Noticias del mercado

-

17:37

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the U.S. weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index

The U.S. dollar traded mixed to higher against the most major currencies after the U.S. weaker-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2.

The harsh weather may have been a key factor of the drop.

The U.S. import price index dropped by 2.8 percent in January, beating expectations for a 3.1% fall, after a 1.9% decline in December. That was the biggest drop since December 2008.

December's figure was revised up from a 2.5% decrease.

The euro traded lower against the U.S. dollar. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar after the better-than-expected Canadian manufacturing shipments. Canadian manufacturing shipments climbed 1.7% in December, beating forecasts of a 0.9% decrease, after a 1.3% drop in November. November's figure was revised up from a 1.4% decline.

The increase was driven by higher sales in the transportation equipment industry.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's producer and import prices declined 0.6% in January, in line with expectations, after a 0.4% fall in December.

On a yearly basis, producer and import prices decreased 2.7% in January, missing expectation for a 1.5% decline, after a 2.1% drop in December.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback. New Zealand's food price index rose 1.3% in January, after a 0.3% increase in December.

The Australian dollar climbed against the U.S. dollar. In the overnight trading session, the Aussie climbed against the greenback after comments by the Reserve Bank of Australia Glenn Stevens. He said that the government has to increase spending in order to boost demand as the economy has to grow at a faster pace. Monetary policy, at the current level of interest rates, has become more limited in spurring demand compared to a decade ago but still has some ability to assist the economy.

The Japanese yen increased against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any major economic data from Japan.

-

16:55

Thomson Reuters/University of Michigan preliminary consumer sentiment index falls to 93.6 in February

The Thomson Reuters/University of Michigan preliminary consumer sentiment index declined to 93.6 in February from a final reading of 98.1 in January, missing expectations for an increase to 98.2. That was the highest level since January 2004.

The harsh weather may have been a key factor of the drop.

A gauge of consumers' current economic conditions dropped to 103.1 in February from 109.3 in January.

The index of consumer expectations declined to 87.5 from 91.0.

The one-year inflation expectations in February climbed to 2.8% from 2.5% at the end of January.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that the decline was a result of "renewed concerns over employment and wage growth".

-

16:05

U.S. import price index dropped by 2.8 percent in January, driven by falling fuel prices

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index dropped by 2.8 percent in January, beating expectations for a 3.1% fall, after a 1.9% decline in December. That was the biggest drop since December 2008.

December's figure was revised up from a 2.5% decrease.

The decline was driven by falling fuel prices.

U.S. export prices plunged by 2.0% in January, after a 1.0% decrease in December.

For 2014 as a whole, import prices dropped by 8.0%.

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, February 93.6 (forecast 98.2)

-

15:24

Canadian manufacturing shipments rises 1.7% in December

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments climbed 1.7% in December, beating forecasts of a 0.9% decrease, after a 1.3% drop in November.

November's figure was revised up from a 1.4% decline.

The increase was driven by higher sales in the transportation equipment industry. Sales of motor vehicles increased 9.0%, while sales of machinery rose 5.2% in December, the highest level since November 2011.

Food sales rose 1.8% in December, while sales of chemical products climbed 2.5%.

Sales in the petroleum and coal product industry declined 9.3% in December. That was the sixth consecutive decline.

-

15:08

Switzerland's producer and import prices declined 0.6% in January

The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices declined 0.6% in January, in line with expectations, after a 0.4% fall in December.

On a yearly basis, producer and import prices decreased 2.7% in January, missing expectation for a 1.5% decline, after a 2.1% drop in December.

The decline was driven by lower prices for petroleum and petroleum products.

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1340(E1.16bn), $1.1355(E590mn), $1.1365(E404mn), $1.1400(E571mn), $1.1450(E400mn)

USD/JPY: Y118.25($2.26bn), Y118.50($893mn), Y119.00($736mn), Y119.20-25($1.8bn), Y119.40($630mn), Y120.00($3.9bn)

GBP/USD: $1.5100(Gbp1.5bn), $1.5300(Gbp1.5bn), $1.5400(Gbp587mn)

AUD/USD: $0.7700(A$4.1bn)

NZD/USD: $0.7500(NZ$300mn)

USD/CAD: C$1.2200($1.3bn), C$1.2415($245mn), C$1.2500(280mn)

-

14:30

U.S.: Import Price Index, July -2.8% (forecast -3.1%)

-

14:30

Canada: Manufacturing Shipments (MoM), December +1.7% (forecast -0.9%)

-

14:01

Foreign exchange market. European session: the euro fell against the U.S. dollar after the mixed GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China Leading Index January +1.1% +0.9%

06:30 France GDP, q/q (Preliminary) Quarter IV +0.3% +0.1% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.4% +0.2%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.3% +0.7%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.2% +1.0% +1.6%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.2% -0.1% 0.0%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.6% -0.6%

08:15 Switzerland Producer & Import Prices, y/y January -2.1% -1.5% -2.7%

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.2% +0.2% +0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV +0.8% +0.8% +0.9%

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to rise to 98.2 in February from a final reading of 98.1 in January.

The U.S. import price index is expected to plunge 3.1% in January, after a 2.5 drop in December.

The euro fell against the U.S. dollar after the mixed GDP data from the Eurozone. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian manufacturing shipments. Canada's manufacturing shipments are expected to decrease 0.9% in December, after a 1.4% drop in November.

The Swiss franc traded lower against the U.S. dollar. Switzerland's producer and import prices declined 0.6% in January, in line with expectations, after a 0.4% fall in December.

On a yearly basis, producer and import prices decreased 2.7% in January, missing expectation for a 1.5% decline, after a 2.1% drop in December.

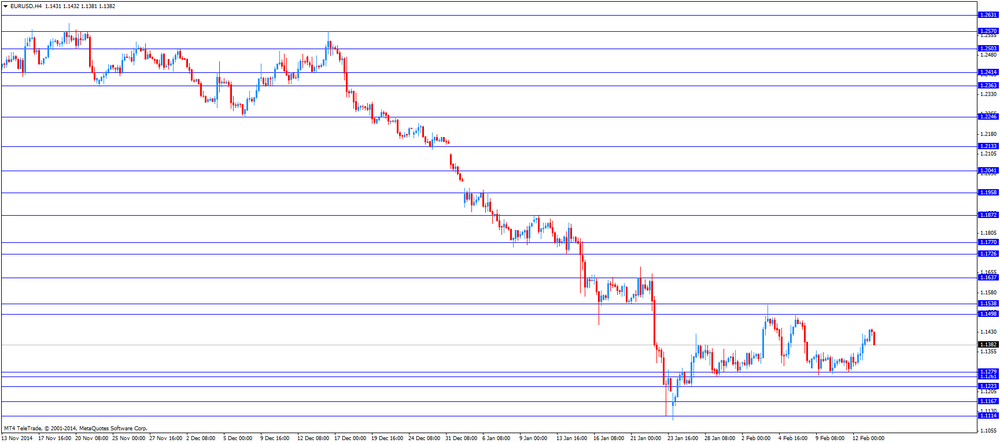

EUR/USD: the currency pair declined to $1.1381

GBP/USD: the currency pair decreased to $1.5369

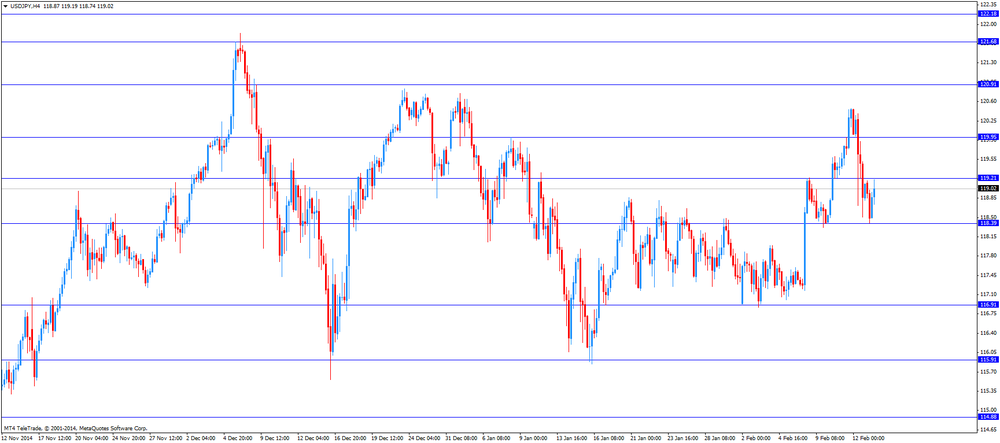

USD/JPY: the currency pair rose to Y119.19

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) December -1.4% -0.9%

13:30 U.S. Import Price Index January -2.5% -3.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.1 98.2

-

14:00

Orders

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1400 1.1380 1.1350 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5400 1.5420-25 1.5450 1.5465 1.5480 1.5500

Bids 1.5370 1.5350 1.5325-30 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.00-10 136.50 136.80 137.00

Bids 135.60 135.20 135.00 134.80 134.50 134.00

USD/JPY

Offers 119.00 119.20 119.50 119.80 120.00 120.20-30 120.50

Bids 118.60 118.40 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7400 0.7385 0.7370-75 0.7350 0.7325 0.7300

AUD/USD

Offers 0.7785 0.7800 0.7820 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:22

EU’s economy grew by 1.4% in 2014

Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.2% gain in the third quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 0.8% in the fourth quarter, exceeding expectations for a 0.8% increase, after a 0.8% gain in the third quarter.

For 2014 as a whole, GDP rose by 1.4% in the European Union. In comparison, the U.S. economy grew at an annual pace of 2.6% in 2014.

Germany's preliminary GDP gained by 0.7% in the fourth quarter, beating forecasts of a 0.3% rise, after a 0.1% increase in the third quarter.

France's preliminary GDP increased by 0.1% in the fourth quarter, in line with expectations, after a 0.3% gain in the previous quarter.

-

11:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1340(E1.16bn), $1.1355(E590mn), $1.1365(E404mn), $1.1400(E571mn), $1.1450(E400mn)

USD/JPY: Y118.25($2.26bn), Y118.50($893mn), Y119.00($736mn), Y119.20-25($1.8bn), Y119.40($630mn), Y120.00($3.9bn)

GBP/USD: $1.5100(Gbp1.5bn), $1.5300(Gbp1.5bn), $1.5400(Gbp587mn)

AUD/USD: $0.7700(A$4.1bn)

NZD/USD: $0.7500(NZ$300mn)

USD/CAD: C$1.2200($1.3bn), C$1.2415($245mn), C$1.2500(280mn)

-

11:00

Eurozone: GDP (QoQ), Quarter IV +0.3% (forecast +0.2%)

-

11:00

Eurozone: GDP (YoY), Quarter IV +0.9% (forecast +0.8%)

-

09:30

RBA Governor Stevens: Growth will remain low and monetary easing may be less effective

Royal Bank of Australia's Governor Glenn Stevens stated in yesterday's speech that the government has to increase spending in order to boost demand as the economy has to grow at a faster pace. Monetary policy, at the current level of interest rates, has become more limited in spurring demand compared to a decade ago but still has some ability to assist the economy.

The bank cut interest rates this month to 2.25% after a 17-month pause as unemployment has risen to a 12-year high. Australia's economy faces challenges as prices for commodities, the most important export, slumped and China's economic growth slows. China is Australia's biggest trade partner.

-

09:15

Switzerland: Producer & Import Prices, m/m, January -0.6% (forecast -0.6%)

-

09:15

Switzerland: Producer & Import Prices, y/y, January -2.7% (forecast -1.5%)

-

08:45

France: Non-Farm Payrolls, Quarter IV 0.0% (forecast -0.1%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar drops across the board after yesterday’s weaker-than-expected retail sales data

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 China Leading Index January +1.1% +0.9%

06:30 France GDP, q/q (Preliminary) Quarter IV +0.3% +0.1% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.4% +0.2%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.3% +0.7%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.2% +1.0% +1.6%

The U.S. dollar traded lower against the most major currencies after the weaker-than-expected U.S. retail sales data. The U.S. retail sales dropped 0.8% in January, missing expectations for a 0.3% decrease, after a 0.9% decline in December. Retail sales excluding automobiles fell 0.9% in January, missing forecasts for a 0.4% decrease, after a 0.9% drop in December. December's figure was revised up from a 1.0% decline.

The number of initial jobless claims in the week ending February 07 in the U.S. rose by 25,000 to 304,000 from 279,000 in the previous week. The previous week's figure was revised down from 278,000. Analysts had expected the number of initial jobless claims to decrease to 278,000.

The U.S. business inventories rose by 0.1% in December, after a 0.2% gain in November. Analysts had expected a 0.2% increase.

The euro strengthened against the greenback as the ECB raised the Emergency Liquidity Assistance cap for Greek banks by 5 billion euro and supported by signs of easing tension between Greece and its euro-area creditors but the outcome of Greece's bailout negotiations is still open. The next meeting is scheduled for Monday. A ceasefire agreement between Russia and Ukraine also supported the single currency.

The Australian dollar booked gains versus the greenback after Royal Bank of Australia's Governor Glenn Stevens speech stating that the government has to increase spending in order to boost demand and that monetary policy, at the current level of interest rates, has become more limited in spurring demand compared to a decade ago but still has some ability to assist the transition the economy is making, and we regarded it as appropriate to provide that support. The bank cut interst rates this month to2.25% after a 17-month pause.

China's Leading Index declined from a previous reading of +1.1% to +0.9% in January. China is Australia's most important trade partner.

New Zealand's dollar added against the greenback in Asian trade. Data on the Food Price Index came in yesterday with a reading of +1.3% in January compared to +0.2% in December.

The Japanese yen traded stronger against the greenback on Friday amid speculations that the Bank of Japan will not expand monetary easing. Now all eyes are on Governor Kuroda and his comments on that matter.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar weakened against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.6%

08:15 Switzerland Producer & Import Prices, y/y January -2.1% -1.5%

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV +0.8% +0.8%

13:30 Canada Manufacturing Shipments (MoM) December -1.4% -0.9%

13:30 U.S. Import Price Index July -2.5% -3.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.1 98.2

-

08:01

Germany: GDP (QoQ), Quarter IV +0.7% (forecast +0.3%)

-

08:01

Germany: GDP (YoY), Quarter IV +1.6% (forecast +1.0%)

-

07:30

France: GDP, q/q, Quarter IV +0.1% (forecast +0.1%)

-

07:30

France: GDP, Y/Y, Quarter IV +0.2%

-

07:27

Options levels on friday, February 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1595 (5709)

$1.1545 (2906)

$1.1506 (1836)

Price at time of writing this review: $1.1433

Support levels (open interest**, contracts):

$1.1360 (2233)

$1.1323 (3697)

$1.1273 (3918)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 102162 contracts, with the maximum number of contracts with strike price $1,1500 (5709);

- Overall open interest on the PUT options with the expiration date March, 6 is 104783 contracts, with the maximum number of contracts with strike price $1,1200 (5467);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from February, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (846)

$1.5605 (1884)

$1.5508 (2405)

Price at time of writing this review: $1.5411

Support levels (open interest**, contracts):

$1.5291 (1338)

$1.5194 (1782)

$1.5096 (1751)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 26181 contracts, with the maximum number of contracts with strike price $1,5500 (2405);

- Overall open interest on the PUT options with the expiration date March, 6 is 31607 contracts, with the maximum number of contracts with strike price $1,5000 (2055);

- The ratio of PUT/CALL was 1.21 versus 1.20 from the previous trading day according to data from February, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:37

China: Leading Index , January +0.9%

-

00:39

Currencies. Daily history for Feb 12’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1403 +0,58%

GBP/USD $1,5382 +0,94%

USD/CHF Chf0,9307 +0,25%

USD/JPY Y119,10 -1,13%

EUR/JPY Y135,81 -0,53%

GBP/JPY Y183,21 -0,19%

AUD/USD $0,7733 +0,22%

NZD/USD $0,7423 +0,82%

USD/CAD C$1,2507 -0,98%

-

00:01

Schedule for today, Friday, Feb 13’2015:

(time / country / index / period / previous value / forecast)

02:00 China Leading Index January +1.1%

06:30 France GDP, q/q (Preliminary) Quarter IV +0.3% +0.1%

06:30 France GDP, Y/Y (Preliminary) Quarter IV +0.4%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV +0.1% +0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV +1.2% +1.0%

07:45 France Non-Farm Payrolls (Preliminary) Quarter IV -0.2% -0.1%

08:15 Switzerland Producer & Import Prices, m/m January -0.4% -0.6%

08:15 Switzerland Producer & Import Prices, y/y January -2.1% -1.5%

10:00 Eurozone Trade Balance s.a. December 20.0 21.3

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter IV +0.2% +0.2%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter IV +0.8% +0.8%

13:30 Canada Manufacturing Shipments (MoM) December -1.4% -0.9%

13:30 U.S. Import Price Index July -2.5% -3.1%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) February 98.1 98.2

-