Noticias del mercado

-

17:33

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies in the absence of any major economic data from the U.S.

The U.S. dollar traded lower against the most major currencies in the absence of any major economic data from the U.S.

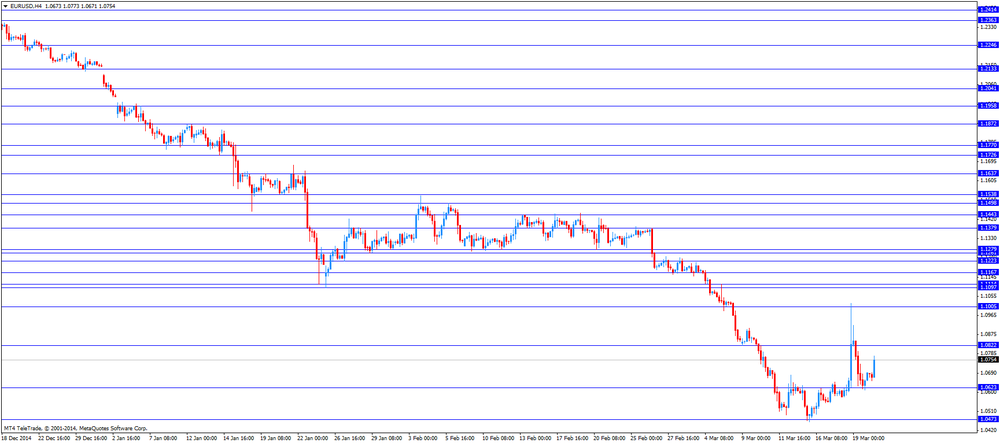

The euro traded higher against the U.S. dollar as the European Commission said that it commits €2 billion to help Greece.

Eurozone's adjusted current account surplus rose to €29.4 billion in January from €22.5 billion in December. December's figure was revised up from a surplus of €17.8 billion. Analysts had expected a surplus of €21.3 billion.

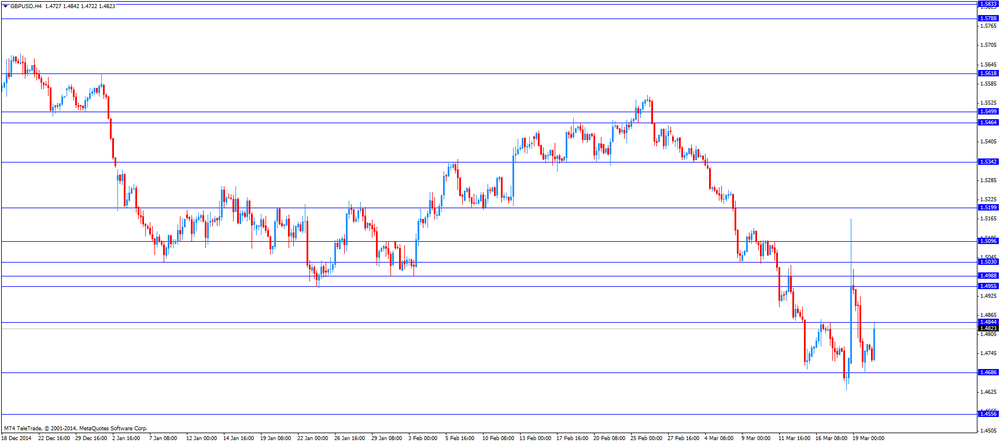

The British pound rose against the U.S. dollar. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes.

The Canadian dollar rose against the U.S. dollar. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February.

The consumer price index was driven by price increases in seven of the index's eight major components.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback. Credit card spending in New Zealand rose 5.8% in February, after a 6.2% gain in January.

The Australian dollar increased against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after comments by the Reserve Bank of Australia (RBA) governor Glenn Stevens. He said in a speech in Melbourne on Friday that while interest rate is expected to be hiked in the U.S., interest rate in Australia it is expected to be cut. The RBA governor noted that interest rate hike in the U.S. will bring turbulence in asset and financial markets.

Stevens thinks that the Australian dollar is likely to depreciate further despite the recent decline.

The RBA governor pointed out that a weaker Australian dollar is assisting the major transition from mining driven growth to other sectors of Australia's economy.

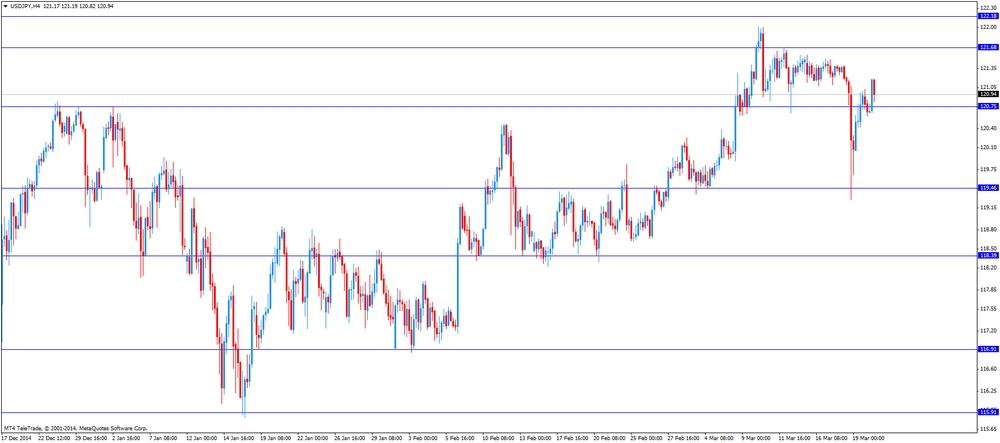

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the Bank of Japan's (BoJ) minutes. The central bank said that Japan's economy continues to recover moderately.

The BoJ board members noted that stimulus measures have the desired effects. They added that consumer inflation slowed due to falling energy prices.

-

16:40

Ex Federal Reserve Bank of Dallas Richard Fisher: stocks in the U.S. are “hyper-overpriced”

Ex Federal Reserve Bank of Dallas Richard Fisher said on Friday that stocks in the U.S. are "hyper-overpriced" in part because interest rate remained low too long. He added that he think that there will be a significant equity market correction.

-

16:04

Atlanta Federal Reserve President Dennis Lockhart: U.S. regulators should intensify monitoring of shadow banks

The Atlanta Federal Reserve President Dennis Lockhart said on Friday that U.S. regulators should intensify monitoring of shadow banks. He added that too much regulation could hurt economic growth.

"Shadow banking activity is large, growing, and opaque," he noted.

-

15:39

Public sector net borrowing in the U.K. climbs to £6.2 billion in February

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes. Income tax related payments climbed 16.3%, corporation tax rose 11.9%, while stamp duties dropped 9.6%.

-

15:23

Canadian retail sales drops by 1.7% in January

Statistics Canada released retail sales data on Friday. Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Sales at gasoline stations dropped 8.8% in January, the largest decline since November 2008.

Motor vehicle and parts sales fell 1.4%.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

-

15:01

Canadian consumer price inflation climbs 0.9% in February

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February. It was the lowest since November 2013.

The consumer price index was driven by price increases in seven of the index's eight major components.

Gasoline prices plunged 21.8% in February, while natural gas rose 10.8%.

Food prices increased 3.9%.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

The Bank of Canada's inflation target is the range of 1% to 3%.

-

14:55

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500 (E1.2bn), $1.0600(E1.1bn), $1.0700(E932mn), $1.0800(E2.7bn)

USD/JPY: Y120.00 ($1.1bn), Y120.50($900mn), Y121.00($3.65bn), Y121.50($695mn), Y122.00($2.22bn)

GBP/USD: $1.4700(Gbp210mn), $1.4900 (Gbp309mn)

USD/CHF: Chf0.9900($255mn), Chf1.0000($251mn), Chf1.0100($401mn)

AUD/USD: $0.7625(A$847mn), $0.7700(A$752mn), $0.7750(A$1.3bn), $0.7800(A$400mn)

NZD/USD: $0.7300(NZ$570mn), $7325(NZ$612mn), $0.7350(NZ$926mn)

USD/CAD: C$1.2700($250mn), C$1.2750($1.2bn), C$1.2800($1.3bn)

-

14:08

Foreign exchange market. European session: the Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 New Zealand Credit Card Spending February +6.2% +5.8%

02:10 Australia RBA's Governor Glenn Stevens Speech

07:00 Germany Producer Price Index (MoM) February -0.6% +0.2% +0.1%

07:00 Germany Producer Price Index (YoY) February -2.2% -2.1%

09:00 Eurozone Current account, adjusted, bln January 22.5 Revised From 17.8 21.3 29.4

09:00 Eurozone Current account, unadjusted, bln January 35.2 Revised From 29.2 8.2

09:30 United Kingdom PSNB, bln February -8.9 Revised From -9.7 7.7 6.2

10:00 Eurozone EU Economic Summit

12:30 Canada Retail Sales, m/m January -1.8% Revised From -2.0% -0.3% -1.7%

12:30 Canada Retail Sales YoY January +4.0% +1.2%

12:30 Canada Retail Sales ex Autos, m/m January -2.0% Revised From -2.3% +0.1% -1.8%

12:30 Canada Consumer Price Index m / m February -0.2% +0.7% +0.9%

12:30 Canada Consumer price index, y/y February +1.0% +1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m February +0.2% +0.5% +0.6%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February +2.2% +2.1%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic data from the U.S.

The euro traded higher against the U.S. dollar as Greece and the European Union has agreed to implement a new reform plan.

Eurozone's adjusted current account surplus rose to €29.4 billion in January from €22.5 billion in December. December's figure was revised up from a surplus of €17.8 billion. Analysts had expected a surplus of €21.3 billion.

The British pound traded higher against the U.S. dollar after the better-than-expected public sector net borrowing data from the U.K. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February.

The consumer price index was driven by price increases in seven of the index's eight major components.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

EUR/USD: the currency pair rose to $1.0773

GBP/USD: the currency pair increased to $1.4842

USD/JPY: the currency pair climbed to Y121.19

The most important news that are expected (GMT0):

14:20 U.S. FOMC Member Dennis Lockhart Speaks

-

13:45

Orders

EUR/USD

Offers 1.0800 1.0920 1.1025 1.1100 1.1115

Bids 1.0600 1.0550 1.0500 1.0460 1.0400 1.0300

GBP/USD

Offers 1.4865-60 1.5010-00 1.5100 1.5165 1.5200 1.5270

Bids 1.4790-00 1.4635 1.4600 1.4500

EUR/JPY

Offers 130.00 130.80 131.60 132.00

Bids 128.20 128.00 127.00 126.85 126.55 126.00 124.95

USD/JPY

Offers 121.40 121.80-70 122.00-10 122.35 122.50 122.80 123.00

Bids 120.60 120.00 119.70 119.30 119.10 119.00 118.60

EUR/GBP

Offers 0.7290 0.7300 0.7325 0.7345

Bids 0.7200 0.7170 0.7120 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7700 0.7800 0.7845 0.7860 0.7900 0.7910

Bids 0.7600 0.7590 0.7560 0.7500

-

13:41

Reserve Bank of Australia governor Glenn Stevens: interest rate hike in the U.S. will bring turbulence in asset and financial markets

The Reserve Bank of Australia (RBA) governor Glenn Stevens said in a speech in Melbourne on Friday that while interest rate is expected to be hiked in the U.S., interest rate in Australia it is expected to be cut. He noted that interest rate hike in the U.S. will bring turbulence in asset and financial markets.

Stevens thinks that the Australian dollar is likely to depreciate further despite the recent decline.

The RBA governor pointed out that a weaker Australian dollar is assisting the major transition from mining driven growth to other sectors of Australia's economy.

Stevens also said that Australian businesses and households are less optimistic about the future.

-

13:32

Canada: Retail Sales YoY, January +1.2%

-

13:31

Canada: Retail Sales, m/m, January -1.7% (forecast -0.3%)

-

13:31

Canada: Consumer price index, y/y, February +1.0%

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, February +2.1%

-

13:30

Canada: Retail Sales ex Autos, m/m, January -1.8% (forecast +0.1%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, February +0.6% (forecast +0.5%)

-

13:30

Canada: Consumer Price Index m / m, February +0.9% (forecast +0.7%)

-

13:10

Bank of Japan minutes: consumer inflation slowed due to falling energy prices

The Bank of Japan (BoJ) released its minutes from February meeting. The central bank said that Japan's economy continues to recover moderately.

The BoJ board members noted that stimulus measures have the desired effects. They added that consumer inflation slowed due to falling energy prices.

The central bank voted 8-1 to keep its monetary policy unchanged.

Japan's central bank downgraded its consumer inflation forecast to around 0.5% from the range of 0.5% - 1.0%.

-

11:14

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500 (E1.2bn), $1.0600(E1.1bn), $1.0700(E932mn), $1.0800(E2.7bn)

USD/JPY: Y120.00 ($1.1bn), Y120.50($900mn), Y121.00($3.65bn), Y121.50($695mn), Y122.00($2.22bn)

GBP/USD: $1.4700(Gbp210mn), $1.4900 (Gbp309mn)

USD/CHF: Chf0.9900($255mn), Chf1.0000($251mn), Chf1.0100($401mn)

AUD/USD: $0.7625(A$847mn), $0.7700(A$752mn), $0.7750(A$1.3bn), $0.7800(A$400mn)

NZD/USD: $0.7300(NZ$570mn), $7325(NZ$612mn), $0.7350(NZ$926mn)

USD/CAD: C$1.2700($250mn), C$1.2750($1.2bn), C$1.2800($1.3bn)

-

10:30

United Kingdom: PSNB, bln, February 6.2 (forecast 7.7)

-

10:20

Press Review: Greek PM assures EU creditors reforms coming to unlock cash

BLOOMBERG

More Iran Oil May Flow Within Months of Deal, Officials Say

(Bloomberg) -- World powers have offered to suspend U.S. and European restrictions on Iranian oil exports, but only if the Islamic Republic accepts strict limits on its nuclear program for at least a decade, according to American and European officials.

The offer to begin lifting some sanctions within months of a deal comes amid the effort in Lausanne, Switzerland to reach the framework of an agreement by the end of the month, with the outcome still in doubt.

Iran has yet to agree to such conditions in exchange for relief from oil and banking sanctions. Even if the Islamic Republic does, the limits on its oil exports would be suspended only after it complied with an initial set of restrictions, such as disconnecting the majority of the centrifuges it uses to enrich uranium and submitting them for verification, said the officials, who spoke to Bloomberg News on condition of anonymity to describe the private negotiations.

REUTERS

Greek PM assures EU creditors reforms coming to unlock cash(Reuters) - Greek Prime Minister Alexis Tsipras assured European Union creditors at late-night crisis talks in Brussels that his leftist-led coalition would present soon a full set of economic reforms in order to unlock cash to stave off bankruptcy.

After two months of mounting frustration on both sides since Tsipras was elected with a mandate to end years of austerity imposed by creditors' conditions, the three-hour meeting on the sidelines of an EU summit was requested by Tsipras to break an impasse that risks seeing Athens stumble out of the euro zone.

But while a joint statement by the EU institutions spoke of a "spirit of mutual trust" and Tsipras said he left feeling more optimistic, German Chancellor Angela Merkel stressed no money would be released before Athens implements budget measures and other reforms that it has so far been reluctant to consent to.

Source: http://www.reuters.com/article/2015/03/20/us-eurozone-greece-idUSKBN0MF0WY20150320

BLOOMBERG

Yuan Nearing PBOC Rate Spurs Band Speculation: Chart

(Bloomberg) -- The yuan is converging with the central bank's reference rate at a record pace, a sign to ING Groep NV that China may be planning to widen the currency's daily trading band.

The CHART OF THE DAY shows the gap has narrowed to 0.6 percent in Shanghai, having been on the cusp of its 2 percent limit at the start of the month. The People's Bank of China doubled the yuan's trading range a year ago after the difference narrowed to less than 0.3 percent from a January 2014 average of 0.9 percent. Intervention may be a factor behind the latest convergence, according to Standard Chartered Plc and Overseas-Chinese Banking Corp Ltd.

"It's like a parallel with a year ago as they are in a concerted effort to push the spot away from the band's limit," Tim Condon, head of Asia research at ING in Singapore, said by phone. "A wider band is in line with the thinking that China wants more market forces in determining the exchange rate."

-

10:00

Eurozone: Current account, adjusted, bln , January 29.4 (forecast 21.3)

-

10:00

Eurozone: Current account, unadjusted, bln , January 8.2

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers as markets digest the FED comments

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 New Zealand Credit Card Spending February +6.2% +5.8%

02:10 Australia RBA's Governor Glenn Stevens Speech

06:00 Germany Producer Price Index (YoY) February -2.2% +0.1%

07:00 Germany Producer Price Index (MoM) February -0.6% +0.2 -2.1%%

The U.S. dollar is trading mixed against its major peers. On Wednesday the Fed kept its monetary policy unchanged but dropped the word "patient" from its outlook for monetary policy. The central bank lowered its forecasts for growth and inflation.

Yesterday the Philadelphia Federal Reserve Bank's manufacturing index declined to 5.0 in March from 5. 2 in February, missing expectations for a rise to 7.3. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending March 14 in the U.S. rose by 1,000 to 291,000 from 290,000 in the previous week. The U.S. current account deficit widened to $113.5 billion in the fourth quarter from $98.9 billion in the third quarter, missing expectations for a deficit of $103.0 billion.

The euro is trading moderately higher after yesterday's sell-off.

The Australian dollar rebounded from yesterday's slump. Reserve Bank governor Glenn Stevens held a speech at the American Chamber of Commerce in Australia today. He said that the country is likely to enter a phase of below-average economic growth. The RBA will take the necessary steps to reduce the impact on the economy in this phase of transition but also mentioned that the options for and the impact of measures taken by the bank are limited.

New Zealand's dollar gained against the greenback during the Asian session. Data in Credit Card Spending came in at +5.8% for February compared to +6.2% in January.

The Japanese yen traded slightly lower against the greenback on Friday after the minutes of the Monetary Policy Meeting were published yesterday late in the day. The minutes showed concern that even with a better outlook on economic growth the inflation target of 2% might not be reached and wages could decline as a consequence of low oil prices. Some members expressed that the pace of easing has to be re-assessed.

EUR/USD: the euro traded moderately higher against the greenback

USD/JPY: the U.S. dollar traded slightly higher against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Current account, adjusted, bln January 17.8 21.3

09:00 Eurozone Current account, unadjusted, bln January 29.2

09:30 United Kingdom PSNB, bln February -9.7 7.7

10:00 Eurozone EU Economic Summit

12:30 Canada Retail Sales, m/m January -2.0% -0.3%

12:30 Canada Retail Sales YoY January +4.0%

12:30 Canada Retail Sales ex Autos, m/m January -2.3% +0.1%

12:30 Canada Consumer Price Index m / m February -0.2% +0.7%

12:30 Canada Consumer price index, y/y February +1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m February +0.2% +0.5%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February +2.2%

14:20 U.S. FOMC Member Dennis Lockhart Speaks

-

08:18

Options levels on friday, March 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0854 (2635)

$1.0790 (1391)

$1.0742 (1399)

Price at time of writing this review: $1.0660

Support levels (open interest**, contracts):

$1.0599 (2451)

$1.0563 (2216)

$1.0511 (6502)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 64688 contracts, with the maximum number of contracts with strike price $1,1100 (3583);

- Overall open interest on the PUT options with the expiration date April, 2 is 69497 contracts, with the maximum number of contracts with strike price $1,0600 (6502);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from March, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5003 (1285)

$1.4906 (1283)

$1.4809 (695)

Price at time of writing this review: $1.4741

Support levels (open interest**, contracts):

$1.4688 (1850)

$1.4592 (1404)

$1.4494 (615)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 25953 contracts, with the maximum number of contracts with strike price $1,5100 (1650);

- Overall open interest on the PUT options with the expiration date April, 2 is 28154 contracts, with the maximum number of contracts with strike price $1,5050 (2333);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from March, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Producer Price Index (YoY), February -2.1%

-

08:00

Germany: Producer Price Index (MoM), February +0.1% (forecast +0.2%)

-

03:04

New Zealand: Credit Card Spending, February +5.8%

-

00:31

Currencies. Daily history for Mar 19’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $1,0656 -1,60%

GBP/USD $1,4754 -1,38%

USD/CHF Chf0,99 +0,79%

USD/JPY Y120,78 +0,47%

EUR/JPY Y128,71 -1,17%

GBP/JPY Y178,2 -0,90%

AUD/USD $0,7647 -1,22%

NZD/USD $0,7412 -0,76%

USD/CAD C$1,2711 +0,97%

-