Noticias del mercado

-

17:22

European Central Bank: banks borrowed €15.5 billion in loans

The European Central Bank (ECB) said on Thursday that banks borrowed €15.5 billion in loans, the so-called TLTROs.

The ECB is offering banks the loans as part of its stimulus measures to spur Eurozone's economy and to boost inflation to its 2% target.

The ECB said there were 88 bidders (June: 28) for this week's TLTROs.

Banks borrowed €73.8 billion in June, €97.8 billion in March, €129.8 billion euros in December 2014 and €82.6 billion in September 2014.

-

17:02

European Central Bank (ECB) Governing Council member Erkki Liikanen: the central bank could adjust its asset-buying programme if needed

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Thursday that the central bank could adjust its asset-buying programme if needed.

"The ECB stands ready to take all necessary measures. The monetary policy stimulus can, if necessary, be increased by adjusting the scale, composition or duration of the expanded purchase programme," he said.

Liikanen pointed out that the slowdown in the global economy involves risks for the recovery in the Eurozone, adding that inflation in the Eurozone could rise slower than expected.

-

16:30

New home sales in the U.S. rise 5.7% in August

The U.S. Commerce Department released new home sales data on Thursday. New home sales increased 5.7% to a seasonally adjusted annual rate of 552,000 units in August from 522,000 units in July. July's figure was revised up from 507,000 units. It was the highest figure since February 2008.

Analysts had expected new home sales to reach 515,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast climbed 24.1% in August.

This data points to a strong recovery in the U.S. housing market.

-

16:20

New Zealand’s trade deficit widens to NZ$1,035 million in August

Statistics New Zealand released its trade data on late Wednesday evening. New Zealand's trade deficit widened to NZ$1,035 million in August from NZ$726 million in July. July's figure was revised up from a deficit of NZ$649 million.

Analysts had expected the deficit to rise to NZ$850 million.

The increase in deficit was driven by higher imports. Exports rose 5.6% year-on-year in August, while imports increased by 19.0%.

Beef exports soared 46% in August from a year earlier.

"International shortages, rising production, and a falling New Zealand dollar have contributed to this record beef season," Statistics NZ international statistics senior manager Jason Attewell said.

-

16:04

NBB business climate declines to -6.8 in September

The National Bank of Belgium (NBB) released its business survey on Thursday. The business climate declined to -6.8 in September from -5.1 in August, missing forecasts for a fall to -5.3. It was the third consecutive decline.

3 of 4 indicators declined in September.

The business climate index for the manufacturing sector dropped to -8.7 in September from -8.0 in August due to less favourable assessments of total order books.

The business climate index for the services sector was down to 3.3 in September from 11.8 in August due to less optimistic outlook about current levels of activity.

The business climate index for the building sector decreased to -9.0 in September from -8.3 in August due to a drop in new orders.

The business climate index for the trade sector rose to -6.5 in September from -8.0 in August due to more favourable assessments of orders.

-

16:01

U.S.: New Home Sales, August 552 (forecast 515)

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.6bn), $1.1100(E1.4bn), $1.1185($827mn), $1.1200($1.3bn), $1.1215($963mn), $1.1220/25(E1.1bn)

GBP/USD: $1.5300(stg213mn)

USD/JPY: Y119.00($620mn),Y11965($465mn), Y120.00($1.2bn), Y120.35($415mn), Y121.00($400mn)

USD/CAD: Cad1.3200($220mn), Cad1.3250($500mn), Cad1.3275($250mn), Cad1.3300($201mn)

AUD/USD: $0.6950(A$378mn), $0.7000(A$471mn), $0.7100(A$307mn)

NZD/USD: $0.6480(NZ$300mn)

-

15:03

Chicago Fed National Activity Index drops to -0.41 in August

The Federal Reserve Bank of Chicago released its National Activity Index on Thursday. The index fell to -0.41 in August from 0.51 in July. July's figure was revised up from 0.34.

The decline was mainly driven by a weakness in the production.

The production-related indicator declined to -0.30 in August from +0.36 in July.

The employment-related indicator dropped to -0.01 in August from +0.18 in July.

The personal consumption and housing indicator was down to -0.08 in August from -0.06 in July.

-

15:01

Belgium: Business Climate, September -6.8 (forecast -5.3)

-

14:53

U.S. durable goods orders drop 2.0% in August

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders decreased 2.0% in August, in line with expectations, after a 1.9% gain in July. July's figure was revised down from a 2.2% rise.

The decline was partly driven by a weak demand for aircraft.

The U.S. durable goods orders excluding transportation was flat in August, missing expectations for a 0.1% gain, after a 0.6% increase in July.

The U.S. durable goods orders excluding defence dropped 1.0 % in August, beating expectations for a 1.2% fall, after a 0.9% gain in July. July's figure was revised down from a 1.0% increase.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

14:41

Initial jobless claims increase by 3,000 to 267,000 in the week ending September 19

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 19 in the U.S. rose by 3,000 to 267,000 from 264,000 in the previous week. Analysts had expected the initial jobless claims to increase to 271,000.

Jobless claims remained below 300,000 the 29th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 1,000 to 2,242,000 in the week ended September 12.

-

14:31

U.S.: Durable Goods Orders , August -2.0% (forecast -2%)

-

14:31

U.S.: Durable goods orders ex defense, -1% (forecast -1.2%)

-

14:31

U.S.: Durable Goods Orders ex Transportation , August 0.0% (forecast 0.1%)

-

14:30

U.S.: Initial Jobless Claims, September 267 (forecast 271)

-

14:30

U.S.: Chicago Federal National Activity Index, August -0.41

-

14:30

U.S.: Continuing Jobless Claims, September 2242 (forecast 2235)

-

14:24

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan decreases to 50.9 in September

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan decreased to 50.9 in September from 51.7 in August.

A reading below 50 indicates contraction of activity.

The index was partly driven by a decline in new export orders, employment and output prices.

"September PMI data pointed to a general slowdown in the expansion of the Japanese manufacturing sector. New order growth moderated, having increased in August at the fastest rate since January. Underpinning the slowdown in total new order growth was a sharp reduction in international demand as new export orders dropped to the greatest extent for 31 months," economist at Markit, Amy Brownbill, said.

-

14:14

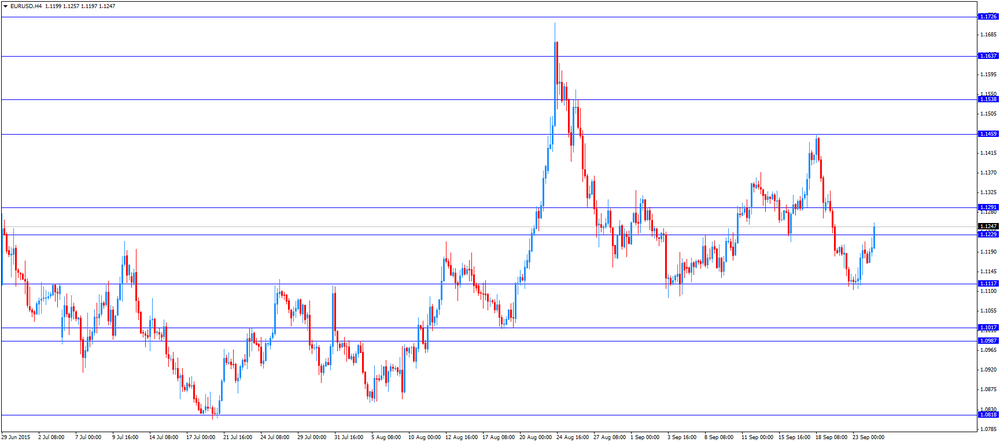

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the release of the positive economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) September 51.7 50.9

04:30 Japan All Industry Activity Index, m/m July 0.5% Revised From 0.3% 0.2%

06:00 Germany Gfk Consumer Confidence Survey October 9.9 9.8 9.6

08:00 Germany IFO - Current Assessment September 114.8 114.7 114

08:00 Germany IFO - Expectations September 102.2 101.5 103.3

08:00 Germany IFO - Business Climate September 108.4 Revised From 108.3 108 108.5

08:30 United Kingdom BBA Mortgage Approvals August 46.3 Revised From 46.0 46.74

09:15 Eurozone Targeted LTRO 73.8 15.5

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The U.S. durable goods orders are expected to decrease 2.0% in August, after a 2.2% gain in July.

The U.S. durable goods orders excluding transportation are expected to rise 0.1% in August, after a 0.6% gain in July.

The number of initial jobless claims in the U.S. is expected to rise by 7,000 271,000 last week.

New home sales in the U.S. are expected to rise to 515,000 units in August from 507,000 units in July.

The Fed Chairwoman Janet Yellen will speak at 21:00 GMT.

The euro traded higher against the U.S. dollar after the release of the positive economic data from Germany. German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index rose to 108.4 in September from 108.3 in August, beating expectations for a decline to 108.0.

"The German economy is proving robust. In manufacturing the business climate continued to deteriorate slightly. Manufacturers scaled back their very good assessments of the current business situation, but were nevertheless more optimistic about short-term business developments. More companies plan to ramp up production in the months ahead," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index declined to 114.0 from 114.8. Analysts had expected the index to fell to 114.7.

The Ifo expectations index rose to 103.3 from 102.2. Analysts had expected the index to decrease to 101.5.

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 104 in September from 103 in August. It was the highest level since August 2011.

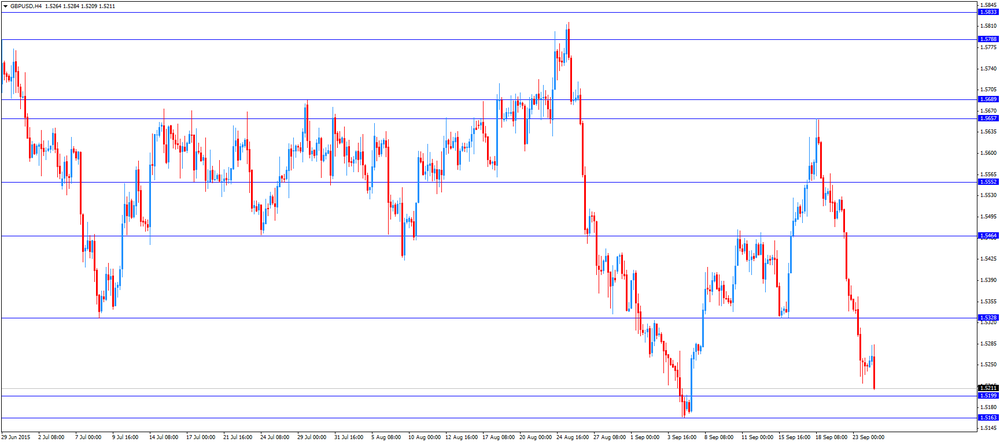

The British pound traded lower against the U.S. dollar despite the positive mortgage approvals data from the U.K. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals increased to 46,743 in August from 46,315 in July. It was the highest reading since February 2014.

"Mortgage borrowing continues to pick up. The August increase is the largest in five years, although borrowing is still some way below pre-crisis levels," the chief economist at the BBA, Richard Woolhouse, said.

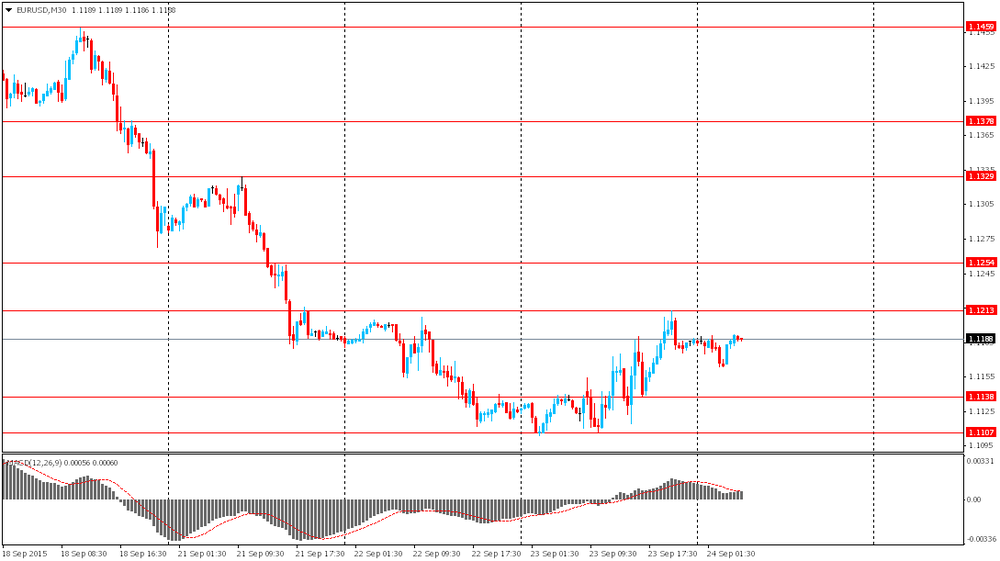

EUR/USD: the currency pair increased to $1.1257

GBP/USD: the currency pair fell to $1.5209

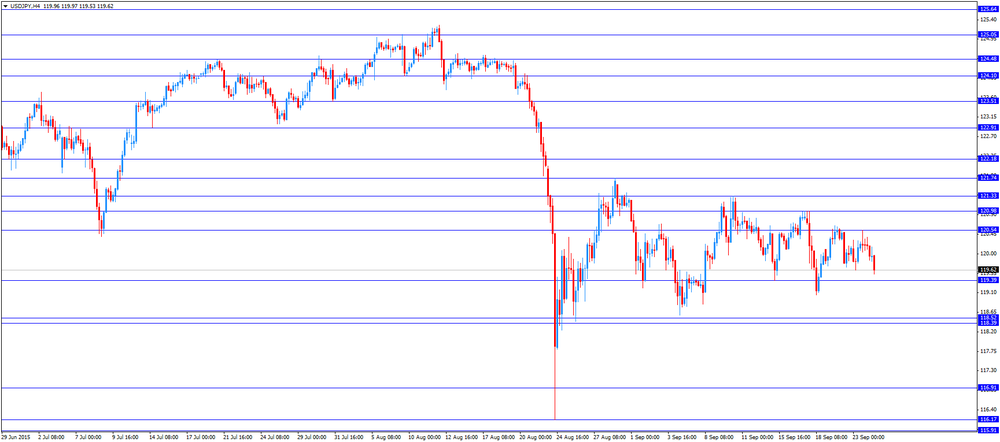

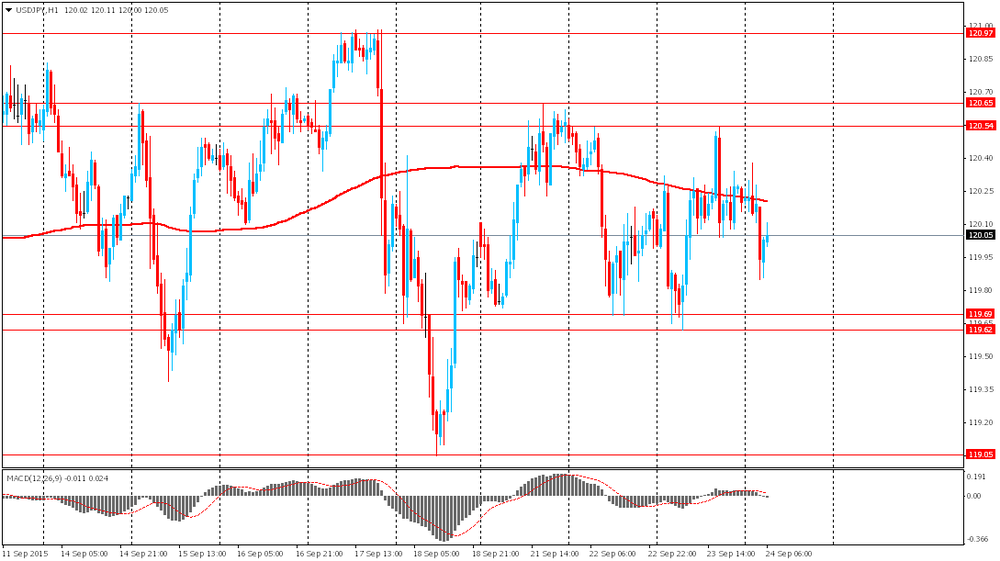

USD/JPY: the currency pair declined to Y119.53

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims September 264 271

12:30 U.S. Durable Goods Orders August 2.2% -2%

12:30 U.S. Durable Goods Orders ex Transportation August 0.6% 0.1%

12:30 U.S. Durable goods orders ex defense 1.0% -1.2%

14:00 U.S. New Home Sales August 507 515

21:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Japan Tokyo Consumer Price Index, y/y September 0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y August 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y August 0.0% -0.1%

-

14:00

Orders

EUR/USD

Offers 1.1220-25 1.1245 1.1275 1.1300 1.1330 1.1350

Bids 1.1185 1.1165 1.1150 1.1135 1.1120 1.1100 1.1085 1.1065 1.1050

GBP/USD

Offers 1.5285-90 1.5300 1.5320 1.5335 1.5360 1.5375 1.5400

Bids 1.5250 1.5225-30 1.5200 1.5180 1.5165 1.5150

EUR/GBP

Offers 0.7350-55 0.7375 0.7385 0.7400 0.7420 0.7535 0.7450

Bids 0.7320 0.7300 0.7285 0.7265 0.7250 0.7225-30 0.7200

EUR/JPY

Offers 134.80 135.00 135.50 135.80 136.00

Bids 134.00 133.80 133.50 133.30 133.00 132.75 132.50

USD/JPY

Offers 120.20-25 120.40 120.60-65 120.85 121.00 121.30 121.50

Bids 119.80-85 119.65 119.50 119.30 119.10 119.00 118.85 118.50

AUD/USD

Offers 0.6985 0.7000 0.7020 0.7050 0.7065 0.7080 0.7100

Bids 0.6950 0.6925-30 0.6900 0.6885 0.6870 0.6850

-

11:44

Italian retail sales climb at a seasonally adjusted rate of 0.4% in July

The Italian statistical office Istat released its retail sales data for Italy on Thursday. Italian retail sales climbed at a seasonally adjusted rate of 0.4% in July, after a 0.4% decline in June. June's figure was revised down from a 0.3% decrease.

On a yearly basis, retail sales in Italy climbed 1.7% in July, after a 1.7% increase in June.

Sales of food products jumped 3.2% year-on-year in July, while sales of non-food products climbed by 0.8%.

-

11:39

Industrial orders in Italy rise at a seasonally adjusted rate of 1.1% in July

The Italian statistical office Istat released its industrial orders data for Italy on Thursday. Industrial orders in Italy rose at a seasonally adjusted rate of 1.1% in July, after a 0.7% increase in June.

Domestic market orders climbed 3.1% in July, while demand from non-domestic markets dropped by 2.9%.

On a yearly basis, the seasonally adjusted industrial orders in Italy jumped 2.3% in July, after a 3.4% gain in June.

The seasonally adjusted industrial new orders index rose by 0.6% month-on-month in July.

-

11:24

French manufacturing confidence index rises to 104 in August, the highest level since August 2011

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 104 in September from 103 in August. It was the highest level since August 2011.

Past change in production index was up to 7 in September from 4 in August.

Personal production expectations index rose to 14 in September from 8 in August, while general production outlook index climbed to 7 in September from 3 in August.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.6bn), $1.1100(E1.4bn), $1.1185($827mn), $1.1200($1.3bn), $1.1215($963mn), $1.1220/25(E1.1bn)

GBP/USD: $1.5300(stg213mn)

USD/JPY: Y119.00($620mn),Y11965($465mn), Y120.00($1.2bn), Y120.35($415mn), Y121.00($400mn)

USD/CAD: Cad1.3200($220mn), Cad1.3250($500mn), Cad1.3275($250mn), Cad1.3300($201mn)

AUD/USD: $0.6950(A$378mn), $0.7000(A$471mn), $0.7100(A$307mn)

NZD/USD: $0.6480(NZ$300mn)

-

11:15

Number of mortgage approvals in the U.K. is up to 46,743 in August, the highest reading since February 2014

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals increased to 46,743 in August from 46,315 in July. It was the highest reading since February 2014.

"Mortgage borrowing continues to pick up. The August increase is the largest in five years, although borrowing is still some way below pre-crisis levels," the chief economist at the BBA, Richard Woolhouse, said.

-

11:09

German Gfk consumer confidence index declines to 9.6 in October

Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index fell to 9.6 in October from 9.9 in September.

Analysts had expected the index to remain unchanged at 9.8.

The decrease was driven by declines in all three indicators.

The economic expectations index plunged by 10.2 points to 6.4 points in September, while the willingness to buy index fell 1.6 points to 50.4.

The income expectations index dropped by 5.8 points in September and is now at 47.7.

"The indicator is at a very good level. In consideration of the extremely positive development of the retail sector, it can be assumed that the consumption will continue to be an important pillar of the economy this year overall," Gfk noted.

-

10:56

German business confidence index climbs to 108.4 in September

German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index rose to 108.4 in September from 108.3 in August, beating expectations for a decline to 108.0.

"The German economy is proving robust. In manufacturing the business climate continued to deteriorate slightly. Manufacturers scaled back their very good assessments of the current business situation, but were nevertheless more optimistic about short-term business developments. More companies plan to ramp up production in the months ahead," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index declined to 114.0 from 114.8. Analysts had expected the index to fell to 114.7.

The Ifo expectations index rose to 103.3 from 102.2. Analysts had expected the index to decrease to 101.5.

-

10:43

Atlanta Fed President Dennis Lockhart: markets overreacted to the weak Chinese economic data

Atlanta Fed President Dennis Lockhart said on Wednesday that markets overreacted to the weak Chinese economic data.

"China is slowing to still a very respectable pace of growth. It is ratcheting down a little bit, but there is a decent chance that the world is overreacting," he said.

Lockhart added that the spillover to the U.S. economy "is likely to be small".

Atlanta Fed president noted that the Fed should concentrate on the U.S. economy more than on the slowdown in the global economy.

-

10:35

European Central Bank Governing Council member Jens Weidmann: the central bank’s asset-buying programme should not be continued any longer than necessary

European Central Bank (ECB) Governing Council member Jens Weidmann said Wednesday that the central bank's asset-buying programme should not be continued any longer than necessary.

"The expansive monetary policy shouldn't be continued any longer than absolutely necessary," he said.

Weidmann noted that the low inflation is caused by low energy prices and it is temporary.

"I remain of the opinion that monetary policy should look through inflation fluctuations that are caused by energy prices, because these are temporary and the economy benefits anyway through an increase in purchasing power," he said.

-

10:32

United Kingdom: BBA Mortgage Approvals, August 46.74

-

10:25

European Central Bank Executive Board member Peter Praet: the central bank could adjust its asset-buying programme if needed

European Central Bank (ECB) Executive Board member Peter Praet said in Dublin on Wednesday that the central bank could adjust its asset-buying programme if needed.

"Monetary policy will play its part for as long as needed, which means the full implementation of the asset purchase program and, if necessary, adjustments to its size, composition and duration," he said.

-

10:21

Bill Gross, fund manager at Janus Capital: the Fed should start raising its interest rates immediately

Bill Gross, fund manager at Janus Capital, said in his monthly letter that the Fed should start raising its interest rates immediately.

"The developed world is beginning to run on empty because investments discounted at near zero over the intermediate future cannot provide cash flow or necessary capital gains to pay for past promises in an aging society," he wrote.

-

10:09

International Monetary Fund approves another tranche of €126 million for Cyprus

The International Monetary Fund (IMF) has approved another tranche of €126 million for Cyprus, noting that the country's reform programme continues to be "a success."

IMF Deputy Managing Director Mitsuhiro Furusawa said that the country's economy recovered better than expected in the first half of the year.

-

10:01

Germany: IFO - Expectations , September 103.3 (forecast 101.5)

-

10:00

Germany: IFO - Business Climate, September 108.5 (forecast 108)

-

10:00

Germany: IFO - Current Assessment , September 114 (forecast 114.7)

-

08:17

Options levels on thursday, September 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1292 (1199)

$1.1262 (540)

$1.1237 (787)

Price at time of writing this review: $1.1182

Support levels (open interest**, contracts):

$1.1155 (1381)

$1.1109 (5129)

$1.1080 (3887)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 55395 contracts, with the maximum number of contracts with strike price $1,1350 (5593);

- Overall open interest on the PUT options with the expiration date October, 9 is 69712 contracts, with the maximum number of contracts with strike price $1,1000 (7313);

- The ratio of PUT/CALL was 1.26 versus 1.30 from the previous trading day according to data from September, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.5503 (1686)

$1.5405 (578)

$1.5308 (613)

Price at time of writing this review: $1.5263

Support levels (open interest**, contracts):

$1.5192 (2759)

$1.5095 (1684)

$1.4997 (2024)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22544 contracts, with the maximum number of contracts with strike price $1,5500 (1686);

- Overall open interest on the PUT options with the expiration date October, 9 is 22484 contracts, with the maximum number of contracts with strike price $1,5200 (2759);

- The ratio of PUT/CALL was 0.99 versus 1.00 from the previous trading day according to data from September, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:16

Germany: Gfk Consumer Confidence Survey, October 9.6 (forecast 9.8)

-

08:13

Foreign exchange market. Asian session: the New Zealand dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) September 51.7 50.9

04:30 Japan All Industry Activity Index, m/m July 0.3% 0.2%

The yen advanced against the U.S. dollar after safe-haven demand rose on declines in Japanese stocks.

The euro is range-bound amid correction. Yesterday European Central Bank President Mario Draghi said that the ECB needs time to discuss existing risks to euro zone's economic outlook and assess whether these risks need additional stimulating measures.

The New Zealand dollar rose against the greenback after world's largest milk producer Fonterra raised its milk price forecast by 75 cents, which would increase the company's profit by $506 million. Nevertheless the NZD is weighed by trade balance data. New Zealand's trade deficit came in at Nz$1035 billion in August, while analysts had expected a deficit of Nz$850 billion. Previouly it posted Nz$-649 billion.

EUR/USD: the pair fluctuated within $1.1165-95 in Asian trade

USD/JPY: the pair fell to Y119.85

GBP/USD: the pair traded within $1.5240-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:00 Germany Gfk Consumer Confidence Survey October 9.9 9.8

06:00 Switzerland UBS Consumption Indicator August 1.64

08:00 Germany IFO - Current Assessment September 114.8 114.7

08:00 Germany IFO - Expectations September 102.2 101.5

08:00 Germany IFO - Business Climate September 108.3 108

08:30 United Kingdom BBA Mortgage Approvals August 46.0

09:15 Eurozone Targeted LTRO 73.8

12:30 U.S. Chicago Federal National Activity Index August 0.34

12:30 U.S. Continuing Jobless Claims September 2237 2235

12:30 U.S. Initial Jobless Claims September 264 271

12:30 U.S. Durable Goods Orders August 2.2% -2%

12:30 U.S. Durable Goods Orders ex Transportation August 0.6% 0.1%

12:30 U.S. Durable goods orders ex defense 1.0% -1.2%

13:00 Belgium Business Climate September -5.1 -5.3

14:00 U.S. New Home Sales August 507 515

21:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Japan Tokyo Consumer Price Index, y/y September 0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y August 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y August 0.0% -0.1%

-

06:46

Japan: All Industry Activity Index, m/m, July 0.2%

-

03:35

Japan: Manufacturing PMI, September 50.9

-

01:02

Currencies. Daily history for Sep 23’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1187 +0,55%

GBP/USD $1,5248 -0,72%

USD/CHF Chf0,9789 +0,44%

USD/JPY Y120,20 +0,06%

EUR/JPY Y134,47 +0,61%

GBP/JPY Y183,28 -0,67%

AUD/USD $0,7003 -1,13%

NZD/USD $0,6269 -0,29%

USD/CAD C$1,3325 +0,41%

-

00:45

New Zealand: Trade Balance, mln, August -1035 (forecast -850)

-

00:03

Schedule for today, Thursday, Sep 24’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) September 51.7

04:30 Japan All Industry Activity Index, m/m July 0.3%

05:00 Japan Coincident Index (Finally) July 112.3 112.2

05:00 Japan Leading Economic Index (Finally) July 106.5 104.9

06:00 Germany Gfk Consumer Confidence Survey October 9.9 9.8

06:00 Switzerland UBS Consumption Indicator August 1.64

08:00 Germany IFO - Current Assessment September 114.8 114.7

08:00 Germany IFO - Expectations September 102.2 101.5

08:00 Germany IFO - Business Climate September 108.3 108

08:30 United Kingdom BBA Mortgage Approvals August 46.0

09:15 Eurozone Targeted LTRO 73.8

12:30 U.S. Chicago Federal National Activity Index August 0.34

12:30 U.S. Continuing Jobless Claims September 2237 2235

12:30 U.S. Initial Jobless Claims September 264 271

12:30 U.S. Durable Goods Orders August 2.2% -2%

12:30 U.S. Durable Goods Orders ex Transportation August 0.6% 0.1%

12:30 U.S. Durable goods orders ex defense 1.0% -1.2%

13:00 Belgium Business Climate September -5.1 -5.3

14:00 U.S. New Home Sales August 507 515

21:00 U.S. Fed Chairman Janet Yellen Speaks

23:30 Japan Tokyo Consumer Price Index, y/y September 0.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y September -0.1% -0.2%

23:30 Japan National Consumer Price Index, y/y August 0.2%

23:30 Japan National CPI Ex-Fresh Food, y/y August 0.0% -0.1%

-