Noticias del mercado

-

19:23

American focus: the British pound rose significantly against the US dollar

The British pound appreciated significantly against the US dollar, almost completely recovered after yesterday's fall. Analysts say the reason for such dynamics was profit-taking by some investors, and position correction in anticipation of the long weekend. Support for the pair also had weak US data. The US Commerce Department said that orders for manufactured durable goods decreased overall in the last month against the backdrop of weak global growth, as low oil prices and financial instability continue to put pressure on companies costs. New orders for durable goods fell by a seasonally adjusted 2.8% in February compared with the previous month. Economists had expected overall orders to fall by 2.9% in February compared with the previous month. Falling new orders for all durable goods followed a growth in January, has suggested a glimmer of hope to the troubled manufacturing sector. Revised January growth was lowered to increase by 4.2% compared with the earlier estimate of growth by 4.7%.

In addition, market participants continue to analyze the current statistics for the UK. The Office for National Statistics said that UK retail sales fell at a slower pace than expected in February. The volume of retail sales decreased by 0.4 percent for the month, offset by growth in January by 2.3 percent. It was slower than the expected decline of 0.7 percent. Sales in grocery stores decreased by 0.3 percent and sales of non-food items in stores dropped by 0.1 percent. Sales excluding automotive fuel decreased by 0.2 percent as opposed to 2.3 percent growth a month ago and was less than 1 percent decline economists forecast. In view of automotive fuel, sales growth fell to 3.8 percent per annum from 5.4 percent. Economists had forecast an increase of 3.9 percent.

The euro rose against the dollar, returning to the level of opening of the session. Analysts said trading volume today was lower than usual, as market participants tried not to open new positions before the onset of the long Easter weekend. Little influenced by the US data. The Labor Department reported that the number of initial applications for unemployment benefits rose last week to the United States, but remained at a low level that is compatible with the improvement of the labor market. Unemployment The number of initial claims for benefits rose by 6,000 and reached a seasonally adjusted 265,000 for the week ended 19 March, the Labor Department reported Thursday. The data for the previous week were revised downward to 259,000 from the initial estimate of 265 000. Economists had expected 268,000 initial claims last week. The moving average of four weeks increased by 250 last week to 259 750. The number of repeated applications for unemployment benefits fell by 39,000 to 2.179 million in the week ended March 12.

In addition, the company Markit said the seasonally adjusted preliminary index of business activity in the US services sector rose to 51.0 in March, up from 49.7 in February, indicating only a slight expansion of the activity of the services sector. As a result, the latter index was significantly lower post-crisis trend (55.6). In addition, the average reading for the first three months of 2016 (51.3) showed the slowest quarterly growth rate since the third quarter of 2012.

The Canadian dollar retreated from session low against the US dollar, but still shows a moderate decrease, mainly due to the negative dynamics of oil. Quotes of oil fell today, heading for its first weekly drop in the past month. Pressure on prices have a record-high oil reserves in the US, the weakening of stock markets and a stronger dollar. Tuesday oil futures fell by about 6 percent, which is the biggest two-day decline since mid-February. Analysts believe that the oil rally, which lasted for the past five weeks, gradually coming to an end. Meanwhile. Report oilfield services company Baker Hughes showed that from March 19 to March 24 in the US the number of active drilling rigs for oil production decreased by 15 units - up to 372 units. The number of gas production plants rose to 92 units from 89 units. Meanwhile, the total number of drilling rigs (oil and gas) fell by 12 units to 464 units, while writing the 14th consecutive weekly decline.

-

14:45

U.S.: Services PMI, March 51

-

14:30

Option expiries for today's 10:00 ET NY cut

USD/JPY 110.70 (USD 700m) 111.95 (360m) 113.65 (285m)

EUR/USD 1.1000 (EUR 654m) 1.1025 (298m) 1.1035 (299m) 1.1050 (657m) 1.10550-60 (1.03bln) 1.1075 (375m) 1.1195-00(1.65bln) 1.1245-50 (903m) 1.1300 (252m) 1.1338 (370m0

GBP/USD 1.3900 (GBP 281m) 1.4050 (261m) 1.4250 (262m) 1.4330-35 (362m)

USD/CHF 1.0000 (USD 301m)

AUD/USD 0.7300 (AUD 1.02bln) 0.7490-00 (512m) 0.7550 (163m) 0.7625 (249m)

USD/CAD 1.3100 (USD 210m) 1.3120 (340m)

NZD/USD 0.6745 (NZD 198m) 0.6790 (200m)

-

13:41

Orders

EUR/USD

Offers: 1.1200 1.1220 1.1235 1.1250 1.1275-80 1.1300 1.1320 1.1350

Bids: 1.1150 1.1130 1.1100 1.1080-85 1.1050 1.1030 1.1000

GBP/USD

Offers: 1.4100 1.4120 1.4140-50 1.4180 1.4200 1.4220 1.4235 1.4250

Bids: 1.4065 1.4050 14025-30 1.4000 1.3980 1.3965 1.3950 1.3920-25 1.3900

EUR/JPY

Offers: 126.20 126.50 126.80 127.00 127.30 127.50

Bids: 125.75-80 125.50 125.30 125.00 124.80-85 124.50

EUR/GBP

Offers: 0.7950 0.7975-80 0.8000 0.8020 0.8035-40 0.8080 0.8100

Bids: 0.7920 0.7900 0.7880 0.7850 0.7825-30 0.7800

USD/JPY

Offers: 113.00 113.20 113.50 113.80 114.00 114.30 114.50

Bids: 112.70 112.50 112.20 112.00 111.80-85 111.50 111.20 111.00

AUD/USD

Offers: 0.7520 0.7535 0.7550 0.7575-80 0.7600 0.7620 0.7650

Bids: 0.7480 0.7450 0.7435 0.7420 0.7400 0.7385 0.7350

-

13:30

U.S.: Initial Jobless Claims, March 265 (forecast 268)

-

13:30

U.S.: Continuing Jobless Claims, March 2179 (forecast 2230)

-

13:30

U.S.: Durable Goods Orders , February -2.8% (forecast -2.9%)

-

13:30

U.S.: Durable Goods Orders ex Transportation , February -1.0% (forecast -0.2%)

-

13:30

U.S.: Durable goods orders ex defense, February -1.9%

-

12:30

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the mixed economic data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany Gfk Consumer Confidence Survey April 9.5 9.5 9.4

09:00 Eurozone ECB Economic Bulletin

09:30 United Kingdom BBA Mortgage Approvals February 46.9 Revised From 47.5 45.9

09:30 United Kingdom Retail Sales (MoM) February 2.3% -0.7% -0.4%

09:30 United Kingdom Retail Sales (YoY) February 5.4% Revised From 5.2% 3.8% 3.8%

10:15 Eurozone Targeted LTRO 18.3 24.3 7.3

11:00 United Kingdom CBI retail sales volume balance March 10 15 7

The U.S. dollar traded lower against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 3,000 to 268,000 last week.

The U.S. durable goods orders are expected to decrease 2.9% in February, after a 4.9% rise in January.

The U.S. durable goods orders excluding transportation are expected to fell 0.2% in February, after a 1.8% increase in January.

The euro traded mixed against the U.S. dollar after the weaker-than-expected data from the Eurozone. Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index fell to 9.4 in April from 9.5 in March. Analysts had expected the index to remain unchanged at 9.5.

The economic expectations index declined by 2.9 points to 0.5 points in March, while the willingness to buy index fell by 2.7 points to 50.0.

The income expectations index dropped by 6.2 points to 50.5 in March.

"The weak demand for German products in certain important markets will probably not leave economic growth in Germany unaffected. A signal of this is the decline in economic expectations this month," Gfk noted.

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index declined to 101 in March from 103 in February.

The British pound traded higher against the U.S. dollar after the release of the mixed economic data from the U.K. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.4% in February, beating expectations for a 0.7% drop, after a 2.3% rise in January.

The decline was driven by a weak demand for clothing. Clothing and footwear sales fell 0.4% in February.

Food store sales were down 0.3% in February, while non-food store sales decreased 0.1%.

On a yearly basis, retail sales in the U.K. climbed 3.8% in February, in line with forecasts, after a 5.4% rise in January. January's figure was revised up from a 5.2% gain.

The Confederation of British Industry (CBI) released its retail sales balance data on Thursday. The CBI retail sales balance declined to +7% in March from +10% in February, missing expectations for a rise to +15%. Sales are expected to rise next month, while orders are expected to be flat.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals declined to 45,982 in February from 46,900 in January. January's figure was revised down from 47,509.

"Mortgage borrowing remained buoyant in February. It appears that borrowers are continuing to try to get ahead of the increases in stamp duty for buy-to-let and second home buyers scheduled to come into effect next month," the chief economist at the BBA, Richard Woolhouse, said.

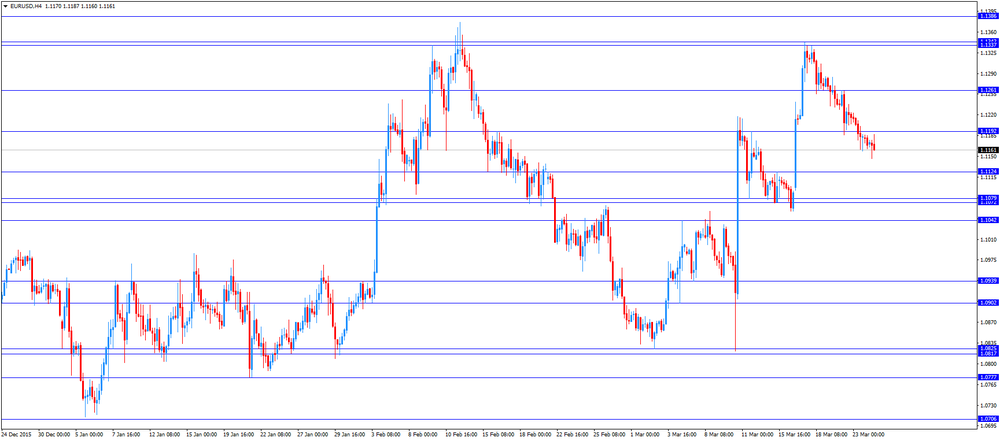

EUR/USD: the currency pair traded mixed

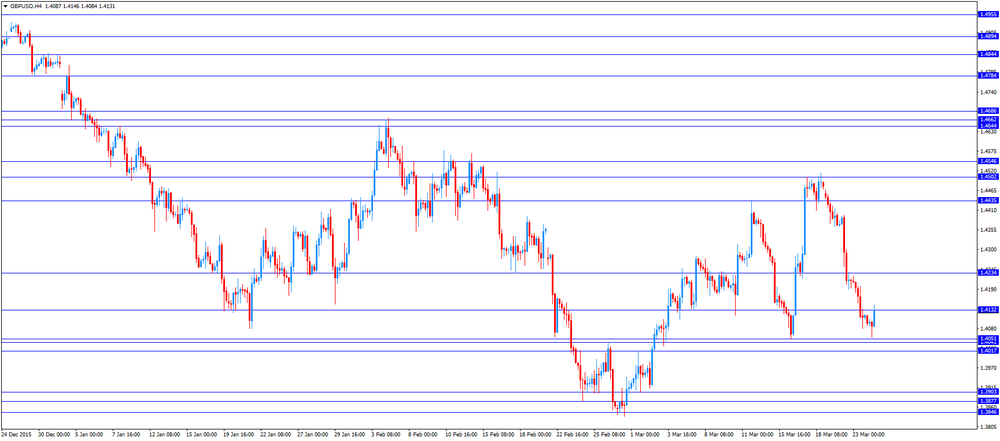

GBP/USD: the currency pair increased to $1.4146

USD/JPY: the currency pair fell to Y112.56

The most important news that are expected (GMT0):

12:15 U.S. FOMC Member James Bullard Speaks

12:30 U.S. Durable Goods Orders February 4.9% -2.9%

12:30 U.S. Durable Goods Orders ex Transportation February 1.8% -0.2%

12:30 U.S. Durable goods orders ex defense February 4.5%

12:30 U.S. Initial Jobless Claims March 265 268

13:00 U.S. Housing Price Index, m/m January 0.4%

13:45 U.S. Services PMI (Preliminary) March 49.7

23:30 Japan Tokyo Consumer Price Index, y/y March 0.1% 0%

23:30 Japan Tokyo CPI ex Fresh Food, y/y March -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y February 0% 0%

23:30 Japan National CPI Ex-Fresh Food, y/y February 0% 0.1%

-

12:11

CBI retail sales balance declines to +7% in March

The Confederation of British Industry (CBI) released its retail sales balance data on Thursday. The CBI retail sales balance declined to +7% in March from +10% in February, missing expectations for a rise to +15%.

Sales are expected to rise next month, while orders are expected to be flat.

"Retailers are still face challenging global conditions but will welcome the Chancellor's Budget reforms to business rates, making it easier for them to operate on the high street. Continued low levels of inflation and more jobs will continue to boost household spending, also giving a helping hand to firms," CBI Director of Economics, Rain Newton-Smith, said.

-

12:00

United Kingdom: CBI retail sales volume balance, March 7 (forecast 15)

-

11:50

European Central Bank’s monthly economic bulletin: the Eurozone’s economy continues to recover

The European Central Bank (ECB) released its monthly economic bulletin on Thursday. The central bank said that the Eurozone's economy continued to recover, but the growth was weaker than previously estimated. The ECB expects the economy to continue to recover moderately, supported the central bank's stimulus measures and a rise in employment. There are downside risks to the outlook from the slowdown in emerging countries, volatile financial markets, the balance sheet adjustments and the sluggish pace of implementation of structural reforms.

-

11:42

Japanese Prime Minister Shinzo Abe: the Bank of Japan’s monetary policy does not target to directly weaken the yen

Japanese Prime Minister Shinzo Abe said before the parliament on Thursday that the Bank of Japan's monetary policy did not target to directly weaken the yen. But a weaker yen was likely a result of the central bank's monetary policy actions, he noted.

-

11:36

Italian retail sales are flat in January

The Italian statistical office Istat released its retail sales data for Italy on Thursday. Italian retail sales were flat in January, after a 0.1% decrease in December.

Sales of food products were flat in January, while sales of non-food products increased by 0.1%.

On a yearly basis, retail sales in Italy declined 0.8% in January, after a 0.7% gain in December. December's figure was revised up from a 0.6% rise.

-

11:32

Industrial orders in Italy rise at a seasonally adjusted rate of 0.7% in January

The Italian statistical office Istat released its industrial orders data for Italy on Thursday. Industrial orders in Italy rose at a seasonally adjusted rate of 0.7% in January, after a 2.8% drop in December.

Domestic orders were up 0.6% in Japan, while non-domestic orders rose 0.8%.

On a yearly basis, the unadjusted industrial orders in Italy increased 0.1% in January, after a 1.5% rise in December.

The seasonally adjusted industrial turnover in Italy climbed 1.0% in January, after a 1.6% decrease in December.

Domestic turnover increased 1.2% in January, while non-domestic turnover rose 0.4%.

On a yearly basis, the adjusted industrial turnover in Italy declined 0.3% in January, after a 3.0% decrease in December.

-

11:09

French manufacturing confidence index declines to 101 in March

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index declined to 101 in March from 103 in February.

Past change in production index was down to -6 in March from -3 in February.

Personal production expectations index fell to 14 in March from 19 in February, while general production outlook index rose to -1 from -4.

-

11:01

UK retail sales fall 0.4% in February

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.4% in February, beating expectations for a 0.7% drop, after a 2.3% rise in January.

The decline was driven by a weak demand for clothing. Clothing and footwear sales fell 0.4% in February.

Food store sales were down 0.3% in February, while non-food store sales decreased 0.1%.

On a yearly basis, retail sales in the U.K. climbed 3.8% in February, in line with forecasts, after a 5.4% rise in January. January's figure was revised up from a 5.2% gain.

-

10:49

Number of mortgage approvals in the U.K. declines to 45,982 in February

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals declined to 45,982 in February from 46,900 in January. January's figure was revised down from 47,509.

"Mortgage borrowing remained buoyant in February. It appears that borrowers are continuing to try to get ahead of the increases in stamp duty for buy-to-let and second home buyers scheduled to come into effect next month," the chief economist at the BBA, Richard Woolhouse, said.

He added that consumer confidence was robust.

-

10:32

United Kingdom: BBA Mortgage Approvals, February 45.9

-

10:30

United Kingdom: Retail Sales (MoM), February -0.4% (forecast -0.7%)

-

10:30

United Kingdom: Retail Sales (YoY) , February 3.8% (forecast 3.8%)

-

10:17

German construction orders increase 1.0% in January

Destatis released its construction orders data on Thursday. German construction orders rose by a seasonally and working-day-adjusted rate of 1.0% in January.

On an annual basis, German construction orders climbed by a seasonally adjusted rate of 12.6% in January.

Turnover of companies with 20 or more persons fell 1.5% year-on-year in January.

-

10:11

German import prices decline 0.6% in January

Destatis released its import prices data for Germany on Thursday. German import prices declined by 5.7% in February from last year, after a 3.8% fall in January. It was the biggest drop since October 2009.

The decline was driven by a drop in energy prices, which plunged 34.1% year-on-year in February.

Import prices decline since January 2013.

On a monthly base, import prices decreased 0.6% in February, after a 1.5% fall in January.

On a yearly base, import prices excluding crude oil and mineral oil products fell by 2.8% in February.

Export prices dropped 1.2% year-on-year in February, after a 0.5% decrease in January.

On a monthly base, export prices were down 0.5% in February, after a 0.2% fall in January.

-

10:06

German Gfk consumer confidence index falls to 9.4 in April

Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index fell to 9.4 in April from 9.5 in March. Analysts had expected the index to remain unchanged at 9.5.

The economic expectations index declined by 2.9 points to 0.5 points in March, while the willingness to buy index fell by 2.7 points to 50.0.

The income expectations index dropped by 6.2 points to 50.5 in March.

"The weak demand for German products in certain important markets will probably not leave economic growth in Germany unaffected. A signal of this is the decline in economic expectations this month," Gfk noted.

-

09:59

German cabinet approves fiscal plans for 2017

The German cabinet approved fiscal plans for 2017 on Wednesday. Fiscal plans include higher spending on migrants, security and infrastructure without new debt.

"We are investing in infrastructure, education and research, we are doing what is needed to guarantee domestic and external security and we are helping migrants - all without new borrowing," German Finance Minister Wolfgang Schaeuble said.

Germany plans to spend on migrants €10 billion in 2017. The government's spending is expected to rise by €30.9 billion to €347.8 billion by 2020.

-

09:47

New Zealand’s trade surplus widens to NZ$339 million in February

Statistics New Zealand released its trade data on late Wednesday evening. New Zealand's trade surplus widened to NZ$339 million in February from NZ$13 million in January. January's figure was revised up from a surplus of NZ$8 million.

Analysts had expected the surplus to rise to NZ$50 million.

Exports climbed 9.3% year-on-year in February, mainly driven by fish, crustaceans, and molluscs, and wine, while imports increased by 2.8%, mainly driven by a rise in pharmaceuticals, toys, and sporting equipment.

"Export results were mixed in February 2016, with many commodities rising in value. But falls for some of our main commodities, including beef, lamb, and milk powder, meant that the rise was limited," Statistics NZ international statistics senior manager Stuart Jones said.

-

09:19

Option expiries for today's 10:00 ET NY cut

USD/JPY 110.70 (USD 700m) 111.95 (360m) 113.65 (285m)

EUR/USD 1.1000 (EUR 654m) 1.1025 (298m) 1.1035 (299m) 1.1050 (657m) 1.10550-60 (1.03bln) 1.1075 (375m) 1.1195-00(1.65bln) 1.1245-50 (903m) 1.1300 (252m) 1.1338 (370m0

GBP/USD 1.3900 (GBP 281m) 1.4050 (261m) 1.4250 (262m) 1.4330-35 (362m)

USD/CHF 1.0000 (USD 301m)

AUD/USD 0.7300 (AUD 1.02bln) 0.7490-00 (512m) 0.7550 (163m) 0.7625 (249m)

USD/CAD 1.3100 (USD 210m) 1.3120 (340m)

NZD/USD 0.6745 (NZD 198m) 0.6790 (200m)

-

08:30

Options levels on thursday, March 24, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1284 (2917)

$1.1246 (3090)

$1.1215 (3120)

Price at time of writing this review: $1.1163

Support levels (open interest**, contracts):

$1.1124 (2043)

$1.1095 (2348)

$1.1062 (3925)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 47008 contracts, with the maximum number of contracts with strike price $1,1500 (4391);

- Overall open interest on the PUT options with the expiration date April, 8 is 67852 contracts, with the maximum number of contracts with strike price $1,0900 (6045);

- The ratio of PUT/CALL was 1.44 versus 1.45 from the previous trading day according to data from March, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.4403 (1870)

$1.4305 (924)

$1.4209 (484)

Price at time of writing this review: $1.4085

Support levels (open interest**, contracts):

$1.3992 (2684)

$1.3895 (1078)

$1.3797 (1050)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 20392 contracts, with the maximum number of contracts with strike price $1,4400 (1870);

- Overall open interest on the PUT options with the expiration date April, 8 is 23146 contracts, with the maximum number of contracts with strike price $1,4000 (2684);

- The ratio of PUT/CALL was 1.14 versus 1.10 from the previous trading day according to data from March, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:23

Asian session: The dollar climbed

Economic indicators due later on Thursday include the U.S. durable goods orders and jobless claims data. Upbeat readings would help support the case for the Fed to steadily tighten monetary policy.

The dollar climbed to a one-week high against a basket of currencies on Thursday while awaiting data due later in the session that could back some Federal Reserve officials' relatively optimistic views on the U.S. economy. The U.S. currency was on the front foot after St. Louis Fed President James Bullard added his support to the possibility of more U.S. interest rate hikes this year.

EUR/USD: during the Asian session the pair traded in the range of $1.1160-80

GBP/USD: during the Asian session the pair fell to $1.4085

USD/JPY: during the Asian session the pair rose to Y112.85

Based on Reuters materials

-

08:01

Germany: Gfk Consumer Confidence Survey, April 9.4 (forecast 9.5)

-

00:28

Currencies. Daily history for Mar 23’2016:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1180 -0,31%

GBP/USD $1,4117 -0,67%

USD/CHF Chf0,9751 +0,23%

USD/JPY Y112,38 +0,01%

EUR/JPY Y125,63 -0,30%

GBP/JPY Y158,63 -0,66%

AUD/USD $0,7533 -1,08%

NZD/USD $0,6706 -0,61%

USD/CAD C$1,3205 +1,23%

-