Noticias del mercado

-

23:59

Schedule for today, Thursday, May 19’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Unemployment rate April 5.7% 5.8%

01:30 Australia Changing the number of employed April 26.1 12.5

04:30 Japan All Industry Activity Index, m/m March -1.2% 0.7%

08:30 United Kingdom Retail Sales (YoY) April 2.7% 2.5%

08:30 United Kingdom Retail Sales (MoM) April -1.3% 0.5%

09:00 Eurozone Construction Output, y/y March 2.5%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Wholesale Sales, m/m March -2.2% -0.5%

12:30 U.S. Continuing Jobless Claims May 2161 2163

12:30 U.S. Chicago Federal National Activity Index April -0.44

12:30 U.S. Philadelphia Fed Manufacturing Survey May -1.6 3.5

12:30 U.S. Initial Jobless Claims May 294 275

14:00 U.S. Leading Indicators April 0.2% 0.4%

14:30 U.S. FOMC Member Dudley Speak

22:45 New Zealand Visitor Arrivals April 18%

-

18:24

U.K. household finance index declines to 42.3 in May

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index decreased to 42.3 in May from 45.1 in April, reaching 22-month low.

The index measuring the outlook for financial well-being over the coming twelve months increased to 49.6 in May from 49.5 in April.

The current inflation perceptions index climbed to 68.0 in May from 66.9% in April. It was the highest level since December 2014.

The index measuring expected living costs over the twelve months was up to 82.9 in May.

46% of respondents expects the Bank of England's monetary policy to tighten next over next 12 months.

"In a period of heightened uncertainty ahead of the EU referendum, Markit's HFI survey pointed to a marked financial squeeze in May, but households' expectations for the year-ahead were little-changed since April," economist at Markit, Philip Leake, said.

-

17:21

European Central Bank Governing Council member Vitas Vasiliauskas: the central bank should wait at least until autumn before considering new stimulus measures

The European Central Bank (ECB) Governing Council member Vitas Vasiliauskas said in an interview with The Wall Street Journal on Wednesday that the central bank should wait at least until autumn before considering new stimulus measures.

"If there will be no need, we will do nothing," he said.

Vasiliauskas noted that inflation in the Eurozone was lower than expected, but added that inflation would be in positive territory by the end of the year.

-

16:35

Number of employed persons in Germany climbs by 1.3% in the first quarter

Destatis released its number of persons in employment in Germany on Wednesday. The number of employed persons climbed by 1.3% in the first quarter from the corresponding period last year, after a 1.0% rise in the fourth quarter.

The increase was driven by the growth in the service sector.

-

16:30

U.S.: Crude Oil Inventories, May 1.31 (forecast -3.16)

-

16:22

Home prices in China rise in April

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 6.2% in April, after a 4.9% gain in March. It was the fastest annual rise since April 2014.

The main contributor was Shenzhen, where home prices jumped by 62.4% year-on-year in April.

On a monthly base, house prices increased in 65 of 70 cities, while prices slid in 5 cities, according to the NBS.

The monthly rise was mainly driven by higher prices in Hefei, which climbed 5.8% in April.

-

15:55

U.K. leading economic index is flat in March

The Conference Board (CB) released its leading economic index for the U.K. on Wednesday. The leading economic index (LEI) was flat in March, after a 0.1% rise in February. February's figure was revised down from a 0.2% gain.

The coincident index was flat in March, after a flat reading in February.

-

15:49

Option expiries for today's 10:00 ET NY cut

USDJPY 109.00 (USD 241m) 109.25 (230m) 109.50 (550m) 110.00 (220m)

EURUSD: 1.1320 (1.36bln) 1.1330 (451m) 1.1425 (288m) 1.1450 (220m) 1.1475 (218m)

USDCHF 0.9795 (USD 264m)

AUDUSD 0.7300 (USD 944m) 0.7495-00 (385m)

USDCAD 1.2800 (USD 1.01bln) 1.2875 (234m) 1.2900 (675m) 1.3000 (870m)

NZDUSD 0.6790 (NZD 301m)

-

15:20

Foreign investors purchase C$17.17 billion of Canadian securities in March

Statistics Canada released foreign investment figures on Wednesday. Foreign investors purchased C$17.17 billion of Canadian securities in March, after an investment of C$15.94 billion in February.

The investment was led by securities issued by Canadian private corporations.

Canadian investors added C$2.3 billion of foreign securities in March, mainly US corporate securities.

-

15:01

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the mixed labour data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia RBA Assist Gov Debelle Speaks

01:30 Australia Wage Price Index, q/q Quarter I 0.5% 0.5% 0.4%

01:30 Australia Wage Price Index, y/y Quarter I 2.2% 2.2% 2.1%

08:30 United Kingdom Average Earnings, 3m/y March 1.9% Revised From 1.8% 1.7% 2.0%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y March 2.2% 2.3% 2.1%

08:30 United Kingdom ILO Unemployment Rate March 5.1% 5.1% 5.1%

08:30 United Kingdom Claimant count April 14.7 Revised From 6.7 4.3 -2.4

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) April 1% 0.7% 0.7%

09:00 Eurozone Harmonized CPI April 1.2% 0.0% 0%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April 0.0% -0.2% -0.2%

11:00 U.S. MBA Mortgage Applications May 0.4% -1.6%

12:30 Canada Foreign Securities Purchases March 15.94 17.17

The U.S. dollar traded mixed against the most major currencies ahead of the release of the latest Fed's minutes. Market participants will closely analyse the minutes for hints for further interest rate hikes. The minutes will be released at 18:00 GMT.

The euro traded mixed against the U.S. dollar after the release of the final consumer price inflation data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index was flat in April, in line with expectations, after a 1.2% increase in March.

On a yearly basis, Eurozone's final consumer price inflation decreased to -0.2% in April from 0.0% in March, in line with the preliminary reading.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in April from 1.0 in March, in line with the preliminary reading.

The British pound traded higher against the U.S. dollar on the mixed labour data from the U.K. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the January to March quarter, in line with expectations.

The claimant count fell by 2,400 people in April, beating expectations for a rise by 4,300, after an increase of 14,300 people in March. March's figure was revised up from a 6,700 increase.

Average weekly earnings, excluding bonuses, climbed by 2.1% in the January to March quarter, missing expectations for a 2.3% rise, after a 2.2% gain in the December to February quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the January to March quarter, exceeding expectations for a 1.7% gain, after a 1.9% increase in the December to February quarter. The previous quarter's figure was revised up from a 1.7% rise.

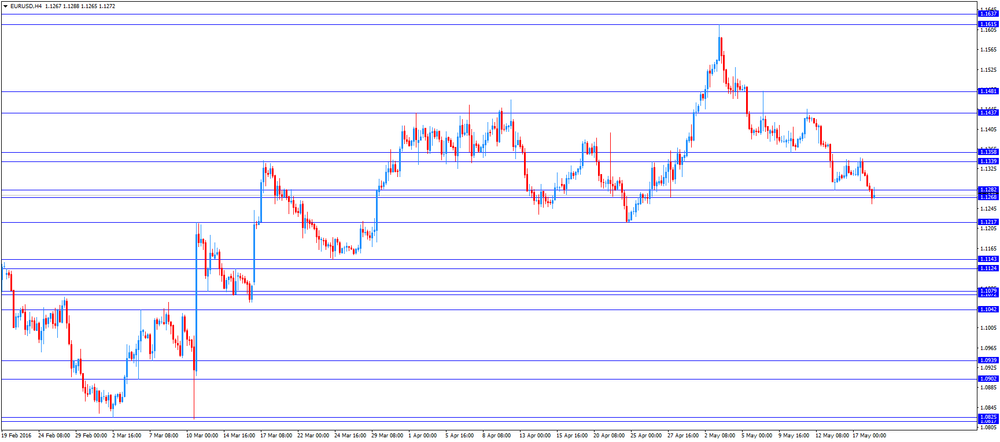

EUR/USD: the currency pair traded mixed

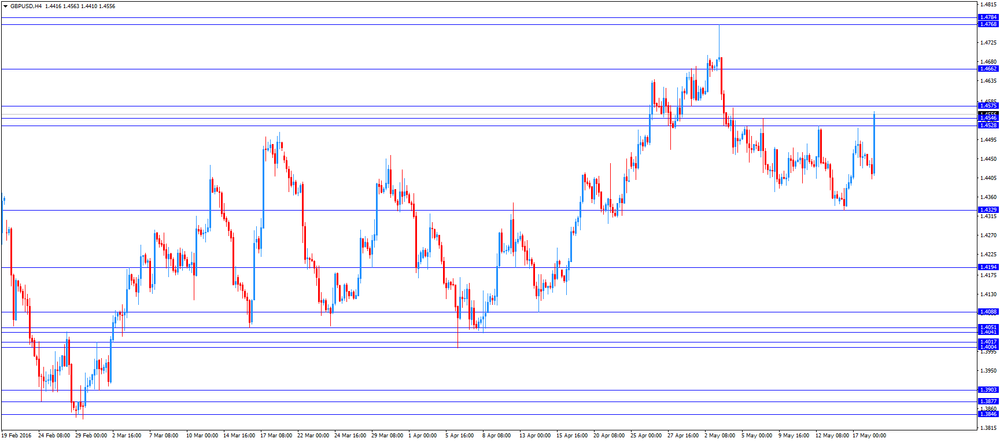

GBP/USD: the currency pair rose to $1.4563

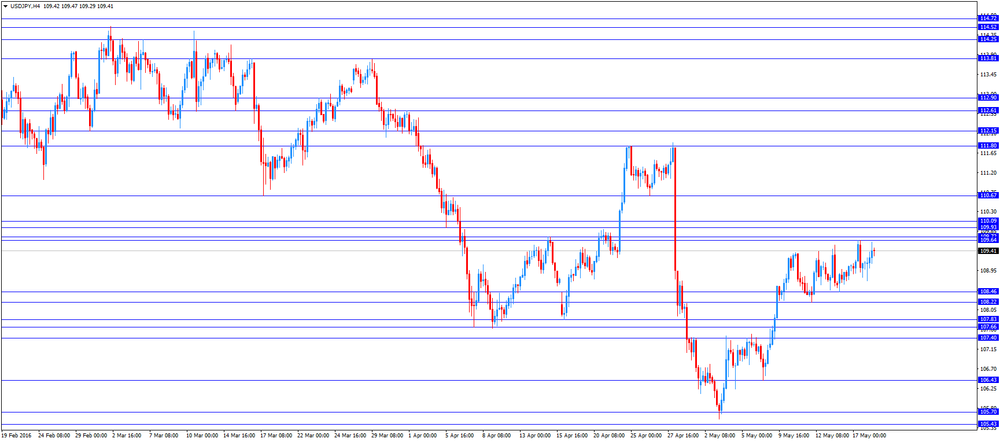

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories May -3.41 -3.16

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y April -0.7% 0.8%

23:50 Japan Core Machinery Orders March -9.2% 0.5%

-

14:52

Eurozone's harmonized consumer price index is flat in April

Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index was flat in April, in line with expectations, after a 1.2% increase in March.

On a yearly basis, Eurozone's final consumer price inflation decreased to -0.2% in April from 0.0% in March, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in April, rents increased by 0.08%, tobacco rose by 0.05%, fuel prices for transport declined by 0.54%, heating oil prices decreased by 0.22%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in April from 1.0 in March, in line with the preliminary reading.

-

14:46

U.K. unemployment rate remains unchanged at 5.1% in the January to March quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the January to March quarter, in line with expectations.

The claimant count fell by 2,400 people in April, beating expectations for a rise by 4,300, after an increase of 14,300 people in March. March's figure was revised up from a 6,700 increase.

U.K. unemployment in the January to March period was 1.69 million, little changed compared with October to December 2015.

The employment rate was 74.2% in the January to March quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.1% in the January to March quarter, missing expectations for a 2.3% rise, after a 2.2% gain in the December to February quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the January to March quarter, exceeding expectations for a 1.7% gain, after a 1.9% increase in the December to February quarter. The previous quarter's figure was revised up from a 1.7% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

14:37

Atlanta Fed President Dennis Lockhart: the Fed could raise its interest rate in June

Atlanta Fed President Dennis Lockhart said on Tuesday that the Fed could raise its interest rate in June.

"I wouldn't take it off the table," he said.

Lockhart noted that the Fed could hike its interest rate two or three times this year.

Atlanta Fed president also said that the referendum on Britain's membership in the European Union would not be a reason for the delay in raising interest rate.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:31

Dallas Fed President Robert Kaplan: the U.S. economy is strong enough for further interest rate hikes in the near future

Dallas Fed President Robert Kaplan said on Tuesday that the U.S. economy was strong enough for further interest rate hikes in the near future, adding he would support an interest rate hike at next monetary policy meetings.

"Whether that's June or July, I can't say right now," he said.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:30

Canada: Foreign Securities Purchases, March 17.17

-

13:49

Orders

EUR/USD

Offers 1.1285 1.1300 1.1325 1.1355-60 1.1380 1.1400 1.1430 1.1450-60

Bids 1.1250 1.1235 1.1220 1.1200 1.1185 1.1165 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4450 1.4470 1.4500 1.4530 1.4550 1.4570 1.4585 1.4600

Bids 1.4420-25 1.4400 1.4385 1.4350 1.4330 1.4300-10 1.4280 1.4250

EUR/GBP

Offers 0.7820 0.7830-35 0.7850 0.7880 0.7900 0.7920 0.7930 0.7950

Bids 0.7780 0.7760 0.7735 0.7700 0.7685 0.7670 0.7650

EUR/JPY

Offers 123.50 123.85 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50

Bids 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers 109.40-50 109.80 110.00 110.30 110.50

Bids 109.00 108.75-80 108.50 108.30 108.20 108.00 107.85 107.60

AUD/USD

Offers 0.7300 0.7325-30 0.7350 0.7365-70 0.7385 0.7400

Bids 0.7250-60 0.7235 0.7200 0.7180 0.7165 0.7150

-

13:01

U.S.: MBA Mortgage Applications, May 0.4%

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, April 0.7% (forecast 0.7%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, April -0.2% (forecast -0.2%)

-

11:00

Eurozone: Harmonized CPI, April 0% (forecast 0.0%)

-

10:31

United Kingdom: Claimant count , April -2.4 (forecast 4.3)

-

10:30

United Kingdom: Average Earnings, 3m/y , March 2.0% (forecast 1.7%)

-

10:30

United Kingdom: ILO Unemployment Rate, March 5.1% (forecast 5.1%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, March 2.1% (forecast 2.3%)

-

10:04

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00 (USD 241m) 109.25 (230m) 109.50 (550m) 110.00 (220m)

EUR/USD: 1.1320 (1.36bln) 1.1330 (451m) 1.1425 (288m) 1.1450 (220m) 1.1475 (218m)

USD/CHF 0.9795 (USD 264m)

AUD/USD 0.7300 (USD 944m) 0.7495-00 (385m)

USD/CAD 1.2800 (USD 1.01bln) 1.2875 (234m) 1.2900 (675m) 1.3000 (870m)

NZD/USD 0.6790 (NZD 301m)

-

09:17

European Central Bank Governing Council member Visco worries about the deflation in the Eurozone

The European Central Bank (ECB) Governing Council member Visco said in an interview with German newspaper Handelsblatt that he worried about the deflation in the Eurozone.

"I believe we still face a concrete deflation risk," he said.

-

09:00

San Francisco Fed President John Williams: the Fed could hike its interest rate two or three times this year

San Francisco Fed President John Williams said in an interview with The Wall Street Journal on Tuesday that the Fed could hike its interest rate two or three times this year.

San Francisco Fed president pointed out that he did not worry about the U.S. economic growth.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

08:50

Japan’s preliminary GDP rises 0.4% in the first quarter

Japan's Cabinet Office released its preliminary gross domestic product (GDP) data for Japan late Tuesday evening. Japan's GDP rose by 0.4% in the first quarter, beating expectations for a 0.1% gain, after a 0.4% drop in the fourth quarter. The fourth quarter's figure was revised down from a 0.3% fall.

The increase was driven by a rise in private consumption. Private consumption rose 0.5% in the first quarter, while capital expenditure slid 1.4%.

On a yearly basis, Japan's economy climbed 1.7% in the first quarter, beating forecasts of a 0.2% rise, after a 1.7% fall in the fourth quarter. The fourth quarter's figure was revised down from a 1.1% drop.

-

08:41

Wages in Australia rise 0.4% in the first quarter

The Australian Bureau of Statistics released its wage price data on Wednesday. Wages in Australia rose at a seasonally adjusted rate of 0.4% in the first quarter, missing forecasts of a 0.5% gain, after a 0.5% increase in the previous quarter.

Public wages rose 0.5% in the first quarter, while private wages increased 0.4%.

On a yearly basis, wages climbed 2.1% in the first quarter, missing expectations for a 2.2% increase, after a 2.2% gain in the fourth quarter. It was the weakest rise since 1998.

On a yearly basis, private wages were up 1.9% in the first quarter, while public wages jumped 2.5%.

-

08:32

Options levels on wednesday, May 18, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1450 (5065)

$1.1396 (2944)

$1.1351 (1074)

Price at time of writing this review: $1.1284

Support levels (open interest**, contracts):

$1.1230 (5572)

$1.1199 (3430)

$1.1164 (9453)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68112 contracts, with the maximum number of contracts with strike price $1,1400 (5065);

- Overall open interest on the PUT options with the expiration date June, 3 is 89197 contracts, with the maximum number of contracts with strike price $1,1200 (9453);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from May, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.4703 (1875)

$1.4606 (2481)

$1.4510 (2406)

Price at time of writing this review: $1.4430

Support levels (open interest**, contracts):

$1.4391 (1401)

$1.4294 (2610)

$1.4197 (2970)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 30993 contracts, with the maximum number of contracts with strike price $1,4600 (2481);

- Overall open interest on the PUT options with the expiration date June, 3 is 33239 contracts, with the maximum number of contracts with strike price $1,4200 (2970);

- The ratio of PUT/CALL was 1.07 versus 1.06 from the previous trading day according to data from May, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:24

New Zealand’s producer price inflation slides in the first quarter

Statistics New Zealand released its output and input producer price index (PPI) data on the late Tuesday evening. New Zealand's input PPI slid 1.0% in the first quarter, after a 1.2% fall in the fourth quarter.

"The petroleum and coal product manufacturing industry makes a broad range of fuel products, including petrol, diesel, and aviation fuel," business prices manager Sarah Williams said.

Output PPI fell 0.2% in the first quarter, after a 0.8% decline in the fourth quarter.

Prices received by petroleum and coal product manufacturers plunged 22% in the first quarter. Prices paid by petroleum and coal product manufacturers slid 18%.

-

08:19

Asian session: The yen gained

The yen gained against the dollar and the euro on Wednesday, after data showed Japan's economy expanded at the fastest pace in a year in the first quarter and some investors pared bets on further stimulus. Japan's economy expanded by an annualised 1.7 percent in January-March, easily beating the median market forecast for a 0.2 percent increase and rebounding from a 1.7 percent contraction in the previous quarter, the Cabinet Office data showed. Many analysts said Japan narrowly dodged recession, defined as two straight quarters of contraction, because of the boost from the extra day in a leap year. The Bank of Japan chose to hold policy steady at its last meeting, but many still believe it will muster additional easing steps as early as next month.

The Australian dollar slipped, giving back some of the previous session's rally on minutes of the Reserve Bank of Australia's (RBA) May policy meeting, which encouraged markets to pare back the chances of a cut in interest rates.

EUR/USD: during the Asian session the pair fell to $1.1280

GBP/USD: during the Asian session the pair fell to $1.4430

USD/JPY: during the Asian session the pair traded in the range of Y108.70-40

Based on Reuters materials

-

03:30

Australia: Wage Price Index, q/q, Quarter I 0.4% (forecast 0.5%)

-

03:30

Australia: Wage Price Index, y/y, Quarter I 2.1% (forecast 2.2%)

-

01:51

Japan: GDP, q/q, Quarter I 0.4% (forecast 0.1%)

-

01:50

Japan: GDP, y/y, Quarter I 1.7% (forecast 0.2%)

-

01:00

Currencies. Daily history for May 17’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1311 -0,03%

GBP/USD $1,4460 +0,36%

USD/CHF Chf0,9802 +0,29%

USD/JPY Y109,12 +0,05%

EUR/JPY Y123,43 +0,03%

GBP/JPY Y157,78 +0,41%

AUD/USD $0,7322 +0,45%

NZD/USD $0,6808 +0,38%

USD/CAD C$1,2905 +0,09%

-

00:46

New Zealand: PPI Output (QoQ) , Quarter I -0.2%

-

00:45

New Zealand: PPI Input (QoQ), Quarter I -1%

-