Noticias del mercado

-

20:00

Dow -0.01% 17,622.60 -1.27 Nasdaq +0.43% 4,829.63 +20.76 S&P +0.14% 2,054.52 +2.92

-

18:09

WSE: Session Results

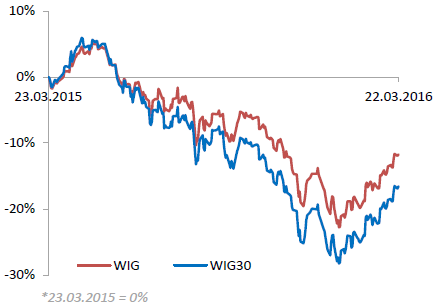

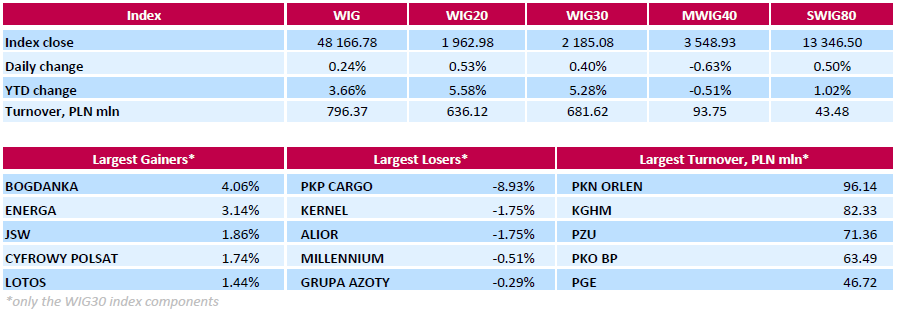

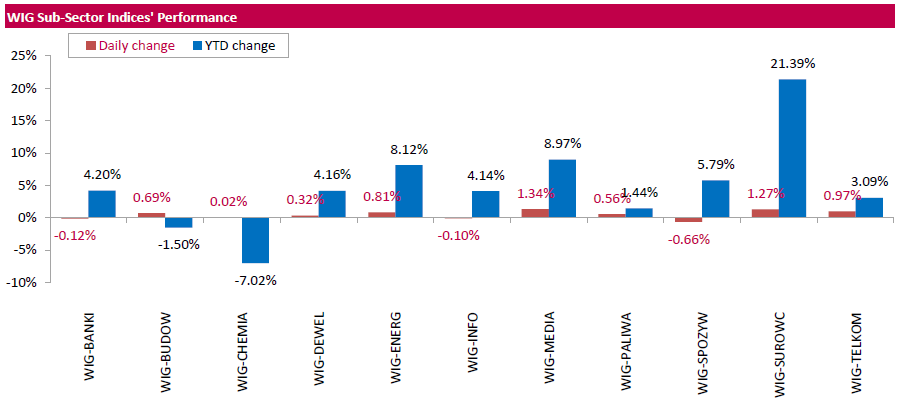

Polish equity market closed higher on Tuesday, with the broad market measure, the WIG index, adding 0.24%. Sector-wise, media names (+1.34%) fared the best, while food sector stocks (-0.66%) tumbled the most.

The large-cap stocks' benchmark, the WIG30 Index, advanced 0.40%. In the index basket, thermal coal miner BOGDANKA (WSE: LWB) and genco ENERGA (WSE: ENG) were the strongest performers, gaining 4.06% and 3.14% respectively. They were followed by coking coal miner JSW (WSE: JSW) and media group CYFROWY POLSAT (WSE: CPS), growing by 1.86% and 1.74% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) continued to plunge, losing 8.93%. Other major laggards were agricultural holding KERNEL (WSE: KER) and bank ALIOR (WSE: ALR), each losing 1.75%.

-

18:00

European stocks closed: FTSE 100 6,192.74 +8.16 +0.13% CAC 40 4,431.97 +4.17 +0.09% DAX 9,990 +41.36 +0.42%

-

18:00

European stocks close: stocks closed slightly higher after explosions in Brussels

Stock indices closed slightly higher after explosions (terrorist attacks) at the international airport in Brussels. News reported that at least 31 people have been killed.

Market participants also eyed the economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's preliminary manufacturing PMI rose to 51.4 in March from 51.2 in February. Analysts had expected the index to increase to 51.3.

The increase was driven by a faster growth in output and new orders.

Eurozone's preliminary services PMI increased to 54.0 in March from 53.3 in February. Analysts had expected the index to remain unchanged at 53.3.

The index was driven by a rise in in new business.

"The Eurozone saw renewed signs of life at the start of spring. The March PMI showed a welcome end to the worrying slowdown trend seen in the first two months of the year, putting the region on course for a 0.3% expansion of GDP in the first quarter ", Markit's Chief Economist Chris Williamson said.

Germany's preliminary manufacturing PMI fell to 50.4 in March from 50.5 in February, missing forecasts of a rise to 50.8. The fall in the manufacturing PMI was driven by a weaker increase in new export business.

Germany's preliminary services PMI was up to 55.5 in March from 55.3 in February. Analysts had expected index to decrease to 55.0. Output charges climbed in the services sector.

France's preliminary manufacturing PMI dropped to 49.6 in March from 50.2 in February. Analysts had expected the index to remain unchanged at 50.2.

France's preliminary services PMI climbed to 51.2 in March from 49.2 in February. Analysts had expected the index to rise to 49.5. The services index was driven by a rise in new business.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in February, missing expectations for a rise to 0.4%.

A rise in food prices offset a drop in the transport sector prices.

On a monthly basis, U.K. consumer prices increased 0.2% in February, missing expectations for a 0.4% gain, after a 0.8% drop in January.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in February, in line with expectations.

The Retail Prices Index remained unchanged at 1.3% year-on-year in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,192.74 +8.16 +0.13 %

DAX 9,990 +41.36 +0.42 %

CAC 40 4,431.97 +4.17 +0.09 %

-

17:15

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed in late-morning trading on Tuesday as the ripples of the deadly explosions in Brussels were limited by a 1 percent rise in Apple (AAPL) and gains in healthcare stocks. At least 34 people were killed in twin attacks on Brussels airport and a rush-hour metro train in the Belgian capital, triggering security alerts across western Europe. European markets fell, while traditional safe havens gold and government bonds firmed up as reports of the events in the de facto capital of the European Union unfolded. Airline and travel-related stocks were the worst hit.

Most of Dow stocks in negative area (20 of 15). Top looser - American Express Company (AXP, -1,50%). Top gainer - Pfizer Inc. (PFE, +1,21%).

Most of S&P sectors also in negative area. Top looser - Conglomerates (-0,6%). Top gainer - Healthcare (+0,5%).

At the moment:

Dow 17497.00 -31.00 -0.18%

S&P 500 2039.00 -3.75 -0.18%

Nasdaq 100 4418.75 +2.50 +0.06%

Oil 41.31 -0.21 -0.51%

Gold 1252.90 +8.70 +0.70%

U.S. 10yr 1.89 -0.04

-

16:51

Australian house price index rises 0.2% in the fourth quarter

The Australian Bureau of Statistics released its house price index on Tuesday. The Australian house price index rose 0.2% in the fourth quarter, beating expectations for a flat reading, after a 2.0% gain in the third quarter.

Main contributors were Canberra (+2.8%), Hobart (+2.5%), Melbourne (+1.6%), and Brisbane (+1.6%).

On a yearly basis, house prices climbed 8.7% in the fourth quarter, after a 10.7% rise in the third quarter.

The total value of residential dwellings in Australia rose by A$31.6 billion to A$5.9 trillion in the fourth quarter.

-

16:21

Japan’s all industry activity index slides 0.9% in January

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Friday. The index slid 0.9% in January, missing expectations for a 1.9% rise, after a 0.9% drop in December.

Construction industry activity index rose 2.5% in January, industrial production index climbed 3.7%, while tertiary industry activity increased 1.5%.

-

16:04

Greece’s current account narrows to €0.74 billion in January

The Bank of Greece released its current account data on Tuesday. Greece's current account deficit narrowed to €0.74 billion in January from €0.78 billion in December.

The Greek deficit on trade in goods declined to €1.14 billion in January from €1.43 billion in January last year, while the services surplus fell to €230 million from €448 million.

The primary income surplus decreased to €173 million in January from €624 million in January last year, while the surplus on secondary income turned into a deficit of €7 million from a surplus of €80 million last year.

The capital account surplus climbed to €388.1 million in January from €50.4 million last year.

-

15:38

Richmond Fed Manufacturing Index jumps to 22 in March, the highest level since April 2010

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing jumped to 22 in March from -4 in February. It was the highest level since April 2010.

Analysts had expected the index to increase to -1.

The increase was mainly driven by rises in shipments and new orders.

Shipments sub-index climbed to 27 in March from -11 in February, while new orders sub-index was up to 24 from -6.

The employment sub-index rose to 11 from 9.

"Overall, manufacturing activity increased markedly in March. The composite index for manufacturing climbed to a reading of 22, the highest since April 2010," the survey said.

-

14:57

U.S. preliminary manufacturing purchasing managers' index rises to 51.4 in March

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 51.4 in March from 51.3 in February, missing expectations for an increase to 51.8.

A reading above 50 indicates expansion in economic activity.

The rise was driven by a faster pace of expansion in output and new business.

"US factories continue to endure their worst spell for three and a half years. Headwinds include reduced spending by the struggling energy sector, the strength of the dollar, persistent weak global demand and growing uncertainty caused by the looming presidential election," Markit Chief Economist Chris Williamson.

-

14:49

WSE: After start on Wall Street

The US markets began the downward drift on the S&P 500 by 0.4 percent (Dow -0.29%, Nasdaq -0.52%), that is quite similar to yesterday's session. Of course we have to have in mind that the market is in the area of strong resistance designated by peaks of November and December, which will be difficult to overcome.

-

14:40

U.S. house price index rise 0.5% in January

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.5% on a seasonally adjusted basis in January, in line with expectations, after a 0.5% gain in December. December's figure was revised up from a 0.4% rise.

On a yearly basis, U.S. house prices climbed 6.0% in January, after a 5.7% rise in December.

-

14:34

U.S. Stocks open: Dow -0.29%, Nasdaq -0.52%, S&P -0.43%

-

14:19

Before the bell: S&P futures -0.34%, NASDAQ futures -0.41%

U.S. stock-index fell.

Global Stocks:

Nikkei 17,048.55 +323.74 +1.94%

Hang Seng 20,666.75 -17.40 -0.08%

Shanghai Composite 3,000.67 -18.13 -0.60%

FTSE 6,152.45 -32.13 -0.52%

CAC 4,394.05 -33.75 -0.76%

DAX 9,902.22 -46.42 -0.47%

Crude oil $40.97 (-1.32%)

Gold $1255.00 (+0.87%)

-

13:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.74

-0.15(-1.5167%)

619530

Amazon.com Inc., NASDAQ

AMZN

547.2

-6.78(-1.2239%)

20006

American Express Co

AXP

60.8

-0.41(-0.6698%)

589

Apple Inc.

AAPL

105.62

-0.29(-0.2738%)

75946

AT&T Inc

T

38.86

-0.06(-0.1542%)

15875

Barrick Gold Corporation, NYSE

ABX

14.97

0.28(1.9061%)

35100

Boeing Co

BA

135.08

-0.78(-0.5741%)

3245

Caterpillar Inc

CAT

75.55

-0.34(-0.448%)

4363

Chevron Corp

CVX

95.48

-0.96(-0.9954%)

5043

Cisco Systems Inc

CSCO

28.15

-0.04(-0.1419%)

2800

Citigroup Inc., NYSE

C

43.34

-0.26(-0.5963%)

71130

Exxon Mobil Corp

XOM

83.09

-0.53(-0.6338%)

4337

Facebook, Inc.

FB

111.3

-0.55(-0.4917%)

91255

Ford Motor Co.

F

13.58

-0.08(-0.5857%)

15900

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.63

-0.17(-1.5741%)

127341

General Electric Co

GE

30.95

-0.14(-0.4503%)

16019

General Motors Company, NYSE

GM

31.89

-0.19(-0.5923%)

536

Goldman Sachs

GS

155.51

-0.78(-0.4991%)

251

Google Inc.

GOOG

739.05

-3.04(-0.4097%)

1299

Intel Corp

INTC

32.16

-0.18(-0.5566%)

5845

International Business Machines Co...

IBM

148.02

-0.61(-0.4104%)

2375

Johnson & Johnson

JNJ

107.24

-0.04(-0.0373%)

720

JPMorgan Chase and Co

JPM

60.1

-0.36(-0.5954%)

839

McDonald's Corp

MCD

123.4

-0.41(-0.3312%)

1515

Microsoft Corp

MSFT

53.5

-0.36(-0.6684%)

4975

Nike

NKE

65.05

0.33(0.5099%)

73204

Pfizer Inc

PFE

29.94

-0.13(-0.4323%)

400

Procter & Gamble Co

PG

83.24

-0.08(-0.096%)

767

Starbucks Corporation, NASDAQ

SBUX

58.85

-0.25(-0.423%)

2390

Tesla Motors, Inc., NASDAQ

TSLA

237.1

-1.22(-0.5119%)

19181

The Coca-Cola Co

KO

45.59

-0.08(-0.1752%)

5326

Twitter, Inc., NYSE

TWTR

16.76

-0.13(-0.7697%)

18640

Verizon Communications Inc

VZ

53.35

-0.09(-0.1684%)

3140

Visa

V

73.61

-0.16(-0.2169%)

1080

Wal-Mart Stores Inc

WMT

67.94

-0.03(-0.0441%)

943

Walt Disney Co

DIS

97.89

-0.57(-0.5789%)

3184

Yahoo! Inc., NASDAQ

YHOO

34.84

-0.63(-1.7761%)

12066

-

13:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Yahoo! (YHOO) downgraded to Neutral from Buy at Citigroup; target raised to $37 from $32

Chevron (CVX) downgraded to Market Perform from Outperform at Raymond James

Amazon (AMZN) downgraded to Outperform from Strong Buy at Raymond James

Other:

-

12:45

WSE: Mid session comment

As might be expected, the impact of today's tragic events in Brussels on the financial markets was only temporary. It took several hours for the market to revert into the green. Such a situation we have today in Frankfurt, where the DAX for the first time rebounded today, albeit cosmetically from below the equilibrium level. However that has not convinced the WSE market to perform the same move. The WIG20 index in the middle of the session is still at the level of today's opening.

-

12:00

European stock markets mid session: stocks traded lower after terrorist attacks in Brussels

Stock indices traded lower after explosions (terrorist attacks) at the international airport in Brussels. News reported that at least 23 people have been killed.

Market participants also eyed the economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's preliminary manufacturing PMI rose to 51.4 in March from 51.2 in February. Analysts had expected the index to increase to 51.3.

The increase was driven by a faster growth in output and new orders.

Eurozone's preliminary services PMI increased to 54.0 in March from 53.3 in February. Analysts had expected the index to remain unchanged at 53.3.

The index was driven by a rise in in new business.

"The Eurozone saw renewed signs of life at the start of spring. The March PMI showed a welcome end to the worrying slowdown trend seen in the first two months of the year, putting the region on course for a 0.3% expansion of GDP in the first quarter ", Markit's Chief Economist Chris Williamson said.

Germany's preliminary manufacturing PMI fell to 50.4 in March from 50.5 in February, missing forecasts of a rise to 50.8. The fall in the manufacturing PMI was driven by a weaker increase in new export business.

Germany's preliminary services PMI was up to 55.5 in March from 55.3 in February. Analysts had expected index to decrease to 55.0. Output charges climbed in the services sector.

France's preliminary manufacturing PMI dropped to 49.6 in March from 50.2 in February. Analysts had expected the index to remain unchanged at 50.2.

France's preliminary services PMI climbed to 51.2 in March from 49.2 in February. Analysts had expected the index to rise to 49.5. The services index was driven by a rise in new business.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in February, missing expectations for a rise to 0.4%.

A rise in food prices offset a drop in the transport sector prices.

On a monthly basis, U.K. consumer prices increased 0.2% in February, missing expectations for a 0.4% gain, after a 0.8% drop in January.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in February, in line with expectations.

The Retail Prices Index remained unchanged at 1.3% year-on-year in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,149.61 -34.97 -0.57 %

DAX 9,904.29 -44.35 -0.45 %

CAC 40 4,402.54 -25.26 -0.57 %

-

11:52

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan declines to 50.2 in February

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 49.1 in March from 50.1 in February, missing expectations for a rise to 50.6. it was the lowest level since April 2015.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was driven by a drop in new orders and output.

"Operating conditions at Japanese manufacturers deteriorated in March. Production and new orders both contracted, with output decreasing for the first time in nearly a year. This suggests industrial production will continue to fall," economist at Markit, Amy Brownbill, said.

-

11:44

France's preliminary manufacturing PMI declines in March, while services PMI increases

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Tuesday. France's preliminary manufacturing PMI dropped to 49.6 in March from 50.2 in February. Analysts had expected the index to remain unchanged at 50.2.

France's preliminary services PMI climbed to 51.2 in March from 49.2 in February. Analysts had expected the index to rise to 49.5.

The services index was driven by a rise in new business.

"Overall, PMI data suggest a further modest rise in GDP during Q1, doing little to suggest any break from the sluggish growth pattern seen during recent times," the Senior Economist at Markit Jack Kennedy said.

-

11:40

Germany's preliminary manufacturing PMI falls in March, while services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Tuesday. Germany's preliminary manufacturing PMI fell to 50.4 in March from 50.5 in February, missing forecasts of a rise to 50.8.

The fall in the manufacturing PMI was driven by a weaker increase in new export business.

Germany's preliminary services PMI was up to 55.5 in March from 55.3 in February. Analysts had expected index to decrease to 55.0.

Output charges climbed in the services sector.

"It looks as if momentum in the German economy will remain sluggish in the months ahead, as slowing new order growth was accompanied by the weakest increase in backlogs of work since the summer of last year. Furthermore, there are signs that subdued demand is now also affecting the labour market, as the rate of job creation eased to a near one-year low," Markit's economist Oliver Kolodseike noted.

-

11:35

Eurozone's preliminary manufacturing and services PMIs rise in March

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's preliminary manufacturing PMI rose to 51.4 in March from 51.2 in February. Analysts had expected the index to increase to 51.3.

The increase was driven by a faster growth in output and new orders.

Eurozone's preliminary services PMI increased to 54.0 in March from 53.3 in February. Analysts had expected the index to remain unchanged at 53.3.

The index was driven by a rise in in new business.

"The Eurozone saw renewed signs of life at the start of spring. The March PMI showed a welcome end to the worrying slowdown trend seen in the first two months of the year, putting the region on course for a 0.3% expansion of GDP in the first quarter ", Markit's Chief Economist Chris Williamson said.

He noted that the recent stimulus measures by the European Central Bank (ECB) should help to boost growth further in the second quarter.

-

11:27

Public sector net borrowing in the U.K. declines to £7.2 billion in February

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. Public sector net borrowing excluding banks declined to £7.2 billion in February from £13.8 billion in January. January's figure was revised up from £11.2 billion.

The debt-to-gross domestic product ratio rose to 83.1% in February.

-

11:18

UK house price inflation increases 0.9% in January

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index increased at a seasonally adjusted rate of 0.9% in January, after a flat reading in December.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.9% in January, after a 6.7% in December. It was the biggest rise since March 2015.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £292,000 in January, up from £288,000 in December.

-

11:10

Germany's ZEW economic sentiment index increases to 4.3 in March

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 4.3 in March from 1.0 in February, missing expectations for a rise to 5.0.

The assessment of the current situation in Germany declined by 1.6 points to 50.7 points.

"The uncertainty associated with the future economic development of important emerging economies, with the development of the oil price and with the external value of the euro continues to call for caution. Apparently, the renewed move of the ECB to considerably ease its monetary policy has not had a substantial effect on economic sentiment," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 10.6 in March from 13.6 in February, beating expectations for a decline to 8.2.

The assessment of the current situation in the Eurozone fell by 3.8 points to -11.8 points.

-

10:57

UK consumer price inflation remains unchanged at 0.3% year-on-year in February

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at 0.3% year-on-year in February, missing expectations for a rise to 0.4%.

A rise in food prices offset a drop in the transport sector prices.

On a monthly basis, U.K. consumer prices increased 0.2% in February, missing expectations for a 0.4% gain, after a 0.8% drop in January.

Consumer price inflation excluding food, energy, alcohol and tobacco prices remained unchanged at 1.2% year-on-year in February, in line with expectations.

The Retail Prices Index remained unchanged at 1.3% year-on-year in February, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

-

10:48

German Ifo business confidence index rises to 106.7 in March

German Ifo Institute released its business confidence figures for Germany on Tuesday. German business confidence index rose to 106.7 in March from 105.7 in February, exceeding expectations for an increase to 106.0.

"After weakening for three consecutive months, sentiment among German businesses brightened slightly in March," Ifo President Hans-Werner Sinn said, adding that German businesses were less sceptical than in February.

The Ifo current conditions index increased to 113.8 from 112.9. Analysts had expected the index to decline to 112.6.

The Ifo expectations index climbed to 100.0 from 98.9, missing expectations for a rise to 99.5. February's figure was revised up from 98.8.

-

10:40

Swiss trade surplus rises to CHF4.07 billion in February

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus widened to CHF4.07 billion in February from CHF3.509 billion in the previous month. January's figure was revised down from a surplus of CHF3.513 billion.

Exports climbed 8.8% year-on-year in February, while imports were down 2.6%.

On a monthly basis, exports rose 2.8% in February, while imports declined 2.0%.

-

10:35

Reserve Bank of Australia Governor Glenn Stevens: Australia has a sound and credible macroeconomic policy framework to respond to significant negative events

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in a speech on Tuesday that Australia had a sound and credible macroeconomic policy framework to respond to significant negative events.

"Even with interest rates at already low levels, and public debt higher than it was, there would, in the event of a serious economic downturn, be more room to ease both monetary and fiscal policy than in many, indeed most, other countries," he added.

Stevens pointed out that the Australian economy was adjusting well to lower commodity prices.

-

10:15

Atlanta Fed President Dennis Lockhart: the Fed could raise its interest rate in April due to the strong U.S. economy

Atlanta Fed President Dennis Lockhart said in a speech on Monday that the Fed could raise its interest rate in April due to the strong U.S. economy.

"In my opinion, there is sufficient momentum evidenced by the economic data to justify a further step at one of the coming meetings, possibly as early as the meeting scheduled for end of April," he said.

Lockhart noted that the U.S. continued to expand moderately, adding that there were not enough changes since mid-December to justify the delay of further interest rate hikes.

He also said that the Fed's next interest rate decision will depend on the incoming economic data.

Lockhart is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

09:52

WSE: After the publication of the preliminary PMI readings

The preliminary readings of PMI indices of the two largest Euro area economies have been announced. In both cases, we have a negative surprise in the industrial sector and positive in the sector of services. In the case of France, the industry index returned to the values typically associated with recession.

Currently, we see larger declines from Euroland. The DAX index lost after opening 0.9 percent and now its decline was deepened to 1.6 percent. In Paris the CAC40 lost 1.25 percent.

-

09:11

WSE: After opening

The WIG20 futures contract (WSE: FW20M16) started trading from a fall of 0.21% (1,940 points).

Markets in Europe are also dominated by declines in opposition to a calmer mood on other continents. Some influence on it may have the explosions at the airport reported from Brussels.

The WIG20 index opened at 1948.94 points (-0.19% to previous close)

WIG 47956.74 -0.20%

WIG20 1948.94 -0.19%

WIG30 2169.48 -0.31%

mWIG40 3576.74 0.15%

-

08:28

WSE: Before opening

The global atmosphere in the morning is quite calm. The market in Japan after yesterday's feast gaining nearly 2% with reason of a weaker Yen. Yesterday's session on Wall Street also ended with slight increases.

Taking into account light red prevailing in Asia (outside of Japan), the mood in the morning should be neutral to even slightly upward. The Warsaw market is around the level of 1950 points (the WIG 20) and stopped after the recent rally.

Today will be announced the preliminary PMI readings, where the attention will be traditionally associated with information from Europe. Additionally, today they will be also published the IFO and ZEW indexes from Germany. We do not expect a major impact on the markets of the published data.

-

07:16

Global Stocks: U.S. stocks mustered small gains on Monday

European stocks closed lower Monday, swaying between small gains and losses and tracking moves in the U.S. dollar and oil prices. "After three weeks of momentous macro moments things slow down as March begins to wrap up," wrote Connor Campbell, financial analyst, at Spreadex, in a Monday note.

The Federal Reserve's softer approach on interest-rate hikes may have restored some bonhomie to the beaten-down stock market, but a continuing profits recession could crash the party before it even gets started.

U.S. stocks mustered small gains on Monday, but climbed enough to see the Dow log its longest win streak in months, while the S&P 500 reached its best close since late 2015. Monday's moves came amid a few high-profile mergers, including a sweetened bid for Starwood Hotels & Resorts World by Marriott International Inc. Merger activity can deliver a boost to Wall Street sentiment.

Asian markets were quiet Tuesday, except for gains in Japan's stocks. With the exception of Japan, stock markets in Asia wavered as few investors seemed inclined to make big bets ahead of the Good Friday holiday. The tepid session mirrors quiet trading overnight in U.S. stocks.

Based on MarketWatch materials

-

03:29

Nikkei 225 17,065.02 +340.21 +2.03 %, Hang Seng 20,663.04 -21.11 -0.10 %, Shanghai Composite 3,004.97 -13.83 -0.46 %

-

00:36

Stocks. Daily history for Sep Mar 21’2016:

(index / closing price / change items /% change)

Hang Seng 20,684.15 +12.52 +0.06 %

Shanghai Composite 3,020.12 +64.97 +2.20 %

FTSE 100 6,184.58 -5.06 -0.08 %

CAC 40 4,427.8 -34.71 -0.78 %

Xetra DAX 9,948.64 -2.16 -0.02 %

FTSE 100 6,184.58 -5.06 -0.08 %

CAC 40 4,427.8 -34.71 -0.78 %

Xetra DAX 9,948.64 -2.16 -0.02 %

-