Noticias del mercado

-

21:00

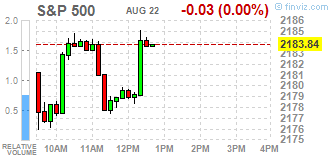

DJIA 18527.47 -25.10 -0.14%, NASDAQ 5237.99 -0.38 -0.01%, S&P 500 2181.37 -2.50 -0.11%

-

18:44

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday as oil prices fell and investors remained cautious ahead of Federal Reserve Chair Janet Yellen's speech this week. With the earnings season coming to an end, investor focus will shift to Yellen's speech on Friday at the annual central bankers' meeting in Jackson Hole, Wyoming to see whether the Fed is keen on raising interest rates in the coming months.

Most of Dow stocks in negative area (21 of 30). Top gainer - The Boeing Company (BA, +0.61%). Top loser - Apple Inc. (AAPL, -1.23%).

Most of S&P sectors also in negative area. Top gainer - Utilities (+0.3%). Top loser - Conglomerates (-2.9%).

At the moment:

Dow 18540.00 0.00 0.00%

S&P 500 2182.25 +0.50 +0.02%

Nasdaq 100 4809.50 +2.50 +0.05%

Oil 47.68 -1.43 -2.91%

Gold 1343.80 -2.40 -0.18%

U.S. 10yr 1.54 -0.04

-

18:01

European stocks closed: FTSE 6828.54 -30.41 -0.44%, DAX 10494.35 -50.01 -0.47%, CAC 4389.94 -10.58 -0.24%

-

17:48

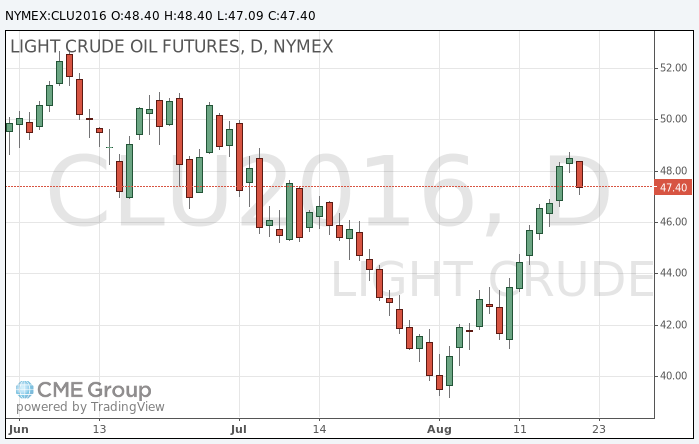

Oill show a negative dynamic

Oil has recently demonstrated the highest volatility among all asset classes in global markets. Today, prices are down sharply after rising almost 11% from the previous week. Analysts doubt that the upcoming talks of the world producers of "black gold" will solve the oversupply problem and said that the sharp rise in oil prices in August are not fundamental.

The prices of oil at $ 50 a barrel or above are unstable due to the ongoing overproduction and excess inventory in the energy markets, and are likely to experience another short-term dip in the coming weeks, Barclays analysts wrote.

The recent rebound of oil prices is more technical than fundamental in nature, according to Morgan Stanley. "In fact, new buyers are virtually absent during the last few months," - said in a research.

Another fact that confirms the saturation of the world's oil supply, was the growth of drilling rigs in the United States for another ten units last week. Compared with May the minimum number of installations has increased by 28%.

In addition, Iraq plans to increase oil exports by 5%, increasing the volume of exports of refined petroleum products from China and the strengthening of the dollar is also not in favor of the further growth of oil prices.

The cost of the October futures for WTI fell to 47.09 dollars per barrel.

October futures for Brent fell to 49.16 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:44

WSE: Session Results

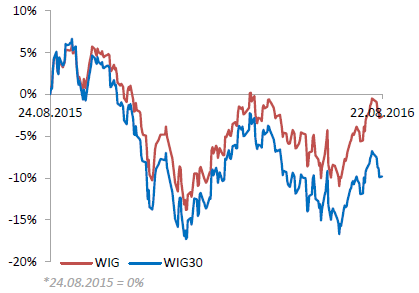

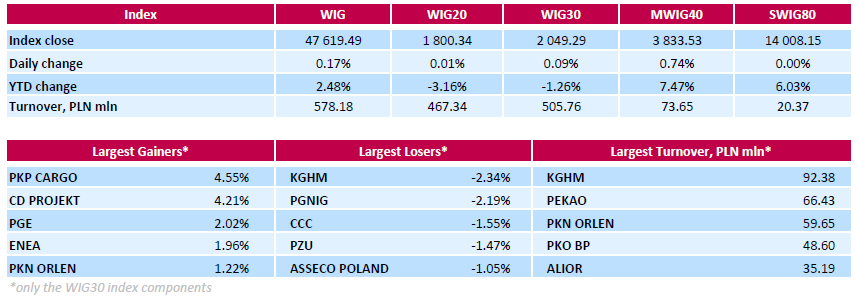

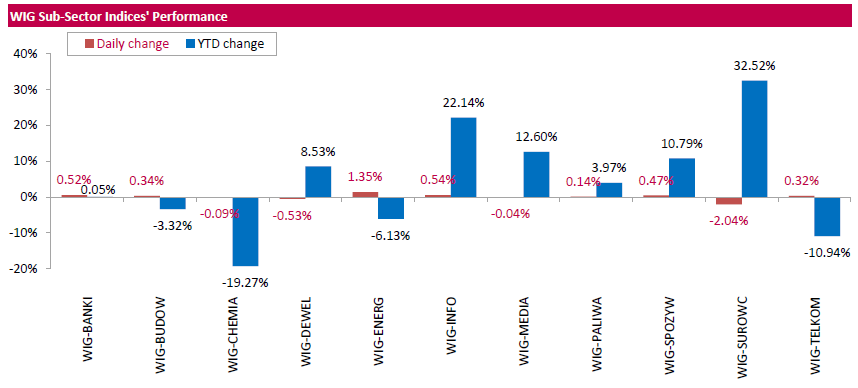

Polish equity market closed higher on Monday. The broad market measure, the WIG index, advanced by 0.17%. Sector performance within the WIG Index was mixed. Utilities (+1.35%) outperformed, while materials (-2.04%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, inched up 0.09%. In the index basket, railway freight transport operator PKP CARGO (WSE: PKP) and videogame developer CD PROJEKT (WSE: CDR) generated the biggest advances, soaring by 4.55% and 4.21% respectively. Other major gainers were oil refiner PKN ORLEN (WSE: PKN), two gencos ENEA (WSE: ENA) and PGE (WSE: PGE) as well as two banking sector names ING BSK (WSE: ING) and ALIOR (WSE: ALR), adding between 1.11% and 2.02%. On the other side of the ledger, copper producer KGHM (WSE: KGH) led the decliners, dropping by 2.34% on news Poland's 2017 draft budget envisages that mining tax, paid almost solely by the state-controlled KGHM, will stay in place next year. It was followed by oil and gas producer PGNIG (WSE: PGN), footwear retailer CCC (WSE: CCC) and insurer PZU (WSE: PZU), sliding by 2.19%, 1.55% and 1.47% respectively.

-

17:24

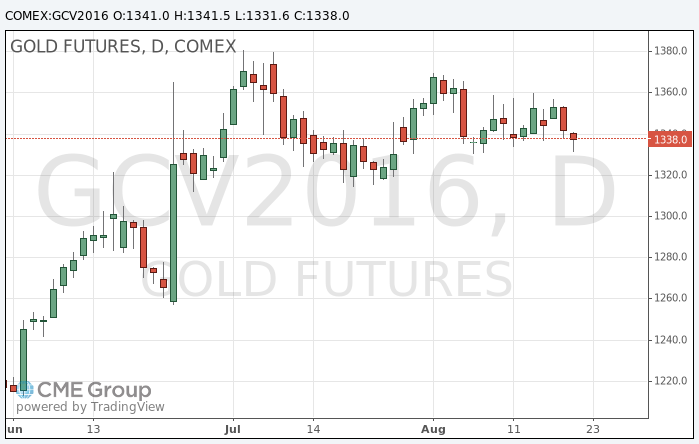

Gold price moderately lower today

Gold declined after comments from Fed officials about improves in the state of the US economy, to strengthen market confidence in raising interest rates this year.

The dollar rose after the Fed's Deputy Stanley Fischer said on Sunday that the US central bank is close to achieving its goal of full employment and two percent inflation.

The presidents of the Federal Reserve Bank of San Francisco and New York's John Williams and William Dudley also expressed confidence in the imminent rate increase.

Stocks of the largest gold exchange-traded fund iSPDR Gold Trust fell last week by 4.5 tonnes after a 20-tonne outflow of the previous week.

"The inflow of funds in the ETF stopped, and hedge funds cut long positions in five of the last six weeks - said the chief analyst of commodity markets at Saxo Bank, Ole Hansen - i think gold may weaken in the short term."

"Everyone will be watching the meeting in Jackson Hole as Fisher and Dudley reinforced expectations of a possible increase in interest rates.", - he added.

Representatives of central banks around the world will gather on Aug. 25 at the annual meeting in Jackson Hole, Wyoming, and Fed Chairman Janet Yellen will deliver a speech the next day.

The cost of the October futures on COMEX fell to $ 1331.60 per ounce.

-

16:36

The Conference Board Leading Economic Index for Australia increased 0.1 percent in June

The Conference Board Leading Economic Index®(LEI) for Australia increased 0.1 percent in June 2016 to 102.6 (2010=100).

The Conference Board Coincident Economic Index®(CEI) for Australia increased 0.2 percent in June 2016 to 111.3 (2010=100).

This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously

-

16:31

Australia: Conference Board Australia Leading Index, June 0.1%

-

15:50

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.1125 (EUR 235m) 1.1345 (240m)

USDJPY: 100.00 (USD 551m)

GBPUSD: 1.2850(GBP 250m) 1.3000 (206m)

AUDUSD: 0.7300(AUD 201m) 0.7600 (258m)

NZDUSD: 0.7275 (NZD 201m) 0.7325 (NZD657m)

USDCAD: 1.3000 (USD 250m)

-

15:42

WSE: After start on Wall Street

Afternoon trading phase brought a deeper decline in Euroland and the bulls on the Warsaw market may boast relative strength to the European stock exchanges where the German DAX clearly went under the line, going directly to the support area 10,400-10,500 points.

Thus begins to materialize the negative scenario of evolving in the environment correction, even though the session is not over yet.

At the beginning of the US session the mood generated by European investors has prompted Americans to start trading with somewhat lower levels.

-

15:33

U.S. Stocks open: Dow -0.32%, Nasdaq -0.17%, S&P -0.24%

-

15:26

Moody's: US retail sales will suffer as student debt exceeds USD 1.3trln

-

student debt is set to negatively affect US retail sales

-

the debt burden is also shifting toward the highest spending demographic, with 30 to 39-year-olds now holding the largest share of student loans outstanding.

-

-

15:26

Before the bell: S&P futures -0.17%, NASDAQ futures -0.16%

U.S. stock-index futures slipped with crude oil, amid increased speculation that interest rates may rise this year after Federal Reserve Vice Chairman Stanley Fischer said the economy was close to meeting the central bank's goals.

Global Stocks:

Nikkei 16,598.19 +52.37 +0.32%

Hang Seng 22,997.91 +60.69 +0.26%

Shanghai 3,084.76 -23.34 -0.75%

FTSE 6,831.03 -27.92 -0.41%

CAC 4,394.17 -6.35 -0.14%

DAX 10,487.54 -56.82 -0.54%

Crude $48.08 (-2.10%)Gold $1341.40 (-0.36%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.61

0.00(0.00%)

65986

ALCOA INC.

AA

10.22

-0.05(-0.4869%)

95529

ALTRIA GROUP INC.

MO

66.57

0.24(0.3618%)

978

Amazon.com Inc., NASDAQ

AMZN

756.75

-0.56(-0.0739%)

4287

American Express Co

AXP

65.53

0.00(0.00%)

161700

AMERICAN INTERNATIONAL GROUP

AIG

58.74

-0.12(-0.2039%)

6100

Apple Inc.

AAPL

109.35

-0.01(-0.0091%)

23161

AT&T Inc

T

40.95

-0.06(-0.1463%)

5955

Barrick Gold Corporation, NYSE

ABX

20.3

-0.31(-1.5041%)

83088

Boeing Co

BA

134.44

0.00(0.00%)

24683

Caterpillar Inc

CAT

83.5

-0.34(-0.4055%)

937

Chevron Corp

CVX

101.26

-1.06(-1.036%)

686

Cisco Systems Inc

CSCO

30.47

-0.05(-0.1638%)

3790

Citigroup Inc., NYSE

C

46.4

-0.13(-0.2794%)

6765

Deere & Company, NYSE

DE

86.79

-0.53(-0.607%)

13635

E. I. du Pont de Nemours and Co

DD

69.9

0.12(0.172%)

150

Exxon Mobil Corp

XOM

87.3

-0.50(-0.5695%)

7337

Facebook, Inc.

FB

123.57

0.01(0.0081%)

65209

FedEx Corporation, NYSE

FDX

168.63

0.00(0.00%)

464

Ford Motor Co.

F

12.4

0.01(0.0807%)

29200

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.73

-0.24(-2.005%)

111783

General Electric Co

GE

31.23

-0.02(-0.064%)

12977

General Motors Company, NYSE

GM

31.9

0.07(0.2199%)

1200

Goldman Sachs

GS

166.07

-0.16(-0.0962%)

9447

Google Inc.

GOOG

775.42

0.00(0.00%)

641

Hewlett-Packard Co.

HPQ

14.47

0.05(0.3467%)

121099

Home Depot Inc

HD

135.47

0.01(0.0074%)

255

HONEYWELL INTERNATIONAL INC.

HON

116.04

-0.07(-0.0603%)

41128

Intel Corp

INTC

35.15

-0.09(-0.2554%)

3917

International Business Machines Co...

IBM

160

-0.04(-0.025%)

1016

International Paper Company

IP

47.15

-0.31(-0.6532%)

132

Johnson & Johnson

JNJ

119.92

0.00(0.00%)

3602

JPMorgan Chase and Co

JPM

66

0.14(0.2126%)

5735

McDonald's Corp

MCD

114.81

-0.20(-0.1739%)

490

Merck & Co Inc

MRK

63.44

0.08(0.1263%)

400

Microsoft Corp

MSFT

57.5

-0.12(-0.2083%)

726

Nike

NKE

58.92

0.02(0.034%)

655206

Pfizer Inc

PFE

34.64

-0.34(-0.972%)

74852

Procter & Gamble Co

PG

87.3

-0.01(-0.0114%)

194119

Starbucks Corporation, NASDAQ

SBUX

54.86

-0.08(-0.1456%)

5362

Tesla Motors, Inc., NASDAQ

TSLA

224.35

-0.65(-0.2889%)

4789

The Coca-Cola Co

KO

44

0.08(0.1821%)

859

Travelers Companies Inc

TRV

117.47

0.00(0.00%)

173163

Twitter, Inc., NYSE

TWTR

18.99

0.01(0.0527%)

17893

United Technologies Corp

UTX

109.14

0.00(0.00%)

79089

UnitedHealth Group Inc

UNH

142.04

0.00(0.00%)

36927

Verizon Communications Inc

VZ

52.48

0.03(0.0572%)

218838

Visa

V

80.63

0.16(0.1988%)

147684

Wal-Mart Stores Inc

WMT

72.89

0.08(0.1099%)

5050

Walt Disney Co

DIS

96.39

-0.00(-0.00%)

1593

Yahoo! Inc., NASDAQ

YHOO

42.94

-0.08(-0.186%)

1550

Yandex N.V., NASDAQ

YNDX

22.42

-0.06(-0.2669%)

1900

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

HP (HPQ) target raised to $14 from $12 at RBC Capital Mkts

Deere (DE) target raised to $80 from $72 at RBC Capital Mkts

-

14:32

Canadian wholesale sales increased for a third consecutive month

Wholesale sales increased for a third consecutive month in June, up 0.7% to $56.4 billion. Four of the seven subsectors, representing 68% of wholesale sales, recorded gains.

In volume terms, wholesale sales rose 0.6% from May to June.

In the second quarter, wholesale sales in current dollars grew 0.6%, while those in constant dollars advanced 1.1%.

Higher sales in four subsectors

The motor vehicle and parts subsector posted the largest increase in dollar terms in June, rising 3.1% to $11.2 billion, mainly on the strength of higher sales in the motor vehicle industry (+3.8%). For both the subsector and the industry, higher sales in the second quarter more than offset the decline in the first quarter. Imports of motor vehicles and parts, and manufacturing sales of motor vehicles also recorded gains in June.

The personal and household goods subsector posted the second largest increase in June, up 2.0% to $8.4 billion. This was the fifth consecutive monthly rise. While sales advanced in five of the subsector's six industries, the textile, clothing and footwear industry (+6.9%) and pharmaceuticals and pharmacy supplies industry (+1.4%) contributed the most to the gain.

Sales in the building material and supplies subsector increased for the second consecutive month in June, up 1.8% to $7.6 billion, with all of the subsector's industries reporting gains. The lumber, millwork, hardware and other building supplies industry (+2.6%) contributed the most to the rise, its sales reaching their highest level on record.

The machinery, equipment and supplies subsector rose 1.1% to $11.1 billion, a second consecutive increase. Higher sales were recorded in three of its four industries.

-

14:30

Canada: Wholesale Sales, m/m, June 0.7%

-

14:30

U.S.: Chicago Federal National Activity Index, July 0.27

-

13:51

Orders

EUR/USD

Offers 1.1300 1.1320 1.1335 1.1350 1.1380-85 1.1400 1.1425-30 1.1450

Bids 1.1270 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.3080-85 1.3100 1.3120-25 1.3150 1.3180-85 1.3200 1,3230 1.3250

Bids 1.3025-30 1.3000 1.2980 1.2950 1.2930 1.2900

EUR/GBP

Offers 0.8655-60 0.8685 0.8700 0.8725-30 0.8750

Bids 0.8625-30 0.8600 0.8585 0.8570 0.8550 0.8530 0.8500

EUR/JPY

Offers 113.80 114.00 114.30 114.50 114.75 115.00

Bids 113.50 113.30-35 113.00 112.75-80 112.50 112.30 112.00-10

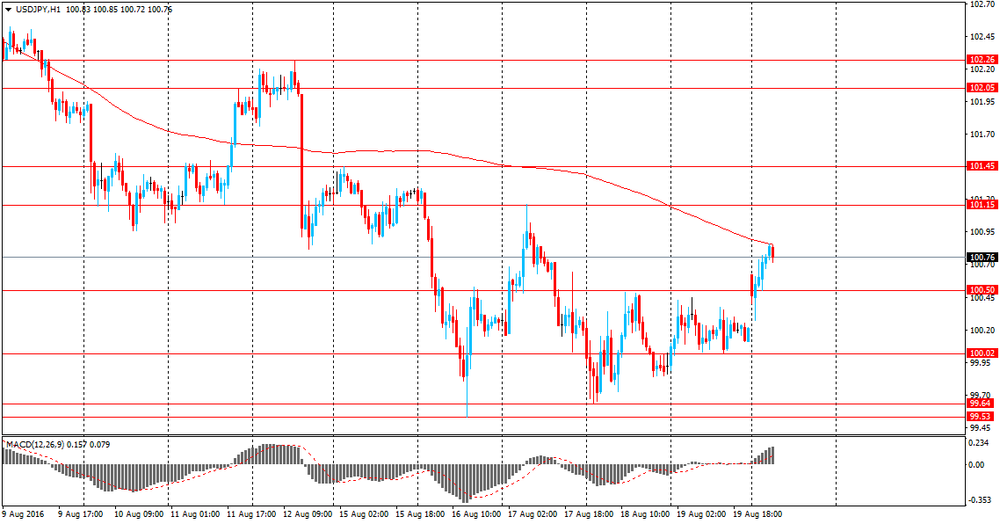

USD/JPY

Offers 100.85 101.00 101.25-30 101.50 101.75-80 102.00

Bids 100.50 100.30 100.00 99.85 99.65 99.50 99.30 99.00 98.80 98.50

AUD/USD

Offers 0.7620 0.7650 0.7680 0.7700 0.7725-30 0.7750-55

Bids 0.7600 0.7585 0.7565 0.7550 0.7500

-

13:50

-

13:02

WSE: Mid session comment

In the first hour of trading the WIG20 index defended the level of support and started up inspired by similar attitude of surrounding. Unfortunately, the next trading hours brought the return of part of earlier gains. A similar situation took place on the European markets. The Warsaw market easily gave a large part of the morning gains and the index WIG20 moved down at around the level of 1,800 points, which only briefly managed to halt the process of withdrawal. At the halfway point of the session the index of the largest companies stood at the level of 1,797 points (-0,18%) with the turnover close to PLN 200 mln.

-

12:43

Major stock indices in Europe trading mixed in very low activity

European stocks mostly rise, getting support from the corporate news and a rise in price of shares of exporters in response to the weakening of the euro against the US dollar.

The dollar strengthened on recent statements by Fed Vice Chairman Stanley Fischer that the central bank is still considering the possibility of a rate hike in 2016. He also noted that the US economy is already close to objectives and will continue to gain momentum. "I look forward to at the accelerating growth of GDP in the coming quarters on the background of recovery in investment after unexpectedly weak performance, as well as reducing the effect of the strengthening of the dollar which occurred earlier," - said Fisher, but did not give precise forecasts on rates. Later this week, the focus will be the speech of the Fed's Janet Yellen at Jackson Hole. In her statement may signal whether the economy is strong enough and could afford a rate hike in September or in the coming months. According to the futures market, the probability of a Fed rate hike is 12% in September and in December is estimated at 39.1%.

The composite index of Europe's largest enterprises, Stoxx 600 added 0.4 percent. Recall, at the end of last week, the index recorded the biggest drop since the beginning of June. The trading volume today is 37 percent lower than the average for the last 30 days. Strategists expect the index to bring its annual decline to 8.6 percent. Meanwhile, the report of Bank of America Corp. showed that investors continued to withdraw money from funds in the region, extending this series to 28 consecutive weeks.

Bank shares rebounded after the bigest fall in two weeks, while the shares of exporters, including automakers, rose against the euro weakness. Shares of mining companies shows a negative trend, due to the fall in commodity prices due to the strengthening of the dollar.

Shares of Syngenta AG - a Swiss chemical company - jumped 11 percent, the largest increase in more than a year. Today, China National Chemical Corp reported that the US National Security officials approved the merger with Syngenta AG.

The cost of Teleperformance SA rose 6.5 percent after the call-center operator agreed to buy LanguageLine Solutions LLC for $ 1.5 billion to expand in the US market.

Quotes of Kingspan Group Plc climbed 6.2 percent, as the Irish manufacturer of building insulation panels reported a 19 percent increase in revenues in the first half of the year.

At the moment:

FTSE 100 6827.27 -31.68 -0.46%

DAX +3.11 10547.47 + 0.03%

CAC 40 +2.45 4402.97 + 0.06%

-

11:25

JPY: Focus On 20Y Auction And On Rhetoric From BoJ, FOMC 20Y Auction - Credit Agricole

"The fortunes of the JPY remain strongly tied to the outlooks for the BoJ and the FOMC. JGB auctions provide regular updates on investors' thinking about the BoJ and have shown 20-30bp rises in the yields of auctions held since the BoJ's meeting on 29 July. So, the 20Y auction this week will be worth paying attention to.

However, it will be the rhetoric from BoJ Governor, Haruhiko Kuroda, and FOMC Chairwoman, Janet Yellen - who will both be speaking this week - that will dominate the JPY's fortunes.

Any reaction to Japan's inflation data at the end of the week will likely be muted by investors waiting to hear what Yellen has to say at Jackson Hole. PPI inflation, which has been weighed down by the strong JPY, suggests continued weakness in inflation".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

11:24

China's government will maintain ample liquidity in banking system

-

will support commercial banks to replenish capital

-

government to push forward with reform of fiscal, financial mechanisms in an orderly manner

-

will maintain appropriate monetary and financial environment

-

will encourage qualified firms to issue local and foreign ccy bonds overseas

-

aims to reduce tax burden on firms by more than 500bln yuan per year in next 1-2 years

-

will strengthen anti-monopoly, IPR regulations

*via forexlive -

-

10:37

Oil trading lower in strong moves

This morning, New York crude oil futures for WTI fell by 1.71% to $ 48.24 and Brent oil futures were down -1.89% to $ 49.94 per barrel. Thus, the black gold is trading lower as analysts began to doubt that oil producers will be able to reduce the surplus of oil. Also, oil products export in China grow and this figure is considered to be one of the global oversupply indicator, experts say. Exports of diesel and gasoline from China in July rose by 181.8% and 145.2% respectively year on year, putting pressure on margins of refined petroleum products.

Recall that OPEC members, along with other oil-producing countries will meet in September to discuss the possible restriction of oil production to curb the oversupply. Although analysts believe that the conflict between Saudi Arabia and Iran reduce the chances of a deal.

-

10:05

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1350 (EUR 605m)

USD/JPY 101.00 (USD 1.46bln) 103.00 (USD 877m) 104.00 (1.08bln)

AUD/USD 0.7650 (AUD 640m)

USD/CAD 1.2990-1.3000 (USD 756m)

AUD/NZD 1.0700 (AUD 310m) 1.0710-12 (AUD (485m)

-

09:26

Major stock markets trading lower after opening: FTSE -0.2%, DAX -0.1%, CAC40 -0.1%, FTMIB -0.1%, IBEX -0.2%

-

09:14

WSE: After opening

WIG20 index opened at 1799.87 points (-0.02%)*

WIG 47513.29 -0.05%

WIG30 2045.04 -0.12%

mWIG40 3814.26 0.23%

*/ - Change to Previous Close

The futures market (FW20U1620) began a new week from discount of 0.22% to 1,804 points. The contract for the German DAX lost 0.4% at the opening. The cash market (WIG20) opened with a modest discount of -0.02% to 1,799 points at a fairly low turnover. Very little is needed to go down and this is the main risk for today's session. At this stage it means continuation of the direction seen in the past few days.

-

09:03

Today’s events:

At 15:30 GMT United States will hold an auction of 3 and 6 month bills.

-

09:02

Asian session review: the Dollar strengthened against major currencies

The dollar rose against the yen after the head of the Bank of Japan Haruhiko Kuroda said in an interview with Sankei newspaper that did not rule out the possibility of further reduction in interest rates. He also noted that the change in asset purchases in September will receive a more detailed analysis of the results of the monetary policy.

Also this week, investors will be expecting the Federal Reserve Janet Yellen's speechs at the annual meeting of leading bankers and economists in Jackson Hole, to receive fresh signals on the timing of the next interest rate increase in the United States. After a speech at Jackson Hole in 2014 the dollar changed course and started a long period of apreciation lasting to this day.

The dollar rose against the euro also. Support for the US currency was recent comments by the Fed, which increased the likelihood of a new interest rate hike. The president of the Federal Reserve Bank of San Francisco, Williams said that the Central Bank should hike "sooner rather than later." He added that the US economy is strong enough to withstand the increase in the cost of borrowing, but expressed concern about inflation. According to Williams, the strength of the economy confirms the steady growth of employment, strong consumer spending and improving in the financial condition of households. Meanwhile, the president of the Federal Reserve Bank of New York Dudley also expressed optimism about the US economic outlook, noting that strong data on the number of jobs in the past two months, helped soothe fears that the pace of job creation beginning to slow down. "However, the situation began to change. For the first time in quite a long period the number of new jobs with an average salary was higher than in the categories with the highest and lowest wages"

Futures on interest rates suggest that investors see a 18% chance of a rate hike in September and 43.1% probability of such a move in December.

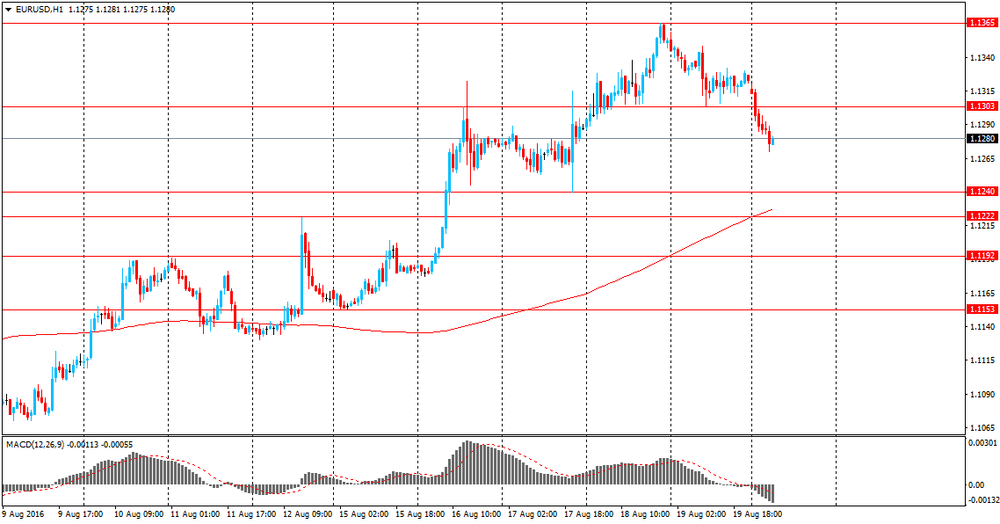

EUR / USD: during the Asian session, the pair was trading in the $ 1.1280-1.1320 range

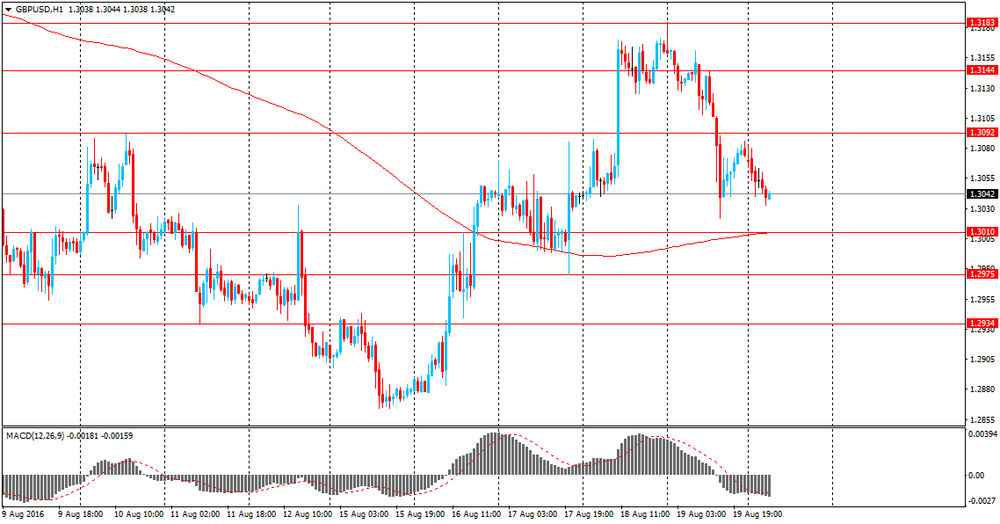

GBP / USD: during the Asian session, the pair was trading in the $ 1.3030-50 range

USD / JPY: during the Asian session, the pair was trading in the Y96.00-40 range.

-

08:28

WSE: Before opening

The moods in the morning are not particularly beneficial, because in Asia dominate declines and contracts in the US lose on the value. These changes are not big, although the situation of the bulls will not be much improved.

On the Warsaw market in the past week, each session brought declines, although the main European indices as well as Wall Street presented a stronger stance. This paints a very disturbing picture indicating a prompt return of local weaknesses as well signaled last week by restatement of energy companies. Investors did not like the results of larger companies of which the latest example was Eurocash (WSE: EUR). It seems that if the correction in the environment will start the WSE may develop the declines of the past week. So far, the market (the WIG20 index) was at 1,800 pts., which means support, prevents access to the next psychological barrier of 1,750 points.

This week will bring more consequential information, but this day will be quiet in this regard. Also macro calendar remains empty and only tomorrow's preliminary PMI readings may somewhat enliven the atmosphere. Investors in recent days live mainly in words of members of the Federal Reserve, who began to signal the possibility of the September rate hike.

Markets news said that the German government encourages citizens to take inventory in the event of a crisis. Of course this is just the kind of exercise, but who knows if some does not see a real threat behind it. Perhaps this message is behind the decline in Eurodollar. A pair of EURUSD lose the morning approx. 0,45%

-

08:08

Expected negative start of trading on the major stock exchanges in Europe: DAX-0.1%, CAC40 -0.1%, FTSE -0.2%

-

08:07

Risk/Reward Favors Bullish USD Positions Vs EUR, GBP And JPY - RBS

"The minutes from the July FOMC meeting were less hawkish than the market feared as the Committee was divided on the need for another interest rate hike. It's important to remember that the decision to act will ultimately rest with Yellen and that there will be no rate hike until she believes a rate hike is warranted. As our economic desk strategists not some participants stressed that the Committee needed to consider the constraints on the conduct of monetary policy associated with proximity to the effective lower bound on short-term interest rates. In their view, the "some" participants noted above almost certainly includes Yellen. She seems to be sticking to her risk management policy approach and feels little urgency to raise rates. However, the minutes pre-date the strong July US employment report. Dudley appeared to want to stress this in his comments this week.

So could Yellen reinforce Dudley's comments at Jackson-Hole on Friday? We think not. It's an academic conference that concentrates on long-term themes and has in recent years moved away from short-term policy signals. The tone may therefore reflect recent comments from Powell/Williams about low productivity growth and low neutral rates. But Yellen talking about lower long-term rates isn't the same as dampening expectations of a near-term rate increase.

We therefore still believe risk/reward favours USD upside against the EUR, GBP and JPY. Discussions about lower terminal rates should ensure that EM FX out-performs the G4 currencies".

Copyright © 2016 RBS, eFXnews™

-

08:05

Typhoon Mindulle nearing Tokyo

Typhoon Mindulle could make landfall near Tokyo at around noon on Monday. Japan Meteorological Agency officials say that as of 11 AM, Mindulle was near Izu Oshima Island. They expect the typhoon to move north at a speed of 20 kilometers per hour, and to continue traveling north after making landfall. Mindulle is packing winds of about 125 kilometers per hour near its center. Izu city, Shizuoka Prefecture, also recorded 103 millimeters of rainfall for the one hour through 8:40 AM. Mindulle could bring more than 50 millimeters per hour of rain to the greater Tokyo area, the Tokai region, and northern Japan.

-

08:01

FED Vice Chairman Stanley Fischer, remarks on the US economy: we are close to our targets

"The Fed's dual mandate aims for maximum sustainable employment and an inflation rate of 2 percent, as measured by the price index for personal consumption expenditures (PCE). Employment has increased impressively over the past six years since its low point in early 2010, and the unemployment rate has hovered near 5 percent since August of last year, close to most estimates of the full-employment rate of unemployment. The economy has done less well in reaching the 2 percent inflation rate. Although total PCE inflation was less than 1 percent over the 12 months ending in June, core PCE inflation, at 1.6 percent, is within hailing distance of 2 percent--and the core consumer price index inflation rate is currently above 2 percent.

So we are close to our targets. Not only that, the behavior of employment has been remarkably resilient. During the past two years we have been concerned at various stages by the possible negative effects on the U.S. economy of the Greek debt crisis, by the 20 percent appreciation of the trade-weighted dollar, by the Chinese growth slowdown and accompanying exchange rate uncertainties, by the financial market turbulence during the first six weeks of this year, by the dismaying pothole in job growth this May, and by Brexit--among other shocks. Yet, even amid these shocks, the labor market continued to improve: Employment has continued to increase, and the unemployment rate is currently close to most estimates of the natural rate".

-

07:58

BOJ's Kuroda says won't rule out deepening negative rate cut - Sankei. USD/JPY gaps higher

-

07:08

Options levels on monday, August 22, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1456 (4565)

$1.1403 (4699)

$1.1371 (4631)

Price at time of writing this review: $1.1280

Support levels (open interest**, contracts):

$1.1232 (2391)

$1.1165 (2660)

$1.1083 (4064)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 53696 contracts, with the maximum number of contracts with strike price $1,1250 (4984);

- Overall open interest on the PUT options with the expiration date September, 9 is 57672 contracts, with the maximum number of contracts with strike price $1,1000 (5805);

- The ratio of PUT/CALL was 1.07 versus 1.09 from the previous trading day according to data from August, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.3304 (3062)

$1.3207 (1915)

$1.3111 (1306)

Price at time of writing this review: $1.3042

Support levels (open interest**, contracts):

$1.2992 (2043)

$1.2895 (2014)

$1.2797 (2675)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 32661 contracts, with the maximum number of contracts with strike price $1,3300 (3062);

- Overall open interest on the PUT options with the expiration date September, 9 is 26829 contracts, with the maximum number of contracts with strike price $1,2800 (2675);

- The ratio of PUT/CALL was 0.82 versus 0.81 from the previous trading day according to data from August, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:07

Global Stocks

European stocks fell Friday, with Italian shares leading the charge lower as concerns over the country's banking system sent lenders lower across the eurozone.

The Stoxx Europe 600 SXXP, -0.81% lost 0.8% to close at 340.14, extending its weekly loss to 1.7%.

U.K. stocks and the British pound declined on Friday after a news report suggested Prime Minister Theresa May is "sympathetic: to starting Brexit talks with the European Union by April at the latest.

The FTSE 100 UKX, -0.15% finished 0.2% lower at 6,858.95, erasing a 0.1% gain from Thursday.

U.S. stocks finished lower Friday as investors worried about whether the Federal Reserve will raise interest rates sooner rather than later.

But the Nasdaq Composite managed to notch its eighth consecutive weekly gain, marking the longest such stretch for the tech-laden index since April 23, 2010, according to Dow Jones data.

Few catalysts and the expiration of August options contracts contributed to fairly lackluster moves during a week that has offered little guidance for investors about the Fed's policy plans, following the release on Wednesday of minutes from the central bank's July meeting.

Asian shares slipped on Monday and the dollar pulled away from last week's lows on expectations that a signal might emerge from a Federal Reserve gathering this week in Jackson Hole, Wyoming that the U.S. central bank is gearing up to hike interest rates.

Global central bankers will join the annual mountain retreat that opens on Thursday, with Fed Chair Janet Yellen due to speak the following day.

On Sunday, Fed Vice Chairman Stanley Fischer gave a generally upbeat assessment of the U.S. economy's current strength in prepared remarks, saying the job market was close to full strength and still improving.

-

00:31

Commodities. Daily history for Aug 19’2016:

(raw materials / closing price /% change)

Oil 49.12 +0.02%

Gold 1,345.80 -0.03%

-

00:30

Stocks. Daily history for Aug 19’2016:

(index / closing price / change items /% change)

Nikkei 225 16,545.82 +59.81 +0.36%

Shanghai Composite 3,108.72 +4.61 +0.15%

S&P/ASX 200 5,526.68 +18.86 +0.34%

FTSE 100 6,858.95 -10.01 -0.15%

CAC 40 4,400.52 -36.54 -0.82%

Xetra DAX 10,544.36 -58.67 -0.55%

S&P 500 2,183.87 -3.15 -0.14%

Dow Jones Industrial Average 18,552.57 -45.13 -0.24%

S&P/TSX Composite 14,687.46 -8.22 -0.06%

-

00:29

Currencies. Daily history for Aug 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1323 -0,26%

GBP/USD $1,3074 -0,66%

USD/CHF Chf0,9602 +0,57%

USD/JPY Y100,21 +0,29%

EUR/JPY Y113,48 +0,05%

GBP/JPY Y131 -0,37%

AUD/USD $0,7624 -0,79%

NZD/USD $0,7270 -0,22%

USD/CAD C$1,287 +0,76%

-

00:00

Schedule for today, Monday, Aug 22’2016

(time / country / index / period / previous value / forecast)

12:30 Canada Wholesale Sales, m/m June 1.8%

12:30 U.S. Chicago Federal National Activity Index July 0.16

-