Noticias del mercado

-

16:36

The Conference Board Leading Economic Index for Australia increased 0.1 percent in June

The Conference Board Leading Economic Index®(LEI) for Australia increased 0.1 percent in June 2016 to 102.6 (2010=100).

The Conference Board Coincident Economic Index®(CEI) for Australia increased 0.2 percent in June 2016 to 111.3 (2010=100).

This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously

-

16:31

Australia: Conference Board Australia Leading Index, June 0.1%

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1125 (EUR 235m) 1.1345 (240m)

USDJPY: 100.00 (USD 551m)

GBPUSD: 1.2850(GBP 250m) 1.3000 (206m)

AUDUSD: 0.7300(AUD 201m) 0.7600 (258m)

NZDUSD: 0.7275 (NZD 201m) 0.7325 (NZD657m)

USDCAD: 1.3000 (USD 250m)

-

15:26

Moody's: US retail sales will suffer as student debt exceeds USD 1.3trln

-

student debt is set to negatively affect US retail sales

-

the debt burden is also shifting toward the highest spending demographic, with 30 to 39-year-olds now holding the largest share of student loans outstanding.

-

-

14:32

Canadian wholesale sales increased for a third consecutive month

Wholesale sales increased for a third consecutive month in June, up 0.7% to $56.4 billion. Four of the seven subsectors, representing 68% of wholesale sales, recorded gains.

In volume terms, wholesale sales rose 0.6% from May to June.

In the second quarter, wholesale sales in current dollars grew 0.6%, while those in constant dollars advanced 1.1%.

Higher sales in four subsectors

The motor vehicle and parts subsector posted the largest increase in dollar terms in June, rising 3.1% to $11.2 billion, mainly on the strength of higher sales in the motor vehicle industry (+3.8%). For both the subsector and the industry, higher sales in the second quarter more than offset the decline in the first quarter. Imports of motor vehicles and parts, and manufacturing sales of motor vehicles also recorded gains in June.

The personal and household goods subsector posted the second largest increase in June, up 2.0% to $8.4 billion. This was the fifth consecutive monthly rise. While sales advanced in five of the subsector's six industries, the textile, clothing and footwear industry (+6.9%) and pharmaceuticals and pharmacy supplies industry (+1.4%) contributed the most to the gain.

Sales in the building material and supplies subsector increased for the second consecutive month in June, up 1.8% to $7.6 billion, with all of the subsector's industries reporting gains. The lumber, millwork, hardware and other building supplies industry (+2.6%) contributed the most to the rise, its sales reaching their highest level on record.

The machinery, equipment and supplies subsector rose 1.1% to $11.1 billion, a second consecutive increase. Higher sales were recorded in three of its four industries.

-

14:30

Canada: Wholesale Sales, m/m, June 0.7%

-

14:30

U.S.: Chicago Federal National Activity Index, July 0.27

-

13:51

Orders

EUR/USD

Offers 1.1300 1.1320 1.1335 1.1350 1.1380-85 1.1400 1.1425-30 1.1450

Bids 1.1270 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.3080-85 1.3100 1.3120-25 1.3150 1.3180-85 1.3200 1,3230 1.3250

Bids 1.3025-30 1.3000 1.2980 1.2950 1.2930 1.2900

EUR/GBP

Offers 0.8655-60 0.8685 0.8700 0.8725-30 0.8750

Bids 0.8625-30 0.8600 0.8585 0.8570 0.8550 0.8530 0.8500

EUR/JPY

Offers 113.80 114.00 114.30 114.50 114.75 115.00

Bids 113.50 113.30-35 113.00 112.75-80 112.50 112.30 112.00-10

USD/JPY

Offers 100.85 101.00 101.25-30 101.50 101.75-80 102.00

Bids 100.50 100.30 100.00 99.85 99.65 99.50 99.30 99.00 98.80 98.50

AUD/USD

Offers 0.7620 0.7650 0.7680 0.7700 0.7725-30 0.7750-55

Bids 0.7600 0.7585 0.7565 0.7550 0.7500

-

13:50

-

11:25

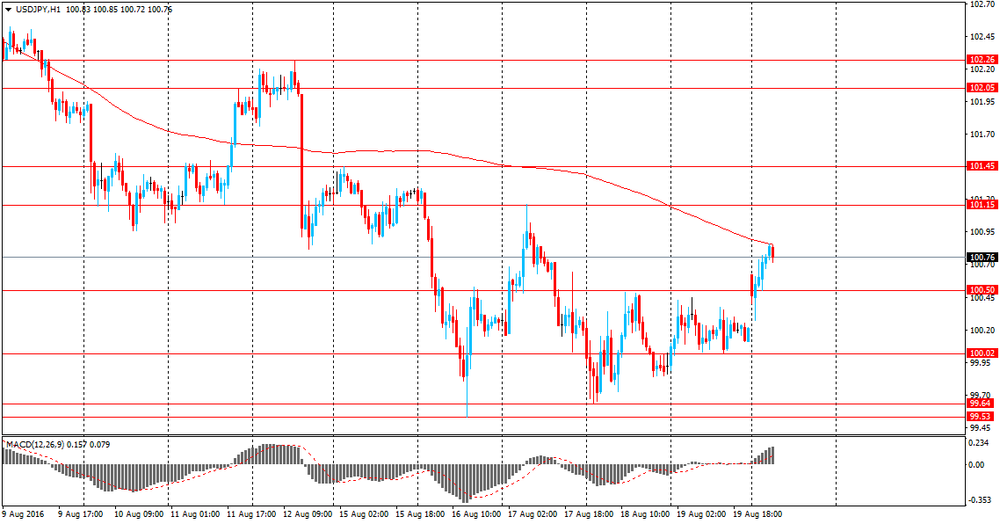

JPY: Focus On 20Y Auction And On Rhetoric From BoJ, FOMC 20Y Auction - Credit Agricole

"The fortunes of the JPY remain strongly tied to the outlooks for the BoJ and the FOMC. JGB auctions provide regular updates on investors' thinking about the BoJ and have shown 20-30bp rises in the yields of auctions held since the BoJ's meeting on 29 July. So, the 20Y auction this week will be worth paying attention to.

However, it will be the rhetoric from BoJ Governor, Haruhiko Kuroda, and FOMC Chairwoman, Janet Yellen - who will both be speaking this week - that will dominate the JPY's fortunes.

Any reaction to Japan's inflation data at the end of the week will likely be muted by investors waiting to hear what Yellen has to say at Jackson Hole. PPI inflation, which has been weighed down by the strong JPY, suggests continued weakness in inflation".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

11:24

China's government will maintain ample liquidity in banking system

-

will support commercial banks to replenish capital

-

government to push forward with reform of fiscal, financial mechanisms in an orderly manner

-

will maintain appropriate monetary and financial environment

-

will encourage qualified firms to issue local and foreign ccy bonds overseas

-

aims to reduce tax burden on firms by more than 500bln yuan per year in next 1-2 years

-

will strengthen anti-monopoly, IPR regulations

*via forexlive -

-

10:05

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1350 (EUR 605m)

USD/JPY 101.00 (USD 1.46bln) 103.00 (USD 877m) 104.00 (1.08bln)

AUD/USD 0.7650 (AUD 640m)

USD/CAD 1.2990-1.3000 (USD 756m)

AUD/NZD 1.0700 (AUD 310m) 1.0710-12 (AUD (485m)

-

09:03

Today’s events:

At 15:30 GMT United States will hold an auction of 3 and 6 month bills.

-

09:02

Asian session review: the Dollar strengthened against major currencies

The dollar rose against the yen after the head of the Bank of Japan Haruhiko Kuroda said in an interview with Sankei newspaper that did not rule out the possibility of further reduction in interest rates. He also noted that the change in asset purchases in September will receive a more detailed analysis of the results of the monetary policy.

Also this week, investors will be expecting the Federal Reserve Janet Yellen's speechs at the annual meeting of leading bankers and economists in Jackson Hole, to receive fresh signals on the timing of the next interest rate increase in the United States. After a speech at Jackson Hole in 2014 the dollar changed course and started a long period of apreciation lasting to this day.

The dollar rose against the euro also. Support for the US currency was recent comments by the Fed, which increased the likelihood of a new interest rate hike. The president of the Federal Reserve Bank of San Francisco, Williams said that the Central Bank should hike "sooner rather than later." He added that the US economy is strong enough to withstand the increase in the cost of borrowing, but expressed concern about inflation. According to Williams, the strength of the economy confirms the steady growth of employment, strong consumer spending and improving in the financial condition of households. Meanwhile, the president of the Federal Reserve Bank of New York Dudley also expressed optimism about the US economic outlook, noting that strong data on the number of jobs in the past two months, helped soothe fears that the pace of job creation beginning to slow down. "However, the situation began to change. For the first time in quite a long period the number of new jobs with an average salary was higher than in the categories with the highest and lowest wages"

Futures on interest rates suggest that investors see a 18% chance of a rate hike in September and 43.1% probability of such a move in December.

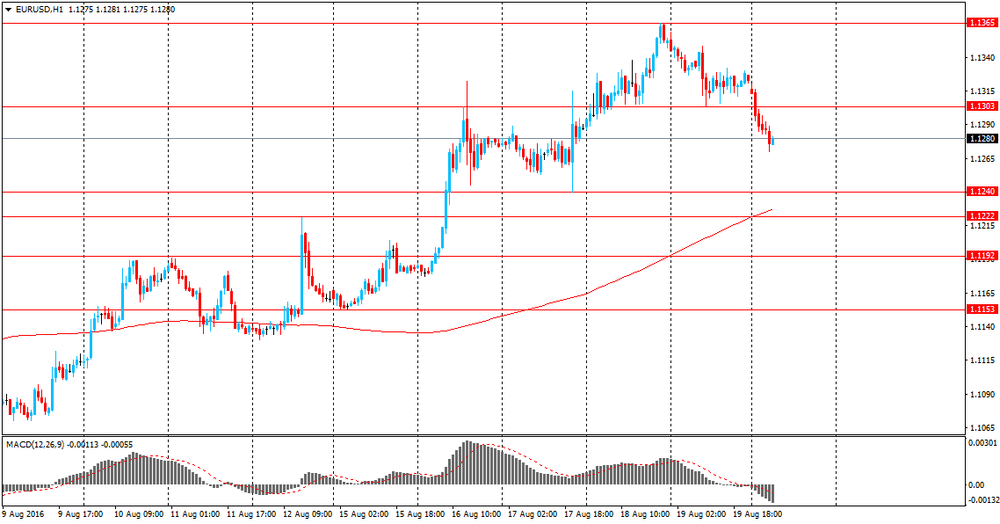

EUR / USD: during the Asian session, the pair was trading in the $ 1.1280-1.1320 range

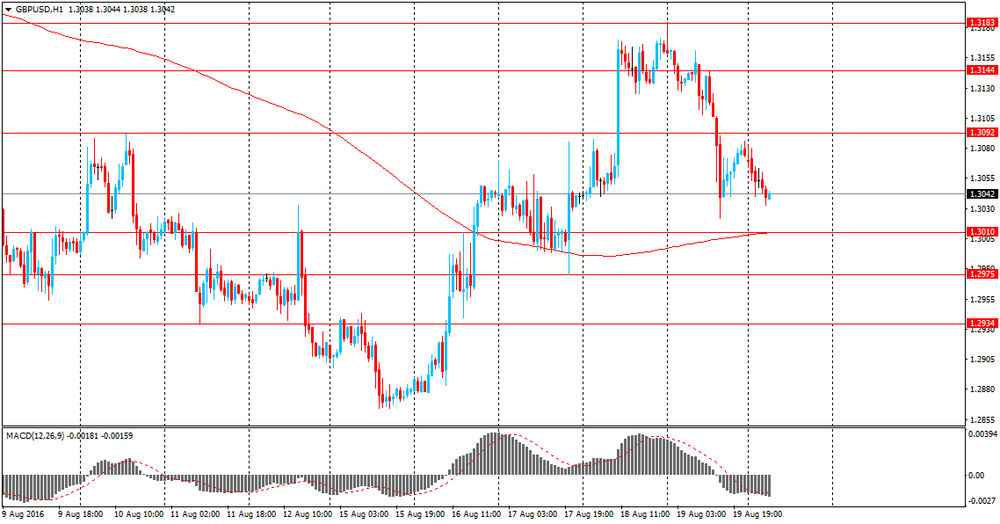

GBP / USD: during the Asian session, the pair was trading in the $ 1.3030-50 range

USD / JPY: during the Asian session, the pair was trading in the Y96.00-40 range.

-

08:07

Risk/Reward Favors Bullish USD Positions Vs EUR, GBP And JPY - RBS

"The minutes from the July FOMC meeting were less hawkish than the market feared as the Committee was divided on the need for another interest rate hike. It's important to remember that the decision to act will ultimately rest with Yellen and that there will be no rate hike until she believes a rate hike is warranted. As our economic desk strategists not some participants stressed that the Committee needed to consider the constraints on the conduct of monetary policy associated with proximity to the effective lower bound on short-term interest rates. In their view, the "some" participants noted above almost certainly includes Yellen. She seems to be sticking to her risk management policy approach and feels little urgency to raise rates. However, the minutes pre-date the strong July US employment report. Dudley appeared to want to stress this in his comments this week.

So could Yellen reinforce Dudley's comments at Jackson-Hole on Friday? We think not. It's an academic conference that concentrates on long-term themes and has in recent years moved away from short-term policy signals. The tone may therefore reflect recent comments from Powell/Williams about low productivity growth and low neutral rates. But Yellen talking about lower long-term rates isn't the same as dampening expectations of a near-term rate increase.

We therefore still believe risk/reward favours USD upside against the EUR, GBP and JPY. Discussions about lower terminal rates should ensure that EM FX out-performs the G4 currencies".

Copyright © 2016 RBS, eFXnews™

-

08:05

Typhoon Mindulle nearing Tokyo

Typhoon Mindulle could make landfall near Tokyo at around noon on Monday. Japan Meteorological Agency officials say that as of 11 AM, Mindulle was near Izu Oshima Island. They expect the typhoon to move north at a speed of 20 kilometers per hour, and to continue traveling north after making landfall. Mindulle is packing winds of about 125 kilometers per hour near its center. Izu city, Shizuoka Prefecture, also recorded 103 millimeters of rainfall for the one hour through 8:40 AM. Mindulle could bring more than 50 millimeters per hour of rain to the greater Tokyo area, the Tokai region, and northern Japan.

-

08:01

FED Vice Chairman Stanley Fischer, remarks on the US economy: we are close to our targets

"The Fed's dual mandate aims for maximum sustainable employment and an inflation rate of 2 percent, as measured by the price index for personal consumption expenditures (PCE). Employment has increased impressively over the past six years since its low point in early 2010, and the unemployment rate has hovered near 5 percent since August of last year, close to most estimates of the full-employment rate of unemployment. The economy has done less well in reaching the 2 percent inflation rate. Although total PCE inflation was less than 1 percent over the 12 months ending in June, core PCE inflation, at 1.6 percent, is within hailing distance of 2 percent--and the core consumer price index inflation rate is currently above 2 percent.

So we are close to our targets. Not only that, the behavior of employment has been remarkably resilient. During the past two years we have been concerned at various stages by the possible negative effects on the U.S. economy of the Greek debt crisis, by the 20 percent appreciation of the trade-weighted dollar, by the Chinese growth slowdown and accompanying exchange rate uncertainties, by the financial market turbulence during the first six weeks of this year, by the dismaying pothole in job growth this May, and by Brexit--among other shocks. Yet, even amid these shocks, the labor market continued to improve: Employment has continued to increase, and the unemployment rate is currently close to most estimates of the natural rate".

-

07:58

BOJ's Kuroda says won't rule out deepening negative rate cut - Sankei. USD/JPY gaps higher

-

07:08

Options levels on monday, August 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1456 (4565)

$1.1403 (4699)

$1.1371 (4631)

Price at time of writing this review: $1.1280

Support levels (open interest**, contracts):

$1.1232 (2391)

$1.1165 (2660)

$1.1083 (4064)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 53696 contracts, with the maximum number of contracts with strike price $1,1250 (4984);

- Overall open interest on the PUT options with the expiration date September, 9 is 57672 contracts, with the maximum number of contracts with strike price $1,1000 (5805);

- The ratio of PUT/CALL was 1.07 versus 1.09 from the previous trading day according to data from August, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (3062)

$1.3207 (1915)

$1.3111 (1306)

Price at time of writing this review: $1.3042

Support levels (open interest**, contracts):

$1.2992 (2043)

$1.2895 (2014)

$1.2797 (2675)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32661 contracts, with the maximum number of contracts with strike price $1,3300 (3062);

- Overall open interest on the PUT options with the expiration date September, 9 is 26829 contracts, with the maximum number of contracts with strike price $1,2800 (2675);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from August, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:29

Currencies. Daily history for Aug 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1323 -0,26%

GBP/USD $1,3074 -0,66%

USD/CHF Chf0,9602 +0,57%

USD/JPY Y100,21 +0,29%

EUR/JPY Y113,48 +0,05%

GBP/JPY Y131 -0,37%

AUD/USD $0,7624 -0,79%

NZD/USD $0,7270 -0,22%

USD/CAD C$1,287 +0,76%

-

00:00

Schedule for today, Monday, Aug 22’2016

(time / country / index / period / previous value / forecast)

12:30 Canada Wholesale Sales, m/m June 1.8%

12:30 U.S. Chicago Federal National Activity Index July 0.16

-