (5456);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from February, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (960)

$1.5604 (1992)

$1.5507 (2698)

Price at time of writing this review: $1.5433

Support levels (open interest**, contracts):

$1.5292 (1763)

$1.5195 (2087)

$1.5097 (1765)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 27121 contracts, with the maximum number of contracts with strike price $1,5500 (2698);

- Overall open interest on the PUT options with the expiration date March, 6 is 32976 contracts, with the maximum number of contracts with strike price $1,5200 (2087);

- The ratio of PUT/CALL was 1.22 versus 1.21 from the previous trading day according to data from February, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:34

Japan: Industrial Production (MoM) , December +0.8% (forecast +1.0%)

-

05:33

Japan: Industrial Production (YoY), December +1.0% (forecast +0.3%)

-

01:32

Australia: New Motor Vehicle Sales (YoY) , January +0.2%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , January -1.5%

-

01:02

United Kingdom: Rightmove House Price Index (MoM), February +2.1%

-

01:02

United Kingdom: Rightmove House Price Index (YoY), February +6.6%

-

00:52

Japan: GDP, y/y, Quarter IV +2.2%

-

00:50

Japan: GDP, q/q, Quarter IV +0.6%

-

00:32

Currencies. Daily history for Feb 13’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1398 -0,04%

GBP/USD $1,5402 +0,13%

USD/CHF Chf0,9323 +0,17%

USD/JPY Y118,78 -0,27%

EUR/JPY Y135,39 -0,31%

GBP/JPY Y182,94 -0,15%

AUD/USD $0,7765 +0,41%

NZD/USD $0,7458 +0,47%

USD/CAD C$1,2460 -0,38%

-

00:27

China: New Loans, January 1470 (forecast 1355)

-

00:01

Schedule for today, Monday, Feb 16’2015:

(time / country / index / period / previous value / forecast)

00:01 United Kingdom Rightmove House Price Index (MoM) February +1.4%

00:01 United Kingdom Rightmove House Price Index (YoY) February +8.2%

00:30 Australia New Motor Vehicle Sales (MoM) January +3.0%

00:30 Australia New Motor Vehicle Sales (YoY) January -1.0%

02:00 China New Loans January 697 1355

04:30 Japan Industrial Production (MoM) (Finally) December +1.0% +1.0%

04:30 Japan Industrial Production (YoY) (Finally) December +0.3% +0.3%

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone Eurogroup Meetings

11:00 Germany Bundesbank Monthly Report

13:00 U.S. Bank holiday

-