Noticias del mercado

-

23:57

Schedule for today, Wednesday, May 18’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia RBA Assist Gov Debelle Speaks

01:30 Australia Wage Price Index, q/q Quarter I 0.5% 0.5%

01:30 Australia Wage Price Index, y/y Quarter I 2.2% 2.2%

08:30 United Kingdom Average Earnings, 3m/y March 1.8% 1.7%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y March 2.2% 2.3%

08:30 United Kingdom ILO Unemployment Rate March 5.1% 5.1%

08:30 United Kingdom Claimant count April 6.7 4

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) April 1% 0.7%

09:00 Eurozone Harmonized CPI April 1.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April 0.0% -0.2%

11:00 U.S. MBA Mortgage Applications May 0.4%

12:30 Canada Foreign Securities Purchases March 15.94

14:30 U.S. Crude Oil Inventories May -3.41

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y April -0.7% 0.8%

23:50 Japan Core Machinery Orders March -9.2% 0.5%

-

18:03

New motor vehicle sales in Australia slide 2.5% in April

The Australian Bureau of Statistics released its new motor vehicle sales data on Tuesday. New motor vehicle sales in Australia slid 2.5% in April, missing expectations for a 0.5% fall, after a 2.2% rise in March.

Sales of passenger vehicles declined 1.2% in April, sales of sports utility vehicles were down 2.6%, while sales of other vehicles plunged 4.8%.

On a yearly basis, new motor vehicle sales climbed 2.4% in April, after a 4.2% increase in February.

-

17:55

Reserve Bank of New Zealand’s inflation expectations for the next 12 months rise to 1.22% in the three months to May

According to the Reserve Bank of New Zealand's survey published on Tuesday, New Zealand's inflation expectations for the next 12 months rose to 1.22% in the three months to May from 1.09% the previous quarter.

Inflation expectations for the next 24 months were up to 1.64% from 1.63%.

-

17:46

Final industrial production in Japan climbs 3.8% in March

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Tuesday. Final industrial production in Japan climb 3.8% in March, up from the preliminary estimate of a 3.6% rise, after a 5.2% decrease in February.

Industrial shipments rose 1.8% in March, while inventories jumped 2.9%.

On a yearly basis, Japan's industrial production was up 0.2% in March, up from the preliminary estimate of a 0.1% gain, after a 1.2% drop in February.

-

17:26

Bundesbank’s monthly report: Germany's economy is expected to lose momentum in spring

Germany's Bundesbank released its monthly report on Tuesday. The central bank said that Germany's economy was expected to lose momentum in spring.

"The consistently upbeat labour market, rising income expectations along with stable prices will keep consumption activity buoyant, they write, but the unlikely prospect of a further drop in oil prices leads them to believe that the sizeable purchasing power gains in the past two quarters will dwindle," the report said.

"The solid underlying cyclical trend would probably remain intact into the second quarter," Bundesbank added.

-

17:16

European Central Bank Governing Council member Jens Weidmann: the government bonds purchases by the ECB are problematic

The European Central Bank (ECB) Governing Council member and Bundesbank President Jens Weidmann said in an interview with German newspaper Die Welt that he thought the government bonds purchases by the ECB were problematic as central bank become the biggest creditors that states.

He also said that the criticism on the recent stimulus measures by the ECB was driven by some measures that blurred the lines between monetary and fiscal policy.

-

16:31

Italian economy is expected to expand 1.1% in 2016

The Italian statistical office Istat released its gross domestic product (GDP) forecast data for Italy on Tuesday. The Italian GDP is expected to rise 1.1% this year, down from the previous forecast of 1.4% growth, after a 0.8% rise last year.

According to the Istat, domestic demand is expected to rise 1.3% this year, residential households consumption expenditure to increase 1.4%, while exports to climb 1.7% and imports to jump 2.3%.

-

16:10

Italy’ trade surplus widens to €5.36 billion in March

The Italian statistical office Istat released its trade data for Italy on Tuesday. Italy' trade surplus widened to €5.36 billion in March from €3.86 billion in February.

Exports fell 1.1% year-on-year in March, while imports decreased 5.9%.

On a monthly basis, exports declined a seasonally-adjusted 1.4% in March, while imports were down 2.4%.

The seasonally-adjusted trade surplus with the EU was €1.18 billion in March, while the trade surplus with non-EU countries was €3.50 billion.

-

15:55

U.S. weekly earnings rise 0.2% in April

The U.S. Labor Department released its real earnings data on Tuesday. Average weekly earnings rose 0.2% in April, after a 0.1% increase in March. March's figure was revised down from a 0.2% gain.

Average hourly earnings decreased 0.1% in April, after a 0.2% rise in March.

On a yearly basis, real average weekly earnings increased 1.3% in April, while hourly earnings rose 1.3%.

-

15:55

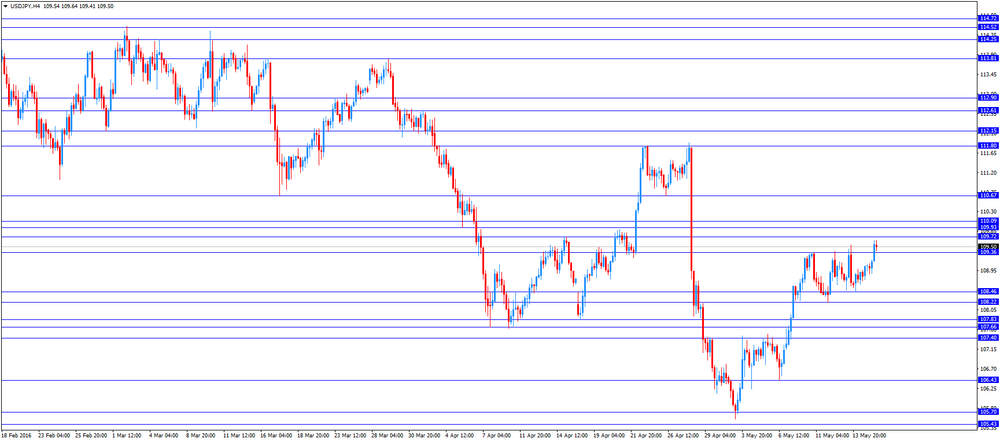

Option expiries for today's 10:00 ET NY cut

USDJPY 107.50 (USD 243m) 108.70-75 (343m) 109.30 (USD 576m) 110.00 (607m) 110.50 (600m)

EURUSD: 1.1275-80 (EUR 640m) 1.1295-1.1300 (290m) 1.1450 (1.19bln) 1.1500 (779m)

USDCHF 0.9630 (USD 200m)

USDCAD 1.2500 (USD 800m) 1.2695-1.2700 (563m) 1.2840 (370m) 1.2880 (630m) 1.2990 (410m) 1.3195-1.3200 (600m)

-

15:37

U.S. industrial production rises 0.7% in April

The Federal Reserve released its industrial production report on Tuesday. The U.S. industrial production rose 0.7% in April, exceeding expectations for a 0.3% increase, after a 0.9% drop in March. March's figure was revised down from a 0.6% decrease.

The increase was mainly driven by a rise in utilities. Mining output fell 2.3% in April, while utilities production climbed 5.8%.

Manufacturing output was up 0.3% in April, after a 0.3% increase in March.

Capacity utilisation rate increased to 75.4% in April from 74.9% in March, beating expectations for a rise to 75.0%. March's figure was revised up from 74.8%.

-

15:15

U.S.: Industrial Production (MoM), April 0.7% (forecast 0.3%)

-

15:15

U.S.: Capacity Utilization, April 75.4% (forecast 75%)

-

15:15

U.S.: Industrial Production YoY , April -1.1%

-

15:01

U.S. consumer price inflation rises 0.4% in April

The U.S. Labor Department released consumer price inflation data on Tuesday. The U.S. consumer price inflation rose 0.4% in April, exceeding expectations for a 0.3% gain, after a 0.1% increase in March.

The index was mainly driven by higher energy prices, which climbed 3.4% in April.

Shelter costs climbed 0.3% in April, medical care costs were up 0.3%, while food prices increased 0.2%.

On a yearly basis, the U.S. consumer price index increased to 1.1% in April from 0.9% in March, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.2% in April, in line with expectations, after a 0.1% increase in March.

The increase was mainly driven by rises in shelter, medical care, motor vehicle insurance, airline fares, recreation, and education costs.

On a yearly basis, the U.S. consumer price index excluding food and energy fall to 2.1% in April from 2.2% in March, in line with forecasts.

The consumer price index is not preferred Fed's inflation measure.

-

14:52

Housing starts in the U.S. climb 6.6% in April

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. climbed 6.6% to 1.172 million annualized rate in April from a 1.099 million pace in March, exceeding expectations for an increase to 1.130 million. March's figure was revised up from 1.089 million units.

The increase was driven by rises in starts of single-family and multi-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. rose 3.6% to 1.116 million annualized rate in April from a 1.077 million pace in March, missing expectations for a 1,140 million pace. March's figure was revised up from 1.076 million units.

Starts of single-family homes rose 3.3% in April. Building permits for single-family homes were up 1.5%.

Starts of multi-family buildings jumped 13.9% in April. Permits for multi-family housing climbed 8.0%.

-

14:40

Canadian manufacturing shipments drop 0.9% in March

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments declined 0.9% in March, beating expectations for a 1.8% decrease, after a 4.0% drop in February. February's figure was revised down from a 3.3% fall.

The decrease was mainly driven by lower sales of transportation equipment and primary metals. Transportation equipment sales plunged 3.4% in March, while sales of petroleum and coal products dropped 5.6%.

Inventories decreased 0.4% in March, driven by drops in aerospace product and parts, primary metals, and wood product industries inventories.

-

14:31

U.S.: Building Permits, April 1116 (forecast 1140)

-

14:31

U.S.: CPI, m/m , April 0.4% (forecast 0.3%)

-

14:31

U.S.: CPI excluding food and energy, Y/Y, April 2.1% (forecast 2.1%)

-

14:30

Canada: Manufacturing Shipments (MoM), March -0.9% (forecast -1.8%)

-

14:30

U.S.: CPI, Y/Y, April 1.1% (forecast 1.1%)

-

14:30

U.S.: CPI excluding food and energy, m/m, April 0.2% (forecast 0.2%)

-

14:30

U.S.: Housing Starts, April 1172 (forecast 1130)

-

14:19

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar on the weak consumer price inflation data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) April 2.2% -0.5% -2.5%

01:30 Australia New Motor Vehicle Sales (YoY) April 4.2% 2.4%

01:30 Australia RBA Meeting's Minutes

04:30 Japan Industrial Production (MoM) (Finally) March -5.2% 3.6% 3.8%

04:30 Japan Industrial Production (YoY) (Finally) March -1.2% 0.1% 0.2%

07:15 Switzerland Producer & Import Prices, m/m April 0% 0.1% 0.3%

07:15 Switzerland Producer & Import Prices, y/y April -4.7% -2.4%

08:30 United Kingdom Producer Price Index - Output (MoM) April 0.3% 0.2% 0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) April -0.9% -0.8% -0.7%

08:30 United Kingdom Producer Price Index - Input (MoM) April 2.2% Revised From 2.0% 1.1% 0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) April -6.5% -6.7% -6.5%

08:30 United Kingdom Retail Price Index, m/m April 0.4% 0.3% 0.1%

08:30 United Kingdom Retail prices, Y/Y April 1.6% 1.5% 1.3%

08:30 United Kingdom HICP, m/m April 0.4% 0.3% 0.1%

08:30 United Kingdom HICP, Y/Y April 0.5% 0.5% 0.3%

08:30 United Kingdom HICP ex EFAT, Y/Y April 1.5% 1.4% 1.2%

09:00 Eurozone Trade balance unadjusted March 19.3 Revised From 19 22.5 28.6

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data from the U.S. The U.S. consumer price inflation is expected to rise to 1.1% year-on-year in April from 0.9% in March.

The U.S. consumer price index excluding food and energy is expected to decline to 2.1% year-on-year in April from 2.2% in March.

Housing starts in the U.S. are expected to rise to 1.130 million units in April from 1.089 million units in March.

The number of building permits is expected to increase to 1.140 million units in April from 1.076 million units in March.

The U.S. industrial production is expected to climb to 0.3% in April, after a 0.6% fall in March.

The euro traded lower against the U.S. dollar despite the positive trade data from the Eurozone. Eurostat released its trade data for the Eurozone on Tuesday. Eurozone's unadjusted trade surplus climbed to €28.6 billion from €19.0 billion in February. Exports fell at an unadjusted annual rate of 3.0% in March, while imports dropped 8.0%.

The British pound traded lower against the U.S. dollar on the weak consumer price inflation data from the U.K. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.3% year-on-year in April from 0.5% in March. Analysts had expected to remain unchanged at 0.5%.

The decrease was mainly driven by declines in air fares and prices for clothing, vehicles and social housing rent.

On a monthly basis, U.K. consumer prices increased 0.1% in April, missing expectations for a 0.3% gain, after a 0.4% rise in March.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 1.2% year-on-year in April from 1.5% in March, missing expectations for a decrease to 1.4%.

The U.K. house price index increased at a seasonally adjusted rate of 2.5% in March, after a 0.2% gain in February.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 9.0% in March, after a 7.6% rise in February. It was the biggest rise since March 2015.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the manufacturing shipments data from Canada. Canadian manufacturing shipments are expected to drop 1.8% in March, after a 3.3% fall in February.

The Swiss franc traded lower against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.3% in April, beating expectations for a 0.1% gain, after a flat reading in March. The rise was driven by higher prices for petroleum products.

On a yearly basis, producer and import prices plunged 2.4% in April, after a 4.7% drop in March.

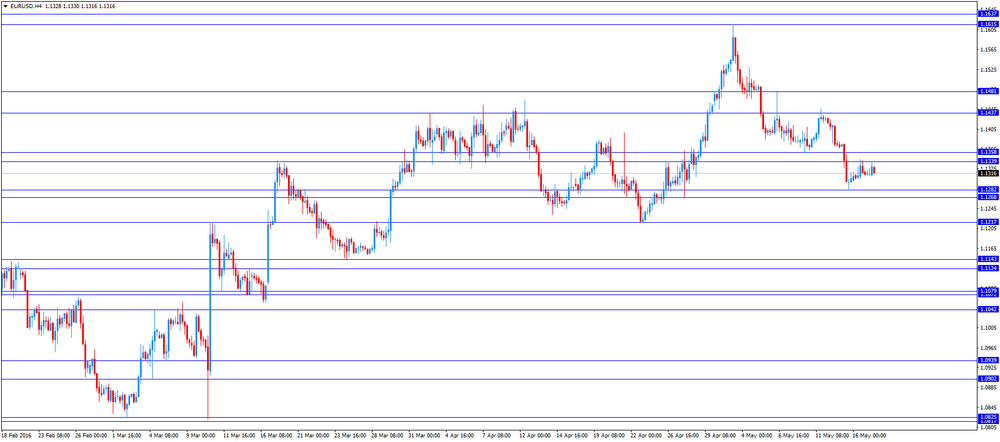

EUR/USD: the currency pair fell to $1.1316

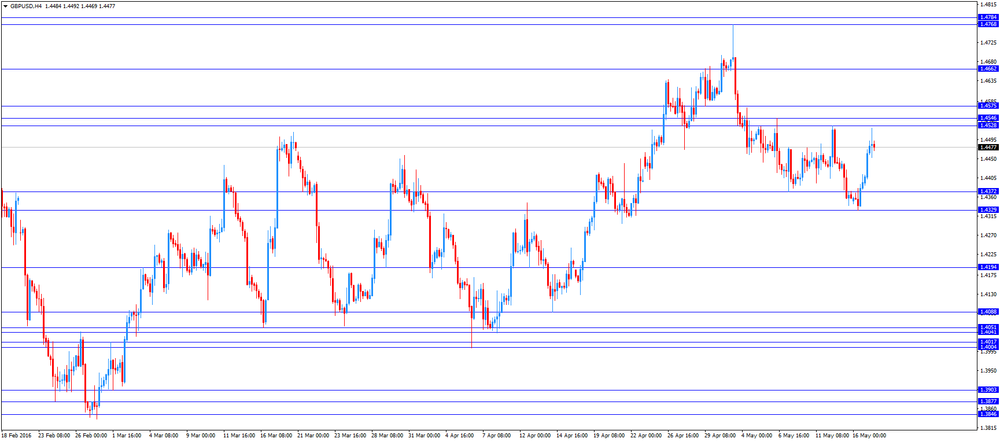

GBP/USD: the currency pair declined to $1.4453

USD/JPY: the currency pair climbed to Y109.64

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) March -3.3% -1.8%

12:30 U.S. Housing Starts April 1089 1130

12:30 U.S. Building Permits April 1076 1140

12:30 U.S. CPI, m/m April 0.1% 0.3%

12:30 U.S. CPI excluding food and energy, Y/Y April 2.2% 2.1%

12:30 U.S. CPI, Y/Y April 0.9% 1.1%

12:30 U.S. CPI excluding food and energy, m/m April 0.1% 0.2%

13:15 U.S. Capacity Utilization April 74.8% 75%

13:15 U.S. Industrial Production (MoM) April -0.6% 0.3%

13:15 U.S. Industrial Production YoY April -2%

22:45 New Zealand PPI Input (QoQ) Quarter I -1.2%

22:45 New Zealand PPI Output (QoQ) Quarter I -0.8%

23:50 Japan GDP, q/q (Preliminary) Quarter I -0.3% 0.1%

23:50 Japan GDP, y/y (Preliminary) Quarter I -1.1% 0.2%

-

14:01

Orders

EUR/USD

Offers 1.1355-60 1.1380 1.1400 1.14301.1450-60 1.1475-80 1.1500

Bids 1.1300 1.1280-85 1.1270 1.1250 1.1230 1.1200 1.1185 1.1165 1.1150

GBP/USD

Offers 1.4530 1.4550 1.4570 1.4585 1.4600 1.4630 1.4650 1.4680 1.4700

Bids 1.4475-80 1.4450 1.4420.25 1.4400 1.4385 1.4350 1.4330 1.4300-10

EUR/GBP

Offers 0.7820 0.7835 0.7850 0.7880 0.7900 0.7920 0.7930 0.7950

Bids 0.7800 0.7780 0.7760 0.7735 0.7700

EUR/JPY

Offers 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50 126.00

Bids 123.50 123.30 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers 109.50109.80110.00 110.30 110.50

Bids 109.00 108.80 108.50 108.30 108.20 108.00 107.85 107.60

AUD/USD

Offers 0.7365-70 0.7385 0.7400 0.7420-25 0.7450

Bids 0.7330 0.7300 0.7280 0.7270 0.7250 0.7200

-

11:46

Switzerland's producer and import prices rise in April

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.3% in April, beating expectations for a 0.1% gain, after a flat reading in March.

The rise was driven by higher prices for petroleum products.

The Import Price Index increased 0.4% in April, while producer prices rose 0.2%.

On a yearly basis, producer and import prices plunged 2.4% in April, after a 4.7% drop in March.

The Import Price Index fell by 4.1% year-on year in April, while producer prices dropped 1.7%.

-

11:37

UK house price inflation increases 2.5% in March

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index increased at a seasonally adjusted rate of 2.5% in March, after a 0.2% gain in February.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 9.0% in March, after a 7.6% rise in February. It was the biggest rise since March 2015.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £292,000 in March, up from £284,000 in February.

-

11:29

UK consumer price inflation declines to 0.3% year-on-year in April

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index fell to 0.3% year-on-year in April from 0.5% in March. Analysts had expected to remain unchanged at 0.5%.

The decrease was mainly driven by declines in air fares and prices for clothing, vehicles and social housing rent.

On a monthly basis, U.K. consumer prices increased 0.1% in April, missing expectations for a 0.3% gain, after a 0.4% rise in March.

Consumer price inflation excluding food, energy, alcohol and tobacco prices declined to 1.2% year-on-year in April from 1.5% in March, missing expectations for a decrease to 1.4%.

The Retail Prices Index decreased to 1.4% year-on-year in April from 1.6% in March, missing expectations for a fall to 1.5%.

The consumer price inflation is below the Bank of England's 2% target.

-

11:22

Eurozone's unadjusted trade surplus climbs €28.6 billion in March

Eurostat released its trade data for the Eurozone on Tuesday. Eurozone's unadjusted trade surplus climbed to €28.6 billion from €19.0 billion in February.

Exports fell at an unadjusted annual rate of 3.0% in March, while imports dropped 8.0%.

-

11:16

Fitch Ratings: Britain’s exit from the European Union will have a negative impact on ratings of the EU countries

Rating agency Fitch Ratings said on Monday that Britain's exit from the European Union (EU) would have a negative impact on ratings of the EU countries.

"An exit from the EU by the UK ('Brexit') would weigh on the economies of other EU countries and increase political risks in Europe," the agency said.

"Negative actions would become more likely in the medium term if the economic impact were severe or significant political risks materialised," Fitch added.

The agency noted that the economic impact would be lower for the EU than for the U.K.

Fitch also said that there could be risks that Scotland could leave the U.K. or Catalonia could leave Spain.

-

11:09

Richmond Fed President Jeffrey Lacker: an interest rate hike in June will be appropriate

Richmond Fed President Jeffrey Lacker said in an interview with the Washington Post on Monday that an interest rate hike in June would be appropriate as inflation was moving toward the Fed' 2% target, the labour market continued to strengthen and downside risks dissipated.

"To me that adds up to a pretty strong case for a June move," he said.

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

11:00

Eurozone: Trade balance unadjusted, March 28.6 (forecast 22.5)

-

10:51

ICM telephone poll: 47% of Britons support Britain’s membership in the European Union

According to ICM telephone poll published on Monday, 47% of Britons supported Britain's membership in the European Union (EU), 39% of Britons would vote for the exit from the EU, while 14% of Britons were undecided.

The poll was conducted on May 13-15 and surveyed 1,002 people.

-

10:45

NAHB housing market index remains unchanged at 58 in May

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index remained unchanged at 58 in May, missing expectations for an increase to 59.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index remained unchanged at 44 in May, the current sales conditions sub-index remained unchanged at 63, while the sub-index measuring sales expectations in the next six months increased to 65 from 62.

"Builder confidence has held steady at 58 for four straight months, which indicates that the single-family housing sector remains in positive territory," the NAHB Chairman Ed Brady.

"The fact that future sales expectations rose slightly this month shows that builders are confident that the market will continue to strengthen. Job creation, low mortgage interest rates and pent-up demand will also spur growth in the single-family housing sector moving forward," the NAHB Chief Economist Robert Dietz said.

-

10:31

United Kingdom: Producer Price Index - Output (MoM), April 0.4% (forecast 0.2%)

-

10:31

United Kingdom: Retail prices, Y/Y, April 1.4% (forecast 1.5%)

-

10:31

United Kingdom: Retail Price Index, m/m, April 0.1% (forecast 0.3%)

-

10:31

United Kingdom: Producer Price Index - Input (YoY) , April -6.5% (forecast -6.7%)

-

10:31

United Kingdom: Producer Price Index - Input (MoM), April 0.9% (forecast 1.1%)

-

10:30

United Kingdom: HICP, Y/Y, April 0.3% (forecast 0.5%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , April -0.7% (forecast -0.8%)

-

10:30

United Kingdom: HICP, m/m, April 0.1% (forecast 0.3%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, April 1.2% (forecast 1.4%)

-

10:15

May’s Reserve Bank of Australia monetary policy meeting: the outlook for economic activity or the unemployment rate does not changed

The Reserve Bank of Australia (RBA) released its minutes from May monetary policy meeting on Tuesday. The central bank noted that the economic activity and employment were little changed, while the exchange rate depreciation was supporting the economic growth.

The RBA also said that the economic growth was a bit stronger than expected over 2015.

Members noted that the outlook for economic activity or the unemployment rate did not changed, while the inflation forecast was downgraded.

The central bank said that next interest rate decision will depend on the incoming economic data.

The RBA lowered its interest rate to 1.75% from 2.00% in May.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 107.50 (USD 243m) 108.70-75 (343m) 109.30 (USD 576m) 110.00 (607m) 110.50 (600m)

EUR/USD: 1.1275-80 (EUR 640m) 1.1295-1.1300 (290m) 1.1450 (1.19bln) 1.1500 (779m)

USD/CHF 0.9630 (USD 200m)

USD/CAD 1.2500 (USD 800m) 1.2695-1.2700 (563m) 1.2840 (370m) 1.2880 (630m) 1.2990 (410m) 1.3195-1.3200 (600m)

-

09:15

Switzerland: Producer & Import Prices, y/y, April -2.4%

-

09:15

Switzerland: Producer & Import Prices, m/m, April 0.3% (forecast 0.1%)

-

08:27

Options levels on tuesday, May 17, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1487 (4406)

$1.1423 (2882)

$1.1380 (1218)

Price at time of writing this review: $1.1313

Support levels (open interest**, contracts):

$1.1275 (3782)

$1.1228 (5670)

$1.1162 (9163)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68437 contracts, with the maximum number of contracts with strike price $1,1600 (5171);

- Overall open interest on the PUT options with the expiration date June, 3 is 88494 contracts, with the maximum number of contracts with strike price $1,1200 (9163);

- The ratio of PUT/CALL was 1.29 versus 1.31 from the previous trading day according to data from May, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.4703 (1928)

$1.4605 (2365)

$1.4508 (2406)

Price at time of writing this review: $1.4477

Support levels (open interest**, contracts):

$1.4386 (1409)

$1.4291 (2351)

$1.4194 (2896)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 30849 contracts, with the maximum number of contracts with strike price $1,4500 (2406);

- Overall open interest on the PUT options with the expiration date June, 3 is 32709 contracts, with the maximum number of contracts with strike price $1,4200 (2896);

- The ratio of PUT/CALL was 1.06 versus 1.07 from the previous trading day according to data from May, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:46

Japan: Industrial Production (MoM) , March 3.8% (forecast 3.6%)

-

06:46

Japan: Industrial Production (YoY), March 0.2% (forecast 0.1%)

-

03:32

Australia: New Motor Vehicle Sales (YoY) , April 2.4%

-

03:31

Australia: New Motor Vehicle Sales (MoM) , April -2.5% (forecast -0.5%)

-

00:30

Currencies. Daily history for May 16’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1314 +0,07%

GBP/USD $1,4408 +0,35%

USD/CHF Chf0,9774 +0,21%

USD/JPY Y109,06 +0,40%

EUR/JPY Y123,39 +0,45%

GBP/JPY Y157,13 +0,75%

AUD/USD $0,7289 +0,30%

NZD/USD $0,6782 +0,24%

USD/CAD C$1,2893 -0,34%

-

00:01

Schedule for today, Tuesday, May 17’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia New Motor Vehicle Sales (MoM) April 2.2%

01:30 Australia New Motor Vehicle Sales (YoY) April 4.2%

01:30 Australia RBA Meeting's Minutes

04:30 Japan Industrial Production (MoM) (Finally) March -5.2% 3.6%

04:30 Japan Industrial Production (YoY) (Finally) March -1.2% 0.1%

07:15 Switzerland Producer & Import Prices, m/m April 0%

07:15 Switzerland Producer & Import Prices, y/y April -4.7%

08:30 United Kingdom Producer Price Index - Output (MoM) April 0.3% 0.3%

08:30 United Kingdom Producer Price Index - Output (YoY) April -0.9% -0.8%

08:30 United Kingdom Producer Price Index - Input (MoM) April 2.0% 1.1%

08:30 United Kingdom Producer Price Index - Input (YoY) April -6.5%

08:30 United Kingdom Retail Price Index, m/m April 0.4%

08:30 United Kingdom Retail prices, Y/Y April 1.6% 1.5%

08:30 United Kingdom HICP, m/m April 0.4% 0.3%

08:30 United Kingdom HICP, Y/Y April 0.5% 0.5%

08:30 United Kingdom HICP ex EFAT, Y/Y April 1.5% 1.4%

09:00 Eurozone Trade balance unadjusted March 19 22.5

10:00 Germany Bundesbank Monthly Report

12:30 Canada Manufacturing Shipments (MoM) March -3.3% -1.3%

12:30 U.S. Housing Starts April 1089 1130

12:30 U.S. Building Permits April 1076 1140

12:30 U.S. CPI, m/m April 0.1% 0.3%

12:30 U.S. CPI excluding food and energy, Y/Y April 2.2% 2.1%

12:30 U.S. CPI, Y/Y April 0.9% 1.1%

12:30 U.S. CPI excluding food and energy, m/m April 0.1% 0.2%

13:15 U.S. Capacity Utilization April 74.8% 75%

13:15 U.S. Industrial Production (MoM) April -0.6% 0.3%

13:15 U.S. Industrial Production YoY April -2%

22:45 New Zealand PPI Input (QoQ) Quarter I -1.2%

22:45 New Zealand PPI Output (QoQ) Quarter I -0.8%

23:50 Japan GDP, q/q (Preliminary) Quarter I -0.3% 0.1%

23:50 Japan GDP, y/y (Preliminary) Quarter I -1.1% 0.2%

-