Noticias del mercado

-

23:59

Schedule for today, Thursday, May 19’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Unemployment rate April 5.7% 5.8%

01:30 Australia Changing the number of employed April 26.1 12.5

04:30 Japan All Industry Activity Index, m/m March -1.2% 0.7%

08:30 United Kingdom Retail Sales (YoY) April 2.7% 2.5%

08:30 United Kingdom Retail Sales (MoM) April -1.3% 0.5%

09:00 Eurozone Construction Output, y/y March 2.5%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Wholesale Sales, m/m March -2.2% -0.5%

12:30 U.S. Continuing Jobless Claims May 2161 2163

12:30 U.S. Chicago Federal National Activity Index April -0.44

12:30 U.S. Philadelphia Fed Manufacturing Survey May -1.6 3.5

12:30 U.S. Initial Jobless Claims May 294 275

14:00 U.S. Leading Indicators April 0.2% 0.4%

14:30 U.S. FOMC Member Dudley Speak

22:45 New Zealand Visitor Arrivals April 18%

-

21:00

DJIA 17486.12 -43.86 -0.25%, NASDAQ 4726.21 10.47 0.22%, S&P 500 2043.50 -3.71 -0.18%

-

18:28

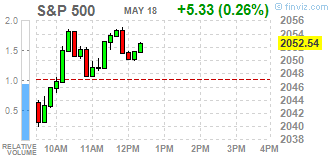

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes slightly higher on Wednesday as the prospect of higher interest rates sent financial stocks up, offsetting a fall in retail shares. The minutes from the Federal Reserve's April meeting could give clues on the path of rate hikes.

Dow stocks mixed (15 vs 15). Top looser - Wal-Mart Stores Inc. (WMT, -2,73). Top gainer - JPMorgan Chase & Co. (JPM, +3,12%).

S&P sectors also mixed. Top looser - Basic Materials (-0,5%). Top gainer - Conglomerates (+1,2%).

At the moment:

Dow 17508.00 +19.00 +0.11%

S&P 500 2047.75 +4.25 +0.21%

Nasdaq 100 4338.75 +19.25 +0.45%

Oil 49.38 +0.39 +0.80%

Gold 1273.90 -3.00 -0.23%

U.S. 10yr 1.82 +0.06

-

18:24

U.K. household finance index declines to 42.3 in May

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index decreased to 42.3 in May from 45.1 in April, reaching 22-month low.

The index measuring the outlook for financial well-being over the coming twelve months increased to 49.6 in May from 49.5 in April.

The current inflation perceptions index climbed to 68.0 in May from 66.9% in April. It was the highest level since December 2014.

The index measuring expected living costs over the twelve months was up to 82.9 in May.

46% of respondents expects the Bank of England's monetary policy to tighten next over next 12 months.

"In a period of heightened uncertainty ahead of the EU referendum, Markit's HFI survey pointed to a marked financial squeeze in May, but households' expectations for the year-ahead were little-changed since April," economist at Markit, Philip Leake, said.

-

18:00

European stocks close: stocks traded mixed ahead of the latest Fed’s minutes

Stock closed mixed ahead of the release of the latest Fed's minutes later in the day. Market participants will closely analyse the minutes for hints for further interest rate hikes.

Market participants eyed the trade data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index was flat in April, in line with expectations, after a 1.2% increase in March.

On a yearly basis, Eurozone's final consumer price inflation decreased to -0.2% in April from 0.0% in March, in line with the preliminary reading.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in April from 1.0 in March, in line with the preliminary reading.

The European Central Bank (ECB) Governing Council member Vitas Vasiliauskas said in an interview with The Wall Street Journal on Wednesday that the central bank should wait at least until autumn before considering new stimulus measures.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the January to March quarter, in line with expectations.

The claimant count fell by 2,400 people in April, beating expectations for a rise by 4,300, after an increase of 14,300 people in March. March's figure was revised up from a 6,700 increase.

Average weekly earnings, excluding bonuses, climbed by 2.1% in the January to March quarter, missing expectations for a 2.3% rise, after a 2.2% gain in the December to February quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the January to March quarter, exceeding expectations for a 1.7% gain, after a 1.9% increase in the December to February quarter. The previous quarter's figure was revised up from a 1.7% rise.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,165.8 -1.97 -0.03 %

DAX 9,943.23 +53.04 +0.54 %

CAC 40 4,319.3 +21.73 +0.51 %

-

18:00

European stocks closed: FTSE 6165.80 -1.97 -0.03%, DAX 9943.23 53.04 0.54%, CAC 40 4319.30 21.73 0.51%

-

17:45

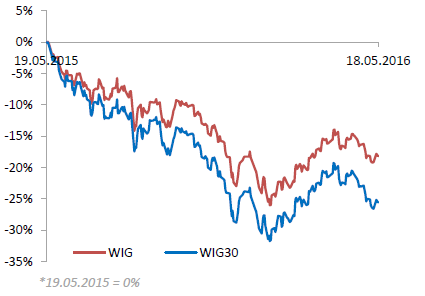

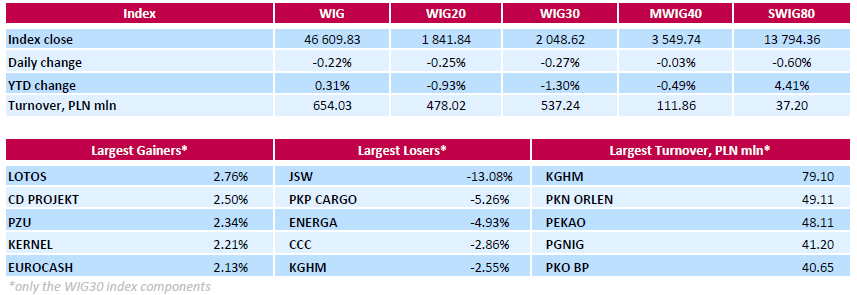

WSE: Session Results

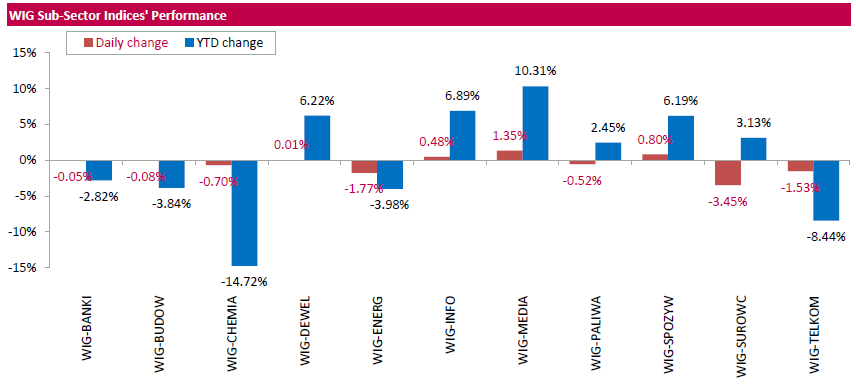

Polish equities closed lower on Wednesday. The broad market benchmark, the WIG Index, lost 0.22%. Sector-wise, materials (-3.45%) recorded the biggest losses, while media sector (+1.35%) outpaced.

The large-cap stocks plunged by 0.27%, as measured by the WIG30 Index. Within the index components, coking coal producer JSW (WSE: JSW) suffered the steepest decline, tumbling by 13.08%, after Poland's energy minister Krzysztof Tchorzewski stated the company might need to run a rights issue to secure enough capital to survive. According to Mr. Tchorzewski, JSW has larger needs than PLN 1 bln ($257 mln) flagged earlier. Other major decliners were railway freight transport operator PKP CARGO (WSE: PKP) and genco ENERGA (WSE: ENG), dropping by 5.26% and 4.93% respectively. On the other side of the ledger, oil refiner LOTOS (WSE: LTS), videogame developer CD PROJEKT (WSE: CDR) and insurer PZU (WSE; PZU) were the best-performing names, advancing by 2.76%, 2.5% and 2.34% respectively.

-

17:21

European Central Bank Governing Council member Vitas Vasiliauskas: the central bank should wait at least until autumn before considering new stimulus measures

The European Central Bank (ECB) Governing Council member Vitas Vasiliauskas said in an interview with The Wall Street Journal on Wednesday that the central bank should wait at least until autumn before considering new stimulus measures.

"If there will be no need, we will do nothing," he said.

Vasiliauskas noted that inflation in the Eurozone was lower than expected, but added that inflation would be in positive territory by the end of the year.

-

16:52

U.S. crude inventories rise by 1.3 million barrels to 541.3 million in the week to May 13

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories rose by 1.3 million barrels to 541.3 million in the week to May 13.

Analysts had expected U.S. crude oil inventories to decline by 3.16 million barrels.

Gasoline inventories decreased by 2.5 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 461,000 barrels.

U.S. crude oil imports increased by 22,000 barrels per day.

Refineries in the U.S. were running at 90.5% of capacity, up from 89.1% the previous week.

Oil production fell by 0.1% last week to 8.791 million barrels a day from 8.802 million barrels a day in the previous week.

-

16:35

Number of employed persons in Germany climbs by 1.3% in the first quarter

Destatis released its number of persons in employment in Germany on Wednesday. The number of employed persons climbed by 1.3% in the first quarter from the corresponding period last year, after a 1.0% rise in the fourth quarter.

The increase was driven by the growth in the service sector.

-

16:30

U.S.: Crude Oil Inventories, May 1.31 (forecast -3.16)

-

16:22

Home prices in China rise in April

According to Reuters calculations based on data from China's National Bureau of Statistics (NBS), average new home prices in 70 major cities climbed at an annual rate of 6.2% in April, after a 4.9% gain in March. It was the fastest annual rise since April 2014.

The main contributor was Shenzhen, where home prices jumped by 62.4% year-on-year in April.

On a monthly base, house prices increased in 65 of 70 cities, while prices slid in 5 cities, according to the NBS.

The monthly rise was mainly driven by higher prices in Hefei, which climbed 5.8% in April.

-

15:55

U.K. leading economic index is flat in March

The Conference Board (CB) released its leading economic index for the U.K. on Wednesday. The leading economic index (LEI) was flat in March, after a 0.1% rise in February. February's figure was revised down from a 0.2% gain.

The coincident index was flat in March, after a flat reading in February.

-

15:49

Option expiries for today's 10:00 ET NY cut

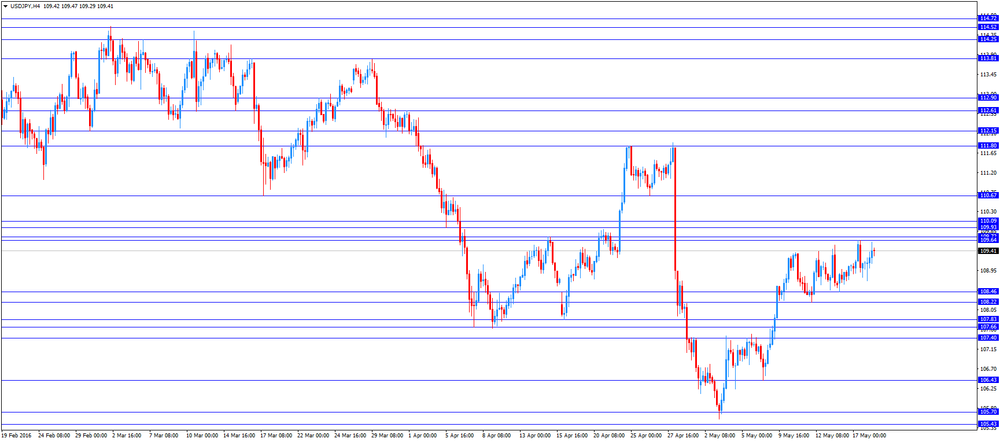

USDJPY 109.00 (USD 241m) 109.25 (230m) 109.50 (550m) 110.00 (220m)

EURUSD: 1.1320 (1.36bln) 1.1330 (451m) 1.1425 (288m) 1.1450 (220m) 1.1475 (218m)

USDCHF 0.9795 (USD 264m)

AUDUSD 0.7300 (USD 944m) 0.7495-00 (385m)

USDCAD 1.2800 (USD 1.01bln) 1.2875 (234m) 1.2900 (675m) 1.3000 (870m)

NZDUSD 0.6790 (NZD 301m)

-

15:39

WSE: After start on Wall Street

Cash market in the US opened in the area of over the past two days lows, which is just above the support line, or neck line of head and shoulders formation. Formation of course, should frighten potential global market, as the breaking of it may be assumed as beginning of greater correction on Wall Street, which probably would move into a level of global investment sentiment.

-

15:33

U.S. Stocks open: Dow -0.39%, Nasdaq -0.17%, S&P -0.28%

-

15:24

Before the bell: S&P futures -0.33%, NASDAQ futures -0.25%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 16,644.69 -8.11 -0.05%

Hang Seng 19,826.41 -292.39 -1.45%

Shanghai Composite 2,807.15 -36.53 -1.28%

FTSE 6,129.25 -38.52 -0.62%

CAC 4,281.55 -16.02 -0.37%

DAX 9,866.82 -23.37 -0.24%

Crude $48.25 (-0.12%)

Gold $1272.00 (-0.38%)

-

15:23

JSW S.A.

Energy Minister mentioned that being in trouble listed coal miner company JSW (WSE: JSW) may conduct rights share issue to raise fund. JSW financial needs are now estimated at over PLN 1 bln. The company is currently negotiating a debt restructuring deal with banks. As a result, the valuation of the company fell by 11%

-

15:20

Foreign investors purchase C$17.17 billion of Canadian securities in March

Statistics Canada released foreign investment figures on Wednesday. Foreign investors purchased C$17.17 billion of Canadian securities in March, after an investment of C$15.94 billion in February.

The investment was led by securities issued by Canadian private corporations.

Canadian investors added C$2.3 billion of foreign securities in March, mainly US corporate securities.

-

15:01

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the mixed labour data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia RBA Assist Gov Debelle Speaks

01:30 Australia Wage Price Index, q/q Quarter I 0.5% 0.5% 0.4%

01:30 Australia Wage Price Index, y/y Quarter I 2.2% 2.2% 2.1%

08:30 United Kingdom Average Earnings, 3m/y March 1.9% Revised From 1.8% 1.7% 2.0%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y March 2.2% 2.3% 2.1%

08:30 United Kingdom ILO Unemployment Rate March 5.1% 5.1% 5.1%

08:30 United Kingdom Claimant count April 14.7 Revised From 6.7 4.3 -2.4

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) April 1% 0.7% 0.7%

09:00 Eurozone Harmonized CPI April 1.2% 0.0% 0%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) April 0.0% -0.2% -0.2%

11:00 U.S. MBA Mortgage Applications May 0.4% -1.6%

12:30 Canada Foreign Securities Purchases March 15.94 17.17

The U.S. dollar traded mixed against the most major currencies ahead of the release of the latest Fed's minutes. Market participants will closely analyse the minutes for hints for further interest rate hikes. The minutes will be released at 18:00 GMT.

The euro traded mixed against the U.S. dollar after the release of the final consumer price inflation data from the Eurozone. Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index was flat in April, in line with expectations, after a 1.2% increase in March.

On a yearly basis, Eurozone's final consumer price inflation decreased to -0.2% in April from 0.0% in March, in line with the preliminary reading.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in April from 1.0 in March, in line with the preliminary reading.

The British pound traded higher against the U.S. dollar on the mixed labour data from the U.K. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the January to March quarter, in line with expectations.

The claimant count fell by 2,400 people in April, beating expectations for a rise by 4,300, after an increase of 14,300 people in March. March's figure was revised up from a 6,700 increase.

Average weekly earnings, excluding bonuses, climbed by 2.1% in the January to March quarter, missing expectations for a 2.3% rise, after a 2.2% gain in the December to February quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the January to March quarter, exceeding expectations for a 1.7% gain, after a 1.9% increase in the December to February quarter. The previous quarter's figure was revised up from a 1.7% rise.

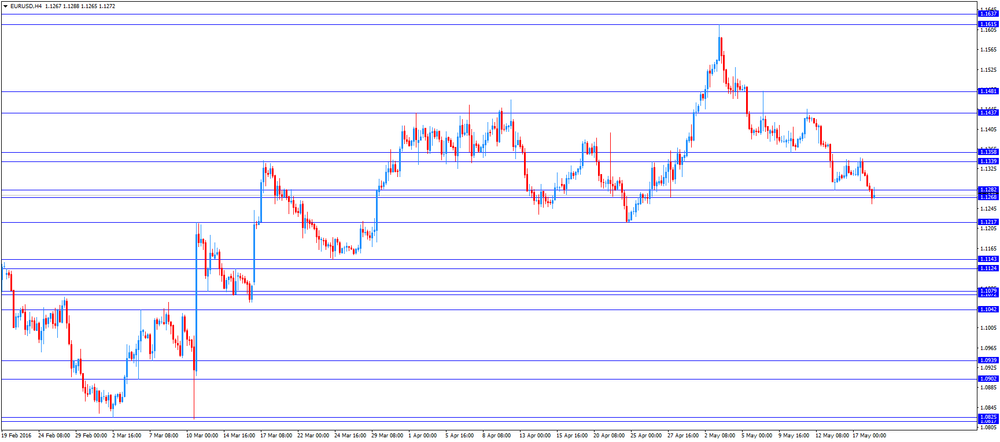

EUR/USD: the currency pair traded mixed

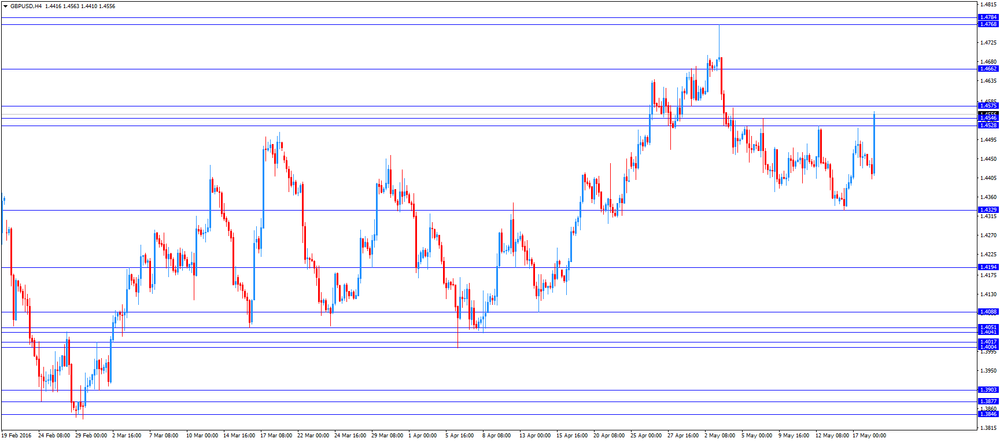

GBP/USD: the currency pair rose to $1.4563

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:30 U.S. Crude Oil Inventories May -3.41 -3.16

18:00 U.S. FOMC meeting minutes

23:50 Japan Core Machinery Orders, y/y April -0.7% 0.8%

23:50 Japan Core Machinery Orders March -9.2% 0.5%

-

14:52

Eurozone's harmonized consumer price index is flat in April

Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index was flat in April, in line with expectations, after a 1.2% increase in March.

On a yearly basis, Eurozone's final consumer price inflation decreased to -0.2% in April from 0.0% in March, in line with the preliminary reading.

Restaurants and cafés prices were up 0.13% year-on-year in April, rents increased by 0.08%, tobacco rose by 0.05%, fuel prices for transport declined by 0.54%, heating oil prices decreased by 0.22%, while gas prices were down by 0.13%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.7% in April from 1.0 in March, in line with the preliminary reading.

-

14:48

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.22

-0.08(-0.8602%)

6054

Amazon.com Inc., NASDAQ

AMZN

693.03

-2.24(-0.3222%)

13681

American Express Co

AXP

62.67

-0.09(-0.1434%)

2718

Apple Inc.

AAPL

93.65

0.16(0.1711%)

91968

AT&T Inc

T

39.05

-0.06(-0.1534%)

6000

Barrick Gold Corporation, NYSE

ABX

19.13

-0.24(-1.239%)

59005

Caterpillar Inc

CAT

70.6

-0.45(-0.6334%)

3720

Chevron Corp

CVX

100.8

0.05(0.0496%)

808

Cisco Systems Inc

CSCO

26.5

-0.15(-0.5629%)

9408

Citigroup Inc., NYSE

C

43.56

-0.14(-0.3204%)

9000

Exxon Mobil Corp

XOM

89.41

-0.12(-0.134%)

14435

Facebook, Inc.

FB

117.06

-0.29(-0.2471%)

62707

Ford Motor Co.

F

13.12

-0.02(-0.1522%)

5660

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.31

-0.20(-1.7376%)

361208

General Electric Co

GE

29.61

-0.10(-0.3366%)

11166

General Motors Company, NYSE

GM

30.63

-0.00(-0.00%)

650

Goldman Sachs

GS

154.25

-0.40(-0.2586%)

100

Google Inc.

GOOG

706.31

0.08(0.0113%)

304

Home Depot Inc

HD

130.88

-1.12(-0.8485%)

36022

Intel Corp

INTC

29.97

-0.01(-0.0334%)

1423

International Paper Company

IP

40.87

-0.32(-0.7769%)

445

Johnson & Johnson

JNJ

113.9

0.07(0.0615%)

322

JPMorgan Chase and Co

JPM

61.6

-0.06(-0.0973%)

27581

McDonald's Corp

MCD

127.3

-0.39(-0.3054%)

524

Microsoft Corp

MSFT

50.38

-0.13(-0.2574%)

8286

Nike

NKE

57.25

0.15(0.2627%)

1530

Starbucks Corporation, NASDAQ

SBUX

54.43

-0.45(-0.82%)

3687

Tesla Motors, Inc., NASDAQ

TSLA

209.35

4.69(2.2916%)

74012

The Coca-Cola Co

KO

44.77

0.02(0.0447%)

238

Twitter, Inc., NYSE

TWTR

14.3

-0.04(-0.2789%)

28498

Verizon Communications Inc

VZ

50.7

-0.20(-0.3929%)

250

Visa

V

76.78

-0.01(-0.013%)

2400

Wal-Mart Stores Inc

WMT

62.9

-2.20(-3.3794%)

99295

Walt Disney Co

DIS

99.93

-0.01(-0.01%)

343

Yahoo! Inc., NASDAQ

YHOO

37.2

-0.07(-0.1878%)

780

-

14:46

U.K. unemployment rate remains unchanged at 5.1% in the January to March quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.1% in the January to March quarter, in line with expectations.

The claimant count fell by 2,400 people in April, beating expectations for a rise by 4,300, after an increase of 14,300 people in March. March's figure was revised up from a 6,700 increase.

U.K. unemployment in the January to March period was 1.69 million, little changed compared with October to December 2015.

The employment rate was 74.2% in the January to March quarter. It was the highest reading since 1971.

Average weekly earnings, excluding bonuses, climbed by 2.1% in the January to March quarter, missing expectations for a 2.3% rise, after a 2.2% gain in the December to February quarter.

Average weekly earnings, including bonuses, rose by 2.0% in the January to March quarter, exceeding expectations for a 1.7% gain, after a 1.9% increase in the December to February quarter. The previous quarter's figure was revised up from a 1.7% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Exxon Mobil (XOM) upgraded to Buy from Hold at Argus

Tesla Motors (TSLA) upgraded to Buy from Neutral at Goldman; target $250

Downgrades:

Other:

-

14:37

Atlanta Fed President Dennis Lockhart: the Fed could raise its interest rate in June

Atlanta Fed President Dennis Lockhart said on Tuesday that the Fed could raise its interest rate in June.

"I wouldn't take it off the table," he said.

Lockhart noted that the Fed could hike its interest rate two or three times this year.

Atlanta Fed president also said that the referendum on Britain's membership in the European Union would not be a reason for the delay in raising interest rate.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:31

Dallas Fed President Robert Kaplan: the U.S. economy is strong enough for further interest rate hikes in the near future

Dallas Fed President Robert Kaplan said on Tuesday that the U.S. economy was strong enough for further interest rate hikes in the near future, adding he would support an interest rate hike at next monetary policy meetings.

"Whether that's June or July, I can't say right now," he said.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:30

Canada: Foreign Securities Purchases, March 17.17

-

13:49

Orders

EUR/USD

Offers 1.1285 1.1300 1.1325 1.1355-60 1.1380 1.1400 1.1430 1.1450-60

Bids 1.1250 1.1235 1.1220 1.1200 1.1185 1.1165 1.1150 1.1130 1.1100

GBP/USD

Offers 1.4450 1.4470 1.4500 1.4530 1.4550 1.4570 1.4585 1.4600

Bids 1.4420-25 1.4400 1.4385 1.4350 1.4330 1.4300-10 1.4280 1.4250

EUR/GBP

Offers 0.7820 0.7830-35 0.7850 0.7880 0.7900 0.7920 0.7930 0.7950

Bids 0.7780 0.7760 0.7735 0.7700 0.7685 0.7670 0.7650

EUR/JPY

Offers 123.50 123.85 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50

Bids 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers 109.40-50 109.80 110.00 110.30 110.50

Bids 109.00 108.75-80 108.50 108.30 108.20 108.00 107.85 107.60

AUD/USD

Offers 0.7300 0.7325-30 0.7350 0.7365-70 0.7385 0.7400

Bids 0.7250-60 0.7235 0.7200 0.7180 0.7165 0.7150

-

13:10

WSE: Mid session comment

The situation on the market so far remains unchanged. The WIG20 boasts volatility at 8 points. However, if we look at today's intraday chart - changes narrowing steadily, which means that it is slowly running out of space to continue this process and one of the parties will have to at least try to take short-term control. Perhaps now is the time for the bulls.

In the mid-session the WIG20 index was at heights of 1,842 points (-0.21%) with the turnover of PLN 165 mln.

-

13:01

U.S.: MBA Mortgage Applications, May 0.4%

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, April 0.7% (forecast 0.7%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, April -0.2% (forecast -0.2%)

-

11:00

Eurozone: Harmonized CPI, April 0% (forecast 0.0%)

-

10:31

United Kingdom: Claimant count , April -2.4 (forecast 4.3)

-

10:30

United Kingdom: Average Earnings, 3m/y , March 2.0% (forecast 1.7%)

-

10:30

United Kingdom: ILO Unemployment Rate, March 5.1% (forecast 5.1%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, March 2.1% (forecast 2.3%)

-

10:04

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00 (USD 241m) 109.25 (230m) 109.50 (550m) 110.00 (220m)

EUR/USD: 1.1320 (1.36bln) 1.1330 (451m) 1.1425 (288m) 1.1450 (220m) 1.1475 (218m)

USD/CHF 0.9795 (USD 264m)

AUD/USD 0.7300 (USD 944m) 0.7495-00 (385m)

USD/CAD 1.2800 (USD 1.01bln) 1.2875 (234m) 1.2900 (675m) 1.3000 (870m)

NZD/USD 0.6790 (NZD 301m)

-

09:17

European Central Bank Governing Council member Visco worries about the deflation in the Eurozone

The European Central Bank (ECB) Governing Council member Visco said in an interview with German newspaper Handelsblatt that he worried about the deflation in the Eurozone.

"I believe we still face a concrete deflation risk," he said.

-

09:13

WSE: After opening

Future contracts - June series (WSE: FW20M16) declined at the start by 0.6 percent an located at around 1,840 points.

WIG20 index opened at 1845.98 points (-0.03%)*

WIG 46663.77 -0.10%

WIG30 2051.65 -0.12%

mWIG40 3547.43 -0.10%

*/ - change to previous close

The beginning of trading on the Warsaw Stock Exchange brings red, but very delicate. It is in some ways a plus for the bulls, because maybe in time we can fight for a little independence. The daily chart shows that the market is still playing at levels higher than the gap from Monday, but the failure of resistance in the area of 1,883 points takes further confirmation. The domestic currency in the morning clearly losing all along the line. External risks can naturally create further pressure on the risky active, including assets and emerging market currencies.

-

09:00

San Francisco Fed President John Williams: the Fed could hike its interest rate two or three times this year

San Francisco Fed President John Williams said in an interview with The Wall Street Journal on Tuesday that the Fed could hike its interest rate two or three times this year.

San Francisco Fed president pointed out that he did not worry about the U.S. economic growth.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

08:50

Japan’s preliminary GDP rises 0.4% in the first quarter

Japan's Cabinet Office released its preliminary gross domestic product (GDP) data for Japan late Tuesday evening. Japan's GDP rose by 0.4% in the first quarter, beating expectations for a 0.1% gain, after a 0.4% drop in the fourth quarter. The fourth quarter's figure was revised down from a 0.3% fall.

The increase was driven by a rise in private consumption. Private consumption rose 0.5% in the first quarter, while capital expenditure slid 1.4%.

On a yearly basis, Japan's economy climbed 1.7% in the first quarter, beating forecasts of a 0.2% rise, after a 1.7% fall in the fourth quarter. The fourth quarter's figure was revised down from a 1.1% drop.

-

08:41

Wages in Australia rise 0.4% in the first quarter

The Australian Bureau of Statistics released its wage price data on Wednesday. Wages in Australia rose at a seasonally adjusted rate of 0.4% in the first quarter, missing forecasts of a 0.5% gain, after a 0.5% increase in the previous quarter.

Public wages rose 0.5% in the first quarter, while private wages increased 0.4%.

On a yearly basis, wages climbed 2.1% in the first quarter, missing expectations for a 2.2% increase, after a 2.2% gain in the fourth quarter. It was the weakest rise since 1998.

On a yearly basis, private wages were up 1.9% in the first quarter, while public wages jumped 2.5%.

-

08:32

Options levels on wednesday, May 18, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1450 (5065)

$1.1396 (2944)

$1.1351 (1074)

Price at time of writing this review: $1.1284

Support levels (open interest**, contracts):

$1.1230 (5572)

$1.1199 (3430)

$1.1164 (9453)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68112 contracts, with the maximum number of contracts with strike price $1,1400 (5065);

- Overall open interest on the PUT options with the expiration date June, 3 is 89197 contracts, with the maximum number of contracts with strike price $1,1200 (9453);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from May, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.4703 (1875)

$1.4606 (2481)

$1.4510 (2406)

Price at time of writing this review: $1.4430

Support levels (open interest**, contracts):

$1.4391 (1401)

$1.4294 (2610)

$1.4197 (2970)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 30993 contracts, with the maximum number of contracts with strike price $1,4600 (2481);

- Overall open interest on the PUT options with the expiration date June, 3 is 33239 contracts, with the maximum number of contracts with strike price $1,4200 (2970);

- The ratio of PUT/CALL was 1.07 versus 1.06 from the previous trading day according to data from May, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:28

WSE: Before opening

Yesterday's session on Wall Street was not successful. The main indices lost from 0.9 to 1.3 percent due to concerns that the market was mistaken in the estimation of the Fed monetary policy. Yesterday's report on CPI-Core looks conducive to raise interest rates. Major declines in the US appeared after the close of European stock exchanges, while the contract for the S&P500 is trading now around minus 0.12 percent.

At the opening European markets should adjust their pricing to the American weakness. Element that can inhibit the aspirations of supply is the weakening of the euro against the dollar.

The macroeconomic calendar will show today important data on stocks of fuel in the USA (16:30 Warsaw time). The market is sensitive to the price of oil, and this is close to the level of $ 50 per barrel.

In the case of WSE growing concern about the change in the Fed's monetary policy are mixed with doubts about the strength of local demand and stare at the condition of PLN. Although buyers always have had a defense of 1,800 points on the chart of the WIG20 index, but yesterday's decline signals that Monday's reaction to the rating of Moody's does not trigger a wave of purchases able to push the index over the support in the area of 1,875-1,900 points. Then technical analysts should expect more consolidation et technically neutral level than a fast walk over 1,900 points.

-

08:24

New Zealand’s producer price inflation slides in the first quarter

Statistics New Zealand released its output and input producer price index (PPI) data on the late Tuesday evening. New Zealand's input PPI slid 1.0% in the first quarter, after a 1.2% fall in the fourth quarter.

"The petroleum and coal product manufacturing industry makes a broad range of fuel products, including petrol, diesel, and aviation fuel," business prices manager Sarah Williams said.

Output PPI fell 0.2% in the first quarter, after a 0.8% decline in the fourth quarter.

Prices received by petroleum and coal product manufacturers plunged 22% in the first quarter. Prices paid by petroleum and coal product manufacturers slid 18%.

-

08:19

Asian session: The yen gained

The yen gained against the dollar and the euro on Wednesday, after data showed Japan's economy expanded at the fastest pace in a year in the first quarter and some investors pared bets on further stimulus. Japan's economy expanded by an annualised 1.7 percent in January-March, easily beating the median market forecast for a 0.2 percent increase and rebounding from a 1.7 percent contraction in the previous quarter, the Cabinet Office data showed. Many analysts said Japan narrowly dodged recession, defined as two straight quarters of contraction, because of the boost from the extra day in a leap year. The Bank of Japan chose to hold policy steady at its last meeting, but many still believe it will muster additional easing steps as early as next month.

The Australian dollar slipped, giving back some of the previous session's rally on minutes of the Reserve Bank of Australia's (RBA) May policy meeting, which encouraged markets to pare back the chances of a cut in interest rates.

EUR/USD: during the Asian session the pair fell to $1.1280

GBP/USD: during the Asian session the pair fell to $1.4430

USD/JPY: during the Asian session the pair traded in the range of Y108.70-40

Based on Reuters materials

-

07:05

Global Stocks

European stocks ended a volatile session almost flat Monday, as investors weighed disappointing Chinese data against a rally in oil prices. European shares had started in negative territory on Monday after data released over the weekend from China showed figures for industrial output, retail sales and fixed-asset income in April missed analyst expectations.

The Dow Jones Industrial Average slumped nearly 200 points and the broader market sank after Federal Reserve officials implied that interest rates could be raised as early as June. Atlanta Fed President Dennis Lockhart and San Francisco Fed President John Williams said the Fed's decision on whether to raise rates at the June 14-15 meeting hinges on the data.

Asian stocks fell for the first time in three days and the dollar strengthened against all of its major peers on prospects for a U.S. interest-rate hike. Japanese shares and the yen fluctuated as investors weighed whether better-than-expected economic growth reduces the need for stimulus.

Based on MarketWatch materials

-

04:12

Nikkei 225 16,726.3 +73.50 +0.44 %, Hang Seng 19,905.93 -212.87 -1.06 %, Shanghai Composite 2,816.99 -26.69 -0.94 %

-

03:30

Australia: Wage Price Index, q/q, Quarter I 0.4% (forecast 0.5%)

-

03:30

Australia: Wage Price Index, y/y, Quarter I 2.1% (forecast 2.2%)

-

01:51

Japan: GDP, q/q, Quarter I 0.4% (forecast 0.1%)

-

01:50

Japan: GDP, y/y, Quarter I 1.7% (forecast 0.2%)

-

01:02

Commodities. Daily history for May 17’2016:

(raw materials / closing price /% change)

Oil 48.59 +0.58%

Gold 1,280.30 +0.27%

-

01:01

Stocks. Daily history for Sep Apr May 17’2016:

(index / closing price / change items /% change)

Nikkei 225 16,652.8 +186.40 +1.13 %

Hang Seng 20,118.8 +234.85 +1.18 %

S&P/ASX 200 5,395.87 +36.93 +0.69 %

Shanghai Composite 2,843.73 -7.13 -0.25 %

Nikkei 225 16,652.8 +186.40 +1.13 %

Hang Seng 20,118.8 +234.85 +1.18 %

S&P/ASX 200 5,395.87 +36.93 +0.69 %

Shanghai Composite 2,843.73 -7.13 -0.25 %

NASDAQ Composite 4,715.73 -59.73 -1.25 %

Dow Jones 17,529.98 -180.73 -1.02 %

-

01:00

Currencies. Daily history for May 17’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1311 -0,03%

GBP/USD $1,4460 +0,36%

USD/CHF Chf0,9802 +0,29%

USD/JPY Y109,12 +0,05%

EUR/JPY Y123,43 +0,03%

GBP/JPY Y157,78 +0,41%

AUD/USD $0,7322 +0,45%

NZD/USD $0,6808 +0,38%

USD/CAD C$1,2905 +0,09%

-

00:46

New Zealand: PPI Output (QoQ) , Quarter I -0.2%

-

00:45

New Zealand: PPI Input (QoQ), Quarter I -1%

-