Noticias del mercado

-

20:00

S&P 500 2,111.4 +22.13 +1.06 %, NASDAQ 5,036.11 +43.74 +0.88 %, Dow 18,177.5 +218.47 +1.22 %

-

18:07

European stocks close: stocks closed higher as the European Commission said that it commits €2 billion to help Greece and on quantitative easing by the European Central Bank

Stock indices closed higher as the European Commission said that it commits €2 billion to help Greece and on quantitative easing by the European Central Bank.

Eurozone's adjusted current account surplus rose to €29.4 billion in January from €22.5 billion in December. December's figure was revised up from a surplus of €17.8 billion. Analysts had expected a surplus of €21.3 billion.

The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,022.51 +60.19 +0.86 %

DAX 12,039.37 +139.97 +1.18 %

CAC 40 5,087.49 +50.31 +1.00 %

-

18:00

European stocks closed: FTSE 100 7,023.14 +60.82 +0.87 %, CAC 40 5,102.66 +65.48 +1.30 %, DAX 12,065.6 +166.20 +1.40 %

-

17:33

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies in the absence of any major economic data from the U.S.

The U.S. dollar traded lower against the most major currencies in the absence of any major economic data from the U.S.

The euro traded higher against the U.S. dollar as the European Commission said that it commits €2 billion to help Greece.

Eurozone's adjusted current account surplus rose to €29.4 billion in January from €22.5 billion in December. December's figure was revised up from a surplus of €17.8 billion. Analysts had expected a surplus of €21.3 billion.

The British pound rose against the U.S. dollar. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes.

The Canadian dollar rose against the U.S. dollar. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February.

The consumer price index was driven by price increases in seven of the index's eight major components.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback. Credit card spending in New Zealand rose 5.8% in February, after a 6.2% gain in January.

The Australian dollar increased against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after comments by the Reserve Bank of Australia (RBA) governor Glenn Stevens. He said in a speech in Melbourne on Friday that while interest rate is expected to be hiked in the U.S., interest rate in Australia it is expected to be cut. The RBA governor noted that interest rate hike in the U.S. will bring turbulence in asset and financial markets.

Stevens thinks that the Australian dollar is likely to depreciate further despite the recent decline.

The RBA governor pointed out that a weaker Australian dollar is assisting the major transition from mining driven growth to other sectors of Australia's economy.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback after the Bank of Japan's (BoJ) minutes. The central bank said that Japan's economy continues to recover moderately.

The BoJ board members noted that stimulus measures have the desired effects. They added that consumer inflation slowed due to falling energy prices.

-

16:40

Ex Federal Reserve Bank of Dallas Richard Fisher: stocks in the U.S. are “hyper-overpriced”

Ex Federal Reserve Bank of Dallas Richard Fisher said on Friday that stocks in the U.S. are "hyper-overpriced" in part because interest rate remained low too long. He added that he think that there will be a significant equity market correction.

-

16:04

Atlanta Federal Reserve President Dennis Lockhart: U.S. regulators should intensify monitoring of shadow banks

The Atlanta Federal Reserve President Dennis Lockhart said on Friday that U.S. regulators should intensify monitoring of shadow banks. He added that too much regulation could hurt economic growth.

"Shadow banking activity is large, growing, and opaque," he noted.

-

15:39

Public sector net borrowing in the U.K. climbs to £6.2 billion in February

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes. Income tax related payments climbed 16.3%, corporation tax rose 11.9%, while stamp duties dropped 9.6%.

-

15:23

Canadian retail sales drops by 1.7% in January

Statistics Canada released retail sales data on Friday. Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Sales at gasoline stations dropped 8.8% in January, the largest decline since November 2008.

Motor vehicle and parts sales fell 1.4%.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

-

15:01

Canadian consumer price inflation climbs 0.9% in February

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February. It was the lowest since November 2013.

The consumer price index was driven by price increases in seven of the index's eight major components.

Gasoline prices plunged 21.8% in February, while natural gas rose 10.8%.

Food prices increased 3.9%.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

The Bank of Canada's inflation target is the range of 1% to 3%.

-

14:55

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500 (E1.2bn), $1.0600(E1.1bn), $1.0700(E932mn), $1.0800(E2.7bn)

USD/JPY: Y120.00 ($1.1bn), Y120.50($900mn), Y121.00($3.65bn), Y121.50($695mn), Y122.00($2.22bn)

GBP/USD: $1.4700(Gbp210mn), $1.4900 (Gbp309mn)

USD/CHF: Chf0.9900($255mn), Chf1.0000($251mn), Chf1.0100($401mn)

AUD/USD: $0.7625(A$847mn), $0.7700(A$752mn), $0.7750(A$1.3bn), $0.7800(A$400mn)

NZD/USD: $0.7300(NZ$570mn), $7325(NZ$612mn), $0.7350(NZ$926mn)

USD/CAD: C$1.2700($250mn), C$1.2750($1.2bn), C$1.2800($1.3bn)

-

14:42

New electronic gold fixing system will be launched today

A near century old London gold fixing will be replaced by an electronic gold fixing system today. Six banks will be able to set gold prices twice a day. The new procedure should make the global gold market more transparent. The gold market will become a partially regulated market, reducing the possibility for price manipulation. Chinese companies may be added in future.

-

14:36

U.S. Stocks open: Dow +0.58%, Nasdaq +0.77%, S&P +0.59%

-

14:26

Before the bell: S&P futures +0.68%, NASDAQ futures +0.79%

U.S. stock-index futures rose as indexes head towards their biggest weekly gain in five.

Global markets:

Nikkei 19,560.22 +83.66 +0.43%

Hang Seng 24,375.24 -93.65 -0.38%

Shanghai Composite 3,617.45 +35.18 +0.98%

FTSE 6,979.36 +17.04 +0.24%

CAC 5,070.31 +33.13 +0.66%

DAX 12,047.91 +148.51 +1.25%

Crude oil $45.40 (-0.33%)

Gold $1170.90 (+0.16%)

-

14:08

Foreign exchange market. European session: the Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 New Zealand Credit Card Spending February +6.2% +5.8%

02:10 Australia RBA's Governor Glenn Stevens Speech

07:00 Germany Producer Price Index (MoM) February -0.6% +0.2% +0.1%

07:00 Germany Producer Price Index (YoY) February -2.2% -2.1%

09:00 Eurozone Current account, adjusted, bln January 22.5 Revised From 17.8 21.3 29.4

09:00 Eurozone Current account, unadjusted, bln January 35.2 Revised From 29.2 8.2

09:30 United Kingdom PSNB, bln February -8.9 Revised From -9.7 7.7 6.2

10:00 Eurozone EU Economic Summit

12:30 Canada Retail Sales, m/m January -1.8% Revised From -2.0% -0.3% -1.7%

12:30 Canada Retail Sales YoY January +4.0% +1.2%

12:30 Canada Retail Sales ex Autos, m/m January -2.0% Revised From -2.3% +0.1% -1.8%

12:30 Canada Consumer Price Index m / m February -0.2% +0.7% +0.9%

12:30 Canada Consumer price index, y/y February +1.0% +1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m February +0.2% +0.5% +0.6%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February +2.2% +2.1%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic data from the U.S.

The euro traded higher against the U.S. dollar as Greece and the European Union has agreed to implement a new reform plan.

Eurozone's adjusted current account surplus rose to €29.4 billion in January from €22.5 billion in December. December's figure was revised up from a surplus of €17.8 billion. Analysts had expected a surplus of €21.3 billion.

The British pound traded higher against the U.S. dollar after the better-than-expected public sector net borrowing data from the U.K. The public sector net borrowing in the U.K. climbed to £6.2 billion in February from -£8.9 billion in January, exceeding expectations for a rise to £7.7 billion. January's figure was revised up from -£9.7 billion.

The decline was driven by a strong recovery income taxes.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data. Canadian consumer price inflation increased 0.9% in February, beating expectations for a 0.7% rise, after a 0.2% drop in January.

On a yearly basis, the consumer price index remained unchanged at 1.0% February.

The consumer price index was driven by price increases in seven of the index's eight major components.

Canadian core consumer price index, which excludes some volatile goods, increased 0.6% in February, exceeding expectations for a 0.5% gain, after a 0.2% rise in January.

On a yearly basis, core consumer price index in Canada declined to 2.1% in February from 2.2% in January.

Canadian retail sales plunged by 1.7% in January, missing expectations for a 0.3% decline, after a 1.8% drop in December. December's figure was revised up from a 2.0% decline.

The drop was driven by lower new cars sales.

Canadian retail sales excluding automobiles dropped 1.8% in January, missing expectations for a 0.1% increase, after a 2.0% fall in December. December's figure was revised up from a 2.3% decrease.

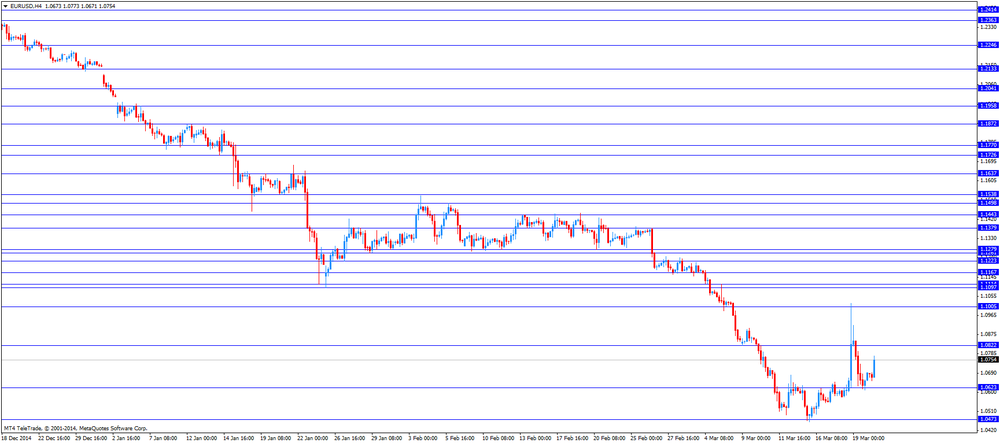

EUR/USD: the currency pair rose to $1.0773

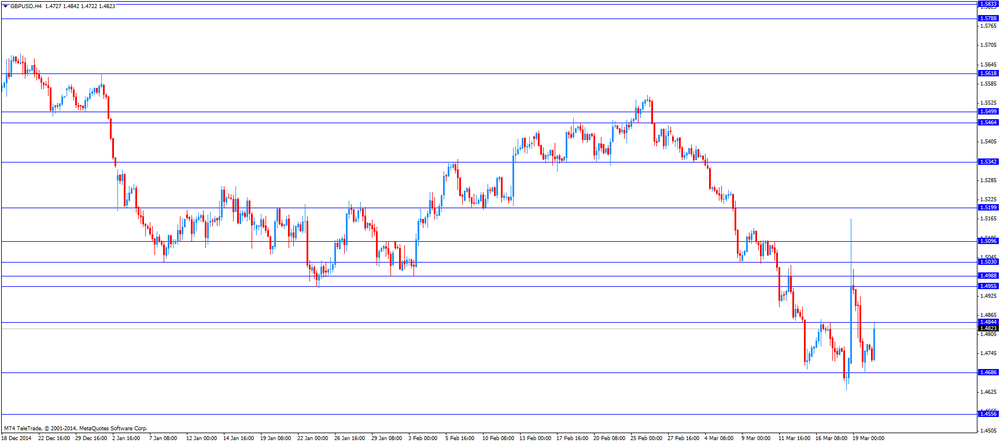

GBP/USD: the currency pair increased to $1.4842

USD/JPY: the currency pair climbed to Y121.19

The most important news that are expected (GMT0):

14:20 U.S. FOMC Member Dennis Lockhart Speaks

-

14:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

General Motors Company, NYSE

GM

38.70

+0.13%

0.9K

The Coca-Cola Co

KO

40.08

+0.15%

9.2K

AMERICAN INTERNATIONAL GROUP

AIG

55.75

+0.18%

0.6K

Verizon Communications Inc

VZ

49.40

+0.20%

1.2K

AT&T Inc

T

33.31

+0.33%

9.6K

General Electric Co

GE

25.42

+0.36%

4.2K

Johnson & Johnson

JNJ

102.07

+0.37%

1.5K

E. I. du Pont de Nemours and Co

DD

74.80

+0.39%

0.1K

Intel Corp

INTC

30.86

+0.39%

7.5K

Merck & Co Inc

MRK

58.45

+0.41%

2.1K

JPMorgan Chase and Co

JPM

61.46

+0.42%

6.5K

Chevron Corp

CVX

105.22

+0.45%

27.6K

Walt Disney Co

DIS

107.85

+0.45%

0.3K

Exxon Mobil Corp

XOM

84.80

+0.46%

4.9K

Ford Motor Co.

F

16.42

+0.49%

6.5K

Boeing Co

BA

154.89

+0.51%

1.5K

Caterpillar Inc

CAT

80.50

+0.51%

0.1K

Cisco Systems Inc

CSCO

28.41

+0.53%

4.3K

Amazon.com Inc., NASDAQ

AMZN

375.23

+0.53%

0.9K

Google Inc.

GOOG

561.12

+0.56%

0.2K

American Express Co

AXP

82.02

+0.59%

1.2K

Visa

V

67.30

+0.73%

31.7K

Tesla Motors, Inc., NASDAQ

TSLA

197.10

+0.74%

16.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

17.39

+0.75%

8.3K

Facebook, Inc.

FB

83.40

+0.79%

124.8K

Twitter, Inc., NYSE

TWTR

48.33

+0.83%

30.7K

Microsoft Corp

MSFT

42.64

+0.84%

1.2K

ALCOA INC.

AA

13.07

+0.85%

20.1K

Wal-Mart Stores Inc

WMT

82.42

+1.10%

1.4K

Starbucks Corporation, NASDAQ

SBUX

98.89

+1.16%

10.7K

HONEYWELL INTERNATIONAL INC.

HON

104.66

+1.59%

3.0K

Nike

NKE

103.02

+4.78%

19.7K

Yandex N.V., NASDAQ

YNDX

14.46

0.00%

1.0K

-

13:59

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

NIKE (NKE) target raised to $106 from $99 at Credit Suisse, Outperform

-

13:45

Orders

EUR/USD

Offers 1.0800 1.0920 1.1025 1.1100 1.1115

Bids 1.0600 1.0550 1.0500 1.0460 1.0400 1.0300

GBP/USD

Offers 1.4865-60 1.5010-00 1.5100 1.5165 1.5200 1.5270

Bids 1.4790-00 1.4635 1.4600 1.4500

EUR/JPY

Offers 130.00 130.80 131.60 132.00

Bids 128.20 128.00 127.00 126.85 126.55 126.00 124.95

USD/JPY

Offers 121.40 121.80-70 122.00-10 122.35 122.50 122.80 123.00

Bids 120.60 120.00 119.70 119.30 119.10 119.00 118.60

EUR/GBP

Offers 0.7290 0.7300 0.7325 0.7345

Bids 0.7200 0.7170 0.7120 0.7080 0.7050 0.7035 0.7020 0.7000

AUD/USD

Offers 0.7700 0.7800 0.7845 0.7860 0.7900 0.7910

Bids 0.7600 0.7590 0.7560 0.7500

-

13:41

Reserve Bank of Australia governor Glenn Stevens: interest rate hike in the U.S. will bring turbulence in asset and financial markets

The Reserve Bank of Australia (RBA) governor Glenn Stevens said in a speech in Melbourne on Friday that while interest rate is expected to be hiked in the U.S., interest rate in Australia it is expected to be cut. He noted that interest rate hike in the U.S. will bring turbulence in asset and financial markets.

Stevens thinks that the Australian dollar is likely to depreciate further despite the recent decline.

The RBA governor pointed out that a weaker Australian dollar is assisting the major transition from mining driven growth to other sectors of Australia's economy.

Stevens also said that Australian businesses and households are less optimistic about the future.

-

13:32

Canada: Retail Sales YoY, January +1.2%

-

13:31

Canada: Retail Sales, m/m, January -1.7% (forecast -0.3%)

-

13:31

Canada: Consumer price index, y/y, February +1.0%

-

13:31

Canada: Bank of Canada Consumer Price Index Core, y/y, February +2.1%

-

13:30

Canada: Retail Sales ex Autos, m/m, January -1.8% (forecast +0.1%)

-

13:30

Canada: Bank of Canada Consumer Price Index Core, m/m, February +0.6% (forecast +0.5%)

-

13:30

Canada: Consumer Price Index m / m, February +0.9% (forecast +0.7%)

-

13:10

Bank of Japan minutes: consumer inflation slowed due to falling energy prices

The Bank of Japan (BoJ) released its minutes from February meeting. The central bank said that Japan's economy continues to recover moderately.

The BoJ board members noted that stimulus measures have the desired effects. They added that consumer inflation slowed due to falling energy prices.

The central bank voted 8-1 to keep its monetary policy unchanged.

Japan's central bank downgraded its consumer inflation forecast to around 0.5% from the range of 0.5% - 1.0%.

-

13:00

European stock markets mid-session: Indices add gains at the end of the week

European indices are trading higher at the end of the week amid hopes on a progress in the negotiations between the E.U and Greece. Prime Minister Alexis Tsipras assured European Union creditors that Greece will soon submit a concrete program of reforms. European Parliament President Martin Schulz said that Greece's financial situation is dangerous. The FED's statement on Wednesday lends further support as FED chair Yellen indicated that rates will rise at a slower pace - although dropping the word 'patient' from the minutes.

German Producer Price Index rose +0.1% month on month, below the estimated growth of +0.2%. Year on year the decline was slower, at -2.1% compared to -2.2%.

Eurozone's adjusted Current Account published by the ECB for January rose from revised 22.5 billion to 29.4 billion, above the estimated 21.3 billion. The unadjusted Current Account declined from 35.2 billion to 8.2 billion.

U.K.'s Public Sector Net Borrowing rose less-than-expected to a seasonally adjusted 6.2 billion in February. Analysts expected an increase of 7.7 billion.

The FTSE 100 index is currently trading higher, quoted at 6,971.31 +0.13%. Germany's DAX 30 added +1.18% trading at 12,039.78 points. France's CAC 40 is currently trading at 5,048.69 points, +0.23%.

-

12:20

Oil: prices under pressure after comments on OPEC output - U.S. stockpiles at record still weigh

Oil is trading lower today and is set for a weekly loss after a statement of Kuwait's oil minister saying that the OPEC, whose members account for 40% of worldwide production, have no choice but to maintain output levels I order to fight for market share. The possibility of a deal with Iran and an easing of sanctions further weighed on prices. Earlier this week data showed that oil supplies in the U.S. rose to the highest level on record last week putting pressure on oil prices. U.S. crude oil inventories rose by 9.6 million barrels. Brent Crude lost -1.01%, currently trading at USD53.88 a barrel. On January 13th Crude set a low at USD45.19. West Texas Intermediate lost -1.11% currently quoted at USD43.47.

Oil prices declined sharply in recent months as worldwide supply exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

12:00

Gold climbs for a third day after FED

Gold is trading higher for a third day - the somehow dovish FED statement still lends some support to the precious metal and helped prices to rebound from the recent slump. The bank kept its monetary policy unchanged but dropped the word "patient" from its outlook for monetary policy. That means that the Fed could start to raise its interest rate soon but stated that it will closely watch economic data and international developments. Gold erased 2015 gains before adding the most gains in six weeks on Wednesday.

As a strong U.S. dollar and the prospect for higher U.S. rates weigh on the precious metal - as gold is dollar-denominated and not yield-bearing.

Gold is currently quoted at USD1,171.70, +0,03% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. On Tuesday gold traded as low as USD1,142.50, a three-month low.

-

11:14

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0500 (E1.2bn), $1.0600(E1.1bn), $1.0700(E932mn), $1.0800(E2.7bn)

USD/JPY: Y120.00 ($1.1bn), Y120.50($900mn), Y121.00($3.65bn), Y121.50($695mn), Y122.00($2.22bn)

GBP/USD: $1.4700(Gbp210mn), $1.4900 (Gbp309mn)

USD/CHF: Chf0.9900($255mn), Chf1.0000($251mn), Chf1.0100($401mn)

AUD/USD: $0.7625(A$847mn), $0.7700(A$752mn), $0.7750(A$1.3bn), $0.7800(A$400mn)

NZD/USD: $0.7300(NZ$570mn), $7325(NZ$612mn), $0.7350(NZ$926mn)

USD/CAD: C$1.2700($250mn), C$1.2750($1.2bn), C$1.2800($1.3bn)

-

10:30

United Kingdom: PSNB, bln, February 6.2 (forecast 7.7)

-

10:20

Press Review: Greek PM assures EU creditors reforms coming to unlock cash

BLOOMBERG

More Iran Oil May Flow Within Months of Deal, Officials Say

(Bloomberg) -- World powers have offered to suspend U.S. and European restrictions on Iranian oil exports, but only if the Islamic Republic accepts strict limits on its nuclear program for at least a decade, according to American and European officials.

The offer to begin lifting some sanctions within months of a deal comes amid the effort in Lausanne, Switzerland to reach the framework of an agreement by the end of the month, with the outcome still in doubt.

Iran has yet to agree to such conditions in exchange for relief from oil and banking sanctions. Even if the Islamic Republic does, the limits on its oil exports would be suspended only after it complied with an initial set of restrictions, such as disconnecting the majority of the centrifuges it uses to enrich uranium and submitting them for verification, said the officials, who spoke to Bloomberg News on condition of anonymity to describe the private negotiations.

REUTERS

Greek PM assures EU creditors reforms coming to unlock cash(Reuters) - Greek Prime Minister Alexis Tsipras assured European Union creditors at late-night crisis talks in Brussels that his leftist-led coalition would present soon a full set of economic reforms in order to unlock cash to stave off bankruptcy.

After two months of mounting frustration on both sides since Tsipras was elected with a mandate to end years of austerity imposed by creditors' conditions, the three-hour meeting on the sidelines of an EU summit was requested by Tsipras to break an impasse that risks seeing Athens stumble out of the euro zone.

But while a joint statement by the EU institutions spoke of a "spirit of mutual trust" and Tsipras said he left feeling more optimistic, German Chancellor Angela Merkel stressed no money would be released before Athens implements budget measures and other reforms that it has so far been reluctant to consent to.

Source: http://www.reuters.com/article/2015/03/20/us-eurozone-greece-idUSKBN0MF0WY20150320

BLOOMBERG

Yuan Nearing PBOC Rate Spurs Band Speculation: Chart

(Bloomberg) -- The yuan is converging with the central bank's reference rate at a record pace, a sign to ING Groep NV that China may be planning to widen the currency's daily trading band.

The CHART OF THE DAY shows the gap has narrowed to 0.6 percent in Shanghai, having been on the cusp of its 2 percent limit at the start of the month. The People's Bank of China doubled the yuan's trading range a year ago after the difference narrowed to less than 0.3 percent from a January 2014 average of 0.9 percent. Intervention may be a factor behind the latest convergence, according to Standard Chartered Plc and Overseas-Chinese Banking Corp Ltd.

"It's like a parallel with a year ago as they are in a concerted effort to push the spot away from the band's limit," Tim Condon, head of Asia research at ING in Singapore, said by phone. "A wider band is in line with the thinking that China wants more market forces in determining the exchange rate."

-

10:00

Eurozone: Current account, adjusted, bln , January 29.4 (forecast 21.3)

-

10:00

Eurozone: Current account, unadjusted, bln , January 8.2

-

10:00

European stock markets First hour: Indices higher amid Greece talks

European stocks open higher at the end of the week amid hopes on a progress in the negotiations between the E.U and Greece. Greece agreed on working on a new reform plan to prevent the country from bankruptcy. European Parliament President Martin Schulz said that Greece's financial situation is dangerous. The FED's statement on Wednesday lends further support as FED chair Yellen indicated that rates will rise at a slower pace - although dropping the word 'patient' from the minutes - predicting lower economic growth and inflation.

The FTSE 100 index is currently trading +0.17% quoted at 6,974.06 points. Germany's DAX 30 is trading higher at 11,954.35 points +0.46%. France's CAC 40 is currently trading at 5,045.91 points, +0.17%.

-

09:00

Global Stocks: Wall Street retreats after rally, Nikkei at new 15-year highs

U.S. stocks declined on Thursday after markets rallied a day earlier on FED chair Janet Yellens more dovish comments that a future interest rate hike will follow a lower trajectory and lowered the forecasts for growth and inflation. The Philadelphia Federal Reserve Bank's manufacturing index declined to 5.0 in March from 5. 2 in February, missing expectations for a rise to 7.3. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending March 14 in the U.S. rose by 1,000 to 291,000 from 290,000 in the previous week - still indicating a solid labour market.

The S&P 500 closed -0.49% with a final quote of 2,089.27 points. The DOW JONES index traded lower -0.65% closing at 17,959.03 points.

Chinese stocks were mixed on Friday. Hong Kong's Hang Seng is trading lower -0.33% at 24,388.61 points. China's Shanghai Composite closed at 3,617.45 points +0.98% - up for an eighth consecutive day and setting intraday a new 7-year high at 3,632.34 points. Brokerages and technology shares recorded the biggest gains. The index rallied over 7% this week. Markets were supported by Premier Li Keqiang comments on Sunday to further stimulate the economy if necessary

The Nikkei continued its rally-mode reversing early losses and set a new 15-year high on Friday - the highest closing since April 2000. The index closed +0.43% with a final quote of 19,560.22 points.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers as markets digest the FED comments

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 New Zealand Credit Card Spending February +6.2% +5.8%

02:10 Australia RBA's Governor Glenn Stevens Speech

06:00 Germany Producer Price Index (YoY) February -2.2% +0.1%

07:00 Germany Producer Price Index (MoM) February -0.6% +0.2 -2.1%%

The U.S. dollar is trading mixed against its major peers. On Wednesday the Fed kept its monetary policy unchanged but dropped the word "patient" from its outlook for monetary policy. The central bank lowered its forecasts for growth and inflation.

Yesterday the Philadelphia Federal Reserve Bank's manufacturing index declined to 5.0 in March from 5. 2 in February, missing expectations for a rise to 7.3. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending March 14 in the U.S. rose by 1,000 to 291,000 from 290,000 in the previous week. The U.S. current account deficit widened to $113.5 billion in the fourth quarter from $98.9 billion in the third quarter, missing expectations for a deficit of $103.0 billion.

The euro is trading moderately higher after yesterday's sell-off.

The Australian dollar rebounded from yesterday's slump. Reserve Bank governor Glenn Stevens held a speech at the American Chamber of Commerce in Australia today. He said that the country is likely to enter a phase of below-average economic growth. The RBA will take the necessary steps to reduce the impact on the economy in this phase of transition but also mentioned that the options for and the impact of measures taken by the bank are limited.

New Zealand's dollar gained against the greenback during the Asian session. Data in Credit Card Spending came in at +5.8% for February compared to +6.2% in January.

The Japanese yen traded slightly lower against the greenback on Friday after the minutes of the Monetary Policy Meeting were published yesterday late in the day. The minutes showed concern that even with a better outlook on economic growth the inflation target of 2% might not be reached and wages could decline as a consequence of low oil prices. Some members expressed that the pace of easing has to be re-assessed.

EUR/USD: the euro traded moderately higher against the greenback

USD/JPY: the U.S. dollar traded slightly higher against the yen

GPB/USD: Sterling lost against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Current account, adjusted, bln January 17.8 21.3

09:00 Eurozone Current account, unadjusted, bln January 29.2

09:30 United Kingdom PSNB, bln February -9.7 7.7

10:00 Eurozone EU Economic Summit

12:30 Canada Retail Sales, m/m January -2.0% -0.3%

12:30 Canada Retail Sales YoY January +4.0%

12:30 Canada Retail Sales ex Autos, m/m January -2.3% +0.1%

12:30 Canada Consumer Price Index m / m February -0.2% +0.7%

12:30 Canada Consumer price index, y/y February +1.0%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m February +0.2% +0.5%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y February +2.2%

14:20 U.S. FOMC Member Dennis Lockhart Speaks

-

08:18

Options levels on friday, March 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0854 (2635)

$1.0790 (1391)

$1.0742 (1399)

Price at time of writing this review: $1.0660

Support levels (open interest**, contracts):

$1.0599 (2451)

$1.0563 (2216)

$1.0511 (6502)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 64688 contracts, with the maximum number of contracts with strike price $1,1100 (3583);

- Overall open interest on the PUT options with the expiration date April, 2 is 69497 contracts, with the maximum number of contracts with strike price $1,0600 (6502);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from March, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5003 (1285)

$1.4906 (1283)

$1.4809 (695)

Price at time of writing this review: $1.4741

Support levels (open interest**, contracts):

$1.4688 (1850)

$1.4592 (1404)

$1.4494 (615)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 25953 contracts, with the maximum number of contracts with strike price $1,5100 (1650);

- Overall open interest on the PUT options with the expiration date April, 2 is 28154 contracts, with the maximum number of contracts with strike price $1,5050 (2333);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from March, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Producer Price Index (YoY), February -2.1%

-

08:00

Germany: Producer Price Index (MoM), February +0.1% (forecast +0.2%)

-

03:04

New Zealand: Credit Card Spending, February +5.8%

-

03:01

Nikkei 225 19,439.53 -37.03 -0.19 %, Hang Seng 24,507.48 +38.59 +0.16 %, Shanghai Composite 3,587.08 +4.81 +0.13 %

-

00:32

Commodities. Daily history for Mar 19’2015:

(raw materials / closing price /% change)

Oil 43.96 -1.57%

Gold 1,170.40 +0.12%

-

00:32

Stocks. Daily history for Mar 19’2015:

(index / closing price / change items /% change)

Nikkei 225 19,476.56 -67.92 -0.35 %

Hang Seng 24,468.89 +348.81 +1.45 %

Shanghai Composite 3,582.75 +5.44 +0.15 %

FTSE 100 6,962.32 +17.12 +0.25 %

CAC 40 5,037.18 +3.76 +0.07 %

Xetra DAX 11,899.4 -23.37 -0.20 %

S&P 500 2,089.27 -10.23 -0.49 %

NASDAQ Composite 4,992.38 +9.55 +0.19 %

Dow Jones 17,959.03 -117.16 -0.65 %

-

00:31

Currencies. Daily history for Mar 19’2015:

(pare/closed(GMT +2)/change, %)

EUR/JPY $1,0656 -1,60%

GBP/USD $1,4754 -1,38%

USD/CHF Chf0,99 +0,79%

USD/JPY Y120,78 +0,47%

EUR/JPY Y128,71 -1,17%

GBP/JPY Y178,2 -0,90%

AUD/USD $0,7647 -1,22%

NZD/USD $0,7412 -0,76%

USD/CAD C$1,2711 +0,97%

-