Noticias del mercado

-

19:15

American focus: the US dollar strengthened considerably against the pound

The euro retreated from session low against the dollar, but still trading lower. Initially, the pressure on the euro was news of the terrorist attacks in Brussels, who leveled from positive data on business activity. Analysts say the attacks may strike at an important unit for the tourism sector and strengthen the movement against migrants. Belgian broadcaster RTBF reported that in the course of attacks killed 34 people. The explosions took place four days after the arrest of a suspect in Brussels to participate in the terrorist attacks in Paris that killed 130 people. The responsibility for the current attacks have taken the militants of the terrorist group "Islamic State." The level of terrorist threat in Belgium increased to the maximum. With this level of threat is usually shuts down public transport, and people should avoid mass gatherings. Also, the authorities closed the country's borders.

With regard to statistics, the company Markit Economics reported that the euro zone private sector activity regained momentum in March, as it has grown at the fastest pace since December. The composite output index rose to 53.7 from 53.0 in February. It was expected that the index improve to 53.2. PMI index for the services sector rose to 54 from 53.3 a month ago. The expected reading was 53.3. The manufacturing PMI rose to 51.4 from 51.2 and was higher than the expected 51.3.

Meanwhile, the Ifo research institute said that German business confidence improved more than expected in March, following the deterioration in the previous three months. Indicator Ifo business climate rose to 106.7 from 105.7 in February. Economists had forecast 106. The current conditions index rose to 113.8 from 112.9. Economists had forecast a reading of 112.6. The expectations index rose to 100 from 98.9. Economists expected the index to be 99.5.

In focus were also data on the US, which fell short of forecasts and pressured the dollar. The Markit reported that the seasonally adjusted preliminary manufacturing PMI index rose to 51.4 from 51.3 in February, but remained well below the average post-crisis figure (54.1). Slightly stronger growth of output, new orders and employment have helped support the index, while the key factor to exert pressure, was the sharp drop in inventories since January, 2014. Although manufacturing output growth has pushed up by a 28-month low recorded in February, the latest increase was only modest and the weakest one of the registered in the last two and a half years. The responses suggested that the relatively restrained demand conditions and efforts to streamline post-production stocks, acted as a counter to the growth production.

The pound fell nearly 200 points against the dollar, updating at least 17 March, which was connected with the terrorist attacks in Brussels. Experts believe that after today's UK events can begin to strive for greater isolation from other EU countries, and the British are more inclined to vote for the country's exit from the bloc in a referendum on 23 June. Another factor reducing the pound was inflation data. The Office for National Statistics said consumer prices rose 0.3 percent in February compared with a year earlier, as in January. It was expected that the prices will increase by 0.4 percent. On a monthly measurement of consumer prices rose by 0.2 percent, offsetting a 0.8 percent fall in January. Economists had forecast an increase of 0.4 percent. Core inflation, excluding energy, food, alcoholic beverages and tobacco products remained stable at 1.2 percent. In another ONS report shows that sales prices fell by 1.1 percent after easing by 1 percent in January. The decline was less than the expected fall of 1.2 percent. At the same time, a month selling prices increased by 0.1 percent, offsetting the January drop by 0.1 percent. Purchasing prices continued the downward trend in February. Purchase prices fell by 8.1 percent compared with a decrease of 8 per cent in January. Prices are expected to decline by 7.4 percent. On a monthly basis, the purchase prices have risen by 0.1 percent compared to 1.1 percent decline in January.

The yen strengthened sharply against the dollar, as the news of the terrorist attacks in Brussels stepped up demand for safe-haven assets. However, the latest market sentiment began to improve and the currency lost all previously-earned positions. The attention of investors is gradually switched to the inflation data for Japan, the publication of which is scheduled for Thursday. According to the median estimate of 22 analysts who were interviewed to Reuters, the base consumer price index, which includes oil products but excludes prices of fresh food, rose 0.1 percent annually in February. Basic consumer prices in Tokyo, available a month before the nationwide data, are expected to fall by 0.2 percent in March compared to the previous year.

-

16:51

Australian house price index rises 0.2% in the fourth quarter

The Australian Bureau of Statistics released its house price index on Tuesday. The Australian house price index rose 0.2% in the fourth quarter, beating expectations for a flat reading, after a 2.0% gain in the third quarter.

Main contributors were Canberra (+2.8%), Hobart (+2.5%), Melbourne (+1.6%), and Brisbane (+1.6%).

On a yearly basis, house prices climbed 8.7% in the fourth quarter, after a 10.7% rise in the third quarter.

The total value of residential dwellings in Australia rose by A$31.6 billion to A$5.9 trillion in the fourth quarter.

-

16:21

Japan’s all industry activity index slides 0.9% in January

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Friday. The index slid 0.9% in January, missing expectations for a 1.9% rise, after a 0.9% drop in December.

Construction industry activity index rose 2.5% in January, industrial production index climbed 3.7%, while tertiary industry activity increased 1.5%.

-

16:04

Greece’s current account narrows to €0.74 billion in January

The Bank of Greece released its current account data on Tuesday. Greece's current account deficit narrowed to €0.74 billion in January from €0.78 billion in December.

The Greek deficit on trade in goods declined to €1.14 billion in January from €1.43 billion in January last year, while the services surplus fell to €230 million from €448 million.

The primary income surplus decreased to €173 million in January from €624 million in January last year, while the surplus on secondary income turned into a deficit of €7 million from a surplus of €80 million last year.

The capital account surplus climbed to €388.1 million in January from €50.4 million last year.

-

15:38

Richmond Fed Manufacturing Index jumps to 22 in March, the highest level since April 2010

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing jumped to 22 in March from -4 in February. It was the highest level since April 2010.

Analysts had expected the index to increase to -1.

The increase was mainly driven by rises in shipments and new orders.

Shipments sub-index climbed to 27 in March from -11 in February, while new orders sub-index was up to 24 from -6.

The employment sub-index rose to 11 from 9.

"Overall, manufacturing activity increased markedly in March. The composite index for manufacturing climbed to a reading of 22, the highest since April 2010," the survey said.

-

15:00

U.S.: Richmond Fed Manufacturing Index, March 22 (forecast -1)

-

14:57

U.S. preliminary manufacturing purchasing managers' index rises to 51.4 in March

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 51.4 in March from 51.3 in February, missing expectations for an increase to 51.8.

A reading above 50 indicates expansion in economic activity.

The rise was driven by a faster pace of expansion in output and new business.

"US factories continue to endure their worst spell for three and a half years. Headwinds include reduced spending by the struggling energy sector, the strength of the dollar, persistent weak global demand and growing uncertainty caused by the looming presidential election," Markit Chief Economist Chris Williamson.

-

14:45

U.S.: Manufacturing PMI, March 51.4 (forecast 51.8)

-

14:40

U.S. house price index rise 0.5% in January

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.5% on a seasonally adjusted basis in January, in line with expectations, after a 0.5% gain in December. December's figure was revised up from a 0.4% rise.

On a yearly basis, U.S. house prices climbed 6.0% in January, after a 5.7% rise in December.

-

14:31

Option expiries for today's 10:00 ET NY cut

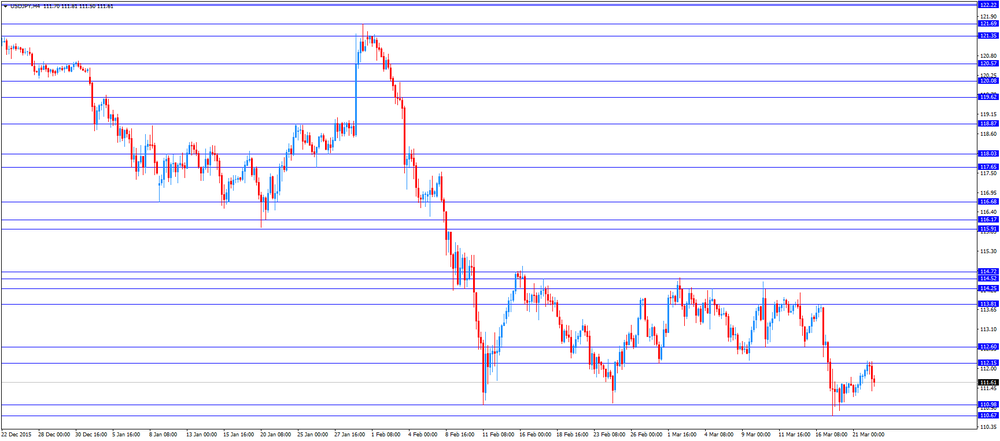

USD/JPY 111.00 (660m), 111.35, 111.45/50, 112.75/80 (680m), 112.95/113.05 (542m), 113.60

EUR/USD 1.1000, 1.1025 (259m), 1.1035/40 (566m), 1.1050 (229m), 1.1215/20, 1.1300 (500m)

AUD/USD 0.7450, 0.7575

AUD/NZD 1.1230

USD/CAD 1.3265

GBP/USD 1.4500, 1.4550, 1.4635

EUR/GBP 0.7625

USD/CHF 0.9800

-

14:28

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after explosions in Brussels

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia House Price Index (QoQ) Quarter IV 2.0% 0.0% 0.2%

02:00 Japan Manufacturing PMI (Preliminary) March 50.1 50.6 49.1

04:30 Japan All Industry Activity Index, m/m January -0.9% 1.9% -0.9%

05:35 Australia RBA's Governor Glenn Stevens Speech

07:00 Switzerland Trade Balance February 3.51 Revised From 3.513 2.88 4.07

08:00 France Services PMI (Preliminary) March 49.2 49.5 51.2

08:00 France Manufacturing PMI (Preliminary) March 50.2 50.2 49.6

08:30 Germany Services PMI (Preliminary) March 55.3 55 55.5

08:30 Germany Manufacturing PMI (Preliminary) March 50.5 50.8 50.4

09:00 Eurozone Manufacturing PMI (Preliminary) March 51.2 51.3 51.4

09:00 Eurozone Services PMI (Preliminary) March 53.3 53.3 54

09:00 Germany IFO - Expectations March 98.9 Revised From 98.8 99.5 100

09:00 Germany IFO - Current Assessment March 112.9 112.6 113.8

09:00 Germany IFO - Business Climate March 105.7 106 106.7

09:30 United Kingdom PSNB, bln February 14.41 Revised From 11.81 -5.4 -6.49

09:30 United Kingdom Producer Price Index - Input (MoM) February -1.1% Revised From -0.7% 0.6% 0.1%

09:30 United Kingdom Producer Price Index - Output (MoM) February -0.1% -0.1% 0.1%

09:30 United Kingdom Producer Price Index - Input (YoY) February -8% Revised From -7.6% -7.3% -8.1%

09:30 United Kingdom Retail prices, Y/Y February 1.3% 1.3% 1.3%

09:30 United Kingdom Retail Price Index, m/m February -0.7% 0.5% 0.5%

09:30 United Kingdom Producer Price Index - Output (YoY) February -1.0% -1.2% -1.1%

09:30 United Kingdom HICP, m/m February -0.8% 0.4% 0.2%

09:30 United Kingdom HICP, Y/Y February 0.3% 0.4% 0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y February 1.2% 1.2% 1.2%

10:00 Eurozone ZEW Economic Sentiment March 13.6 8.2 10.6

10:00 Germany ZEW Survey - Economic Sentiment March 1 5 4.3

13:00 U.S. Housing Price Index, m/m January 0.5% Revised From 0.4% 0.5% 0.5%

The U.S. dollar traded mixed against the most major currencies ahead the release of the existing economic data. The U.S. preliminary manufacturing PMI is expected to rise to 51.8 in March from 51.3 in February.

The euro traded lower against the U.S. dollar after explosions (terrorist attacks) at the international airport in Brussels. News reported that at least 26 people have been killed.

Market participants also eyed the economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's preliminary manufacturing PMI rose to 51.4 in March from 51.2 in February. Analysts had expected the index to increase to 51.3.

The increase was driven by a faster growth in output and new orders.

Eurozone's preliminary services PMI increased to 54.0 in March from 53.3 in February. Analysts had expected the index to remain unchanged at 53.3.

The index was driven by a rise in in new business.

"The Eurozone saw renewed signs of life at the start of spring. The March PMI showed a welcome end to the worrying slowdown trend seen in the first two months of the year, putting the region on course for a 0.3% expansion of GDP in the first quarter ", Markit's Chief Economist Chris Williamson said.

Germany's preliminary manufacturing PMI fell to 50.4 in March from 50.5 in February, missing forecasts of a rise to 50.8. The fall in the manufacturing PMI was driven by a weaker increase in new export business.

Germany's preliminary services PMI was up to 55.5 in March from 55.3 in February. Analysts had expected index to decrease to 55.0. Output charges climbed in the services sector.

France's preliminary manufacturing PMI dropped to 49.6 in March from 50.2 in February. Analysts had expected the index to remain unchanged at 50.2.

France's preliminary services PMI climbed to 51.2 in March from 49.2 in February. Analysts had expected the index to rise to 49.5. The services index was driven by a rise in new business.

The British pound traded lower against the U.S. dollar after the release of the consumer price inflation data from the U.K. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in February, missing expectations for a rise to 0.4%.

A rise in food prices offset a drop in the transport sector prices.

On a monthly basis, U.K. consumer prices increased 0.2% in February, missing expectations for a 0.4% gain, after a 0.8% drop in January.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in February, in line with expectations.

The Retail Prices Index remained unchanged at 1.3% year-on-year in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian annual budget.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus widened to CHF4.07 billion in February from CHF3.509 billion in the previous month. January's figure was revised down from a surplus of CHF3.513 billion.

Exports climbed 8.8% year-on-year in February, while imports were down 2.6%.

On a monthly basis, exports rose 2.8% in February, while imports declined 2.0%.

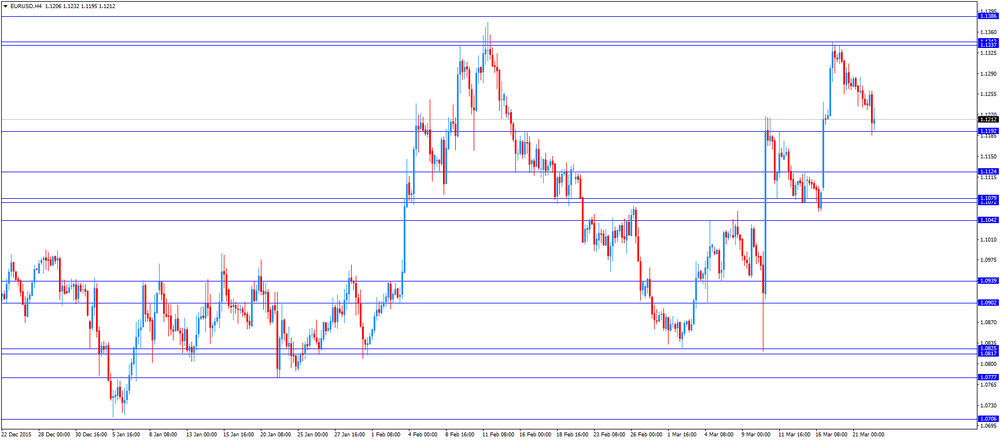

EUR/USD: the currency pair fell to $1.1186

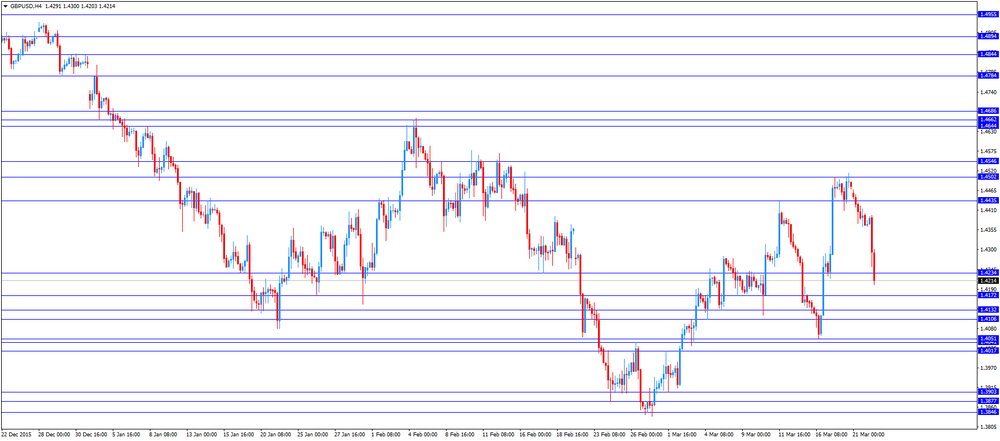

GBP/USD: the currency pair declined to $1.4203

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Preliminary) March 51.3 51.8

14:00 U.S. Richmond Fed Manufacturing Index March -4 -1

20:00 Canada Annual Budget

-

14:00

U.S.: Housing Price Index, m/m, January 0.5% (forecast 0.5%)

-

11:52

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 50.2 in February

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 49.1 in March from 50.1 in February, missing expectations for a rise to 50.6. it was the lowest level since April 2015.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was driven by a drop in new orders and output.

"Operating conditions at Japanese manufacturers deteriorated in March. Production and new orders both contracted, with output decreasing for the first time in nearly a year. This suggests industrial production will continue to fall," economist at Markit, Amy Brownbill, said.

-

11:44

France's preliminary manufacturing PMI declines in March, while services PMI increases

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Tuesday. France's preliminary manufacturing PMI dropped to 49.6 in March from 50.2 in February. Analysts had expected the index to remain unchanged at 50.2.

France's preliminary services PMI climbed to 51.2 in March from 49.2 in February. Analysts had expected the index to rise to 49.5.

The services index was driven by a rise in new business.

"Overall, PMI data suggest a further modest rise in GDP during Q1, doing little to suggest any break from the sluggish growth pattern seen during recent times," the Senior Economist at Markit Jack Kennedy said.

-

11:40

Germany's preliminary manufacturing PMI falls in March, while services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Tuesday. Germany's preliminary manufacturing PMI fell to 50.4 in March from 50.5 in February, missing forecasts of a rise to 50.8.

The fall in the manufacturing PMI was driven by a weaker increase in new export business.

Germany's preliminary services PMI was up to 55.5 in March from 55.3 in February. Analysts had expected index to decrease to 55.0.

Output charges climbed in the services sector.

"It looks as if momentum in the German economy will remain sluggish in the months ahead, as slowing new order growth was accompanied by the weakest increase in backlogs of work since the summer of last year. Furthermore, there are signs that subdued demand is now also affecting the labour market, as the rate of job creation eased to a near one-year low," Markit's economist Oliver Kolodseike noted.

-

11:35

Eurozone's preliminary manufacturing and services PMIs rise in March

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's preliminary manufacturing PMI rose to 51.4 in March from 51.2 in February. Analysts had expected the index to increase to 51.3.

The increase was driven by a faster growth in output and new orders.

Eurozone's preliminary services PMI increased to 54.0 in March from 53.3 in February. Analysts had expected the index to remain unchanged at 53.3.

The index was driven by a rise in in new business.

"The Eurozone saw renewed signs of life at the start of spring. The March PMI showed a welcome end to the worrying slowdown trend seen in the first two months of the year, putting the region on course for a 0.3% expansion of GDP in the first quarter ", Markit's Chief Economist Chris Williamson said.

He noted that the recent stimulus measures by the European Central Bank (ECB) should help to boost growth further in the second quarter.

-

11:27

Public sector net borrowing in the U.K. declines to £7.2 billion in February

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. Public sector net borrowing excluding banks declined to £7.2 billion in February from £13.8 billion in January. January's figure was revised up from £11.2 billion.

The debt-to-gross domestic product ratio rose to 83.1% in February.

-

11:18

UK house price inflation increases 0.9% in January

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index increased at a seasonally adjusted rate of 0.9% in January, after a flat reading in December.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.9% in January, after a 6.7% in December. It was the biggest rise since March 2015.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £292,000 in January, up from £288,000 in December.

-

11:10

Germany's ZEW economic sentiment index increases to 4.3 in March

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 4.3 in March from 1.0 in February, missing expectations for a rise to 5.0.

The assessment of the current situation in Germany declined by 1.6 points to 50.7 points.

"The uncertainty associated with the future economic development of important emerging economies, with the development of the oil price and with the external value of the euro continues to call for caution. Apparently, the renewed move of the ECB to considerably ease its monetary policy has not had a substantial effect on economic sentiment," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 10.6 in March from 13.6 in February, beating expectations for a decline to 8.2.

The assessment of the current situation in the Eurozone fell by 3.8 points to -11.8 points.

-

11:00

Germany: ZEW Survey - Economic Sentiment, March 4.3 (forecast 5)

-

11:00

Eurozone: ZEW Economic Sentiment, March 10.6 (forecast 8.2)

-

10:57

UK consumer price inflation remains unchanged at 0.3% year-on-year in February

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in February, missing expectations for a rise to 0.4%.

A rise in food prices offset a drop in the transport sector prices.

On a monthly basis, U.K. consumer prices increased 0.2% in February, missing expectations for a 0.4% gain, after a 0.8% drop in January.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in February, in line with expectations.

The Retail Prices Index remained unchanged at 1.3% year-on-year in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

-

10:48

German Ifo business confidence index rises to 106.7 in March

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rose to 106.7 in March from 105.7 in February, exceeding expectations for an increase to 106.0.

"After weakening for three consecutive months, sentiment among German businesses brightened slightly in March," Ifo President Hans-Werner Sinn said, adding that German businesses were less sceptical than in February.

The Ifo current conditions index increased to 113.8 from 112.9. Analysts had expected the index to decline to 112.6.

The Ifo expectations index climbed to 100.0 from 98.9, missing expectations for a rise to 99.5. February's figure was revised up from 98.8.

-

10:40

Swiss trade surplus rises to CHF4.07 billion in February

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus widened to CHF4.07 billion in February from CHF3.509 billion in the previous month. January's figure was revised down from a surplus of CHF3.513 billion.

Exports climbed 8.8% year-on-year in February, while imports were down 2.6%.

On a monthly basis, exports rose 2.8% in February, while imports declined 2.0%.

-

10:35

Reserve Bank of Australia Governor Glenn Stevens: Australia has a sound and credible macroeconomic policy framework to respond to significant negative events

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in a speech on Tuesday that Australia had a sound and credible macroeconomic policy framework to respond to significant negative events.

"Even with interest rates at already low levels, and public debt higher than it was, there would, in the event of a serious economic downturn, be more room to ease both monetary and fiscal policy than in many, indeed most, other countries," he added.

Stevens pointed out that the Australian economy was adjusting well to lower commodity prices.

-

10:32

United Kingdom: Producer Price Index - Output (MoM), February 0.1% (forecast -0.1%)

-

10:31

United Kingdom: PSNB, bln, February -6.49 (forecast -5.4)

-

10:31

United Kingdom: Retail Price Index, m/m, February 0.5% (forecast 0.5%)

-

10:31

United Kingdom: Producer Price Index - Input (MoM), February 0.1% (forecast 0.6%)

-

10:30

United Kingdom: HICP, Y/Y, February 0.3% (forecast 0.4%)

-

10:30

United Kingdom: HICP, m/m, February 0.2% (forecast 0.4%)

-

10:30

United Kingdom: Retail prices, Y/Y, February 1.3% (forecast 1.3%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , February -8.1% (forecast -7.3%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, February 1.2% (forecast 1.2%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , February -1.1% (forecast -1.2%)

-

10:15

Atlanta Fed President Dennis Lockhart: the Fed could raise its interest rate in April due to the strong U.S. economy

Atlanta Fed President Dennis Lockhart said in a speech on Monday that the Fed could raise its interest rate in April due to the strong U.S. economy.

"In my opinion, there is sufficient momentum evidenced by the economic data to justify a further step at one of the coming meetings, possibly as early as the meeting scheduled for end of April," he said.

Lockhart noted that the U.S. continued to expand moderately, adding that there were not enough changes since mid-December to justify the delay of further interest rate hikes.

He also said that the Fed's next interest rate decision will depend on the incoming economic data.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:00

Eurozone: Manufacturing PMI, March 51.4 (forecast 51.3)

-

10:00

Eurozone: Services PMI, March 54 (forecast 53.3)

-

10:00

Germany: IFO - Business Climate, March 106.7 (forecast 106)

-

10:00

Germany: IFO - Current Assessment , March 113.8 (forecast 112.6)

-

10:00

Germany: IFO - Expectations , March 100 (forecast 99.5)

-

09:30

Germany: Manufacturing PMI, March 50.4 (forecast 50.8)

-

09:30

Germany: Services PMI, March 55.5 (forecast 55)

-

09:28

Option expiries for today's 10:00 ET NY cut

USD/JPY 111.00 (660m), 111.35, 111.45/50, 112.75/80 (680m), 112.95/113.05 (542m), 113.60

EUR/USD 1.1000, 1.1025 (259m), 1.1035/40 (566m), 1.1050 (229m), 1.1215/20, 1.1300 (500m)

AUD/USD 0.7450, 0.7575

AUD/NZD 1.1230

USD/CAD 1.3265

GBP/USD 1.4500, 1.4550, 1.4635

EUR/GBP 0.7625

USD/CHF 0.9800

-

09:01

France: Services PMI, March 51.2 (forecast 49.5)

-

09:00

France: Manufacturing PMI, March 49.6 (forecast 50.2)

-

08:28

Options levels on tuesday, March 22, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1374 (3079)

$1.1349 (2076)

$1.1303 (3136)

Price at time of writing this review: $1.1244

Support levels (open interest**, contracts):

$1.1206 (1727)

$1.1150 (2108)

$1.1116 (2629)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 46484 contracts, with the maximum number of contracts with strike price $1,1500 (4490);

- Overall open interest on the PUT options with the expiration date April, 8 is 67165 contracts, with the maximum number of contracts with strike price $1,0900 (6136);

- The ratio of PUT/CALL was 1.44 versus 1.45 from the previous trading day according to data from March, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.4702 (1608)

$1.4604 (1093)

$1.4507 (1668)

Price at time of writing this review: $1.4383

Support levels (open interest**, contracts):

$1.4292 (586)

$1.4195 (623)

$1.4097 (739)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20094 contracts, with the maximum number of contracts with strike price $1,4400 (2036);

- Overall open interest on the PUT options with the expiration date April, 8 is 21452 contracts, with the maximum number of contracts with strike price $1,3850 (2259);

- The ratio of PUT/CALL was 0.94 versus 1.05 from the previous trading day according to data from March, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Asian session: The Australian dollar rose

The dollar held firm on Tuesday, having extended its rebound for a second session after two Federal Reserve officials supported the case for a hike in interest rates sooner rather than later. Atlanta Fed President Dennis Lockhart said there was sufficient economic momentum to justify a further rate hike "possibly as early as the meeting scheduled for end of April". San Francisco Federal Reserve Bank President John Williams told Market News International that April or June would be "potential times for a rate hike."

The Australian dollar rose as Reserve Bank of Australia governor Glenn Stevens has cheered signs that house price growth in Sydney and Melbourne have cooled thanks to a "timely" regulatory crackdown on lending standards. In a speech in which he said it was too soon to know whether the turmoil that up-ended global financial markets early this year has come to an end, Mr Stevens emphasised Australia's resilience against any potential disaster.

EUR / USD: during the Asian session, the pair rose to $ 1.1260

GBP / USD: during the Asian session, the pair was trading in the $ 1.4365-85

USD / JPY: during the Asian session, the pair was trading in range Y111.80-20

Based on Reuters materials

-

08:00

Switzerland: Trade Balance, February 4.07 (forecast 2.88)

-

05:32

Japan: All Industry Activity Index, m/m, January -0.9% (forecast 1.9%)

-

03:00

Japan: Manufacturing PMI, March 49.1 (forecast 50.6)

-

01:32

Australia: House Price Index (QoQ), Quarter IV 0.2% (forecast 0.0%)

-

00:36

Currencies. Daily history for Mar 21’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1238 -0,28%

GBP/USD $1,4368 -0,75%

USD/CHF Chf0,9705 +0,13%

USD/JPY Y111,95 +0,38%

EUR/JPY Y125,87 +0,17%

GBP/JPY Y160,84 -0,38%

AUD/USD $0,7579 -0,30%

NZD/USD $0,6766 -0,44%

USD/CAD C$1,3097 +0,72%

-