Noticias del mercado

-

23:58

Schedule for today, Friday, Mar 20’2015:

(time / country / index / period / previous value / forecast)

02:00 New Zealand Credit Card Spending February +6.2%

02:10 Australia RBA's Governor Glenn Stevens Speech

06:00 Germany Producer Price Index (YoY) February -2.2%

07:00 Germany Producer Price Index (MoM) February -0.6% +0.2%

09:00 Eurozone Current account, adjusted, bln January 17.8 21.3

09:00 Eurozone Current account, unadjusted, bln January 29.2

09:30 United Kingdom PSNB, bln February -9.7 7.7

10:00 Eurozone EU Economic Summit

12:30 Canada Retail Sales, m/m January -2.0% -0.3%

12:30 Canada Retail Sales YoY January +4.0%

12:30 Canada Retail Sales ex Autos, m/m January -2.3% +0.1%

12:30 Canada Consumer Price Index m / m February -0.2% +0.7%

12:30 Canada Consumer price index, y/y February +1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m February +0.2% +0.5%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February +2.2%

14:20 U.S. FOMC Member Dennis Lockhart Speaks

-

17:31

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies, recovering its losses after the Fed's monetary policy decision on Wednesday

The U.S. dollar traded mixed to higher against the most major currencies, recovering its losses after the Fed's monetary policy decision on Wednesday. The Fed kept its monetary policy unchanged but dropped the word "patient" from its outlook for monetary policy. The central bank lowered its forecasts for growth and inflation.

The Philadelphia Federal Reserve Bank's manufacturing index declined to 5.0 in March from 5. 2 in February, missing expectations for a rise to 7.3. That was the lowest reading since February 2014. The index fell the fourth consecutive month.

A reading above zero indicates expansion.

The decline was driven by a slowdown in new order growth, decrease in unfilled orders and the average workweek for employees, and lower inventories and shipments.

The Conference Board's leading economic index climbed by 0.2% in February, missing expectations a 0.3% gain, after a 0.2% increase in January.

The number of initial jobless claims in the week ending March 14 in the U.S. rose by 1,000 to 291,000 from 290,000 in the previous week. The previous week's figure was revised down from 289,000. Analysts had expected the number of initial jobless claims to decrease to 297,000.

The U.S. current account deficit widened to $113.5 billion in the fourth quarter from $98.9 billion in the third quarter, missing expectations for a deficit of $103.0 billion. The third's quarter figure was revised up from a deficit of $100.3 billion.

The euro traded lower against the U.S. dollar on concerns over Greek's bailout talks. The European Central Bank (ECB) said on Thursday that banks borrowed €97.8 billion in loans, the so-called TLTROs. This figure indicates that the recovery in the Eurozone is spurring lending.

The ECB said in its economic bulletin that the economic activity is expected to rise due to the recent improvements in business and consumer confidence, falling oil prices and a weaker euro.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. The Swiss National Bank's (SNB) kept its interest rate unchanged at -0.75%. Analysts had expected this decision.

The SNB President Thomas Jordan said that the Swiss franc is overvalued and the central bank will intervene in the foreign exchange market if needed.

Switzerland's central bank lowered its growth and inflation forecasts. The SNB expects GDP to grow 0.9% in 2015, down from a December estimate of +2.1%. GDP for 2016 was cut to 1.8% from 2.4%.

The inflation forecast for 2015 was lowered to -1.1% from -0.1%. The SNB expect that inflation will be at -0.5%. Inflation is expected to be 0.4% in 2017.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after New Zealand's GDP. New Zealand's GDP rose 0.8% in the fourth quarter, in line with expectations, after a 0.9% gain in the third quarter. The third's quarter figure was revised down from a 1.0% rise.

On a yearly basis, New Zealand's GDP climbed by 3.5% in the fourth quarter, after a 3.2% rise in the third quarter.

In 2014 as a whole, New Zealand's economy climbed by 3.3%, the fastest pace since 2007.

The Australian dollar fell against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen declined against the greenback in the absence of any major economic reports from Japan.

-

16:59

U.S. leading economic index increased 0.2% in February

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index climbed by 0.2% in February, missing expectations a 0.3% gain, after a 0.2% increase in January.

The increase was driven by rises of seven of the ten indicators.

The Conference Board economist Ataman Ozyildirim said that the leading economic index "remains in growth territory, but weakness in the industrial sector and business investment is holding economic growth back, despite improvements in labor markets and consumer confidence".

-

16:27

European Central Bank: banks borrowed €97.8 billion in loans

The European Central Bank (ECB) said on Thursday that banks borrowed €97.8 billion in loans, the so-called TLTROs. This figure indicates that the recovery in the Eurozone is spurring lending.

The ECB is offering banks the loans as part of its stimulus measures to spur Eurozone's economy and to boost inflation to its 2% target.

The ECB said there were 143 bidders for this week's TLTROs. Italian banks had been expected to be the biggest borrowers.

Banks borrowed €82.6 billion in September and €129.8 billion euros of the four-year TLTRO loans in December.

-

15:54

Philadelphia Federal Reserve Bank’s manufacturing index declines to 5.0 in March

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index declined to 5.0 in March from 5. 2 in February, missing expectations for a rise to 7.3. That was the lowest reading since February 2014.

The index fell the fourth consecutive month.

A reading above zero indicates expansion.

The decline was driven by a slowdown in new order growth, decrease in unfilled orders and the average workweek for employees, and lower inventories and shipments.

Shipments index declined to -7.8 in March from +8.1 in February.

The unfilled orders index dropped to -13.8 in March from +7.3 in February, while the new orders index plunged to 3.9 from 5.4.

The number of employees index was up to 3.5 in March from 3.9 last month.

The prices paid index fell to -3.0 in March from +4.7 in February, while the prices received index plunged to -6.4 from -0.2.

The diffusion index for future activity rose to 32.0 in March from 29.7 in February.

According to the report, the indicators of future activity continue to show that the manufacturing sector is expected to continue growing over the next six months.

-

15:22

Swiss National Bank President Thomas Jordan: inflation could decline below zero in short terms

The Swiss National Bank (SNB) President Thomas Jordan said on Thursday that the Swiss franc is overvalued and the central bank will intervene in the foreign exchange market if needed.

Mr Jordan noted that it was the right decision to discontinue the minimum exchange rate of 1.20 per euro.

The SNB president expects that inflation could decline below zero in short terms, but inflation will be positive in early 2017.

He pointed out that there will a slowdown in economy in the first half of the year.

Mr Jordan declined to comment on whether the SNB has intervened in the foreign exchange market.

-

15:00

U.S.: Philadelphia Fed Manufacturing Survey, March 5.0 (forecast 7.3)

-

15:00

U.S.: Leading Indicators , February +0.2% (forecast +0.3%)

-

14:58

U.S. current account deficit widens to $113.5 billion in the fourth quarter, the largest decline since the second quarter of 2012

The U.S. Commerce Department released its current account data on Thursday. The U.S. current account deficit widened to $113.5 billion in the fourth quarter from $98.9 billion in the third quarter, missing expectations for a deficit of $103.0 billion. It was the largest decline since the second quarter of 2012.

The third's quarter figure was revised up from a deficit of $100.3 billion.

The increase was driven by the slowdown in economic growth in the fourth quarter.

Goods exports fell 1.2% to $410.1 billion as exports of U.S. petroleum and automobiles dropped.

Imports of goods decreased 0.1% to $595.3 billion due to lower petroleum imports.

In 2014 as a whole, the current account deficit climbed 2.6% to $410.6 billion. It was the largest annual deficit since 2012.

-

14:45

Option expiries for today's 10:00 ET NY cut

AUD/USD: 0.7630 (A$230M), 0.7700 (A$314M), 0.7800 (A$2BLN), 0.7915 (A$2BLN)

NZD/USD: 0.7180 (N$441M), 0.7350 (N$201M),

USD/CAD: 1.2750 ($240M), 1.2780 ($320M),

EUR/USD: 1.0500 (E3.3BLN), 1.0600 (E2.1BLN),

GBP/USD: 1.4875 (Gbp252M),1.4910 (Gbp531M), 1.4950 (Gbp717M)

USD/JPY: Y120.00 ($447M), Y121.00 ($330M), Y122.00 ($2.4BLN), Y122.50 ($661M)

EUR/JPY: Y128.50 (E326M), Y130.00 ($258M)

-

14:43

New Zealand's economy rises 3.3% in 2014, the fastest pace since 2007

Statistics New Zealand released it GDP data on Thursday. New Zealand's GDP rose 0.8% in the fourth quarter, in line with expectations, after a 0.9% gain in the third quarter. The third's quarter figure was revised down from a 1.0% rise.

On a yearly basis, New Zealand's GDP climbed by 3.5% in the fourth quarter, after a 3.2% rise in the third quarter.

In 2014 as a whole, New Zealand's economy climbed by 3.3%, the fastest pace since 2007.

Retail trade and accommodation rose 2.3% due to higher tourist spending, while New Zealand's household spending climbed 0.6%.

Rental, hiring, and real estate services added 1.2 percent in Q4.

Real estate services were up more than 20 due to higher house sales.

Banking activity rose due to a 1.1% increase in financial services, while housing investment climbed 5.2%.

Manufacturing activity surged 1.0%. Food, beverage, and tobacco manufacturing increased 1.5%.

-

14:11

Foreign exchange market. European session: the Swiss franc traded lower against the U.S. dollar after the Swiss National Bank’s (SNB) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Bulletin

04:30 Japan All Industry Activity Index, m/m January -0.3% +1.7% +1.9%

06:45 Switzerland SECO Economic Forecasts

07:00 Switzerland Trade Balance February 3.43 2.87 2.47

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75% -0.75%

08:30 Switzerland SNB Press Conference

08:30 Switzerland SNB Monetary Policy Assessment

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone EU Economic Summit

10:15 Eurozone Targeted LTRO 129.8 97.8

12:30 U.S. Initial Jobless Claims March 290 Revised From 289 297 291

12:30 U.S. Current account, bln Quarter IV -98.92 Revised From -100 -103 -113.45

The U.S. dollar rose against the most major currencies, recovering its losses after the Fed's monetary policy decision on Wednesday. The Fed kept its monetary policy unchanged but dropped the word "patient" from its outlook for monetary policy. The central bank lowered its forecasts for growth and inflation.

The number of initial jobless claims in the week ending March 14 in the U.S. rose by 1,000 to 291,000 from 290,000 in the previous week. The previous week's figure was revised down from 289,000. Analysts had expected the number of initial jobless claims to decrease to 297,000.

The U.S. current account deficit widened to $113.5 billion in the fourth quarter from $98.9 billion in the third quarter, missing expectations for a deficit of $103.0 billion. The third's quarter figure was revised up from a deficit of $100.3 billion.

The euro traded lower against the U.S. dollar. The European Central Bank (ECB) said on Thursday that banks borrowed €97.8 billion in loans, the so-called TLTROs. This figure indicates that the recovery in the Eurozone is spurring lending.

The ECB said in its economic bulletin that the economic activity is expected to rise due to the recent improvements in business and consumer confidence, falling oil prices and a weaker euro.

The British pound traded lower against the U.S. dollar as the U.S. dollar continued to recover from yesterday's decline. There were released no major economic reports in the U.K.

The Swiss franc traded lower against the U.S. dollar after the Swiss National Bank's (SNB) interest rate decision. The Swiss National Bank's (SNB) kept its interest rate unchanged at -0.75%. Analysts had expected this decision.

The SNB President Thomas Jordan said that the Swiss franc is overvalued and the central bank will intervene in the foreign exchange market if needed.

Switzerland's central bank lowered its growth and inflation forecasts. The SNB expects GDP to grow 0.9% in 2015, down from a December estimate of +2.1%. GDP for 2016 was cut to 1.8% from 2.4%.

The inflation forecast for 2015 was lowered to -1.1% from -0.1%. The SNB expect that inflation will be at -0.5%. Inflation is expected to be 0.4% in 2017.

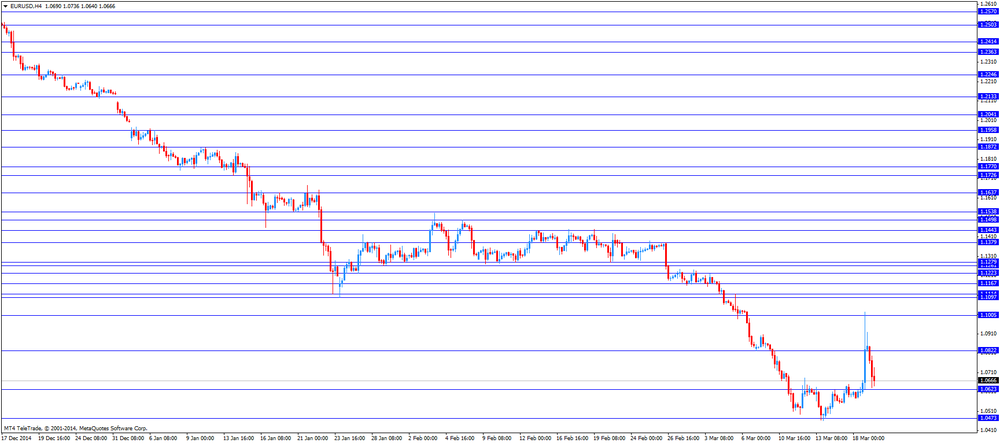

EUR/USD: the currency pair declined to $1.0640

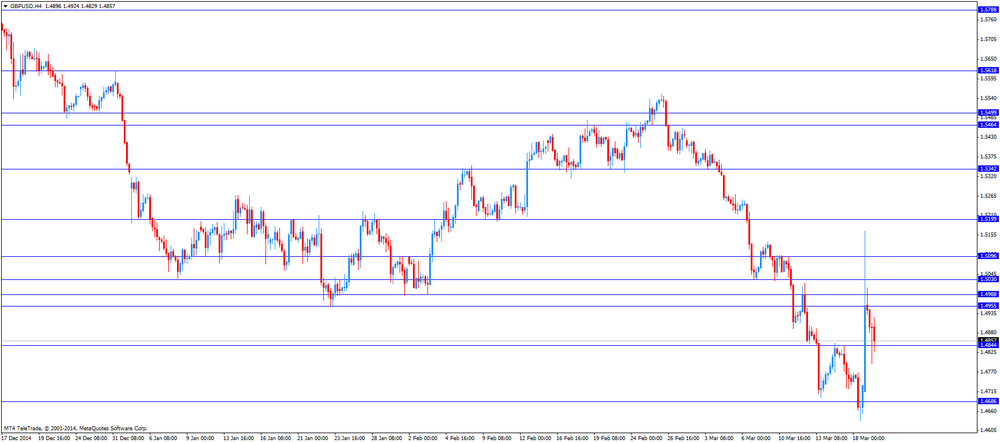

GBP/USD: the currency pair decreased to $1.4794

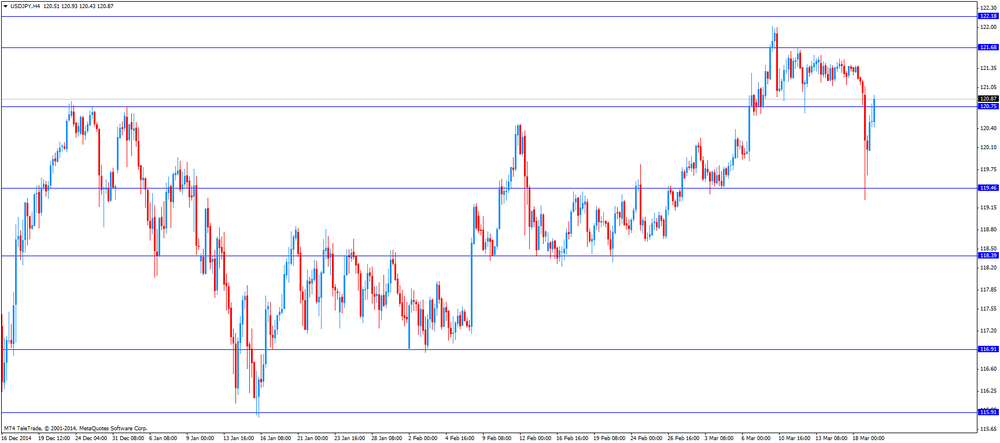

USD/JPY: the currency pair rose to Y120.93

The most important news that are expected (GMT0):

14:00 U.S. Philadelphia Fed Manufacturing Survey March 5.2 7.3

23:50 Japan Monetary Policy Meeting Minutes

-

14:00

Orders

EUR/USD

Offers 1.0800 1.0920 1.1025 1.1100 1.1115

Bids 1.0600 1.0550 1.0500 1.0460 1.0400 1.0300

GBP/USD

Offers 1.5010-00 1.5100 1.5165 1.5200 1.5270

Bids 1.4700 1.4635 1.4600 1.4500

EUR/JPY

Offers 130.00 130.80 131.60 132.00

Bids 128.20 128.00 127.00 126.85 126.55 126.00 124.95

USD/JPY

Offers 121.20 121.80-70 122.00-10 122.35 122.50 122.80 123.00

Bids 119.70 119.30 119.10 119.00 118.60

EUR/GBP

Offers 0.7290 0.7300 0.7325 0.7345

Bids 0.7170 0.7120 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7800 0.7845 0.7860 0.7900 0.7910

Bids 0.7600 0.7590 0.7560 0.7500

-

13:31

U.S.: Current account, bln, Quarter IV -113.45 (forecast -103)

-

13:31

Fed drops the word “patient” from its outlook for monetary policy

The Fed released its interest rate decision on Wednesday. It kept its monetary policy unchanged but dropped the word "patient" from its outlook for monetary policy. That means that the Fed could start to raise its interest rate soon.

The Fed noted that it would hike interest rate when it is "reasonably confident" that low inflation is on track to return to its 2% target and as long as the labour market keeps strengthening.

The Fed Chair Janet Yellen said dropping the word "patient" does not mean that the Fed will start to hike its interest rate. It will depend on the economic data, she noted.

The central bank cut its forecasts of the fed funds rate for 2015 to 0.625% from 1.125%. Inflation forecasts for 2015 were lowered to 1.3% - 1.4% from 1.5% - 1.8%.

The Fed cannot rule out that it starts to raise its interest rate in June, but the pace of rate hikes could be slower than expected.

"It will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium-term," the Fed noted.

The central bank downgraded its economic activity forecast as it said that it said growth has "moderated somewhat". It said in January that the economic growth is solid.

The Fed also said that a stronger U.S. dollar weighs on U.S. exports

-

13:30

U.S.: Initial Jobless Claims, March 291 (forecast 297)

-

13:05

Moody’s warns that Grexit would have “serious consequences” for the Eurozone

Moody's said on Wednesday that if Greece leave the Eurozone, it would have "serious consequences" for the Eurozone. A risk could be that Italy, Spain and Portugal might follow Greece, pushing up their interest on their bonds, the agency said.

Moody's pointed out that France made poor progress with economic reforms.

-

11:21

Eurozone: Targeted LTRO, 97.8

-

11:10

Option expiries for today's 10:00 ET NY cut

AUD/USD: 0.7630 (A$230M), 0.7700 (A$314M), 0.7800 (A$2BLN), 0.7915 (A$2BLN)

NZD/USD: 0.7180 (N$441M), 0.7350 (N$201M),

USD/CAD: 1.2750 ($240M), 1.2780 ($320M),

EUR/USD: 1.0500 (E3.3BLN), 1.0600 (E2.1BLN),

GBP/USD: 1.4875 (Gbp252M),1.4910 (Gbp531M), 1.4950 (Gbp717M)

USD/JPY: Y120.00 ($447M), Y121.00 ($330M), Y122.00 ($2.4BLN), Y122.50 ($661M)

EUR/JPY: Y128.50 (E326M), Y130.00 ($258M)

-

10:35

Press Review: EU's Schulz warns before summit Greek finances are 'dangerous'

BLOOMBERG

The Way Gold Prices Are Set is Changing Forever(Bloomberg) -- Almost a century of tradition will disappear from the gold market as technology takes over.

Thursday will be the last day that traders at four banks agree by phone twice-daily prices used by miners to central banks to deal and value bullion. Gold will be the last precious metal to drop the London fixings after silver, platinum and palladium made way for electronic auctions last year.

More firms able to participate in the benchmark will make the $18 trillion global market more transparent, said ICE Benchmark Administration, which will start running the LBMA Gold Price on Friday. Anyone can follow auctions online, rather than needing a line to a fixing dealer.

REUTERS

EU's Schulz warns before summit Greek finances are 'dangerous'

(Reuters) - European Parliament President Martin Schulz said on Thursday, shortly before EU leaders meet in Brussels, that Greece's financial situation was "dangerous" and it needed two to three billion euros in the short term to avoid bankruptcy.

"Time is short," Schulz told Deutschlandfunk radio just hours before European Union leaders discuss Greece's bailout at their summit. "In the short term, two to three billion (euros) are needed to keep to the existing obligations," he said.

Source: http://www.reuters.com/article/2015/03/19/us-eurocrisis-greece-germany-schulz-idUSKBN0MF0MV20150319

BLOOMBERG

Norway Signals Reduction After Unexpectedly Holding Rate

(Bloomberg) -- Norway's central bank unexpectedly left interest rates unchanged and signaled it's prepared for more pronounced monetary easing to protect the economy against a plunge in oil prices. The krone surged.

The overnight deposit rate was kept at 1.25 percent, the Oslo-based bank said. The decision was forecast by only one of 19 economists surveyed by Bloomberg, while the remainder estimated a cut. The bank predicted its rate may drop to as low as 0.95 percent in the first quarter of next year, versus a December forecast of 1.13 percent. The krone gained 1.96 percent to 8.6979 per euro as of 10:20 a.m.

"If economic developments ahead are broadly in line with that projected, there are prospects for a reduction in the key policy rate," Norges Bank Governor Oeystein Olsen said in a statement. He's scheduled to speak at a press conference at 10:30 a.m. in the Norwegian capital.

-

10:15

SNB keeps rates steady at -0.75% and lowers growth and inflation outlook

Today the Swiss National Bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market as the swiss franc is significantly overvalued and effects inflation and economic growth. The SNB sees inflation at -0.5% in 2016 and growth under 1% - almost half the pace predicted 3 months agp.

On January 15th the SNB abandoned its ceiling on the franc versus the euro in a surprise move. The Swiss export-oriented economy was hit hard by the stronger Swiss franc.

Switzerland's trade balance fell more-than-expected last month to a seasonally adjusted 2.47 billion in February from 3.43 billion in the previous month. Economists expected a decline to 2.87 billion.

-

09:30

Switzerland: SNB Interest Rate Decision, -0.75% (forecast -0.75%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers after yesterday’s slump on FED comments

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Bulletin

04:30 Japan All Industry Activity Index, m/m January -0.3% +1.7% +1.9%

06:45 Switzerland SECO Economic Forecasts

07:00 Switzerland Trade Balance February 3.43 2.87 2.47

The U.S. dollar moderately rebounded from yesterday's slump against its major peers. Yesterday the Federal Reserve, although removing the 'patient' wording from its minutes, lowered forecasts on economic growth and inflation - the strong dollar keeps inflation below the targeted 2% and slows export-growth. FED chair Janet Yellen said that the FED has not yet decided on the timing of a rate hike but it could happen at any FOMC meeting this year. The bank will have a close eye on international developments before hiking rates.

The euro is trading lower after yesterday's gains where the single currency shortly traded as high as USD1.1022 after the more dovish-than-expected FED comments.

The Australian dollar lost against the greenback. In its bulletin the RBA warned that the Chinese government might not stimulate the property market as much as needed and that the market remains a key risk for China's economy. China is Australia's biggest trade partner and the Australian economy strongly depends on its commodity exports to the world's second largest economy.

New Zealand's dollar lost against the greenback during the Asian session. Yesterday data on the country's gross domestic product was reported. The GDP rose quarter on quarter by +0.8%, in line with estimates. Data on the third quarter was revised down from +1.0% to +0.9%. Year on year the GDP rose +3.5%, compared to a previous reading of +3.2%.

The Japanese yen traded lower against the greenback on Thursday currently trading at USD120.46 but slid under the USD120 mark for the first time in three weeks. Japan's All Industry Activity Index rose in January from a previous reading of -0.3% by +1.9%, above the estimated +1.7%. Late in the day at 23:50 GMT the minutes of the Monetary Policy Meeting will be published.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

08:30 Switzerland SNB Press Conference

08:30 Switzerland SNB Monetary Policy Assessment

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone EU Economic Summit

10:15 Eurozone Targeted LTRO 129.8

12:30 U.S. Initial Jobless Claims March 289 297

12:30 U.S. Current account, bln Quarter IV -100 -103

14:00 U.S. Leading Indicators February +0.2% +0.3%

14:00 U.S. Philadelphia Fed Manufacturing Survey March 5.2 7.3

21:45 New Zealand Visitor Arrivals February +0.8%

23:50 Japan Monetary Policy Meeting Minutes

-

08:20

Options levels on thursday, March 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0984 (2174)

$1.0912 (2082)

$1.0856 (3237)

Price at time of writing this review: $1.0756

Support levels (open interest**, contracts):

$1.0671 (2533)

$1.0619 (2464)

$1.0551 (6797)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 63879 contracts, with the maximum number of contracts with strike price $1,1150 (3569);

- Overall open interest on the PUT options with the expiration date April, 2 is 69180 contracts, with the maximum number of contracts with strike price $1,0600 (6797);

- The ratio of PUT/CALL was 1.08 versus 1.12 from the previous trading day according to data from March, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5104 (1716)

$1.5006 (1283)

$1.4910 (1249)

Price at time of writing this review: $1.4867

Support levels (open interest**, contracts):

$1.4790 (1283)

$1.4693 (1538)

$1.4596 (1561)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 25297 contracts, with the maximum number of contracts with strike price $1,5100 (1716);

- Overall open interest on the PUT options with the expiration date April, 2 is 27848 contracts, with the maximum number of contracts with strike price $1,5050 (2364);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from March, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Switzerland: Trade Balance, February 2.47 (forecast 2.87)

-

05:34

Japan: All Industry Activity Index, m/m, January +1.9% (forecast +1.7%)

-

00:32

Currencies. Daily history for Mar 18’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0827 +2,13%

GBP/USD $1,4957 +1,43%

USD/CHF Chf0,9822 -2,40%

USD/JPY Y120,21 -0,95%

EUR/JPY Y130,21 +1,25%

GBP/JPY Y179,8 +0,50%

AUD/USD $0,7740 +1,55%

NZD/USD $0,7468 +2,04%

USD/CAD C$1,2588 -1,57%

-

00:00

Schedule for today, Thursday, Mar 19’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Bulletin

04:30 Japan All Industry Activity Index, m/m January -0.3% +1.7%

06:45 Switzerland SECO Economic Forecasts

07:00 Switzerland Trade Balance February 3.43 2.87

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

08:30 Switzerland SNB Press Conference

08:30 Switzerland SNB Monetary Policy Assessment

09:00 Eurozone ECB Economic Bulletin

10:00 Eurozone EU Economic Summit

10:15 Eurozone Targeted LTRO 129.8

12:30 U.S. Initial Jobless Claims March 289 297

12:30 U.S. Current account, bln Quarter IV -100 -103

14:00 U.S. Leading Indicators February +0.2% +0.3%

14:00 U.S. Philadelphia Fed Manufacturing Survey March 5.2 7.3

21:45 New Zealand Visitor Arrivals February +0.8%

23:50 Japan Monetary Policy Meeting Minutes

-