Noticias del mercado

-

17:43

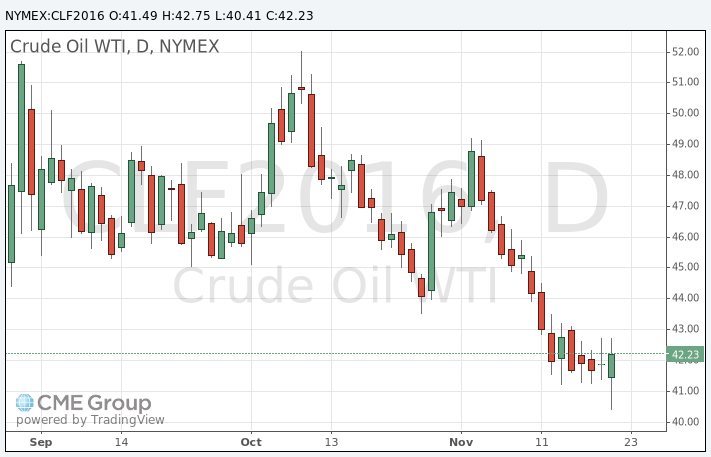

Oil prices climb news that Saudi Arabia is ready to cooperate with all oil producing countries to stabilise oil prices

Oil prices rose on news that Saudi Arabia is ready to cooperate with all oil producing countries to stabilise oil prices.

"Perhaps it would be fitting here to mention the role of the Kingdom of Saudi Arabia in the stability of the oil market, and its continued willingness and prompt, assiduous efforts to cooperate with all oil producing and exporting countries, both from within and outside OPEC, in order to maintain market and price stability," the Saudi minister for petroleum and mineral resources, Ali bin Ibrahim Al-Naimi, said.

Venezuelan Oil Minister Eulogio Del Pino warned on Sunday that oil price could drop to the mid-$20s a barrel next year if OPEC will not take any action to stabilise oil prices.

The oil rigs data also supported oil prices. The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 564 last week.

WTI crude oil for January delivery climbed to $42.75 a barrel on the New York Mercantile Exchange.

Brent crude oil for January rose to $44.89 a barrel on ICE Futures Europe.

-

17:26

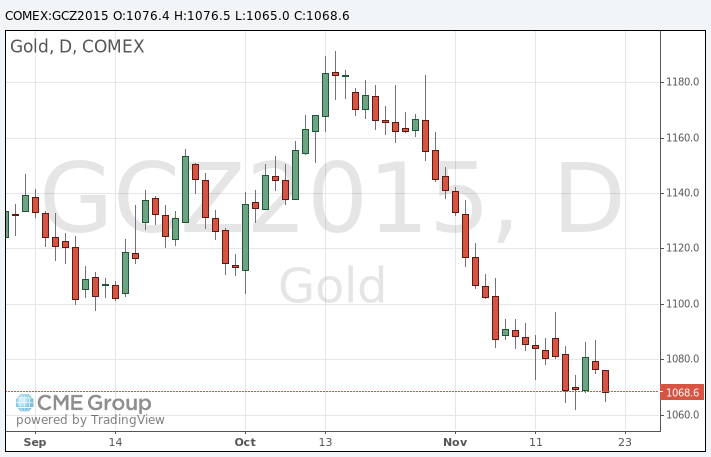

Gold price falls on a stronger U.S. dollar

Gold price declined on a stronger U.S. dollar. The greenback rose against other currencies on speculation that the Fed will start raising its interest rate next month.

Market participants are awaiting an unscheduled Fed meeting later in the day. According to the Fed's website, the Fed will review the advance and discount rates to be charged by the Federal Reserve Banks. The meeting is scheduled to begin at 16:30 GMT.

December futures for gold on the COMEX today fell to 1065.00 dollars per ounce.

-

14:46

Standard & Poor's affirms its AA- sovereign rating for China

Standard & Poor's Ratings Services affirmed its AA- sovereign rating for China on Monday. The outlook remained stable.

The agency said that China will make a significant progress toward economic rebalancing in the next two years. According to S&P, China's economy should be driven by consumer spending and not by investments. The agency noted that there is progress in reforming the financial sector.

-

10:36

Iran’s Oil Minister Bijan Namdar Zanganeh: the Organization of Petroleum Exporting Countries (OPEC) should allow Iran to raise its crude output within the OPEC’s ceiling

Iran's Oil Minister Bijan Namdar Zanganeh said on Saturday that the Organization of Petroleum Exporting Countries (OPEC) should allow Iran to raise its crude output within the OPEC's ceiling. Iran plans to add 1 million barrels a day within five to six months.

Zanganeh noted that the OPEC will unlikely change its oil output limit at its next meeting in December.

"I don't expect to receive any new agreement. OPEC is producing more than its approved ceiling and I asked them to reduce production and to respect the ceiling, but it doesn't mean we won't produce more because it is our right to return to the market," he said.

-

10:21

The number of active U.S. rigs falls by 10 rigs to 564 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 564 last week.

Combined oil and gas rigs declined by 10 to 757.

The total rig count is now down 1,010 from a year ago.

-

07:33

Oil prices dropped

West Texas Intermediate futures for January delivery plunged to $40.64 (-3.01%), while Brent crude fell to $43.76 (-2.02%) amid persisting oversupply concerns.

Industry group Baker Hughes reported on Friday that the U.S. oil rig count fell by 10. However market participants are focused on the existing supply glut, which may worsen when Iran adds more crude to the market.

The Organization of the Petroleum Exporting Countries is set to meet on December 4 in Vienna. However it is widely expected that the member countries, led by Saudi Arabia, will stick to their current policy and will not reduce output in order to support prices.

-

07:19

Gold declined

Gold fell to $1,070.20 (-0.57%) amid expectations for a Fed's interest rate hike in December after several central bank's officials indicated they were ready for a liftoff in rates.

New York Federal Reserve Bank President William Dudley said on Friday that the Fed should raise rates "soon" as inflation is likely to pick up pace. San Francisco Federal Reserve Bank President John Williams signaled on Saturday he was prepared for a rate hike in December.

Higher rates would harm demand for the non-interest-bearing precious metal.

SPDR Gold Trust, the world's biggest gold-backed exchange-traded fund, said its holdings fell 0.18% to 660.75 tonnes on Friday, the lowest since September 2008.

-

01:02

Commodities. Daily history for Nov 20’2015:

(raw materials / closing price /% change)

Oil 41.46 -1.05%

Gold 1,076.70 +0.04%

-