Noticias del mercado

-

21:00

DJIA 17403.63 -122.99 -0.70%, NASDAQ 4694.71 -44.41 -0.94%, S&P 500 2034.05 -13.58 -0.66%

-

18:08

New York Fed President William Dudley: an interest rate hike in June or July will be appropriate if the U.S. economy continues to improve

New York Fed President William Dudley said on Thursday that an interest rate hike in June or July would be appropriate if the U.S. economy continues to improve after the weak first quarter.

New York Fed president noted that wage pressures picked up.

He also said that he did not think the referendum on Britain's membership in the European Union would influence the Fed's interest rate decision.

Dudley is a voting member of the Federal Open Market Committee (FOMC).

-

18:01

European stocks close: stocks traded lower as the latest Fed’s minutes weighed stock markets

Stock closed lower on the Fed's minutes. The Fed released its April monetary policy meeting minutes on Wednesday. The minutes showed that most Fed officials would support an interest rate hike in June if the U.S. economy continued to improve.

Oil prices also weighed on stock markets. Oil prices traded lower on a stronger U.S. dollar and on U.S. crude inventories data. According to the U.S. Energy Information Administration on Wednesday, U.S. crude inventories rose by 1.3 million barrels to 541.3 million in the week to May 13. Analysts had expected U.S. crude oil inventories to decline by 3.16 million barrels.

The European Central Bank's (ECB) its minutes of April meeting on Thursday. The minutes said that members agreed there was a need to counter criticism on the central bank's actions. The central bank noted that the recent stimulus measures needed more time to take effect. According to the minutes, the downside risks to the economic growth in the Eurozone remained but moderated somewhat.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.3% in April, exceeding expectations for a 0.5% gain, after a 0.5% decline in March. March's figure was revised up from a 1.3% decrease.

Food sales were up 0.1% in April, while non-food store sales increased 2.5%.

On a yearly basis, retail sales in the U.K. jumped 4.3% in April, beating forecasts of a 2.5% increase, after a 3.0% rise in March. March's figure was revised up from a 2.7% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,053.35 -112.45 -1.82 %

DAX 9,795.89 -147.34 -1.48 %

CAC 40 4,282.54 -36.76 -0.85 %

-

18:00

European stocks closed: FTSE 6053.35 -112.45 -1.82%, DAX 9795.89 -147.34 -1.48%, CAC 40 4282.54 -36.76 -0.85%

-

17:56

WSE: Session Results

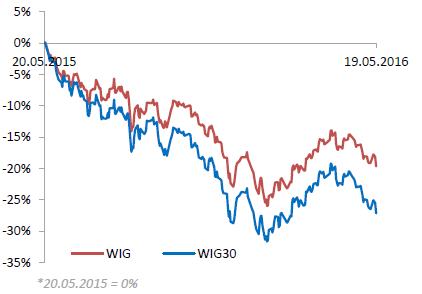

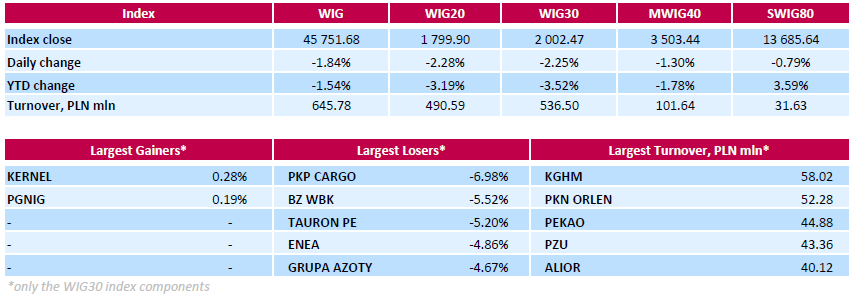

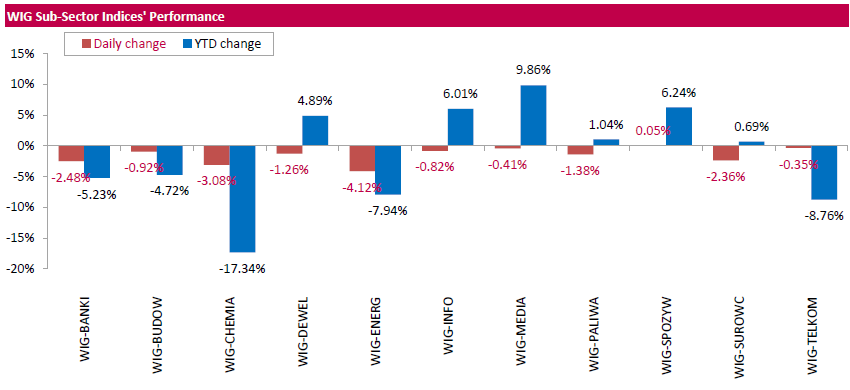

Polish equity market plunged on Tuesday. The broad market measure, the WIG Index, declined by 1.84%. Food sector (+0.05%) was sole gainer within the WIG Index. At the same time, utilities (-4.12%) recorded the worst result. Poland's energy minister Krzysztof Tchórzewski said on Wednesday that Poland needed a power capacity market to help coal-fired power plants compete with producers of renewable energy and to avoid power shortages. Poland generates nearly 80% of its electricity from highly-polluting coal power plants, mainly operated by state-run power companies PGE (WSE: PGE), TAURON (WSE: TPE) and ENEA (WSE: ENA), which are coming under pressure from subsidized renewables such as wind power, reducing investment in new capacity. Mr. Tchorzewski stated that Poland had to call on the European Commission for a system of financing conventional generation. If it does not build around 7 gigawatts of new capacities in six years, then it will have to regulate electricity consumption.

The large-cap companies' measure, the WIG30 Index, lost 2.25%. Only two index constituents managed to generate positive returns: agricultural producer KERNEL (WSE: KER) gained 0.28%, while oil and gas producer PGNIG (WSE: PGN) added 0.19%. At the same time, railway freight transport operator PKP CARGO (WSE: PKP) suffered the steepest drop, plunging by 6.98%. Other major underperformers were bank BZ WBK (WSE: BZW), chemical producer GRUPA AZOTY (WSE: ATT) and three gencos PGE (WSE: PGE), TAURON (WSE: TPE) and ENEA (WSE: ENA), which lost between 4.03% and 5.52%.

-

17:54

Moody's: the slowdown in emerging economies continues to weigh on the global growth

Moody's Investors Service said on Wednesday that the slowdown in emerging economies, which was driven by lower low commodity prices and weak export demand, continued to weigh on the global growth.

"The global recovery has weakened further and the outlook across countries remains uneven and largely weaker than over the past two decades," an Associate Managing Director at Moody's, Elena Duggar, said.

"Global trade remains subdued, while spillovers from emerging markets shocks to financial markets globally have increased substantially," she added.

The agency downgraded its growth forecast for the US to 2.0% from 2.3% for 2016, driven by the weak first quarter.

Moody's expect the Fed to raise its interest rate twice this year.

-

17:40

ECB April Monetary Policy Meeting Account: members agree there is a need to counter criticism on the central bank’s actions

The European Central Bank's (ECB) its minutes of April meeting on Thursday. The minutes said that members agreed there was a need to counter criticism on the central bank's actions.

"There was general agreement that there was a need to counter the perception that monetary policy could no longer contribute to a return of inflation to the Governing Council's aim of below, but close to, 2%," the ECB said in its minutes.

The central bank noted that the recent stimulus measures needed more time to take effect.

According to the minutes, the downside risks to the economic growth in the Eurozone remained but moderated somewhat.

The ECB kept its monetary policy unchanged in April.

-

17:38

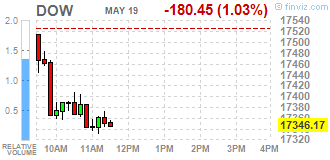

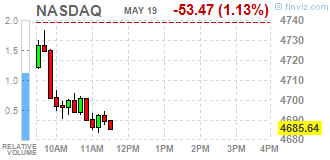

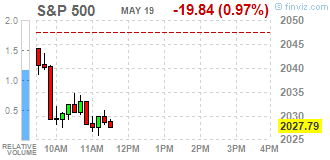

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Thursday after the U.S. Federal Reserve signaled the possibility of an interest rate hike as early as June and oil prices dropped on fresh concerns of oversupply. Minutes of the Fed's April meeting, released on Wednesday, caught the market by surprise as they showed that most policymakers thought a June rate hike was appropriate, given continued improvement in the U.S. economy.

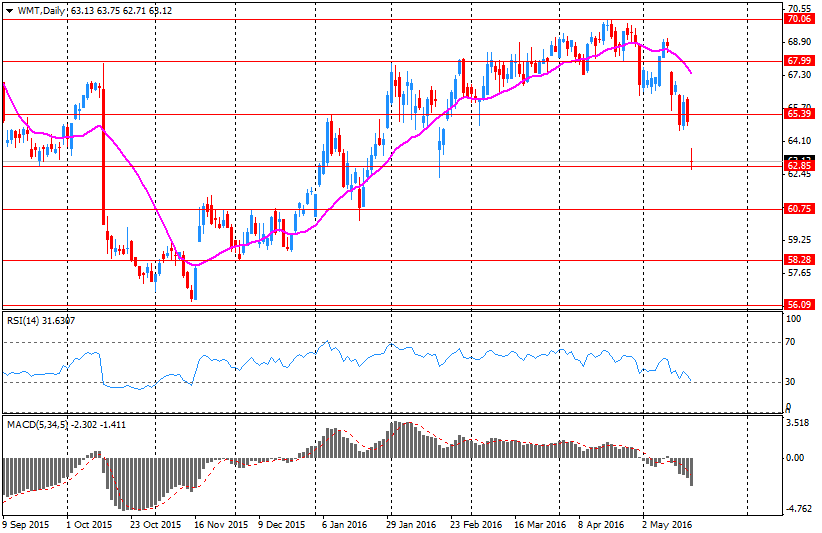

Most of Dow stocks in negative area (26 of 30). Top looser - The Boeing Company (BA, -2,86%). Top gainer - Wal-Mart Stores Inc. (WMT, +9,45%).

All S&P sectors also in negative area. Top looser - Industrial goods (-1,4%).

At the moment:

Dow 17326.00 -153.00 -0.88%

S&P 500 2026.25 -15.25 -0.75%

Nasdaq 100 4293.00 -39.25 -0.91%

Oil 47.64 -1.14 -2.34%

Gold 1252.60 -21.80 -1.71%

U.S. 10yr 1.85 -0.03

-

17:30

Bank of Japan Governor Haruhiko Kuroda: the BoJ is ready to add further stimulus measures

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that the central bank was ready to add further stimulus measures if there were risks for reaching 2% inflation target.

"If market moves, be it currency rates or something else, threaten achievement of our price target, we won't hesitate taking additional monetary easing steps," he said.

-

16:47

New York Fed President William Dudley: the monetary policy is more effective if the central bank’s actions are transparent for the public

New York Fed President William Dudley said in prepared remarks on Thursday that the monetary policy was more effective if the central bank's actions were transparent for the public.

"Market participants and households both understand and can anticipate actions by the central bank. By doing so, the transmission channels of monetary policy are enhanced," he said.

Dudley pointed out that the monetary policy was data-depended.

"It is, therefore, important for market participants and households to be able to follow the data along with the FOMC and to understand how we are likely to interpret and react to incoming data," New York Fed president said.

"If people know more about how the economy is performing and how that is likely to influence our actions, this should make it easier for us to achieve our twin objectives [maximum sustainable employment and price stability]," he added.

Dudley is a voting member of the Federal Open Market Committee (FOMC).

-

16:32

Richmond Fed President Jeffrey Lacker: markets misunderstood the Fed in March and April

Richmond Fed President Jeffrey Lacker said in an interview with Bloomberg Radio on Thursday that markets misunderstood the Fed in March and April.

"My sense of things is that markets took the wrong signal from us pausing in March and April," he said.

Lacker pointed out that an interest rate hike in June would be appropriate, adding that the referendum on Britain's membership in the European Union (EU) could wait until July before raising its interest rate.

Lacker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

16:09

U.S. leading economic index rises 0.6% in April

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index rose 0.6% in April, exceeding expectations for a 0.4% increase, after a flat reading in March. March's figure was revised down from a 0.2% rise.

The coincident economic index climbed 0.3% in April, after a flat reading in March.

"The U.S. LEI picked up sharply in April, with all components except consumer expectations contributing to the rebound from an essentially flat first quarter. Despite a slow start in 2016, labour market and financial indicators, and housing permits all point to a moderate growth trend continuing in 2016," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:00

U.S.: Leading Indicators , April 0.6% (forecast 0.4%)

-

15:49

WSE: After start on Wall Street

Opening in the US was downward and practically on the support line. It is worth to mention that the rise in the last session were not supported by any convincing messages. In turn, the bears get precisely the argument in the form of a stronger dollar and the possibility of rate hikes sooner than expected. So far this risk is a possible gift for the selling party, which could opt for stronger impact.

-

15:45

Option expiries for today's 10:00 ET NY cut

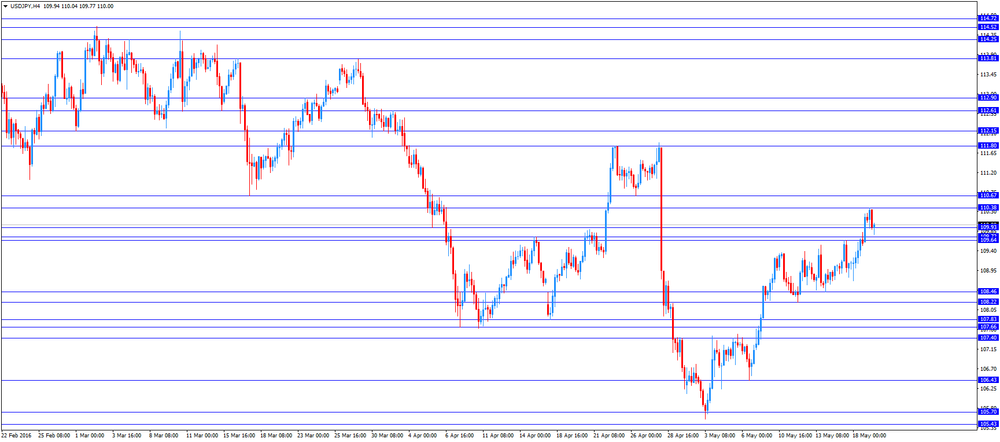

USDJPY 108.00 (USD 381m) 108.50 (382m) 108.95-109.10 109.25 (1.86bln) 109.25 (550m) 110.00 (567m) 111.00 (526m)

EURUSD: 1.1100 (EUR 474m) 1.1145-50 (313m) 1.1220 (495m) 1.1235 (225m) 1.1250 (408m) 1.1280-90 (546m) 1.1295-1.1305 (887m) 1.1315 (247m) 1.1355 (332m) 1.1379-80 (503m) 1.1500 (1.52bln)

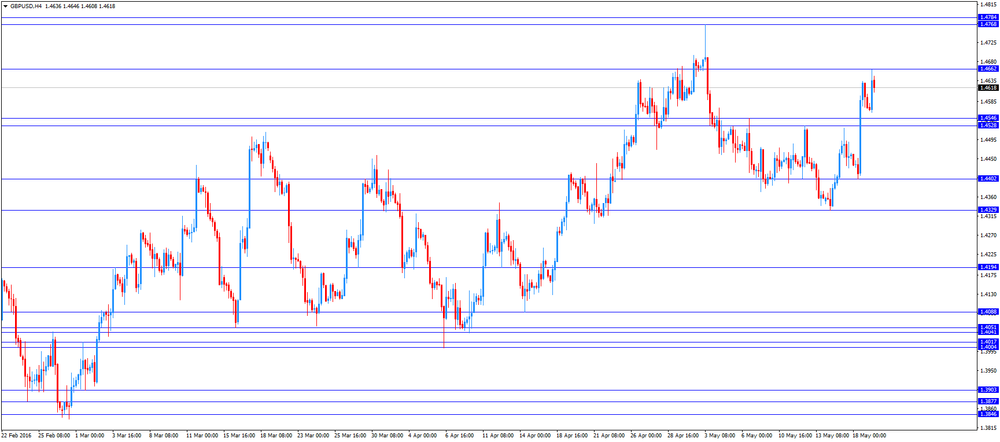

GBPUSD 1.4412 (GBP 389m) 1.4500 (588m) 1.4600 (220m)

USDCHF 0.9800 (USD 567m)

AUDUSD 0.7250 (AUD 313m) 0.7500 (1.07bln)

USDCAD 1.3000 (238m)

NZDUSD 0.6835 (NZD 429m)

EURJPY 121.50 (EUR 340m)

-

15:32

U.S. Stocks open: Dow -0.24%, Nasdaq -0.43%, S&P -0.35%

-

15:19

Before the bell: S&P futures -0.24%, NASDAQ futures -0.28%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 16,646.66 +1.97 +0.01%

Hang Seng 19,694.33 -132.08 -0.67%

Shanghai Composite 2,807.33 -0.18 -0.01%

FTSE 6,093.27 -72.53 -1.18%

CAC 4,301.84 -17.46 -0.40%

DAX 9,866.45 -76.78 -0.77%

Crude $47.11 (-2.24%)

Gold $1252.10 (-1.91%)

-

15:09

Chicago Fed National Activity Index rises to 0.10 in April

The Federal Reserve Bank of Chicago released its National Activity Index on Thursday. The index increased to 0.10 in April from -0.55 in March. March's figure was revised down from -0.44.

The production-related indicator rose to 0.19 in April from -0.39 in March.

The employment-related indicator increased to -0.02 in April from -0.04 in March.

The personal consumption and housing indicator was up to -0.07 in April from -0.11 in March.

-

15:00

Philadelphia Federal Reserve Bank’s manufacturing index drops to -1.8 in May

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to -1.8 in May from -1.6 in April, missing expectations for an increase to 3.5.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"This month's Manufacturing Business Outlook Survey suggests essentially no growth of the region's manufacturing sector. The survey's indicators for general activity, new orders, shipments, and employment all remained negative," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index climbed to -0.5 in May from -10.8 in April.

The new orders index decreased to -1.9 in May from 0.0 in April.

The prices paid index rose to 15.7 in May from 13.2 in April, while the prices received index increased to 14.8 from 7.4.

The number of employees index was up to -3.3 in May from -18.5 in April.

According to the report, the future general activity index fell to 36.1 in May from 42.2 in April.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

8.94

-0.08(-0.8869%)

60109

ALTRIA GROUP INC.

MO

62.9

-0.09(-0.1429%)

745

Amazon.com Inc., NASDAQ

AMZN

695.8

-1.65(-0.2366%)

7142

American Express Co

AXP

63.22

-0.30(-0.4723%)

1185

Apple Inc.

AAPL

94.4

-0.16(-0.1692%)

71435

AT&T Inc

T

38.53

0.08(0.2081%)

4368

Barrick Gold Corporation, NYSE

ABX

17.3

-0.32(-1.8161%)

504464

Boeing Co

BA

130.55

-0.44(-0.3359%)

405

Caterpillar Inc

CAT

70.06

-0.53(-0.7508%)

981

Chevron Corp

CVX

99.36

-0.70(-0.6996%)

1896

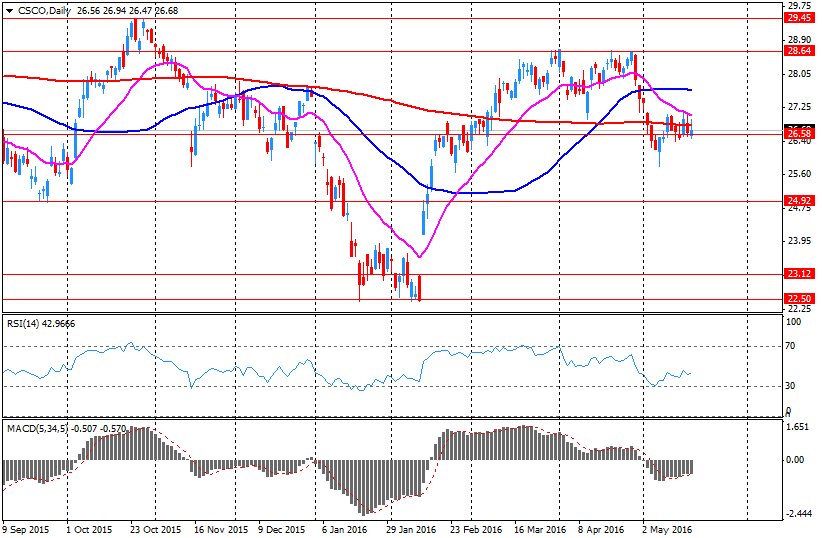

Cisco Systems Inc

CSCO

28.15

1.43(5.3518%)

624080

Citigroup Inc., NYSE

C

45.7

-0.17(-0.3706%)

24663

Deere & Company, NYSE

DE

82.6

-0.00(-0.00%)

199

E. I. du Pont de Nemours and Co

DD

63.87

-0.12(-0.1875%)

125

Exxon Mobil Corp

XOM

88.7

-0.65(-0.7275%)

17570

Facebook, Inc.

FB

117.51

-0.14(-0.119%)

80854

Ford Motor Co.

F

13.15

-0.01(-0.076%)

10475

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.36

-0.18(-1.7078%)

306857

General Electric Co

GE

29.5

-0.11(-0.3715%)

12094

General Motors Company, NYSE

GM

30.61

-0.14(-0.4553%)

200

Goldman Sachs

GS

159.07

-0.87(-0.5439%)

3978

Google Inc.

GOOG

705

-1.63(-0.2307%)

1126

Home Depot Inc

HD

131.5

-0.27(-0.2049%)

7883

Intel Corp

INTC

29.9

-0.09(-0.3001%)

1276

Johnson & Johnson

JNJ

113.07

-0.52(-0.4578%)

1697

JPMorgan Chase and Co

JPM

63.77

-0.27(-0.4216%)

11765

McDonald's Corp

MCD

125.5

-0.71(-0.5626%)

850

Merck & Co Inc

MRK

54.22

-0.45(-0.8231%)

1665

Microsoft Corp

MSFT

50.53

-0.28(-0.5511%)

11555

Nike

NKE

56.12

-0.00(-0.00%)

7490

Pfizer Inc

PFE

33.36

0.19(0.5728%)

27781

Procter & Gamble Co

PG

79.72

-0.13(-0.1628%)

1040

Starbucks Corporation, NASDAQ

SBUX

54.63

-0.17(-0.3102%)

2957

Tesla Motors, Inc., NASDAQ

TSLA

212.5

1.33(0.6298%)

116506

The Coca-Cola Co

KO

44.36

-0.12(-0.2698%)

785

Travelers Companies Inc

TRV

110.5

-0.80(-0.7188%)

1470

Twitter, Inc., NYSE

TWTR

14.14

0.00(0.00%)

25114

UnitedHealth Group Inc

UNH

129.75

-0.76(-0.5823%)

1000

Verizon Communications Inc

VZ

50.18

-0.21(-0.4167%)

1271

Visa

V

77.16

-0.27(-0.3487%)

1153

Wal-Mart Stores Inc

WMT

68.1

4.95(7.8385%)

2073973

Walt Disney Co

DIS

98.96

-0.04(-0.0404%)

2397

Yahoo! Inc., NASDAQ

YHOO

37.16

-0.08(-0.2148%)

200

Yandex N.V., NASDAQ

YNDX

18.8

-0.32(-1.6736%)

509

-

14:49

Initial jobless claims fall to 278,000 in the week ending May 14

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 14 in the U.S. decreased by 16,000 to 278,000 from 295,000 in the previous week. Analysts had expected jobless claims to decline to 275,000.

Jobless claims remained below 300,000 the 63rd straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 13,000 to 2,152,000 in the week ended May 07.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Cisco Systems (CSCO) target raised to $27 from $24 at Wunderlich

Cisco Systems (CSCO) target raised to $33 from $31

Alcoa (AA) initiated with a Neutral at Goldman ; target $9

Freeport-McMoRan (FCX) initiated with a Neutral at Goldman ; target $12

-

14:38

Canada’s wholesale sales drop 1.0% in March

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales dropped 1.0% in March, missing expectations for a 0.5% fall, after a 2.3% decline in February. February's figure was revised down from a 2.2% drop.

The decline was mainly driven by a drop in the motor vehicle and parts subsector and the miscellaneous subsector.

Sales of motor vehicle and parts were down 2.5% in March, while sales in in the miscellaneous subsector slid 3.2%.

Inventories decreased by 0.1% in March.

-

14:31

U.S.: Philadelphia Fed Manufacturing Survey, May -1.8 (forecast 3.5)

-

14:30

Canada: Wholesale Sales, m/m, March -1.0% (forecast -0.5%)

-

14:30

U.S.: Initial Jobless Claims, May 278 (forecast 275)

-

14:30

U.S.: Continuing Jobless Claims, May 2152 (forecast 2163)

-

14:30

U.S.: Chicago Federal National Activity Index, April 0.1

-

14:20

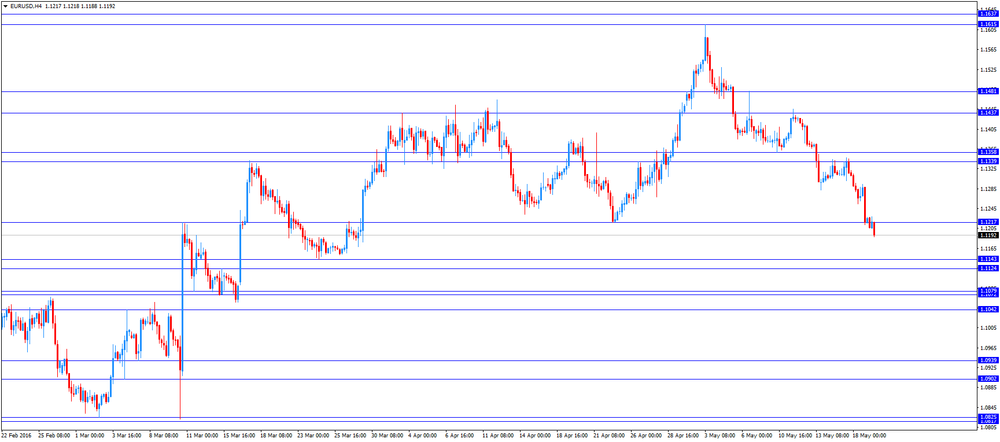

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the better-than-expected retail sales data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate April 5.7% 5.8% 5.7%

01:30 Australia Changing the number of employed April 25.7 Revised From 26.1 12.5 10.8

08:30 United Kingdom Retail Sales (YoY) April 3.0% Revised From 2.7% 2.5% 4.3%

08:30 United Kingdom Retail Sales (MoM) April -0.5% Revised From -1.3% 0.5% 1.3%

09:00 Eurozone Construction Output, y/y March 2.5% -0.5%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 19,000 to 275,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to 3.5 in May from -1.6 in April.

The euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) March minutes. The ECB said that the recent stimulus measures needed time to take effect.

The Eurostat released its construction production data for the Eurozone on Thursday. Construction production in the Eurozone declined 0.9% in March, after a 0.6% fall in February. February's figure was revised up from a 1.1% drop. Civil engineering output slid 2.0% in March, while production in the building sector was down 0.8%.

On a yearly basis, construction output fell 0.5% in March, after a 3.4% gain in February. February's figure was revised up from a 2.5% increase.

The British pound traded higher against the U.S. dollar on the better-than-expected retail sales data from the U.K. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.3% in April, exceeding expectations for a 0.5% gain, after a 0.5% decline in March. March's figure was revised up from a 1.3% decrease.

Food sales were up 0.1% in April, while non-food store sales increased 2.5%.

On a yearly basis, retail sales in the U.K. jumped 4.3% in April, beating forecasts of a 2.5% increase, after a 3.0% rise in March. March's figure was revised up from a 2.7% gain.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. Wholesales sales in Canada are expected to decrease 0.5% in March, after a 2.2% drop in February.

EUR/USD: the currency pair declined to $1.1188

GBP/USD: the currency pair rose to $1.4661

USD/JPY: the currency pair fell to Y109.77

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m March -2.2% -0.5%

12:30 U.S. Chicago Federal National Activity Index April -0.44

12:30 U.S. Philadelphia Fed Manufacturing Survey May -1.6 3.5

12:30 U.S. Initial Jobless Claims May 294 275

14:00 U.S. Leading Indicators April 0.2% 0.4%

14:30 U.S. FOMC Member Dudley Speak

-

14:01

Orders

EUR/USD

Offers 1.1230 1.1250 1.1280-85 1.1300 1.1325 1.1355-60 1.1380 1.1400

Bids 1.1200 1.1185 1.1165 1.1150 1.1125-30 1.1100 1.1080 1.1065 1.1050

GBP/USD

Offers 1.4600-10 1.4630 1.4650 1.4670 1.4685 1.4700 1.4730 1.4750

Bids 1.4565-70 1.4550 1.4520 1.4500 1.4485 1.4470 1.4450 1.4420-25 1.4400

EUR/GBP

Offers 0.7720 0.7735 0.7750 0.7785 0.7800 0.7820 0.7830-35 0.7850

Bids 0.7675-80 0.7650 0.7625-30 0.7600 0.7580 0.7550

EUR/JPY

Offers 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50

Bids 123.30 123.00 122.80 122.50 122.00 121.70 121.50

USD/JPY

Offers 110.50 110.65 110.80 111.00 111.30 111.50 111.75-80 112.00

Bids 110.00 109.85 109.70 109.50 109.40 109.00 108.75-80 108.50 108.30 108.20 108.00

AUD/USD

Offers 0.7220 0.7240 0.7280 0.7300 0.7325-30 0.7350

Bids 7180-85 0.7165 0.7150 0.7130 0.7100 0.7070 0.7050 0.7000

-

13:44

Company News: Wal-Mart (WMT) Q1 results beat analysts’ estimates

Wal-Mart reported Q1 FY 2016 earnings of $0.98 per share (versus $1.03 in Q1 FY 2015), beating analysts' consensus of $0.88.

The company's quarterly revenues amounted to $114.986 bln (+0.9% y/y), beating consensus estimate of $112.676 bln.

The company also issued upside guidance for Q2, projecting EPS of $0.95-1.08 versus analysts' consensus estimate of $0.98.

WMT rose to $68.95 (+9.18%) in pre-market trading.

-

13:30

Company News: Cisco Systems (CSCO) Q3 results beat expectations

Cisco Systems reported Q3 FY 2016 earnings of $0.57 per share (versus $0.54 in Q3 FY 2015), beating analysts' consensus of $0.55.

The company's quarterly revenues amounted to $12 bln (-1.1% y/y), slightly beating consensus estimate of $11.952 bln.

The company issued guidance for Q4, projecting EPS of $0.59-0.61 (versus analysts' consensus estimate of $0.58) and revenues of $12.36-12.73 bln (+0-3% y/y) (versus analysts' consensus estimate of $12.43 bln).

CSCO rose to $28.25 (+5.73%) in pre-market trading.

-

13:24

WSE: Mid session comment

After the fall from the first hour of the session, the market went into consolidation at the minima losing approx. 1%. The turnover has not yet exceeded the level of PLN 200 mln, which means that a significant capital still standing on the side. Practically it appeared only on Tuesday and took advantage of Monday's rise in prices to sell, which is not a positive signal. Currently, we already returned to levels before Monday. The cooling can also be seen in the segment of small and medium-sized companies whose indices lose approx. 0.5%.

-

12:00

European stock markets mid session: stocks traded lower on the Fed’s minutes

Stock indices traded lower on the Fed's minutes. The Fed released its April monetary policy meeting minutes on Wednesday. The minutes showed that most Fed officials would support an interest rate hike in June if the U.S. economy continued to improve.

Oil prices also weighed on stock markets. Oil prices traded lower on a stronger U.S. dollar and on U.S. crude inventories data. According to the U.S. Energy Information Administration on Wednesday, U.S. crude inventories rose by 1.3 million barrels to 541.3 million in the week to May 13. Analysts had expected U.S. crude oil inventories to decline by 3.16 million barrels.

Market participants also eyed the economic data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Thursday. Construction production in the Eurozone declined 0.9% in March, after a 0.6% fall in February. February's figure was revised up from a 1.1% drop. Civil engineering output slid 2.0% in March, while production in the building sector was down 0.8%.

On a yearly basis, construction output fell 0.5% in March, after a 3.4% gain in February. February's figure was revised up from a 2.5% increase.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.3% in April, exceeding expectations for a 0.5% gain, after a 0.5% decline in March. March's figure was revised up from a 1.3% decrease.

Food sales were up 0.1% in April, while non-food store sales increased 2.5%.

On a yearly basis, retail sales in the U.K. jumped 4.3% in April, beating forecasts of a 2.5% increase, after a 3.0% rise in March. March's figure was revised up from a 2.7% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,079.21 -86.59 -1.40 %

DAX 9,784.13 -159.10 -1.60 %

CAC 40 4,277.46 -41.84 -0.97 %

-

11:43

France’s unemployment rate remains unchanged at 10.2% in the first quarter

The French statistical office Insee released its unemployment data on Thursday. The unemployment rate in France remained unchanged at 10.2% in the first quarter. The fourth quarter's figure was revised down from 10.3%.

The number of unemployed people in metropolitan France remained unchanged at 2.8 million in the first quarter.

The employment rate rose to 64.6% in the first quarter from 64.4% in the fourth quarter.

The number of unemployed people under 24 years increased to 24.2% in the first quarter from 23.9% in the fourth quarter.

The unemployment in France remains at high levels since French President Francois Hollande took office in 2012.

The French government is struggling to bring down unemployment.

-

11:28

Core machinery orders in Japan jump 5.5% in March

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan jumped 5.5% in March, beating expectations for a 0.5% increase, after a 9.2% drop in February.

The total number of machinery orders climbed 2.0% in March from a month earlier.

Orders from non-manufacturers were down 6.9% in March, while orders from manufacturers jumped 19.7%.

On a yearly basis, core machinery orders climbed 3.2% in March, beating expectations for a 0.8% rise, after a 0.7% decrease in February.

-

11:10

Construction production in the Eurozone declines 0.9% in March

The Eurostat released its construction production data for the Eurozone on Thursday. Construction production in the Eurozone declined 0.9% in March, after a 0.6% fall in February. February's figure was revised up from a 1.1% drop.

Civil engineering output slid 2.0% in March, while production in the building sector was down 0.8%.

On a yearly basis, construction output fell 0.5% in March, after a 3.4% gain in February. February's figure was revised up from a 2.5% increase.

Civil engineering output decreased 2.9% year-on-year in March, while production in the building sector rose 0.1%.

-

11:00

Eurozone: Construction Output, y/y, March -0.5%

-

10:55

Australia's unemployment rate remains unchanged at 5.7% in April

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate remained unchanged at 5.7% in April. Analysts had expected the unemployment rate to rise to 5.8%.

The number of employed people in Australia increased by 10,800 in April, missing forecast of a rise by 12,500, after a decline by 25,700 in March. March's figure was revised down from a rise by 26,100.

Full-time employment declined by 9,300 in April, while part-time employment climbed by 20,200.

The participation rate declined to 64.8% in April from 64.9% in March.

-

10:42

UK retail sales climb 1.3% in April

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.3% in April, exceeding expectations for a 0.5% gain, after a 0.5% decline in March. March's figure was revised up from a 1.3% decrease.

Food sales were up 0.1% in April, while non-food store sales increased 2.5%.

On a yearly basis, retail sales in the U.K. jumped 4.3% in April, beating forecasts of a 2.5% increase, after a 3.0% rise in March. March's figure was revised up from a 2.7% gain.

-

10:30

United Kingdom: Retail Sales (MoM), April 1.3% (forecast 0.5%)

-

10:30

United Kingdom: Retail Sales (YoY) , April 4.3% (forecast 2.5%)

-

10:23

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00 (USD 381m) 108.50 (382m) 108.95-109.10 109.25 (1.86bln) 109.25 (550m) 110.00 (567m) 111.00 (526m)

EUR/USD: 1.1100 (EUR 474m) 1.1145-50 (313m) 1.1220 (495m) 1.1235 (225m) 1.1250 (408m) 1.1280-90 (546m) 1.1295-1.1305 (887m) 1.1315 (247m) 1.1355 (332m) 1.1379-80 (503m) 1.1500 (1.52bln)

GBP/USD 1.4412 (GBP 389m) 1.4500 (588m) 1.4600 (220m)

USD/CHF 0.9800 (USD 567m)

AUD/USD 0.7250 (AUD 313m) 0.7500 (1.07bln)

USD/CAD 1.3000 (238m)

NZD/USD 0.6835 (NZD 429m)

EUR/JPY 121.50 (EUR 340m)

-

10:22

UBS upgrades its growth forecasts for Germany, France and Spain

Swiss bank UBS upgraded on Wednesday its growth forecasts for Germany, France and Spain for 2016, but downgraded its forecast for Italy. The German economy is expected to expand 1.6% in 2016, up from the previous estimate of a 1.4% rise, the French economy is expected to grow 1.5%, up from the previous estimate of a 1.2% increase, while the Spanish economy is expected to expand 2.9%, up from the previous estimate of a 2.6% gain.

UBS expects the Italian economy to grow 1.1% in 2016, down from the previous estimate of a 1.1% growth.

-

10:10

Fed’s April monetary policy meeting minutes: Fed officials will support an interest rate hike in June if the U.S. economy continues to improve

The Fed released its April monetary policy meeting minutes on Wednesday. The Fed kept its interest rate unchanged in April. The minutes showed that most Fed officials would support an interest rate hike in June if the U.S. economy continued to improve.

"Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labour market conditions continuing to strengthen, and inflation making progress toward the Committee's 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June," the minutes said.

Fed officials noted that the interest rate decision would depend on the incoming economic data.

Kansas City Fed President Esther George for an interest rate hike.

-

09:15

WSE: After opening

WIG20 index opened at 1844.07 points (+0.12%)*

WIG 46489.70 -0.26%

WIG30 2040.71 -0.39%

mWIG40 3547.11 -0.07%

*/ - change to previous close

The cash market (the WIG20 index) started the day with increase of 0.12% to 1,844 points, but quickly moved to the red side of trading. We may see continuation of the pressure on energy companies. The German DAX already lost 1%, which does not help the Warsaw Stock Exchange.

-

08:40

Asian session: The Australian dollar hit a two-and-a-half month low

The Australian dollar hit a two-and-a-half month low after mixed Australian jobs data sparked some speculative selling though the numbers were unlikely to build the case for an imminent rate cut by the Reserve Bank of Australia.

The dollar stood tall and set a three-week high against the yen on Thursday, after the minutes of the U.S. Federal Reserve's latest policy meeting rekindled expectations for a June interest rate hike. While the dollar could see further gains against the yen in the near term, the pace is likely to become more gradual given the potential for dollar-selling by Japanese exporters, said a trader for a Japanese bank in Tokyo. A number of major Japanese exporters have set their dollar/yen exchange rate assumptions for the 2016/17 business year, which began in April, at levels around 110 yen to 105 yen.

The dollar's rebound against the yen no doubt came as a relief to Japanese officials, who were concerned that the yen's recent strength would stifle Japan's nascent economic recovery. Currency stability is likely to be a topic at the G7 finance leaders' meeting in Sendai, northern Japan on Friday and Saturday. The meeting could expose a rift on issues ranging from currency to fiscal policies within the group of advanced economies.

Data earlier this week showed U.S. consumer prices increased the most in three years in April while industrial output and housing starts both rebounded, suggesting the economy was regaining steam at the start of the second quarter after almost stalling early in the year.

EUR/USD: during the Asian session the pair fell to $1.1210

GBP/USD: during the Asian session the pair fell to $1.4565

USD/JPY: during the Asian session the pair traded in the range of Y109.90-20

Based on Reuters materials -

08:38

Options levels on thursday, May 19, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1425 (4772)

$1.1354 (3028)

$1.1303 (2911)

Price at time of writing this review: $1.1221

Support levels (open interest**, contracts):

$1.1162 (3369)

$1.1135 (9693)

$1.1103 (4774)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 68258 contracts, with the maximum number of contracts with strike price $1,1550 (4903);

- Overall open interest on the PUT options with the expiration date June, 3 is 89017 contracts, with the maximum number of contracts with strike price $1,1200 (9693);

- The ratio of PUT/CALL was 1.30 versus 1.31 from the previous trading day according to data from May, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.4902 (1923)

$1.4804 (1616)

$1.4707 (1853)

Price at time of writing this review: $1.4598

Support levels (open interest**, contracts):

$1.4492 (1244)

$1.4395 (1380)

$1.4297 (2634)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 31530 contracts, with the maximum number of contracts with strike price $1,4600 (2474);

- Overall open interest on the PUT options with the expiration date June, 3 is 33874 contracts, with the maximum number of contracts with strike price $1,4200 (2952);

- The ratio of PUT/CALL was 1.07 versus 1.07 from the previous trading day according to data from May, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

WSE: Before opening

The beginning of today's session will react to published yesterday's evening the minutes of the last FOMC meeting. Most of the members was ready to raise rates in June, provided the improvement of the economic condition in the second quarter. The likelihood of changes in interest at the next meeting implied by the derivatives market grew from 19% to 34%. This caused the reaction of reinforcing the dollar and creating pressure on the market of raw materials and the stock market as well. The S&P500 index, despite earlier gains, ended yesterday's session at neutral level. The US futures market falls slightly in the morning. Asians markets were dominated by caution and a slight decline.

This will also create pressure on the Warsaw Stock Exchange, which is one of the emerging markets. Disturbing is also the situation in our domestic politics.

Yesterday, a warning was issued by Fitch, the third rating agency, and the European Commission undertook in relation to Poland the next step in the procedure for the rule of law, indicating that by the next Monday communicate Warsaw its opinion on the constitutional crisis, provided that any "significant progress" will not happen until this time.

-

06:43

Global Stocks

European stocks advanced Wednesday as food wholesaler Booker Group PLC helped to offset a slump in miners, which were pinched by a strengthening dollar. Booker Group BOK, +6.06% shares jumped 6.1% after Goldman Sachs raised its rating on the food wholesaler to buy. Booker, the Stoxx 600's biggest winner on Wednesday, will release financial results on Thursday.

U.S. stocks finished little-changed late Wednesday following a bumpy session after minutes from the Federal Reserve's most recent meeting indicated that "most" of its members are ready to lift rates as early as June. The minutes of the April 26-27 Federal Open Market Committee meeting appeared to echo concerns articulated in recent speeches from Fed officials, namely that the market is too complacent about the U.S. central bank's intentions to normalize interest-rate policy sooner rather than later.

Asian stocks fell after minutes of the Federal Reserve's April meeting showed policy makers discussed raising interest rates as early as next month. Commodity shares led the retreat. The Fed's statement indicated most policy makers said a rate hike would be appropriate in June if the economy continued to improve.

Based on MarketWatch materials

-

04:03

Nikkei 225 16,646.77 +2.08 +0.01 %, Hang Seng 19,663.66 -162.75 -0.82 %, Shanghai Composite 2,815.64 +8.13 +0.29 %

-

03:30

Australia: Changing the number of employed, April 10.8 (forecast 12.5)

-

03:30

Australia: Unemployment rate, April 5.7% (forecast 5.8%)

-

01:52

Japan: Core Machinery Orders, March 5.5% (forecast 0.5%)

-

01:51

Japan: Core Machinery Orders, y/y, April 3.2% (forecast 0.8%)

-

00:35

Commodities. Daily history for May 18’2016:

(raw materials / closing price /% change)

Oil 47.89 -0.62%

Gold 1,259.80 -1.15%

-

00:33

Stocks. Daily history for Sep Apr May 18’2016:

(index / closing price / change items /% change)

Nikkei 225 16,644.69 -8.11 -0.05 %

Hang Seng 19,826.41 -292.39 -1.45 %

S&P/ASX 200 5,356.16 -39.71 -0.74 %

Shanghai Composite 2,807.15 -36.53 -1.28 %

FTSE 100 6,165.8 -1.97 -0.03 %

CAC 40 4,319.3 +21.73 +0.51 %

Xetra DAX 9,943.23 +53.04 +0.54 %

S&P 500 2,047.63 +0.42 +0.02 %

NASDAQ Composite 4,739.12 +23.39 +0.50 %

Dow Jones 17,526.62 -3.36 -0.02 %

-

00:32

Currencies. Daily history for May 18’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1216 -0,85%

GBP/USD $1,4595 +0,92%

USD/CHF Chf0,9877 +0,76%

USD/JPY Y110,18 +0,96%

EUR/JPY Y123,58 +0,12%

GBP/JPY Y160,81 +1,88%

AUD/USD $0,7222 -1,38%

NZD/USD $0,6735 -1,08%

USD/CAD C$1,3026 +0,93%

-