Noticias del mercado

-

23:59

Schedule for today, Tuesday, Nov 24’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) November 52.4

07:00 Germany GDP (QoQ) (Finally) Quarter III 0.4% 0.3%

07:00 Germany GDP (YoY) (Finally) Quarter III 1.6% 1.8%

09:00 Germany IFO - Business Climate November 108.2 108.2

09:00 Germany IFO - Expectations November 103.8 104

09:00 Germany IFO - Current Assessment November 112.6 112.4

09:05 Australia RBA's Governor Glenn Stevens Speech

11:00 United Kingdom CBI retail sales volume balance November 19 25

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter III 1.9% 1.3%

13:30 U.S. GDP, q/q (Revised) Quarter III 3.9% 2.0%

14:00 Belgium Business Climate November -4

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September 5.1% 5.1%

15:00 U.S. Richmond Fed Manufacturing Index November -1

15:00 U.S. Consumer confidence November 97.6 99.5

23:50 Japan Monetary Policy Meeting Minutes

-

17:16

Standard & Poor’s affirms Switzerland’s sovereign credit rating at AAA

Standard & Poor's Ratings Services affirmed Switzerland's sovereign credit rating at AAA on Friday. The outlook is stable.

The agency said that the country can handle the loss of competitiveness resulting from Swiss franc appreciation.

-

17:11

Standard & Poor’s upgrades the Netherlands’ sovereign credit rating to AAA

Standard & Poor's Ratings Services raised the Netherlands' sovereign credit rating to AAA from AA+ on Friday. The outlook is stable.

"The upgrade reflects our view of the strengthening of the economic recovery in the Netherlands, with domestic demand growing strongly as a result of increases in real disposable income, employment, and investment activity," the agency said.

S&P expects the economy to continue to recover.

The agency lowered the Netherlands' credit rating in 2013.

-

16:47

Federal Reserve Governor Daniel Tarullo is worried about the low inflation in the U.S.

Federal Reserve Governor Daniel Tarullo said in an interview with Bloomberg TV on Monday that he is worried about the low inflation in the U.S.

"The U.S. economy seems still to be chugging along with modestly above-trend growth. We've certainly seen continued improvement in the labor market, but the environment for inflation is still one where there is still a lot of uncertainty," he said.

Tarullo noted that market participants were focussed more on particular month, when the Fed will start raising its interest rate, than on the pace of interest rate hikes.

-

16:17

U.S. existing homes sales fall 3.7% in October

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes declined 3.7% to a seasonally adjusted annual rate of 5.36 million in October from 5.55 in September.

Analysts had expected a decrease to 5.40 million units.

"New and existing-home supply has struggled to improve so far this fall, leading to few choices for buyers and no easement of the ongoing affordability concerns still prevalent in some markets. Furthermore, the mixed signals of slowing economic growth and volatility in the financial markets slightly tempered demand and contributed to the decreasing pace of sales," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 31% in October from 29% in September.

"As long as solid job creation continues, a gradual easing of credit standards even with moderately higher mortgage rates should support steady demand and sales continuing to rise above a year ago," Yun said.

-

16:11

European Central Bank purchases €12.57 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.57 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.56 billion of covered bonds, and €156 million of asset-backed securities.

-

16:08

U.S. preliminary manufacturing purchasing managers' index drops to 52.6 in November, the lowest level since October 2013

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) dropped to 52.6 in November from 54.1 in October, missing expectations for a decline to 53.9. It was the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

The decline was partly driven by a slower pace of expansion in output, new orders and employment.

"November's flash PMI survey indicates that the manufacturing sector lost some growth momentum after the nice pick up seen in October, but still suggests the goods producing sector is expanding at a robust pace which should help support wider economic growth in the fourth quarter," Markit Chief Economist Chris Williamson.

"With the survey continuing to show modest growth, and any weakness linked to the global economy rather than a deterioration in domestic demand, there seems little in the survey results to throw up any roadblocks to a Fed that seems intent on hiking interest rates in December," he added.

-

16:00

U.S.: Existing Home Sales , October 5.36 (forecast 5.4)

-

15:46

Greece's second largest bank Piraeus Bank SA fails to raise enough funds from private investors

Greece's second largest bank by assets Piraeus Bank SA said on Saturday that it failed to raise enough funds from private investors. The lender raised €1.34 billion, but it needs €4.93 billion to pass the European Central Bank's stress test.

Piraeus Bank will likely need capital from Greece's bank rescue fund.

-

15:45

U.S.: Manufacturing PMI, November 52.6 (forecast 53.9)

-

14:54

Option expiries for today's 10:00 ET NY cut

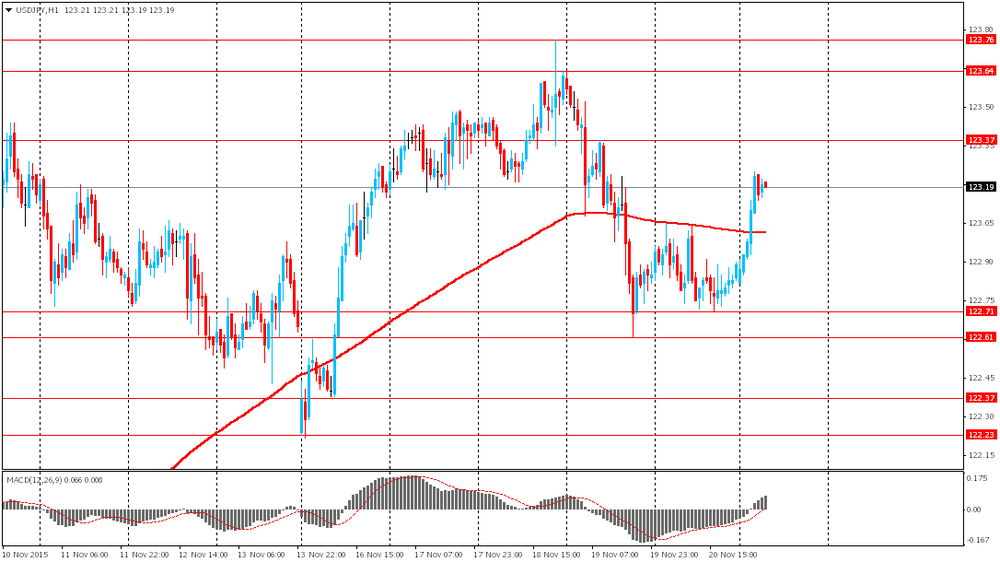

USDJPY 122.95-123.00 (USD 940m)

EURUSD 1.0700 (EUR 809m) 1.0720 (1bln) 1.0750 (595m) 1.0770 (1.7bln)

USDCHF 1.0040-50 (USD 486m) 1.0100 (296m) 1.0200 (220m)

USDCAD 1.3500 (USD 651m)

AUDUSD 0.7150 (AUD 320m)

NZDUSD 0.6550 (NZD 258m) 0.6620 (784m)

EURJPY 131.40 (EUR 303m)

EURGBP 0.7100 (EUR 280m)

-

14:46

Standard & Poor's affirms its AA- sovereign rating for China

Standard & Poor's Ratings Services affirmed its AA- sovereign rating for China on Monday. The outlook remained stable.

The agency said that China will make a significant progress toward economic rebalancing in the next two years. According to S&P, China's economy should be driven by consumer spending and not by investments. The agency noted that there is progress in reforming the financial sector.

-

14:14

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

08:00 France Services PMI (Preliminary) November 52.7 52.6 51.3

08:00 France Manufacturing PMI (Preliminary) November 50.6 50.8 50.8

08:30 Germany Manufacturing PMI (Preliminary) November 52.1 52 52.6

08:30 Germany Services PMI (Preliminary) November 54.5 54.3 55.6

09:00 Eurozone Manufacturing PMI (Preliminary) November 52.3 52.3 52.8

09:00 Eurozone Services PMI (Preliminary) November 54.1 54.1 54.6

The U.S. dollar traded mixed against the most major currencies ahead of the release of the economic data from the U.S. The U.S. preliminary manufacturing PMI is expected to decline to 53.9 in November from 54.1 in October.

The existing home sales in the U.S. are expected to decrease to 5.40 million units in October from 5.55 million units in September.

Market participants are awaiting an unscheduled Fed meeting later in the day. According to the Fed's website, the Fed will review the advance and discount rates to be charged by the Federal Reserve Banks. The meeting is scheduled to begin at 16:30 GMT.

The euro traded mixed against the U.S. dollar on the better-than-expected economic data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI rose to 52.8 in November from 52.3 in October. Analysts had expected the index to remain unchanged at 52.3.

Eurozone's preliminary services PMI climbed to 54.6 in November from 54.1 in October. Analysts had expected the index to remain unchanged at 54.1.

Business activity and employment were main contributors for the rise.

Markit's Chief Economist Chris Williamson said that Eurozone's economic growth accelerated, "putting the region on course for one of its best quarterly performances over the past four-and-a-half year".

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter.

"November's slightly improved PMI reading will no doubt do little to dissuade policymakers that more needs to be done at their December meeting to ensure stronger and more sustainable growth," Williamson added.

Germany's preliminary manufacturing PMI climbed to 52.6 in November from 52.1 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary services PMI was up to 55.6 in November from 54.5 in October. Analysts had expected index to decline to 54.3.

France's preliminary manufacturing PMI rose to 50.8 in November from 50.6 in October, in line with forecasts.

France's preliminary services PMI decreased to 51.3 in November from 52.7 in October. Analysts had expected the index to fall to 52.6.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from U.K.

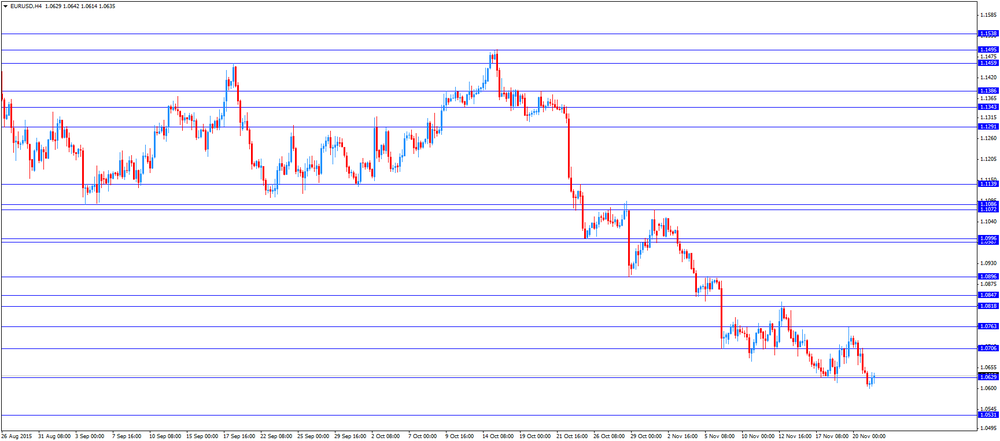

EUR/USD: the currency pair traded mixed

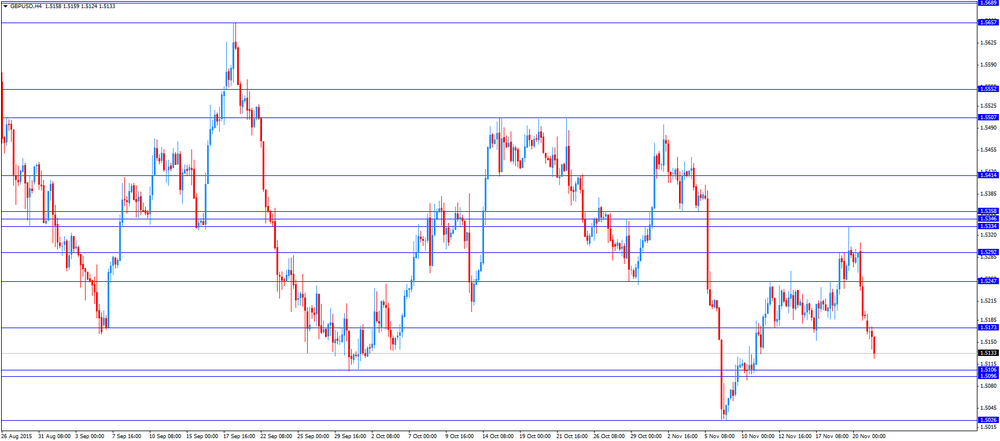

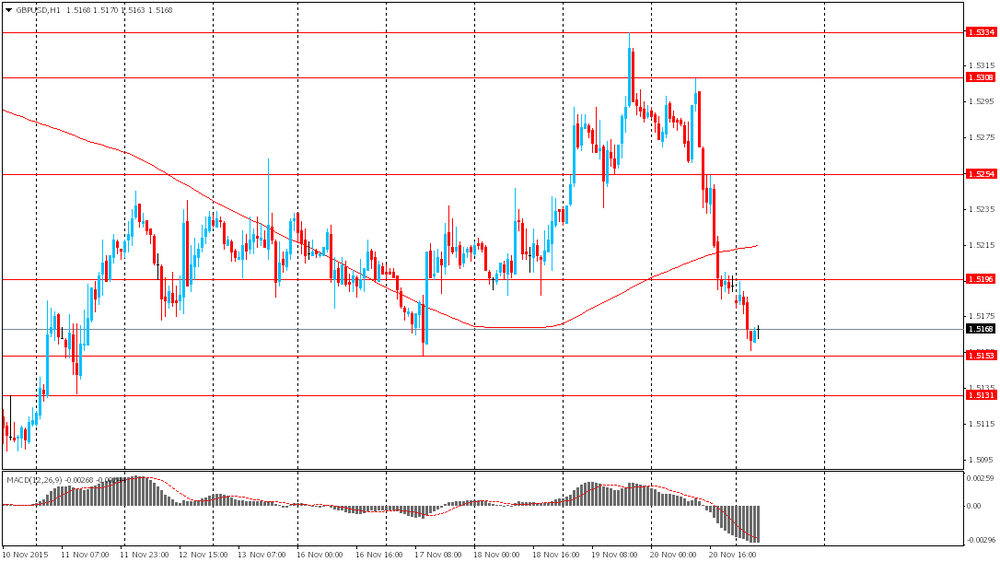

GBP/USD: the currency pair fell to $1.5124

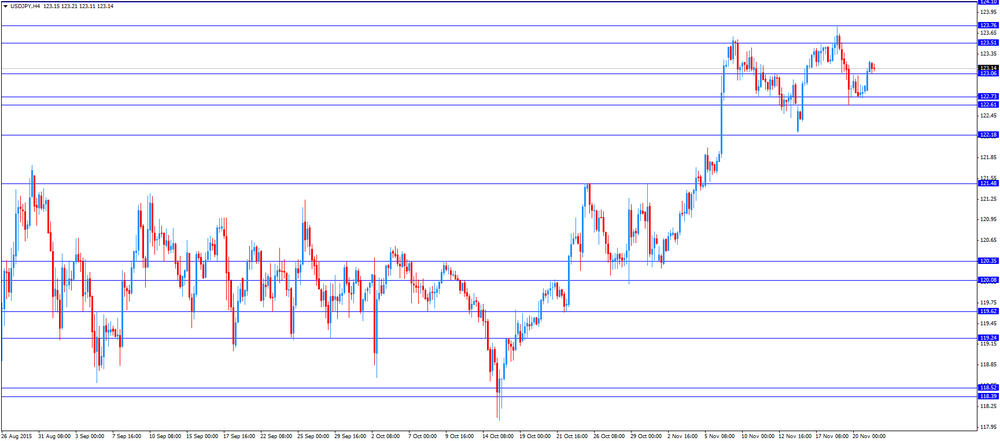

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:45 U.S. Manufacturing PMI (Preliminary) November 54.1 53.9

15:00 U.S. Existing Home Sales October 5.55 5.4

16:30 U.S. Fed Announcement

-

13:49

Orders

EUR/USD

Offers 1.0650-55 1.0680-85 1.0700* 1.0720-25 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0615-20 1.0600 1.0580-85 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5170 1.5180-85 1.5200 1.5300 1.5325-30 1.5350 1.5380 1.5400 1.5420 1.5435 1.5450 1.54880-85 1.5500

Bids 1.5125-30 1.5100 1.5085 1.5065 1.5050 1.5030 1.5000 1.4985 1.4965 1.4950

EUR/GBP

Offers 0.7020 0.7035 0.7050 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.7000 0.6980-85 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 131.00 131.20 131.50 131.85 132.00 132.40 132.60 132.75-80 133.00

Bids 130.75-80 130.50 130.25-30 130.00 129.85 129.50

USD/JPY

Offers 123.20-25 123.35 123.50 123.65.70 123.85 124.00

Bids 123.00 122.85 122.65-70 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7200 0.7220 0.7235 0.7250 0.7275-80 0.7300 0.7325-30 0.7350

Bids 0.7165 0.7150 0.7120-25 0.7100 0.7085 0.7065 0.7050

-

11:46

Swiss National Bank: M3 money supply climbs 1.4% in October

The Swiss National Bank (SNB) released its money supply data on Monday. M3 money supply climbed at an annual rate of 1.4% in October, after a 1.3% rise in September.

M1 money supply dropped 2.9% year-on-year in October, after a 0.6% gain in September.

-

11:32

France's preliminary manufacturing PMI rises in November, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 50.8 in November from 50.6 in October, in line with forecasts.

France's preliminary services PMI decreased to 51.3 in November from 52.7 in October. Analysts had expected the index to fall to 52.6.

"French private sector output growth weakened slightly in November, with the Paris attacks reported to have hit activity among some service providers. However, the trend in new business firmed a little, with growth quickening to a five-month high, while backlogs of work rose again," the Senior Economist at Markit Jack Kennedy said.

-

11:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 436m) 123.50 (485m) 124.00 (1.67bln)

EUR/USD 1.0600 (EUR 2.3bln) 1.0700 (1.3bln) 1.0735 (1.4bln) 1.0750 (421m) 1.0765 (1.1bln) 1.0815 (1.6bln)

AUD/USD 0.7050 (AUD 530m) 0.7075 (202m) 0.7150 (260m)

NZD/USD 0.6400 (NZD 695m)

-

11:17

Germany's preliminary manufacturing and services PMIs climb in November

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI climbed to 52.6 in November from 52.1 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary services PMI was up to 55.6 in November from 54.5 in October. Analysts had expected index to decline to 54.3.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by "efficiency improvements and increased new order intakes".

"There was some divergence by sector, however, with accelerated output growth at service providers contrasting with a further slowdown at goods producers. While the Manufacturing PMI edged slightly higher, both output and new orders in the sector rose at marginally weaker rates," he noted.

-

11:06

Eurozone's preliminary manufacturing and services PMIs rise in November

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI rose to 52.8 in November from 52.3 in October. Analysts had expected the index to remain unchanged at 52.3.

Eurozone's preliminary services PMI climbed to 54.6 in November from 54.1 in October. Analysts had expected the index to remain unchanged at 54.1.

Business activity and employment were main contributors for the rise.

Markit's Chief Economist Chris Williamson said that Eurozone's economic growth accelerated, "putting the region on course for one of its best quarterly performances over the past four-and-a-half year".

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter.

"November's slightly improved PMI reading will no doubt do little to dissuade policymakers that more needs to be done at their December meeting to ensure stronger and more sustainable growth," Williamson added.

-

10:51

Canadian government downgrades its growth and fiscal forecasts

The Canadian government downgraded its growth and fiscal forecasts. The downward revision was driven by a slower-than-expected recovery for the Canadian economy. Low oil prices weigh on the economy in Canada.

The government expects the economy to expand 1.2% in 2015 and 2% in 2016.

The budget deficit is expected to be C$3 billion this year, and C$3.9 billion in 2016-2017.

-

10:13

France’s leading economic index declines 0.1% in September

The Conference Board released its leading economic index (LEI) for France on Friday. The leading economic index fell 0.1% in September, after a 0.4% gain in August.

The coincident economic index rose 0.1% in September, after a 0.2% increase in August.

"The recent behaviour of the composite indexes suggests that economic growth is likely to continue at a moderate pace in the coming year," the Conference Board said in its statement.

-

10:00

Eurozone: Manufacturing PMI, November 52.8 (forecast 52.3)

-

10:00

Eurozone: Services PMI, November 54.6 (forecast 54.1)

-

09:30

Germany: Manufacturing PMI, November 52.6 (forecast 52)

-

09:30

Germany: Services PMI, November 55.6 (forecast 54.3)

-

09:00

France: Services PMI, November 51.3 (forecast 52.6)

-

09:00

France: Manufacturing PMI, November 50.8 (forecast 50.8)

-

07:56

Foreign exchange market. Asian session: the euro declined against the greenback

The euro declined against the U.S. dollar and traded around a seven-month low after ECB President Mario Draghi's speech intensified expectations for an expansion of the ECB's quantitative easing program. Speaking at 25th Frankfurt European Banking Congress Draghi said that the central bank will assess the degree of stability of factors, which hold back inflation. He added if the 2% inflation target is at risk the central bank will use all tools available to support it.

This week's data are likely to show that the European economic sentiment and business activity rates little changed in November.

The U.S. dollar rose against major currencies after several Fed officials indicated that the central bank should raise interest rates soon. Market participants are also waiting for today's Fed announcement, which may contain important statements on the bank's policy.

New York Federal Reserve Bank President William Dudley said that the timing of a liftoff in rates depends on data. He expects the U.S. economy to be fine in 2016. Dudley added that the FOMC still has time to take a decision to raise rates in December.

EUR/USD: the pair fell to $1.0600 in Asian trade

USD/JPY: the pair rose to Y123.25

GBP/USD: the pair fell to $1.5155

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 France Services PMI (Preliminary) November 52.7 52.6

08:00 France Manufacturing PMI (Preliminary) November 50.6 50.8

08:30 Germany Manufacturing PMI (Preliminary) November 52.1 52

08:30 Germany Services PMI (Preliminary) November 54.5 54.3

09:00 Eurozone Manufacturing PMI (Preliminary) November 52.3 52.3

09:00 Eurozone Services PMI (Preliminary) November 54.1 54.1

14:45 U.S. Manufacturing PMI (Preliminary) November 54.1 53.9

15:00 U.S. Existing Home Sales October 5.55 5.4

15:00 U.S. Fed Announcement

-

07:06

Options levels on monday, November 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0822 (1870)

$1.0765 (733)

$1.0723 (272)

Price at time of writing this review: $1.0613

Support levels (open interest**, contracts):

$1.0584 (5685)

$1.0564 (7499)

$1.0541 (3506)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 91555 contracts, with the maximum number of contracts with strike price $1,1100 (5830);

- Overall open interest on the PUT options with the expiration date December, 4 is 116878 contracts, with the maximum number of contracts with strike price $1,0500 (8847);

- The ratio of PUT/CALL was 1.28 versus 1.27 from the previous trading day according to data from November, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5501 (1001)

$1.5402 (1893)

$1.5304 (2618)

Price at time of writing this review: $1.5167

Support levels (open interest**, contracts):

$1.5096 (2594)

$1.4998 (2656)

$1.4899 (2447)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28367 contracts, with the maximum number of contracts with strike price $1,5600 (3578);

- Overall open interest on the PUT options with the expiration date December, 4 is 32316 contracts, with the maximum number of contracts with strike price $1,5050 (5071);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from November, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:01

Currencies. Daily history for Nov 20’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0644 -0,84%

GBP/USD $1,5192 -0,64%

USD/CHF Chf1,0184 +0,57%

USD/JPY Y122,89 +0,03%

EUR/JPY Y130,81 -0,81%

GBP/JPY Y186,7 -0,61%

AUD/USD $0,7234 +0,58%

NZD/USD $0,6565 +0,17%

USD/CAD C$1,3342 +0,45%

-

00:01

Schedule for today, Monday, Nov 23’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

08:00 France Services PMI (Preliminary) November 52.7 52.6

08:00 France Manufacturing PMI (Preliminary) November 50.6 50.8

08:30 Germany Manufacturing PMI (Preliminary) November 52.1 52

08:30 Germany Services PMI (Preliminary) November 54.5 54.3

09:00 Eurozone Manufacturing PMI (Preliminary) November 52.3 52.3

09:00 Eurozone Services PMI (Preliminary) November 54.1 54.1

14:45 U.S. Manufacturing PMI (Preliminary) November 54.1 53.9

15:00 U.S. Existing Home Sales October 5.55 5.4

15:00 U.S. Fed Announcement

-