Noticias del mercado

-

22:15

U.S. stocks closed

U.S. stocks slipped following the Standard & Poor's 500 Index's best weekly rally this year, as gains in consumer companies were overshadowed by a retreat in Allergan Plc and Pfizer Inc. amid their record $160 billion merger deal.

The S&P 500 fell 0.1 percent to 2,086.66 at 4 p.m. in New York, after rising 3.3 percent last week, the most since December.

Stocks earlier extended declines as concerns over terrorism intensified after AFP reported an explosive belt was found in a trash bin in a Paris suburb. The search for a key suspect in the Paris terror attacks kept Brussels in an unprecedented lockdown that brought business to a standstill.

The main U.S. equity gauge surged last week after Federal Reserve officials signaled the economy is strong enough to withstand the first rate increase since 2006, and investors grew more comfortable with the notion that borrowing costs may soon be higher. Stocks have gained in seven of the past eight weeks, boosted by raw-material, industrial and technology shares, taking the S&P 500 to within 2 percent of a record set in May.

San Francisco Fed President John Williams said on Saturday there's a "strong case" for a rate increase in December assuming U.S. economic data continues to be encouraging. Fed Governor Daniel Tarullo said today in an interview on Bloomberg Television economic data received since the central bank met in September had been mixed, as continued low inflation tempered his enthusiasm over progress made this year in lowering unemployment.

A report today showed sales of previously owned homes retreated in October from the second-highest level since 2007 as lean inventory limited momentum in residential real estate. Recent data have bolstered the case for raising borrowing costs for the first time since 2006, with traders now pricing in a 72 percent probability that the Fed will move next month. The Commerce Department's second reading on gross domestic product for the third quarter is due tomorrow.

The earnings season is drawing to a close, with almost all companies in the S&P 500 having reported. Of those, 75 percent beat earnings estimates, while only 44 percent exceeded sales forecasts. Analysts project profits for index members dropped 3.8 percent in the third quarter, compared with for a 7.2 percent decline at the start of the season.

-

21:00

FTSE 6305.49 -29.14 -0.46%, DAX 11092.31 -27.52 -0.25%, CAC 40 4889.12 -21.85 -0.44%

-

18:54

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Monday, helped by gains in materials and energy stocks, but trading was subdued in the run-up to Thursday's Thanksgiving holiday.

The two stocks were the biggest drags on the S&P 500, while Pfizer was the biggest drag on the Dow. Analysts expressed concerns about what were seen as the low synergies from the deal, its complexity, antitrust issues and a possible delay in Pfizer's plan to split in two companies.

Most of Dow stocks in negative area (18 of 30). Top looser - Pfizer Inc. (PFE, -2.14%). Top gainer - The Coca-Cola Company (KO +1.47%).

Almost all of S&P index sectors also in positive area. Top looser - Utilities (-0.5%). Top gainer - Conglomerates (+1,0%).

At the moment:

Dow 17787.00 -14.00 -0.08%

S&P 500 2089.25 +0.50 +0.02%

Nasdaq 100 4688.50 -1.00 -0.02%

Oil 42.29 +0.39 +0.93%

Gold 1068.90 -7.40 -0.69%

U.S. 10yr 2.26 +0.00

-

18:06

WSE: Session Results

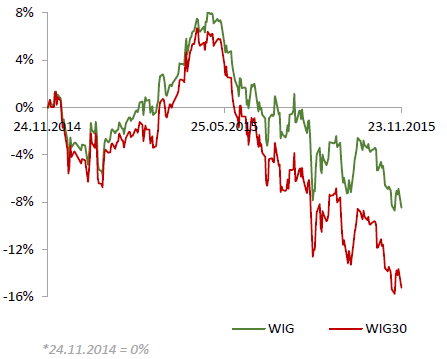

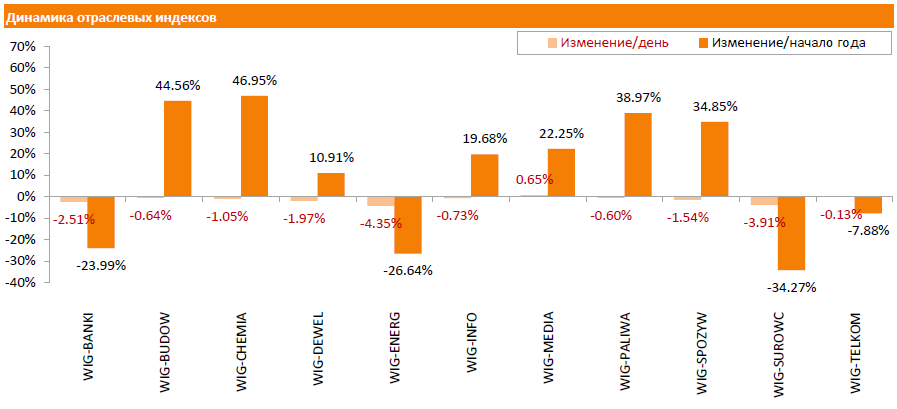

Polish equity market plunged on Monday. The broad market measure, the WIG index, fell by 1.69%. All sectors, but for media sector (+0.65%) posted negative daily returns. Utilities sector (-4.35%) and materials sector (-3.91%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, declined by 1.85%. Only four index constituents generated positive returns. Retailer CCC (WSE: CCC) was the biggest gainer, advancing 2.38%. It was followed by CYFROWY POLSAT (WSE: CPS), EUROCASH (WSE: EUR) and ASSECO POLAND (WSE: ACP), adding 0.17%-0.97%. On the other side of the ledger, banking sector name MBANK (WSE: MBK) was the weakest performer, slumping by 5.84%. Other major decliners were utilities names ENERGA (WSE: ENG), PGE (WSE: PGE) and TAURON PE (WSE: TPE), dropping by 5.36%, 5.32% and 3.99% respectively. Elsewhere, copper producer KGHM (WSE: KGH) tumbled by 4.16% as copper prices slumped to a fresh six-and-a-half year low.

-

18:00

European stocks close: stocks closed lower on a drop in commodity prices

Stock indices closed lower on a drop in commodity prices. Global oversupply and a weak demand weigh on commodity prices.

Meanwhile, the economic data from the Eurozone was positive. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI rose to 52.8 in November from 52.3 in October. Analysts had expected the index to remain unchanged at 52.3.

Eurozone's preliminary services PMI climbed to 54.6 in November from 54.1 in October. Analysts had expected the index to remain unchanged at 54.1.

Business activity and employment were main contributors for the rise.

Markit's Chief Economist Chris Williamson said that Eurozone's economic growth accelerated, "putting the region on course for one of its best quarterly performances over the past four-and-a-half year".

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter.

"November's slightly improved PMI reading will no doubt do little to dissuade policymakers that more needs to be done at their December meeting to ensure stronger and more sustainable growth," Williamson added.

Germany's preliminary manufacturing PMI climbed to 52.6 in November from 52.1 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary services PMI was up to 55.6 in November from 54.5 in October. Analysts had expected index to decline to 54.3.

France's preliminary manufacturing PMI rose to 50.8 in November from 50.6 in October, in line with forecasts.

France's preliminary services PMI decreased to 51.3 in November from 52.7 in October. Analysts had expected the index to fall to 52.6.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,305.49 -29.14 -0.46 %

DAX 11,092.31 -27.52 -0.25 %

CAC 40 4,889.12 -21.85 -0.44 %

-

18:00

European stocks closed: FTSE 6305.49 -29.14 -0.46%, DAX 11092.31 -27.52 -0.25%, CAC 40 4889.12 -21.85 -0.44%

-

17:16

Standard & Poor’s affirms Switzerland’s sovereign credit rating at AAA

Standard & Poor's Ratings Services affirmed Switzerland's sovereign credit rating at AAA on Friday. The outlook is stable.

The agency said that the country can handle the loss of competitiveness resulting from Swiss franc appreciation.

-

17:11

Standard & Poor’s upgrades the Netherlands’ sovereign credit rating to AAA

Standard & Poor's Ratings Services raised the Netherlands' sovereign credit rating to AAA from AA+ on Friday. The outlook is stable.

"The upgrade reflects our view of the strengthening of the economic recovery in the Netherlands, with domestic demand growing strongly as a result of increases in real disposable income, employment, and investment activity," the agency said.

S&P expects the economy to continue to recover.

The agency lowered the Netherlands' credit rating in 2013.

-

16:47

Federal Reserve Governor Daniel Tarullo is worried about the low inflation in the U.S.

Federal Reserve Governor Daniel Tarullo said in an interview with Bloomberg TV on Monday that he is worried about the low inflation in the U.S.

"The U.S. economy seems still to be chugging along with modestly above-trend growth. We've certainly seen continued improvement in the labor market, but the environment for inflation is still one where there is still a lot of uncertainty," he said.

Tarullo noted that market participants were focussed more on particular month, when the Fed will start raising its interest rate, than on the pace of interest rate hikes.

-

16:17

U.S. existing homes sales fall 3.7% in October

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes declined 3.7% to a seasonally adjusted annual rate of 5.36 million in October from 5.55 in September.

Analysts had expected a decrease to 5.40 million units.

"New and existing-home supply has struggled to improve so far this fall, leading to few choices for buyers and no easement of the ongoing affordability concerns still prevalent in some markets. Furthermore, the mixed signals of slowing economic growth and volatility in the financial markets slightly tempered demand and contributed to the decreasing pace of sales," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 31% in October from 29% in September.

"As long as solid job creation continues, a gradual easing of credit standards even with moderately higher mortgage rates should support steady demand and sales continuing to rise above a year ago," Yun said.

-

16:11

European Central Bank purchases €12.57 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.57 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.56 billion of covered bonds, and €156 million of asset-backed securities.

-

16:08

U.S. preliminary manufacturing purchasing managers' index drops to 52.6 in November, the lowest level since October 2013

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) dropped to 52.6 in November from 54.1 in October, missing expectations for a decline to 53.9. It was the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

The decline was partly driven by a slower pace of expansion in output, new orders and employment.

"November's flash PMI survey indicates that the manufacturing sector lost some growth momentum after the nice pick up seen in October, but still suggests the goods producing sector is expanding at a robust pace which should help support wider economic growth in the fourth quarter," Markit Chief Economist Chris Williamson.

"With the survey continuing to show modest growth, and any weakness linked to the global economy rather than a deterioration in domestic demand, there seems little in the survey results to throw up any roadblocks to a Fed that seems intent on hiking interest rates in December," he added.

-

15:46

Greece's second largest bank Piraeus Bank SA fails to raise enough funds from private investors

Greece's second largest bank by assets Piraeus Bank SA said on Saturday that it failed to raise enough funds from private investors. The lender raised €1.34 billion, but it needs €4.93 billion to pass the European Central Bank's stress test.

Piraeus Bank will likely need capital from Greece's bank rescue fund.

-

15:34

U.S. Stocks open: Dow -0.01%, Nasdaq +0.01%, S&P +0.02%

-

15:27

Before the bell: S&P futures -0.10%, NASDAQ futures -0.06%

U.S. stock-index futures were little changed.

Global Stocks:

Hang Seng 22,665.9 -88.82 -0.39%

Shanghai Composite 3,610.89 -19.61 -0.54%

FTSE 6,308.77 -25.86 -0.41%

CAC 4,882.68 -28.29 -0.58%

DAX 11,093.64 -26.19 -0.24%

Crude oil $41.38 (-1.24%)

Gold $1068.20 (-0.75%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Hewlett-Packard Co.

HPQ

14.21

1.07%

0.4K

Chevron Corp

CVX

89.46

0.51%

3.5K

Amazon.com Inc., NASDAQ

AMZN

671.70

0.49%

5.2K

AMERICAN INTERNATIONAL GROUP

AIG

62.51

0.48%

2.0K

Yandex N.V., NASDAQ

YNDX

17.57

0.34%

0.6K

General Motors Company, NYSE

GM

36.45

0.30%

1.7K

Apple Inc.

AAPL

119.62

0.27%

78.6K

Nike

NKE

133.00

0.26%

10.8K

Procter & Gamble Co

PG

76.00

0.24%

0.8K

Microsoft Corp

MSFT

54.31

0.22%

13.6K

Ford Motor Co.

F

14.63

0.21%

8.3K

The Coca-Cola Co

KO

42.51

0.19%

0.3K

Google Inc.

GOOG

757.95

0.18%

1.4K

Exxon Mobil Corp

XOM

79.90

0.14%

8.2K

AT&T Inc

T

33.70

0.12%

0.3K

Citigroup Inc., NYSE

C

54.80

0.09%

0.6K

Visa

V

80.25

0.07%

2.4K

International Business Machines Co...

IBM

138.60

0.07%

0.2K

Facebook, Inc.

FB

107.39

0.07%

21.4K

Intel Corp

INTC

34.68

0.06%

21.7K

Wal-Mart Stores Inc

WMT

60.10

0.05%

0.6K

Walt Disney Co

DIS

120.10

0.02%

11.9K

3M Co

MMM

158.95

0.00%

0.5K

Boeing Co

BA

149.40

0.00%

0.4K

Johnson & Johnson

JNJ

102.48

0.00%

3.2K

UnitedHealth Group Inc

UNH

112.97

0.00%

8.8K

Merck & Co Inc

MRK

54.10

0.00%

1.3K

Travelers Companies Inc

TRV

115.83

0.00%

0.5K

ALCOA INC.

AA

8.69

0.00%

0.4K

FedEx Corporation, NYSE

FDX

164.14

0.00%

0.2K

Starbucks Corporation, NASDAQ

SBUX

61.99

0.00%

0.3K

Twitter, Inc., NYSE

TWTR

26.27

0.00%

6.5K

Yahoo! Inc., NASDAQ

YHOO

33.10

-0.03%

0.2K

Cisco Systems Inc

CSCO

27.56

-0.04%

0.1K

Home Depot Inc

HD

130.10

-0.08%

1.9K

Caterpillar Inc

CAT

71.03

-0.15%

1.5K

Verizon Communications Inc

VZ

45.32

-0.15%

6.1K

American Express Co

AXP

72.24

-0.25%

0.1K

General Electric Co

GE

30.56

-0.33%

46.8K

JPMorgan Chase and Co

JPM

67.21

-0.49%

0.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.19

-0.73%

114.2K

ALTRIA GROUP INC.

MO

56.65

-0.84%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

218.00

-0.91%

8.4K

Barrick Gold Corporation, NYSE

ABX

7.04

-2.09%

4.5K

Pfizer Inc

PFE

31.39

-2.45%

310.2K

-

14:47

Upgrades and downgrades before the market open

Upgrades:

HP Inc. (HPQ) upgraded to Buy at Maxim Group; target lowered to $17 from $28

Downgrades:

Other:

Microsoft (MSFT) target raised to $60 from $56 at UBS

Hewlett Packard Enterprise (HPE) initiated with a Hold at Maxim Group; target $13.5

-

14:46

Standard & Poor's affirms its AA- sovereign rating for China

Standard & Poor's Ratings Services affirmed its AA- sovereign rating for China on Monday. The outlook remained stable.

The agency said that China will make a significant progress toward economic rebalancing in the next two years. According to S&P, China's economy should be driven by consumer spending and not by investments. The agency noted that there is progress in reforming the financial sector.

-

12:01

European stock markets mid session: stocks traded lower on a drop in commodity prices

Stock indices traded lower on a drop in commodity prices. Global oversupply and a weak demand weigh on commodity prices.

Meanwhile, the economic data from the Eurozone was positive. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI rose to 52.8 in November from 52.3 in October. Analysts had expected the index to remain unchanged at 52.3.

Eurozone's preliminary services PMI climbed to 54.6 in November from 54.1 in October. Analysts had expected the index to remain unchanged at 54.1.

Business activity and employment were main contributors for the rise.

Markit's Chief Economist Chris Williamson said that Eurozone's economic growth accelerated, "putting the region on course for one of its best quarterly performances over the past four-and-a-half year".

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter.

"November's slightly improved PMI reading will no doubt do little to dissuade policymakers that more needs to be done at their December meeting to ensure stronger and more sustainable growth," Williamson added.

Germany's preliminary manufacturing PMI climbed to 52.6 in November from 52.1 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary services PMI was up to 55.6 in November from 54.5 in October. Analysts had expected index to decline to 54.3.

France's preliminary manufacturing PMI rose to 50.8 in November from 50.6 in October, in line with forecasts.

France's preliminary services PMI decreased to 51.3 in November from 52.7 in October. Analysts had expected the index to fall to 52.6.

Current figures:

Name Price Change Change %

FTSE 100 6,299.63 -35.00 -0.55 %

DAX 11,086.69 -33.14 -0.30 %

CAC 40 4,877.72 -33.25 -0.68 %

-

11:46

Swiss National Bank: M3 money supply climbs 1.4% in October

The Swiss National Bank (SNB) released its money supply data on Monday. M3 money supply climbed at an annual rate of 1.4% in October, after a 1.3% rise in September.

M1 money supply dropped 2.9% year-on-year in October, after a 0.6% gain in September.

-

11:32

France's preliminary manufacturing PMI rises in November, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 50.8 in November from 50.6 in October, in line with forecasts.

France's preliminary services PMI decreased to 51.3 in November from 52.7 in October. Analysts had expected the index to fall to 52.6.

"French private sector output growth weakened slightly in November, with the Paris attacks reported to have hit activity among some service providers. However, the trend in new business firmed a little, with growth quickening to a five-month high, while backlogs of work rose again," the Senior Economist at Markit Jack Kennedy said.

-

11:17

Germany's preliminary manufacturing and services PMIs climb in November

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI climbed to 52.6 in November from 52.1 in October, beating forecasts of a decrease to 52.0.

Germany's preliminary services PMI was up to 55.6 in November from 54.5 in October. Analysts had expected index to decline to 54.3.

Markit's economist Oliver Kolodseike noted that the German economy was partly driven by "efficiency improvements and increased new order intakes".

"There was some divergence by sector, however, with accelerated output growth at service providers contrasting with a further slowdown at goods producers. While the Manufacturing PMI edged slightly higher, both output and new orders in the sector rose at marginally weaker rates," he noted.

-

11:06

Eurozone's preliminary manufacturing and services PMIs rise in November

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI rose to 52.8 in November from 52.3 in October. Analysts had expected the index to remain unchanged at 52.3.

Eurozone's preliminary services PMI climbed to 54.6 in November from 54.1 in October. Analysts had expected the index to remain unchanged at 54.1.

Business activity and employment were main contributors for the rise.

Markit's Chief Economist Chris Williamson said that Eurozone's economic growth accelerated, "putting the region on course for one of its best quarterly performances over the past four-and-a-half year".

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter.

"November's slightly improved PMI reading will no doubt do little to dissuade policymakers that more needs to be done at their December meeting to ensure stronger and more sustainable growth," Williamson added.

-

10:51

Canadian government downgrades its growth and fiscal forecasts

The Canadian government downgraded its growth and fiscal forecasts. The downward revision was driven by a slower-than-expected recovery for the Canadian economy. Low oil prices weigh on the economy in Canada.

The government expects the economy to expand 1.2% in 2015 and 2% in 2016.

The budget deficit is expected to be C$3 billion this year, and C$3.9 billion in 2016-2017.

-

10:13

France’s leading economic index declines 0.1% in September

The Conference Board released its leading economic index (LEI) for France on Friday. The leading economic index fell 0.1% in September, after a 0.4% gain in August.

The coincident economic index rose 0.1% in September, after a 0.2% increase in August.

"The recent behaviour of the composite indexes suggests that economic growth is likely to continue at a moderate pace in the coming year," the Conference Board said in its statement.

-

07:16

Global Stocks: U.S. stock indices gained on Friday and over the week

U.S. stock indices closed higher on Friday amid strong earnings reports from various companies.

The Dow Jones Industrial Average rose 91.06 points, or 0.5%, to 17,823.81 (+3.4% over the week). The S&P 500 climbed 7.93 points, or 0.4%, to 2,089.17 (+3.3% over the week). The Nasdaq Composite added 31.28 points, or 0.6%, to 5,106.78 (+3.6% over the week).

A 5.5% gain Nike Inc. stocks accounts for 46 points of the Dow Jones' increase.

San Francisco Federal Reserve Bank President John Williams signaled on Saturday he was prepared for a rate hike in December. He noted recent favorable data on the U.S. economy and said that upcoming economic reports could give "a clearer view of what's happening in the labor market" and the economy on the whole.

This morning in Asia Hong Kong Hang Seng declined 0.13%, or 30.64, to 22,724.08. China Shanghai Composite Index gained 0.12%, or 4.20, to 3.634.70. Japanese markets are on holiday due to Labor Thanksgiving Day.

Asian indices traded mixed. Banks and airline companies were leading declines in China in the early morning; however the index managed to return to the positive territory after a decline.

Asian investors are waiting for a series of earnings reports, including Ali Health, a unit of Chinese e-commerce company Alibaba.

-

01:01

Stocks. Daily history for Sep Nov 20’2015:

(index / closing price / change items /% change)

Nikkei 225 19,879.81 +20.00 +0.10 %

Hang Seng 22,754.72 +254.50 +1.13 %

Shanghai Composite 3,630.82 +13.76 +0.38 %

FTSE 100 6,334.63 +4.70 +0.07 %

CAC 40 4,910.97 -4.13 -0.08 %

Xetra DAX 11,119.83 +34.39 +0.31 %

S&P 500 2,089.17 +7.93 +0.38 %

NASDAQ Composite 5,104.92 +31.28 +0.62 %

Dow Jones 17,823.81 +91.06 +0.51 %

-