Noticias del mercado

-

17:48

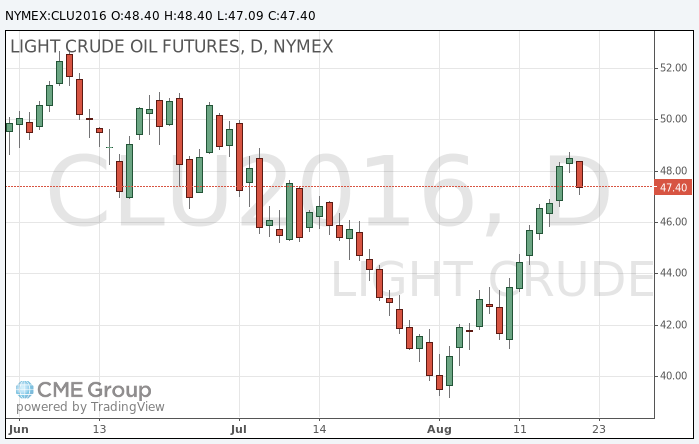

Oill show a negative dynamic

Oil has recently demonstrated the highest volatility among all asset classes in global markets. Today, prices are down sharply after rising almost 11% from the previous week. Analysts doubt that the upcoming talks of the world producers of "black gold" will solve the oversupply problem and said that the sharp rise in oil prices in August are not fundamental.

The prices of oil at $ 50 a barrel or above are unstable due to the ongoing overproduction and excess inventory in the energy markets, and are likely to experience another short-term dip in the coming weeks, Barclays analysts wrote.

The recent rebound of oil prices is more technical than fundamental in nature, according to Morgan Stanley. "In fact, new buyers are virtually absent during the last few months," - said in a research.

Another fact that confirms the saturation of the world's oil supply, was the growth of drilling rigs in the United States for another ten units last week. Compared with May the minimum number of installations has increased by 28%.

In addition, Iraq plans to increase oil exports by 5%, increasing the volume of exports of refined petroleum products from China and the strengthening of the dollar is also not in favor of the further growth of oil prices.

The cost of the October futures for WTI fell to 47.09 dollars per barrel.

October futures for Brent fell to 49.16 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:24

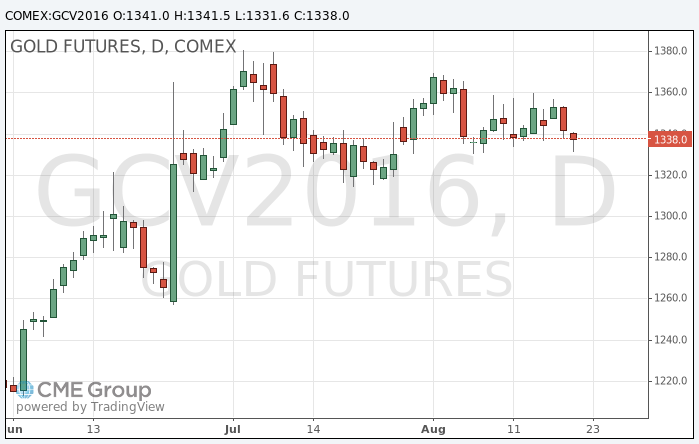

Gold price moderately lower today

Gold declined after comments from Fed officials about improves in the state of the US economy, to strengthen market confidence in raising interest rates this year.

The dollar rose after the Fed's Deputy Stanley Fischer said on Sunday that the US central bank is close to achieving its goal of full employment and two percent inflation.

The presidents of the Federal Reserve Bank of San Francisco and New York's John Williams and William Dudley also expressed confidence in the imminent rate increase.

Stocks of the largest gold exchange-traded fund iSPDR Gold Trust fell last week by 4.5 tonnes after a 20-tonne outflow of the previous week.

"The inflow of funds in the ETF stopped, and hedge funds cut long positions in five of the last six weeks - said the chief analyst of commodity markets at Saxo Bank, Ole Hansen - i think gold may weaken in the short term."

"Everyone will be watching the meeting in Jackson Hole as Fisher and Dudley reinforced expectations of a possible increase in interest rates.", - he added.

Representatives of central banks around the world will gather on Aug. 25 at the annual meeting in Jackson Hole, Wyoming, and Fed Chairman Janet Yellen will deliver a speech the next day.

The cost of the October futures on COMEX fell to $ 1331.60 per ounce.

-

10:37

Oil trading lower in strong moves

This morning, New York crude oil futures for WTI fell by 1.71% to $ 48.24 and Brent oil futures were down -1.89% to $ 49.94 per barrel. Thus, the black gold is trading lower as analysts began to doubt that oil producers will be able to reduce the surplus of oil. Also, oil products export in China grow and this figure is considered to be one of the global oversupply indicator, experts say. Exports of diesel and gasoline from China in July rose by 181.8% and 145.2% respectively year on year, putting pressure on margins of refined petroleum products.

Recall that OPEC members, along with other oil-producing countries will meet in September to discuss the possible restriction of oil production to curb the oversupply. Although analysts believe that the conflict between Saudi Arabia and Iran reduce the chances of a deal.

-

00:31

Commodities. Daily history for Aug 19’2016:

(raw materials / closing price /% change)

Oil 49.12 +0.02%

Gold 1,345.80 -0.03%

-