Noticias del mercado

-

20:00

Dow -0.50% 17,494.59 -87.98 Nasdaq -1.01% 4,772.79 -48.87 S&P -0.64% 2,036.72 -13.08

-

18:49

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes slightly fell. energy stocks weighed on a quiet Wednesday as investors shied away from big bets after the Brussels attacks and ahead of the long Easter weekend. Oil prices fell more than 3% after data showing a rise in U.S. stockpiles last week rekindled worries about a global glut.

Dow stocks mixed (15 vs 15). Top looser - NIKE, Inc. (NKE, -2,43%). Top gainer - UnitedHealth Group Incorporated (UNH, +1,68%).

All S&P sectors in negative area. Top looser - Basic Materials (-1,9%).

At the moment:

Dow 17458.00 -46.00 -0.26%

S&P 500 2032.75 -9.75 -0.48%

Nasdaq 100 4404.00 -30.50 -0.69%

Oil 40.09 -1.36 -3.28%

Gold 1224.10 -24.50 -1.96%

U.S. 10yr 1.89 -0.04

-

18:05

WSE: Session Results

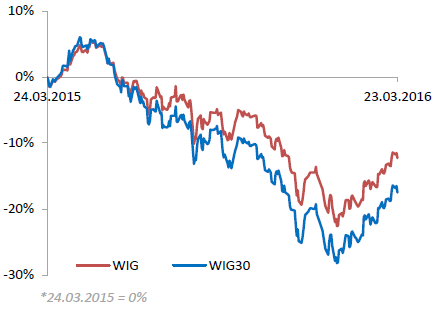

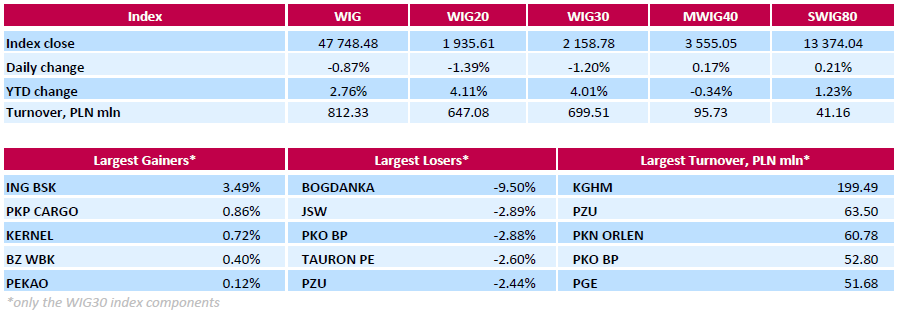

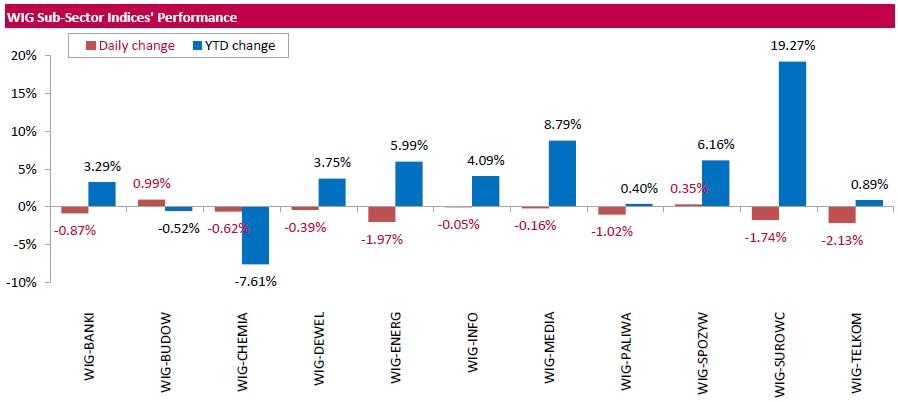

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, slid down 0.87%. Except for construction sector (+0.99%) and food sector (+0.35%), every sector in the WIG Index fell, with telecommunication sector (-2.13%) lagging behind.

The large-cap stocks' measure, the WIG30 Index lost 1.2%. A majority of the index components recorded declines. Thermal coal miner BOGDANKA (WSE: LWB) was the weakest name, retreating by 9.5% after two consecutive sessions of solid gains. Among the other biggest losers were coking coal miner JSW (WSE: JSW), bank PKO BP (WSE: PKO), genco TAURON PE (WSE: TPE) and insurer PZU (WSE: PZU), plunging by 2.44%-2.89%. On the other side of the ledger, bank ING BSK (WSE: ING) led a handful of gainers with a 3.49% advance. It was followed by railway freight transport operator PKP CARGO (WSE: PKP) and agricultural producer KERNEL (WSE: KER), surging by 0.86% and 0.72% respectively.

-

18:00

European stocks closed: FTSE 100 6,199.11 +6.37 +0.10% CAC 40 4,423.98 -7.99 -0.18% DAX 10,022.93 +32.93 +0.33%

-

18:00

European stocks close: stocks closed mixed on lower oil prices

Stock indices closed mixed as oil prices declined on a higher-than-expected increase in U.S. crude oil inventories.

No major economic reports were released in the Eurozone.

European Central Bank (ECB) Governing Council member Jens Weidmann said in a speech on Wednesday that the latest stimulus measures by the ECB went too far and did not convince him.

The German Council of Economic Experts (GCEE) lowered its growth forecast on Wednesday. The German economy is expected to expand 1.5% in 2016, down from its previous estimate of 1.6%, and 1.6% in 2017. The downward revision was driven by weaker external demand.

Eurozone's inflation is expected to be 0.2% in 2016, down from its previous forecast of 1.1%, and 1.1% in 2017.

The experts expects the economy in Germany to continue to expand, driven by consumer spending, expansionary fiscal policy, and monetary policy.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,199.11 +6.37 +0.10 %

DAX 10,022.93 +32.93 +0.33 %

CAC 40 4,423.98 -7.99 -0.18 %

-

17:50

St. Louis Fed President James Bullard: an interest rate hike by the Fed in April is possible as the U.S. labour market continues to improve

St. Louis Fed President James Bullard said in an interview with Bloomberg TV that an interest rate hike by the Fed in April was possible as the U.S. labour market continued to improve.

He was concerned about inflation expectations, which showed signs of stabilisation, but seemed to correlate with oil prices.

St. Louis Fed president criticised the Fed's dot plot forecasts of interest rates.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:29

European Central Bank Governing Council member Jens Weidmann: the latest stimulus measures by the ECB went too far

European Central Bank (ECB) Governing Council member Jens Weidmann said in a speech on Wednesday that the latest stimulus measures by the ECB went too far and did not convince him.

He noted that there was no risk of deflation.

Weidmann warned that low interest rates could lead to asset bubbles and to lower willingness to implement structural reforms.

-

17:16

Japan’s government lowers its assessment of the economy

Japan's Cabinet Office released its monthly economic report on Wednesday. The government cut its assessment of the economy, saying that downward revision was driven by a weakness in consumer spending.

The government pointed out that Japan's economy continued to recover, adding that there were downside risks from the slowdown in emerging economies.

-

16:57

German Council of Economic Experts’ (GCEE) cuts its growth forecast

The German Council of Economic Experts (GCEE) lowered its growth forecast on Wednesday. The German economy is expected to expand 1.5% in 2016, down from its previous estimate of 1.6%, and 1.6% in 2017.

The downward revision was driven by weaker external demand.

Eurozone's inflation is expected to be 0.2% in 2016, down from its previous forecast of 1.1%, and 1.1% in 2017.

The experts expects the economy in Germany to continue to expand, driven by consumer spending, expansionary fiscal policy, and monetary policy.

The GCEE noted that investors expected longer period of low interest rates.

According to the experts, there are risks to the global outlook from the slowdown in emerging economies, turmoil on global financial markets, geopolitical conflicts, the resurgence of the euro crisis and possible Britain's exit from the European Union.

-

16:44

European Central Bank Executive Board member Sabine Lautenschlaeger: interest rates could be cut further but the balance between the costs and the benefits is needed

European Central Bank (ECB) Executive Board member Sabine Lautenschlaeger said on Wednesday that interest rates could be cut further but the balance between the costs and the benefits is needed.

"You can always go lower with rates," she said.

Lautenschlaeger noted that she would support the exit from accommodative monetary policy.

-

16:12

NBB business climate for Belgium rises to -4.2 in March

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate rose to -4.2 in March from -6.6 in February. Analysts had expected the index to rise to -6.0.

All 4 indicators climbed in March.

The business climate index for the manufacturing sector was up to -7.9 in March from -11.2 in February due to a more favourable assessments of total order books.

The business climate index for the services sector rose to 11.2 in March from 10.5 in February due to a more favourable assessment of the current activity and expectations for an increase general market demand.

The business climate index for the building sector increased to -3.9 in March from -4.1 in February due to an improvement of the demand-side components.

The business climate index for the trade sector climbed to -4.1 in March from -5.1 in February due to a rise in employment.

-

15:41

New home sales in the U.S. increase 2.0% in February

The U.S. Commerce Department released new home sales data on Wednesday. New home sales increased 2.0% to a seasonally adjusted annual rate of 512,000 units in February from 502,000 units in January. January's figure was revised up from 494,000 units.

Analysts had expected new home sales to reach 510,000 units.

The increase was mainly driven higher sales in the West region. New home sales in the West region climbed 38.5% in February.

-

14:56

The KOF Swiss Economic Institute lowers its growth forecasts for Switzerland

The KOF Swiss Economic Institute released its growth forecasts for Switzerland on Wednesday. The Swiss economy is expected to expand 1.0% in 2016, down from the previous estimate of 1.1%, and 2.0% in 2017, unchanged from its previous estimate.

The downward revision was driven by the global economic weakness and the structural adjustments in Switzerland.

"Following a difficult 2015 for the Swiss economy as a whole, the prospects are gradually brightening. The weak international development towards the end of 2015 curbed the opportunities for exporters. Thanks to the gradual recovery of the economies of Switzerland's trading partners, the local economy is expected to regain its footing," the KOF said in its statement.

The KOF forecasted that consumer prices in Switzerland would be at -0.7% year-on-year in 2016, down from the previous estimate of -0.5%, and 0.1% in 2017, down from the previous estimate of 0.2%.

The unemployment rate is expected to be 3.5% in 2016, down from the previous estimate of 3.6%.

-

14:53

WSE: After start on Wall Street

After the opening of Wall Street sessions, major indexes are in the red (U.S. Stocks open: Dow -0.25%, Nasdaq -0.22%, S&P -0.22%). This resulted in a prompt adjustment of the German market, where the DAX fell to daily lows and currently hovers below the level of today's opening. WIG20 index weakened further, and fell to the daily minimum on the way to the level of 1942 points (-1,04%). Another risk is the behavior of KGHM, which due to falling prices of raw materials and along with them the strengthening of the American currency, begun to decline (-0,18%).

-

14:33

U.S. Stocks open: Dow -0.25%, Nasdaq -0.22%, S&P -0.22%

-

14:22

Before the bell: S&P futures -0.09%, NASDAQ futures -0.03%

U.S. stock-index were flat.

Global Stocks:

Nikkei 17,000.98 -47.57 -0.28%

Hang Seng 20,615.23 -51.52 -0.25%

Shanghai Composite 3,010.79 +11.43 +0.38%

FTSE 6,199.48 +6.74 +0.11%

CAC 4,448.99 +17.02 +0.38%

DAX 10,078.94 +88.94 +0.89%

Crude oil $40.96 (-1.18%)

Gold $1224.40 (-2.00%)

-

14:07

European stock markets mid session: stocks traded higher in the absence of any major economic reports from the Eurozone

Stock indices recovered after terrorist attacks at the international airport in Brussels. At least 34 people have been killed and about 250 injured.

No major economic reports were released in the Eurozone.

Reuters reported on Tuesday that according to a draft of Germany's Finance Ministry, the government plans to raise its spending by €30.9 billion to €347.8 billion by 2020, while the budget should remain balanced.

Current figures:

Name Price Change Change %

FTSE 100 6,200.26 +7.52 +0.12 %

DAX 10,089.45 +99.45 +1.00 %

CAC 40 4,450.5 +18.53 +0.42 %

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.76

-0.09(-0.9137%)

45956

ALTRIA GROUP INC.

MO

61.14

0.14(0.2295%)

900

Amazon.com Inc., NASDAQ

AMZN

561.99

1.51(0.2694%)

4335

Apple Inc.

AAPL

106.84

0.12(0.1124%)

42773

AT&T Inc

T

38.67

0.04(0.1035%)

5282

Barrick Gold Corporation, NYSE

ABX

14.01

-0.49(-3.3793%)

231848

Boeing Co

BA

135.55

0.43(0.3182%)

821

Caterpillar Inc

CAT

75.16

-0.39(-0.5162%)

2920

Chevron Corp

CVX

95

-0.50(-0.5236%)

567

Cisco Systems Inc

CSCO

28.29

0.01(0.0354%)

554

Citigroup Inc., NYSE

C

43.32

-0.06(-0.1383%)

9754

Exxon Mobil Corp

XOM

83.83

-0.29(-0.3447%)

1886

Facebook, Inc.

FB

112.43

0.18(0.1604%)

55964

Ford Motor Co.

F

13.65

0.06(0.4415%)

29500

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.76

-0.23(-2.0928%)

134654

General Electric Co

GE

31.03

-0.03(-0.0966%)

34471

General Motors Company, NYSE

GM

31.75

-0.15(-0.4702%)

333

Google Inc.

GOOG

745.22

4.47(0.6034%)

2774

Hewlett-Packard Co.

HPQ

12.21

-0.05(-0.4078%)

1550

Intel Corp

INTC

32.39

0.07(0.2166%)

3517

International Business Machines Co...

IBM

147.97

-0.13(-0.0878%)

473

JPMorgan Chase and Co

JPM

60.24

0.00(0.00%)

1600

McDonald's Corp

MCD

123.96

0.14(0.1131%)

800

Merck & Co Inc

MRK

54

0.97(1.8292%)

10124

Microsoft Corp

MSFT

54.2

0.13(0.2404%)

13283

Nike

NKE

61.34

-3.56(-5.4854%)

438393

Pfizer Inc

PFE

30.48

0.10(0.3292%)

3568

Tesla Motors, Inc., NASDAQ

TSLA

233.8

-0.44(-0.1878%)

18026

The Coca-Cola Co

KO

45.48

-0.02(-0.044%)

2570

Twitter, Inc., NYSE

TWTR

16.96

0.10(0.5931%)

35880

United Technologies Corp

UTX

98.8

0.14(0.1419%)

1685

Verizon Communications Inc

VZ

53.18

-0.03(-0.0564%)

2140

Visa

V

72.99

0.03(0.0411%)

1288

Wal-Mart Stores Inc

WMT

68

0.13(0.1915%)

1722

Walt Disney Co

DIS

97.8

0.22(0.2255%)

1967

Yahoo! Inc., NASDAQ

YHOO

35.35

-0.06(-0.1694%)

1403

-

13:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Barrick Gold Corp (ABX) downgraded to Hold from Buy at Deutsche Bank

Other:

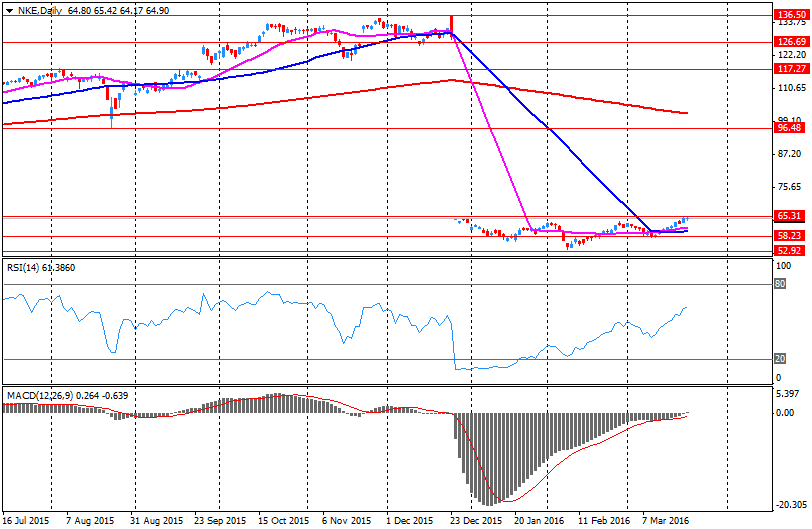

NIKE (NKE) target lowered to $57 rom $66 at Canaccord Genuity

Dow Chemical (DOW) target raised to $62 from $60 at RBC Capital Mkts

-

13:11

WSE: Mid session comment

Rally in European markets - especially Germany - have gained momentum, although trading retains low volatility. The DAX doubled increase from the morning and, the pressure from the environment seems to mount. Warsaw Stock Exchange today did not display similar sentiment, and as of the middle of the session WIG20 is trading at a loss of about 0.15 per cent to the previous close.

At the same time, the futures contracts for S&P500 increased by almost 0.2 percent, so the Wall Street seems to keep the distance ahead of Europe. We expect this to be one of the major considerations for the second half of the session.

-

12:53

Company News: NIKE (NKE) Q3 Earnings Beat Expectations

NIKE reported Q3 FY2016 earnings of $0.55 per share (versus $0.89 in Q3 FY 2015), beating analysts' consensus of $0.47. The company's quarterly revenues amounted to $8.032 bln (+7.7% y/y), slightly missing consensus estimate of $8.201 bln.

NIKE provided financials guidance targets for Q4 and FY 2017. The company expects its revenue to grow at mid-single digit rate in Q4 (analysts forecast an increase of 8.9% y/y). For FY2017, NIKE projects its revenue to grow at high single digit rate and EPS to grow at low teen rate.

NKE fell to $61.50 (-5.24%) in pre-market trading.

-

11:40

Spanish producer prices decline 1.3% in February

The Spanish statistical office INE released its producer price index (PPI) data for Spain on Wednesday. The Spanish producer prices dropped 1.3% in February, after a 2.5% fall in January.

On a yearly basis, producer price inflation in Spain fell 5.7% in February, after a 4.2% decline in January. Producer prices have been declining since July 2014.

Energy prices slid 19.8% year-on-year in February, capital goods prices rose 0.8%, and consumer goods prices increased 0.2%, while intermediate goods prices declined 2.1%.

-

11:22

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 2.5 in March

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 2.5 in March from -5.9 in February.

"The economic expectations reach a slightly positive balance. Still, a majority of 71.1 per cent of analysts expect economic growth in Switzerland to remain unchanged," the ZEW said.

The current conditions rose to -2.7 in March from-6.0 in February.

-

11:07

Bank of Japan board member Yukitoshi Funo: the central bank is ready to add further stimulus measures if risks to the economy increase

Bank of Japan (BoJ) board member Yukitoshi Funo said on Wednesday that the central bank was ready to add further stimulus measures if risks to the economy increase. He added that there was limit to interest rate cuts.

Funo noted that further stimulus measures will depend on the economic data.

Funo voted for negative interest rate at the January monetary policy meeting.

-

10:53

Canadian 2016-2017 budget deficit is larger than previously estimated

Canadian Finance Minister Bill Morneau presented 2016-2017 (starting on April 1) budget on Tuesday. The government plans to spend more than C$47 billion ($36 billion) over the next five years, beginning with the 2016-2017 fiscal year. This spending should add to the Canadian economic growth 0.5% in 2016 and 1% in 2017, according to the government. The budget deficit is expected to be C$29.4 billion ($23 billion), or 1.5% of GDP, in fiscal year 2016-2017, up from the previous estimate of a C$18.4 billion ($14 billion), and up from the forecasted C$5.4 billion deficit in the fiscal year 2015-2017.

The government expects the debt-to-GDP ratio to be 32.5% in 2017.

-

10:39

German government plans to raise its spending by €30.9 billion to €347.8 billion by 2020

Reuters reported on Tuesday that according to a draft of Germany's Finance Ministry, the government plans to raise its spending by €30.9 billion to €347.8 billion by 2020, while the budget should remain balanced. The government expect to boost its spending by €8.6 billion to €325.5 billion in 2017. The 2017 budget and financing plan up to 2020 are expected to be approved on July 06.

-

10:23

Philadelphia Fed President Patrick Harker: the Fed should hike its interest rate in April if the U.S. economy continues to improve

Philadelphia Fed President Patrick Harker said on Tuesday that the Fed should hike its interest rate in April if the U.S. economy continues to improve. He pointed out that he would like to see more than two interest rate hikes this year, adding that the monetary policy would remain accommodative.

Harker is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:13

Chicago Fed President Charles Evans expects two interest rate hikes by the Fed this year

Chicago Fed President Charles Evans said on Tuesday that he expected two interest rate hikes by the Fed this year but declined to say when the Fed should raise interest rate.

He also said that the Fed should wait until inflation in the U.S. will pick up toward 2% target before hiking interest rate further.

Evans pointed out that a weak corporate spending, low commodities prices, the slowdown in the Chinese economy and market volatility weigh on the U.S. economic growth.

Evans is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

09:24

WSE: After opening

WIG20 index opened at 1959.07 points (-0.20%)*; other indexes:

WIG 48171.20 0.01%

WIG20 1959.07 -0.20%

WIG30 2184.81 -0.01%

mWIG40 3549.45 0.01%

*/ change to previous close

Europe begins trading on increases which in turn puts upward pressure on the Warsaw Stock Exchange, however the WSE selects a scenario of consolidation and extension of the drift at the levels achieved at the end of the last week. The WIG20 index after the first few minutes has placed in the region of 1,966 pts. Due to indicators the market is heavily bought, so the task for the bulls to play 2,000 points is not easy. Nevertheless, defeated the resistance in the region of 1,905 points and pending resistance in the region of 2,000 points make an opening in the region of 1,960 points technically neutral.

-

08:28

WSE: Before opening

Tuesday's trading on Wall Street brought modest changes in the major indices. The sessions were in many respects similar to Europeans ones. The broad market index S&P500 fell by 0.09 percent. Here we can talk about the extension of the stabilization observed at the end of yesterday's session in Europe and the USA. The same is true of the Asian markets and the FX market.

Maintaining a similar atmosphere to 9:00 should lead to small changes in the opening of indexes for today's trading in Europe. In the following hours, it is difficult to expect from return of any excessive optimism. In total, the exchange already operate under the upcoming holidays.

The most important report on today's macroeconomic calendar will be the read of fuel stocks levels in the United States.

On the Warsaw market, we expect today to observe core markets and move in correlation with major global indices.

-

07:33

Global Stocks: stocks closed lower after explosions at the Brussels Airport

Europe's main stock benchmark closed lower Tuesday, albeit well off session lows, after explosions at the Brussels Airport and a local subway station left dozens dead and injured.

U.S. stocks gave up meager gains to end slightly lower Tuesday as a decline in financial and consumer-staples shares weighed on the main benchmarks. Wall Street spent most of the session lower as investors wrestled with the fallout from deadly attacks in Belgium.

Equity markets in the Asia-Pacific region were largely quiet on Wednesday, despite losses in Europe following the deadly attacks in Brussels. Analysts say investors are reluctant to place large bets ahead of the Good Friday and Easter holidays.

Based on MarketWatch materials

-

03:04

Nikkei 225 17,082.47 +33.92 +0.20 %, Hang Seng 20,683.82 +17.07 +0.08 %, Shanghai Composite 2,995.58 -3.78 -0.13 %

-

01:02

Stocks. Daily history for Sep Mar 22’2016:

(index / closing price / change items /% change)

Nikkei 225 17,048.55 +323.74 +1.94 %

Hang Seng 20,666.75 -17.40 -0.08 %

Shanghai Composite 3,000.67 -18.13 -0.60 %

FTSE 100 6,192.74 +8.16 +0.13 %

CAC 40 4,431.97 +4.17 +0.09 %

Xetra DAX 9,990 +41.36 +0.42 %

S&P 500 2,049.8 -1.80 -0.09 %

NASDAQ Composite 4,821.66 +12.79 +0.27 %

Dow Jones 17,582.57 -41.30 -0.23 %

-