Noticias del mercado

-

21:00

Dow -0.21% 16,245.15 -34.74 Nasdaq -0.16% 4,745.00 -7.74 S&P -0.09% 1,937.07 -1.69

-

18:22

WSE: Session Results

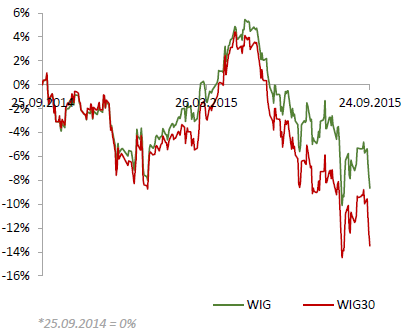

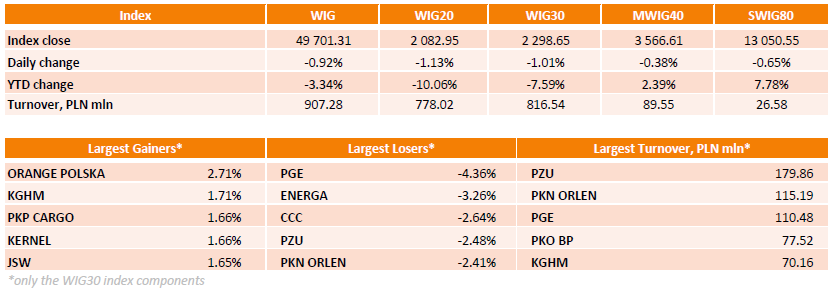

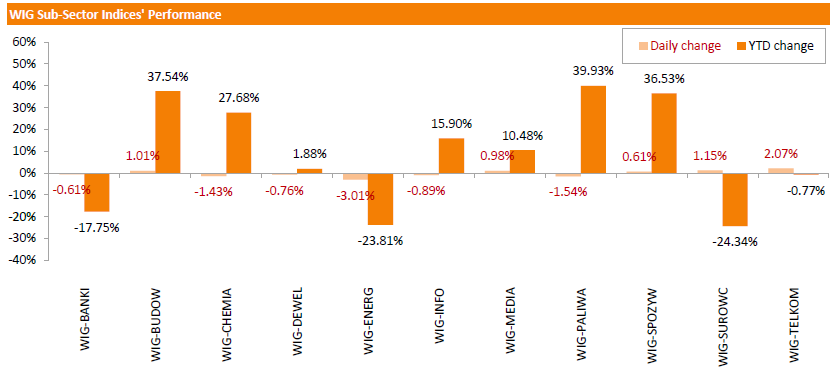

Polish equity market finished Thursday's session 0.92% lower, as measured by the WIG index. Sector-wise, utilities (-3.01%) fared the worst on concerns that Polish power companies could be forced to aid a coal miner Kompania Weglowa (KW) as the government announced it had withdrawn a rescue plan for KW to avoid European probe. On the contrary, telecommunication stocks (+2.07%) outperformed.

The large-cap stocks' measure, the WIG30 Index, fell by 1.01%. The decliners were led by PGE (WSE: PGE) and ENERGA (WSE: ENG), which tumbled by 4.36% and 3.26% respectively. Other major fallers were CCC (WSE: CCC), PZU (WSE: PZU), PKN ORLEN (WSE: PKN), GRUPA AZOTY (WSE: ATT) and TAURON PE (WSE: TPE), plunging by 2.11%-2.64%. On the other side of the ledger, ORANGE POLSKA (WSE: OPL) recorded the strongest daily result, soaring by 2.71%.

-

18:00

European stocks closed: FTSE 100 5,961.49 -70.75 -1.17% CAC 40 4,347.24 -85.59 -1.93% DAX 9,427.64 -184.98 -1.92%

-

18:00

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell more 1% on Thursday as Caterpillar's sales forecast cut dragged down industrials and exacerbated concerns of slowing global economic growth. Caterpillar fell as much as 7.9% to its lowest level since 2010 after the world's biggest mining and construction equipment maker slashed its 2015 revenue forecast and said it could cut up to 10,000 jobs.

Almost all of Dow stocks in negative area (27 of 30). Top looser - Caterpillar Inc. (CAT, -6.28%). Top gainer - The Procter & Gamble Company (PG, +0.44).

Almost all of S&P index sectors also in negative area. Top looser - Healthcare (-2.0%). Top gainer - Utilities (+0,1%).

At the moment:

Dow 15956.00 -231.00 -1.43%

S&P 500 1904.00 -24.50 -1.27%

Nasdaq 100 4200.25 -62.50 -1.47%

10 Year yield 2,10% -0,05

Oil 44.75 +0.27 +0.61%

Gold 1155.20 +23.70 +2.09%

-

17:59

European stocks close: stocks closed lower as shares of automakers dropped

Stock indices closed lower as shares of automakers dropped, caused by the Volkswagen emissions scandal.

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Thursday that the central bank could adjust its asset-buying programme if needed.

Liikanen pointed out that the slowdown in the global economy involves risks for the recovery in the Eurozone, adding that inflation in the Eurozone could rise slower than expected.

Meanwhile, the economic data from the Eurozone was mostly positive. German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index rose to 108.4 in September from 108.3 in August, beating expectations for a decline to 108.0.

"The German economy is proving robust. In manufacturing the business climate continued to deteriorate slightly. Manufacturers scaled back their very good assessments of the current business situation, but were nevertheless more optimistic about short-term business developments. More companies plan to ramp up production in the months ahead," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index declined to 114.0 from 114.8. Analysts had expected the index to fell to 114.7.

The Ifo expectations index rose to 103.3 from 102.2. Analysts had expected the index to decrease to 101.5.

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 104 in September from 103 in August. It was the highest level since August 2011.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals increased to 46,743 in August from 46,315 in July. It was the highest reading since February 2014.

"Mortgage borrowing continues to pick up. The August increase is the largest in five years, although borrowing is still some way below pre-crisis levels," the chief economist at the BBA, Richard Woolhouse, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,961.49 -70.75 -1.17 %

DAX 9,427.64 -184.98 -1.92 %

CAC 40 4,347.24 -85.59 -1.93 %

-

17:22

European Central Bank: banks borrowed €15.5 billion in loans

The European Central Bank (ECB) said on Thursday that banks borrowed €15.5 billion in loans, the so-called TLTROs.

The ECB is offering banks the loans as part of its stimulus measures to spur Eurozone's economy and to boost inflation to its 2% target.

The ECB said there were 88 bidders (June: 28) for this week's TLTROs.

Banks borrowed €73.8 billion in June, €97.8 billion in March, €129.8 billion euros in December 2014 and €82.6 billion in September 2014.

-

17:02

European Central Bank (ECB) Governing Council member Erkki Liikanen: the central bank could adjust its asset-buying programme if needed

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Thursday that the central bank could adjust its asset-buying programme if needed.

"The ECB stands ready to take all necessary measures. The monetary policy stimulus can, if necessary, be increased by adjusting the scale, composition or duration of the expanded purchase programme," he said.

Liikanen pointed out that the slowdown in the global economy involves risks for the recovery in the Eurozone, adding that inflation in the Eurozone could rise slower than expected.

-

16:30

New home sales in the U.S. rise 5.7% in August

The U.S. Commerce Department released new home sales data on Thursday. New home sales increased 5.7% to a seasonally adjusted annual rate of 552,000 units in August from 522,000 units in July. July's figure was revised up from 507,000 units. It was the highest figure since February 2008.

Analysts had expected new home sales to reach 515,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast climbed 24.1% in August.

This data points to a strong recovery in the U.S. housing market.

-

16:20

New Zealand’s trade deficit widens to NZ$1,035 million in August

Statistics New Zealand released its trade data on late Wednesday evening. New Zealand's trade deficit widened to NZ$1,035 million in August from NZ$726 million in July. July's figure was revised up from a deficit of NZ$649 million.

Analysts had expected the deficit to rise to NZ$850 million.

The increase in deficit was driven by higher imports. Exports rose 5.6% year-on-year in August, while imports increased by 19.0%.

Beef exports soared 46% in August from a year earlier.

"International shortages, rising production, and a falling New Zealand dollar have contributed to this record beef season," Statistics NZ international statistics senior manager Jason Attewell said.

-

16:04

NBB business climate declines to -6.8 in September

The National Bank of Belgium (NBB) released its business survey on Thursday. The business climate declined to -6.8 in September from -5.1 in August, missing forecasts for a fall to -5.3. It was the third consecutive decline.

3 of 4 indicators declined in September.

The business climate index for the manufacturing sector dropped to -8.7 in September from -8.0 in August due to less favourable assessments of total order books.

The business climate index for the services sector was down to 3.3 in September from 11.8 in August due to less optimistic outlook about current levels of activity.

The business climate index for the building sector decreased to -9.0 in September from -8.3 in August due to a drop in new orders.

The business climate index for the trade sector rose to -6.5 in September from -8.0 in August due to more favourable assessments of orders.

-

15:35

U.S. Stocks open: Dow -0.81%, Nasdaq -0.67%, S&P -0.64%

-

15:29

Before the bell: S&P futures -0.75%, NASDAQ futures -0.87%

U.S. stock-index futures sliding.

Nikkei 17,571.83 -498.38 -2.76%

Hang Seng 21,095.98 -206.93 -0.97%

Shanghai Composite 3,143.58 +27.69 +0.89%

FTSE 5,990.43 -41.81 -0.69%

CAC 4,356.08 -76.75 -1.73%

DAX 9,418.03 -194.59 -2.02%

Crude oil $43.84 (-1.30%)

Gold $1136.70 (+0.46%)

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

5.97

0.51%

89.6K

McDonald's Corp

MCD

97.55

0.17%

0.1K

Merck & Co Inc

MRK

50.90

-0.25%

0.9K

Verizon Communications Inc

VZ

43.80

-0.41%

4.9K

ALTRIA GROUP INC.

MO

54.16

-0.44%

0.6K

Procter & Gamble Co

PG

69.90

-0.51%

2.3K

AT&T Inc

T

32.03

-0.53%

15.1K

E. I. du Pont de Nemours and Co

DD

47.63

-0.58%

0.6K

Johnson & Johnson

JNJ

92.45

-0.58%

0.3K

HONEYWELL INTERNATIONAL INC.

HON

94.04

-0.58%

0.1K

Boeing Co

BA

130.85

-0.62%

5.8K

The Coca-Cola Co

KO

38.52

-0.62%

1.6K

Home Depot Inc

HD

115.44

-0.63%

1.2K

Yandex N.V., NASDAQ

YNDX

11.09

-0.63%

17.8K

Wal-Mart Stores Inc

WMT

63.30

-0.66%

0.4K

Intel Corp

INTC

28.54

-0.70%

10.5K

Nike

NKE

114.60

-0.72%

5.5K

American Express Co

AXP

75.06

-0.75%

1.1K

Visa

V

70.42

-0.75%

6.7K

Exxon Mobil Corp

XOM

71.75

-0.76%

28.6K

Facebook, Inc.

FB

93.23

-0.79%

117.1K

Tesla Motors, Inc., NASDAQ

TSLA

258.90

-0.83%

20.7K

3M Co

MMM

136.50

-0.84%

0.7K

Walt Disney Co

DIS

100.71

-0.85%

2.3K

Apple Inc.

AAPL

113.34

-0.86%

252.6K

Amazon.com Inc., NASDAQ

AMZN

531.35

-0.88%

13.9K

General Electric Co

GE

24.91

-0.91%

5.0K

Starbucks Corporation, NASDAQ

SBUX

57.25

-0.93%

3.8K

Cisco Systems Inc

CSCO

25.04

-0.95%

4.1K

International Business Machines Co...

IBM

142.25

-0.98%

0.4K

Microsoft Corp

MSFT

43.43

-1.00%

19.7K

Goldman Sachs

GS

177.60

-1.01%

0.6K

Chevron Corp

CVX

75.35

-1.01%

0.8K

Google Inc.

GOOG

616.00

-1.02%

1K

JPMorgan Chase and Co

JPM

60.01

-1.04%

3.7K

Yahoo! Inc., NASDAQ

YHOO

29.43

-1.04%

2.5K

Citigroup Inc., NYSE

C

49.58

-1.08%

9.8K

Deere & Company, NYSE

DE

76.83

-1.11%

3.0K

ALCOA INC.

AA

9.09

-1.20%

6.4K

Twitter, Inc., NYSE

TWTR

26.44

-1.31%

13.8K

Hewlett-Packard Co.

HPQ

25.15

-1.33%

1K

Ford Motor Co.

F

13.44

-1.75%

18.6K

General Motors Company, NYSE

GM

29.10

-2.09%

3.6K

Caterpillar Inc

CAT

68.42

-2.54%

51.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.71

-2.90%

14.7K

-

15:03

Chicago Fed National Activity Index drops to -0.41 in August

The Federal Reserve Bank of Chicago released its National Activity Index on Thursday. The index fell to -0.41 in August from 0.51 in July. July's figure was revised up from 0.34.

The decline was mainly driven by a weakness in the production.

The production-related indicator declined to -0.30 in August from +0.36 in July.

The employment-related indicator dropped to -0.01 in August from +0.18 in July.

The personal consumption and housing indicator was down to -0.08 in August from -0.06 in July.

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

American Express (AXP) target lowered to $70 from $85 at Jefferies; Hold

Caterpillar (CAT) initiated with a Sell at Axiom Capital; target $28

-

14:53

U.S. durable goods orders drop 2.0% in August

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders decreased 2.0% in August, in line with expectations, after a 1.9% gain in July. July's figure was revised down from a 2.2% rise.

The decline was partly driven by a weak demand for aircraft.

The U.S. durable goods orders excluding transportation was flat in August, missing expectations for a 0.1% gain, after a 0.6% increase in July.

The U.S. durable goods orders excluding defence dropped 1.0 % in August, beating expectations for a 1.2% fall, after a 0.9% gain in July. July's figure was revised down from a 1.0% increase.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

14:41

Initial jobless claims increase by 3,000 to 267,000 in the week ending September 19

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 19 in the U.S. rose by 3,000 to 267,000 from 264,000 in the previous week. Analysts had expected the initial jobless claims to increase to 271,000.

Jobless claims remained below 300,000 the 29th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 1,000 to 2,242,000 in the week ended September 12.

-

14:24

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan decreases to 50.9 in September

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan decreased to 50.9 in September from 51.7 in August.

A reading below 50 indicates contraction of activity.

The index was partly driven by a decline in new export orders, employment and output prices.

"September PMI data pointed to a general slowdown in the expansion of the Japanese manufacturing sector. New order growth moderated, having increased in August at the fastest rate since January. Underpinning the slowdown in total new order growth was a sharp reduction in international demand as new export orders dropped to the greatest extent for 31 months," economist at Markit, Amy Brownbill, said.

-

12:01

European stock markets mid session: stocks traded lower despite the positive economic data from Germany

Stock indices traded lower despite the positive economic data from Germany. Concerns over the slowdown in the global economy weighed on markets.

German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index rose to 108.4 in September from 108.3 in August, beating expectations for a decline to 108.0.

"The German economy is proving robust. In manufacturing the business climate continued to deteriorate slightly. Manufacturers scaled back their very good assessments of the current business situation, but were nevertheless more optimistic about short-term business developments. More companies plan to ramp up production in the months ahead," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index declined to 114.0 from 114.8. Analysts had expected the index to fell to 114.7.

The Ifo expectations index rose to 103.3 from 102.2. Analysts had expected the index to decrease to 101.5.

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 104 in September from 103 in August. It was the highest level since August 2011.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals increased to 46,743 in August from 46,315 in July. It was the highest reading since February 2014.

"Mortgage borrowing continues to pick up. The August increase is the largest in five years, although borrowing is still some way below pre-crisis levels," the chief economist at the BBA, Richard Woolhouse, said.

Current figures:

Name Price Change Change %

FTSE 100 6,016.45 -15.79 -0.26 %

DAX 9,528.92 -83.70 -0.87 %

CAC 40 4,407.42 -25.41 -0.57 %

-

11:44

Italian retail sales climb at a seasonally adjusted rate of 0.4% in July

The Italian statistical office Istat released its retail sales data for Italy on Thursday. Italian retail sales climbed at a seasonally adjusted rate of 0.4% in July, after a 0.4% decline in June. June's figure was revised down from a 0.3% decrease.

On a yearly basis, retail sales in Italy climbed 1.7% in July, after a 1.7% increase in June.

Sales of food products jumped 3.2% year-on-year in July, while sales of non-food products climbed by 0.8%.

-

11:39

Industrial orders in Italy rise at a seasonally adjusted rate of 1.1% in July

The Italian statistical office Istat released its industrial orders data for Italy on Thursday. Industrial orders in Italy rose at a seasonally adjusted rate of 1.1% in July, after a 0.7% increase in June.

Domestic market orders climbed 3.1% in July, while demand from non-domestic markets dropped by 2.9%.

On a yearly basis, the seasonally adjusted industrial orders in Italy jumped 2.3% in July, after a 3.4% gain in June.

The seasonally adjusted industrial new orders index rose by 0.6% month-on-month in July.

-

11:24

French manufacturing confidence index rises to 104 in August, the highest level since August 2011

The French statistical office Insee released its manufacturing confidence index for France on Thursday. The French manufacturing confidence index increased to 104 in September from 103 in August. It was the highest level since August 2011.

Past change in production index was up to 7 in September from 4 in August.

Personal production expectations index rose to 14 in September from 8 in August, while general production outlook index climbed to 7 in September from 3 in August.

-

11:15

Number of mortgage approvals in the U.K. is up to 46,743 in August, the highest reading since February 2014

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Thursday. The number of mortgage approvals increased to 46,743 in August from 46,315 in July. It was the highest reading since February 2014.

"Mortgage borrowing continues to pick up. The August increase is the largest in five years, although borrowing is still some way below pre-crisis levels," the chief economist at the BBA, Richard Woolhouse, said.

-

11:09

German Gfk consumer confidence index declines to 9.6 in October

Market research group GfK released its consumer confidence index for Germany on Thursday. German Gfk consumer confidence index fell to 9.6 in October from 9.9 in September.

Analysts had expected the index to remain unchanged at 9.8.

The decrease was driven by declines in all three indicators.

The economic expectations index plunged by 10.2 points to 6.4 points in September, while the willingness to buy index fell 1.6 points to 50.4.

The income expectations index dropped by 5.8 points in September and is now at 47.7.

"The indicator is at a very good level. In consideration of the extremely positive development of the retail sector, it can be assumed that the consumption will continue to be an important pillar of the economy this year overall," Gfk noted.

-

10:56

German business confidence index climbs to 108.4 in September

German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index rose to 108.4 in September from 108.3 in August, beating expectations for a decline to 108.0.

"The German economy is proving robust. In manufacturing the business climate continued to deteriorate slightly. Manufacturers scaled back their very good assessments of the current business situation, but were nevertheless more optimistic about short-term business developments. More companies plan to ramp up production in the months ahead," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index declined to 114.0 from 114.8. Analysts had expected the index to fell to 114.7.

The Ifo expectations index rose to 103.3 from 102.2. Analysts had expected the index to decrease to 101.5.

-

10:43

Atlanta Fed President Dennis Lockhart: markets overreacted to the weak Chinese economic data

Atlanta Fed President Dennis Lockhart said on Wednesday that markets overreacted to the weak Chinese economic data.

"China is slowing to still a very respectable pace of growth. It is ratcheting down a little bit, but there is a decent chance that the world is overreacting," he said.

Lockhart added that the spillover to the U.S. economy "is likely to be small".

Atlanta Fed president noted that the Fed should concentrate on the U.S. economy more than on the slowdown in the global economy.

-

10:35

European Central Bank Governing Council member Jens Weidmann: the central bank’s asset-buying programme should not be continued any longer than necessary

European Central Bank (ECB) Governing Council member Jens Weidmann said Wednesday that the central bank's asset-buying programme should not be continued any longer than necessary.

"The expansive monetary policy shouldn't be continued any longer than absolutely necessary," he said.

Weidmann noted that the low inflation is caused by low energy prices and it is temporary.

"I remain of the opinion that monetary policy should look through inflation fluctuations that are caused by energy prices, because these are temporary and the economy benefits anyway through an increase in purchasing power," he said.

-

10:25

European Central Bank Executive Board member Peter Praet: the central bank could adjust its asset-buying programme if needed

European Central Bank (ECB) Executive Board member Peter Praet said in Dublin on Wednesday that the central bank could adjust its asset-buying programme if needed.

"Monetary policy will play its part for as long as needed, which means the full implementation of the asset purchase program and, if necessary, adjustments to its size, composition and duration," he said.

-

10:09

International Monetary Fund approves another tranche of €126 million for Cyprus

The International Monetary Fund (IMF) has approved another tranche of €126 million for Cyprus, noting that the country's reform programme continues to be "a success."

IMF Deputy Managing Director Mitsuhiro Furusawa said that the country's economy recovered better than expected in the first half of the year.

-

08:15

Global Stocks: U.S. indices fell

U.S. stock indices declined on Wednesday amid concerns over global economic growth as weak manufacturing data from China and the euro zone weighed on oil prices.

The Dow Jones Industrial Average fell 50.58 points, or 0.3%, to 16279.89. The S&P 500 declined 3.98 points, or 0.2%, to 1938.76. The Nasdaq Composite Index lost 3.98 points, or 0.1%, to 4752.74.

Data from Markit Economics showed on Wednesday that activity in the manufacturing sector of the U.S. economy grew in September at the same modest pace as in August. Markit's preliminary Manufacturing PMI came in at 53.0 in line with expectations.

This morning in Asia Hong Kong Hang Seng dropped 0.93%, or 199.11 points, to 21,103.80. China Shanghai Composite Index rose 0.27%, or 8.28 point, to 3,124.17. The Nikkei lost 1.99%, or 358.82, to 17,711.39.

Asian stock indices mostly fell as investors continued assessing disappointing Chinese manufacturing data released on Wednesday.

Shares of Japanese car manufacturers fell amid Volkswagen's emission scandal.

-

04:12

Nikkei 225 17,739.54 -330.67 -1.83 %, Hang Seng 21,272.6 -30.31 -0.14 %, Shanghai Composite 3,137.27 +21.38 +0.69 %

-

01:03

Stocks. Daily history for Sep 23’2015:

(index / closing price / change items /% change)

Hang Seng 21,302.91 -493.67 -2.26 %

S&P/ASX 200 4,998.13 -105.42 -2.07 %

Shanghai Composite 3,116.71 -68.91 -2.16 %

FTSE 100 6,032.24 +96.40 +1.62 %

CAC 40 4,432.83 +4.32 +0.10 %

Xetra DAX 9,612.62 +41.96 +0.44 %

S&P 500 1,938.76 -3.98 -0.20 %

NASDAQ Composite 4,752.74 -3.98 -0.08 %

Dow Jones 16,279.89 -50.58 -0.31 %

-